Buying shares in Estonia is a process that rarely takes more than a few minutes from start to finish. After opening a stockbroker account and depositing money, you simply need to submit an investment order.

This article is for those people who are completely new to online investing and want to buy stocks.

We explain how to invest in shares with a Financial Conduct Authority (FCA) regulated broker and explore some popular trading platforms.

Listed below are four simple steps for buying shares in Estonia, a more detailed step-by-step guide to buying shares is at the bottom of the article: Look for an app that offers a free and easy-to-use app for beginners, 0% commission and thousands of stocks. Your trading platform should also be very reliable and fully regulated by the FCA. After downloading the app or heading to the website, create an account and complete KYC steps such as uploading a passport or ID card image. If the initial investment is less than €2,000 (around £1,750), this stage can be completed at a later date. Next, users need to deposit money, the minimum is generally only $10. Most platforms accepts debit cards, PayPal, e-wallets, bank transfers and other payment methods. Enter the name of the selected stock in the search box and click the trade button. In the “Amount” field, enter the total amount of the investment (note that this is done in US dollars) and then click the “Open Trade” button to buy shares.How to buy shares in Estonia in four simple steps

Step 1 – Open an account with a regulated broker:

Step 2 – uploading identification information:

Step 3 – Deposit the money:

Step 4 – Buying Shares:

How to buy shares in Estonia – Review of the best stock trading apps

Below we review some of the leading trading platforms on the market and look at their advantages and disadvantages.

Different clients have different needs, so we’ve highlighted the best stock apps for beginners and experts, and we’re also looking at the best mobile stock trading apps.

Most of the brokers we reviewed are regulated by the FCA (Financial Conduct Authority) and covered by the Financial Services Compensation Scheme (FSCS).

They offer a variety of financial instruments including stocks, commodities, currencies, indices and cryptocurrencies.

Buying shares – the basics

To buy shares in Estonia, you need to choose one of the best stock brokers and open an account. Investors then have to make a deposit, which can often be done instantly by debit or credit card.

After that, you need to search for the desired company and submit a purchase order. With this, the investor gets a small part of the company. For example, if a company has 100,000 shares outstanding and an investor buys 1,000 shares, he owns 1% of the company.

The return on investments ultimately depends on the performance of the company and the wider economy. However, if the investor can sell the shares for more than they initially paid, they will make a profit.

This is known as capital gains. Profits can also be earned through quarterly dividends. This happens when a company distributes some of its retained earnings to shareholders. The amount received depends on the size of the distribution and the number of shares owned.

Perhaps the most difficult part of learning to buy stocks in Estonia is finding out which companies to invest in. Although some Estonian investors focus on stocks listed on the London Stock Exchange, others turn to the US markets.

Buying Stocks – How to Find Popular Stocks to Follow?

As mentioned above, the tricky part of buying stocks is knowing which companies to choose. Thousands of listed stocks can be bought online.

And when you consider the US and other international markets, it makes the decision-making process even more complicated. However, even beginners are advised to make their own investment decisions and not buy stocks based on third-party advice.

Search popular markets

Some investors first analyze which markets are currently popular. For example, when there is a cost-of-living crisis in the UK, investors often turn to foundation companies that sell products and services that are always in demand.

This may include companies such as Tesco or GlaxoSmithKline. After all, demand for food and medicine is always certain, regardless of the state of the economy.

During the COVID-19 pandemic, one of the hottest investment trends was among work-at-home-focused stocks. This refers to companies that took advantage of global lock-down measures, such as Amazon and Facebook (now Meta Platforms).

In general, investors should first focus on companies that operate in popular markets to find popular stocks to watch.

Income statement

Every three months, public companies must publish an income statement. It provides an overview of the company’s fundamentals, such as how much money the company has and what revenue it generated during the period. The basic idea here is to compare the income statement with two different indicators.

Dividend policy

Although not a strict recommendation, it is always beneficial for companies to pay dividends. By being a shareholder in a company that pays dividends, investors are entitled to a share of the dividends, which are usually paid every three months.

- Dividend payments can be invaluable in a bear market, as paying dividends can help cushion some of the losses from falling stock prices.

- Those looking for consistent dividends can turn to UK-listed AstraZeneca.

- In the United States, for example, Coca-Cola and Johnson & Johnson have increased their dividend for 60 consecutive years.

On the other hand, companies like Amazon and Google have never paid dividends.

Buying stocks – popular stocks to watch in Estonia right now

While we recommend that investors choose stocks on their own, it can be challenging for first-time investors.

Therefore, in the sections below, we discuss which stocks to buy today – based on our market research and analysis.

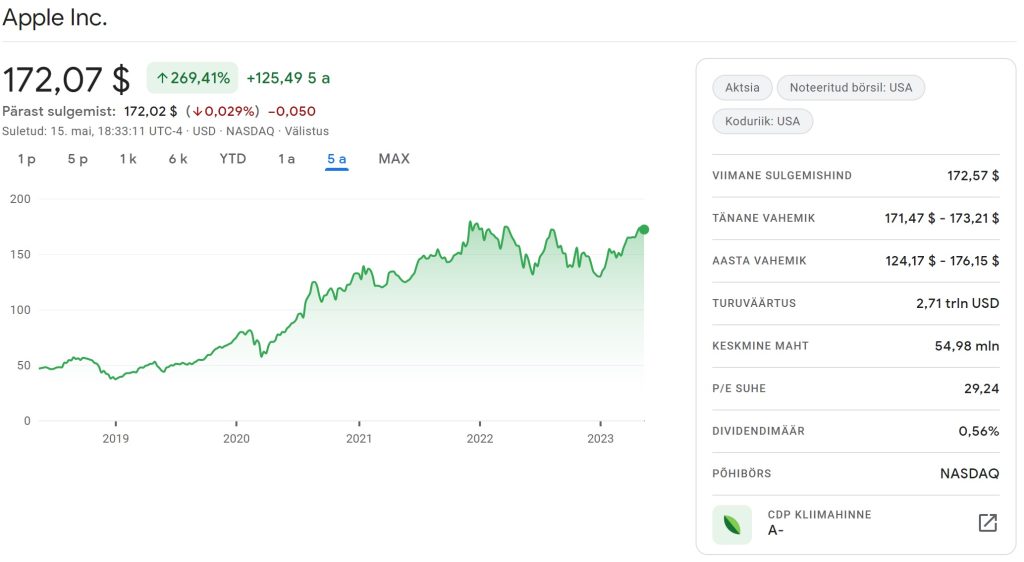

1. Apple

Those looking for international diversification could turn to the US – as this market has outperformed the London Stock Exchange for decades. One of the most popular stocks to watch in the US is Apple. This trusted brand covers smartphones, tablets, laptops and even streaming services.

The thing about Apple stock is that it can now be bought at an entry price. That’s because — like the broader market decline — Apple shares fell 25% in the first half of 2022. On the other hand, Apple shares are up 280% over the past five years. Over the same period, the FTSE 100 has fallen by over 4%.

Apple’s corporate news has been positive and exciting lately. For example, the company reported its second quarter results on May 4, 2023, showing growth in all of its major product categories and geographies. Also, on May 2, 2023, Apple announced a partnership with Google to create an industry standard that addresses unwanted tracking. In addition, Apple opened new stores in China , New Delhi and Mumbai, expanding its global presence and customer experience.

Apple shares are therefore an attractive investment for those who believe in the company’s ability to innovate and grow. If you want to know how to buy Apple shares in Estonia, you need to find a reliable broker that offers access to the US stock exchange and low trading fees.

2. Berkshire Hathaway

Berkshire Hathaway is a US-based investment holding company controlled by investor legend Warren Buffett. On the NYSE, Berkshire Hathaway has an investment portfolio that includes dozens of companies from various industries and sectors. Interestingly, one share of Berkshire Hathaway costs hundreds of thousands of dollars.

However, it is possible to invest through this company through FCA-regulated brokerage firms, forking out just $10 (around £8). However, Berkshire Hathaway investors have exposure to several companies, including Apple, Bank of America, Coca-Cola, American Express and Amazon.

As for the company’s performance, shares of Berkshire Hathaway are down just under 2% over the past year. But over five years, shares are up 63%. Although Berkshire Hathaway owns shares of companies that pay dividends, the company reinvests the funds to buy new shares.

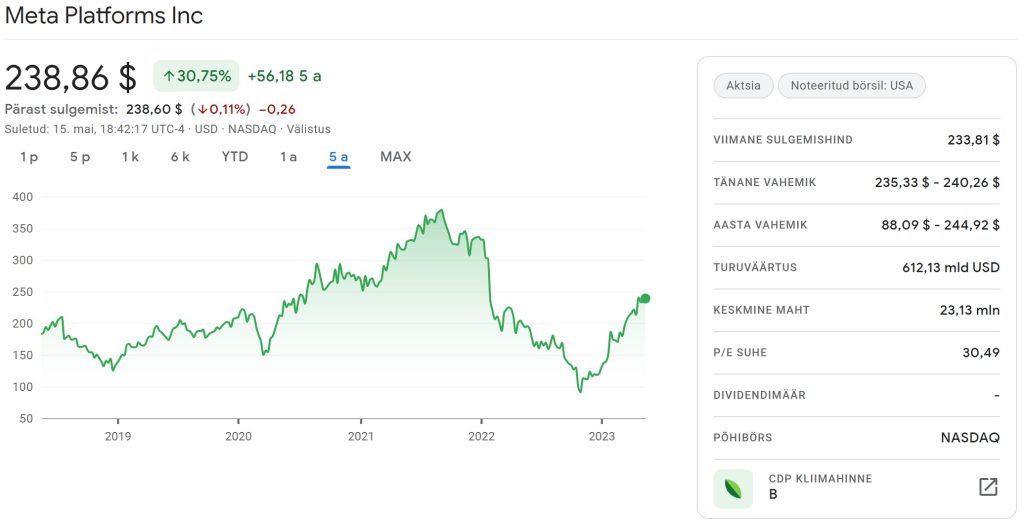

3. Meta Platforms

Meta Platforms is the parent company to some of the world’s largest social media platforms. This includes Facebook, Instagram and WhatsApp. The company also owns dozens of other subsidiaries, including virtual reality brand Oculus. Although Meta Platforms reported strong quarterly earnings, its stock continues to decline in value.

In fact, Meta Platforms shares are down nearly 50% over the past 12 months. However, given that several billion people use at least one of the company’s social media platforms every day, Meta Platforms has a huge customer base – especially in terms of advertising revenue.

Meta Platforms company news has been varied and challenging recently. For example, the company reported lower-than-expected profits and a decline in revenue and active users. The company also announced massive layoffs that could affect thousands of employees . At the same time, the company is investing heavily in VR and the metaverse, launching its first high-end VR headset and acquiring a Cambridge startup.

Meta Platforms stock is thus a risky investment for those who believe in the company’s long-term vision and potential. If you want to know how to buy Meta Platforms shares in Estonia, you need to find a reliable broker that offers access to the US stock exchange and low trading fees.

4. Amazon

Those looking for international diversification could turn to the US – as this market has outperformed the London Stock Exchange for decades. One of the most popular stocks to watch in the US is Amazon. This powerful company is now one of the largest in the world due to its wide range of activities. Its trusted brand spans e-commerce, cloud services, streaming services and artificial intelligence.

The thing about Amazon stock is that it can now be bought at a bargain price. That’s because — in line with the broader market decline — Amazon shares fell 26% in the first half of 2022. On the other hand, Amazon shares are up 230% over the past five years. Over the same period, the FTSE 100 has fallen by over 4%.

Amazon’s corporate news has been positive and exciting lately. For example, the company announced its fourth quarter results on February 3, 2023, showing record sales and profits thanks to growth in demand for e-commerce and cloud services. Amazon also announced the resignation of its founder and CEO Jeff Bezos in July 2023 and his replacement by AWS chief Andy Jassy. In addition, Amazon announced a new partnership with Ford Motor Company to integrate its Alexa voice service into Ford vehicles .

Amazon shares are thus an attractive investment for those who believe in the company’s versatility and growth potential. If you want to know how to buy Amazon shares in Estonia, you need to find a reliable broker that offers access to the US stock exchange and low trading fees.

How to buy shares in Estonia – a step-by-step guide

The step-by-step guide below shows you in detail how to buy shares in Estonia using trading platforms.

Step 1 – Register on a platform.

Find a free platform that can be downloaded as a mobile app or run on a website for desktop.

With either method, you must create an account with a username, email address, and password, and then submit and verify your personal information.

Step 2 – Go through the verification process.

If an investor already has an account with another stock app, some platforms can electronically verify their identity without any additional steps for a new user.

However, beginners and first-time investors must provide proof of identity and proof of address – this can be done electronically and usually requires an ID card or passport.

If the user doesn’t have the documents on hand right away, they can be submitted later, but this means the first deposit must generally be less than $2,000 (£1,650).

In addition, according to the rules of knowing the customer, it must be checked that the investment is not beyond the power of those interested, which means that questions related to the investment must be answered.

Step 3 – Make a deposit.

Once the account is verified, the investor can deposit into it.

Most platforms allow users to deposit in a number of ways, including credit or debit card, bank transfer, PayPal or e-wallet.

Transactions are carried out on the platform in USD, and a minimum deposit of at least $10 (around £8) is required to get started. Bank transfers can also take between four and seven days.

Step 4 – Find a stock and make a trade.

Once the funds are deposited into the account, the user can start trading – stocks can be easily searched in the search bar, while some sites also have a “Discover” feature that shows popular stocks that may be of interest to investors.

Find the relevant stock, press the “Trade” button and then select either “Buy” or “Sell” – depending on whether the investor wants to go long or short.

Enter the purchase amount and then complete the transaction, after which the shares will appear in the “Portfolio” section of the application.

Step 5 – How to sell on a trading platform.

To sell a stock, go to the “Portfolio” section and then select the desired stock to sell from your list of assets.

After confirmation of the sell order, the platform will execute the transaction immediately if there is an opportunity in the market at that moment.

If the market is not open, the sale will be executed as soon as the market reopens. In any case, the money received from the sale will be added to the user’s account balance.

Conclusion – buying shares

This beginner’s guide explains how to buy and sell shares in Estonia. We’ve also covered popular stocks to watch right now and factors to consider before investing.

All you need to do is find is a fully regulated broker with one of the best stock buying apps that are user-friendly and great for both beginners and experienced investors.

Frequently asked questions FAQ

How can I buy shares in Estonia?

How to buy Apple shares in Estonia?