DeFi – or decentralized finance, is a fast-growing sector that aims to revolutionize traditional banking and lending methods.

More specifically, DeFi enables you to earn interest on your idle crypto tokens, borrow funds, secure insurance, and more without needing to go through a third-party entity.

In this guide, we explore what DeFi crypto is and how you can benefit from this investment space from the comfort of your home.

DeFi Crypto Explained

In a nutshell, DeFi is a relatively new segment of the cryptocurrency and blockchain technology arena. The overarching objective of DeFi is to replace conventional banks and financial institutions with decentralized smart contracts.

- For example, let’s suppose that you wish to earn interest on your savings.

- When putting your capital into a traditional savings account, you will likely earn in the region of 0.1% per year.

- In comparison, when depositing crypto tokens into a DeFi platform, you can earn double or even triple-digit APYs.

- Moreover, there is no requirement to go through a centralized body, as DeFi platforms are decentralized.

- Therefore, you do not need to trust that your money is being well looked after, as the tokens are held by a smart contract that is immutable.

The above example can be achieved in a number of different ways – such as through a crypto interest account, staking, or yield farming. We explore these terms in great detail throughout this guide on DeFi crypto.

Another segment of the DeFi sector centers on borrowing capital. Ordinarily, if you wish to take out a loan, you would go through a bank or online lender.

The provider in question would ask you to fill out an application form that details specifics surrounding your financial profile and credit history.

- At the other end of the scale, you have DeFi crypto loan platforms.

- These are decentralized providers that allow you to borrow funds without needing to provide any personal information or have a credit check run on you.

- No documents need to be uploaded to support your loan application either.

- Instead, DeFi crypto lending sites simply require you to put up a security deposit in the form of crypto – and your loan will be approved instantly.

All in all, DeFi crypto platforms put everyday financial services back into the hands of ordinary citizens. As a result, you can retain full control over your financial needs rather than needing to go through a third-party institution.

How DeFi Works

So now that we have covered the basics, this section of our beginner’s guide on DeFi crypto will break down the core fundamentals of this sector.

To begin, we will explore some of the most common ways that DeFi allows you to generate an attractive yield on your money.

DeFi Crypto Interest Accounts

The first niche market that DeFi is likely to take over soon is traditional interest accounts. In the US, retail banks are currently offering less than 0.10% per year to savers. While this could rise a bit due to the Federal Reserve increasing interest rates, don’t expect it to go beyond an APY of 1% in the near future.

You might also look at CD accounts, which offer a higher rate of interest when you agree to lock your funds for a minimum number of months or years. Nonetheless, CD accounts still pay a pittance, so you’ll be lucky to get more than 2-3% annually.

In comparison, the best DeFi crypto platforms in the market will offer much higher returns.

For example:

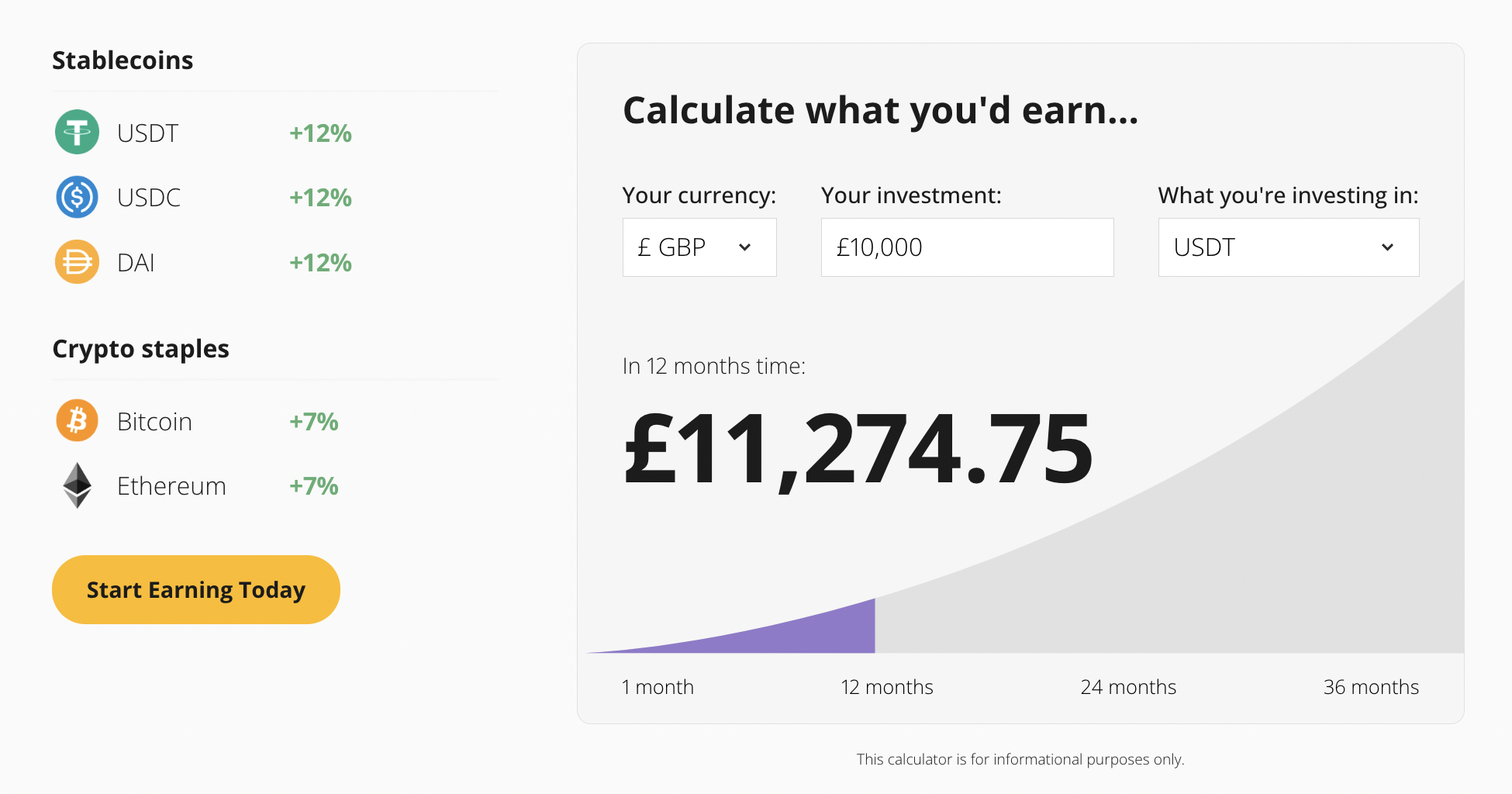

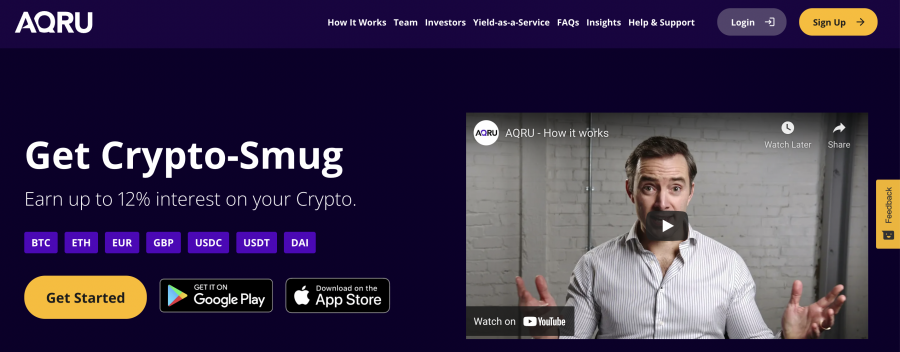

- You could deposit USD, EUR, or GBP into leading crypto interest account provider Aqru

- You can then convert your deposit into a stablecoin like USD Coin (USDC) – which is pegged to the US dollar

- In doing so, you will earn an APY of 12%

- Best of all, unlike CD accounts, there are no lock-up terms to meet when using Aqru

In addition to being able to earn 12% annually on stablecoins, Aqru offers an APY of 7% on both Bitcoin and Ethereum.

DeFi Crypto Staking

Putting funds into a DeFi interest account is not the only way that you can generate a yield in the decentralized finance sphere. On the contrary, you might also consider staking.

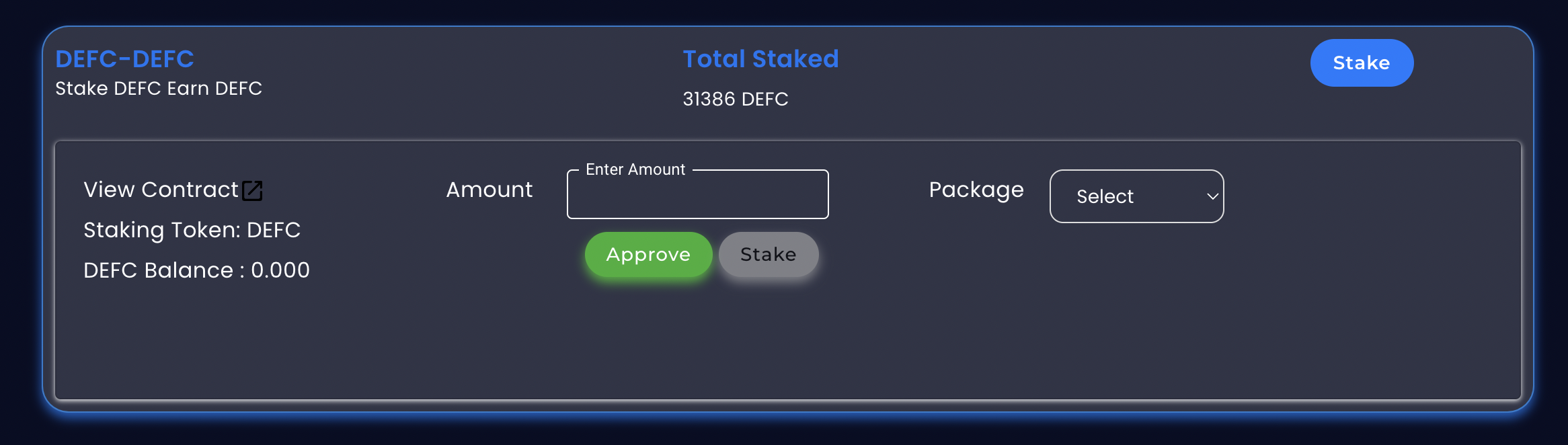

Staking allows you to earn an attractive APY simply for locking your tokens away for a certain number of days or months. You can do this directly with the respective blockchain, but yields are much higher when going through a specialist DEX (decentralized exchange).

For example, leading DEX DeFi Swap allows you to earn an APY of up to 75% when staking your tokens for 365 days. You can earn a slightly less attractive yield when staking for 30, 90, or 180 days.

Either way, once your chosen term has expired, you will receive your tokens back alongside the interest that you have generated.

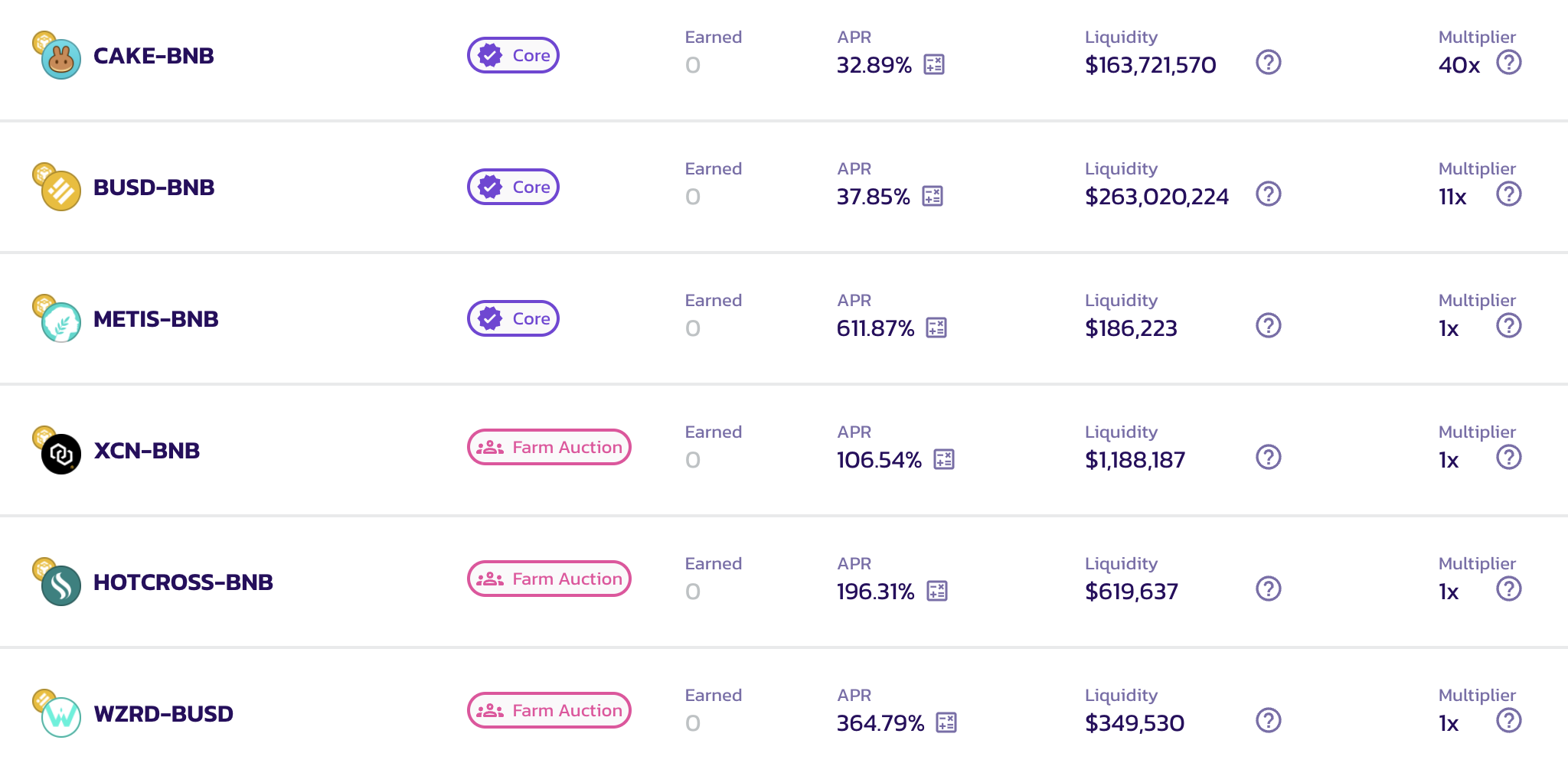

DeFi Yield Farming

You might also consider yield farming when learning how the DeFi crypto space works. This investment scene is somewhat similar to staking, insofar as you will generate a yield for lending out your tokens.

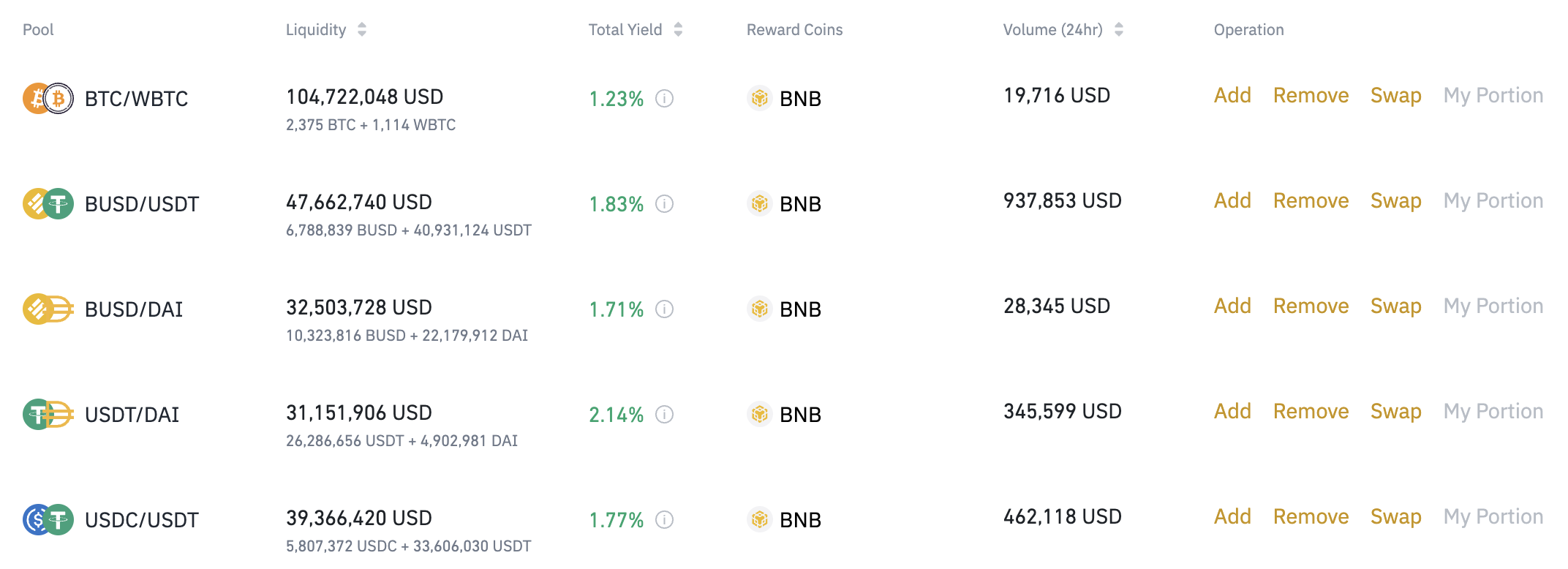

However, while staking requires just one crypto asset, yield farming will see you lend funds to a trading pair. This is because the tokens will be used to provide liquidity for buyers and sellers at the respective DEX.

For example:

- Let’s say that a DEX offers the trading pair ETH/DAI

- This means that traders can use the DEX to swap ETH tokens for DAI – or visa-versa

- However, in order for traders to be able to do this without a third party, there needs to be a sufficient number of tokens deposited into the liquidity pool

- And, by providing the liquidity needed with your idle crypto tokens, you will earn a yield

When utilizing a DeFi yield farming platform, you will need to provide equal amounts of each token within the respective pair. For example, if you provide $500 worth of Ethereum, the same amount needs to be supplied in DAI.

In terms of APYs, this won’t be fixed like in staking. Instead, you will receive a percentage share of any fees collected by the DEX – when buyers and sellers trade the pair that you have provided liquidity for.

DeFi Loan Facilities

As we briefly mentioned earlier, DeFi crypto sites will oftentimes provide instant loan facilities that require no credit checks or even personal information.

Instead, in order to obtain a DeFi crypto loan, you simply need to deposit some collateral. The LTV (Loan-to-Value) ratio that you have access to will depend on the platform you are using, albeit, this typically averages 50%.

This means that by depositing collateral of $4,000, you will have access to an instant credit line of $2,000. Best of all, many DeFi loan sites not only give you the option of receiving your borrowed funds in crypto – but fiat money too.

As a result, this can be a great way to access real-time financing without needing to sell your digital asset holdings. And, if the assets that you deposit as collateral appreciate while the loan is outstanding, you will still benefit from this.

DeFi Swaps

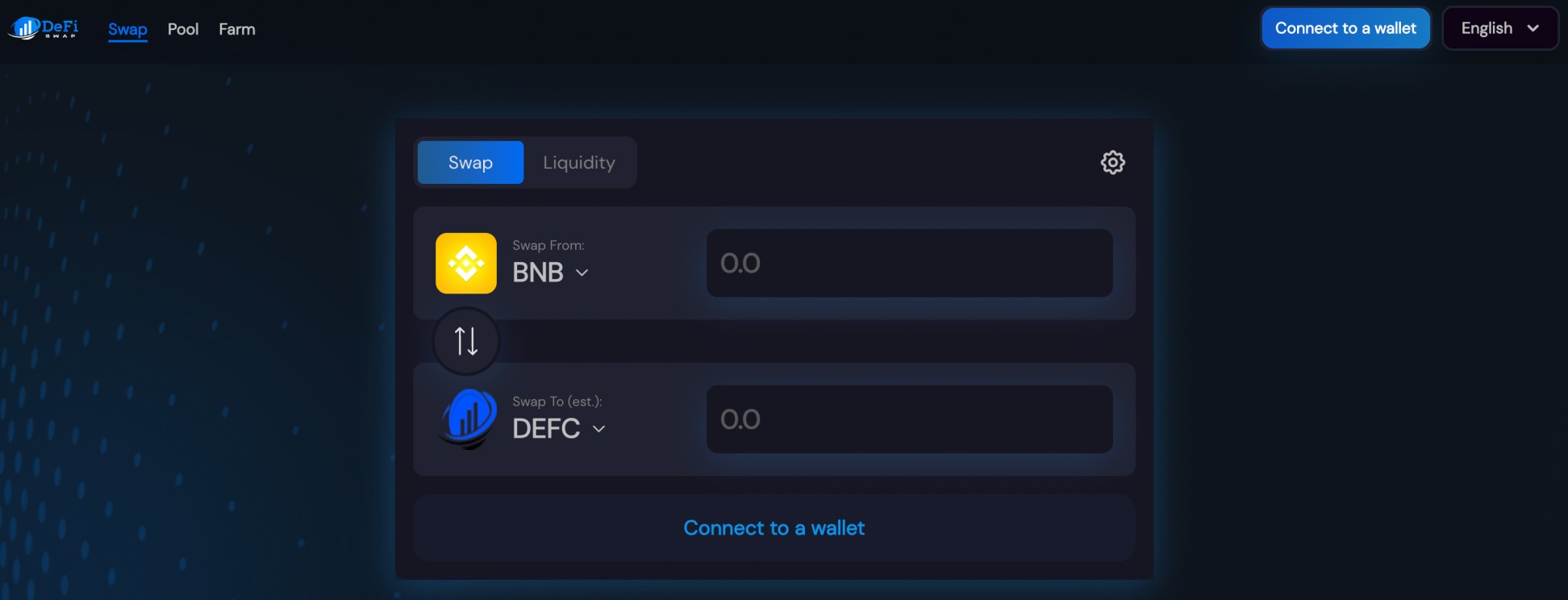

Another popular segment of the DeFi crypto space is the ability to swap assets without needing to go through a centralized broker or exchange.

- For instance, let’s suppose that you wish to swap Tether for DAI – because you believe that the latter is the safest stablecoin of the two.

- Ordinarily, you would need to transfer the Tether tokens from your private wallet and into a centralized exchange after opening an account.

- You would then need to manually exchange Tether for DAI

- You would then be required to withdraw the DAI back to your private wallet

The above process can be completed at the click of a button on a DeFi crypto site without needing to transfer any tokens to a centralized exchange.

Instead, the process is instantly carried out by a smart contract. This feeds back into the previously discussed section of crypto yield farming.

In the very near future, we will likely see DeFi swaps go above and beyond just crypto assets. Perhaps, it might be possible to swap gold for silver or stocks for bonds. Ultimately, the possibilities are endless with DeFi.

Decentralized Finance vs Centralized Finance

At the heart of DeFi is its decentralized status. This means that when using a leading DeFi platform like DeFi Swap, there is no interaction from centralized third parties.

The reason for this is that decentralized finance providers take advantage of smart contract technology. The underlying code backing the smart contract is both immutable and transparent – just like its blockchain counterpart.

And, smart contracts on decentralized finance sites allow the platform to operate autonomously. This means that users can engage with DeFi crypto investment and lending products without actually needing to deposit funds.

Instead, you simply need to connect your crypto wallet to the DeFi platform and choose the service that interests you. This is in stark contrast to how centralized finance providers work.

For example, let’s suppose that you wish to invest in stocks with a traditional broker. In doing so, you would be required to:

- Open an account by providing a wealth of personal and financial information, alongside your contact details and social security number

- Upload KYC documents – such as a copy of your government-issued ID and proof of address

- Make a deposit into your account

- Search for assets and leave them in your brokerage portfolio

There are many issues with the above processes executed by centralized finance providers. First and foremost, you are required to supply a significant amount of personal data – which then needs to be backed up by documentation.

In comparison, decentralized finance platforms require no personal information or contact details from you.

You then have the issue surrounding deposits and investments. When using a centralized finance platform, you need to trust that the provider will keep your payment details secure and that your investments are safe.

On the other hand, decentralized finance platforms do not act as a custodial for your funds or investments at any time. On the contrary, payments and transactions are handled by smart contracts autonomously, which the DeFi platform cannot amend.

Therefore, many would argue that DeFi providers are not only less intrusive than centralized finance platforms, but more secure.

Why DeFi is Important

The introduction of Bitcoin and the blockchain protocol in 2009 created a life change in how we view money.

That is to say, it has since become apparent that we no longer require conventional banks and centralized providers to access everyday financial services like savings, interest, loans, and international transfers.

Instead, DeFi enables us to access the aforementioned services without the need for a centralized body at all. Instead, the entire industry works on the peer-to-peer ethos.

- This means that you can transfer funds to friends and family without needing approval from a bank.

- This also means that you can earn interest on your idle digital assets without needing to deposit anything into a centralized account.

- And moreover, this also means that you can access financing without needing to go through a long and drawn-out application process or check with a traditional lender.

Not only does DeFi allow us to bypass the middleman, but this also reduces the cost of doing business. It’s similar to open source crypto.

For example, let’s suppose that you wish to borrow funds to cover a short-term debt. The standard process would require you to fill out an application form that asks for your personal information and financial background.

The lender would then run a credit check to assess whether or not you can afford to repay the loan. This cumbersome application process can be costly for lenders, which in turn, will result in high-interest rates.

However, when using a DeFi crypto loan platform, there are no credit or affordability checks, so you will benefit from much lower APRs.

Benefits of DeFi

In this section of our beginner’s guide, we will explore the many benefits of DeFi crypto.

Very Attractive Yields

It goes without saying that one of the biggest benefits of DeFi crypto is that the sector gives you the opportunity to earn very attractive yields.

Although the specific APY will depend on your chosen platform and token, as well as the lock-up term and specific DeFi product, double and triple-digit APYs are highly achievable.

This will allow you to grow your wealth at a much faster rate when compared to depositing funds into a conventional checking or savings account.

Stablecoins Reduce Volatility Risk

There is no denying that crypto assets are volatile. This is even the case with large-cap market leaders like Bitcoin and Ethereum.

This means that although you might earn an attractive interest yield on your idle tokens if their market value declines by more than the APY that you generate, you will make a loss.

Therefore, you might instead consider a DeFi crypto provider that supports stablecoins. After all, stablecoins are pegged to the value of a fiat currency like the US dollar.

Furthermore, and perhaps most importantly, the likes of USD Coin and DAI are actually backed by reserves. While in the case of the former its reserves consist of US dollars the latter is backed by Ethereum.

Either way, you can earn an APY of 12% on both USD Coin and DAI when using Aqru. This will allow you to reap the benefits of DeFi without taking on volatility risk.

Note: Stablecoins also come with an inherent level of risk. Terra USD, for example, was recently de-pegged from the US dollar and subsequently hit lows of $0.13. The stablecoin was, however, backed by an algorithm rather than actual reserves.

Retain Full Control Over Your Wealth

Whether you have US dollars in a bank account, digital assets in an exchange, or stocks in a brokerage account – there is one common denominator. That is to say, you never really have full control over your wealth.

After all, what if your bank decides to freeze your account or your crypto exchange provider is hacked remotely? Either way, you can never be 100% sure that your funds are safe.

Once again, this is where DeFi comes in. First and foremost, if you hold your digital assets in a DeFi wallet, you are the only person to have access to your private keys and password.

This means that no matter what, the provider of the DeFi wallet is not able to gain access to your funds. Therefore, you retain full control of your digital assets at all times.

Another thing to note is that DeFi platforms never touch your tokens when you utilize one of its investment products.

- For instance, let’s suppose that you wish to use DeFi Swap to benefit from a staking APY of 75%.

- To proceed, you simply need to connect your wallet to the DeFi Swap website.

- Then, after choosing your required terms, the DeFi Swap smart contract will transfer the tokens from your connected wallet and into the respective staking pool.

- When the staking term concludes, the smart contract will transfer your original tokens plus interest back into your wallet.

All in all, DeFi is slowly but surely putting control back into the hands of individuals and away from centralized banks and financial institutions.

Passive Income

Another benefit of DeFi crypto is that you can earn income passively. Irrespective of whether you opt for an interest account, staking, or yield farming – once you have made a deposit there is nothing else for you to do.

This will appeal to investors that wish to generate a return on their capital without having to constantly research the markets.

Is DeFi Crypto a Good Investment?

As with any investment that you are considering, DeFi isn’t without its risks – which we cover in more detail shortly.

With that said, the types of yields on offer can be highly significant. This is especially the case if you are a long-term crypto investor.

After all, why keep your crypto tokens in a private wallet sitting idle, when you can deposit the funds into a DeFi platform to earn interest?

In fact, you stand the chance of earning income on two fronts. This is because, in addition to your DeFi interest, you will benefit financially if the value of the respective tokens increases.

For instance:

- If you invest $10,000 into Bitcoin and it increases by 20% over the course of 365 days, your portfolio will be worth $12,000

- However, let’s say that after making the $10,000 investment, you deposit the funds into Aqru

- After one year, not only has your $10,000 Bitcoin investment increased by 20%, but you will also generate interest of 7%

Another thing to note about DeFi is that there are multiple ways to gain exposure to this industry.

For example, you can invest in DeFi via stocks, managed smart portfolios, leveraged tokens, yield farming, staking, interest accounts, and much more.

Best DeFi Platforms

This guide has so far explained the ins and outs of how DeFi crypto works. In this section, we are going to discuss the best platforms that operate in this space.

The DeFi platforms discussed below offer a variety of investment and lending products, yields, terms, and payment methods – so be sure to read our reviews in full.

1. DeFi Swap – Overall Best DeFi Platform

We found that the overall top DeFi platform to use right now is DeFi Swap. This online platform is 100% decentralized, which means that transactions are carried out by autonomous smart contracts.

DeFi Swap provides decentralized staking tools for its users. You can select a lock-up plan that fits your needs, with choices from 30 days to one year. For instance, by staking DeFi Coin, you can earn an APY of up to 75%.

DeFi Coin is the native token of the DeFi Swap exchange – which we discuss in more detail shortly. Nonetheless, we also like that DeFi Swap offers decentralized yield farming tools. As we noted earlier, this allows you to provide DeFi Swap with liquidity for one of the trading pairs that it lists. And in doing so, you will earn a share of any trading fees collected on the respective pair.

If you have an interest in swapping one crypto token for another – DeFi Swap has you covered. As of writing, the DEX offers lots of Binance Smart Chain tokens. However, the platform is also working on cross-chain compatibility. This will mean that once live – you will be able to swap a token from one blockchain into another asset from a different network.

We also like the user-friendliness of DeFi Swap, so beginners will appreciate that you only need to connect your wallet to get started. The DeFi Swap roadmap notes that in the coming months, there will be a fully-fledged mobile app for Android and iOS. There are also plans to integrate NFT trading into its DEX.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

2. Crypto.com – Various DeFi Lending Accounts to Choose From

Crucially, it takes minutes to register with Crypto.com and you can deposit funds with fiat money. This means that you can fund your account via a bank wire or a debit/credit card. Or, you can simply deposit crypto tokens into your account. Either way, Crypto.com offers interest accounts that come with a maximum APY of 14.5%.

This covers dozens of digital tokens, so diversification is easy. You can also earn a respectable 10% on stablecoins, albeit, higher rates are available elsewhere. Crypto.com also offers lending facilities at a maximum LTV of 50%. Therefore, for every $100 that you deposit, you can borrow $50. No credit or affordability checks are carried out and all loans are approved instantly.

Another reason that you might opt for Crypto.com as your go-to platform is that it offers a DeFi wallet. This will allow you to store your DeFi investments in a safe place and only you will have access to your password and private key. Furthermore, the Crypto.com DeFi wallet comes via a mobile app that also offers staking tools.

We also like Crypto.com for its pre-paid credit card – which links straight to your wallet. This means that you can spend your crypto tokens online or in-store. After all, the card is issued by Visa. This also means that you can use your Crypto.com card to withdraw cash from an ATM. The crypto is simply sold and converted to fiat at the time of the transaction.

Pros

Cons

3. Aqru – Earn 12% Per Year on Solid Stablecoins

The next DeFi crypto platform to consider is that of Aqru. This leading provider offers some of the best interest accounts in the market. Not only in terms of yields but flexibility. After all, Aqru interest accounts are flexible.

This means that you can earn interest on your idle crypto tokens without needing to lock them away for a minimum number of days. On the contrary, you have 24/7 access to your deposits without penalty. When it comes to rates, Aqru really stands out on its stablecoin offering, which pays 12% per year in interest.

This covers USD Coin and DAI, as well as Tether. Either way, as long as your chosen stablecoin does its job of being pegged to the dollar, you won’t need to worry about volatility risk. Instead, you know exactly how much you will make each year. Moreover, Aqru distributes interest payments every 24 hours.

As such, when you receive a payment, you might consider reinvesting the tokens back into a savings account. This strategy will allow you to grow your wealth faster via dollar-cost averaging. Another great feature offered by Aqru is that you can still benefit from an APY of 12% even if you do not currently own any crypto tokens.

This is because you can instantly deposit funds with a debit/credit card and then convert the cash into your preferred stablecoin. Bank wires are also supported. In addition to stablecoins, Aqru also allows you to earn interest on Bitcoin and Ethereum. Both of these supported tokens pay an APY of 7% – with no limits in place.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

Top DeFi Coins

In addition to choosing a platform, you’ll also need to think about which DeFi coins are worth adding to your portfolio.

Your chosen DeFi coins might offer a high rate of interest via staking or perhaps are pegged to the dollar to avoid volatility.

Alternatively, you might choose a DeFi coin that offers the best upside potential in terms of its token price.

Either way, we found that the five projects discussed below represent the overall best DeFi coins to buy right now.

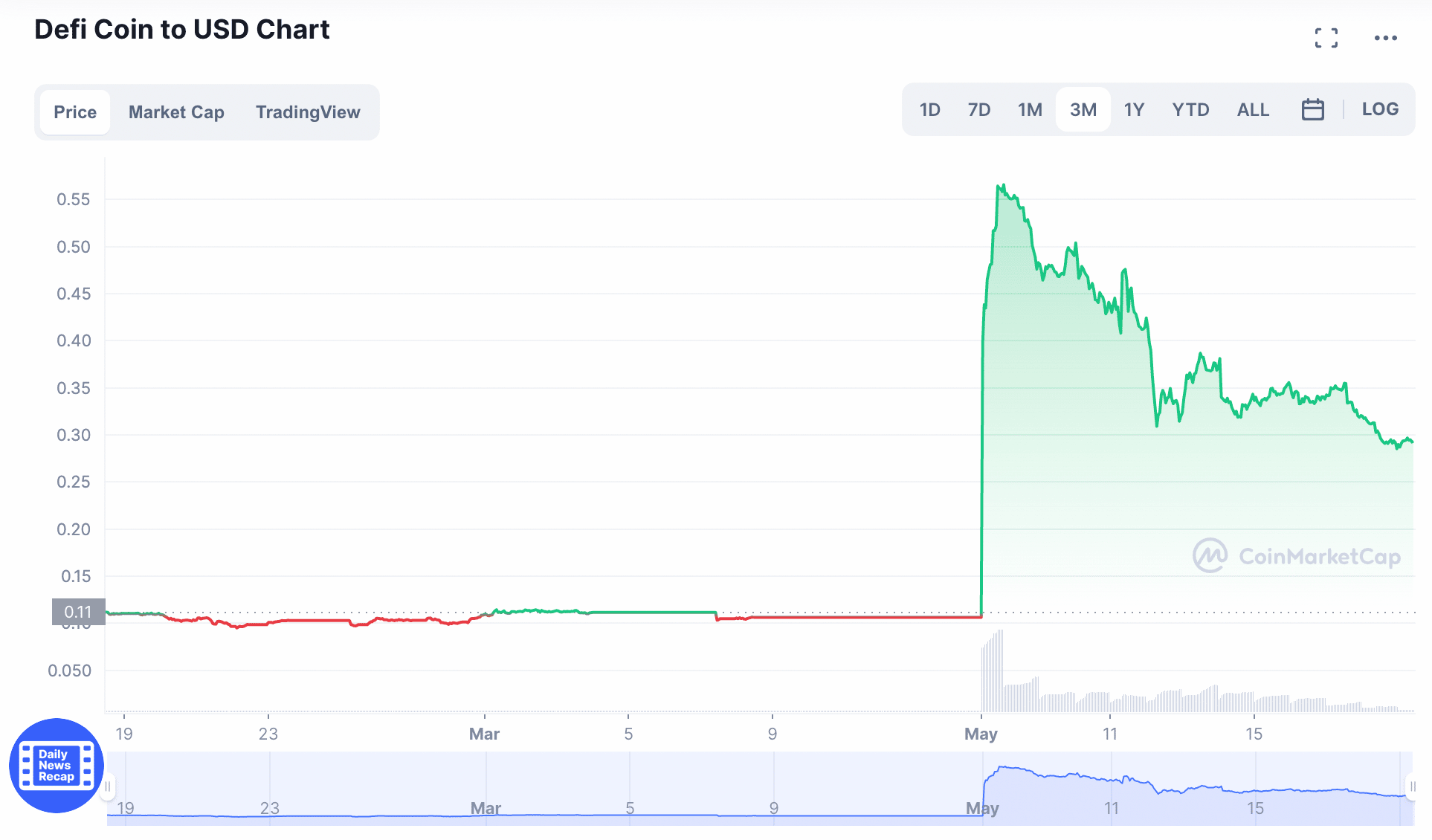

1. DeFi Coin – Overall Best DeFi Coin

DeFi Coin (DEFC) is the underlying token that backs the DeFi Swap exchange. By adding DeFi Coin to your portfolio, you can indirectly invest in the future success of DeFi Swap.

However, it is important to note that DeFi Coin not only gives you the opportunity to target above-average capital gains, but you can also earn interest passively. The DeFi Swap platform gives you two options in this respect. First, you can provide liquidity to the platform via the DEFC/BNB pair. This means that you will need to provide equal measures of both tokens.

But in doing so, every time that somebody exchanges DEFC for BNB (or visa-versa), you will receive a percentage of the fee that they paid. The second option is to deposit your DeFi Coin tokens into the DeFi Swap staking pool. Depending on whether you opt for a 1, 3, 6, or 12-month staking term, you can earn up to 75% annually on your DEFC tokens.

Another reason that we like DEFC as the overall best DeFi Coin to buy is that the project rewards long-term investors. This is because there is a 10% tax on each buy and sell order. As such, you will receive a share of this tax for as long as you remain a DeFi Coin holder. The more DEFC tokens you own, the more you will receive.

Cryptoassets are a highly volatile unregulated investment product.

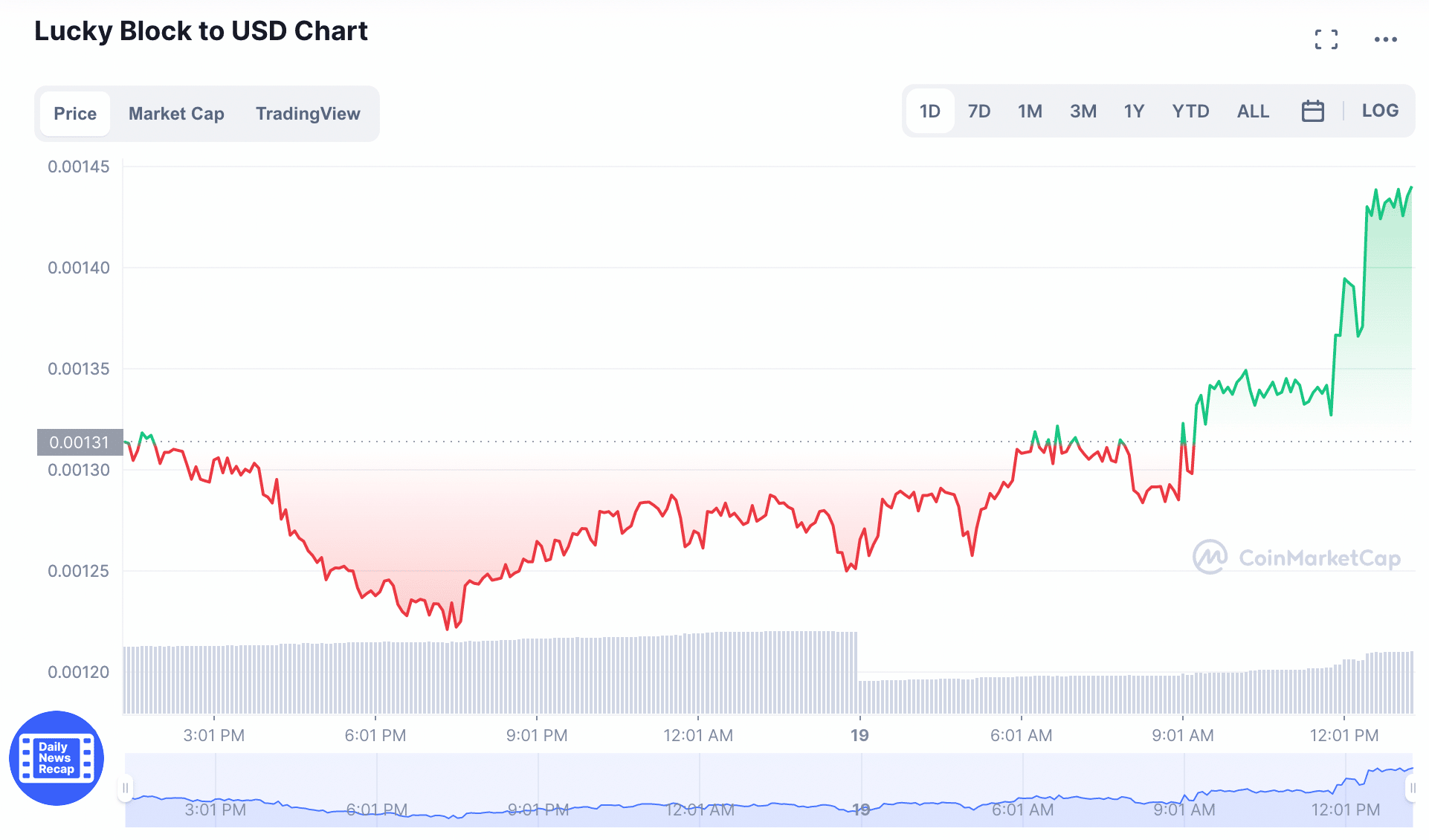

2. Lucky Block – Top-Performing DeFi Gaming Project

Next up we have Lucky Block (LBLOCK) – a new and exciting DeFi project that focuses on daily crypto draws. In a nutshell, by holding the winning ticket for the daily prize draw, you will be entitled to a share of the jackpot.

And, each ticket costs just $5 – to be paid for in LBLOCK tokens. You can, however, get one free ticket entry per day by connecting your wallet to the Lucky Block app. Either way, according to the blockchain ledger, the Lucky Block project already has in excess of $2 million to dedicate to its jackpot draws.

In terms of the LBLOCK token itself, it is actually one of the best-performing digital currencies of 2022 to date. For instance, if you bought Lucky Block tokens during the pre-sale in January 2022, you would have paid just $0.00015.

After launching on January 26th, 2022, it took just a matter of weeks for Lucky Block to hit highs of over $0.009. This represents significant growth in an extremely short period of time. In addition to its BSc token, Lucky Block has also launched 10,000 NFTs. Each NFT corresponds to a unique number, which, if drawn, will get you a share of the daily jackpot prize.

Most importantly, by holding a Lucky Block NFT, you will get lifetime access to the project’s crypto draw – each and every day.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

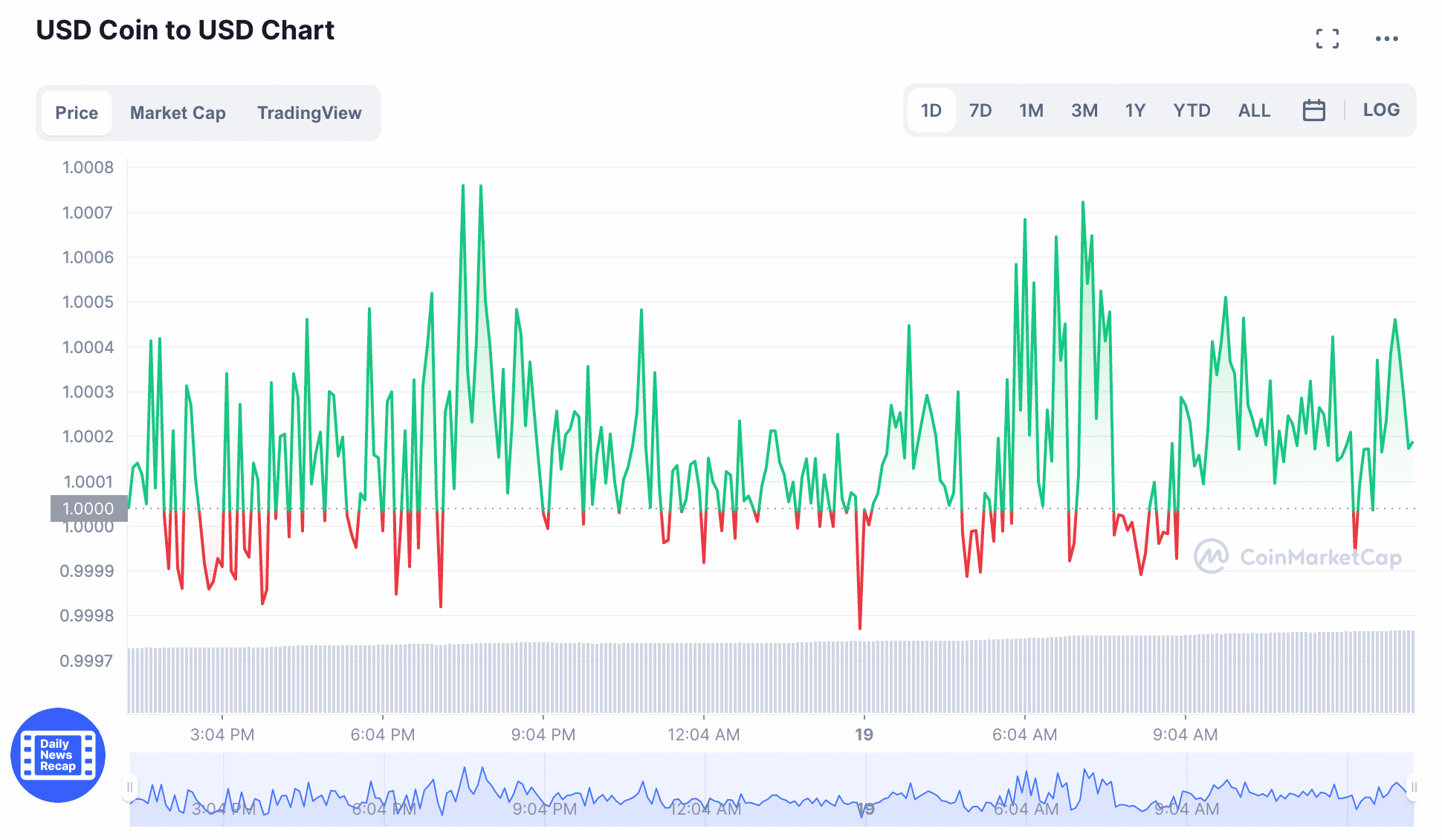

3. USD Coin – Solid Stablecoin to Earn a High DeFi Yield

There are many stablecoins that allow you to earn a solid rate of interest at DeFi platforms. However, not all stablecoins are safe – as we saw from the recent Terra USD saga. With that said, we would argue that USD Coin (USDC) is as solid as it gets in the stablecoin space.

After all, USDC is 100% backed like-for-like by US dollars in an audited bank account. Furthermore, the stablecoin is backed by Coinbase and Circle – both of which have solid reputations in this industry.

Now, in terms of making money on this DeFi crypto coin, Aqru is offering 12% annually. As we noted earlier, this is on a flexible basis – meaning that there are no lock-up terms. Crucially, you shouldn’t need to worry about volatile markets when investing in USD Coin.

Cryptoassets are a highly volatile unregulated investment product.

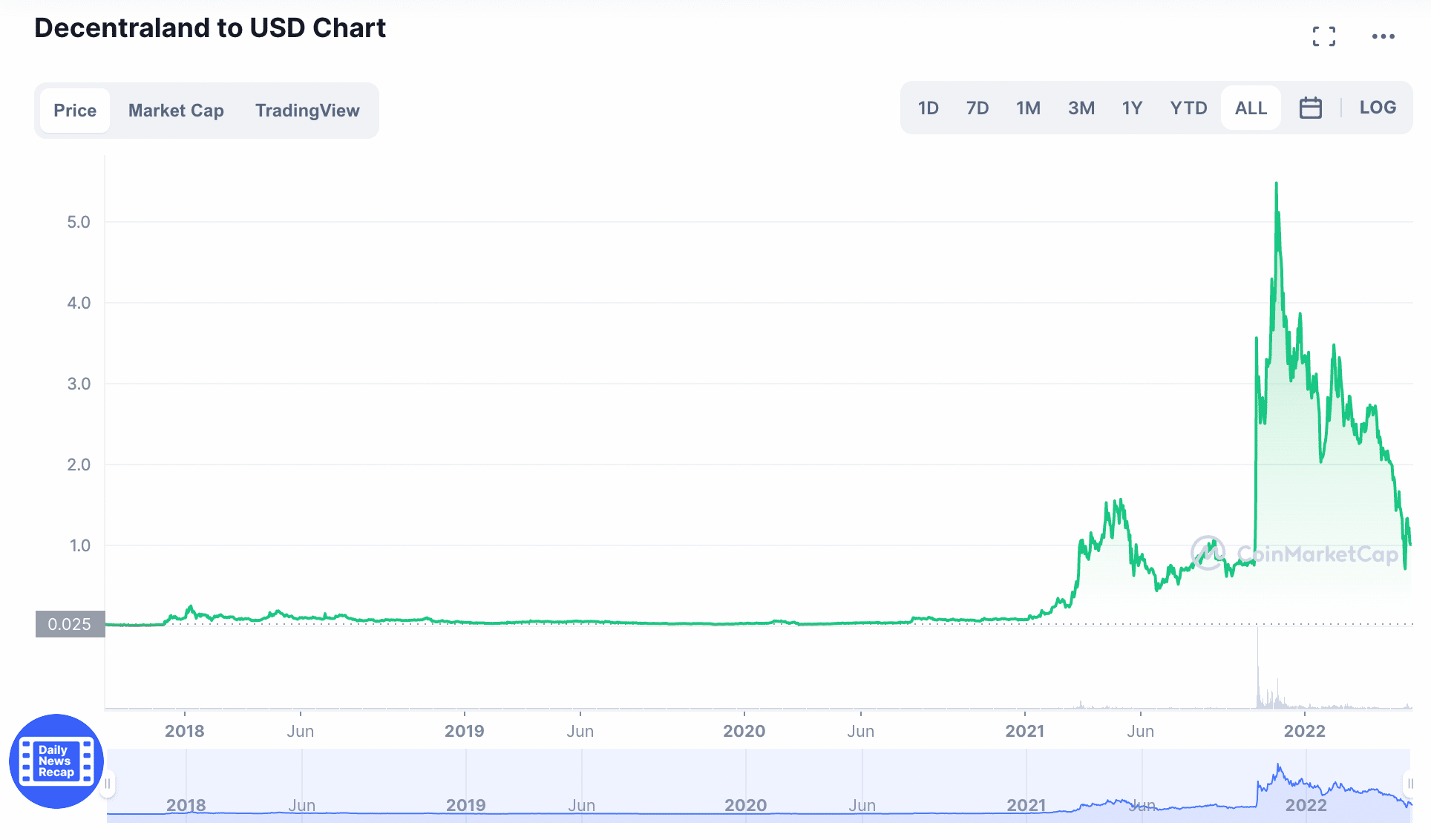

4. Decentraland – Popular DeFi Platform for Real Estate

It can take some time to get your head around how Decentraland works. Nonetheless, in its most basic form, Decentraland offers a virtual world that lets you create an avatar and communicate with other users.

More pertinently, you can buy plots of land within the Decentraland metaverse and then build your own project – such as a villa or store. Either way, you can then list your real estate for sale on an online marketplace.

Over the prior year, some Decentraland plots of land have sold for over a million dollars – so this DeFi platform is well worth exploring. Decentraland also has its own native DeFi token – MANA, which is the sole currency of the project.

5. Yearn.finance – P2P DeFi Loans and Yields With Growing User Base

The final project to consider from our list of the best DeFi coins is Yearn.finance. This project offers a P2P-style platform that connects borrowers and investors. Put simply, you can deposit your funds into Yearn.finance and earn a yield.

Or, should you need access to instant financing, you can use Yearn.finance to borrow money – once you have deposited some collateral. Yearn.finance is home to its own native DeFi coin – YFI. This token trades for thousands of dollars, albeit, at some exchanges, you can invest from $10.

Is DeFi Crypto Safe?

It is important to remember that although DeFi crypto sites offer much higher returns than what you will find in the traditional finance space, the risks can be much higher.

Here’s what you need to know before you invest in DeFi:

No Deposit Insurance

The first thing to note is that when you deposit funds into a DeFi crypto account, you will not have access to the same investor protections as seen in the conventional banking industry.

- For example, in the US, the FDIC covers bank deposits up to the first $250,000 – should the respective financial institution go bust.

- In the UK, there is the FSCS, which covers UK bank deposits up to the first £85,000.

However, if you deposit funds into a DeFi platform and something goes wrong – such as a smart contract failure or an external hack, then you will have nowhere to turn.

This is because traditional deposit insurance schemes do not cover crypto assets.

Volatility

Another risk to consider before you engage with DeFi crypto platforms is that this industry is extremely volatile.

As a prime example, the broader crypto markets lost more than 50% of their value in the first five months of 2022.

Therefore, you can still lose money when investing in DeFi crypto sites. This will happen if the token you hold drops by more than what you receive in interest.

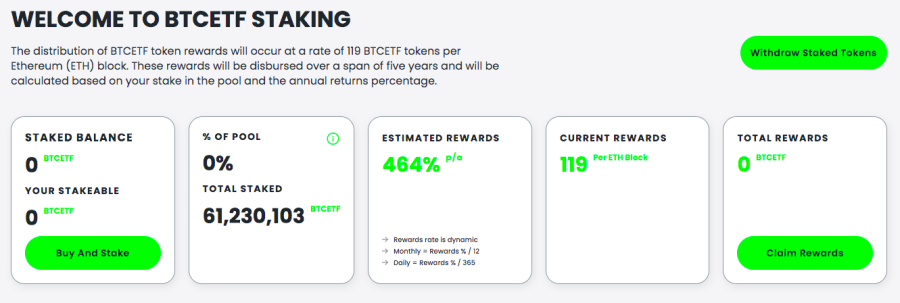

Bitcoin ETF Token – New ERC-20 Token Speculating on the Arrival of a Bitcoin ETF, Offers Huge Staking Yields

Bitcoin ETF Token ($BTCETF) can be a potential alternative to the projects listed above. This new ERC-20 token has recently launched on presale and offers high staking yields.

Bitcoin ETF Token is a speculative project that is linked to the fate of a Bitcoin ETF (Exchange-Traded Fund). The first Bitcoin ETF is yet to be approved by the SEC. Bitcoin ETF Token will offer benefits to token holders, as there is real-life progress made based on the Bitcoin ETF developments.

The project will burn 5% of its token supply and offer staking rewards as each of these milestones are achieved:

- The first Bitcoin ETF is approved by the SEC

- The first Bitcoin ETF is launched

- The first Bitcoin ETF crosses $1 billion worth of assets under management

- Bitcoin reaches an all-time high of $100K

- $BTCETF reaches $100 million in trading volume

As each milestone is achieved, token holders will be rewarded. 25% of the 2.1 billion token supply will be distributed as staking rewards. Tokens can be staked on the smart contract to earn up to 465% in annual staking yields.

The number will decrease as more tokens are locked on the contract. So far, over 60 million tokens have been locked on Bitcoin ETF Token. Since Bitcoin ETF Token is still available to buy on presale, early investors can buy the token before the price increases.

While the live price of $BTCETF is $0.0052 per token, it will increase to $0.0068 by the final round. In only a week since the presale launched, Bitcoin ETF Token has raised more than $540K.

Read the Bitcoin ETF Token whitepaper and join the Telegram channel to learn more about this cryptocurrency.

| Hard Cap | $4.956 Million |

| Total Tokens | 2.1 Billion |

| Tokens available in presale | 840 Million |

| Blockchain | Ethereum Network |

| Token type | ERC-20 |

| Minimum Purchase | NA |

| Purchase with | USDT, ETH, BNB, MATIC, Card |

Conclusion

There is no denying that DeFi will play a major role in the future of financial services. This guide has explained everything there is to know about DeFi crypto sites and how you can maximize your potential returns.

Overall, Bitcoin ETF Token is well worth considering when it comes to choosing a platform. This DeFi cryptocurrency allows token holders to get high staking yields. Furthermore, 25% of the $BTCETF token supply will be burned over time. At press time, $BTCETF is available to buy during the early stages of the presale.

Cryptoassets are a highly volatile unregulated investment product.

FAQs on DeFi Crypto

What is a DeFi in crypto?

What is the best DeFi crypto?

Is DeFi crypto a good investment?