What are Assets?

Assets are resources owned or controlled by an individual, corporation, or country that hold economic value and are capable of producing a benefit.

Assets are reported on a company’s balance sheet and are obtained through past transactions or events.

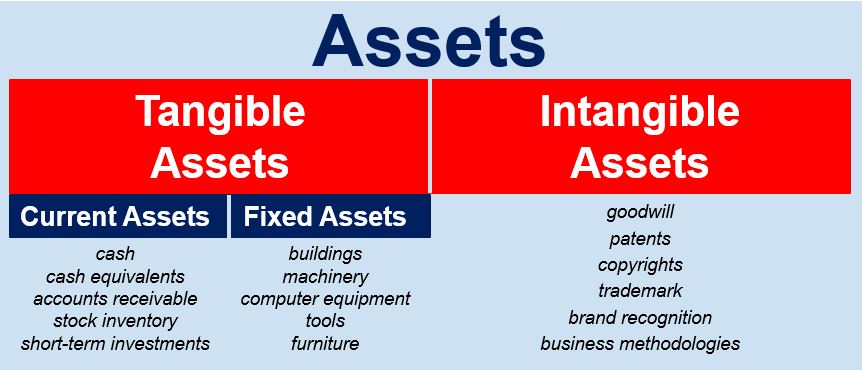

They are classified into different categories like current assets, fixed assets, financial assets, and intangible assets. Assets create value by generating cash flows or providing competitive advantages.

Key Characteristics of an Asset

An asset is a useful resource that an entity owns or controls with the expectation that it will provide a future economic benefit. Aside from that, assets share some or all of the following characteristics:

| Ownership | They must be owned or controlled by an entity like an individual, company, or government. The entity has rights to the asset and can determine how it is used. |

| Value | Assets have economic value that can be measured and expressed in monetary terms. Their value arises from their ability to generate cash flows. |

| Usefulness | Assets are useful resources that enable entities to produce goods/services, strengthen their competitive advantage, or generate income. |

| Future benefit | Assets provide economic benefits in the future, either directly or indirectly. The benefit may arise from producing/selling goods, providing services, investment income, etc. |

Assets create shareholder value for companies as they allow them to generate revenues and profits in the future. Individuals also use assets to build personal wealth.

Types of Assets

Current Assets

Current assets are short-term assets that are expected to be converted to cash within one year during the normal course of operations. This category includes:

- Cash and cash equivalents like bank balances and marketable securities.

- Accounts receivable owed to the company by its customers.

- Inventory such as raw materials, work-in-progress, and finished goods.

- Prepaid expenses for future services like insurance, rent, and utilities.

- Other liquid assets that can be readily converted into cash.

Current assets are the most liquid type of assets. They provide the working capital that is used for day-to-day operations.

Fixed Assets

Fixed assets are long-term tangible assets used for the company’s operations. They include:

- Property, plants, and equipment (PP&E): Land, buildings, factories, machinery, computer equipment, furniture, vehicles, etc.

- Natural resources: Mineral deposits, oil reserves, or water wells owned by the company.

Fixed assets have a useful life of more than one year and are not meant to be sold in the normal course of business. They undergo depreciation to allocate their cost over their lifespan.

Intangible Assets

Intangible assets lack physical substance but provide long-term benefits. Some of the most common intangibles include:

- Intellectual property: Patents, trademarks, copyrights, and business methodologies.

- Goodwill: Value derived from a company’s brand name, customers, and human capital.

- Licenses and franchises that provide rights to market products or services.

- Computer software and proprietary databases.

Intangible assets have a finite useful life and are amortized over that period. In some cases, they may have indefinite lives and are subject to impairment testing.

Financial Assets

Financial assets represent investments or claims owed to the company. They include:

- Equity investments in other companies.

- Debt investments like bonds, debentures, and long-term notes receivable.

- Cash value of life insurance policies or pension plans.

- Lease receivables arising from financial leases.

- Derivative assets like futures, options, and swaps.

Financial assets provide investment returns and capital appreciation. They are generally more liquid than fixed assets.

Is Labor Considered an Asset?

Labor is not categorized as an asset in accounting. Instead, it is considered an expense.

Wages and salaries paid to employees are treated as operating expenses in the income statement, reflecting the cost of labor required to operate the business during a specific accounting period.

Importance of Assets

Assets provide significant benefits to businesses and individuals:

- Generate revenue and cash flows from operations, investments, or financing.

- Enable production of goods and provision of services to customers.

- Serve as collateral to obtain financing from lenders.

- Build wealth through capital appreciation and investment returns.

- Support business growth through mergers and acquisitions.

- Intangible assets like brands, patents, and software provide a competitive edge.

- Tangible assets like plant and equipment are required so a company can operate normally.

- Financial assets provide opportunities to generate income and diversify risks.

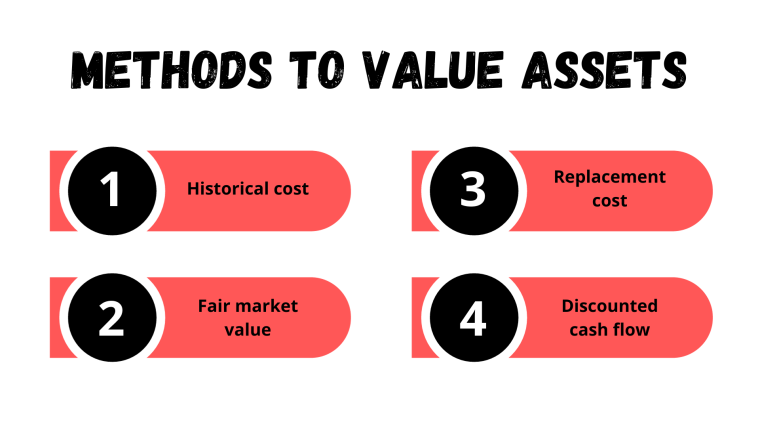

How are Assets Valued?

Several methods are used for asset valuation:

| Historical cost method | Assets are recorded on the books at the amount that was paid to acquire them. |

| Fair market value method | Assets are revalued based on how much a similar asset is worth at the time. |

| Replacement cost method | Assets are valued based on how much it will cost to replace them. |

| Discounted cash flow method | Assets are valued based on the present value of all expected future cash flows. |

Impairment testing is performed when the recoverable amount of assets falls below their carrying value on financial statements. Impairment leads to a write-down of assets.

How Are Current Assets Different From Fixed Assets?

Understanding the distinction between current and fixed (noncurrent) assets is crucial for grasping how businesses allocate and manage their resources.

These two categories of assets serve different purposes and exhibit varying characteristics, reflecting their respective roles in the financial health and operational capacity of a company.

Current assets are those assets that a business anticipates converting into cash, selling, or utilizing within a year or its operating cycle, whichever is longer.

This category includes items like cash and cash equivalents, accounts receivable, inventory, marketable securities, and prepaid expenses. The defining feature of current assets is their liquidity.

They are quick to convert into cash, providing the fluidity necessary for day-to-day business operations.

This liquidity also means their value can change significantly in the short term, reflecting the dynamic nature of a company’s immediate financial activities.

On the other hand, fixed or noncurrent assets are long-term assets that a business does not expect to convert into cash within the next year. These are typically substantial investments that are crucial for the company’s long-term operational goals.

Examples include property, plant, and equipment (PP&E), long-term investments, and intangible assets like patents and goodwill.

Unlike current assets, fixed assets are generally not liquid. They are intended for use over several years and are fundamental to the company’s production and operational capacity. Most fixed assets, excluding land, undergo depreciation.

This accounting practice spreads the cost of the asset over its useful life, reflecting its consumption and wear over time.

The contrast between these two asset types highlights different aspects of a company’s financial strategy. Current assets are about maintaining liquidity and financing short-term operational needs.

In contrast, fixed assets are about long-term investment and the sustainable growth of the company.

Understanding this distinction is vital for analyzing a company’s financial statements, as it sheds light on how effectively the company is managing its resources for both immediate and future growth.

Depreciation of Assets

Depreciation systematically deducts the cost of fixed assets and some intangibles over their useful life from the amount an entity generates in revenue during that same period. It reflects and accounts for the asset’s wear and tear.

Common depreciation methods include:

- Straight-line depreciation: A fixed percentage of the asset’s cost is charged as depreciation every year.

- Declining balance depreciation: Higher depreciation charges in the first few years of the asset’s useful life that start to taper in its latest years.

- Units of production depreciation: The depreciation charged is calculated based on the asset’s usage or output.

Depreciation charges reduce taxable income so companies aim to optimize their depreciation methods to reduce their tax bills. However, aggressive depreciation practices and methods may reduce asset values too rapidly and this can weigh significantly on their balance sheets.

Disposal of Assets

Assets that are no longer useful for operations are disposed to recover their salvage value. Some of the most common methods of disposal include:

- Sale: Assets are sold at market value to interested buyers.

- Exchange: Assets are exchanged for other assets without any cash involved.

- Write-off: The asset’s value is reduced to zero and no salvage value is realized.

- Abandonment: Assets are discarded since they have negligible salvage value.

Any gains or losses on asset disposals are reflected on the income statement. The tax implications and cash proceeds typically affect which method companies choose.

Examples of Assets

Let’s examine some common examples of assets that you will encounter:

Current Assets

- Cash: Money held in cash registers, bank accounts, and on hand.

- Marketable securities: Stocks and bonds that can be quickly converted to cash.

- Accounts receivable: Outstanding invoices owed by customers.

- Inventory: Raw materials, work in progress, and finished goods.

- Prepaid expenses: Rent, insurance, and subscriptions paid in advance.

Fixed Assets

- Land: Property owned by the company.

- Buildings: Factories, warehouses, and office spaces used for operations.

- Equipment: Machinery, hardware, and furniture used to produce goods/services.

- Vehicles: Cars, trucks, and ships used for transporting goods.

- Natural resources: Mineral deposits, timber, oil, and gas reserves.

Intangible Assets

- Brands: Valuable brand names owned by the company.

- Patents: Innovations and inventions protected by patent rights.

- Copyrights: Creative works like books, music, and art that are protected by copyrights.

- Goodwill: Value derived from the company’s brand equity and its customers.

- Software: Custom and packaged software used for operations.

Financial Assets

- Equity investments: Stocks and shares in other companies.

- Bonds: Corporate and government bonds.

- Lease receivables: Assets leased to customers.

- Derivatives: Futures, options, and swaps used for hedging or speculative purposes.

- Insurance assets: Cash value of life and pension policies.

Other Important Considerations About Assets

Some other key considerations regarding assets that our readers may want to be familiar with include:

- Operating assets like machinery is vital for everyday business activities.

- Idle and obsolete assets should be identified and disposed of to save money and free up some otherwise unproductive cash.

- Intangible assets like brands and patents are considered major sources of competitive advantage.

- Depreciation and amortization costs reduce asset values on balance sheets.

- Impairment testing reveals if assets are overvalued on financial statements.

- The value of financial assets should be assessed based on their risks, returns, and liquidity.

Bottom Line

In business, assets are not just possessions; they are the building blocks of success.

Properly managing tangible and intangible assets is fundamental for achieving financial stability, growth, and a competitive edge.

Businesses that prioritize asset management set themselves up for long-term prosperity in today’s ever-evolving marketplace.