A fiscal year (FY) is an essential concept in accounting, signifying a 12-month period used by organizations for financial planning, reporting, and taxation.

Unlike the calendar year, a fiscal year can start and end on any dates, tailored to align with a company’s operational cycles or the tax requirements of its jurisdiction.

Key Takeaways:

- Definition and Purpose: A fiscal year is a 12-month accounting period tailored for budgeting, financial reporting, and taxation, not necessarily aligning with the calendar year.

- Flexibility and Alignment: Companies choose their fiscal year to align with their business cycles, such as retail businesses ending in January to capture holiday sales, or agricultural companies concluding post-harvest.

- Federal Example: The U.S. federal government’s fiscal year runs from October 1st to September 30th, showcasing how fiscal years can vary across entities.

- Identification: A fiscal year is identified by the year it ends, for instance, FY 2021 for a fiscal year running from March 2020 to February 2021.

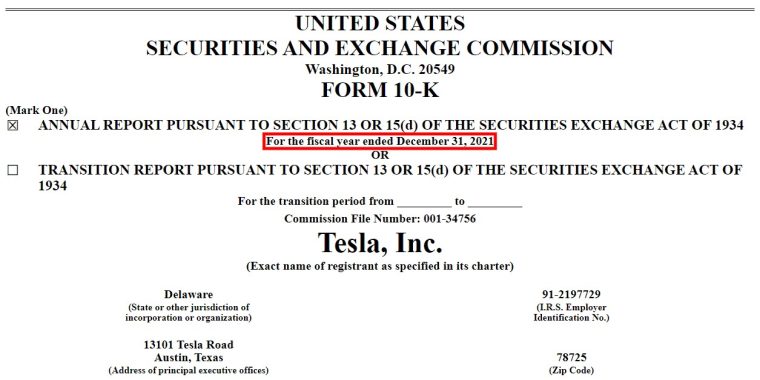

- Public Access: Information about a company’s fiscal year can be found in its Form 10-K filings with the SEC, like Tesla’s, which ends on December 31st.

- Benefits: Using a fiscal year can capture peak performance periods, ease year-end accounting burdens, facilitate better financial comparisons, align with business cycles, and potentially lower taxes.

- IRS Requirements: In the U.S., the IRS mandates that fiscal years be 12 consecutive months ending on the last day of a month, among other criteria.

- Entity-Specific Rules: Certain entities, like sole proprietors, are typically required to adhere to the calendar year unless granted IRS permission for a fiscal year.

What Is a Fiscal Year?

A fiscal year (FY) is a 12-month accounting period used by organizations for budgeting, financial reporting, and tax purposes. The fiscal year does not have to coincide with the calendar year and can begin and end on any date as long as it meets the requirements of the jurisdiction’s tax authority.

How Does a Fiscal Year Work?

Rather than always following the calendar year from January 1st to December 31st, companies can choose a fiscal year that better aligns with their natural business cycle. For example:

- Retail companies often have a fiscal year ending in January to include holiday sales.

- Agriculture companies may end their fiscal year after harvest season.

- The United States federal government fiscal year runs from October 1st to September 30th.

When referencing a fiscal year, the year in which it ends is used. So a fiscal year running from March 2020 to February 2021 is called FY 2021.

Note that a company’s fiscal year could be the same as a normal calendar year from January 1st to December 31st if that’s what makes the most sense for its accounting.

You can find a publicly traded company’s fiscal year on their Form 10-K filings with the SEC. The below SEC form shows that Tesla’s fiscal year ends on December 31st.

Benefits of a Fiscal Year

There are several potential benefits to using a fiscal year rather than a calendar year:

- Captures peak performance – Companies can choose timing that includes their best months in terms of sales.

- Eases year-end accounting – Closing the books outside of the calendar year-end rush alleviates some pressure for the accounting department.

- Improves comparisons – Keeping the fiscal year consistent allows better year-over-year financial analysis.

- Aligns with cycles – A fiscal year can match natural business seasons and cycles.

- Lowers taxes – Shifting income between calendar years may lower total taxes.

Fiscal Year Requirements

The United States Internal Revenue Service (IRS) has specific rules regarding fiscal years, including the following:

- They must be 12 consecutive months.

- They must end on the last day of a month.

- They cannot exceed 53 weeks.

- The due date for filing their tax return is based on the fiscal year-end date.

Some entities like sole proprietors must use the calendar year unless permission is granted by the IRS to use a fiscal year.