As the cryptocurrency market evolves, so does the sector of crypto lending. By offering a space where users can lend their cryptos or borrow against them, we’re presented with an opportunity for new financial gains.

That’s why the experts at Business2Community did extensive research on the matter, looking at several companies, only to come up with the 4 best crypto lending platforms today.

This article will do a deep dive on these platforms, and touch on how crypto lending works, its benefits and drawbacks, the different types of crypto lending, the range of cryptos you can lend and much more.

The Best Crypto Lending Platforms List

The top crypto lending platforms – in terms of yields, security, and supported tokens – can be found in the list below.

- Aqru – Emerging Crypto Lending Platform for 2025

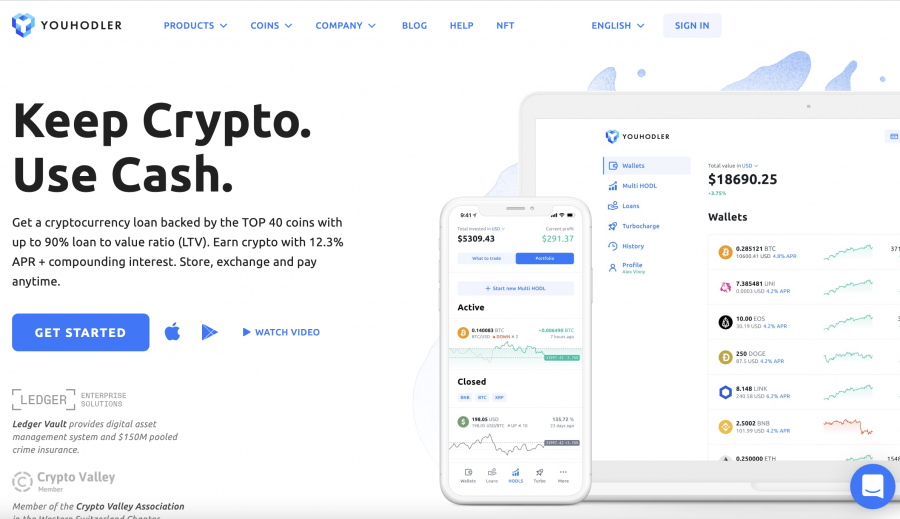

- YouHodler – One of the Best Crypto Lending Companies for Supported Tokens

- Nexo – Top Bitcoin Lending Platform for Low Fees

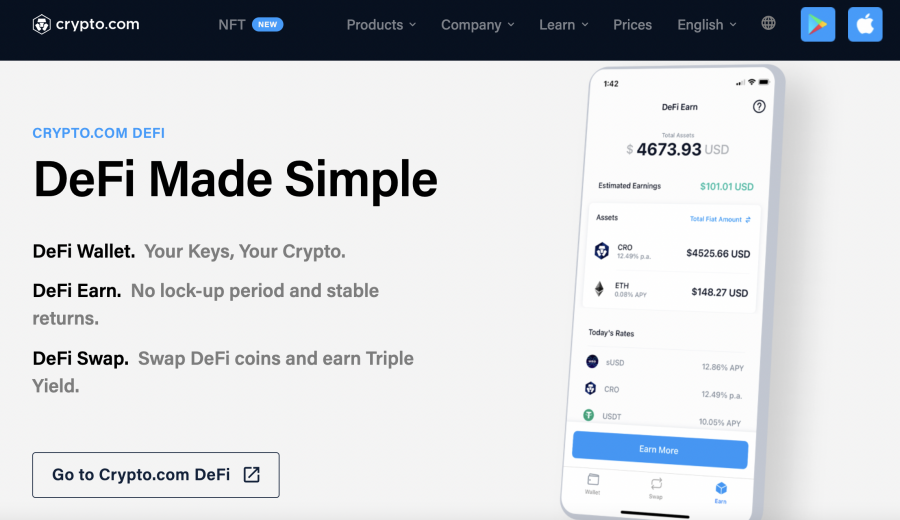

- Crypto.com – Lend Stablecoins to Earn up to 14% APY

Each of the above crypto lending sites comes with a variety of benefits and drawbacks – so read on to find out which provider is right for your goals.

Top Crypto Lending Platforms Reviewed

In this section of our guide, you will find detailed reviews of the best crypto lending platforms for 2025.

As noted above, the providers discussed below stand out in terms of available yields, supported tokens, and safety – as well as customer service, user-friendliness, and other core metrics.

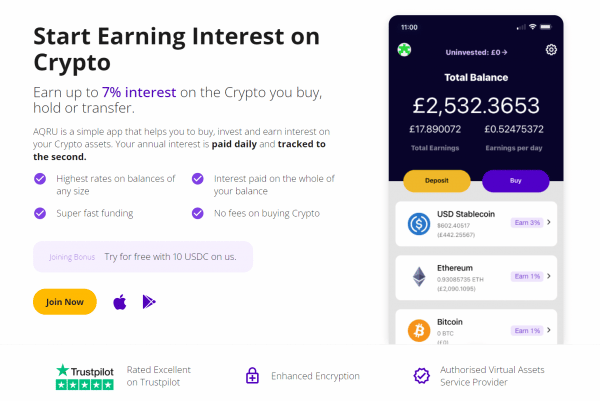

1. Aqru – Emerging Crypto Lending Platform for 2025

Did you know that Aqru is among the best alternatives to popular crypto banks?

Aqru has become the top crypto lending platform for a few reasons. First, after you create an account, you can get up to 7% interest per year on your cryptocurrencies. Aqru will then lend your digital tokens to borrowers who pay a higher interest rate on the loan. This means you’ll be earning money with cryptocurrency through crypto lending.

And as such, this means that the 7% APY that you see advertised is the exact amount that you will earn. Moreover, most crypto savings accounts at Aqru come without lock-up terms. This means withdrawals can be made at any time without penalization.

What we appreciate about the Aqru platform is that it is made for beginners. This means that no matter your experience in crypto lending, you can easily get started. Plus, since it typically takes under 10 minutes to open a verified account, it will attract those who want to earn interest on their crypto right away. This allows you to spend Bitcoin and earn 1% interest.

You can choose from the main Aqru website or the provider’s crypto app when it comes to accessing your account. The latter option is compatible with both iOS and Android devices and the app is free to download. Another reason why Aqru stands out as one of the best Bitcoin lending platforms is that you can also elect to deposit fiat money. This will appeal to those that wish to earn interest but do not currently own any digital tokens.

- APR Offered on Cryptocurrencies – Stablecoins (USDC, USDC Maple) – Up to 7% and Non-Stablecoins (BTC, ETH) – 1%

- Min & Max Deposit Limits – €100 (£110.80) minimum; no maximum stated.

- Lock-In Period – No lock-in period; flexible withdrawals offered

- Security & Regulation Features – Regulated by the Republic of Lithuania; VASP under Lithuanian law

- Additional Rewards Offered – N/A

- Interest Payout Frequency – Daily

What We Like About Aqru:

- Attractive rates of 7% APR on stablecoins

- No lock-up period

- Great reputation

4. YouHodler – One of the Best Crypto Lending Companies for Supported Tokens

If you’re looking to mitigate your long-term risks by lending out a wide variety of digital tokens, YouHodler is one of the best crypto lending platforms for this purpose. Put simply, this top-rated platform offers support for dozens of best cryptocurrencies and stablecoins of all shapes and sizes. And, in most cases, you will find that the yields on offer are highly attractive.

For example, Bitcoin and Ethereum lending rates amount to an APY of 4.8% and 5.5%. Although slightly higher rates are available elsewhere, it is important to note that YouHodler accounts come without lock-up terms. Moreover, there is no requirement to stake any tokens on this platform. Other notable interest rates offered at YouHodler include an APY of 7% on Uniswap, 6.2% on Chainlink, and 4.5% on Yearn.finance.

A good selection of stablecoin interest accounts are also worth considering, with the likes of TrueUSD and USD Coin yielding 12%. All crypto lending accounts at this platform distribute interest rewards on a weekly basis. When it comes to safety, YouHodler is home to a $150 million pooled crime insurance policy, which is backed by Ledger Vault. Additional security features include a blend of hot and cold storage wallets on client digital assets and the ability to disable withdrawals.

- APR Offered on Cryptocurrencies – Up to 12.3%

- Min & Max Deposit Limits – Minimum deposit of $100 USD equivalent

- Lock-In Period – No lock-in period; flexible withdrawals offered

- Security & Regulation Features – Official member of the Blockchain Association; 3FA security level

- Additional Rewards Offered – Interest is compounded

- Interest Payout Frequency – Weekly

What We Like About YouHodler:

- Dozens of tokens supported

- All lending accounts are flexible – no lock-up terms

- $150 million pooled crime insurance

- Great for beginners

3. Nexo – Top Bitcoin Lending Platform for Low Fees

Nexo is a hugely popular crypto lending site that not only offers a large number of supported tokens but highly attractive APYs. It allows you to increase the amount of interest earned when you stake its native digital token. For example, if you’re looking to earn a yield of Bitcoin, you can earn an APY of 6% without staking.

But, by staking Nexo, this APR is increased to 8%. If you’re looking to diversify into other digital currencies, you earn 9/11% on ATOM, 14/16% on MATIC, 16/18% on FTM. Stablecoins like USDT, GBPX, and EURX are also supported with various APYs – most of which are attractive when compared to the industry average. Regardless of which digital token you decide to earn interest on – and whether or not you wish to stake Nexo, no lock-up periods are in place.

And as such, should you need access to fast cash, then you can withdraw your tokens out of Nexo at the click of a button. Another thing to note about the Nexo crypto lending platform is that it offers a variety of other products and services that might be of interest. This includes the Nexo card – which allows you to spend your digital tokens in the real world. You can also use Nexo to exchange between 200+ crypto pairs and even access leverage of up to 3x.

Nexo continued operating despite some other crypto lending platforms such as Celsius and Finblox pausing withdrawals in June 2022 amid the crypto market crash and issues with Three Arrows Capital – which was an investor in Finblox.

- APR Offered on Cryptocurrencies – Up to 36% on certain coins

- Min & Max Deposit Limits – Varies depending on asset (e.g. 0.001 BTC, 0.01 ETH, etc)

- Lock-In Period – Either flexible or one-month lock-in period

- Security & Regulation Features – Registered with FinCEN; Money Transmitter License in various US states

- Additional Rewards Offered – Higher interest rates if you choose to be paid in NEXO

- Interest Payout Frequency – Daily

What We Like About Nexo:

- Earn up to 8% on Bitcoin lending accounts

- Stablecoins yield up to 20%

- No lock-up requirements on withdrawals

- Exchange services and crypto debit cards offered

5. Crypto.com – Lend Stablecoins to Earn up to 14% APY

Next up we have Crypto.com, which is home to some of the best crypto lending rates in the market for stablecoins, as well as offering the best crypto credit and debit cards with great crypto rewards. To give you an example of how competitive this popular altcoin exchange is, Crypto.com offers an APY of 6% on stablecoins like USD Coin, Tether, TrueUSD, and Paxos Standard. And, best of all, to earn this APY of 6% – there is no requirement to lock your tokens up for a minimum amount of time.

With that said, we like the fact that Crypto.com offers even higher yields when you decide to lock up your stablecoins for either one or three months. While the former pays an APY of 8%, the latter increases the yield to 10%. And, should you decide to stake a minimum number of CRO tokens, even higher interest rates are offered. Take note, in addition to stablecoins, Crypto.com supports lots of standard digital tokens.

For instance – based on a 3-month lock-up period and minimum staking requirement of 40,000 CRO tokens, you can earn up to 14.5% on Polkadot, 8.5% on Bitcoin and Ethereum, and 6.5% on Solana. If you are looking to earn interest on Polygon and Shibu Inu then crypto.com also offer attractive rates of 14% and 5%. When it comes to distribution frequency, Crypto.com will forward your interest payments on a weekly basis. This will then allow you to reinvest the funds back into another lending agreement.

- APR Offered on Cryptocurrencies – Stablecoins (USDT, USDC, DAI, etc) – Up to 14% and Non-Stablecoins (BTC, ETH, CRO, LTC, etc) – Up to 14.5%

- Min & Max Deposit Limits – Minimum – Varies depending on coin (e.g. 0.005 BTC, 0.15 ETH), and Maximum – $500,000 (USD equivalent)

- Lock-In Period – Customisable – three months, one month, or flexible

- Security & Regulation Features – Tier 4 assessment from NIST Cybersecurity and Stress-tested by Kudelski Security

- Additional Rewards Offered – APR increases as the amount of CRO staked increases.

- Interest Payout Frequency – Weekly

What We Like About Crypto.com:

- Supports more than 250+ coins

- Attractive rates on interest

- Increase APYs by staking CRO tokens

- Trusted platform

Best Bitcoin Lending Sites Compared

Below you will find a comparison table of the best Bitcoin lending sites reviewed above.

| Interest on BTC | Interest on Stablecoins | Lock-Up Terms | |

| Aqru | 1% | Up to 7% | Flexible |

| YouHodler | Up to 4.8% | Up to 12.3% | Flexible |

| Nexo | Up to 8% | Up to 20% | Flexible |

| Crypto.com | Up to 8.5% | Up to 14% | Flexible to 3 months |

The above APYs are correct as of writing this guide.

How Does Crypto Lending Work?

If you’ve never used a crypto lending platform, it’s best to take a step back before proceeding.

By this, we mean it’s a good idea to understand how crypto lending and loans work – including core factors surrounding yields, lock-up terms, and risk.

The Basics of Crypto Lending

Crypto lending platforms form a crucial bridge between those seeking to borrow funds and investors looking to earn a yield on their digital asset holdings. This financial marketplace can be accessed without needing to go through a traditional lender.

For instance, at one side of the transaction, you have people that want to borrow capital – either in the form of cryptocurrency or fiat money. In order to access such services, the borrower will need to put up a security deposit.

This is in place to protect investors in the event that the borrower defaults on the loan. These crypto lending agreements are funded by those that wish to earn interest on their token investments.

- For example, you might have $1,000 worth of Bitcoin stored in a wallet that is currently earning nothing in interest. But, by using a crypto lending site, you can loan out the BTC tokens in return for an attractive APY.

In terms of Bitcoin lending rates, this ultimately depends on two key factors – the digital asset involved in the transaction and the crypto loan site itself. Rates can also vary depending on whether or not you are happy to lock the tokens away for a certain period of time.

Types of Crypto Lending

As noted above, the crypto lending arena involves two core stakeholders:

- Those looking to borrow funds

- Those looking to lend out their funds in return for interest

The specifics surrounding each segment of the crypto lending industry differ – so we elaborate on the fundamentals in more detail in the sections below.

You are Lending Crypto From a Site

If you’re looking to borrow funds from a crypto lending site, you’ve got plenty of options. Not only in terms of providers, but many platforms allow you to receive funds in either fiat money or digital assets.

Here are the basics of how borrowing funds from a crypto loan site works in practice:

Collateral

First and foremost, the only way to access a crypto loan is to provide the respective platform with collateral. After all, crypto lending platforms are popular because they offer instant funding agreements without the need to carry out a credit check.

And, the only way that the site can protect itself from issuing loans to people that cannot afford to repay the funds is to require an upfront security deposit. The cryptocurrency that you can deposit as collateral will vary depending on your chosen lending site.

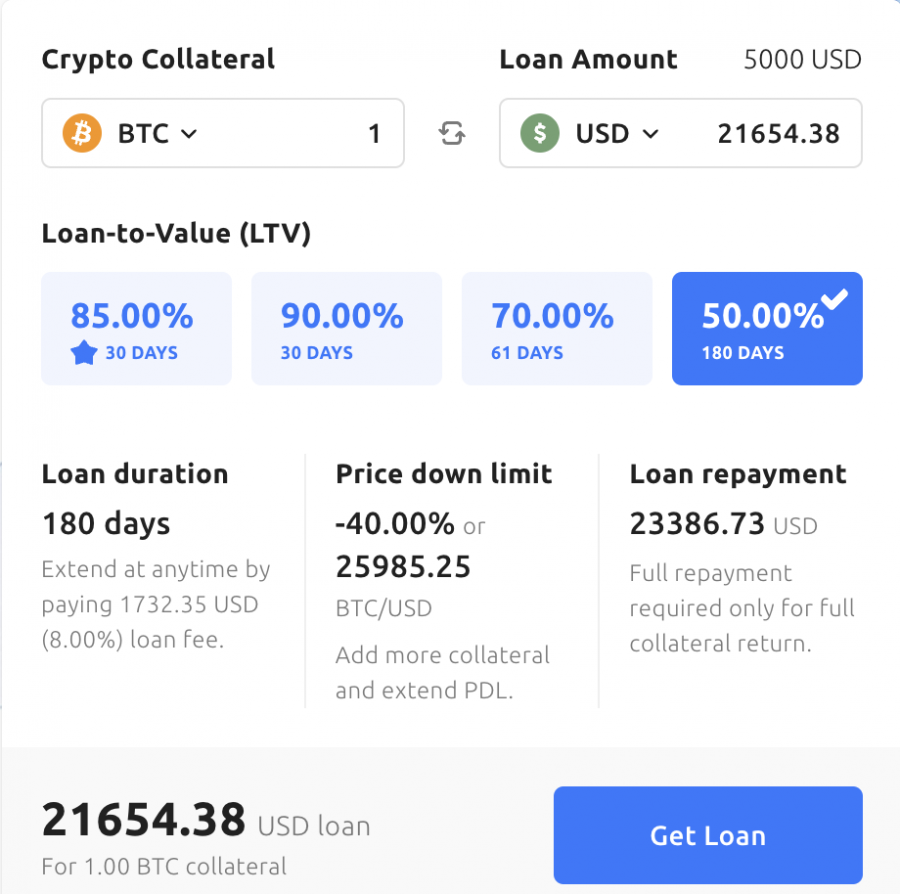

LTV

The amount that you can borrow from a crypto lending site will depend on the loan-to-value, or LTV, on offer. In a nutshell, the LTV determines the maximum amount that you can borrow, based on the amount of collateral you put up.

For example:

- If you add a security deposit at the crypto-equivalent of $1,000 and the maximum LTV is 50%, this means that you can borrow up to $500

- If the security deposit amounts to $5,000 and the maximum LTV is 90%, this means that you can borrow up to $4,500

Crucially, the LTV available will not only depend on your chosen crypto lending site – but the specific digital asset that you deposit.

For instance, if you deposit a large-cap cryptocurrency like Bitcoin or Tether, then you will have access to the higher LTV on offer. However, in depositing a low-cap cryptocurrency like Dash or Neo, you’ll likely have access to a lower LTV.

Receiving Asset

As noted above, the best crypto lending sites in this market give you two options when it comes to taking out a loan. You can either receive the funds in a fiat currency like USD or GBP, or a digital asset like Bitcoin or Ethereum.

Now, the option that you go for will likely depend on what your goals are. For instance, if you are looking to take out a crypto loan because you want to raise money without selling your tokens – then fiat currency will likely be the best option.

However, if you are taking out a loan to increase the size of your digital asset holdings, then you’ll likely opt to receive the funds in crypto.

In terms of receiving fiat money from a crypto lending site, the funds will be distributed via a bank transfer. Crypto loans will be sent to the wallet address of your choosing.

APRs

All crypto lending sites will charge an annual percentage rate (APR) on loans it approves. This is no different from taking out a loan from a traditional lender.

In terms of how much you will need to pay back, this can depend on:

- The asset that you receive as part of the loan – e.g. US dollars or Bitcoin

- The specific crypto lending site you are using

- The length of the loan term

- The amount of funds being borrowed

In most cases, the most attractive loan rates will be offered on a major crypto asset like Bitcoin, across shorter lending terms.

Loan Terms

Like in the traditional lending arena, crypto loans come with certain terms you must adhere to. For example, if you take out a crypto loan on a 30-day period, you must repay the full amount before the stated deadline arrives. With that said, some crypto lending sites offer flexible terms – meaning you can repay the funds at your convenience.

- However, the most important thing to be aware of when reviewing the terms of a crypto lending agreement is concerning your collateral.

- This is because should the value of the collateral drop by a certain amount – as per market forces, then the crypto lending site might be forced to sell some or even all of your security deposit.

- This will happen if the LTV ratio drops by a certain amount.

If you are approaching the point of liquidation, your chosen crypto lending site will usually send you a notification via email. Doing so will give you the opportunity to make a payment or increase the size of your collateral – to avoid being liquidated.

You are Lending Crypto to a Platform

If you’re more interested in using a crypto lending platform to earn a regular yield on your investment, below we explain everything that you need to know before proceeding.

Supported Tokens

The first thing to consider when learning about crypto interest accounts is the specific digital asset that you wish to earn a yield on. This might be a simple choice, insofar that you might look to earn interest on tokens you currently hold in a crypto wallet.

Lock-Up Terms

Some crypto lending platforms stipulate minimum lock-up terms. This is similar to traditional Certificate of Deposit (CD) accounts, whereby you won’t have access to your funds until the term concludes.

On the other hand, some platforms have no lock-up terms at all when you lend your crypto assets out. And as such, this means that at any given time – you can withdraw your tokens from the platform.

You then have the likes of Crypto.com – which gives you the option of a flexible account, alongside a 1-month and 3-month lock-up period. Naturally, the longer you lock your tokens up the higher than APY.

APYs

The annual percentage yield (APY) refers to the interest you will pay when depositing funds into a crypto lending platform. It goes without saying that the higher the APY, the more you will receive.

Now, the APY you have access to will depend on various factors. For instance, if lending out an established, large-cap cryptocurrency like Bitcoin or Ethereum, the APY will likely be more modest.

However, if lending out a small-cap token, you should have access to higher rates of interest. Moreover, we found that most crypto lending sites offer a higher APY on stablecoins like Tether and USDC.

The reason for this is twofold. First, stablecoins are pegged to a fiat currency like the US dollar – so volatility is virtually non-existent. Second, stablecoins can easily be converted into cash, which in turn, can then be used to fund fiat money loans.

Another factor that can determine the APY on offer is whether or not you are prepared to engage in a crypto staking agreement with your chosen lending site. For example, both Crypto.com and Nexo offer enhanced APYs if you stake their native token.

Interest Distribution

In terms of when you will receive your interest payments, this will depend on the crypto lending site that you sign up with.

This is an important factor to consider when searching for the best crypto lending site, as more frequent distributions will allow you to benefit from compound interest.

This means that as soon as you receive an interest payment, you will reinvest the funds back into a crypto savings account. In doing so, you will instantly begin to earn interest on the funds you added.

Peer-to-Peer Crypto Lending

For all intents and purposes, the crypto lending sites discussed on this page offer a peer-to-peer model. In simple terms, this means that loans are facilitated by everyday investors – as opposed to financial institutions.

For example, if you were to borrow fiat money or digital currency via Crypto.com, the loan agreement would not be funded by the platform itself. On the contrary, the loan would be funded by those depositing funds into the Crypto.com website.

This means that there is no longer a need to access capital via a conventional bank. Moreover, there is no requirement to go through a long and drawn-out application process or credit check, as all crypto loans are approved instantly.

Once again, this is because, in order to get a crypto loan, you will be required to deposit funds as collateral.

Crypto Lending Interest Rates Explained

Understanding both APRs and APYs can be a challenging task – even if you are well-versed in how loans work. If you’re looking for some clarity, this section of our guide clears the mist by explaining the ins and outs of Bitcoin lending interest rates.

To recap:

- If you’re borrowing funds from a crypto lending platform, your interest rate on the loan is stipulated as the APR

- If you’re lending funds to a crypto loan platform, the interest rate you will be paid is stipulated as the APY

Example of Crypto Loan APR

- Let’s say that you borrow $5,000 from a crypto lending platform

- The APR on the loan amounts to 10%

- This means that over the course of one year, you will pay $500 in interest

- Of course, should you repay the funds back sooner, the amount of interest paid will be lower

However, it is important to note that the interest on USDC Maple savings accounts is paid in USDC Maple tokens as opposed to cash. For instance, if you deposit 1 USDC Maple at an APY of 7%, you would receive 0.07 USDC Maple in interest over the course of a year.

Therefore, the equivalent amount in fiat money would depend on the market value of the coin deposited.

What Cryptos Can You Lend?

In terms of what crypto you can lend to earn interest, this will ultimately depend on the platform you sign up with. For example, some crypto lending platforms support a wide range of digital assets of various market capitalization.

However, others will only support large-cap projects like Bitcoin and Ethereum, alongside leading stablecoins such as Tether and Gemini Coin.

Crucially, if you own an up-and-coming cryptocurrency, then you might struggle to find a platform that offers interest accounts on the respective token.

How to Minimize Risk with Crypto Lending

Although the crypto lending space is an exciting addition to this growing area of finance, there are certain risks that investors must consider. When you partner with a crypto lending platform, your funds will be borrowed by a third party, meaning there is always a slight chance of default. As unlikely as this is, there are specific approaches that you can take to safeguard yourself from any disastrous outcomes.

The most common approach is to create an account with various DeFi lending platforms and spread your lending amount across all of them, rather than placing the entire amount with one platform. This essentially means that you won’t have ‘all your eggs in one basket’, reducing the impact that one default may have on your financial position. There is no limit to the number of crypto lending platforms that you can sign up with, so you can diversify your investment as much or as little as you wish.

You can also ensure that the platforms that you partner with are reputable by reading reviews and looking for user testimonials.

How to Lend Cryptocurrency

If you’ve read our guide on crypto lending up to this point and wish to get started right now with an interest-bearing account – we’ll now show you the required steps with Aqru.

To recap, this top-rated crypto lending site offers an APY of up to 7% on cryptocurrencies. Most importantly, Aqru has flexible lock-up conditions.

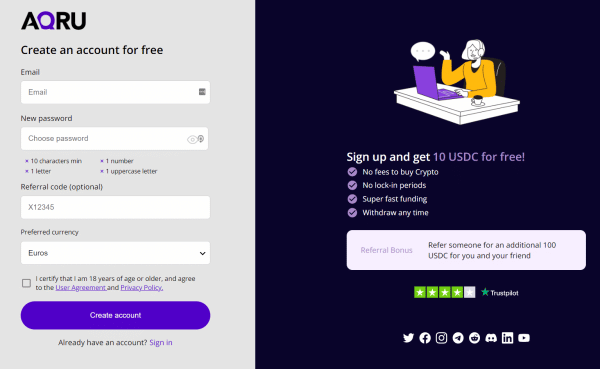

Step 1: Open an Account

Before you can start generating a yield on your crypto holdings, you will need to open an account with Aqru. This will require some personal information and contact details from you – as Aqru complies with all relevant laws surrounding anti-money laundering.

Moreover, this also means that Aqru will ask you to submit a copy of your government-issued ID for verification purposes. You should find that your account is verified in less than 10 minutes once you have uploaded your document.

Step 2: Deposit Funds

Aqru will now ask you to deposit some funds into your crypto savings account so that you can start earning interest instantly.

This part of the process will depend on whether or not you currently hold a supported cryptocurrency.

For instance, if you already own Bitcoin, Ethereum, or one of the platform’s supported stablecoins, you can transfer the funds to the wallet address that Aqru provides on-screen. Be sure to deposit the correct cryptocurrency for the respective wallet address.

Alternatively, if you do not currently own a supported token, then you can deposit funds via bank transfer. Supported fiat currencies include euros and British pounds.

Once the money arrives, you can then choose to swap the funds into crypto – which will then be added to the respective savings account.

Step 3: Earn Interest

The best thing about Aqru accounts is that as soon as the crypto is deposited, you will start earning interest straightaway. Moreover, interest is paid daily at Aqru, so you can easily reinvest your payments as soon as they are received.

If at any time you want to withdraw your crypto assets from Aqru, you can request to cash your funds out whenever you like.

Is it Safe to Lend Bitcoin and Other Coins?

A variety of risks need to be taken into account before you sign up with a crypto lending site. Not only in terms of loaning out crypto but borrowing funds.

Here are the main risks that we identified when reviewing the best crypto lending platforms.

Risks of Lending Crypto

The first risk that you need to consider is with respect to defaults. After all, the overarching concept of crypto interest accounts is that you will be lending funds to a third party.

And, if this third-party individual defaults on their loan, this can result in you receiving less than you originally invested.

The main safeguard in this respect is that the individual will need to have put up a security deposit before having the loan approved.But, if too many individuals default, then collectively – the amount of collateral held by the crypto lending platform might not be sufficient to cover investors.

Another risk you need to consider is with respect to the platform itself. For instance, if the crypto lending platform runs into financial difficulties, it might not have enough capital to cover withdrawal requests. This can also happen if the platform is hacked.

Risks of Borrowing Crypto

The main risk that you need to consider when borrowing funds from a crypto lending site is with respect to falling digital asset prices.

As we briefly mentioned earlier, if the token you deposit as collateral drops in value by a certain amount, this can trigger liquidation. This simply means that the platform needs to sell some of your collateral to ensure you do not fall below the accepted LTV ratio. If prices fall by a significant amount, you might find that all of your collateral is sold.

Another thing to remember is that some platforms allow you to borrow funds without needing to agree to a repayment date. In turn, if you borrow the funds for too long, you might find that you are paying a considerable amount of interest.

Conclusion

Our deep dive into the best crypto lending platforms is done. Simply put, crypto lending is about making crypto work for you, either by earning interest or getting loans. With that said, we hope this article made the entire process a little less complicated. However, crypto markets are known to be tricky, so always research and think twice before investing.