The Uniswap cryptocurrency exchange is one of the largest decentralized exchanges in the world. With it, you can easily exchange cryptocurrency tokens without creating an account. Furthermore, through Uniswap’s liquidity pools, you can also earn interest on your crypto holdings.

These factors make Uniswap a viable option for traders. This guide will tell you about the most relevant security factors you need to know how safe Uniswap is to trade if you’re concerned about this.

How to Use Uniswap Exchange – Step By Step

Uniswap is an excellent tool for staking crypto and trading trustingly and without restriction. It is also quite easy to get started with Uniswap, and it only takes a few steps.

1. Buy Ethereum

To connect to Uniswap, you need to buy Ethereum (ETH) from a crypto exchange. Uniswap is based on the Ethereum network, so purchasing ETH is the easiest way to get started. There are many Ethereum exchanges you can choose from.

2. Send ETH To Your Wallet

In order to use Uniswap, you must send your Ethereum to a wallet. Wallets are places to store your cryptocurrency, while exchanges facilitate the exchange of currencies—for example, MetaMask Ethereum wallet.

3. Connect Your Wallet To Uniswap

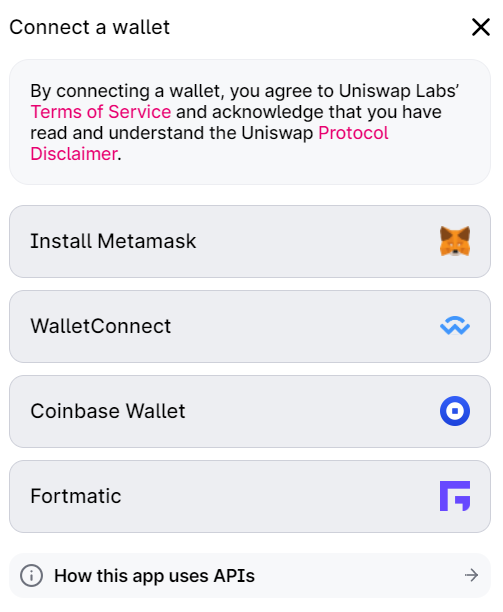

After you have ETH in your wallet, you can use the UniSwap app. Start by clicking the “Connect wallet” button located in the top right corner of the app. Then, select the wallet you want to connect. If you have the MetaMask Chrome extension, you should be able to log in automatically. If you’re using a different supported wallet, you might need to input some details. Once your account is connected to Uniswap, you can begin using the app.

4. Make Your Trade Or Provide Liquidity

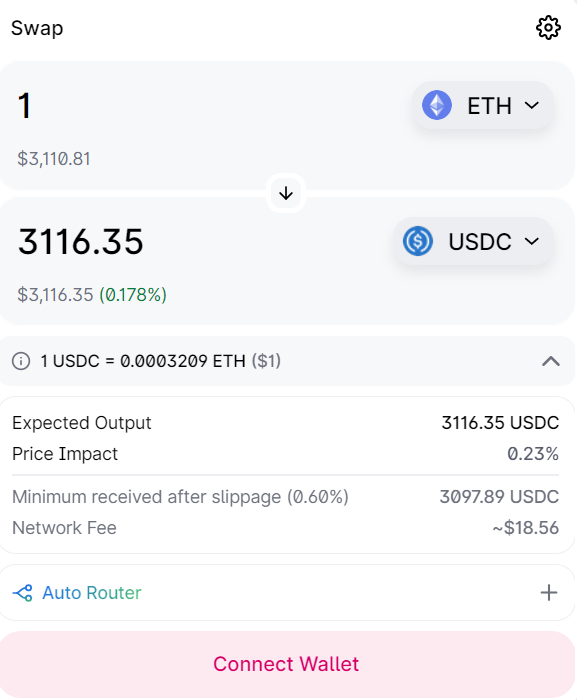

Trade execution and liquidity provision are two primary functions of UniSwap. To begin, you select the amount of ETH you wish to trade and what type of token you wish to use. You’ll likely find the token you’re looking for since hundreds of currencies are available. You can also choose the “Pool” tab at the top of the screen if you are interested in providing liquidity and staking your crypto positions. ETH and AAVE or USDT and DAI are currency pairs for which you can provide liquidity. You should be aware that different currency pairs have different fee tiers, which means you need to find a fee tier and currency pair that you are comfortable with.

If you also want to buy UNI, the native token of the Uniswap DEX, see our guide on how to buy Uniswap.

Uniswap Exchange Regulation & Licenses

There is no central party over which regulators can exercise oversight over DEXs. Therefore, they cannot be regulated. Uniswap, as a decentralized exchange, is an alternative to centralized exchanges such as Coinbase. In other words, it is not owned or operated by a single entity but is governed by holders of UNI, one of the best DeFi coins in the sphere, who vote on important issues. At present, this protocol protects it against regulation.

In terms of licenses, Uniswap holds a license called “GNU General Public License v3”, which acts as a free, copyleft license for software and other kinds of works.

Most software and other practical works come with licenses restricting your freedom to share and change the work. On the other hand, GNU General Public License v3 is designed to ensure your freedom to share and modify a program to keep being free software for everyone.

Along with this license, the DEXs nature of Uniswap remains unaffected.

Uniswap Exchange User Protection & Compensation

The cryptocurrency you store on Uniswap is safe, but there are some risks you wouldn’t encounter on a centralized exchange.

Uniswap does not store your funds for crypto trading. You are responsible for storing them in your crypto wallet. The process is different from simply keeping crypto on an exchange or with a broker, so there’s a bit of a learning curve. You’re ultimately responsible for protecting your crypto wallet. However, most top crypto wallets provide instructions on how to do so.

In contrast, Uniswap allows DeFi insurance. For example, consider that you have capital locked up on the DeFi platform as an individual or company. Considering that this platform or protocol may get hacked and you may lose your capital, you might want to protect yourself against this risk.

Therefore, you must pay a certain amount to a DeFi insurance provider to get covered if you lose your capital due to a predetermined event.

The cost of a cover varies widely depending on its type, duration, and provider. For example, you would pay 0.02559 ETH to cover 1 ETH for one year against a hack on Uniswap.

Uniswap does not offer insurance, so you’ll have to purchase it as a third party.

How Uniswap Exchange Protects Your Account

Uniswap is considered secure since it is a decentralized exchange that uses blockchain technology. While smart contracts on the Uniswap platform are designed to be unalterable, they can generally be hacked. A security breach on the Uniswap platform in 2019 resulted in a loss of $340,000.

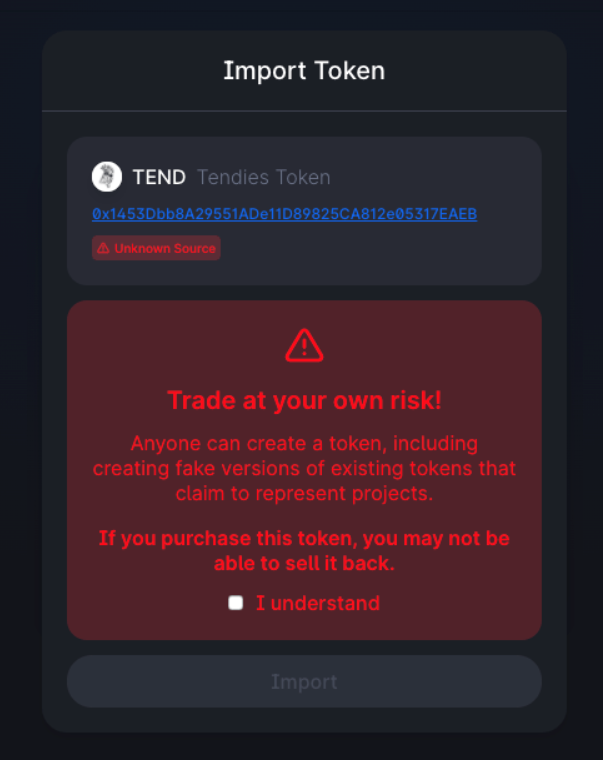

It is common for Uniswap to provide warnings for users to take the initiative in avoiding scammers, as its protocol is permissionless, and both good and bad actors are permitted to list tokens through it. On some DEX exchanges’ swap pages, a similar warning is displayed. In any case, these are useful reminders in general, but because this warning is not displayed for more established sources of a known source, it may also serve as another red flag. This isn’t to say that it isn’t genuine, only that good and bad actors can’t always be distinguished, so care should be taken.

Are Payments Secure On Uniswap Exchange?

In DEXs like Uniswap, servers are normally dispersed. Comparatively, centralized exchanges typically have more concentrated servers. Due to this spread-out of servers, DEXs are almost impervious to attacks, reducing the risk of downtime. If you remove one of the servers, its impact on the entire network is minimal. On the other hand, if you manage to get into a server at a centralized exchange, you can cause more damage.

Furthermore, when you trade at a DEX, the exchange never touches your assets. Therefore, even if a hacker can somehow hack the exchange (despite the above), they will be unable to access your assets. A trade made on a centralized exchange normally stays at that exchange until it is withdrawn to your private wallet. It is, therefore, possible for centralized exchanges to be hacked, which can lead to the theft of funds held at such exchanges. The same cannot be said for decentralized exchanges.

Is Uniswap Exchange A Listed Company?

The Uniswap exchange is not a listed company due to its DEX nature. In addition, Uniswap is managed by a global community of token holders and delegates.

How Many People Use Uniswap Exchange?

Uniswap has more than 1.5 million users, making it the leading Ethereum DEX. As such, DEX lovers can trust the exchange and make their transactions without hesitation.

Uniswap Exchange Customer Service & Contact

A disadvantage of Uniswap Exchange is the lack of a well-established customer service team. They have a help center where customers can find answers to common questions. However, users do not have access to a live chat service or a phone number where they can ask for help.

A chat will be launched if the question provided in the help center does not fit the user’s needs. However, a bot will handle customer requests rather than an agent. They will reply to your request within a few hours if you leave your email address.

How to Keep Safe When Trading With Uniswap Exchange

On Uniswap, there are many scam projects masquerading as legitimate ones, and it is crucial to watch out for them.

The following are some of the risks you should be aware of.

Fake Smart Contracts

A problem of Uniswap is the proliferation of fake projects’ smart contracts, which impersonate real ones. Anyone can create an ERC20 token and add it to Uniswap.

Obviously, this presents a problem since as soon as the main liquidity provider decides, he may be able to remove the liquidity from the pool, leaving the other users at a loss. That is what is known as a rug pull.

To avoid falling for a scam, double-check the token’s address in Etherscan and make sure it’s the one you’re dealing with.

High Gas Fees

Due to heavy network usage, Ethereum’s gas fees are currently skyrocketing: The network congestion is 97% at the time of writing this guide.

Uniswap is very expensive, as a single token transaction can cost up to $20 (depends). Furthermore, Uniswap requires you to approve each new token you want to swap, incurring a fee as high as $2.

Phishing Attacks

Some sites impersonate Uniswap, just like every other crypto-related service. There are only two valid domains in this guide that you should use. Everything else is not the original Uniswap and is highly likely to be a scam.

Be aware of all the possible security breaches mentioned to not affect your trading experience on Uniswap. But, of course, you can always follow the Uniswap community comments to avoid falling into some of these traps.

Is Uniswap Safe? Our Verdict

The Uniswap Exchange is extremely safe since it functions as a decentralized exchange and liquidity pool. It is built on Ethereum, so it has the same level of security as Ethereum’s blockchain. Furthermore, due to the fact that it is decentralized, there is no central server that could be hacked and give access to users’ funds.

Furthermore, in a liquidity pool, any funds you provide are locked by smart contracts and cannot be removed by any account apart from your own. Therefore, a hack would be difficult since the hacker would need account information from each individual to steal anything from the pool. Therefore, the Uniswap Exchange is safe as long as you keep your wallet safe.

You can only run into issues with Uniswap Exchange if you commit user errors since the smart contracts and code have been thoroughly audited and tested.

Providing liquidity to a pool can also result in the loss of assets, which is true of all liquidity pool protocols, not just Uniswap.

| Operating Licenses | GNU General Public License v3.0 |

| Other security Measures | Web security 101

Two-Factor Authentication (2FA) |

| KYC Standards | N/A |

| Segregated Cold Crypto Storage | No |

Bottom Line

Unswap is a convenient exchange protocol requiring no registration or personal information. Besides, it has a simple and intuitive interface.

Be cautious, however, as there are bad actors out there. In addition, thousands of fake tokens impersonate real ones there, so you should ensure that you double-check the contract with Etherscan before making any purchases.

Considering that if you prefer a most transparent and well-known platform, you could try a regulated exchange instead.