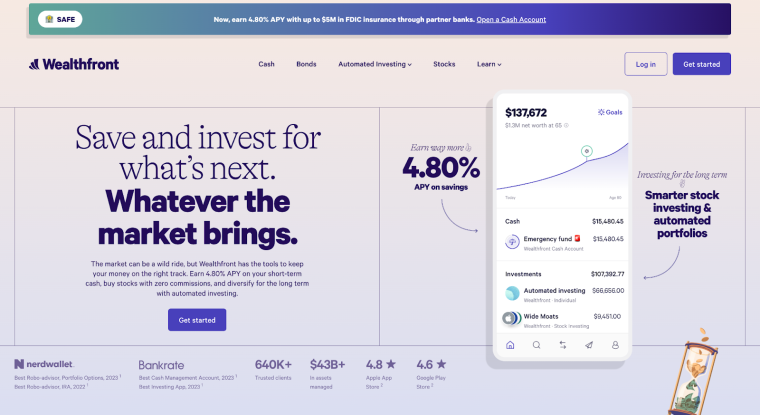

As we kick off our Wealthfront review, it’s important to highlight that the platform is exceptionally well-suited for newcomers and cost-conscious investors aiming to streamline and automate their saving, spending, and investment processes. Wealthfront is a top-tier robo advisor that aims to revolutionize the investing landscape.

According to Statista, assets under management in the robo-advisors market are projected to reach $3 trillion by 2023 and $5 trillion by 2027.

Wealthfront is loaded with many possibilities. From its robust cash management account to its portfolio management and wealth planning tool, the financial app caters to the needs of everyone. In this review, we explore the Wealthfront platform and its features.

| Founded | 2008 |

|---|---|

| Assets | Stocks, ETFs, Index funds, and crypto trusts |

| Deposit fee | $500 for automated investment, $1 for stock and cash management |

| Interest Paid on Cash Balances | 4.80% APY |

| Mobile apps | Android, iOS |

| Financial Advisor | None |

| Customer service | Help Centre |

What Is Wealthfront?

Wealthfront stands at the forefront of modern finance technology, reshaping how people invest and manage their finances.

Established in 2008 by Andy Rachleff and Dan Carroll, Wealthfront has rapidly emerged as a significant contender in the robo-advisory field.

By harnessing sophisticated algorithms and data-driven insights, the platform provides a convenient and economical method for users to access diversified portfolios tailored to their risk preferences and goals.

These portfolios are meticulously overseen and adjusted automatically, optimizing returns and mitigating potential risks to adapt to the ever-evolving market conditions.

Wealthfront strongly believes that advanced financial solutions should not be limited to only the wealthy. This value lies at the heart of their mission.

As a result, the platform has made features like tax-loss harvesting, US direct indexing, high-yield cash accounts, comprehensive retirement planning, access to more than 19,000 no-fee ATMs nationwide with Wealthfront debit cards, and much more accessible to all.

This is supported by its competitive low fees structure, with a minimum deposit of $500 for investment accounts, $1 for cash management accounts, and $1 for stock accounts.

Furthermore, the platform doesn’t impose trading, transfer, or withdrawal fees, except for an annual 0.25% management fee for automated investments.

Customers who choose to keep their funds in Wealthfront will receive Federal Deposit Insurance Corporation (FDIC) coverage. This coverage provides up to $5 million for individual cash accounts and $10 million for joint accounts, along with an impressive annual payment yield (APY) of 4.80%.

This empowers a diverse range of individuals, from seasoned investors to those embarking on their financial journey, to achieve a more robust and secure financial future.

By seamlessly combining finance and technology, Wealthfront has garnered a devoted and rapidly expanding customer base, catering to over 640,000 users.

With over $43 billion in assets under management, Wealthfront continually pushes the envelope of financial innovation through ongoing algorithm refinements, enhanced service offerings, and educational resources.

Pros and Cons of Wealthfront

This section of our Wealthfront review will explore the pros and cons of the platform.

Pros

- Investors can customize their investment portfolio using ETFs and cryptocurrency funds.

- Enjoy fee-free trading, transfers, and withdrawals.

- Direct stock indexing for larger accounts, with a minimum balance of $100,000.

- Benefit up to $5 million in FDIC insurance coverage via partner banks.

- Earn 4.80% APY with no specified minimum or maximum balance.

- Unlimited withdrawals and transfers.

- Debit card availability with access to over 19,000 ATMs.

- Mobile app availability for Android and iOS devices

- Low fee investment starting from $1 for stocks and cash management.

- Multiple account and investment options, including a 529 plan and retirement savings accounts.

- Automated bond portfolio for a less volatile investment approach.

- Goals planning access includes retirement, home purchase, college savings, and travel.

- Customer support through the Help Center.

Cons

- Higher deposit fee ($500) compared to a rival robo-advisor like Sofi that doesn’t charge a minimum deposit.

- No online chat for customer service.

- No human financial advisors.

- No physical branches.

- Only available in the US

Wealthfront Features Explained

Wealthfront offers intrinsic features that provide all traditional investors with complete and real-time management of funds and financial objectives to attain short and long-term goals.

This section explores major features to help investors achieve their financial goals.

Modern Portfolio Theory

As a leading robo-advisor, Wealthfront features the novel Modern Portfolio Theory (MPT) to automate and manage users’ investments.

The MPT is built to seamlessly manage individuals’ diversified investments, which range from index stocks, bonds, exchange-traded funds (ETFs), real estate, and commodities.

Through a data-sourced questionnaire that captures investors’ risk tolerance and financial goals, Wealthfront offers each investing client a recommended portfolio built by MPT.

The MPT approach aims to tailor each portfolio to users’ requirements and optimize returns while managing risks.

Tax-Loss Harvesting

Wealthfront integrates a state-of-the-art tax-loss harvesting feature that stands out amongst other robo-advisor platforms.

The automated investment hub enables long-term investors to minimize taxes on taxable portfolio accounts by automatically selling certain investments at a loss. This offsets high taxable gains and reduces users’ tax liability to the minimum.

The automated Tax-Loss Harvesting optimization helps drive tax savings, enables users to reinvest tax-efficiently, and earns an extra 1.8% after-tax return for investors.

Automated Financial Planning Tools & Account Aggregation

Investors or non-investors can leverage the Wealthfront Path tool to build a real-time view of their financial activities.

The platform’s account aggregation feature enables the connection of various financial accounts, including credit cards, banks, mortgages, and 401(k)s, to the Path tool. This enables clients to understand their financial cash flow, debt, income, and balances.

Investors can also outline long-term financial goals such as a new house, car, and vacation. The path tool will analyze these goals and map out simplified steps to accumulate the necessary funds to cover them.

Furthermore, Wealthfront also provides an Autopilot financial planning tool interlinked with the Path tool.

Here, clients can deposit their paychecks on the platform, and its algorithm will generate the best saving plan.

The Autopilot will save some amount for emergency funds and allocate the rest to portfolios that can earn the best risk-adjusted profits.

529 Education Savings Plan

For those interested in earning interest on education savings, the Wealthfront education savings plan offers an avenue to accumulate funds, achieve significant returns, and facilitate tuition payments conveniently.

This feature enables users to allocate funds for personal or family education purposes, capitalizing on US tax benefits designed to encourage education-related savings.

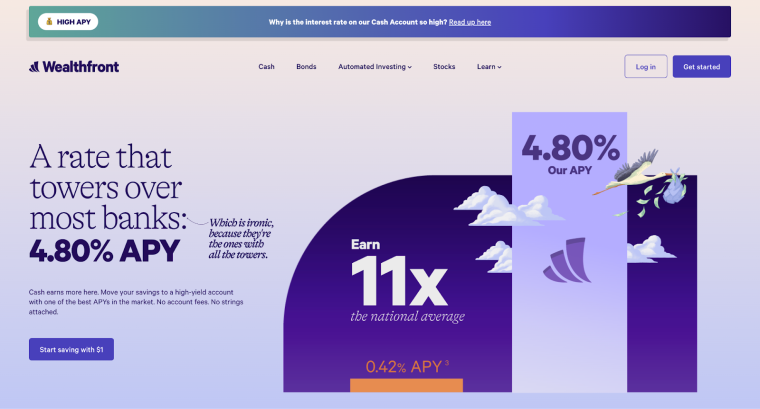

Cash Management Account

The robo-advisor investment firm offers a high-yield cash account option, “Wealthfront Cash.” The account operates like a standard checking account but generates competitive interest rates on cash balances like a savings account.

Investors who use this account feature will earn up to 4.80% annual percentage yield (APY), an incredible yield compared to most banks and financial institutions.

Furthermore, users will enjoy zero charges on account maintenance or automatic teller machine (ATM) withdrawals.

To get started, a minimum deposit of $1 is required. It is worth noting that Wealthfront is insured by the Federal Deposit Insurance Corporation (FDIC). The insurance coverage is up to $250,000.

Portfolio Collaterized Lines of Credit

Another major feature that Wealthfront offers is a collateralized line of credit for clients with a minimum of $25,000 invested in their account balance.

The feature lets users borrow against their investment portfolio balances without selling their assets. Individuals can borrow up to 30% of their portfolio value.

However, it is worth noting that the line of credit application typically charges between 7.65% to 8.90% interest rate per year which isn’t the lowest, especially with collateralized loans.

Nevertheless, the Wealthfront annual percentage rate (APR) is lower than those offered by many credit card or traditional loan providers, with 19.49% and 6.99% to 35.99%, respectively.

The platform loan service is processed in just 30 seconds and is vital for investors keen to enter profit-driven market positions without selling their assets.

What Sets Wealthfront Apart?

The rise in Wealthfront’s popularity can be attributed to its prowess as a robo-advisory platform that simplifies wealth management and provides advantages that empower individuals to achieve their financial goals.

In this segment of our Wealthfront review, we will delve into five key benefits of the platform. These advantages serve as compelling reasons for investors to consider exploring its offerings.

Sophisticated Robo-Advisory Technology

Wealthfront harnesses the power of artificial intelligence and advanced algorithms to provide users with a sophisticated robo-advisory experience.

By employing an intuitive and user-friendly interface, the platform creates custom investment portfolios designed to match an individual’s risk preferences, financial objectives, and timeframes.

Through the automation of their trades, investors allocate their funds across diverse asset classes instead of trying to predict market timing or select specific ‘winners.’ This approach eliminates the chance of human error and instead increases their reliance on the overall market’s long-term growth.

Low-Cost, High-Efficiency Investing

Traditional investment avenues often come with hefty fees, which can eat into potential gains over time. Wealthfront disrupts this paradigm by offering a low-cost alternative that doesn’t compromise quality.

Automated investing incurs a charge of 0.25%, while its stock investing account carries no management fee or commissions.

With significantly lower management fees than many traditional financial advisors, Wealthfront ensures that a larger portion of people’s investment remains hard at work, compounding over time.

This economical approach is particularly advantageous for new investors or individuals seeking to enhance their investment strategies without facing excessively high costs.

Tax-Efficient Investment Strategies

Tax optimization is crucial to wealth accumulation, and Wealthfront excels in this area. The platform employs tax-loss harvesting, a strategy that strategically offsets capital gains with capital losses, thereby minimizing tax liabilities.

Automating this procedure allows Wealthfront to guarantee that investors can retain a larger portion of their diligently earned funds in productive action.

Wealthfront also offers an advanced version of portfolio optimization for investments ranging from $100,000 to $500,000. This enhanced strategy involves stock-level tax-loss harvesting, where Wealthfront substitutes the US stock fund with its underlying individual stocks.

This enables the platform to capitalize on tax losses at the level of individual stocks rather than treating the entire fund as a single entity.

Additionally, the platform offers a 529 College Savings Plan that provides tax advantages for education-related expenses, further solidifying its commitment to helping users maximize their after-tax returns.

Diversification and Customization

Diversification is fundamental to prosperous investment, a principle deeply ingrained in Wealthfront’s approach.

The platform assembles portfolios encompassing an extensive array of asset categories, from equities and bonds to real estate investment trusts (REITs) and funds dedicated to emerging markets.

This diversification minimizes risk by spreading investments across various sectors, industries, and geographic locations.

Furthermore, Wealthfront allows users to customize their portfolios by incorporating specific preferences, such as socially responsible investing or concentrated stock positions, ensuring that individual values are seamlessly integrated into their financial strategies.

Holistic Financial Planning Tools

Wealthfront goes beyond traditional investment management by providing users with holistic financial planning tools.

The platform provides a range of functionalities encompassing various facets of financial health, such as retirement planning, home purchasing, and saving for significant life milestones.

With features like the Path tool, users can simulate various scenarios to visualize the potential outcomes of their financial decisions.

This enables individuals to make knowledgeable decisions, harmonize their actions with their ambitions, and navigate their Path toward financial achievement with clear understanding.

High-Yield Cash Account

Wealthfront offers the Wealthfront Cash Account, a savings solution currently yielding a 4.80% interest rate, on par with various online banking options.

There is one noteworthy feature that makes this account stand out. Through collaborative arrangements with multiple banks, Wealthfront can extend FDIC coverage of up to $5 million for individual accounts and up to $10 million for joint accounts.

Like other savings accounts, funds placed within the Wealthfront Cash Account are immune to investment risks, and the account comes without any associated fees.

Furthermore, for investors who possess a Wealthfront investment account, the cash account remains exempt from the investment management fee.

Whether as a novice investor or a seasoned financial enthusiast, Wealthfront offers a compelling array of benefits that can potentially reshape how investors approach wealth accumulation and management.

Wealthfront Fees

Operating on the Wealthfront platform comes with different fees, and this section of our Wealthfront review will explore them.

Wealthfront’s automated account requires a minimum of $500 to get started, accompanied by an annual 0.25% account management fee. The platform offers a non-automated stock investing account that only mandates a $1 minimum deposit, with no management fee or commissions for those seeking to avoid these charges.

Wealthfront’s 529 plan provides a tax advantage, exempting individuals from federal taxes on qualified education expense withdrawals. Yet, potential underlying fees like commissions and portfolio management could reach up to 0.46%.

Certain account features come with higher thresholds. Both risk parity and US direct indexing necessitate a minimum of $100,000, while smart beta requires a minimum of $500,000 in the account.

While Cash accounts remain exempt from fees, there are several fees associated with the Wealthfront debit card:

| Fee | Amount |

| In-network ATM | Free |

| Out-of-network ATM | $2.50 + ATM owner fee (varies) |

| Bank teller | $2.50 + teller fee (varies) |

| International transaction fee | 2.75% |

| Cash deposits at select retailers | Up to $5.95 |

Investors should note that Wealthfront imposes a $10 fee for each outgoing wire transfer. However, incoming wire transfers do not incur any charges.

Who Is Wealthfront Best for?

Wealthfront is suitable for anyone who wants to invest and plan their lives in an automated fashion. The app makes passive investing simple and easy.

While different classes of investors use the financial app, specific groups are targeted by the robot advisor.

Firstly, Wealthfront is designed for those who are entirely new to financial matters or are inexperienced in investing. The app is built with ease of use in mind, enabling investors to engage in fractional stock investing with $0 commissions.

The platform simplifies the stock selection processes for users by categorizing stocks into themes and opportunities.

New users with limited data can also glean from the platform’s latest perspective to dive into the pros and cons of a stock before investing.

Wealthfront also offers a stock collection, which combines multiple themes and collections to help investors make smarter decisions.

As one of the best robot advisors out there, Wealthfront is best suited for individuals who want a hands-off approach to investing.

These range from automated selection of financial advisory services, optimizing investors’ risk-return tradeoffs, and managing and rebalancing portfolios automatically.

In addition to creating automated portfolios tailored to investors’ financial goals, Wealthfront robo-advisor can also provide other benefits such as the ability to avert human error and bias and low fees.

Wealthfront robo-advisor charges a fee of 0.25% annually, which equals $3.18 per month, lower than traditional financial advisors.

Not only do users enjoy the simplicity of effortless investing, but they also get the luxury of automated payments on the go.

Furthermore, investors looking to invest for the long term at a low cost would find the tool quite beneficial for retirement planning.

Wealthfront makes it easy to choose from globally-diversified automated accounts and build long-term wealth by managing risks and maximizing returns, even with the inevitable up and down of the traditional finance market.

The platform also gives individuals long-term opportunities to invest in a diversified portfolio of low-cost index funds such as stocks and bonds and earn steady returns and potential growth over time.

More so, the robo-advisor’s management fee is competitive and enables users to access various portfolios and financial services, such as index funds, ETFs, and real estate investment trusts (REITs), to increase potential gains.

However, one of the standout features that have caught the eyes of global long-term investors is the Wealthfront tax-loss harvesting ability and its benefits for minimizing tax liabilities.

The platform’s tax optimization services reduce taxes on taxable investments yielded by portfolios, potentially bolstering after-tax returns. This positively impacts the growth of users’ returns over time.

Overall, Wealthfront is best suited for investors with an eye for automated portfolio management, comprehensive financial planning tools, and tax optimization to achieve financial goals for the long term.

How to Get Starting Using Wealthfront

Wealthfront’s automated investment management platform features a simple and intuitive signup process to enable users to get started in five minutes.

This section breaks down this process into a step-by-step guide for easy guidance.

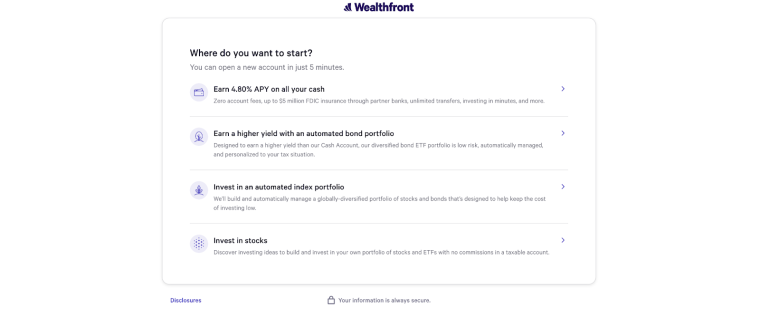

Step 1: Create an Account

The first step to getting started on automated investment is to create an account. To open an account with Wealthfront, an investor must be up to 18 years old and a US citizen.

US investors must visit the Wealthfront official website via a web browser or mobile device and click “Get Started” at the top right corner of the home page.

Once done, a new page will pop up, requiring users to select the type of account best tailored to their investment needs.

These range from annual percentage yield (APY) and automated bond portfolio accounts to automated index portfolio and stock investment accounts.

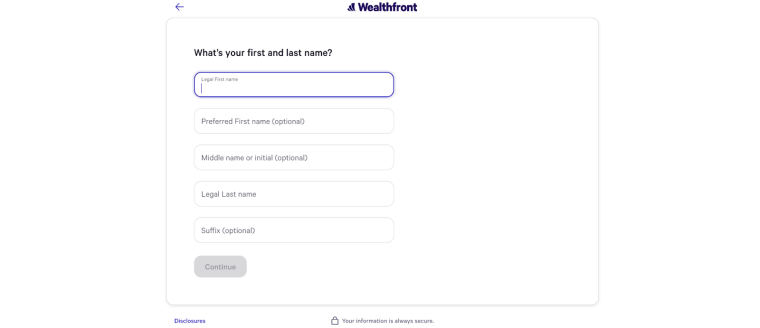

Users will be prompted to enter their personal information, such as a login name, preferred first name, and surname.

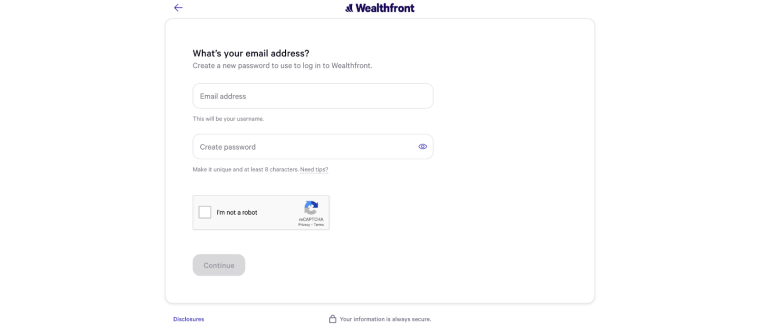

This will be closely followed by a new page that requires users to submit a valid email address and create a secure password.

Next, users will need to verify the email address submitted via their mobile number to prove identification. This only takes a couple of minutes. Afterward, the user must verify their identity by submitting their government ID and other documents.

Step 2: Complete the Brief Investment Questionnaire

After account verifications, Wealthfront will ask users questions about investment goals, current net worth, income, risk tolerance, and so on.

These questions should be filled in accurately, as all responses are used to build and personalize users’ investment plans and portfolio management.

Step 3: Investment Portfolio Creation

After completing the questionnaire, users can view Wealthfront’s recommended investment portfolio for their risk level and other options by increasing and decreasing risk tolerance through a slider.

To further customize an investment portfolio, Click “Edit Portfolio” to add or remove investments.

Wealthfront also offers low-cost ETFs and tax-loss harvesting to build users’ portfolios, minimize tax, and increase returns.

Once the portfolio is created, the platform will use its robo-advisor automation to manage and rebalance it based on users’ financial objectives and conditions.

To further customize an investment portfolio, Click “Edit Portfolio” to add or remove investments.

Step 4: Fund Account & Invest

Once satisfied with the investment portfolio, the next step is linking a bank account to fund the Wealthfront account balance.

Follow the instructions carefully to securely connect a bank account. The platform uses industry-standard bank-level encryption to protect individuals’ financial information.

Bank login credentials will be required for verification purposes. Afterward, investors can seamlessly transfer funds to their Welathfront account and start investing. The minimum deposit required is $500.

Is Wealthfront Worth Using?

If any of the features of Wealthfront detailed in this review caught your eye and the platform is available in your area, there aren’t many reasons not to give it a try (unless you really don’t want to give anyone a picture of your ID). There are no sign up fees and no minimum deposits. Great robo-adviser services with so many features and a shocking lack of fees (with only the 0.25% annual management fee for automatic trading).

References

- Statista

- Investopedia

- Wealthfront

- Wealthfront

- Wealthfront

- Wealthfront

- Tax policy center

- Wealthfront

- Wealthfront

- Wealthfront

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops