What are Economies of Scale?

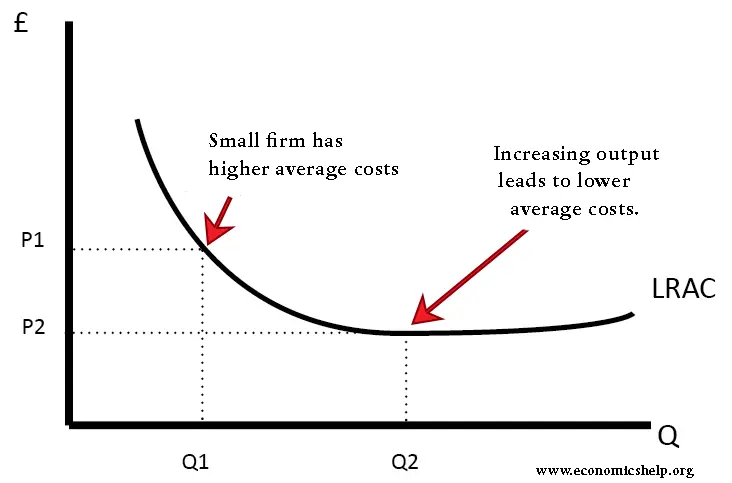

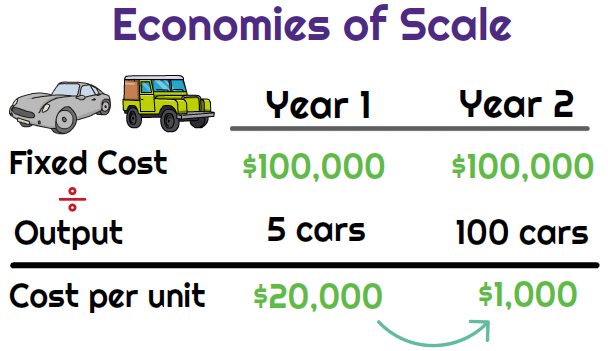

Economies of scale refer to the cost savings that companies can obtain by increasing their production levels, sales, or output. This happens because fixed costs are spread over a larger number of goods produced. As companies become larger, they can leverage these economies of scale to reduce their production costs and enjoy higher profits or offer lower prices to consumers to gain market share.

There are two main types of economies of scale – internal and external.

Internal economies of scale originate within the company due to factors that the company controls such as bulk purchasing, managerial expertise, and technology investments.

External economies of scale originate outside the company in the industry or market, such as government subsidies, access to infrastructure, and skilled labor pools.

How Do Economies of Scale Work?

Companies can achieve economies of scale by embracing some of the following practices:

- Bulk Purchasing Discounts: By purchasing larger volumes of materials and inputs, companies can negotiate lower prices with their key suppliers. This reduces variable costs per unit as volume increases.

- Specialized Equipment: Companies can invest in specialized equipment, machinery, and technology that increases productivity. The cost of the equipment is typically offset and exceeded over time by the lower labor costs and increased efficiency that result from the investment.

- Managerial Expertise: A large business can hire skilled managers and executives with industry expertise to oversee operations. Their knowledge can help optimize the production process.

- Lower Financing Costs: Corporations can access capital much easier than smaller firms through equity issuance and the bond market. They also have higher credit ratings that allow them to borrow at lower interest rates.

- Marketing Power: Large companies can come up with advertising at lower costs due to their high production volumes and have better leverage with distribution channels to get shelf space. Their brand power gives them pricing advantages.

- Learning Curve Effects: As workers repeat tasks, they become more efficient through practice. Companies progressively learn how to expedite their production process.

- Network Effects: Online businesses benefit from network effects where each additional user adds value to the whole user base. Initial fixed costs are spread over a growing user base.

Types of Economies of Scale

Depending on how companies take advantage of their size and output levels, economies of scale can be classified as follows:

Internal Economies of Scale

Internal economies of scale originate from within the company. The management’s decisions and improvements made to the production process are some of the factors that can drive down costs.

- Technical Economies: Improved productivity from investments in specialized equipment and technology.

- Purchasing Economies: Bulk purchase discounts on materials and inputs.

- Managerial Economies: Hiring specialized managers to oversee each function.

- Financial Economies: Better access to capital from size and creditworthiness.

- Marketing Economies: Increased advertising reach and distribution power.

- Risk Bearing Economies: Ability to diversify risk over multiple product lines and geographies.

- Network Economies: Benefits accruing across a higher installed user base.

- Learning Effects: Labor efficiencies over time through repetition and practice.

External Economies of Scale

External economies accrue from outside the company. Location, industry, infrastructure, and other external factors help drive down costs.

- Pooled Labor: Companies benefit from larger labor pools in certain geographic areas. This provides staffing flexibility and typically reduces labor costs.

- Subsidies: Government subsidies tied to size thresholds bring cost savings industry-wide.

- Knowledge Spillovers: Geographic industry clusters promote knowledge-sharing and innovation.

- Specialized Suppliers: Industry clusters attract suppliers that specialize in a given industry. This reduces logistics costs.

- Infrastructure: Industry prominence in an area typically attracts government or private investments in supportive infrastructure.

Limitations of Economies of Scale

While economies of scale help drive down costs as companies grow, there are limits and drawbacks to consider:

- Diseconomies of Scale: Companies that become too large and complex may experience diseconomies of scale, where coordination costs and inefficiencies increase average costs.

- Diminishing Returns: Beyond a certain threshold, additional scale provides limited benefits as other constraints come into play.

- Less Flexibility: Large companies with entrenched processes are less agile and adaptable than small companies.

- Higher Risks When Companies Get Too Large: Larger companies face complex management challenges. Operational risks are greater due to interdependencies.

- Fragmented Markets: For highly segmented markets that demand catering to local preferences, smaller companies may have advantages.

Strategic Considerations

Companies achieve the greatest benefit from economies of scale when the market’s environment aligns with their capabilities and resources. Executives should assess factors such as:

| Market Size | Large and highly consolidated markets favor companies with scale efficiencies. Fragmented markets favor flexibility. |

| Standardization | Highly developed economies tend to favor standardized products. Customized products require more flexibility and may be produced at a higher cost. |

| Technology Intensity | Companies in capital-intensive industries gain larger benefits from scale. |

| Regulation | Regulated markets often have barriers to entry that favor larger incumbents. |

While economies of scale provide powerful cost benefits, companies must weigh scale efficiencies against other strategic considerations affecting competitiveness and profitability. Pursuing scale for its own sake, without aligning it with market realities, can lead to diminishing returns.

Examples of Economies of Scale

The following is a list of examples of how big corporations use economies of scale nowadays to improve their profit margins and financial performance.

Example #1 – Walmart

By centralizing purchasing and inventory management, Walmart negotiates bulk discounts from suppliers to stock up its thousands of retail stores. Its massive purchasing scale delivers rock-bottom costs.

Example #2 – Amazon

Its size allows Amazon to negotiate discounts across a vast array of product categories. AWS also benefits enormously from the large scale of Amazon’s data center infrastructure and cloud capacity.

Example #3 – Airbus

This aerospace company spread its high fixed costs of R&D and equipment over a huge output of aircraft production. It partners with other firms to share some production costs.

Example #4 – Netflix

As its subscriber base grows, Netflix (NFLX) can spread its high content licensing costs over more users. This allows it to beat newer streaming competitors by offering lower subscription costs.

Example #5 – Toyota

Its pioneering ‘just-in-time’ manufacturing system allowed Toyota to minimize the costs associated with procurement and inventory. Their robust supply chain and logistics synergies help boost the company’s economies of scale and profitability.