What does APY mean in crypto is a question many people search for – you’re not the only one curious about it. APY stands for annual percentage yield, which refers to your total return per year expressed as a percentage. It’s used more often than APR (annual percentage rate) in crypto and takes compound interest into account – meaning you earn interest on both your initial investment and the interest you accumulate over time.

In this beginner’s guide, we will explain what APY means, how it connects to crypto staking and earning interest on crypto, and where to find the safest and highest crypto APY rates. This way, you can make more profit when the market is strong and lose less or break even during a bear market.

Best APY Crypto Rates

All major crypto exchanges that you’d first buy cryptocurrency on, now offer ways to earn an APY on crypto, and several dedicated crypto savings accounts do too:

How to Earn APY on Crypto – Best Platforms

It’s common to see an unsustainably high APY in crypto of 1000% or more, that sometimes indicates a scam or a crypto project desperate to lure in investors with a high interest rate. Fortunately there are safe, reliable platforms to earn APY on crypto, of up 17%, far better than a savings account at a high street bank.

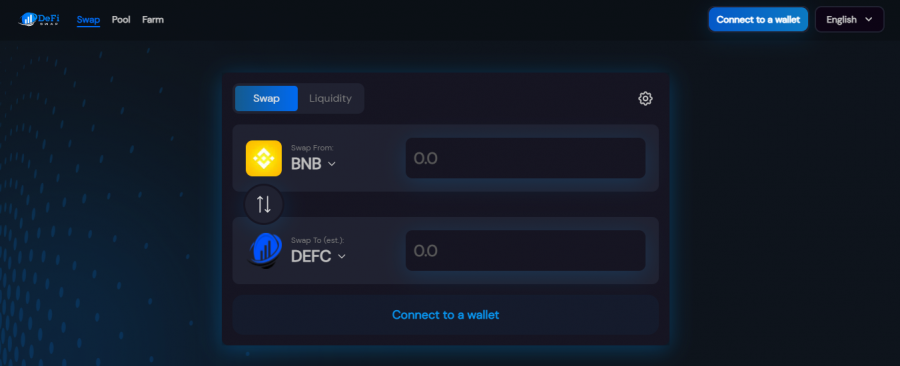

1. DeFi Swap

As one of the best DeFi exchanges, DeFi Swap offers an easy way for investors to generate a return on their idle crypto holdings. Investors can create a steady income stream through DeFi Swap’s automatic liquidity pools, which provide the financial resources to facilitate token swaps. Due to DeFi Swap using these liquidity pools rather than traditional order books, exchanges can be conducted in a cost-effective and decentralized manner.

The specific APY offered via DeFi Swap’s liquidity pools depends on the tier you choose. Four tiers are offered at present:

- Bronze: 30-day lockup, 30% APY

- Silver: 90-day lockup, 45% APY

- Gold: 180-day lockup, 60% APY

- Platinum: 365-day lockup, 75% APY

As you can see, these rates are far higher than what you’d get with a traditional bank account, making DeFi Swap one of the leading DeFi apps for yield generation. In terms of actually getting your crypto holdings onto the DeFi Swap platform, you can easily link a BSC-compatible crypto wallet in just a few minutes. At present, DeFi Swap has full support for MetaMask and WalletConnect, two of the most popular wallet providers.

Looking ahead, the future of DeFi Swap (and DeFi Coin) looks exceedingly optimistic. Plans for upgrades to the DeFi Swap exchange are already in the works, which will see webinars and real-time market data added. Finally, you can even bolster your income further by holding DEFC in your wallet, allowing you to receive a share of the token’s built-in taxation system.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

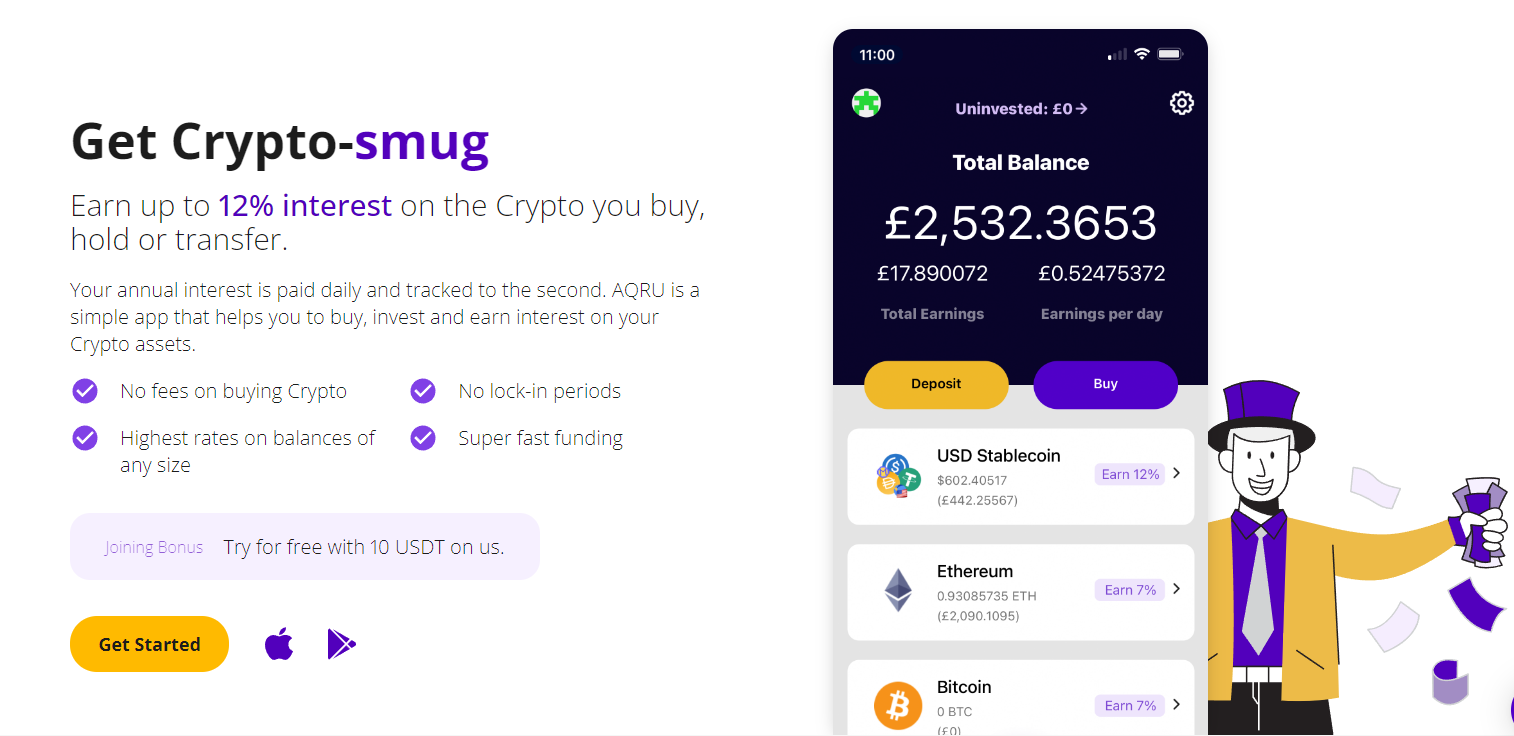

2. AQRU

AQRU aims to make it simple and flexible to accrue interest on your crypto holdings. With no lockup period or fixed terms, you can earn APY on Bitcoin, and earn APY on stablecoins, or both.

The BTC and ETH APY is 7%, and the stablecoins supported are USDT, USDC and DAI at 12% APY.

Savers can deposit via bank transfer, debit or credit card, or transfer crypto to their AQRU wallet. AQRU is a crypto lending platform that lends crypto deposits to institutions like exchanges and retail borrowers, ensuring they are fully collateralized.

Interest is paid daily, so you earn compound interest on your crypto savings balance. Funds can be withdrawn at any time, and fiat withdrawals are free. Crypto has a $20 withdrawal fee.

The minimum to earn APY on AQRU is their minimum deposit of $100, although if the value of BTC or ETH then fall after depositing, you will still earn APY.

AQRU offer a free 10 USDT sign up bonus to test out their crypto savings platform, credited instantly. There’s also a referral bonus of 75 USDT for you and each friend you refer.

AQRU is not currently available in the United States.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

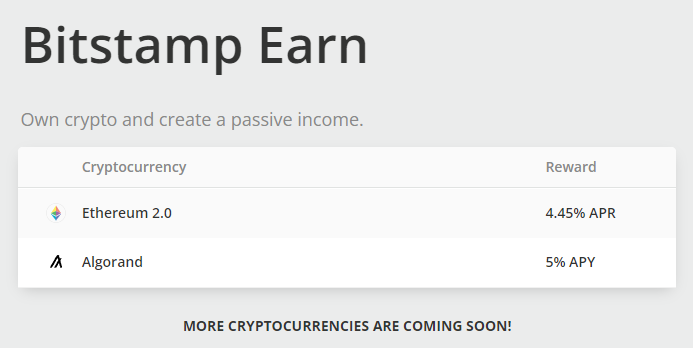

3. Bitstamp

Bitstamp has a Bitstamp Earn program, currently you can earn 5% APY on ALGO (Algorand tokens) alongside one other option to earn APR on crypto – 4.45% on Ethereum 2.0. APR is a simple interest rate rather than compounding. This is due to ETH 2.0 not having fully launched yet.

Bitstamp is a crypto staking platform, so your funds aren’t given out as crypto loans but instead is used to verify and validate blocks on the blockchain, generated staking rewards. There’s no need for you to actively do anything, Bitstamp provide the nodes and other technical tools to stake crypto.

APY is paid directly into your account. As of February 27th, 2022, Algorand staking rewards are paid quarterly at the end of each governance period.

For ETH 2.0 staking rewards are distributed at the beginning of each calendar month. Due to the way Ethereum staking works however, you will only be able to cash out your ETH2 once the Ethereum 2.0 upgrade launches. The same applies to ETH staking on other crypto exchanges.

Bitstamp Earn is currently not available in the USA, but US traders can use Bitstamp to invest in crypto, and it’s one of the best platforms to buy crypto on – many use it as a fiat on-ramp to buy cryptocurrencies to then send to themselves on other crypto exchanges or crypto lending platforms.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

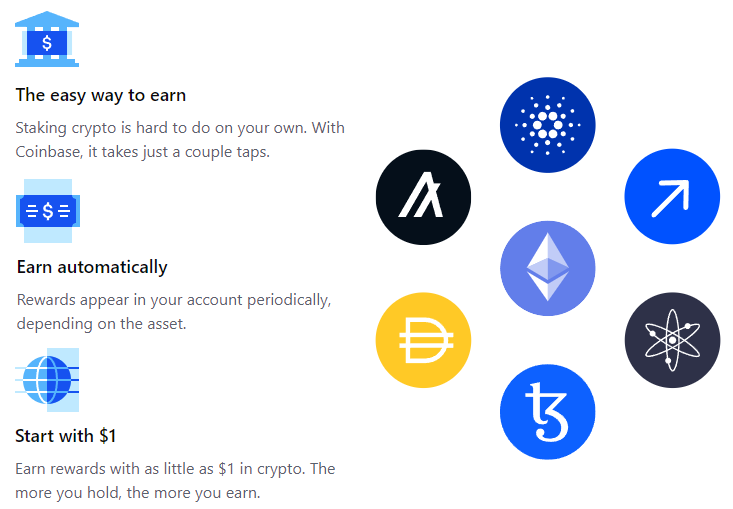

4. Coinbase

Coinbase staking is open to the United States, so Americans can earn APY on crypto on Coinbase.

The best Coinbase APY rate is the Cosmos APY of 5% (ATOM). Followed by Tezos (XTZ) at 4.63%, Ethereum at 3.675% (APR like on Bitstamp), Cardano at 2.6%, Algorand at 0.45%, and DAI at 0.15%.

Cardano APY on Coinbase was announced on March 24th, 2022, initially at 3.75% APY, which was then lowered to 2.6%.

The minimum to earn APY on Coinbase is $1.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Crypto.com

Crypto.com offers a high APY on 50 cryptos, the highest yield is 14.5% APY on Polkadot (DOT) and Polygon (MATIC) tokens.

However there are some extra requirements to earn the highest APY – buying and staking $40,000 worth of Cronos (CRO), the native token of the exchange, and committing to locked terms of three months.

There’s also a maximum amount that yield can be applied to – $30,000 – above which the APY rewards rate is 50% lower. That tier 1 and tier 2 rate was applied as of April 4th, 2022.

The maximum APY on BTC and ETH is 6%, and 10% on stablecoins.

Crypto.com is open to the United States, and is a spot and derivatives trading exchange as well as having its Crypto Earn program. Users can also take out crypto loans, so you can borrow against your crypto assets as collateral without needing to sell them, up to 50% of the value of your holdings.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

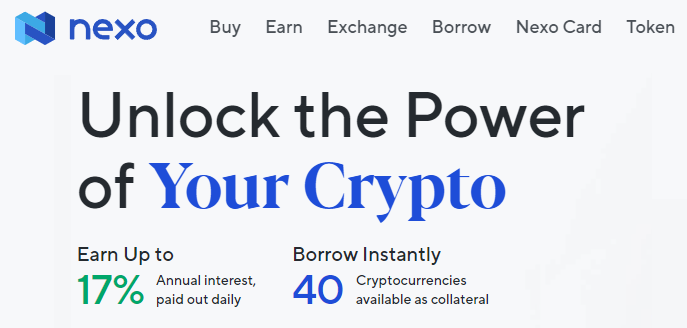

6. Nexo

Nexo pay daily interest of up to 17% APY, and are a popular crypto interest account with a desktop platform and mobile app. It is also possible to buy and exchange crypto on Nexo.

The requirements to earn the highest Nexo APY include holding at least 10% of your portfolio in NEXO tokens, committing to one month fixed terms where your funds are locked, and opting to receive your interest payouts in NEXO.

Nexo users can also take out crypto loans backed against their assets, with a loan-to-value (LTV) of 50% on Bitcoin and 90% on USDT. Earning interest on Nexo isn’t available in the US, but borrowing crypto is.

Over 40 crypto assets are supported, including stablecoin TerraUSD (UST) at up to 17% APY, an alternative to using Anchor Protocol. During some promotional periods higher than 17% APY is possible, for example Nexo offered 36% APY on Axie Infinity (AXS).

Their native token NEXO was listed on Binance in April 2022, so a low fees way of acquiring and selling NEXO (and any other coin you earn crypto interest on) is to do so on Binance.

Withdrawals from Nexo to Binance are free, platinum users receive 5 free withdrawals per month. The 0.1% maker / taker fee on Binance is cheaper than using the Nexo exchange, so transfer holdings to and from there.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

APY Crypto Meaning & Examples

As mentioned the definition of APY is annual percentage yield, or annualized percentage yield. AQRU provide a free crypto APY calculator on their website.

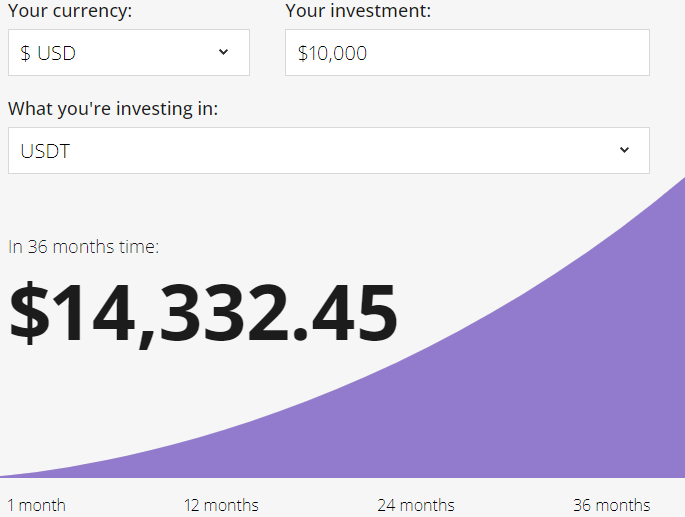

For example if you choose to hold the stablecoin USDT (Tether) as the principal amount in your account balance, at 12% APY a $10,000 investment would be worth $14,332.45 after three years (USDT is pegged to the US dollar).

Annual percentage yield is applied to both the principal and the interest you earn over time, which in the case of the AQRU platform is paid in your account daily. So their calculator factors that in.

That’s why the return on investment (ROI) is higher than just adding 12% to $10000, then 12% on that result for the second year, and 12% again a third time for the final year. That would equal $14,049.28 – a simple interest rate calculation, or APR (annual percentage rate, also called annualized rate of return).

How to Earn APY on Crypto on DeFi Swap – Step by Step

Step 1: Set Up a crypto wallet compatible with the Binance Smart Chain (BSC), such as MetaMask or Trust Wallet.

- Step 2: Purchase some Binance Coin (BNB) from a broker or crypto exchange

- Step 3: Link your crypto wallet to the DeFi Swap exchange

- Step 4: Opt to swap BNB for DEFC

- Step 5: Use your new DEFC tokens to begin earning a yield through DeFi Swap’s automated liquidity pools

To view these steps in screenshots check out our crypto savings accounts page.

Risks and Benefits of Earning APY in Crypto

Cryptocurrencies are more volatile than fiat money markets, bonds, and most financial assets.

For example someone that bought the Bitcoin top at $69,000 in November 2021, would have experienced a 52.5% drawdown to $32,900 at one point. The Bitcoin price has since bounced, but note you’ll have to ‘HODL’ through periods of high volatility as a crypto investor.

The blue chip cryptos like BTC and ETH have also always historically recovered to new all-time highs, even after a multi-year bear market.

Past performance is not an indication of future results, but the crypto markets have been the highest ROI asset class of the last decade, alongside NFTs. Despite the price crash from $69,000, Bitcoin is at a higher price than it was in 2020, and every previous year.

The cryptos listed on the APY platforms we reviewed above are all well-established tokens. If you do see APY percentages of 2000% or similar on a yield farming platform or decentralized application (dApp) those are often new projects that might fail, and make up for that high risk with a higher APY, or potential scams.

Conclusion

‘What is APY in crypto’ is typed into search engines like Google 1,600 times a month according to keyword research data. It’s becoming an increasingly popular way to earn passive income and an alternative to banks which can pay as little as 0.05% interest on customers’ savings deposits.

The best APY crypto rates vary depending on the coin and platform. You might consider opening several accounts with different crypto interest providers to diversify your portfolio, and lower risk.

Our recommended income-generation platform is DeFi Swap, thanks to its high rates and user-friendly interface. However, one of the simplest platforms and quickest to set up is AQRU.

Be prepared for short term volatile price fluctuations, although over the long term cryptos tend to trend up – then you make money in two ways, both from the annual yield and from the valuation of your underlying assets appreciating.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.