Ethereum is an open-source and decentralized platform that underpins most of the cryptocurrency industry.

Today we answer the question is Ethereum a good investment? We will cover the performance of the cryptocurrency and offer some data surrounding highs and lows.

Is Ethereum a Good Investment? Our Summary

The question ‘is Ethereum a smart investment?’ is not an easy one to answer and is something that anyone wanting to buy Ethereum will consider. This means there’s data to review, including the token’s past performance and its practical applications.

Such information can help you decide if it’s worth buying ETH tokens to include in your portfolio.

Ethereum not only allows for peer-to-peer transactions but also serves as a framework for developing smart contracts and distributed applications. In fact, Ethereum is an industry leader in smart contracts. As such it is the blockchain network of choice for the best NFTs, crypto-based games, and tons of decentralized finance apps.

Is Ethereum a smart investment though?

As well as falling transaction fees, another major selling point for Ethereum is its flexibility, which allows it to adapt to changing demands as they arise. That’s how a network can stay relevant and useful for decades, and Ethereum looks set to do just that with its latest upgrade – ETH 2.0.

The Merge increased transaction speed and scalability and dramatically cut energy consumption by 99.99%. Already the leading blockchain for decentralized apps (dApps), Ethereum is unlikely to relinquish that position any time soon and another upgrade – Shanghai, which will introduce sharding – will make the blockchain even faster.

In our opinion, Ethereum may not see the most gains in the next decade, but it is among the surest crypto investments on the market for long-term growth. Let’s explore if it’s too late to buy Ethereum in 2025.

How Ethereum Has Performed Since Launch & in 2025

Prior to placing an order to invest in cryptocurrency, you need to have some idea of how it performs in the market.

Using the best crypto analysis tools is a popular way for investors to gauge the overall health and volatility of the markets. Ethereum was launched in July 2015 at a price of $0.75 per token. Within three months, Ethereum fell to its all-time lowest value of $0.42. Tokens briefly hit over $1,360 in January 2018, before falling again and remaining below $1,000 until January 2021.

The cryptocurrency reached new highs of nearly $4,170 in May 2021 before plummeting by around 60% to almost $1,700 in July the same year. The all-time highest value of this crypto asset was in November 2021 when tokens reached over $4,890.

This illustrates an increase of almost 652,000% since Ethereum was first launched. As is the nature of cryptocurrencies, this high didn’t last. By the following month, Ethereum had fallen by around 8% to a little over $4,500.

If you had chosen to invest in Ethereum upon its release, you would still be looking at very strong gains of 411,000%. As such, if you had invested $1,000, this would translate to a portfolio of ETH tokens worth a whopping $4.1 million by early 2022.

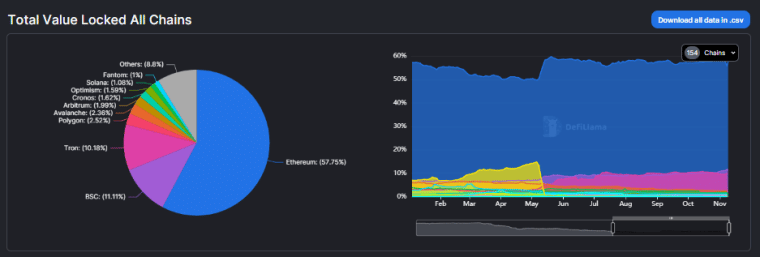

Ethereum remains the most-used and built-upon blockchain, with more dApps built on it than any other chain, more volume, and five-times more TVL (Total Value Locked – the value of dApps built on it) than any other chain, according to DeFiLlama.

Ethereum Price

As we’ve touched on, had you decided to invest in Ethereum between its launch in 2015 and the start of 2018, you would have paid anywhere between $0.75 and $1,360.

Ethereum had not traded below $1,000 from early 2021 until a brief dip in June 2022 before it went on to recover back to nearly $2,000 in mid-August as the Merge drew close.

Interestingly, around the time of Ethereum’s all-time high of around $4,890 in November 2021, the cryptocurrency’s notoriously high transaction price fell by approximately 50%. More recently, Ethereum has experienced heightened volatility in 2022, this is the same for many markets.

At the start of 2022, Ethereum was nearly $3,770. The cryptocurrency’s value continued to fall, before hitting around $2,400 at the end of January, the lowest Ethereum had been seen since July 2021.

Even before the conflict in Ukraine, Ethereum’s volatility was fueled by signs that the Federal Reserve may begin hiking rates.

More crypto legislation, as well as the idea of developing government-issued digital money, has piqued the curiosity of government authorities – Bitcoin’s price has been on a similar downward trend due to such developments.

Between April 2020 and 2022, Ethereum traded at a low of just over $1,700 and a high of around $4,890. In the same time frame, Ethereum increased in value by almost 28%, whilst Bitcoin fell by a little over 34%.

Since then, however, ETH has largely been on a downward trend except for a few weeks in July and August when investors were excited by the upcoming Merge – a major upgrade that saw the blockchain switch from Proof-of-Work (PoW) to Proof-of-Stake (Pos) and increase its speed and scalability, as well as reduce its energy consumption by 99.99%.

So far, though, the Merge has been a ‘buy the rumour, sell the news’ event, with the price immediately crashing after it went live and dropping back to its current price, as of November 2022, of around $1,200.

Unfavorable economic conditions – such as rising inflation, interest rate hikes, the European energy crisis, and the Russo-Ukranian War – have all hit the coin, despite its continued place as, by far, the most consistently used and built-upon blockchain.

Ethereum Highs and Lows

We’ve covered Ethereum’s performance since its inception and have begun to uncover whether the crypto-asset makes a sound investment.

For a recap, see the highs and lows of Ethereum here:

- Ethereum launch July 2015 – $0.75

- October 2015 – Ethereum falls to all-time low of $0.42

- January 2018 – ETH rises to a little over $1,360, over 181,000% increase since launch

- May 2021 – Tokens increase further, to almost $4,170, a rise of 990,000% since its an all-time low

- July 2021 – Plummets to $1,700, a decrease of around 60% in two months

- November 2021 – Reaches an all-time high of $4,890, an increase of almost 158% in four months

- January 2022 – Ethereum plummets to around $2,400, a fall of approximately 50% since its all-time high two months earlier

- June 2022 – ETH briefly crashes below $1,000 for the first time since January 2021

- July and August 2022 – ETH increases to nearly $2,000 ahead of the upcoming Merge upgrade

- September 15, 2022 – Ethereum completes the Merge upgrade, switching from PoW to PoS, increasing speed and drastically reducing energy consumption

- September 2022 – ETH drops again as investors ‘bought the rumor, sold the news’

- November 2022 – ETH trading at around $1,200 – 75% down from its all-time high

These spikes and crashes throughout its history should give you a better understanding of Ethereum’s volatility and whether it’s the right investment for you. Of course, all cryptocurrencies are volatile and speculative,

Ethereum Price Prediction

When researching ‘is Ethereum a good investment?’ Bear in mind that any price predictions you come across should be taken as speculation, especially long-term. This is usually based on technical analysis, studying variables of past, and current trends.

With that said, market analysts are expecting more pain in the immediate term, with some traders predicting a sub-$1,000 ETH that could even test $800 or lower.

The price is expected to recover somewhat before the end of the year and into 2023, with bullish sentiment eventually taking over with the next Bitcoin halving approaching in early 2024.

Some predictions say by the end of 2025, the average expected price of Ethereum will be over $9,560.

Depending on which analysis you study, the maximum forecasted value of Ethereum in 2025 is around $12,780, while the lowest expected value is $6,400.

Ethereum Utility – Is It Investable?

Ethereum is one of the original cryptocurrencies and has long been the top altcoin on the market, therefore one of the first people to think about adding to their portfolio.

This first-mover advantage is likely to be so strong that it will remain the default choice as the smart contract industry matures.

The utility of this cryptocurrency is much higher than that of Bitcoin making it easier to spend ETH.

Ethereum’s technology is used in everything from NFTs, and business blockchain solutions to DeFi apps. Ethereum’s native token, ETH is one of the most valuable cryptocurrencies in the space.

See some of Ethereums uses below:

- Developers may use Ethereum to raise funding for their own projects by creating a contract and soliciting pledges from the general public

- Some of the best NFT games are built on the Ethereum blockchain, as such many NFT marketplaces accept ETH tokens

- The Merge was successfully completed, making Ethereum faster and 99.99% more energy efficient

- Another upgrade, Shanghai, is in development and will introduce Sharding – making Ethereum transaction speed even quicker

- Ethereum is the leading blockchain for dApps with nearly 600 protocols built on it and 5-times more TVL than its rivals

After the release of Ethereum 2.0, the existing chain will become the ‘Beacon Chain’, which will operate as a settlement layer for smart contract interactions on other networks.

Should I Buy Ethereum?

There are a number of methods to benefit from the popularity of Ethereum. You may still be asking yourself ‘is Ethereum a good investment?’

See a list of the key benefits of Ethereum :

- One of the original cryptocurrencies, and usually only second to Bitcoin in terms of market capitalization

- Ethereum is much faster than Bitcoin

- Real-world applications such as DeFi, web-browsing, digital identity and supply chain management, finance/payments, security, health applications, and more

- It is the leading blockchain for dApps, NFTs, and blockchain gaming

- The Merge was successfully completed making it extremely fast and energy-efficient

- Sharding is on the way, allowing ETH to process 100,000 transactions per second

A direct Ethereum investment is the simplest way. It poses the most danger, but also the largest possible return, due to its extraordinary volatility.

Conclusion

Today, we have shed some light on cryptocurrencies and tried to answer the question ‘is Ethereum a good investment?’

There are many benefits of adding Ethereum to your portfolio, because of its place as the top altcoin in the market and, by far, the most used and usable blockchain in the whole space.

Ethereum is the market leader for dApps – boasting more protocols than any other chain and five times more TVL than its rivals.

In real terms today, no other crypto asset comes close to its utility or user base, and Ethereum is among the most ‘sure-thing’ investments in crypto.

However, because Ethereum is so established, the potential for growth and high returns is somewhat stunted – a return to all-time highs will represent an extremely healthy 5x, but many crypto investors seek bigger gains.

Two crypto presale projects, both built on Ethereum, represent more room for growth given their excellent utility and low entry points.

Potential Risks of Investing in Ethereum

- Market Volatility: Ethereum, like most cryptocurrencies, is subject to significant price fluctuations. The value of ETH can drop dramatically in a short period due to external factors such as market sentiment, macroeconomic changes, or unexpected regulatory announcements. This volatility can result in substantial losses for investors who are not prepared for rapid market swings.

- Regulatory Uncertainty: Cryptocurrencies are under increasing scrutiny from governments and regulatory bodies worldwide. While Ethereum has largely been recognized as a decentralized platform, changes in regulation could impact its adoption, trading, or utility, particularly in jurisdictions implementing stricter crypto policies.

- Scalability Challenges: Despite the transition to Ethereum 2.0, scalability remains a concern. The blockchain’s transaction throughput, while improved, could still face congestion issues during periods of high demand. Competing platforms like Solana and Avalanche are offering faster, cheaper alternatives that could divert users from Ethereum.

- Competition from Emerging Blockchains: Ethereum is the dominant player in the decentralized application (dApp) and DeFi ecosystems, but it faces fierce competition from newer blockchains with faster speeds, lower costs, and innovative technologies. Platforms like Binance Smart Chain, Cardano, and Polkadot are vying for market share.

- Hacking and Security Concerns: As the primary blockchain for DeFi, Ethereum is a frequent target for hackers. Vulnerabilities in smart contracts or decentralized applications can result in significant financial losses, affecting investor confidence.

- Environmental and Social Criticism: While the transition to Proof-of-Stake has drastically reduced Ethereum’s energy consumption, some investors remain skeptical about its long-term environmental impact compared to newer blockchains that launched with energy-efficient designs.

- Technological Risks: The Ethereum ecosystem is complex and continuously evolving. Bugs or delays in implementing upgrades such as sharding could negatively impact network performance, adoption rates, and investor confidence.

Ethereum as a Long-Term vs. Short-Term Investment

Here’s a quick comparison between long-term and short-term:

Long-Term Investment: Stability and Growth Potential

Investing in Ethereum for the long term focuses on its foundational role in blockchain technology and its potential for sustained growth as decentralized applications, NFTs, and DeFi continue to expand.

Advantages of Long-Term Investment:

- Steady Returns: Ethereum’s established position as a market leader minimizes the risk of obsolescence.

- Ecosystem Growth: With ongoing upgrades (e.g., sharding), Ethereum aims to improve scalability and efficiency, attracting more developers and users.

- Real-World Use Cases: Adoption in industries like finance, gaming, and supply chain management ensures relevance and utility.

- Historical Resilience: Despite market downturns, Ethereum has consistently rebounded to reach new highs, reflecting investor confidence.

Considerations for Long-Term Investors:

- Be prepared for short-term price fluctuations.

- Diversify your portfolio to mitigate risk.

- Monitor technological developments and regulatory changes.

Short-Term Investment: Capturing Volatility

Short-term trading in Ethereum focuses on capitalizing on price movements caused by market trends, news events, and technical indicators.

Advantages of Short-Term Investment:

- High Liquidity: Ethereum’s significant market volume enables quick entry and exit for traders.

- Profit from Volatility: Active traders can exploit price swings to generate rapid gains.

- Event-Driven Opportunities: Upgrades like the Merge or macroeconomic events can create trading opportunities.

Considerations for Short-Term Traders:

- Master technical analysis to predict price trends.

- Stay updated on Ethereum-related news and global economic conditions.

- Use risk management tools, such as stop-loss orders, to limit potential losses.

Wrapping Up

Ethereum remains a strong contender in the cryptocurrency market, offering unparalleled utility and adaptability. Its continuous advancements through upgrades such as The Merge and Shanghai secure its position as the go-to blockchain for developers and investors alike.

For those seeking diversification, emerging projects like Dash 2 Trade and IMPT provide unique value propositions with significant growth potential.

Whether as a direct investment or through alternative projects, Ethereum’s influence on the crypto space is undeniable.

Key Takeaways:

- Ethereum’s Position in the Market: Ethereum remains the leading blockchain for decentralized applications (dApps), NFTs, and smart contracts, offering unmatched utility compared to other cryptocurrencies.

- Historical Performance: Since its launch in 2015 at $0.75, Ethereum has seen exponential growth, reaching an all-time high of $4,890 in November 2021.

- Upgrades and Advancements: The successful implementation of Ethereum 2.0 (The Merge) and upcoming Shanghai upgrades position Ethereum for long-term scalability, energy efficiency, and faster transactions.

- Volatility and Risks: Ethereum has experienced significant price fluctuations, highlighting both opportunities for high returns and the inherent risks of cryptocurrency investments.

- Alternative Investments: Emerging crypto projects such as Dash 2 Trade and IMPT offer innovative use cases, appealing to investors seeking potentially higher growth rates.