When talking about Bitcoin and other cryptocurrencies’ market caps, a common term mentioned is Bitcoin dominance, but what is Bitcoin dominance?

Bitcoin is the pioneering decentralized and digital crypto asset and is still the most influential crypto worldwide. Considering its market cap, Bitcoin hugely influences the whole crypto market, which is linked to its dominance. Let’s find out more.

Bitcoin Dominance Meaning

What is Bitcoin dominance?

The term refers to the percentage of the total crypto market cap held by Bitcoin. It’s the proportion between BTC’s market cap and the market cap of all other cryptos. Simply put, it measures Bitcoin’s share of the whole crypto market.

Bitcoin dominance demonstrates BTC’s value compared to other cryptos, and investors frequently use this information to assist them in making more informed investment decisions.

Because of Bitcoin’s leading position in the crypto market, the overall direction of the crypto market has followed its market cap throughout time. Given this, Bitcoin dominance has become a critical metric for measuring its impact.

How to Calculate BTC Dominance

As mentioned, Bitcoin dominance is the proportion between Bitcoin’s market cap and the market capitalization of all other cryptos. It can be calculated by dividing BTC’s market cap by the entire market capitalization of all cryptocurrencies.

For example, if the entire crypto market capitalization is $10 trillion, and Bitcoin’s market capitalization is $5 trillion, we can calculate Bitcoin dominance like this:

5T/10T = 0.5 or 50%

How to Read BTC Dominance Chart

Reading the Bitcoin dominance chart is easy. The chart shows a graphic of BTC’s market cap as a proportion of the whole crypto market cap. When Bitcoin market capitalization grows, so does BTC’s dominance percentage, and the other way around. Investors typically search for inflection points and patterns to make better trading decisions.

What Factors Influence BTC Dominance

It can be affected by several factors, so let’s explore each. This can also give you some insights into BTC dominance vs altcoins.

History of Bitcoin Dominance

After discussing the Bitcoin dominance meaning and the factors influencing it, let’s learn about its history.

Bitcoin dominance began being used to check if other cryptocurrencies experienced a rise or decline compared to Bitcoin’s price, especially after 2017, when many altcoins emerged. Even though the BTC dominance index began being used in 2017, it became popular during the boom of altcoins in 2021.

Several early platforms, like CoinMarketCap, allowed traders to observe BTC dominance and monitor market trends and sentiment. BTC accounted for around 95% of the total cryptocurrency market cap until 2017.

Still, at the beginning of 2018, it dropped to 37.6% because of the growing demand for other blockchains, such as Solana, and the ICO boom. Ethereum suffered an 87% price crash the following year, so Bitcoin dominance grew again to about 71%. So, what is Bitcoin dominance right now? Currently, it is around 54%.

How Is Bitcoin Dominance Correlated With Market Capitalization?

Market cap is the total cryptocurrency value, or the total number of mined coins, multiplied by a single coin’s price. It shows the investor’s interest in a cryptocurrency, and they use it to get a complete picture of its market share and position compared to other tokens.

Considering market cap, there are three types of cryptocurrencies: small-cap cryptos (which, despite their potential for short-term growth, are volatile and risky), mid-cap cryptos (which are more volatile but with higher growth potential), and large-cap cryptos (those with a market cap of around $10B or more).

Let’s see how Bitcoin classifies using data from June 2024. Its circulating supply was more than 19.7M, and its price was $61.131. If we multiply these two, we can see that BTC’s market cap that month was over $1.23T. To measure Bitcoin’s market share, BTC dominance uses the market cap as a primary factor.

How to Use Bitcoin Dominance

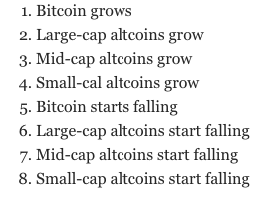

To evaluate the health of the overall crypto market, it’s crucial to understand Bitcoin’s market share. Here are several ways to use Bitcoin dominance:

For instance, if Bitcoin’s value grows but its dominance drops, that may indicate a bull market for altcoins. So, investors who stick to only BTC investments may want to diversify their portfolios and start buying altcoins that have the potential to increase in value.

Conclusion

So, what is Bitcoin dominance? Bitcoin dominance refers to the percentage of the whole crypto market cap held by Bitcoin. It is the proportion between BTC’s market cap and the market cap of all other cryptos. It can be calculated by dividing BTC’s market cap by the entire market cap of all cryptocurrencies.

Bitcoin dominance can be affected by factors like bull and bear markets, changing market trends, new coins and projects, and stablecoins. While BTC accounted for around 95% of the entire cryptocurrency market cap until 2017, Bitcoin dominance is around 54% today. BTC dominance uses the market cap as a primary factor in measuring Bitcoin’s market share. There are several ways to use Bitcoin dominance.

FAQs

What does Bitcoin dominance tell you?

What role does Bitcoin dominance play in the crypto market?

What happens when BTC dominance goes up?

What is the real Bitcoin dominance?