What Is The Inventory Turnover Ratio?

Inventory turnover (or stock turnover), is a term that describes how regularly inventory is sold and replenished.

Inventory turnover ratio (ITR) is a financial metric measuring how often inventory is replaced within a given accounting period. It is a useful indication of the efficiency of a business’s sales and stock management processes.

Pro Tip: You can use an inventory turnover ratio calculator to get quick insights into your business’s inventory dynamics. Keep reading to find out how.

Key Takeaways: The Utility of The Inventory Turnover Ratio Calculator

Did you know?

Increasing your inventory turnover ratio by just 5% can lead to significant cost savings and improved cash flow.

Why Is Inventory Turnover Ratio Useful?

Your inventory turnover ratio tells you if stock is sitting in the warehouse for ages or flying off shelves. This information can help businesses:

- Avoid overstocking or understocking

- Make decisions about pricing, purchasing, and marketing

- Optimize inventory management

- Identify supply chain problems

- Anticipate cash flow

The inventory turnover ratio is also sometimes used as an indication of a company’s liquidity because it shows how quickly a business could sell off inventory to pay off debts if required to do so.

Inventory Turnover Ratio Formula

The formula for the inventory turnover ratio is the cost of goods sold (COGS) divided by the average inventory value. We’ll unpack this more below.

Remember: While a high inventory turnover ratio is generally favorable, it’s crucial to strike a balance to avoid stockouts and ensure customer satisfaction

Inventory Turnover Ratio Calculator

Already know what you’re doing and want to calculate your inventory turnover ratio?

Just plug in your starting inventory, purchased inventory, and ending inventory, and hit calculate!

Keep reading for some more insights into what your inventory turnover ratio might be telling you.

What Is a Good Inventory Turnover Ratio?

The ideal inventory turnover ratio depends on the particular business and industry.

High-volume, low-margin products – like takeaway coffee – tend to have high turnover while low-volume, high-margin products – like private jets – tend to have low inventory turnover. Perishable goods – like flowers and groceries – also tend to have a higher inventory turnover ratio.

Factors like storage space can also be a factor. A big warehouse-style grocery store in the suburbs may have a low inventory turnover ratio compared to a small, corner grocery store in the city because the city store will have less space available to store stock.

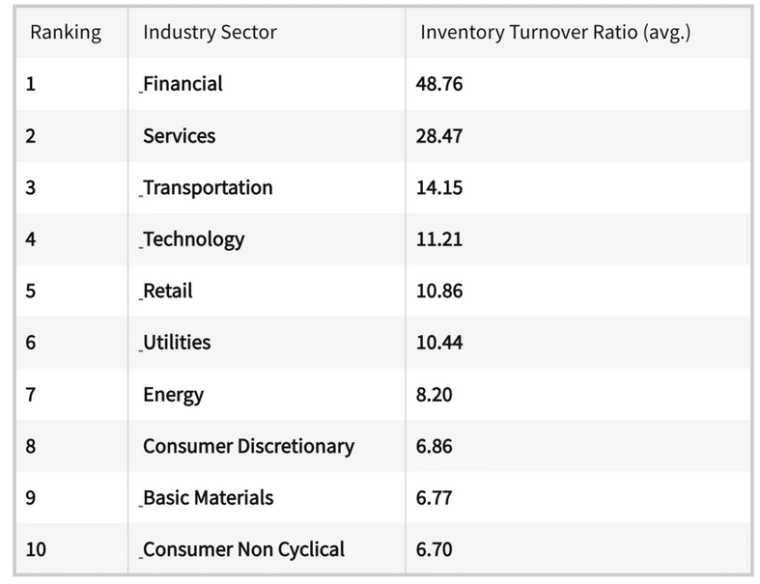

According to a market report from CSIMarket.com, the average inventory turnover ratios by industry sector are as follows.

In general, a high inventory turnover ratio is preferable because it suggests:

- You have strong sales

- There is market demand for your products

- The correct type and volume of inventory is being ordered at the right frequency

- Stock is moving efficiently through the supply chain

On the other hand, a low ratio tends to be negative because it suggests one or more of the following:

- Weak sales

- Inadequate marketing

- High storage costs

- Excess inventory is being ordered

- Inventory is not moving efficiently through the supply chain

Sometimes, however, a very high inventory turnover ratio can indicate that you are not keeping enough inventory on hand. In this case, your product is flying off the shelves and you are losing out on sales because you are not keeping up with demand.

Pro Tip:

Proactively adjusting inventory levels based on market demand fluctuations can help businesses maintain optimal stock levels and avoid excess inventory costs.

How to Calculate and Assess Your Inventory Turnover Ratio [Step-by-Step]

With a few pieces of basic financial data and some simple math, you can calculate your inventory turnover ratio and diagnose problems that are hampering sales or costing your business money.

Step 1: Calculate Cost of Goods Sold

You need two variables to calculate your inventory turnover ratio.

The first is your cost of goods sold (COGS). This variable can usually be found on a business’s income statement. It indicates costs incurred in the production or acquisition of inventory sold and manufactured by a business in a given period of time.

If you are a retailer, COGS includes the cost of buying, storing, and transporting inventory. If you manufacture goods, COGS will include costs like labor and raw materials.

Here is the formula to calculate your cost of goods sold.

Say you started 2023 with $10k in inventory, purchased another $150k in inventory throughout the year, and finished the year with $8k worth of inventory remaining. Your COGS calculation will be:

COGS = $10k + $150k – $8k = $152k

This means that the cost of goods sold by your business in 2023 was $152k.

Step 2: Calculate Average Inventory Value

The second variable required to calculate inventory turnover ratio is average inventory value, often shortened to average inventory (AI).

AI tells you how much inventory a business typically has in stock.

You can measure AI in items (e.g. 50 boxes) or value (e.g. $500). Inventory levels may spike at certain times of the year because of delivery cycles or high demand periods like Black Friday or Valentine’s Day. Using an average allows you to get a clearer picture of the inventory you typically have available.

The simplest way to calculate an AI value is to add the beginning inventory value for a certain period to the ending inventory value for that period and divide by two. Inventory values can be found on a business’s balance sheet, listed under assets.

You can also calculate an AI using more than two values. Say you want to calculate your AI for a six-month period and this is the inventory value data you have available.

- Start of month 1: $2k

- Start of month 2: $8k

- Start of month 3: $6k

- Start of month 4: $6k

- Start of month 5: $6k

- Start of month 6: $3k

To calculate the average, add the inventory values and divide by the number of time periods, as follows:

Inventory average = (2+8+6+6+6+3)/6 months= approx. 5.1

This gives you an AI value of around $5k, which is a more representative value than you would get if you only used a starting and ending value.

Step 3: Calculate Your Inventory Turnover Ratio

When you have the required variables, plug them into the inventory turnover formula:

Inventory turnover ratio = COGS/AI

Step 4: Assess Your Inventory Turnover Ratio

Once you’ve completed your inventory turnover calculation, determine whether your business has a high inventory turnover ratio or a low inventory turnover ratio. The ideal number depends on your sector, the size of your business, and the products you sell.

Always compare your inventory turnover ratio to other businesses in the same industry.

Speak to business owners with similar businesses or to a business mentor to get advice on a suitable target ratio for your business. Where possible, you can also use publicly available information to calculate inventory turnover ratios for your competitors in order to establish a benchmark for your sector.

It’s also useful to compare your own business’s inventory turnover ratios for different periods to identify any obvious changes in demand.

Step 5: Diagnose The Problem

If your inventory turnover ratio is right within the perfect range for your industry you may not have much to improve. However, if it’s looking a bit low, you likely have a problem so start to gather additional information so you can identify the cause.

Here are some of the ways you can do this:

- Check your sales figures. If sales are strong, look at your inventory management. If you have weak sales, you may have a problem with your products, marketing, pricing, or sales team performance. You can isolate the problem by comparing sales figures for different products and outlets/channels. It’s also useful to compare sales figures for different periods. Perhaps market demand for a product has waned over time or you’ve chosen the wrong products for the season.

- Calculate separate inventory turnover ratios for each product category. This will help you identify whether your problem applies to all your products or only some of them.

- Do a competitor analysis. Are other companies charging a lot more or a lot less for similar products? Then you may need to look at your pricing. Do they have a different product mix? Perhaps you need to update your own product line. Are they investing in new marketing strategies? Maybe that’s something worth investigating for your business.

- Do an environmental analysis. Look for factors in the business environment that may impact your company’s inventory turnover ratio, such as economic recessions and industry-wide supply challenges. Consider how these events are likely to play out over time.

- Examine supplier agreements. If manufacturers dictate a minimum or maximum retail price for your products, that may be impacting your ability to efficiently turn over stock. On the other hand, being a favored customer can give you priority over other businesses when there are supply chain disruptions. Identify whether or not your contracts are working in your favor.

How to Improve Your Inventory Turnover Ratio

If your inventory turnover ratio is lower than you would like, there are two ways to improve it: increase sales and/or decrease inventory.

Here are some of the strategies you can use:

Strategies to Increase Sales

- Increase prices to realize higher margins on high demand products.

- Drop prices or use a sale to get dead stock off your shelves.

- Change your product mix to reflect customer demand and anticipate seasonal trends.

- Gather more detailed sales data to improve forecasting.

- Try new sales channels and/or marketing strategies.

- Invest in your sales team with training, more staff, or better incentives.

- Use product bundling to make less popular stock more attractive.

Strategies to Improve Inventory Management

- Order more conservatively – if you can do so without risking stockouts.

- Keep better records of inventory to optimize delivery cycles.

- Improve your forecasting to anticipate trends, seasons, and buying patterns.

- Invest in inventory management software.

- Automate your purchase orders to boost efficiency.

- Address any delays in your supply chain.

- Investigate cheaper storage solutions e.g. alternate location.

- Look for missed opportunities in your purchasing policy and supplier contracts.

- Donate dead stock to charity in return for a tax break.

Inventory Turnover Ratio Examples

Let’s take a look at some examples of how the inventory turnover ratio can be applied to understand and improve business performance.

Example 1: Cathy’s Cupcakes

Cathy has a made-to-order cupcake business. For Q4 of 2023, her business has a COGS of $5k and an average inventory of $100.

Inventory turnover ratio = COGS/Average inventory = 5,000/100 = 50

We can surmise that Cathy went through her inventory 50 times during Q4. This is a very high inventory turnover, which is common for perishable food businesses. It suggests that Cathy’s cupcakes are in high demand. Her made-to-order business model helps her manage her inventory efficiently.

Example 2: Carl’s Croissants

Carl has a street food stall where he sells croissants. In December, his COGS was $1k and his average inventory was $500. Therefore:

Inventory turnover ratio = COGS/Average inventory = 1,000/500 = 2

This is a low inventory turnover ratio, especially when compared to Cathy’s. He only replaced his inventory twice in December. Depending on his business goals, this may suggest that he has excess inventory and low customer demand.

Carl looks at his sales figures and realizes that he sells far more croissants when his stall is placed near metro stations. He also realizes that his blueberry croissants are popular in summer but are not popular in the cold winter months.

He adjusts his product mix and locations and sees his sales improve but his turnover inventory turnover rate is still a bit low. Next, he reduces the number of croissants he prepares each day. By March, his inventory turnover ratio measures 10 and Carl’s profits are growing.

Example 3: Blissful Beds

Furniture company Blissful Beds starts a given period with $30k in inventory, purchases $230k worth of additional inventory, and finishes with $20k in inventory. We can calculate:

COGS = Starting inventory + Purchased inventory – Ending inventory = 30+230-20 = 240

For the same time period, Blissful Beds has an average inventory of $30k. Therefore:

Inventory turnover ratio = COGS/Average inventory = 240/30 = 8

This tells us that Blissful Beds replenished their inventory 8 times during this time period.

This is a good inventory turnover ratio for a furniture business but the CEO wants to improve inventory turnover anyway. A competitor analysis reveals that other businesses are focusing on memory foam mattresses.

When the CEO compares the inventory turnover ratio for different products, he sees that memory foam is in higher demand than other mattress categories.

Blissful Beds introduces a discount on spring mattresses to get the stock moving and moves memory foam mattresses to the front of their stores to reflect consumer demand.

These changes improve inventory turnover rates and generate profit.

Example 4: Mattel

Quarterly reports from toy maker Mattel include these figures for the three months ending September 30, 2023.

- Starting inventory value = $971m

- Ending inventory value = $790m

- Cost of goods sold = $940m

We can then calculate:

Average inventory = (Beginning inventory + Ending inventory)/2 = ($971m + $790m)/2 = $880m

Therefore:

Inventory turnover ratio = COGS/Average inventory = $940m/$880m = 1.068

An inventory ratio of 1.068 means that Mattel replenished its inventory more than once but less than twice. This is not a very good inventory turnover ratio.

We can compare this to the three months ending September 30, 2022:

- Starting inventory value = $1,17B

- Ending inventory value = $1,08B

- Cost of goods sold = $908m

Therefore:

Average inventory = ($1,17B + $1,08B)/2 = $1.125B

and

Inventory turnover ratio = $908m/$1.125B = 0.8

Mattel’s inventory turnover ratio measures lower for the three months ending September 30, 2022, than for the same period in 2023. This means that their inventory turnover rate is improving. If we conduct an environmental analysis, we might conclude that:

- The release of the Barbie movie had a positive impact on Mattel’s sales, resulting in the improvement that we see from 2022 to 2023.

- Inflation and cost of living concerns have been having a negative impact on toy sales across the industry since the pandemic.

Mattel and other toy companies are planning to invest more in movies and television merchandise to improve sales. Mattel may also want to consider reducing their production rate to ensure they carry the optimal inventory level.

What to Look Out for When Analyzing Inventory Turnover

Here are a couple more things to consider when analyzing your inventory turnover ratio.

- Understand the Pareto Principle.According to the Pareto Principle, 80% of consequences come from 20% of causes. In the context of managing inventory, this means that 20% of your company’s inventory generates 80% of your profits. If you can figure out which products constitute the 20%, then you can prioritize them.

- Consider all outcomes.While it makes sense to target a high inventory turnover ratio, there are always other things to consider. For example, you may need to purchase a minimum volume from your supplier in order to be classified as a preferred customer. This might mean that you have too much inventory on your shelves but it guarantees you are first in line when there are supply shortages. Do a cost-benefit analysis before making decisions to improve your inventory turnover.

Other Useful Inventory Turnover Metrics

When you’re trying to get to grips with inventory management, it is useful to look at several different metrics including days inventory outstanding and inventory to sales ratio.

Let’s take a closer look.

What Is “Days Inventory Outstanding”?

Days inventory outstanding (DIO) is the ratio that measures how many days inventory is held before the final product is sold.

It is a measure of inventory liquidity and can be used in combination with the inventory turnover ratio to assess the efficiency of a business’s sales and inventory management.

DIO is also known as:

- days sales of inventory (DSI)

- days in inventory (DII)

- average inventory period (AIP)

It is easy to calculate using your inventory turnover ratio. First, work out the number of days in the accounting period, then divide by inventory turnover ratio.

In a previous example, we concluded that Cathy’s Cupcakes had an inventory turnover ratio of 50 for Q4. There were 92 days in Q4. Therefore, Cathy’s Cupcakes’ DIO is:

92/50 = 1,84

In other words, Cathy’s cupcakes only sit on the shelf for a day or two.

We can also use a different configuration of the DIO formula.

We know Cathy’s Cupcakes had a COGS of $5k and an average inventory of $100 for Q4 2023, so we can calculate the business’s DIO as follows:

DIO = Average inventory value / COGS) x Number of days in period

= 100/5000 x 92 = 1.84

As you can see, both configurations generate the same figure.

What Is Inventory-to-Sales Ratio?

The inventory to sales ratio compares a company’s investment in inventory to its sales. The formula for this metric is:

Inventory-to-sales ratio = Average inventory value / Net sales

A low inventory-to-sales ratio is preferable because it indicates that sales are high and inventory is low. In other words, inventory is moving efficiently through the business.

A high inventory to sales ratio means that inventory is accumulating more quickly than the speed of sales, which means the business is spending money on storing and managing excess stock.

Don’t Underestimate Inventory Management

Managing inventory is both an art and a science.

It requires deep knowledge of your products, customers, processes, and industry.

You need to master the data and have a good eye for trends because even a small mismatch between demand and inventory can sink a business or at least severely hamper its cash flow.

The inventory turnover ratio calculator is one of several simple metrics that can help you avoid logistics disasters, optimize the flow of inventory, and ultimately boost revenues.

Why not add it to your toolkit?