As personal and business finance evolves, the demand for a reliable asset management platform is all the more highlighted. The global digital asset management market size is expected to be twice as much by 2027. Portals like ICONOMI are seeking to simplify investing in crypto by allowing users to start trading cryptocurrencies by leveraging crypto trading strategies.

In this detailed ICONOMI review, we’ll take a look at the platform’s numerous features, tools, fees, and how investors can start buying and selling crypto by using simple trading strategies.

What is ICONOMI?

Intending to transform the way people invest, ICONOMI has set out to make cryptocurrency accessible to everyone. It enables investors and traders to buy cryptocurrency and copy trading strategies on its social trading platform.

While striving to provide an easy and secure way to manage digital assets, ICONOMI is offering an asset management platform and white-label services like providing distribution channels to traditional financial services.

ICONOMI is on a mission to make cryptocurrency investing simple and accessible to everyone. It is giving users a secure path forward to progress from beginners to knowledgeable investors by copying the best crypto strategies. It also enables experienced traders to create their own strategies and earn some extra money.

While differentiating itself from typical crypto exchanges, ICONOMI has devised a user-friendly platform to manage digital assets as an alternative to exchange trading. The platform encourages the concept of social trading wherein investors can share their knowledge and create opportunities for the whole community. In this ICONOMI review, investors will also get a deeper understanding of the platform’s best trading strategies.

ICONOMI’s team comprises experienced individuals in the web 3.0 space with diverse professional backgrounds.

Investors can also download ICONOMI’s app to get started.

ICONOMI Crypto Copy Trading

The platform has empowered its users to start investing in cryptocurrencies with a professional approach. To make this possible, ICONOMI has created a network of over 100k crypto enthusiasts and strategists.

These strategists formulate effective crypto strategies that are dynamic to changing market conditions. Investors can leverage these strategies to stay on top of the market trends and make money work for them. Even today, only a few of the best altcoin exchanges offer features like copy trading on their platforms.

ICONOMI is a host to over 300 public crypto trading strategies. Investors and traders simply need to click on copy and can then start mimicking these trading strategies automatically.

What Cryptocurrencies can you Trade on ICONOMI?

Investors can buy Bitcoin or other cryptocurrencies on ICONOMI’s platform while getting started with a minimal amount as low as 10 EUR. The platform is consistently expanding to include more cryptos.

Currently, investors and traders have the option to buy and sell the best cryptocurrencies from its platform. In addition to prominent coins like Bitcoin, Ethereum, Binance Coin, XRP, and Cardano, buyers have the option to choose from 150+ cryptocurrencies. Investors can buy these cryptos, add them to their strategies and ultimately create their strategy.

ICONOMI tracks real-time prices from all the best crypto exchanges (markets) and ensures the best price buyers.

ICONOMI tracks real-time prices from all the best crypto exchanges (markets) and ensures the best price buyers.

Best Crypto Strategists on ICONOMI

Traders looking to invest in Bitcoin and other cryptocurrencies need to come up with effective strategies. An in-depth ICONOMI review has revealed a few promising strategies on its platform. Investors have the option to choose from several strategies like the ones below.

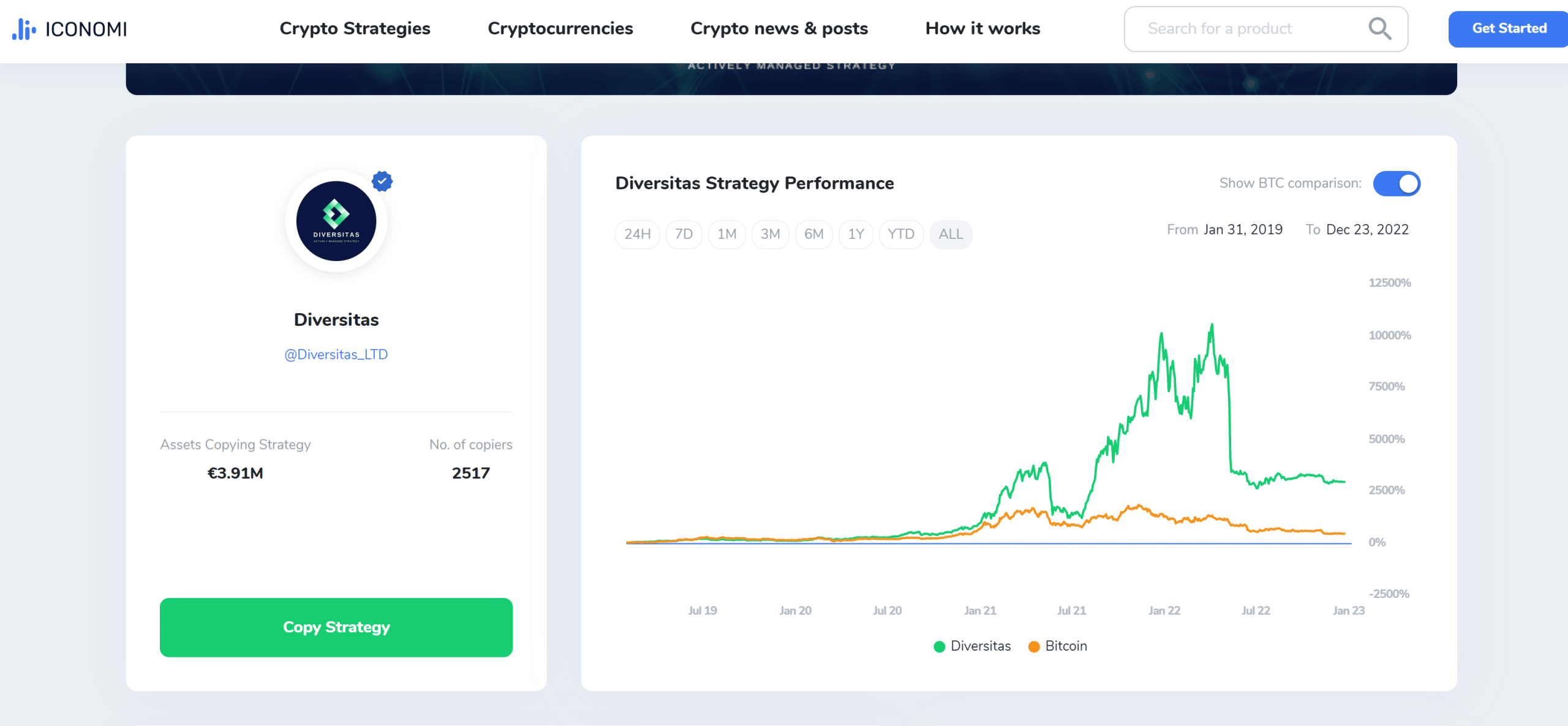

Diversitas

Diversitas is a crypto strategy that is actively managed and focuses on Bitcoin and DeFi. While users may find it difficult to keep track of the best DeFi staking protocols for yielding high returns, they can use this strategy to meet their investment goals.

It also is protected by several rules to protect and grow investors’ portfolios. This strategy has been at the top of all verified strategies that fetched the highest returns to date.

The strategist charges a copy fee (yearly) of only 1% alongside a monthly performance fee of 6% (the performance fee is collected only when buyers/copiers make a profit). Buyers opting for this strategy would have to bear an exit/sell cost of 0.5% per transaction.

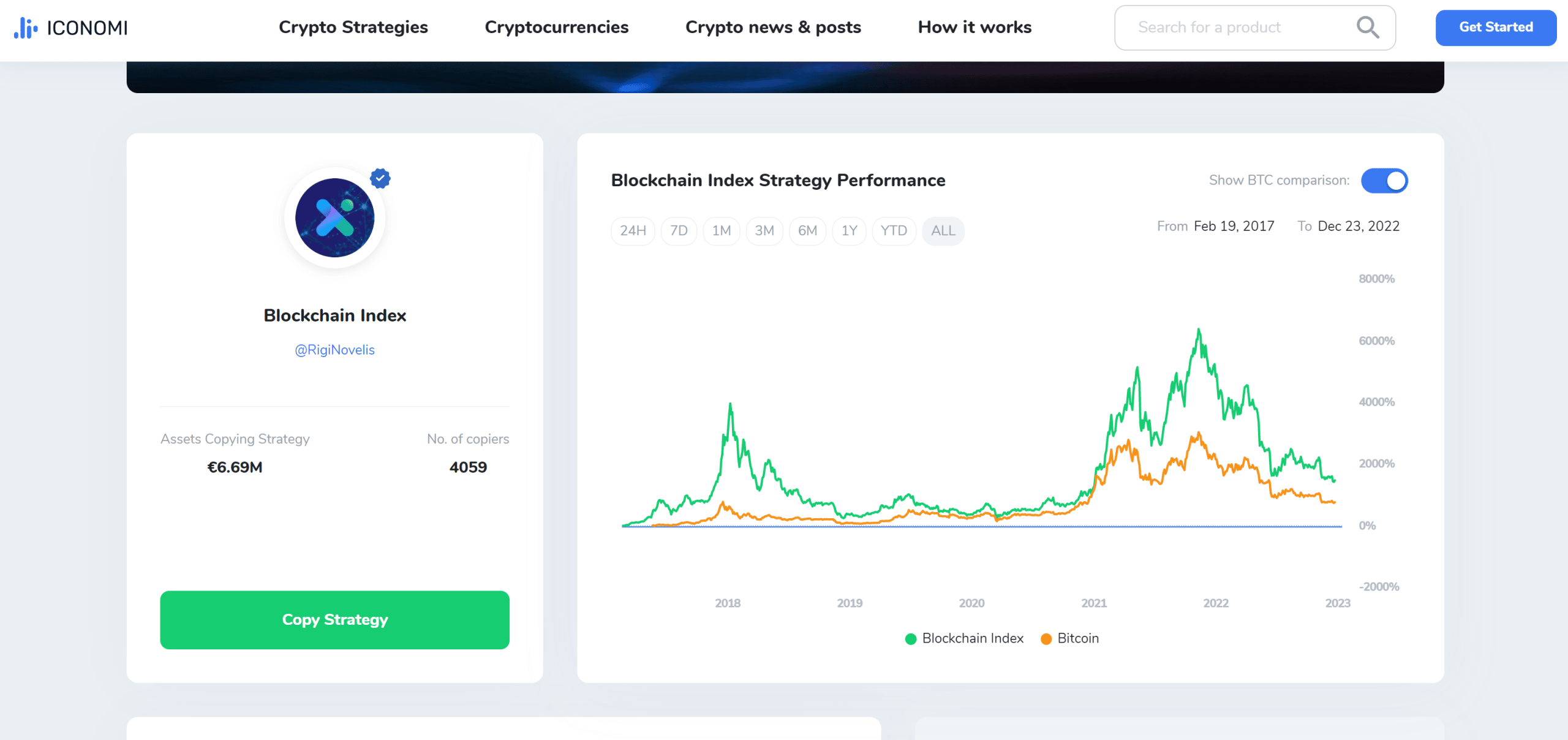

Blockchain Index

It is a passively managed crypto strategy that invests in established blockchain projects with active beta components. This strategy is market-cap weighted and deploys a fixed weight between ETH and BTC. Furthermore, it also keeps track of nascent projects displaying strategic importance.

Although it does not have any active rules in its strategy, the strategy does not charge any performance fee. On the other hand, investors have to bear a 3% copy fee along with 0.50% of the sell/exit cost per transaction.

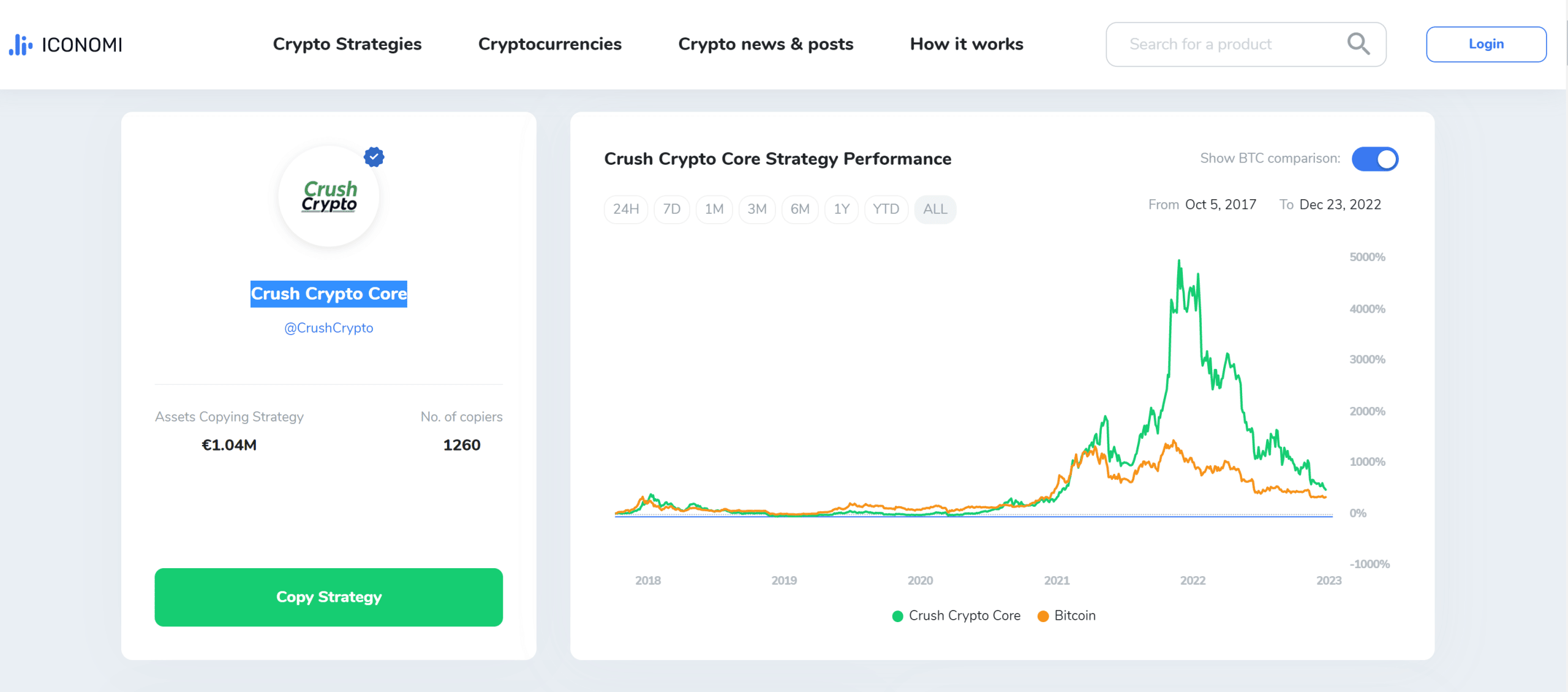

Crush Crypto Core

Crush Crypto Core is a strategy built for investors looking for a mix of high-quality and undervalued projects. The strategy takes a flexible approach to asset allocation depending on the market cycle and sentiment.

The purpose of this crypto strategy is to outperform a typical portfolio comprising BTC and ETH by effectively diversifying into rigorous assets chosen by Crush Crypto. However, the investors will have to pay a 15% monthly performance fee to the strategist for its unique diversification approach (the performance fee is collected only when buyers/copiers make a profit).

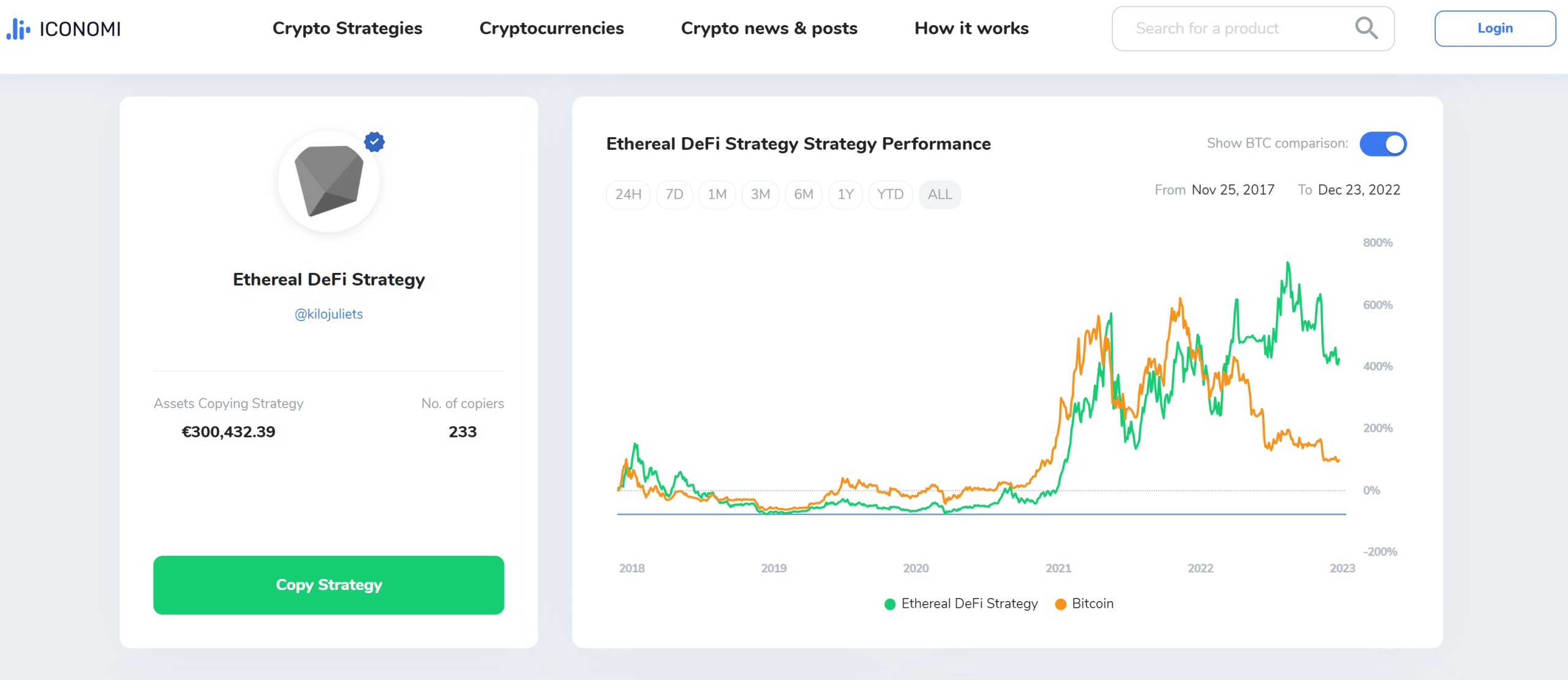

Ethereal DeFi Strategy

The Ethereal DeFi strategy focuses on investments primarily in the Decentralised Finance (DeFI) space. However, it does not have any active rules in its strategy. This strategy has been in the top five of all verified strategies that bagged the highest returns to date. To gain a comprehensive understanding of several DeFi lending platforms, investors can read through our guide.

The strategist charges a copy fee (yearly) of 1.3%. It becomes vital to note that the strategist does not charge a performance fee. Investors opting for this strategy will have to pay an exit/sell cost of 0.5% per transaction.

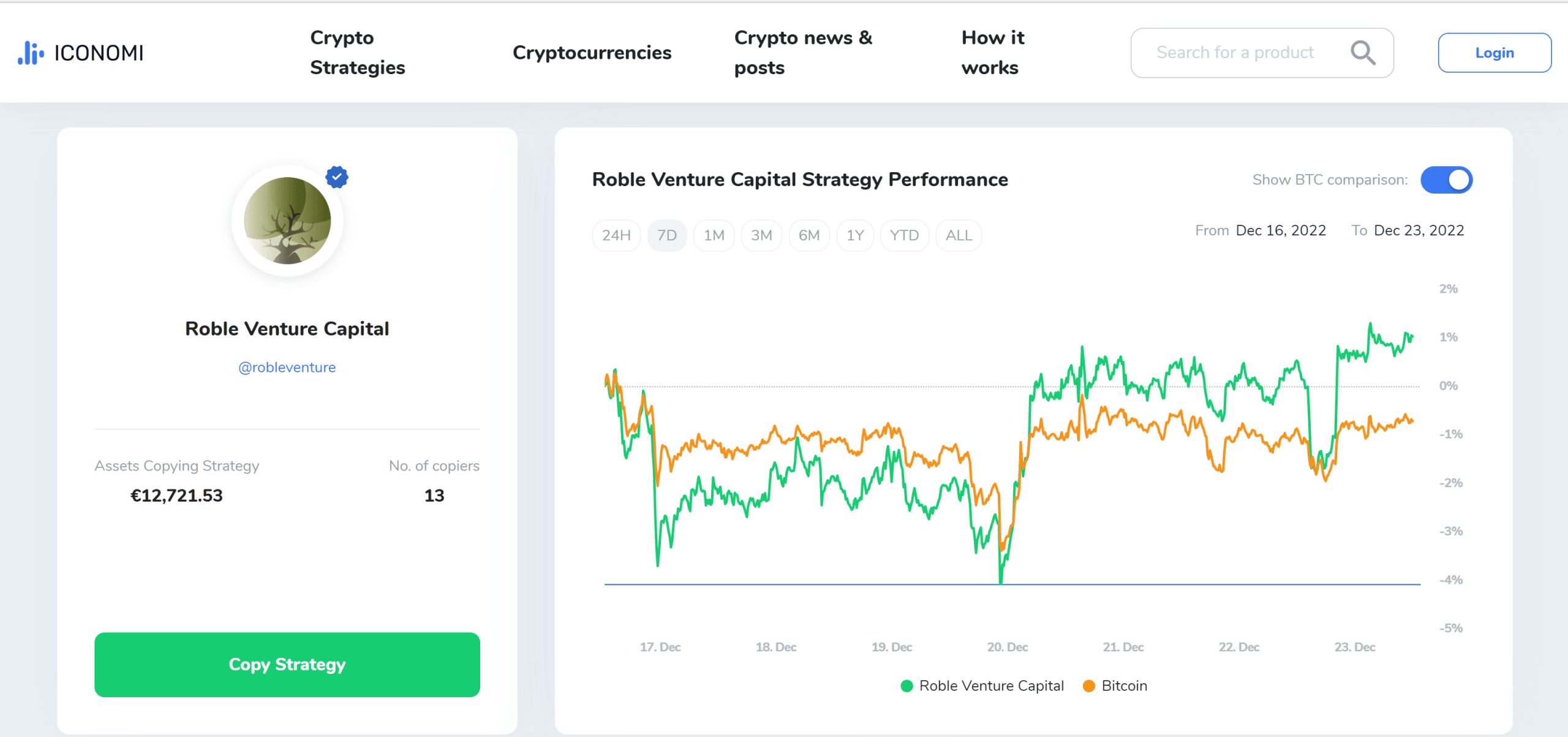

Roble Venture Capital

This strategy will allocate approximately 20% to 40% of its holding to stablecoins. This would help the strategist to protect investors against highly volatile market moves. With around 50% of the holdings in digital stores of value and another 10% in finance projects, investors would be able to maximize their upside exposure while curtailing their downside risk.

ICONOMI Features & Tools

The copy trading platform has a suite of features and tools to make the portal user-friendly through its interface. ICONOMI seeks to cater to beginners and advanced investors or traders by customizing its tools accordingly.

Our team’s ICONOMI review has revealed that the platform believes in simplifying the overall interface for its users by not putting complex charts in it. Instead, investors have access to a bunch of powerful and useful tools they can employ to enhance their trading strategies.

Buyers can set rules for taking profits, stopping losses, schedule strategy rebalances, by utilizing the platform’s leading-edge features. Moreover, investors can also set a Nightwatch rule to protect their crypto holdings. Herein, if the value of their portfolio drops by a certain percentage, they could automatically move their holdings into a stablecoin of their choice. Through this ICONOMI review, investors can glimpse the project’s unique features.

Price Optimization

ICONOMI’s trading engine scans through multiple crypto exchanges to hunt for the best crypto prices. While the portal assures to make each trade economical, ICONOMI also executes it based on the specified algorithm and uses the best pairs to ensure liquidity.

Algorithmic Execution of Trades

In dynamic market conditions, users may seek a high level of flexibility to execute their trades. The platform enables users to trade their assets quickly to avoid a broader market slump while also allowing them to hold assets for a longer time to maximize their investment value. In essence, investors can save their time and money for all size orders.

Effective Automation & Rebalancing Strategies

Buyers can also set automation rules for automatically buying/selling/rebalancing their portfolio. Moreover, they also have the option to rebalance their strategies as per their fancy. Investors can easily add new assets, remove old assets, and adjust the weight of existing assets they already have.

Dollar-cost Averaging

Investors have an excellent opportunity to simply apply an existing strategy and start their investment journey without really putting much effort. This approach works wonders with the dollar-cost averaging concept as buyers can set recurring payments to the platform that would automatically get invested in a strategy of their choice.

Asset Heath

Traders can check how well an asset is doing in the current market scenario before adding any asset to a crypto strategy. This feature allows investors to gauge how a particular crypto is performing and whether or not it lacks volume at a given time.

Templates for Portfolios

ICONOMI’s advanced trading engine empowers users to create a desired strategy structure or a template. Investors can then set a target structure and rebalance their strategies in just a few clicks.

Historical Asset Charts and Rebalance History

Investors can also see empirical price movements over a specific period and glimpse the rebalance history of their strategies. This feature would empower them to assess the effectiveness of trading strategies deployed in the past and accordingly maneuver.

ICONOMI Fee Structure

Our ICONOMI review of the portal’s fee structure led us to conclude that the platform was a relatively cost-effective alternative for investors. The portal uses a spread system to collect its fees.

Account Opening Fees

Investors and traders can open the account for free. In fact, the platform has gone further to state that it will always remain free of any charges. Buyers can register and verify for free.

Deposit Fees

Investors can deposit fiat or cryptocurrencies for free.

Buying or Selling Crypto

The platform does not charge fees for buying and selling cryptocurrencies but charges a 0.75% spread on most conversions. The 0.75% spread applies to major trading pairs. For other pairs, a spread of 1.5% would apply.

Break-up of Spread

- BTC/EUR: 0.75%

- ETH/EUR: 0.75%

- BTC/ETH: 0.75%

- USDT/BTC: 0.75%

- USDT/ETH: 0.75%

- BTC/GBP: 0.75%

- ETH/GBP: 0.75%

- BTC/AUD: 0.75%

- ETH/AUD: 0.75%

All other pairs: 1.5% spread

Copy Crypto Strategy Fees

The crypto strategy fees include copying and performance fees. It becomes important to note that the ‘crypto strategist’ sets the performance fees and copying fees and not ICONOMI. However, anytime crypto strategy fees are collected, they are split between the strategist and ICONOMI and the referrer if any.

Performance Fees

Investors choosing to copy crypto strategies would be charged performance fees of up to 30%. These fees will be collected only when buyers make a profit by copying the strategies. The fees would be collected based on the collection period set by the strategist which could either be weekly, monthly, or quarterly.

For instance, Mr. X decides to copy a certain crypto strategy from an ICONOMI strategist for investing $100. The strategist has set a performance fee of 20% and the collection period is weekly.

Then, at the end of the first week, Mr. X’s portfolio or the market goes up by 15%, and his investment is now worth $115. Now, Mr. X would have to pay a $3 performance fee (20% of $15) to the strategist.

Copying Fees

This is an annual fee that is charged on a daily basis (annual fee/365) to investors choosing to copy crypto strategies. Ultimately, the crypto strategy strategists earn from the copying fee in return for their services of managing the strategies.

Every crypto strategist can set up copying fees of up to 10%.

For instance, if the Crypto strategy copying fee is 3%, a portion of the copying fee is charged daily. To help understand, here is a very simplified formula for the copying fee: 3%/365 = daily charge (3%/365 = 0.00821% per day).

On-boarding Fees

Strategists can charge up to 6% on-boarding fees for covering the costs of education and expertise that they provide. These fees would be charged per transaction and would not apply to all strategies.

Sell/Exit Fees

The sell/exit fees would be charged per transaction. These fees basically get returned to the crypto strategy for covering the trading costs to enter and exit copiers.

Platform Fees for Managing Strategy

The portal charges a fixed fee of 0.37%for rebalancing strategies. It is a trading fee for changing the crypto strategy structure and they will be charged only for the portion of the change.

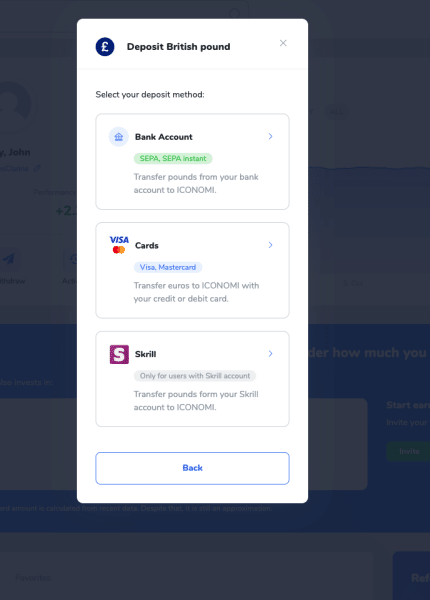

Payment Methods & Minimum Deposit

Investors can get started with an amount of as little as 10 EUR and start buying cryptocurrencies.

Investors can deposit crypto (BTC, ETH, USDT, …) or fiat money (EUR, GBP) and use these currencies as payment methods on the ICONOMI platform.

Buyers transferring fiat money via their bank accounts would be charged no transfer fees.

Investors choosing to transact via a card (MasterCard or Visa) would have to bear a transfer fee of 3%. Furthermore, buyers can also use SKRILL to make their deposits. In this case, they would have to pay a transfer fee of 3.5% + 0,29 EUR. Also, the portal does not support SWIFT payments at the time of writing.

ICONOMI Regulation & Security

Our ICONOMI review of appropriate security revealed that safeguarding and security of assets is the platform’s top priority. All the assets are stored in the portal’s proprietary system comprising a combination of hot and cold wallets.

It also has devised a multi-signature structure and exclusive processes to handle the assets. To move assets, it would need signatures from multiple organizations and people. In addition to this, the time and location complexity enhance the safety of the assets.

If investors copy a Crypto Strategy, the Crypto Strategy Strategist does not have access to their assets (to underlying assets included in the Crypto Strategy structure). All users/ investors’ assets are safely put into ICONOMI’s storage, where ICONOMI holds users’ and investors’ assets in their names and on their behalf.

Moreover, ICONOMI has become one of the first blockchain-based companies to have their blockchain audited by a “Big Four” firm. In 2021, the platform completed its FCA (UK financial regulator) registration process while becoming one of the first registered crypto asset firms in the UK.

How to Trade Crypto on ICONOMI

Most ICONOMI reviews have lacked a simple yet comprehensive guide on how to start trading on its portal. Let’s take a look at the step-by-step guide on how investors can start trading on ICONOMI.

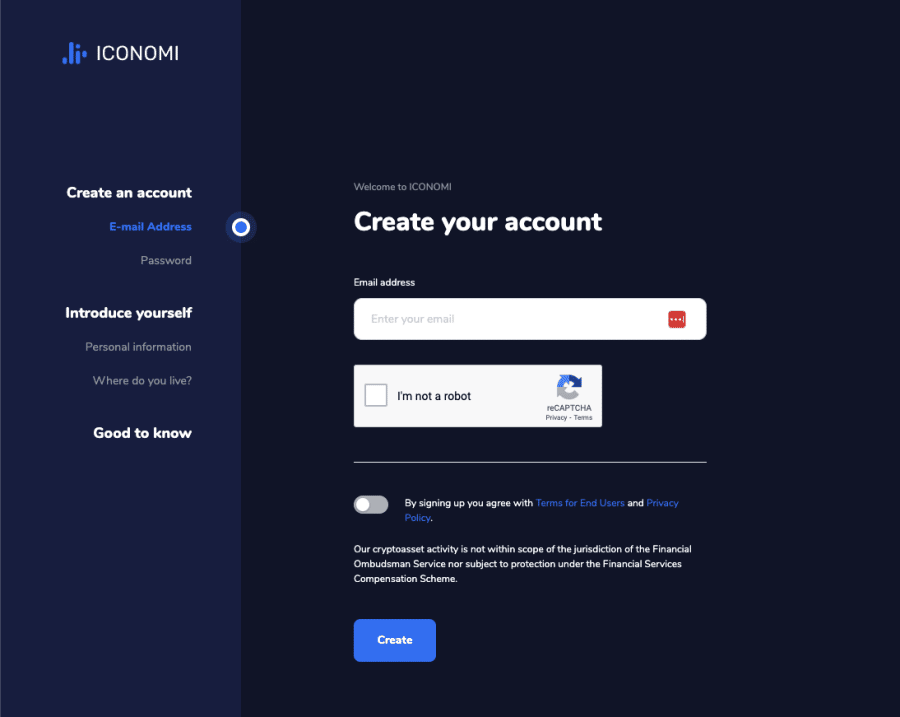

Step 1: Sign Up

Investors must go to ICONOMI’s website and click on the “get started” button. Immediately after, they can sign up and create an account for free.

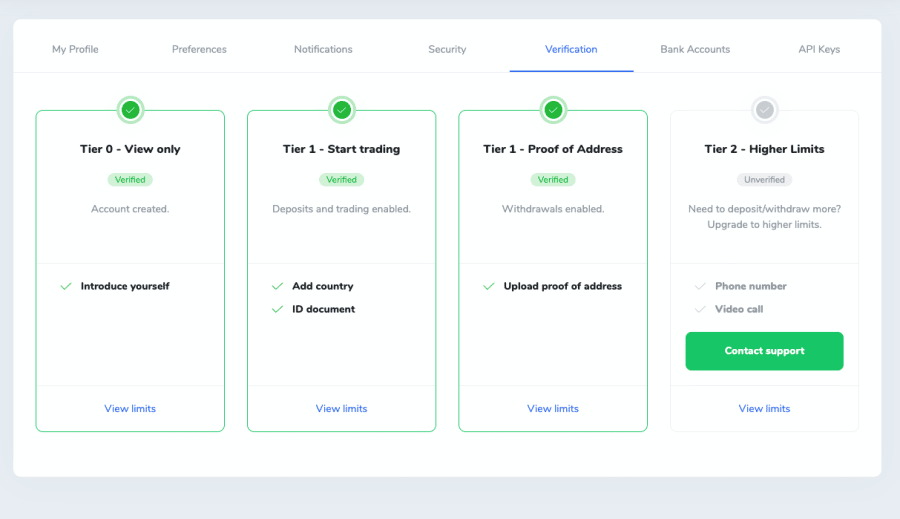

Step 2: Verify

After signing up, buyers need to set an account password and provide personal information. Then, after confirming the e-mail address, buyers must verify their identities via simple and quick KYC and AML procedures.

Step 3: Deposit

Investors can now finally go ahead and deposit a minimum of 10 EUR to get started. Alternatively, they can also deposit cryptocurrencies directly on ICONOMI.

Step 4: Trade Cryptocurrencies and start Copying Strategies

Finally, after the buyers have successfully deposited money or cryptocurrencies into the platform, they can start buying or selling cryptocurrencies. They can also start copying crypto trading strategies.

Step 5: Advanced – create your own Crypto Strategy & earn a little extra

- Define the strategy name:

- Define structure: select cryptocurrencies you want to include in your Crypto Strategy and define their weights (%). You can choose from numerous cryptocurrencies.

- Manage it: you can change/adjust the structure of your Crypto Strategy anytime with one click.

- Set Strategy visibility / Invite others to copy your strategy and deposit

- Earn a little extra: you can set performance and (or) copying fee.

ICONOMI Referral program

Instead of earning once for each referral you bring, ICONOMI creates a long-term connection between you and your friend (newly registered user using your referral during registration), where you earn each month from the fees collected from all your referrals.

The Crypto Strategy Strategist sets Crypto Strategy fees for an individual Crypto Strategy. Anytime Crypto Strategy fees are collected, they are split between ICONOMI, the Crypto Strategy Strategist, and the referrer/user according to the Referral program.

How does the referral program work:

- Invite: To invite new friends: copy the link, code, e-mail invites, or use a gift card and send them out to your friends.

- Earn: Earn from fees. Once your invitees are verified and active, you keep earning by splitting fees with ICONOMI.

- Get paid: Get paid every month: Your earnings are automatically deposited into your account each month.

Conclusion

Our ICONOMI review has revealed the platform to be user-friendly to beginners as well as advanced traders and investors. The platform enables investors to trade over 150 cryptocurrencies. They can also access multiple trading strategies and copy them to their portfolio. These unique features have positioned ICONOMI to be one of the best trading platforms in the market.

Buyers can start with an amount that is as low as 10 EUR and start buying or selling cryptocurrencies at the best prices while also making the most out of crypto trading strategies. ICONOMI has made the process of investing and managing digital assets quite simple.