Learn how to invest in cryptocurrency with our comprehensive beginner’s guide.

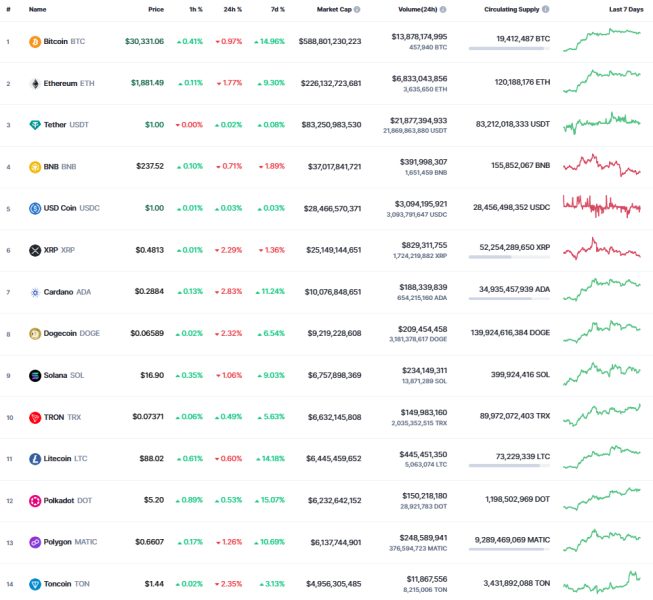

With a market value of over $1.18 trillion and more than 20,000 different cryptocurrencies, it’s important to know how to choose a safe and low-cost cryptocurrency exchange, find the best digital currencies, balance and diversify your portfolio.

In less than five minutes, you’ll be ready to invest, but we’ll also discuss the risks and how to protect yourself from scammers.

Key Takeaways: Crypto Investing for Beginners

- Understand Cryptocurrency: Cryptocurrencies function like stocks, with their value tied to project success and market demand.

- Start Simple: Bitcoin (BTC) and Ethereum (ETH) are beginner-friendly investments due to their stability and wide adoption.

- Budget Wisely: Invest only what you can afford to lose; allocate 1-5% of your portfolio for crypto investments.

- Investing vs. Trading: Beginners should prioritize long-term investing over short-term trading to minimize risk and volatility exposure.

- Platform Selection: Use secure and reliable exchanges like Coinbase or Binance for your crypto transactions.

- Diversify Your Portfolio: Balance your investments across different crypto projects to mitigate risk.

- Volatility Awareness: Crypto markets are highly volatile, offering both high potential returns and significant losses.

- Security First: Protect your investments with secure wallets and stay cautious of scams and exchange vulnerabilities.

- Stay Informed: Follow regulatory updates and research projects thoroughly before investing.

- Focus on Fundamentals: Look for projects with clear roadmaps, utility, and strong community support for long-term success.

Cryptocurrency Investment Explained

A simple way to understand cryptocurrencies is to view them as stocks. Like with companies such as Google, investors are buying into a project, but rather than buying shares of a company, they are buying crypto tokens.

Blockchain technology is, of course, a lot more complex than that, but you don’t necessarily need to know more than fundamentals to make your first investments.

Buying Bitcoin (BTC) or Ethereum (ETH) as a beginner is fairly similar to buying Apple (AAPL), Google (GOOG) or Amazon (AMZN) stock.

Many trading platforms offer crypto trading and investment alongside traditional trading and investment.

The price of a particular crypto is based on supply and demand. The more interested people are in investing in a certain project, the more its value will increase over time.

Although many exchanges and trading platforms offer crypto investment options, novice investors should be aware that the industry will become more regulated in the future.

Binance and Coinbase — two of the largest crypto exchanges in the world — have just been targeted in a lawsuit by the US Securities and Exchange Commission, for allegedly violating securities rules.

Is Cryptocurrency a Good Investment?

Cryptocurrency investment can be lucrative, but it comes with the same risks as all investments do – everything could go wrong at all times.

Crypto price action is much more exaggerated and volatile than investing in stocks or commodities. This will make your wins huge, but losses even greater.

The most important factor new crypto investors need to understand is their personal investor profile.

Several factors contribute to this, including risk tolerance, available capital, and investment goals. For instance, while $100 may be a significant amount for some, it may be inconsequential for others.

So, it goes without saying — only invest amounts that you can afford to lose.

Investing vs Trading

The terms investing and trading are typically used interchangeably in the cryptocurrency industry.

However, just like in the stocks and shares scene, these two terms require completely different strategies.

Investing

When you invest in a cryptocurrency, you typically do so with a long-term vision in mind.

This means that at a minimum, you will likely hold onto your tokens for at least one year, not selling no matter what the price does.

Cryptocurrency investing requires little input from you after you have bought your chosen tokens.

Trading

Cryptocurrency trading is typically viewed as a shorter-term strategy. This means that you might buy a cryptocurrency and cash out within the next few weeks or months, if not sooner.

In some cases, traders will open and close a position, or multiple positions, within one day — this is referred to as crypto day trading.

Crucially, cryptocurrency trading requires active participation in terms of research and technical analysis.

As a newbie in this industry, it’s best to stick with a long-term approach to cryptocurrency and not start trading until learning about the space and the tools needed to do so. It means that you will look to choose solid projects that offer a viable long-term outlook and will have little interest in shorter-term price action and volatility.

How Much Should You Invest in Cryptocurrency?

There is no one-size-fits-all answer to how much one should invest in cryptocurrency. It ultimately depends on an individual’s financial situation, investment goals, and risk tolerance. We’d recommend investing no more than 1% to 5% of one’s portfolio in cryptocurrencies.

However, this is not a hard and fast rule and may vary depending on individual circumstances. It’s important to do thorough research or even consult with a financial advisor before making any investment decisions.

Bottom line with all investments is: invest only what you can afford to lose.

Why Invest in Crypto

In this section, we will talk about some of the reasons investors are turning to cryptocurrencies to make both short and long-term financial gains.

Potential for high returns

Cryptocurrencies have the potential to provide high returns on investment, especially in the long term. Some cryptocurrencies have experienced significant price increases in the past, making early investors very wealthy.

Decentralized and independent

Cryptocurrencies are decentralized and independent of any government or financial institution. This means they are not subject to the same regulations and restrictions as traditional currencies.

Transparency

Transactions made with cryptocurrencies are recorded on a public ledger, which is transparent and can be easily audited. This makes it difficult for fraud and corruption to occur.

Diversification

Investing in cryptocurrencies can provide diversification to an investment portfolio, helping reduce overall risk.

Innovation

Cryptocurrencies are at the forefront of technological innovation and investing in them can support the development of new technologies and applications.

Risks of Investing in Cryptocurrency

All seasoned traders will always consider the risks of an asset class before proceeding with an investment.

We take a closer look at some of the main risks to consider when you invest in cryptocurrency.

Speculation

All investment is speculative and crypto is at the higher end of that scale – no tokens are guaranteed to bring returns and none should be treated as sure-fire ways to profit.

While it’s extremely likely that Bitcoin, for example, will break a new all-time high in 2024 and could even reach six figures, there is no promise that it will happen.

All crypto investors should come to terms with losing some investments. Not all tokens succeed, even if they tick boxes that look like a legitimate path to success.

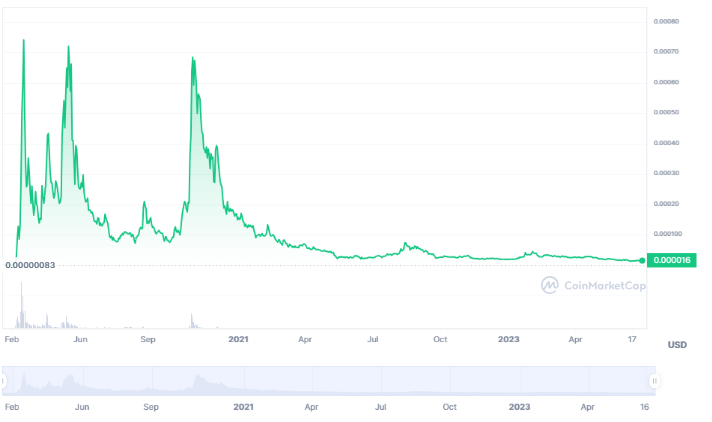

Many cryptos – especially meme coins – have a very short shelf life. They offer no utility or inherent value and once the hype has moved away from them they struggle to ever return to their previous prices.

Volatility

Crypto prices are extremely volatile, especially with small market cap coins.

Stock prices for Apple, Amazon, or Microsoft are never going to dramatically change overnight, because their market caps are hundreds of trillions of dollars.

Conversely, cryptos can make dramatic gains in just hours, days, and weeks, but they can also see dramatic sell-offs.

At the height of its popularity, Dogecoin grew nearly 8,000% to $0.71 in early 2021, before falling to $0.16 – a 77.5% loss just four weeks later. It has not been above that price since.

Security

Hacking crypto wallets and exchanges is another extremely lucrative avenue for crypto scammers.

Protocols, crypto wallets, and exchanges can be hacked remotely with the funds then difficult to recover.

According to blockchain analytics firm Chainalysis, 2022 was the biggest year ever for crypto hacks with almost $4 billion stolen from various DeFi protocols.

Around $1.7 billion of the hacks were accredited to the Lazarus Group, said to be backed by the North Korean government and helping to fund the state’s nuclear missile program.

Regulation

While many agree that increased regulation is key to driving mainstream adoption of crypto, there is also a growing feeling that crypto is under attack from regulators such as the SEC.

Recently, the body filed lawsuits against the top two crypto exchanges — Binance and Coinbase. They also announced that various leading altcoins were in violation of securities laws.

That saw the value of Polygon, Tron, Cosmos, and other leading tokens plummet. The threat of increased regulation in the US will undoubtedly change how crypto operates as well as the price potential of individual tokens.

What Crypto to Invest In

Dozens of new crypto presales launch every day, but it can be difficult to separate proper projects, especially for beginners.

Use social media sites and ICO calendars such as CoinCodex or ICOLink to find new projects.

Read a project’s whitepaper to decide whether it is a worthy investment. Red flags include poorly written, vague, or incomplete whitepapers.

Check the roadmap to see if the timescale is realistic and the tokenomics to ensure the contract is audited and fair.

Check social media sentiment to see if there is interest in the project. Projects with no interest from the community will struggle to launch.

Presale Projects

Bitcoin ETF Token – Deflationary Cryptocurrency Speculating the Arrival of a Bitcoin ETF, Presale is Soaring

One of the top crypto presales right now is $BTCETF – the native token of Bitcoin ETF Token. This is an ERC-20 token that has been created to celebrate the expected arrival of a Bitcoin ETF (Exchange-Traded Fund).

The cryptocurrency will conduct token burning events and offer staking rewards, as the Bitcoin ETF makes progress. Bitcoin ETF Token has listed out 5 milestones – which will be the basis for its burn mechanics and staking rewards. These include:

- SEC approving the first Bitcoin ETF

- The release of the Bitcoin ETF

- Bitcoin ETF reaching $1 billion in assets under management

- Bitcoin reaching a price of $100K

- $BTCETF reaching $100 million in trading volume

As each of these milestones is completed, Bitcoin ETF Token will burn 5% of its token supply. Once $BTCETF lists on exchanges, it will also result in a 5% trading tax. The tax will reduce by 1% as each milestone is met.

From a total supply of 2.1 billion – 25% will be offered through staking rewards. According to the Bitcoin ETF Token whitepaper, the staking rewards will be distributed throughout 5 years. Bitcoin ETF Token allows token holders to stake their holdings and generate APYs (Annual Percentage Yields) as high as 500%.

The tokens will be locked on a smart contract – which has been verified by Coinsult. Early investors can buy $BTCETF before the price increases throughout the presale. At press time, $BTCETF is priced at $0.0052 on presale. By the final round, the price will increase to $0.0068 per token.

In total, 840 million tokens will be distributed across ten rounds. Bitcoin ETF Token aims to raise a presale hard cap of nearly $5 million. So far, the presale has raised over $480K in under a week. Join the Bitcoin ETF Token Telegram channel to stay updated with this cryptocurrency.

| Hard Cap | $4.956 Million |

| Total Tokens | 2.1 Billion |

| Tokens available in presale | 840 Million |

| Blockchain | Ethereum Network |

| Token type | ERC-20 |

| Minimum Purchase | NA |

| Purchase with | USDT, ETH, BNB, MATIC, Card |

Bitcoin Minetrix – Crypto Presale Offering Passive Income and Cloud Mining Credits

$BTCMTX is a new cryptocurrency that lets you earn cloud mining credits. It uses a stake-to-mine mechanism and is more transparent and secure than other cloud mining services.

By staking $BTCMTX, you can generate cloud mining credits and get a share of mining revenues. You can buy $BTCMTX during the presale, with 70% of the total supply of four billion tokens going towards this stage.

The $BTCMTX token is priced at $0.011 during the first round. By the final phase, the price will hike to $0.0119. The goal is to raise a $32 million hard cap by the end of the presale. Bitcoin Minetrix has raised more than half a million dollars in just over a week.

Stay updated with this cryptocurrency’s rise by going through the Bitcoin Minetrix whitepaper and joining their Telegram channel.

Hard Cap

$32 million

Total Tokens

4 Billion

Tokens available in presale

2.8 Billion

Blockchain

Ethereum Network

Token type

ERC-20

Minimum Purchase

$10

Purchase with

USDT, ETH, BNB

yPredict (YPRED)– AI-Powered Crypto Platform to Maximize Profits

While Bitcoin Minetrix is tapping into a new crypto niche, yPredict will utilize another highly influential asset class – artificial intelligence.

The $YPRED token presale has now raised more than $2.6 million with tokens on sale for $0.09, at the time of writing, and rising to $0.012 in the final presale stage.

The yPredict ecosystem is made of AI and machine learning experts, software engineers, financial quants, and professional traders.

Users buy $YPRED tokens to gain access to different tools, predictive trading models, and more through a three-tier subscription model.

Financial data scientists can also offer results and signals generated through their predictive models, with yPredict providing a marketplace to sell model predictors.

Join the Telegram group for more information.

Other Cryptocurrencies

Choosing which cryptocurrency to invest in can be challenging as there are tens of thousands of digital tokens available. It depends on the individual investor’s interests, expectations, and risk tolerance.

However, there are a few projects that the majority of the crypto community invests in, such as Bitcoin and Ethereum, which make up 70% of the entire crypto market.

Bitcoin (BTC)

Bitcoin is the most popular cryptocurrency investment for both new and established investors. It was the first cryptocurrency and has a long track record of success.

Despite a tough 18 months, it’s still an attractive investment opportunity as it’s more than 50% down from its all-time high. Bitcoin has seen increased institutional uptake, and analysts believe it will surpass $100k in the next bull run — an increase of 233%.

It’s considered the best long-term investment and is often referred to as “digital gold.” Additionally, Bitcoin’s performance affects the rest of the market due to its dominance.

Ethereum (ETH)

Ethereum’s native token, ETH, has increased in value by over 5 million percent since its launch in 2015. Unlike Bitcoin, ETH is used by decentralized app (dApp) builders.

Many leading projects, including Lido, AAVE, and Uniswap, are built on the Ethereum blockchain, along with thousands of smaller projects.

Ethereum has almost 60% market dominance over other chains, with a $25 billion Total Value Locked (TVL), which is five times more than its nearest rival. It’s also the leading blockchain for NFT collections and crypto games, making ETH a highly useful currency.

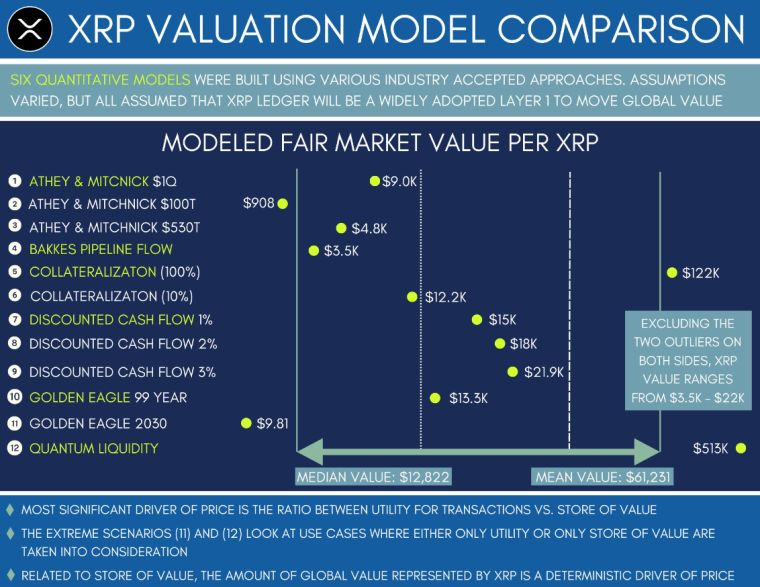

Ripple (XRP)

XRP is a much-loved crypto that could be set to explode in this year given it has been locked in a two-year court case with the US SEC that is ending soon.

The court case is asking whether XRP’s parent company Ripple violated securities laws.

XRP provides banks and large financial institutions with technology that can execute cross-border transactions and unlike traditional systems, XRP permits cheap and near-instant transfers – regardless of the currencies involved.

Currently priced at just less than $0.50, one recent study from private equity firm Valhill Capital – which took two years to undertake – suggests XRP’s fair market value could be around $12,000 per token.

Penny Cryptocurrency

If you came across the term ‘penny cryptocurrency’, this simply refers to digital tokens that trade for less than $1.

It’s important to remember that, just because a cryptocurrency is cheap, this doesn’t mean that you are taking on enhanced risk or that it has less ‘value’ than a more expensive coin.

After all, the value of a cryptocurrency is determined by its tokenomics, which is the total market cap divided by the number of coins in circulation.

Are High-Priced Tokens Better?

- XRP is trading at around $0.47 per token with a market capitalization of $25 billion as it has a large supply.

- Maker has a much smaller market capitalization of less than $660 million but a single token costs around $680 each as it has much fewer coins in circulation.

- Investors should understand that a higher price doesn’t mean a token is necessarily better or more valuable than a cheaper one.

Conducting your due diligence before investing in penny cryptocurrencies is crucial and will help you understand which cryptos are worth investing in now and for the future.

Where to Invest in Cryptocurrency

There are over 100+ exchanges and brokers in the online space that allow you to invest in cryptocurrency.

In the sections below, you will find our reviews of the best investment platforms.

1. Coinbase – Top Exchange for First-Time Cryptocurrency Investors

Coinbase is a simple platform — great for first-time investors. It’s heavily regulated and listed on the NASDAQ as a tradable stock. The platform keeps 98% of client funds in cold storage and requires two-factor authentication for all accounts, making it one of the safest cryptocurrency platforms available.

On the downside, Coinbase charges some of the highest fees in the industry. If you invest via this platform, you pay a standard commission of 1.49%. This commission will again be charged when you close a position.

While ACH payments can be made fee-free, debit/credit card transactions are charged at 3.99%. This does, however, include your trading commission.

Coinbase gives you several options when it comes to storage, including a dedicated wallet app that allows you to manage your private keys.

What We Like:

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection. Launched in 2013, Kraken is used by both beginners and advanced traders. It’s one of the safest crypto exchanges in the world and it never faced a major security breach. Investors can create a new account in under five minutes and start trading over 220 cryptocurrency assets. Those with a tight budget can start investing with as little as $1 on various cryptos. Kraken offers several features to advanced traders. These include margin and futures trading, along with charting options on the Kraken Pro account. Retail clients can access up to 5x leverage to heighten the value of their trades. Further leverage is provided to professional clients. Investors can access instant buying/selling options on Kraken, by paying a 1.5% fee on crypto trades, and a 0.9% fee on stablecoins. The standard fee on the Kraken Pro account starts at only 0.26% per trade if the 30-day trading volume is under $50,000. The higher the trading volume, the lower the fees. Around 95% of users’ assets are stored offline in cold storage, preventing the funds from online attacks. What We Like:

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection. There is no longer a risk of losing large sums of money when you invest in crypto — especially when you have an account with a broker like Webull. This top-rated brokerage site allows you to buy and sell cryptocurrency for just $1 per trade. Best of all? You won’t be required to meet a minimum deposit to open an account. As such, this means that you can deposit $1 to get a feel for how the cryptocurrency platform at Webull works. It’s best to use ACH when depositing funds, as no transaction fees are charged. Domestic bank wires, however, are charged at $8 per transaction Nonetheless, another major benefit of choosing Webull to invest in crypto is that you will not pay any commissions. Bid-ask market spreads start at 1% here, so bear that in mind when calculating your investment costs. If you are looking for a cryptocurrency broker that also enables you to invest in traditional assets, Webull offers stocks and ETFs. These financial instruments can be bought and sold on a commission-free basis. Finally, Webull offers retirement accounts across various IRAs, but no copy trading tools are available. What We Like:

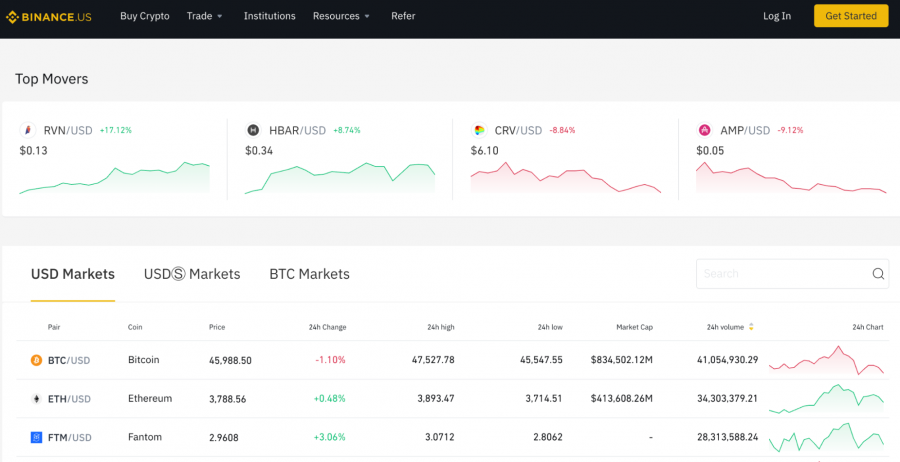

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection. Binance is the largest cryptocurrency exchange globally. The exchange offers a domestic version of its website that is only accessible to US clients, though. Once you open a verified account and make a deposit on Binance, you can trade cryptocurrencies at a commission of just 0.10% per slide. Moreover, when funding your Binance account via ACH or a domestic bank wire, you won’t be charged any transaction fees. On the other hand, depositing with a debit or credit card is expensive. Binance charges 4.5% for this option — in addition to an instant buy fee of 0.5%. When it comes to trading tools, this is where they stand out. You can analyze the cryptocurrency markets through high-level technical indicators and charting features. However, these tools won’t be suitable for beginners, so do bear this in mind before you open an account with Binance. Another popular feature offered by Binance is its Trust Wallet app. It enables you to store thousands of different tokens across multiple blockchains. For a simpler way to store your crypto investments, you can use the main Binance web wallet. What We Like:

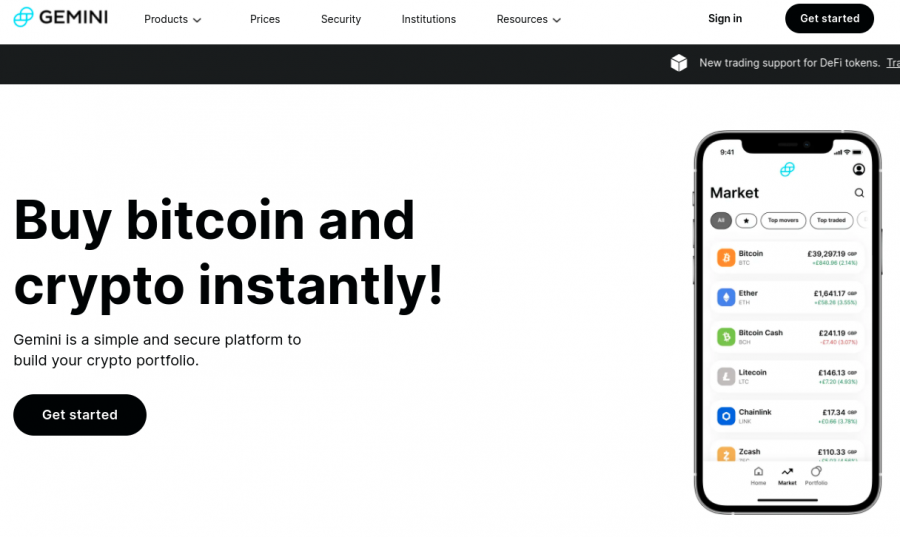

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection. In many ways, Gemini offers a very similar service to that of Coinbase. This is because Gemini, like Coinbase, offers a simple user interface that makes the process of investing in cryptocurrency easy. Furthermore, Gemini is a heavily regulated exchange. This includes a license with the New York State Department of Financial Services (NYSDFS), so you should have no issues regarding safety. However, Gemini is one of the most expensive cryptocurrency exchanges in the market. You will pay a standard commission of 1.49% per slide for any cryptocurrency investments above $200. If you trade less than $200, you will pay a flat fee depending on the size of the investment. Either way, this will work out at more than 1,49%. Another thing to note about the pricing structure at Gemini is that although debit and credit card payments are supported, they’ll set you back for 3.49% of the purchase amount. This is why it’s best to deposit funds via a wire transfer at Gemini, as it’s free of charge. Gemini is home to 75+ leading cryptocurrencies. This includes everything from Bitcoin, Ethereum, and Litecoin to Chainlink, Zcash, and Bitcoin Cash. What We Like: This beginner’s guide on how to invest in cryptocurrency will conclude with a detailed walkthrough of how to buy top crypto presale project, Bitcoin ETF Token. Here’s the process for acquiring $BTCETF during its presale stages: To start, make sure you have a compatible crypto wallet, like MetaMask or TrustWallet, which can be installed from their official websites. After creating an account on a specific wallet, you can go to the Bitcoin ETF Token presale website and then click on the ‘Connect Wallet’ button. In this step, make sure that your wallet has sufficient funds. The presale website will provide different funding options for your crypto wallet. $BTCETF tokens can be purchased with ETH, BNB or USDT tokens. After your wallet has adequate funds, click on ‘buy with ETH/USDT/BNB’ and mention the amount of $BTCETF you want to receive in return for USDT or ETH. Be sure to leave some excess ETH to cover network transaction (gas) fees. Upon approving the transaction fees, the transaction will be authorized. You can redeem the $BTCETF from its presale page after the conclusion of the presale phase.

Cryptocurrency transactions are subject to taxation in many jurisdictions. It’s essential to understand your tax obligations to remain compliant: Remember: Consulting with a tax professional experienced in cryptocurrency can provide personalized guidance and ensure compliance with all applicable laws. Investing in cryptocurrency can be a quick process that takes just five minutes, but it’s important to do your research and select a reputable brokerage or exchange. Keep in mind that digital currencies are highly volatile, so it’s crucial to assess your risk profile before investing. Established tokens like Bitcoin and Ethereum may offer fewer potential gains than newer projects, such as presales and meme coins, which come with higher risks but also higher potential rewards. One such promising project is Bitcoin ETF Token ($BTCETF) which has already raised nearly half a million in a few days since the presale launched. This cryptocurrency can be staked to earn huge annual yields, and will burn 25% of its token supply. $BTCETF is priced at $0.0052 during the presale.

Number of Cryptos

150+

Trading Commission

1.49%

Debit Card Fee

3.99%

Minimum Deposit

Depends on the payment method

2. Kraken – Invest in 220 Cryptos Starting with Just $1

Number of Cryptos

220+

Trading Commission

Starting from 0.26%

Debit Card Fee

3.75%

Minimum Deposit

$1

3. Webull – Invest in Crypto With Just $1

Number of Cryptos

20+

Trading Commission

0% commission plus market spread

Debit Card Fee

ACH and bank wires only

Minimum Deposit

No minimum deposit

4. Binance – Low Fee Exchange to Invest in 600 Cryptocurrencies

Number of Cryptos

80+

Trading Commission

Up to 0.10%

Debit Card Fee

4.5% plus an instant buy fee of 0.5%

Minimum Deposit

Depends on the payment method

5. Gemini – Safe and Regulated Exchange to Invest in Cryptocurrency

Number of Cryptos

75+

Trading Commission

1.49%

Debit Card Fee

3.49%

Minimum Deposit

Depends on the payment method

How to Invest in Cryptocurrency – Bitcoin ETF Token Tutorial

Step 1: Get a Crypto Wallet

Step 2: Link Your Wallet

Step 3: Funding Your Wallet

Step 4: Buy $BTCETF

Step 5: Claim Your Tokens

Top 5 Mistakes to Avoid in Crypto Investing

How to Spot Scams and Stay Safe in Crypto Investing

What You Should Know About Crypto Taxation and Compliance

Conclusion

Frequently Asked Questions on Investing in Cryptocurrency

Is cryptocurrency a good investment?

How do I invest in cryptocurrency?

What is the best way to invest in cryptocurrency?

What is the best site to invest in cryptocurrency?

What cryptocurrency should I invest in?