Crypto lending has become a popular way to leverage crypto-backed loans in order to profit from crypto volatility. YouHodler, a crypto lending startup based in Switzerland, lets users borrow fiat currencies instantly after providing a crypto asset collateral. The requested crypto-backed loan can later be repaid alongside the collateral which may have increased in value.

Although YouHodler is a leading crypto lending platform, is it the right platform for you? In this YouHodler Review 2025, let’s take a look at some of the platform’s main services, key features, interest rates, and more.

What is the YouHodler Platform?

Launched in 2018, the YouHodler crypto lending platform offers crypto loans, crypto and fiat conversions, and some of the best crypto savings accounts available. These services and features make storing and earning from crypto easier and more accessible to those looking to leverage and hedge their crypto positions.

Crypto-backed loans is YouHodler’s flagship feature which offers loans in USD, EARU, GBP, CHF, as well as Tether (USDT) and Bitcoin (BTC). These crypto loans can be used to help crypto holders stay afloat financially while still holding on to their crypto investments. Additionally, the loans can even be used as a means to buy even more crypto.

The YouHodler platform also facilitates the exchange of cryptocurrencies, fiat, and stablecoins. This means that users who open new accounts without owning any cryptocurrencies can buy cryptocurrencies through YouHodler. With bank transfer, bank card, and even PayPal as accepted payment methods, users of different experience levels can easily deposit and withdraw from the platform.

Aside from offering favorable loan rates and loan-to-value (LTV) ratios, YouHodler also offers a plethora of cryptocurrencies that can be used as crypto collateral when getting a crypto-backed loan. Cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) are among the 46 cryptocurrencies that can be used as collateral.

Headquartered in Switzerland, a growing leader in cryptocurrency, YouHodler offers the same value and security to the 180 different countries it is available in. However, the crypto lending platform currently does not provide services to the following countries:

- United States

- China

- Bangladesh

- Iraq

- North Korea

How YouHodler Works

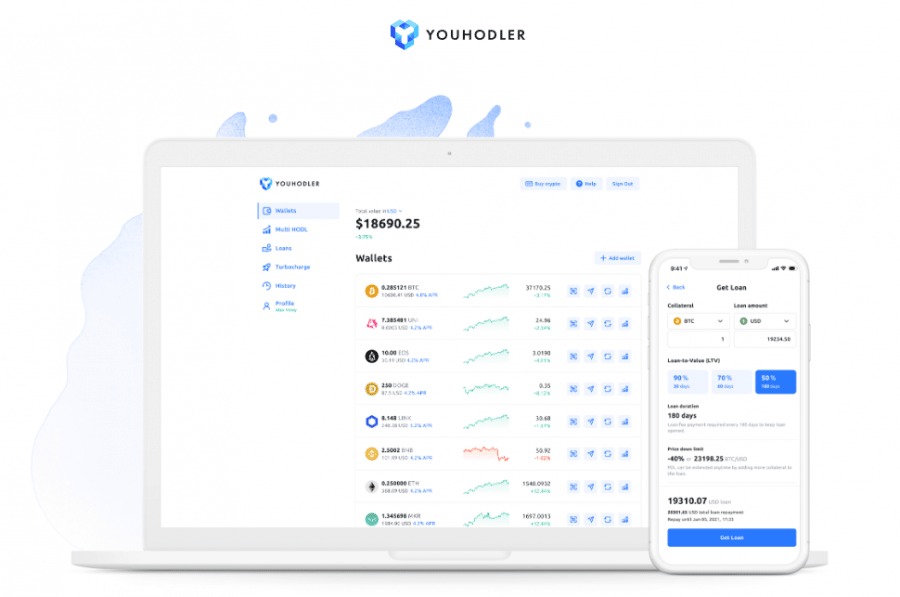

YouHodler works like any other crypto lending platform where a user must register and create an account to start availing of loaning and exchange services. The YouHodler platform can be accessed on a web browser or through their mobile app.

Completing the account verification which requires filling up a short questionnaire, uploading a valid ID, and providing a proof of address. All of YouHodler’s products like crypto loans, conversions, and savings will be available once an account has been fully verified.

A YouHodler user gets access to a YouHodler wallet that starts out with a couple of fiat currency, stablecoins, and crypto options. Users can add wallets to facilitate depositing, withdrawing, and boosting different crypto and fiat assets.

YouHodler Services

Initially, YouHodler was built to only facilitate crypto lending and crypto-backed loans. Over time, the startup has added new and more relevant crypto and fiat products to accommodate the growing demand for crypto financial services. Listed down, these services are:

- Crypto-backed loans

- Crypto exchange

- Crypto and fiat conversions

- Savings accounts

- Multi HODL

- Turbocharge

Multi HODL and Turbocharge are both powered by YouHodler’s crypto-backed loans and make earning through crypto volatility more efficient.

In particular, Multi HODL is a way to create an automated chain of loans. The funds used from the first crypto loan can be used to buy another loan to leverage a crypto position. This can be multiplied up to 50 times.

When using Multi HODL, users will first choose a cryptocurrency pair along with a price direction they want to invest in. Next, they will select an amount for the initial loan as well as the multiplier for the loan chain which is also the amount of risk that is being taken.

How to Get A Crytpo Loan on YouHodler

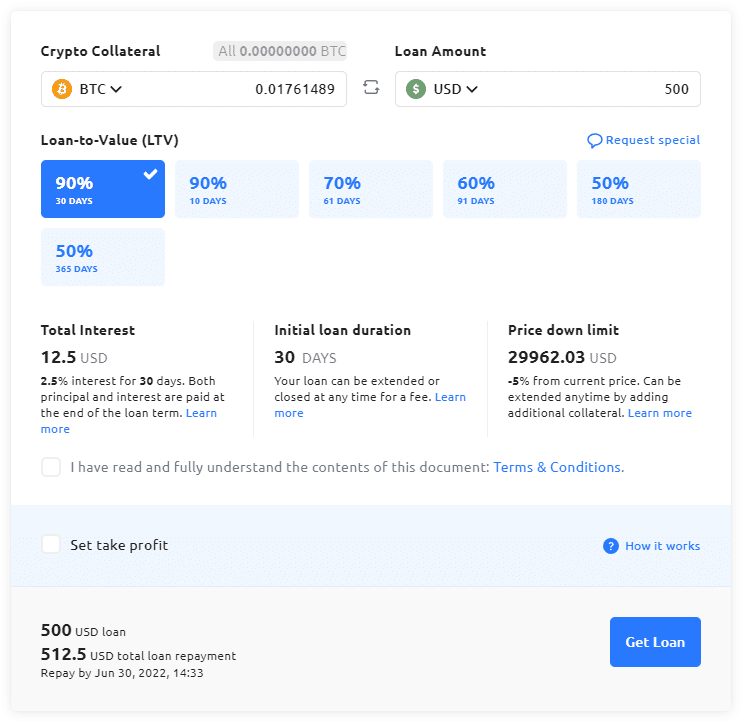

As mentioned earlier, there are many different products that YouHodler offers when it comes to crypto-backed loans. The vanilla crypto loan can be offered with an LTV of 90% for loan durations of 10 or 30 days. The maximum loan duration here is 365 days which is given at a 50% LTV.

Usually, an 80% LTV is considered a favorable loan, so YouHodler’s 90% LTV gives a lot of value. In the case of crypto-backed loans, a 90% LTV for Bitcoin for example means that offering BTC as crypto collateral that’s worth $1,000 gives you a loan amount of $900. The interest as well as principal is paid at the end of the loan’s term.

The first step to getting a crypto loan on YouHodler is by first selecting which crypto you want to use as collateral and which currency you want as the loan amount. There are 46 cryptocurrencies to choose from for collateral and 6 fiat, stablecoins, and crypto to choose from for the loan amount.

Next, you will need to select the LTV and initial loan duration of the crypto-backed loan. Upon choosing these parameters, you can then click ‘Get Loan’ and get the crypto loan. Below is a table showing the interest rate and LTV of every loan duration for Bitcoin.

| Loan Duration | Loan-to-Value (LTV) | Total Interest |

| 10-day loan | 90% | 1% |

| 30-day loan | 90% | 2.5% |

| 61-day loan | 70% | 3.2% |

| 91-day loan | 60% | 5% |

| 180-day loan | 50% | 8% |

| 365-day loan | 50% | 13.5% |

Once you pay the loan within the given loan duration, you can get the crypto collateral offered at any time. Using the built-in loan calculator, users can better manage the loan principal, interest, and potential earnings.

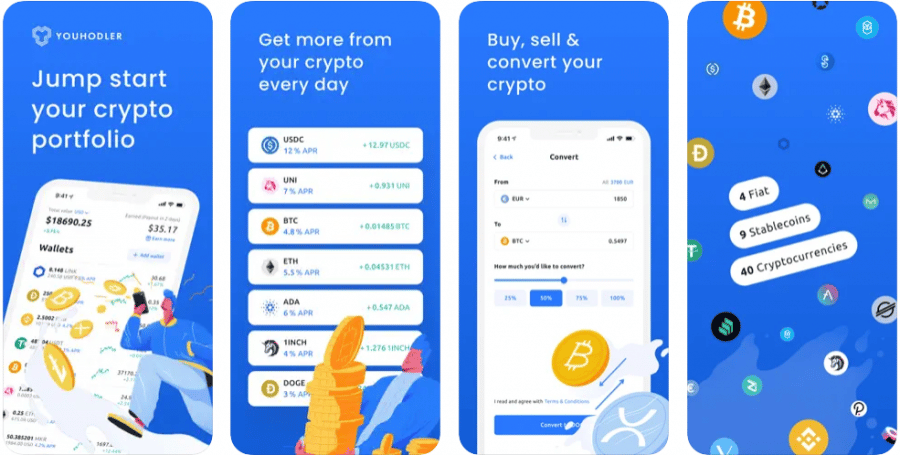

YouHodler Wallet App

The YouHodler Wallet App is available on both the web browser and mobile platform and lets users store 49 cryptocurrencies, 9 stablecoins, and 4 fiat currencies. Crypto-to-crypto, fiat-to-crypto, and crypto-to-fiat conversions are offered on the YouHodler Wallet as well as deposits and withdrawals.

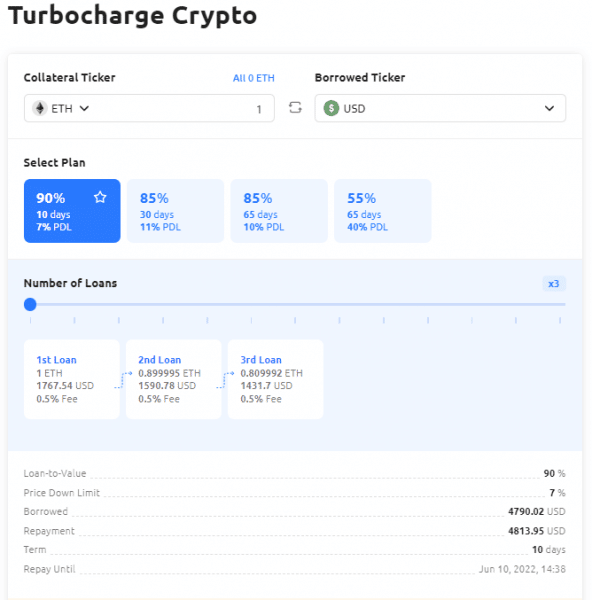

What is YouHodler Turbocharge?

Turbocharge is a crypto-backed loan product offered by YouHodler based on a chain of loans or cascade of loans which is used to leverage a crypto position. Similar to Multi HODL, a user selects how many times a crypto loan is used to buy another crypto loan and so on which can be done 3-15 times.

Those familiar with margin trading can liken Turbocharge and Multi HODL as trading with leverage. The more loans in a cascade of loans, the higher the leverage and the higher the risk.

How to use YouHodler Turbocharge?

The cryptocurrencies stored in your YouHodler wallet can be used as collateral for a Turbocharge. Because the loan payment used from the last loan will be used to pay partially for the first loan in the loan chain, the user will only need to provide the amount of crypto for the first loan.

On the Turbocharge section of the YouHodler dashboard, the user must select a crypto collateral as well as a currency for the loan payment. After that, users must select a plan which denotes the LTV, duration, and price down limit (PDL). The price down limit is the price at which a Turbocharge position is closed from the price of the cryptocurrency when the position was opened.

Here is a list of the Turbocharge plans for Bitcoin as a collateral crypto and USD as the borrowed currency:

- 10 day term, 90% LTV, 7% PDL

- 30 day term, 85% LTV, 11% PDL

- 65 day term, 85% LTV, 10% PDL

- 65 day term, 55% LTV, 40% PDL

Savings Account Interest Rates on YouHodler

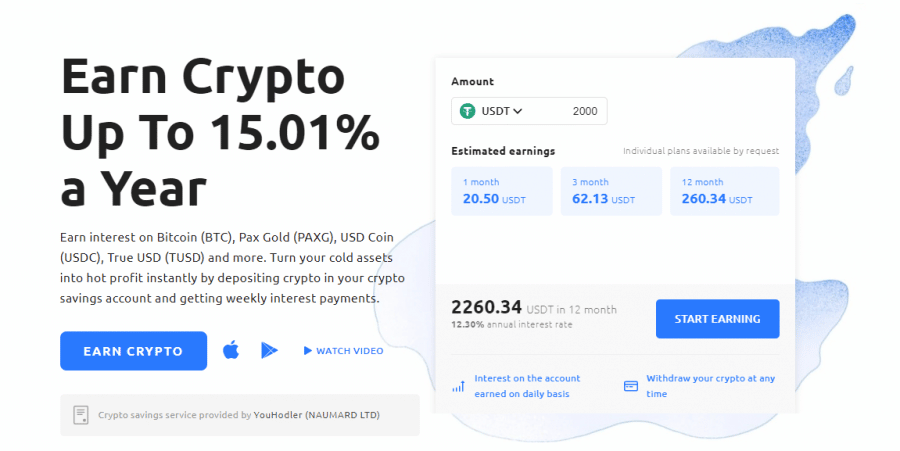

Crypto interest accounts or savings accounts let those who store their cryptocurrencies earn passively. YouHodler offers a crypto savings account for crypto and stablecoins at varying annual percentage rates (APR).

Earn interest on Ethereum (ETH), Bitcoin (BTC), and Litecoin (LTC) as well as stablecoins such as USDT, USDC, and DAI. A minimum of 100 USD in cryptocurrencies is required to start earning interest and the maximum yield is limited to 300,000 USD worth of cryptocurrencies.

Every 4 hours, YouHodler measures the total balance of a user’s wallet and takes the average amount kept on the wallet after a week. It uses this to calculate the interest payout per cryptocurrency stored on the wallet.

Below is a table showing the most popular cryptocurrencies and stablecoins alongside the interest rates offered at YouHodler.

| Stablecoins | Interest Rate |

| USDT (Tether) | 12.3% APR |

| USDC, TrueUSD, DAI, HUSD, EURS, USDP | 12% APR |

| BUSD | 10% APR |

| Other Crypto | |

| Polkadot | 14% APR |

| Cosmos | 10% APR |

| NEAR, Fantom | 9% APR |

| Avalanche | 8% APR |

| Litecoin, Tron, Uniswap, Solana, PancakeSwap, | 7% APR |

| Bitcoin | 6.8% APR |

| Ethereum, Chainlink, Binance Coin, Paxos Gold, Cardano, Bitcoin Cash | 6.5% APR |

YouHodler Fees & Commissions

Crypto loan and exchange fees are one of the key things to take note of when reviewing crypto lending sites. Aside from the usual platform fees like deposits and withdrawal fees, let’s also take a look at YouHodler’s fees for the different crypto products that they offer.

Fees Table

| Platform Fees | Amount |

| Deposit Fees | SWIFT – 25 USD or 20 GBP, Bank Card 1% |

| Withdrawal Fees | USD (SWIFT) – 1.5% min. 70 USD, EUR (SEPA) – 5 EUR, EUR (SWIFT) – 55 EUR, GBP/CHF – 0.15% (55GBP, 15 CHF min.) |

| Conversion Fees | Varies depending on currency |

| Loan Fees | |

| Close Now Fee | 1% of the overdraft amount |

| Reopen Fee | Interest fee + 1% service fee (from the borrowed amount) |

| Extend PDL Fee | 1.5% of the additional collateral |

| Increase LTV Fee | 1.5% of the increased amount |

YouHodler’s Multi HODL involves many moving parts like the chain of loans, interest rates, loan duration, and PDL. In terms of fees, Multi HODL has:

- Rollover fee – the fee incurred for the usage of loans in a position for a fixed amount of time

- Profit share fee – the commission charged for profitable MultiHodls based on the user’s owned funds and loan amount

For YouHodler’s Turbocharge product which comes in 4 different plans, the minimum loan amount to start is 100 USD with a close now fee of 1%. The close now fee lets users repay a loan using the appraised value of their crypto collateral. When the loan is closed, the platform will sell the collateral and use the profit to pay for the repayment of the loan.

YouHodler Exchange Fees

YouHodler’s crypto and fiat conversion services reflect prices of a real crypto exchange. This means that the conversion between crypto-to-crypto, crypto-to-fiat, and fiat-to-crypto will always be changing. Converting USD or EUR to cryptocurrencies takes into account a 0.2% conversion fee then the current exchange rate as well. For example, converting 1,000 USD to BTC (1 USD = 0.000032 BTC exchange rate) gives 0.03168 BTC since only 998 USD of the 1,000 USD is left after the 0.2% conversion fee. For CHF and GBP to crypto, the conversion fee is 0.5%.

Is YouHodler Legit?

The YouHodler brand is a set of services with separate crypto products. The YouHodler wallet and conversion services are offered by Naumard Ltd. a fintech industry expert of over 20 years. YouHodler SA is the Swiss entity that offers YouHodler’s crypto loans, other conversions, Turbocharge, and Multi HODL.

YouHodler is a member of the Crypto Valley Association (CVA), a world leader in blockchain ecosystems that’s also based in Switzerland. The association promotes secured and transparent operations which YouHodler aligns itself with as a member of the CVA. On top of this, YouHodler is also a member of the PolyReg General Self-Regulatory Organization, making it a legal entity that’s recognized by the Swiss Federal Money Laundering Control Authority.

Regulation and honesty is taken very seriously by YouHodler not just as a crypto platform startup, but as a leading global crypto service provider. Their reputation as a quick and efficient loan provider for clients around the world is always held to the best of their abilities. Since crypto security and storage is the most important safety factor for any crypto loaning platform, YouHodler has partnered with Ledger Vault’s custodial wallet solutions so that its clients’ funds are stored in both hot and cold wallets.

YouHodler Security Features

According to YouHodler’s Help Center, the platform is bound by law to give back the cryptocurrencies owned by its users. They state that positions opened on the platform are put in legal contracts that fall under European Union regulations. Each contract is digitally accounted for and made to be executed properly.

Partnering with and integrating Ledger Vault’s services also help to bolster the security of crypto on YouHodler. A crime insurance of 150 million USD in cryptocurrencies is one of the benefits that YouHodler enjoys under Ledger Vault’s program. Wallet private keys and cryptoassets are stored in cold wallets, making the risks of a hack close to none. Also, because hot and cold wallets are integrated in their system, YouHodler gets to maintain a certain level of efficiency and instant access when it comes to executing crypto orders for its clients.

For clients who have balances of over 10,000 USD (can be combination of this worth in crypto and fiat), YouHodler offers the option of locking the assets of these clients. These users can also request to disable crypto withdrawal for security purposes. YouHodler calls this a 3FA security level wherein the user can enable the withdrawals again after added identity verifications steps have been taken.

YouHodler Customer Service & Support

With a live chat and an easy to access help center, YouHodler’s customer support and service meets the standard for the crypto lending industry. In our tests, we got responses from live agents within minutes of sending our inquiry on their chat application. It’s essential that the platform is responsive as clients’ funds and cryptoassets are being handled on YouHodler.

Conclusion

YouHodler builds upon the early stages of investing in decentralized finance where crypto loans were manually executed using the user’s very own crypto wallet connected to decentralized exchanges. The crypto lending platform makes it easy for new and experienced crypto investors to earn passively, leverage crypto positions with loans, and gain access to funds without having to let go of their crypto positions.

There is also a YouHodler product for any type of investor in crypto loans. Those looking to partake in riskier loan investments can use Multi HODL or Turbocharge to earn big on crypto volatility while those looking for stable earnings with crypto savings accounts can store their cryptoassets in the YouHodler wallet.

Above all, YouHodler values the safety of its clients’ crypto assets and has integrated with leading crypto associations like the CVA and custodial wallet services in Ledger Vault to provide industry-level security. Whether you want the option of taking crypto-backed loans to earn or pay for your bills, YouHodler offers these solutions and more in a safe platform. If you want to start earning from your cryptocurrencies and taking crypto loans, open a YouHodler account today by clicking on the link below.

FAQs

How safe exactly is YouHodler?

Is YouHodler considered a cold crypto wallet?

Can you purchase crypto on YouHodler?

Where is YouHodler currently based?