Wondering how to get into cryptocurrency for the very first time? This marketplace moves in cycles – just like stocks. And as such, with leading cryptocurrencies now trading at lows of 70% from prior highs, this offers one of the best times to enter the market.

In this beginner’s guide, we explain how to get into cryptocurrency as a first-time buyer through 10 proven strategies and tactics.

10 Top Tips for Beginners on How to Get Into Cryptocurrency 2025

Here’s a quick overview of how to get started with cryptocurrency today, in a risk-averse and systematical manner.

- Consider Crypto Presales – Invest in New Cryptocurrencies like Dash 2 Trade via a Presale Launch

- Learn the Crypto Market Basics – Understand How the Crypto Market Works

- Crypto Investment Strategy – Create and Follow a Proven Crypto Investment Strategy

- Dollar-Cost Averaging – Avoid Market Volatility by Buying Crypto at Small and Regular Amounts

- Create a Diversified Portfolio – Reduce the Risk Exposure by Diversifying Across Many Cryptos

- Use a Regulated Crypto Exchange – Trade Cryptos Safely by Using Tier-One Platforms

- Explore Crypto ETFs and Index Funds – Diversify Through a Managed Crypto-Focused Fund

- Be Smart With Crypto Storage – Keep Crypto Investments Safe in a Private Wallet

- Use Risk Management Tools – Stay Within the Boundaries of Risk Management at All Times

- Have an Exit Strategy – Always Have Profit Targets in Mind

The 10 tips above explain a variety of methods to consider when learning how to get into cryptocurrency for the first time. Read on to find out more about each strategy.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members

How to Get Started in Crypto – Top Things to Consider

Cryptocurrencies have, over the prior 10 years of trading, outperformed all other asset classes and markets. This means that beginners have the opportunity to invest in a high-growth market from the comfort of their own homes.

However, those learning how to get into cryptocurrency for the first time should ensure that they do so in the correct manner. This ultimately means mitigating the long-term risk of losing money.

Here’s what every beginner should know when assessing how to get started with crypto.

Tip 1: Consider Crypto Presales – Invest in New Cryptocurrencies like Dash 2 Trade via a Presale Launch

Let’s get straight into it – crypto presales are arguably one of the best ways to get into the blockchain arena. Not only in terms of the upside potential and risk profile, but the fact that most presales require an upfront investment of under $50.

Presales are essentially initial public offerings (IPOs) but instead of buying stocks, investors will be purchasing a newly launched cryptocurrency. This is beneficial for both parties involved.

- From the perspective of the crypto project, this enables the entity to raise money from outside investors and thus – fund its operations.

- From the perspective of the investor, presales will sell the newly launched cryptocurrency at the best price possible.

The idea is that once the presale has raised its required funding, the respective cryptocurrency will then be listed on an exchange. This then enables the general public to buy the cryptocurrency in question and thus, its price will rise should there be enough demand in the market.

There are hundreds of examples of how crypto token presales have generated early investors notable returns that far exceed what is possible in the traditional stock market. One of the earliest presales was that of Ethereum which, in 2014, sold its underlying ETH tokens for just $0.31. In the years to follow, Ethereum has since increased by more than a million percent.

- In a more recent example, Lucky Block held its presale in January 2022 and subsequently went on to grow by 6,000% once listed on the PancakeSwap exchange.

- Tamadoge is another recent example, which, after completing its presale in September 2022, generated post-exchange gains of 2,000%.

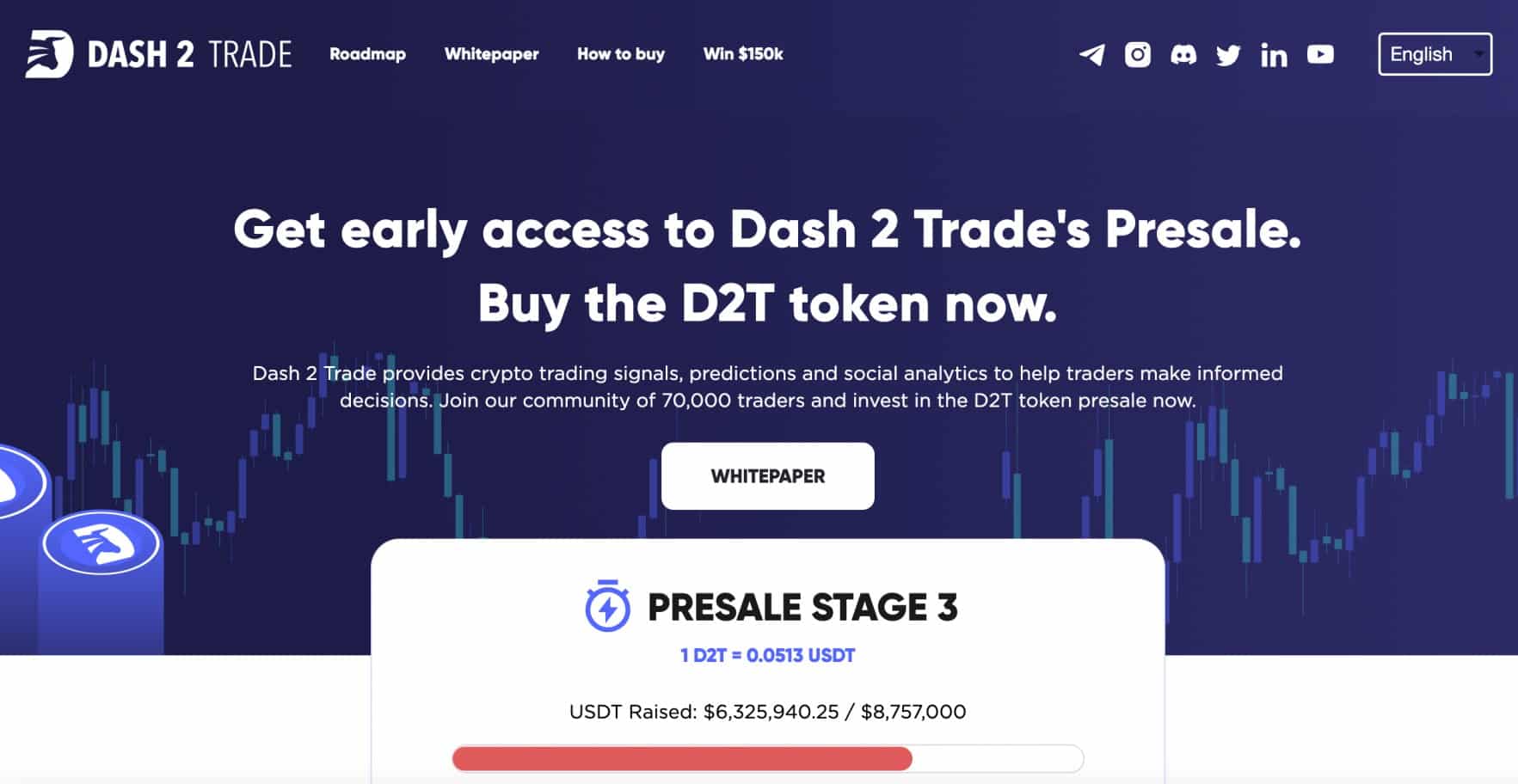

Perhaps the most challenging part is knowing which crypto presale to gain exposure to. We have dedicated countless hours to finding notable projects in this niche market and found that Dash 2 Trade is worth considering.

Read on to find out why these two projects could represent the best ICO cryptos to invest in.

Dash 2 Trade – Cutting-Edge Analytics Terminal With Unrivaled Crypto Insights

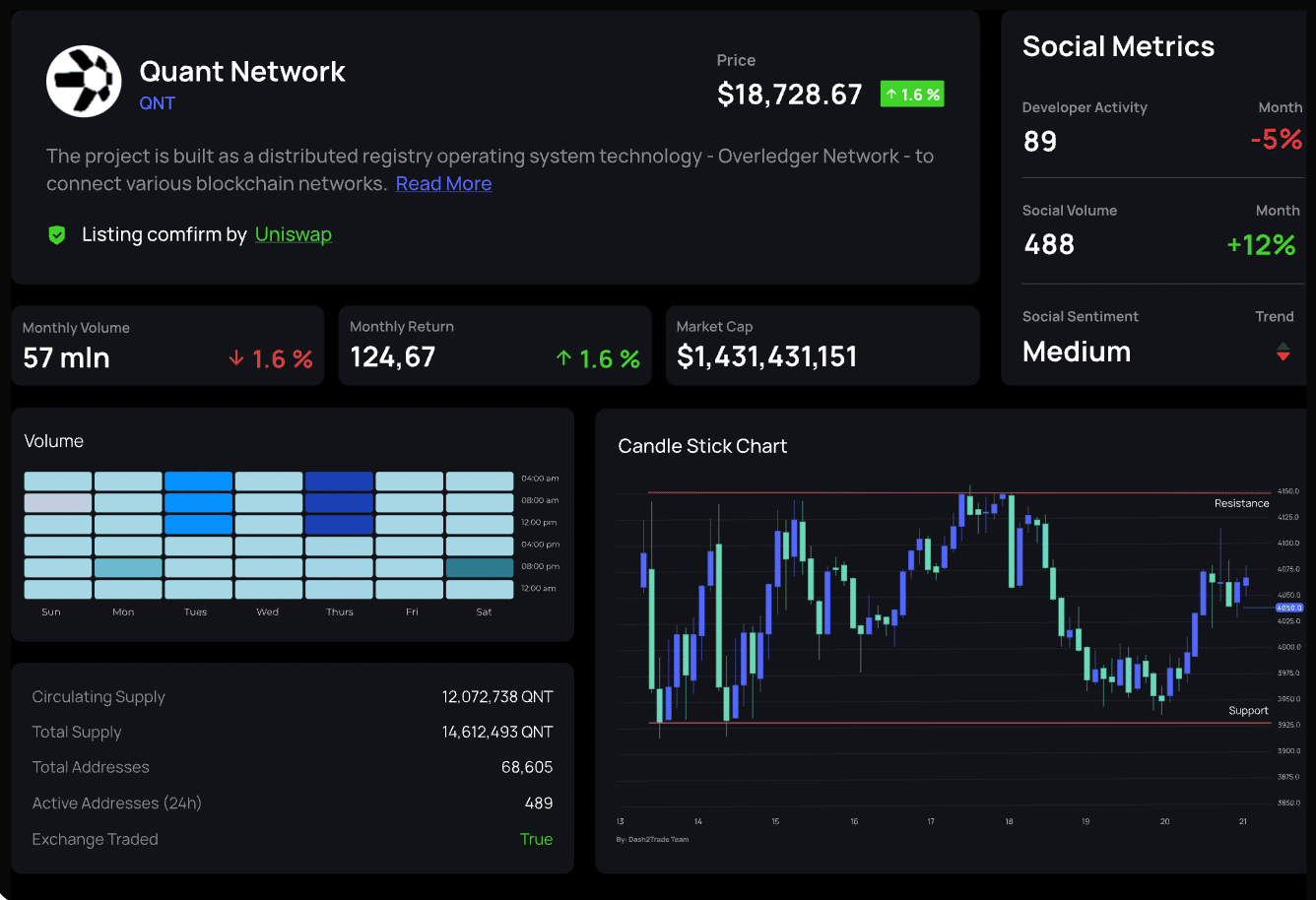

With more than 20,000 cryptocurrencies operating in this highly speculative industry, beginners are often left feeling overwhelmed about where to start. Not only in terms of which coins to buy and sell but when to enter and exit the market. This is why Dash 2 Trade is developing a cutting-edge analytics terminal that provides unrivaled crypto market insights.

In a nutshell, the Dash 2 Trade terminal – which is fueled by its own cryptocurrency, D2T, will enable traders to make smart and informed investment decisions without needing to spend many hours each day researching the markets. There are many innovative features available on the Dash 2 Trade terminal, one of which is its crypto trading signals.

By signing up for a Dash 2 Trade plan – which requires D2T as means of payment, members will receive signals that highlight which coins to buy and at what entry price. For example, the signal might suggest buying Dogecoin when the meme coin hits $0.07. Most importantly, to promote sensible risk management, the signal will also suggest a stop-loss and take-profit price.

The Dash 2 Trade member can then place the suggested orders at their chosen crypto exchange. Dash 2 Trade will also become the global hub of professional-grade cryptocurrency data and insights. This will include metrics that scan social media platforms to assess which coins are trending and thus – likely to explode in the coming hours and days.

Insights also cover on-chain data surrounding large token movements. Not only does this provide an opportunity to make short-term gains, but avoid losses. Dash 2 Trade members can also build their own automated crypto trading strategies via the insights and data offered by the terminal. This can be trialed via the Dash 2 Trade backtesting platform before going live.

Crucially, the aforementioned Dash 2 Trade features can only be accessed in their entirety by holding D2T tokens. In simple terms, this means that, unlike many cryptocurrencies, D2T has a solid, long-term use case. The best part about Dash 2 Trade is that the project is still in the development phase and as such, investors can buy D2T tokens for as long as the presale is ongoing.

The Dash 2 Trade presale is now in stage three – which means that investors will pay just $0.0513/D2T token. This presale price will continue to increase until stage nine – which is when the fundraising campaign will come to a conclusion. Dash 2 Trade will then list D2T tokens on a number of crypto exchanges – with LBank and Bitmart already being approved.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

You can always read the Dash 2 Trade whitepaper to make an informed decision.

Tip 2: Learn the Crypto Market Basics – Understand How Crypto Prices Work and the Basics of Making Money

Now that we have discussed the unparalleled importance of exploring presales when learning how to get into cryptocurrency, we can now take a deeper dive into how this market works. The good news is that from an investment perspective, cryptocurrencies operate in much the same way as traditional stocks.

For instance, stocks can be purchased online in just a few clicks through a broker. The value of the stock will rise and fall based on demand and supply from the broader markets. Investors can then sell their stocks and if their value has since increased, a profit has been made. This process is no different in the case of electing to buy cryptocurrency.

For example, in order to buy Bitcoin and other cryptocurrencies, investors will either use a broker or an exchange. The investor will then keep hold of their cryptocurrencies in the hope that their value increases. If it does, then the investor can sell their cryptocurrencies back to fiat money – at a profit.

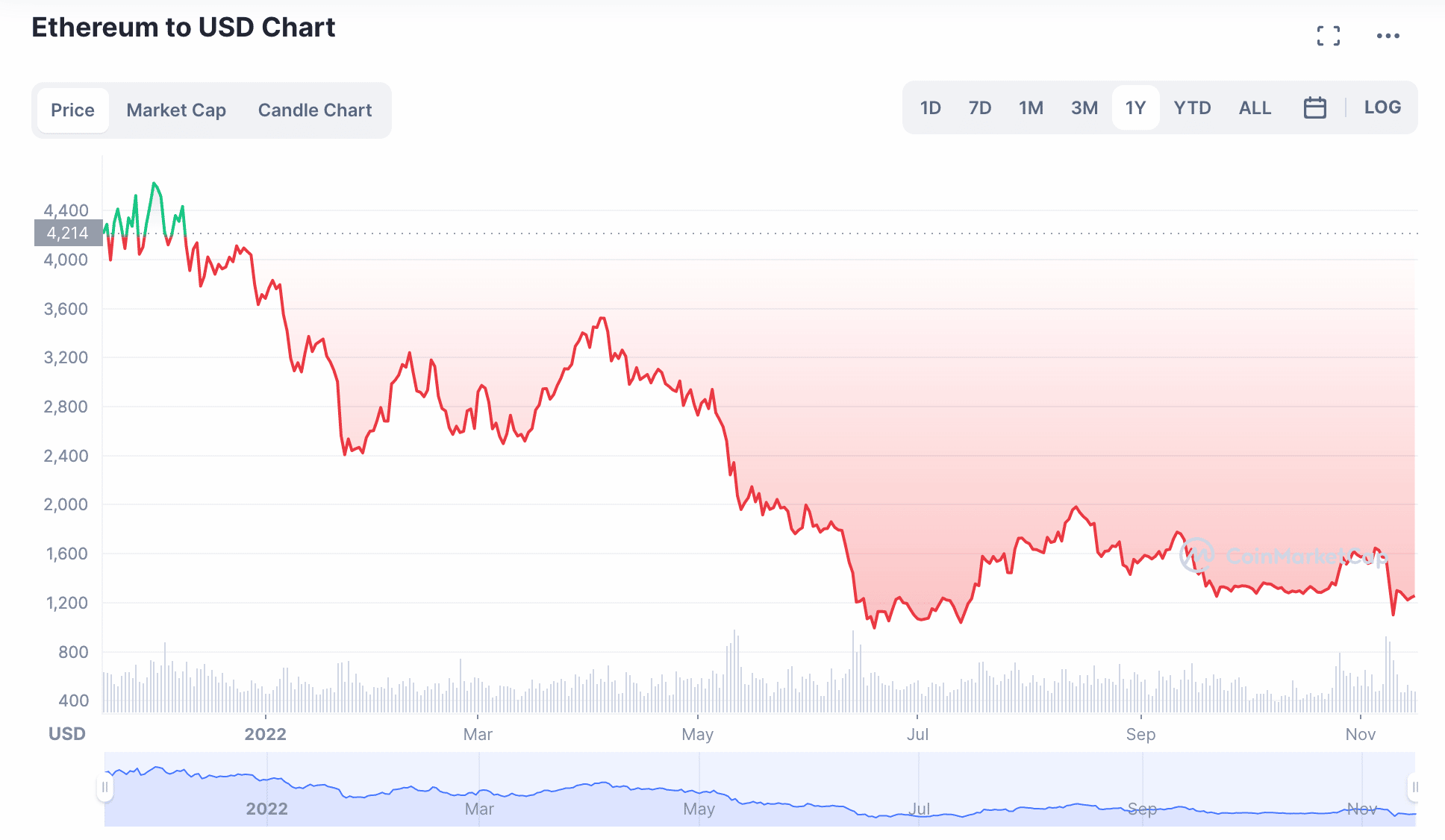

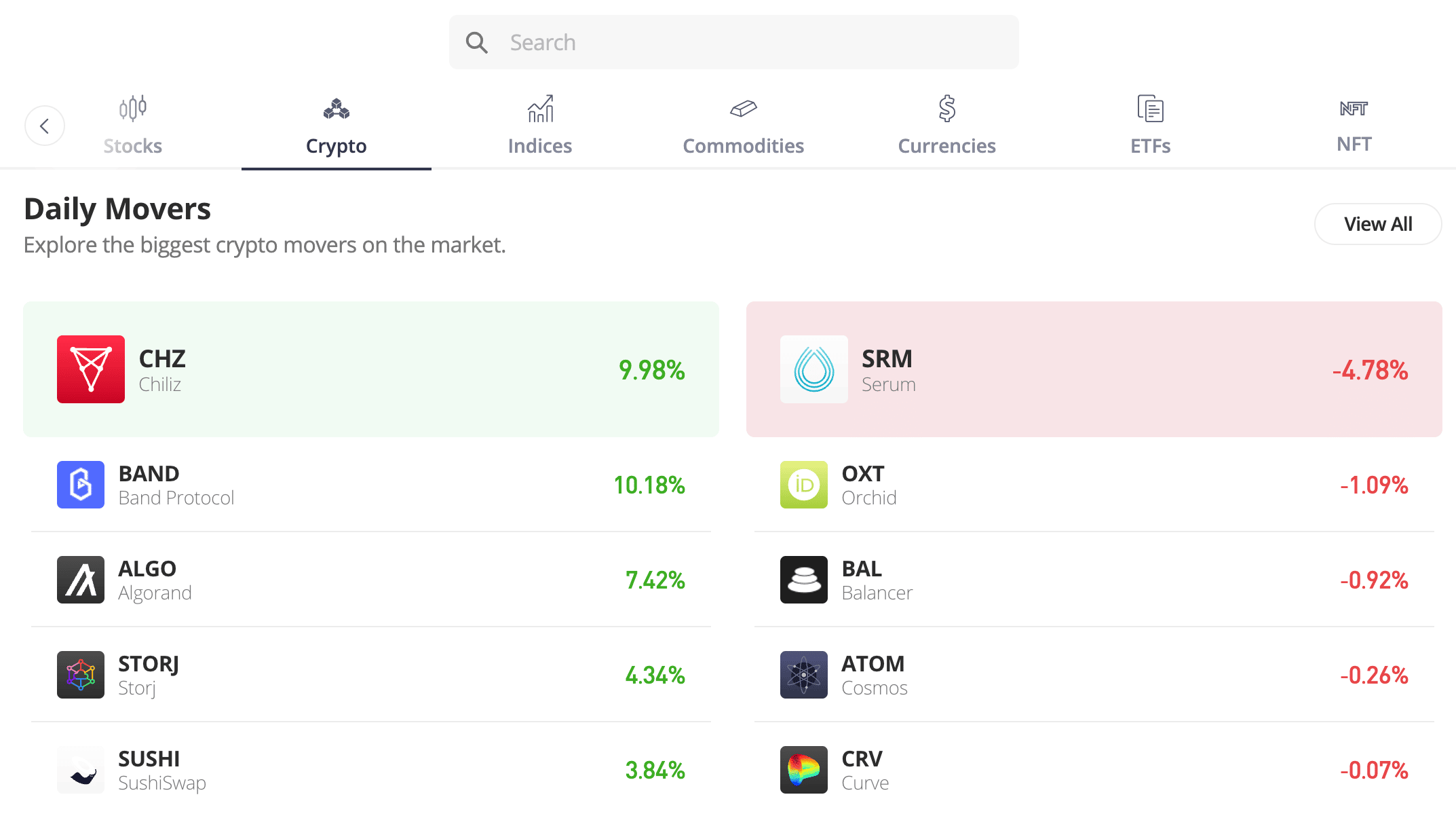

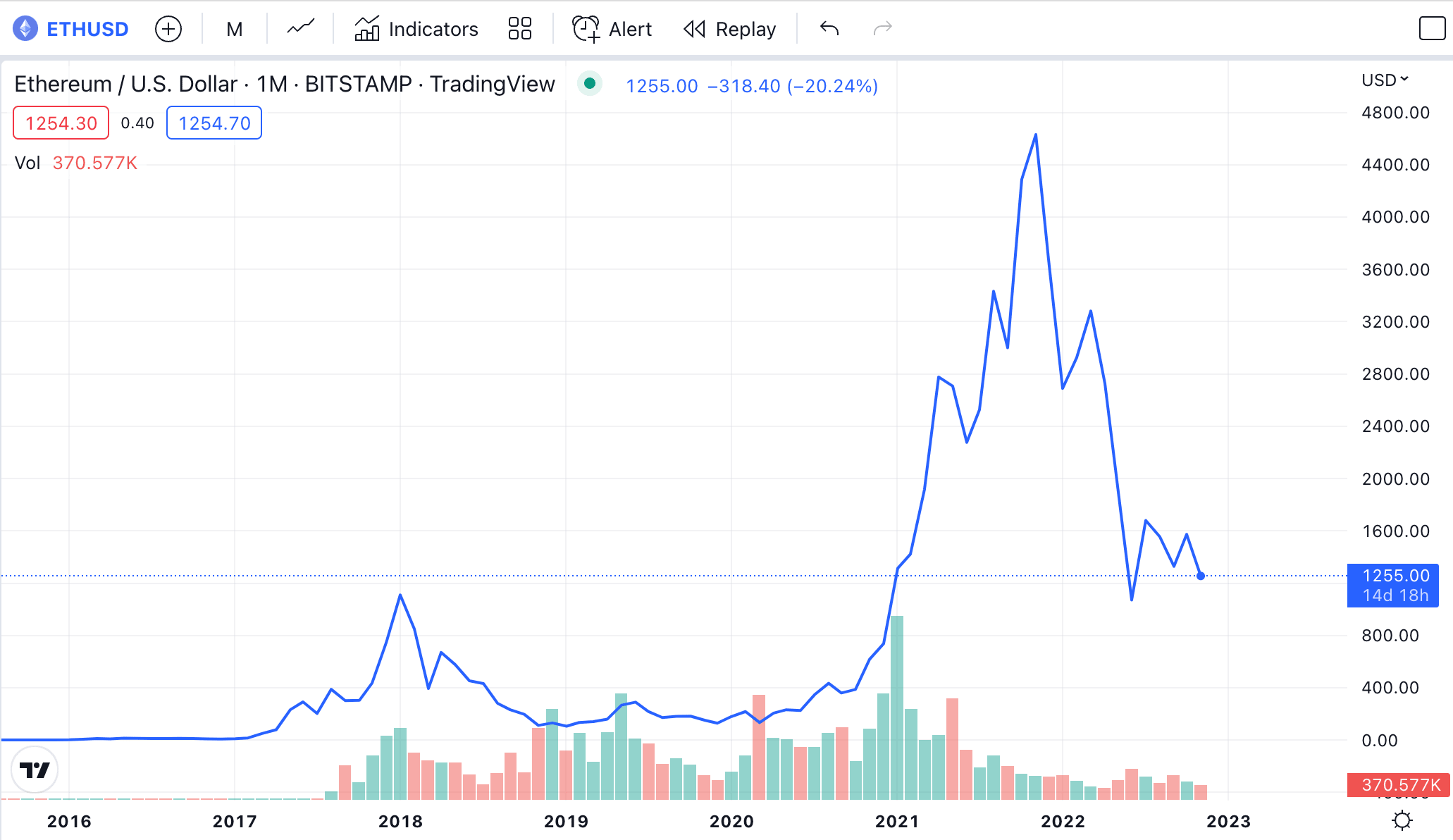

Although cryptocurrencies have only been a tradable asset for a little over a decade, market cycles and trends continue to remain in place. Just like stocks, cryptocurrencies go through bullish (upward trend) and bearish (downward trend) cycles. Since November 2021, cryptocurrency prices have been in a bearish market.

Prior to this, prices were extremely bullish, with Bitcoin going from lows of $5,000 at the start of COVID to highs of $69,000 just 18 months later. Even the most seasoned of crypto investors will have a hard time attempting to predict when a bullish or bearish cycle is about to reverse. As such, we will later discuss dollar-cost averaging, which removes the need to time the market.

Tip 3: Crypto Investment Strategy – Create and Follow a Proven Crypto Investment Strategy

Irrespective of whether it’s cryptocurrency, stocks, or any other asset class, it is crucial to have a strategy in place before risking money. Even the best crypto to buy now in the market can’t promise financial gains or stability at all times.

There are many cryptocurrency investment and trading strategies utilized in this space, such as:

- Day Trading – Buying and selling cryptocurrencies throughout the day. Positions remain open for a matter of hours or even minutes. This strategy requires in-depth knowledge of technical analysis – which won’t be suitable for beginners.

- Swing Trading – This is a more flexible strategy than day trading, albeit, positions rarely stay open for more than a few weeks. The idea here is to buy and sell cryptocurrencies based on short-term trends. Again, this strategy is not suitable for beginners.

- Scalping Trading – This is an even more advanced strategy than day trading. Scalping trading seeks to take advanced of the most minute differences between buy and sell prices. As such, trades will often remain in place for a matter of seconds.

The good news is that when learning how to get into crypto, there is no requirement to understand technical analysis and in-depth chart reading. On the contrary, the easiest and arguably, most successful strategy is to ‘HODL’. This is a crypto-centric term for buying a coin and holding on to the investment for many months or years.

In taking this approach, beginners no longer need to fixate on short-term volatility and cycles. It is, however, important to spend some time assessing the best long-term cryptocurrency investments for this strategy.

Tip 4: Dollar-Cost Averaging – Avoid Market Volatility by Buying Crypto at Small and Regular Amounts

Another proven strategy to explore when learning how to get into cryptocurrency is dollar-cost averaging. This is a strategy that is widely used in the traditional stock market – especially when it comes to index funds like the S&P 500 and Dow Jones. The concept with dollar-cost averaging is that investors will avoid allocating all of their capital in one lump sum.

Instead, the investor will look to buy the underlying asset at set intervals, with more modest amounts. This concept could not be more fitting in the world of cryptocurrencies, considering how volatile market cycles are. As such, to avoid being over-exposed to the top end of a bullish run, dollar-cost averaging solves many problems.

For example, consider an investor that allocated their entire portfolio to Bitcoin and Ethereum when the price of each cryptocurrency was $69,000 and $4,900. In this instance, the investor’s portfolio would now be 70% down.

In comparison, an investor that instead allocated a small percentage of their portfolio to Bitcoin and Ethereum at the end of each month would not be anywhere near as exposed. Instead, the investor would be buying the aforementioned cryptocurrencies during the downtrend, meaning more tokens for each dollar invested.

Tip 5: Create a Diversified Portfolio – Reduce the Risk Exposure by Diversifying Across Many Cryptocurrencies

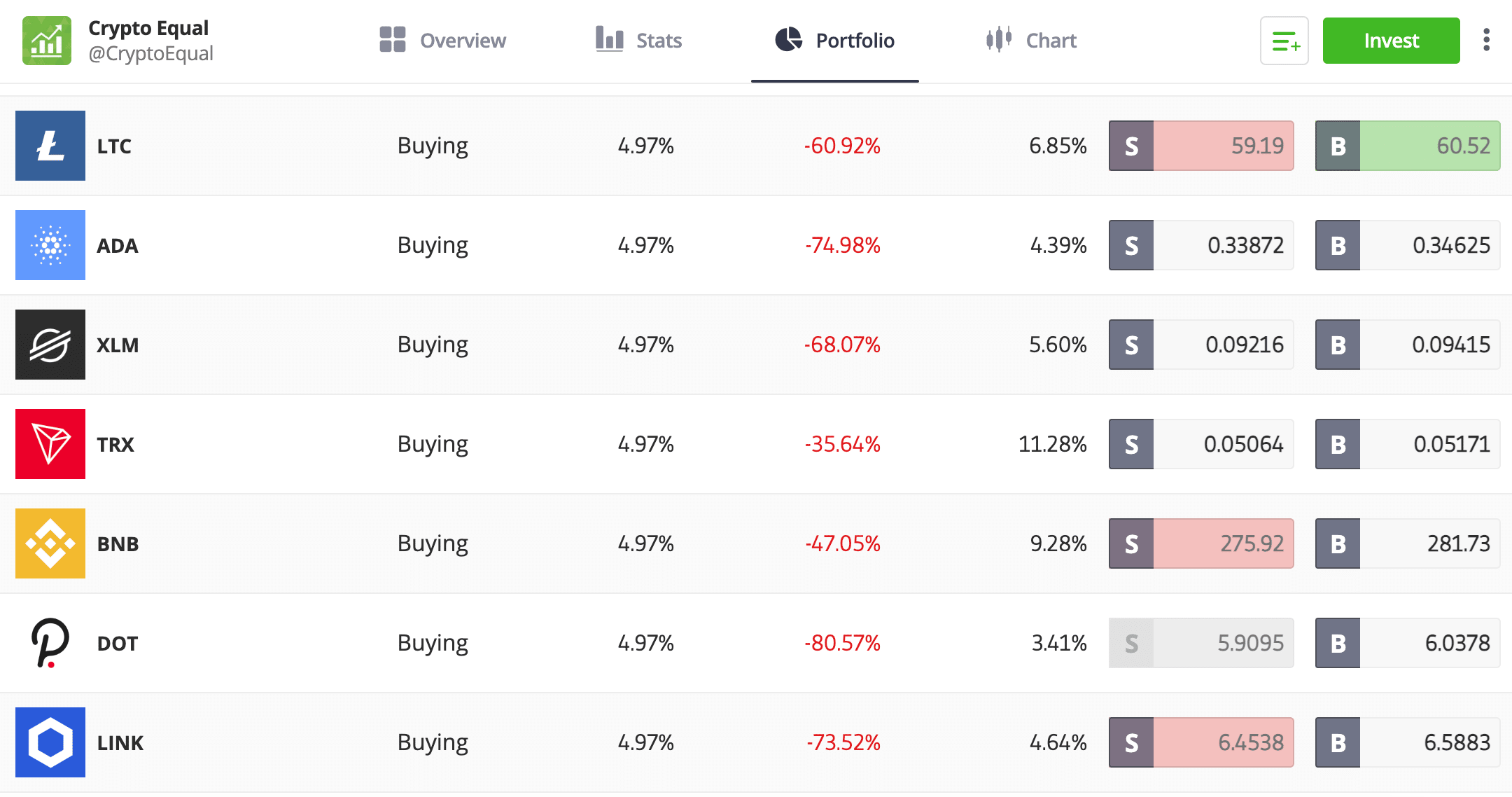

In terms of methods to consider when learning how to get started in cryptocurrency, we have so far established that a long-term, dollar-cost averaging strategy offers the most risk-averse way to access this market. In addition to the aforementioned tactics, diversification is another key strategy that can facilitate a risk-adjusted approach to cryptocurrency.

And once again, this is yet another strategy that is widely used in the traditional stock market. Put simply, by building a diversified portfolio, this will result in the investor buying many different cryptocurrencies. This means that rather than being over-exposed to one cryptocurrency, the risk is spread out across lots of different projects and niche markets.

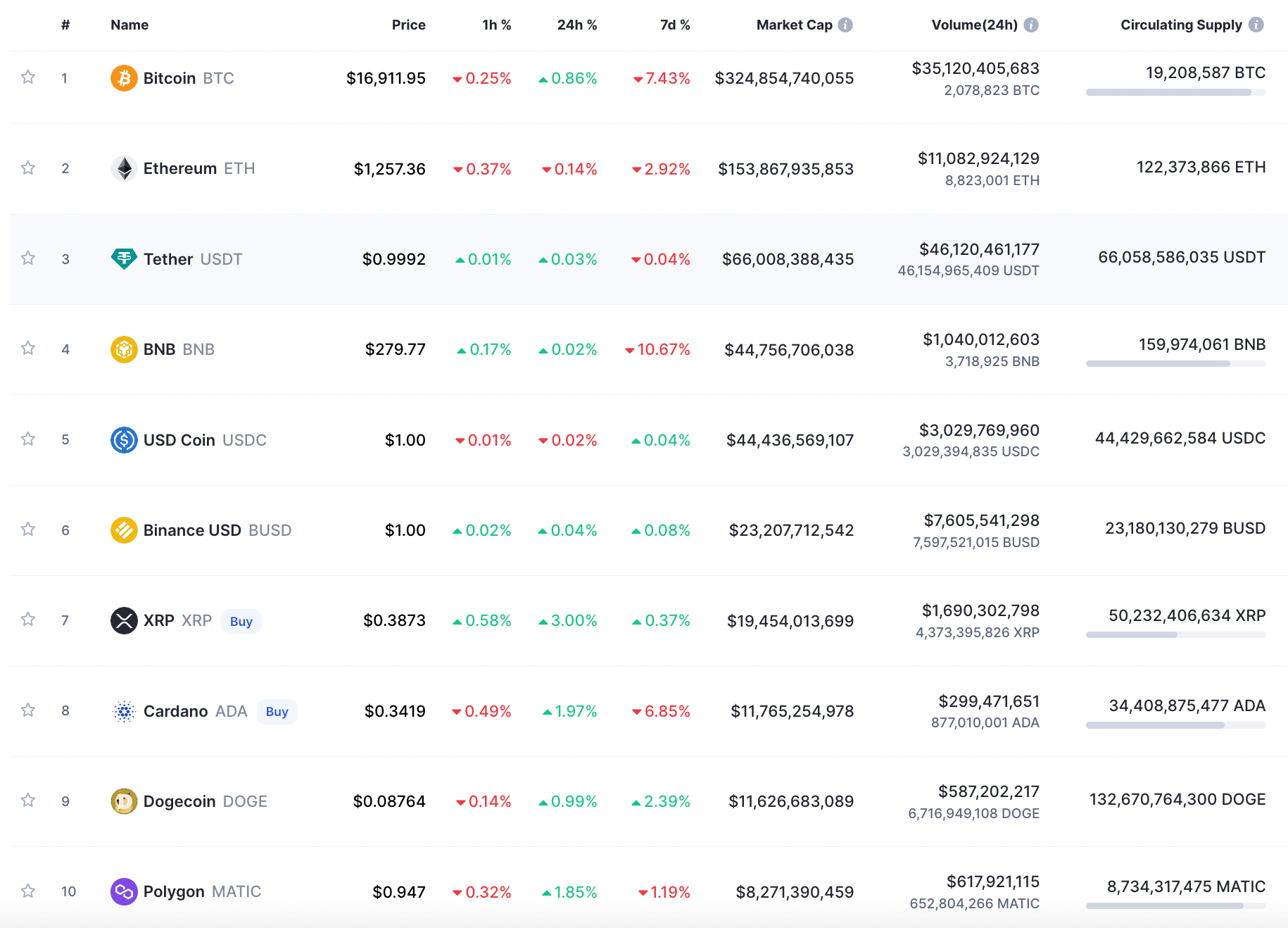

For example, at the top end of the portfolio, the investor might allocate funds to large-cap cryptocurrencies like Bitcoin, Ethereum, BNB, XRP, Cardano, Dogecoin, and Polygon. At the other end of the portfolio, investors might then consider high-growth cryptocurrencies like Dash 2 Trade – both of which are available to buy at presale prices.

And somewhere in between, the investor might consider projects that are somewhat developed, but still hugely undervalued. Projects like Lucky Block and DeFi Coin meet this criterion. Other angles to explore when building a diversified cryptocurrency portfolio include metaverse coins, decentralized finance, NFTs, and DAOs (decentralized autonomous organizations).

Tip 6: Use a Regulated Crypto Exchange – Buy and Sell Cryptocurrencies Safety by Using Tier-One Platforms

This section of our guide on how to get into cryptocurrency is simple – yet of the utmost importance. Put simply, when buying cryptocurrencies online, it is imperative that a regulated exchange or broker is used. This is no different from buying equities and ETFs from a regulated stockbroker.

Furthermore, and most importantly, the exchange or broker should be regulated by a reputable, tier-one body.

- This is one of the key issues that has since come to light regarding the soon-to-be defunct exchange FTX.

- Not only has FTX gone from one of the largest exchanges globally to filing for chapter 11 bankruptcy, but there are now serious allocations surfacing about multi-billion dollar fraud.

These issues can largely be avoided by using a cryptocurrency broker that is regulated by the SEC. US regulators are perhaps viewed as the most stringent, so while not impossible, SEC-licensed brokerage collapses are unlikely.

Among many other safeguards, SEC-regulated brokers are required to hold sufficient reserves and ultimately – keep client funds in segregated accounts.

Tip 7: Explore Crypto ETFs and Index Funds – Diversify Through a Managed Crypto-Focused Fund

Another tip that many beginners consider when learning how to get into cryptocurrency is to invest through an ETF or index fund. This enables investors to diversify their capital across many different cryptocurrencies – but through a single investment. This is much the same as investing in a stock ETF like the S&P 500 – which offers access to 500 large-cap equities.

In the case of a crypto ETF, the investor will gain exposure to a wide range of digital assets that are managed by a regulated provider. Moreover, the ETF provider will rebalance the portfolio of cryptocurrencies – typically every three months. The purpose of rebalancing is to ensure that the ETF continues to align with the goals of the crypto fund manager.

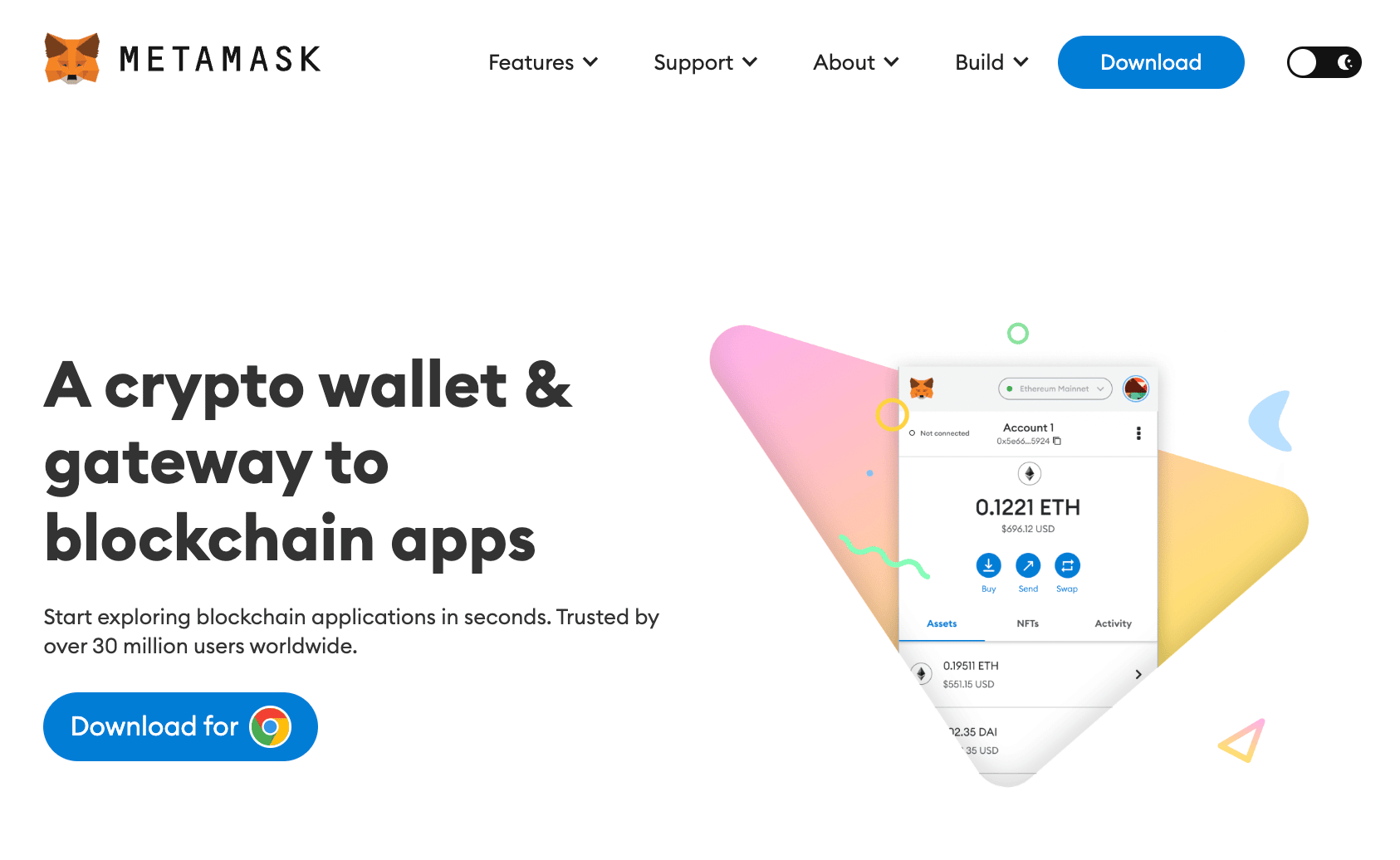

Tip 8: Be Smart With Crypto Storage – Keep Crypto Investments Safe in a Private Wallet

Learning how to get into cryptocurrency also requires beginners to at least have a simplified understanding of how digital assets are stored. When buying stocks, for example, the equities are held with a regulated broker.

However, cryptocurrencies are unregulated financial assets in the vast majority of jurisdictions, which means that investors are advised to take control of their own digital assets. After all, there have been many crypto exchange collapses in recent years – with the most notable being FTX.

As we are seeing with FTX, many investors now have their cryptocurrencies stuck on the exchange – with no way of gaining access. This is why investors are strongly advised to keep their cryptocurrency tokens in a private, non-custodial wallet. While at first glance this might sound intimidating, after understanding the basics the process is actually fairly simple.

- First and foremost, a non-custodial wallet simply means that the only person that has control over the cryptocurrency is the owner of the tokens.

- As such, there is no requirement to trust a third-party exchange.

- The chosen non-custodial wallet will have its own public address. Similar to a bank account number, this enables cryptocurrencies to be transferred to the wallet.

- The non-custodial wallet will also have a private key.

- This is like a password to an online bank account and as such, should never be shared.

Then there is the option between a software or hardware wallet, to be used online or on Bitcoin ATMs. The latter most commonly comes in the form of a mobile app. This is both a convenient and secure way to store and transfer cryptocurrencies. Hardware wallets are physical devices that offer the utmost security, but they are inconvenient when it comes to making transfers.

The ultimate solution here is to keep the vast majority of cryptocurrency funds in a hardware wallet and a small percentage in a mobile software wallet for everyday convenience.

Wondering how to get a crypto wallet? This beginner’s guide on the best crypto wallets explains everything there is to know.

Tip 9: Use Risk Management Tools – Stay Within the Boundaries of Risk Management at All Times

It goes without saying that the most successful investors are those that have a firm grasp of risk management. This term refers to the process of managing investment capital in the most risk-averse way. In other words, targeting financial gains while at the same time ensuring the investment funds are protected from large losses.

In the world of cryptocurrency, risk management has never been so important. We have already discussed a number of ways to achieve this goal – such as diversification, dollar-cost averaging, and utilizing a non-custodial wallet. However, there are additional ways that will enable beginners to take their risk management practices to the next level.

For example, when setting up an investment at a crypto exchange or broker, it is wise to install stop-losses. This will instruct the platform to close the trade if the position declines by a predefined amount. Another option is to create a bankroll management strategy. This entails setting limits on the amount of money that should be risked on a specific cryptocurrency trade.

For example, let’s suppose that the investor has $5,000 worth of capital and they wish to limit their trades to 1%. This means that the maximum cryptocurrency trade size must be limited to $50. As the portfolio grows in value, so will the maximum trade size. And finally, a well-rounded budget should also be considered, taking into account how much disposable income there is.

Tip 10: Have an Exit Strategy – Always Have Profit Targets in Mind

On the one hand, ultra-crypto enthusiasts will argue that they will never sell their digital assets. However, this isn’t a wise investment strategy to take – especially when learning how to get into cryptocurrency for the first time. On the contrary, it is highly suitable to have an exit strategy in place.

This can be a process as simple as evaluating a price that all, or some, of the cryptocurrency tokens should be sold. For example, a beginner might buy Bitcoin at $20,000 and elect to hold on to the tokens until the digital asset hits $60,000. In another example, an investor might elect to sell half of their tokens when a price target is met.

Either way, it is crucial to have a plan in place to ensure that at some point in the future, the investment begins to realize gains. One of the easiest ways to achieve this goal is to deploy a take-profit order when making cryptocurrency investments. This will instruct the broker or exchange to close the trade at a predefined price target – subsequently locking in the profits.

Conclusion

In summary, this beginner’s guide has explored 10 proven strategies and safeguards to consider when learning how to get into cryptocurrency. This includes everything from diversification and dollar-cost averaging to risk management and utilizing a non-custodial wallet.

We also explored the benefit of gaining exposure to crypto presales like Dash 2 Trade. Not only do presales offer the chance to buy into a project while the underlying token is cheap, but there is much greater upside potential on offer when compared to established coins.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members