Besides enhanced security and ownership control, cryptos gained popularity for their fantastic passive income potential. Unfortunately, it takes more than simply holding tokens to turn a profit. To streamline this process, modern tech companies have developed platforms to earn interest on crypto assets. Today, we talk about one of the best — Yield App.

Yield is a digital wealth service that facilitates generating passive income for crypto newbies. Our Yield App review examines its functionality, features, and unique selling points. Read on to get the inside scoop.

What Is Yield App and How Does It Work?

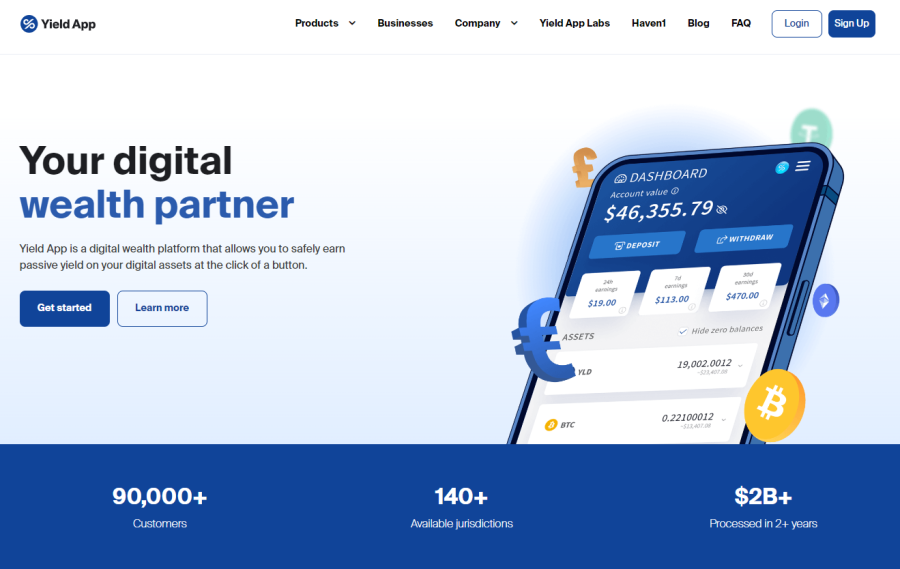

Since its 2021 debut, Yield App’s wealth management platform has generated over $2 billion.

Yield App is a digital wealth management platform designed to help users earn passive income on cryptocurrency assets in a safe and easy manner. It’s based on DeFi protocols, market-neutral strategies and fund allocations backed by traditional banking security measures, and geared toward the average crypto user.

The platform launched in 2021 during a time of crisis but managed to come out of the crypto winter unscathed. Today, Yield is stronger than ever, boasting over 90,000 customers in more than 140 jurisdictions worldwide.

The platform owes its success to a team of financial specialists and a unique, cautious approach to capital management. Drawing from decades of experience in traditional and decentralized finance, Yield’s leaders refrain from leveraging and landing to minimize asset volatility.

Instead, their market-neutral strategies focus on capital preservation, with investments based on due diligence processes and a research and analysis-backed 135-point proprietary risk model.

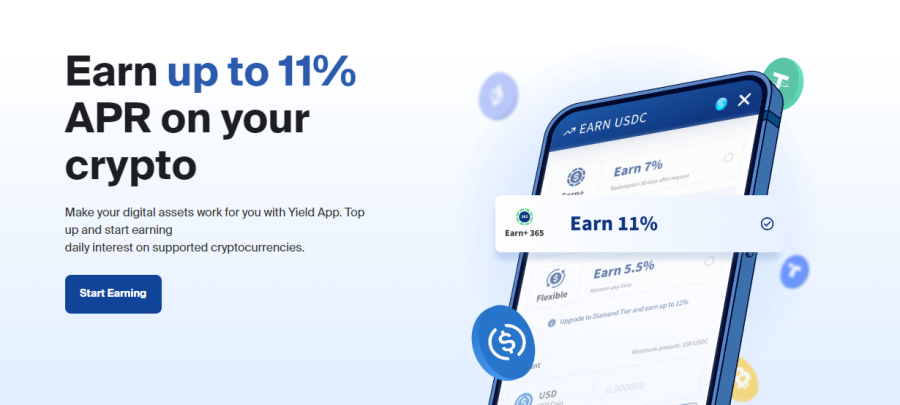

Such a well-rounded strategy allows Yield to offer some of the highest annual percentage yields in the field. The service lets customers earn APYs up to 11% on various popular cryptocurrencies and stablecoins, including BTC, BNB, ETH, USDC, AVAX, and more. It also gives them the option to stake their YLD (native token) reserves for loyalty and referral rewards.

Yield App’s Key Features

Yield App is best known for its crypto interest generation capabilities. However, this platform has a multitude of other features that add to its functionality and appeal. The following Yield App review sections list and discuss each one.

Easy Crypto Interest

Yield App’s primary goal is to help users capitalize on crypto products. The platform leverages market-neutral strategies, investments, and trading to accomplish this.

The specialists behind the brand seek the most profitable Web3 financial investment opportunities, screen for potential risks, and invest in various crypto arbitrage strategies to maximize returns.

To benefit from it, users must go through a standard KYC procedure, make a deposit to fund their first investment and choose one of three Yield App products.

- Earn+ locks your funds for a minimum of 30 days, allowing you to invest in any crypto the platform offers. You can benefit from rates ranging from 5% to 9%.

- Earn+ 365 stakes your deposit for at least a year for potentially higher interest rates. This plan can grant you an APR of up to 11%.

- The Flexible plan doesn’t require you to commit to any timeframe, thus generating smaller daily interest on your investments. This model lets you take out your assets whenever you want without repercussions. Its interest rates vary between 3% and 7%.

The access to these models and the height of interest rates will depend on several factors, including your loyalty tier. Still, the Yield App benefits outweigh the drawbacks.

Substantial Loyalty Rewards

Apart from profiting from popular crypto assets, Yield App also allows you to generate revenue in two other ways:

- Using its native token — YLD

- Through its loyalty program

YLD whitepaper launched in early 2019, with a max supply of 300 million coins. According to CoinMarketCap, around 233 million of them are currently in circulation. Their current price stands at roughly $0.0727 on several major exchange platforms.

To ensure token distribution is fair and to encourage users to invest in them, Yield App developed a Yield App Tier Rewards program. This system awards members for locking their YLD assets based on a four-tier system.

- Bronze: 0–999 YLD

- Silver: 1,000–9,999 YLD

- Gold: 10,000–19,999 YLD

- Diamond: 20,000+ YLD

Interest rates go from 5% to 11%, though they can also reach 12% if you lock your coins for a year.

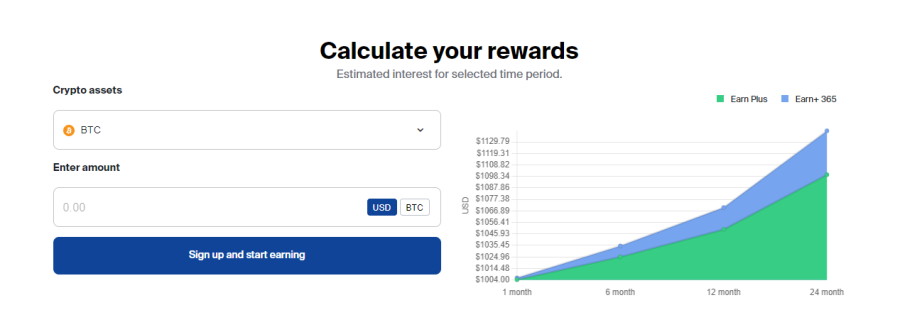

If these numbers seem confusing, Yield App offers a calculator to help you work out your rewards depending on your plan, loyalty level, and assets. The process is simple and can give you an insight into what you can expect before you commit to the app.

Yield App team designed its Rewards program to ensure a fair and sustainable distribution of its maximum coin supply by 2025.

Instant Asset Swap

Yield App’s instant and intuitive exchange is its second most popular feature. It allows users to swap major cryptos (BTC, ETH, USDT, TUSD, DAI, BNB, and AVAX) and two fiat currencies (EUR and GBP). The selection isn’t the broadest in the market, but it ticks all the relevant boxes.

Yield’s Swap tab was designed to be intuitive and offer quick and easy exchanges. Integrated API ensures all quotes are up-to-date, so there’s no discrepancy between the price you see and the one you’ll pay. Flexible limits allow you to swap up to $100,000 worth of crypto and fiat daily, while cutting-edge security keeps your funds safe around the clock.

Yield Pro Crypto-Structured Products

To cater to its professional investors, Yield App offers an advanced version of its digital platform called Yield Pro. The app is compatible with Android and iOS and is built to accommodate any user’s needs.

Depending on your preferences and risk tolerance, Yield Pro users can make the most of market conditions through five unique products.

- Sell-high dual currency deposit strategy allows users who hold popular coins or other crypto assets to trade them for high market prices.

- The dual currency structured product offers customers an opportunity to buy major stablecoins and a cryptocurrency at low market prices.

If you’re unsure which product you prefer, Yield allows you to download a simulator app and test these features free of charge. The simulator offers a chance to try a range of additional products that will soon make their way onto the Yield App platform.

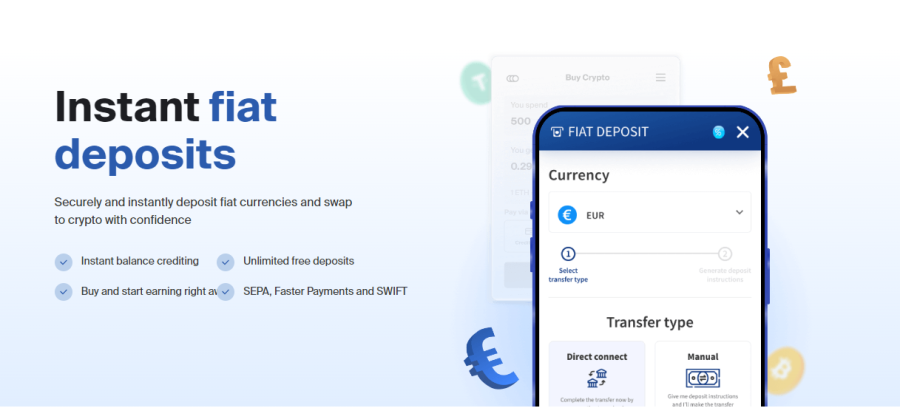

Swift Fiat Deposits

Yield App lets you purchase crypto assets via multiple popular payment solutions, from wire transfers to Apple and Google Pay.

Yield has partnered with premier fiat rails providers, that allow the use of SEPA and Faster Payments, to offer seamless on- and off-ramping. Conversions cover all the above-mentioned cryptos and fiat currencies, offering broad transaction limits. Deposits start as low as 1 EUR/1 GBP and reach a daily limit of $100,000, catering to users with various budgets and investment strategies.

Thanks to a direct connection to major banks, all transfers are uninterrupted and incur no Yield App fees. The platform provides comprehensive instructions, ensuring every user can make a transaction.

Customers can buy and transfer coins to their wallets as soon as their deposit clears. This system streamlines the experience and eliminates the security risks associated with leaving your assets on an exchange platform.

One unique feature of Yield App’s fiat rails is the fact that you are assigned a unique virtual IBAN in your name so all deposits and withdrawals are done in your own name. This eliminates the issue of your bank potentially blocking transactions.

Yield App’s Cryptocurrency Portfolio

As mentioned, Yield App supports eight popular cryptocurrencies, plus its native YLD token. For your convenience, the following list comprises the full selection:

- Tether (USDT)

- Avalanche (AVAX)

- Ethereum (ETH)

- TrueUSD (TUSD)

- Bitcoin (BTC)

- Yield Token (YLD)

- USD Coin (USDC)

- Binance Coin (BNB)

- Dai (DAI)

Users have access to each of these cryptos, whether they’re interested in buying, selling, swapping, or storing them. There are no purchase limits, so you can allocate funds as you see fit. However, your first investment comes with a minimum deposit restriction depending on the asset you’ve chosen, as follows:

- 0.5 BNB

- 0.005 BTC

- 0.1 ETH

- 10 AVAX

- 100 USDT/USDC/TUSD/DAI

What Interest Rates Does Yield App Offer?

In order to gain insight into potential profits with Yield App, we provide a table displaying the interest rates offered by its crypto assets. The table breaks down information according to the three plans our Yield App review outlined.

| Crypto Asset | Flexible plan | Earn+ plan | Earn+ 365 plan |

| BTC | N/A | Up to 5% | 7% |

| ETH | Up to 3.5% | Up to 5.5% | 7.5% |

| AVAX | Up to 3% | Up to 5% | N/A |

| BNB | Up to 4.5% | Up to 6% | N/A |

| USDT, USDC, TUSD, and DAI | Up to 7% | Up to 9% | 11% |

As you can see, Yield App rewards commitment. In general, the longer you lock up your assets, the better rates you’ll enjoy. The same goes for the loyalty program. Rates rise with the loyalty tiers. Users must lock over 20,000 YLD and reach the Diamond tier to gain access to the Earn+ 365 plan.

Yield App’s Withdrawal Process

Yield App clears withdrawals within minutes, offering instant cashouts anytime, anywhere.

When withdrawing crypto the process is as on any platform. Simply withdraw to any wallet on the supported chains. When it comes to fiat, withdrawing is done into the same IBAN or bank account that you have made the deposit from. This whitelists your bank account and ensures the only place to withdraw is where you deposited from.

If you take advantage of Yield App’s loyalty program you can also enjoy 3 free crypto and 1 free fiat withdrawal per month.

Users can withdraw assets regardless of plan selection. Nevertheless, they’ll lose the privilege of interest and rewards if assets are redeemed before the lock-up period ends.

Whatever the case, they must follow Yield App’s withdrawal minimum limits, which are as follows:

- 0.0008 BTC

- 0.1 AVAX

- 0.03 ETH

- 100 YLD

- 0.01 BNB

- $100 USDT/USDC/DAI/TUSD

Customers who’ve completed their identification verification can withdraw up to $1,000,000 a day and $5,000,000 a week. Yield will indicate the transfer was initiated in your name, preventing cancellations or blocked transactions.

Does Yield App Incur Fees?

Most contemporary crypto investment and trading services charge fees as part of their operational structure, and Yield App isn’t an exception. However, as some previous sections note, this wealth management service doesn’t incur traditional fees. It applies a spread to its exchange rates instead.

As a result, users don’t pay costs outside the investing and trading prices they see when choosing between the available assets. They also aren’t subject to inactivity, rollover, or other similar expenses rival networks impose. Withdrawal fees are the only additional costs on this platform.

Such expenses vary depending on the crypto asset and type of currency you’re redeeming. You can see the details in the table below.

| Crypto Asset | Withdrawal fee |

| Bitcoin | 0.0007 BTC |

| Ethereum (ERC-20) | 0.01 ETH |

| Avalanche (AVAXC) | 0.05 AVAX |

| Binance Coin (BEP-20) | 0.005 BNB |

| YLD token (ERC-20) | 20 YLD |

| USDT, USDC, DAI (ERC-20) | $10 |

| EUR and GBP | 0.1% with a minimum of 15 EUR/GBP |

Note: Fiat withdrawals include a refund fee of $/€15. The platform applies it when you initiate a transaction that cannot be completed.

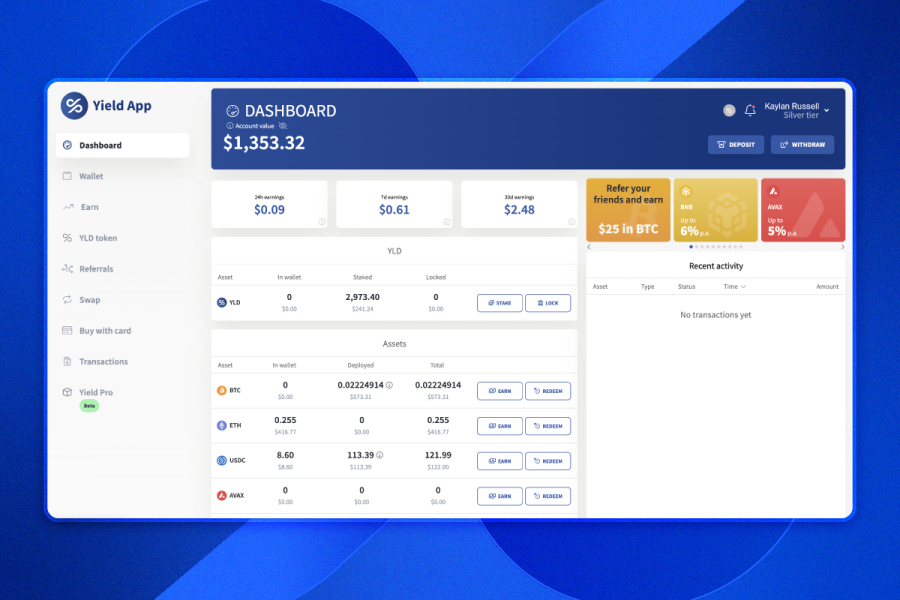

Yield App’s Interface and User Experience

Yield App’s intuitive dashboard allows for easy deposits and withdrawals, enabling users to start earning instantly.

Yield App employs the latest technology to provide users with the ultimate crypto investment and trading experience. It’s developed with desktop and mobile users in mind by providing both a web-based platform and a standalone mobile app. The latter is one of Yield’s most recent launches, compatible with various devices and operating systems.

Yield’s interface is minimalistic across the board. Its clean dashboard and well-organized sidebar are easy to navigate. The software performs well whatever feature you use, with no lags and glitches. This blend of simplicity and functionality appeals to beginners and seasoned investors alike.

Yield App’s Security and Regulatory Standards

Yield App meets the highest standards when it comes to regulations. The platform is operated by Yield App Limited, a business organization incorporated under the laws of the Republic of Seychelles.

It boasts an Organismo Agenti e Mediatori – OAM registration in Italy as a virtual currency provider which complies with the EU guidelines. The organization also employs a team of experienced executives led by CEO Tim Frost, a fintech and blockchain specialist with a background in companies like Wirex and EQIBank.

The situation is similar on the security front. While it doesn’t have a hard asset or collateral backing its crypto assets, Yield App implements a comprehensive risk-averse strategy and a range of advanced safeguards.

The brand is integrated into Amazon Web Services, checking additional safety boxes, from identity management to connection and database security. Yield also works with third-party SOC and GDPR-compliant KYC/KYB/KYT service providers to protect its users and their sensitive information and assets.

Yield’s Customer Support

Yield App has a comprehensive customer support system. The platform’s helpdesk works 24/7 via two communication channels — live chat and email. Users can access the former on Yield’s platforms and the latter at [email protected]. Responses are prompt, and the agents are friendly and helpful.

Those with less urgent questions may find answers in the elaborate Help Center. The FAQ sections have detailed explanations, offering an excellent onboarding experience. Make the most of it by targeting specific questions in the search engine or browsing topics through the filtering system.

Yield’s Help Center covers dozens of topics, answering questions about this platform’s functionality and capabilities.

Yield App Advantages and Disadvantages

In order to understand Yield App, one must weigh its pros and cons. The information below includes both to help you make up your mind about this innovative wealth management platform.

Pros ✅

- Competitive interest rates — Yield App lets users earn up to 11% APY with Earn+ 365 investments and up to 12% through YLD staking.

- Instant crypto swaps — The service allows all users to swap their crypto assets without Yield App fees.

- Streamlined on- and off-ramping — Yield partners with leading fiat rails providers to offer seamless transactions with 1 EUR minimum deposits.

- Fantastic loyalty benefits — Staking YLD coins grants patrons higher interest rates and the opportunity to earn BTC referrals and other generous rewards.

- State-of-the-art security — Yield App is integrated into Amazon Web Services, works with third-party SOC and GDPR-compliant KYC/KYB/KYT providers, and employs 256-bit encryption technology.

Cons ❌

- Few supported cryptos — Yield App supports only nine cryptocurrencies, including four stablecoins and its native token.

- Not available in the US — The platform still hasn’t launched its services in one of the biggest crypto markets, the US.

Bottom Line

Despite being relatively new, Yield App is among the best digital wealth management services in the crypto arena. The company comes from a talented team of financial specialists with decades of experience. It provides market-leading yields on various popular cryptos, facilitates instant crypto swaps and conversions, and offers fantastic loyalty perks and rewards.

As a cherry on top, Yield is protected by military-grade security and is simple to download and use. Whether you’re a beginner or a veteran, the platform makes for an excellent companion for your crypto investment journey. Check it out and see for yourself.