Check out our guide to find out what the altcoin season is and if we’re currently in the altcoin or the Bitcoin season. We’ll also discuss the history of the altcoin season as well as the benefits and risks of investing in crypto during the altseason. Here’s all you need to know about the altcoin season in 2025.

What Is Altcoin Season?

Altcoin season, or altseason, is a period during which the prices of altcoins outperform BTC. The start of the altseason is usually triggered by an increased trading volume of altcoins. The altcoin season cycle is not fixed, meaning it can start at any moment and last for several weeks or months.

As mentioned above, during the altseason, altcoins perform better than Bitcoin. The main factors that can trigger the altseason are the launch of new cryptocurrencies, bullish sentiment, and the decline of Bitcoin’s dominance. The previous altcoin season suggests that these events follow predictable patterns. First, there’s a jump in the price of BTC, after which there is a jump in the value of ETH, whose market cap surpasses BTC’s. This phenomenon is known as “the flippening.” Once ETH gains traction, the prices of altcoins with a large market cap also start to rise. After that, the prices of middle- and low-market-cap crypto coins will rise. This shows that, over a certain period, the crypto market becomes saturated with Bitcoin and Ethereum. When saturation occurs, investors start investing in cryptocurrencies with the most potential, which leads to the beginning of the altcoin season.How Does Altcoin Season Work?

What Is the Altcoin Season Index?

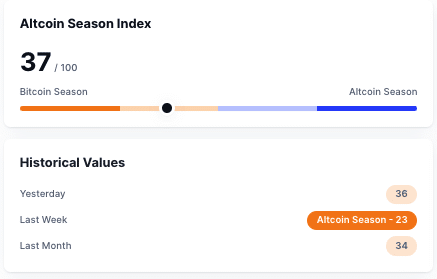

The Altcoin Season Index is a tool that tracks the performance of BTC against altcoins over a 90-day period. If 75% of the top 50 altcoins, except for stablecoins and asset-backed tokens, perform better than BTC within 90 days, the altseason will begin. At the time of writing, the altcoin index stands at 29, which means that we are in Bitcoin season.

This ratio is obtained by dividing the number of altcoins that perform better than BTC by the total number of examined altcoins. Then, this number is multiplied by 100 to get a percentage that ranges from 0 to 100. 100 indicates a strong altcoin year index, while numbers below 50 indicate a strong Bitcoin domination.

Altcoin Season History

There have been several altseasons so far. The most notable occurred between 2017 and 2018 and between 2020 and 2021.

The 2017/18 altseason began with a decline in BTC’s dominance from 86.3% to 38.69%. During the same period, the price of BTC fell from $20,000 to $6,000. This enabled altcoins to outperform BTC. The ICO market had the largest contribution. On that note, many top altcoin projects started raising funds through ICOs. For example, EOS managed to raise more than $4 billion, while Tezos raised $232 million.

The last altcoin season lasted from 2020 to 2021. This altseason was led by popular meme coins, like DOGE and SHIB, which experienced historical growth. NFTs have also contributed to the growth of the altcoin market. During this altseason, BTC’s dominance fell from 70% to 38%, while the value of the altcoin market jumped from 30% to 62%.

When Is the Next Altcoin Season?

At the time of writing, Bitcoin’s market dominance is over 60%, while the altcoin index chart stands at 29. This means that BTC currently performs better than most altcoins. However, in the last few days, BTC has seen a sharp increase in value. In fact, on November 12th, BTC reached its ATH of $89,891.

When its price stabilizes, there will be a shift in market dynamics. Investors will start investing in altcoins like ETH and SOL to diversify their portfolios, raising the altcoin season meter and leading to the beginning of the alt season.

However, crypto analysts don’t believe the next altseason will begin before 2025.

Our Top Picks For Next Altcoin Season

| Project | Market Cap | Presale Supply |

| Pepe Unchained | $70M | 1.6 B PEPU |

| Crypto All-Stars | $64,127,681 | 8,413,939,394 STARS |

| Flockerz | $72,902,064 | 2.4 B FLOCK |

Bitcoin Season vs. Altcoin Season

Bitcoin season is a period during which BTC outperforms other altcoins. During these periods, the Bitcoin dominance index goes up, suggesting that crypto traders favor BTC more than altcoins. During the Bitcoin season, most altcoins will stagnate, while the value of some coins will drop.

On the other hand, when altcoins outperform BTC in terms of market cap and price, the altseason will begin. During the Bitcoin season, the crypto market is more stable, while the same doesn’t apply to the altseason, during which the market is very volatile. This seasonal correlation between BTC and altcoins is what forms the backbone of the dynamics of the crypto market.

In short, the Bitcoin season occurs if 25% of fewer altcoins outperform BTC, while altseason occurs if 75% or more altcoins outperform BTC.

Benefits and Risks of Investing During the Altocin Season

Investing in the next altcoin season tokens comes with both benefits and risks. On that note, the main advantages of investing in altcoins during the altseason are:

The main risks of investing in altcoins during the altseason include:

How Long Does the Altcoin Season Last?

The duration of altseasons can vary from several weeks to several months. For example, the 2017/18 altseason started in the middle of 2017 and ended by the beginning of 2018. The situation was similar with the 2020/21 altseason, which started at the end of 2020 and ended in May 2021. That said, altseasons don’t have a fixed timeline. Their duration will be affected by many factors, from market sentiment to investor interest.

Unlike crypto winters, which can last up to three years, altseasons are usually short and intense. However, so far, there have been only two altcoin seasons, which is why we can’t determine how long the next one will last.

What Happens After Altcoin Season?

Once the altseasons end, the prices of altcoins usually start to drop sharply as investors start to sell them and start investing in BTC again. This is why investors must have a good exit strategy prepared. The end of the altseason also marks the beginning of the growth of Bitcoin dominance. Bitcoin dominance shows whether the crypto market is in a bear or bull cycle. During bear cycles, BTC’s dominance goes up, while during bull cycles, its dominance goes down.

With that in mind, after altseasons, the crypto market will enter a bearish sentiment. Investors can profit the most if they invest in altcoins before the altseason begins and sell them before it ends.

Conclusion

Altseason is a term that refers to the period during which 75% of the top 50 altcoins perform better than Bitcoin during a 90-day period. The performance of altcoins is measured by the Altcoin Season Index, which varies from 0 to 100. If the ASI shows a number higher than 75, the altseason will begin. A sharp decline in BTC dominance indicates that an altseason could start soon. Altseasons can last from several weeks to several months.