If you’re curious about how to earn free crypto, there are several legitimate avenues to explore. However, caution is key, since the promise of free crypto can often lead to scams.

With that in mind, the crypto analysts at Business2Community did their own in-depth research, trying to differentiate the legitimate ways to earn free crypto from scammers. On top of that, you’ll also learn how to do this safely, focusing on trusted platforms and reliable methods, all to boost your crypto wallet.

Earn Free Crypto – 12 Tested Methods

- Stake and earn More than 543% APYs with eTukTuk

- Complete Surveys and Tasks and Play Games on Freecash.com

- Use Crypto Interest Accounts

- Begin Crypto Staking

- Leverage Play 2 Earn (P2E) Gaming

- Hold and Wait For Hard Forks

- Derivative Staking

- Take Part in an Airdrop

- Complete Educational Courses

- Participate in DeFi Lending

- Earn Crypto Credit Card Rewards

- Use Crypto Faucets

How to Earn Free Crypto – A Closer Look

Now that you have a brief overview of what the best ways to earn free crypto instantly are, let’s dive in and explore each of these procedures individually:

1. Stake and earn More than 543% APYs with eTukTuk

One of the best ways to earn free crypto is by joining the eTukTuk ecosystem – the world’s first automotive project built on the Binance Smart Chain.

eTukTuk aims to promote the adoption of electric vehicles (EVs) in developing economies.

This will help tackle the increase in pollution caused by the overuse of internal combustion engines (ICEs). eTukTuk will help territory partners set up EVSEs (Electric Vehicle Supply Equipment) across developing countries’ suburban and urban regions.

On these EVSEse, TukTuk drivers can make EV charging payments using the native token, $TUK. Through a driver’s app, the drivers can easily make the payments. The territory partners will earn a percentage of each transaction as a reward. However, token holders can also earn huge crypto rewards.

Participants can stake $TUK into power nodes and earn rewards for contributing to the shared economy. The higher the usage of the charging stations, the higher your rewards.

At the time of writing, eTukTuk offers a staking APY of 543%, although this will decrease as more tokens are staked on the ecosystem.

To earn high rewards with eTukTuk, investors can join the $TUK presale for $0.028. The presale has raised almost $2M so far.

Stay updated with this sustainable cryptocurrency by going through the eTukTuk whitepaper and joining the Telegram channel.

2. Complete Surveys and Tasks and Play Games on Freecash.com

If you’re wondering how to earn money, Freecash.com is one of the fastest-growing websites online with various surveys, tasks, sign-ups, and games for users to get free crypto instantly.

The website then allows users to withdraw money instantly into Bitcoin, Litecoin, Ethereum, and Doge, and more than $46 million has been earned on the site since 2020.

It also has a clean, modern, and user-friendly design, active direct support, featured offers, and allows international signups.

You can withdraw and convert winnings to crypto starting at $0.50. Withdraw directly to PayPal or redeem for gift cards on Amazon, Steam, Google Play, Netflix, Spotify, PlayStation, Xbox, and more.

There are also options to directly withdraw into popular games such as Fortnite and League of Legends.

The website also features a daily leaderboard that pays $500 per day and a monthly one that offers $2,500.

Freecash.com has active communities and mods on Discord, Facebook, Instagram, Twitter, and Reddit in case of questions or issues.

3. Use Crypto Interest Accounts

Another option if you’re wondering how to earn crypto for free is to use crypto interest accounts. The best crypto interest accounts offer a way to earn interest on your cryptocurrency holdings. However, the great thing about these accounts is that interest rates are often far higher than traditional bank accounts.

A prime example is the interest account offered by AQRU – one of the leading platforms within this growing crypto area. AQRU allows users to deposit cryptocurrency and begin earning interest immediately, with 11 different coins currently supported. Notably, AQRU offers up to 1o% % annual interest on stablecoin deposits and 2% on BTC or ETH deposits.

Another great platform to consider is BlockFi. Like AQRU, BlockFi allows users to earn free crypto coins by making deposits, with over 30 coins supported on the platform. BlockFi also offers compound interest and a speedy application process, making it ideal for users who wish to store their crypto over the longer term.

4. Begin Crypto Staking

Crypto staking is locking up your coins to help validate new blocks on specific blockchain networks. This relates to the method used on Proof-of-Stake (PoS) blockchains rather than Proof-of-Work (Pow) blockchains like Bitcoin. Users who stake their coins will earn free crypto rewards in return for aiding in the validation process.

Much like when you earn interest on crypto, the process of crypto staking can offer much higher returns than traditional bank accounts. One of the best crypto staking platforms to consider partnering with is AQRU, which we mentioned above. Although AQRU doesn’t offer staking services in a validation sense, the platform does offer a way to generate free crypto rewards.

These rewards stand at 10% per year for USDC, USDT, and DAI deposits and 2% for BTC and ETH deposits. AQRU charges no fees for making these deposits or ongoing fees during the interest-generation process. There are also no lock-in periods to be aware of with AQRU, allowing you to withdraw at any time.

BlockFi also offers crypto staking opportunities, which follow a similar structure to AQRU’s. The platform supports over 30 coins and offers up to 11% yearly yields. BlockFi also has no hidden fees or minimum balance thresholds, making it ideal for beginners.

5. Leverage Play-2-Earn (P2E) Gaming

If you’re wondering how to get free crypto but have fun at the same time, then play2earn games are a perfect option for you. Games have always been a great way to earn additional income, such as with eSports, but blockchain adds to this with several new ways to offer rewards to players.

Web3 games are designed from the ground up to reward players for their time and attention – the core concept is often centered around how players are incentivized to participate. You can sell your tokens or in-game assets to other players and the rewards (NFTs or tokens) are often transferable across blockchains.

One of the most well-known P2E games, is Mega Dice. It is a Solana-based token that can be used to play casino games and earn daily rewards based on casino performance. This makes it one of the best gameFi tokens for online casino enthusiasts.

6. Hold & Wait for Hard Forks

Many people benefited from hard forks in the past. A “hard fork” is where there is a split or schism in a given community. This happened with Ethereum in 2016 after a $60 million hack on a Decentralized Autonomous Organization (DAO) led to a blockchain revision (hard fork). The blockchain was essentially re-written so that the funds were returned from the hacker. The result was two tokens – Ethereum and Ethereum Classic (ETC). Ethereum has had many forks, but only one led to a new coin.

Hard forks occurred for Bitcoin holders when it split into Bitcoin Cash (BCH), Bitcoin SV (BSV), and Bitcoin Gold (BCG). These were huge schisms in the community that led to major questions at the time, mainly surrounding centralization concerns and whether or not they were sticking to the ideals set out in the original whitepaper. Essentially, however, holders of BTC were given free cryptos – they just had to go to a wallet that supported the new coins and claim them.

If you had 10 Bitc (BTC) when the split(s) occurred, you would be rewarded with 10 BCH, 10 BSV, and 10 BTG at the time of each fork. But you had to manually claim the tokens, as it did not happen automatically.

Hard Forks vs Soft Forks

A hard fork refers to a modification made to a blockchain protocol that renders older versions obsolete. If older versions continue to operate, they will adopt a distinct protocol and possess dissimilar data compared to the newer version. This situation can lead to considerable confusion and potential errors.

Soft forks are blockchain protocol updates that remain compatible with older versions. Changes made are accepted by nodes on older versions, but the updated version rejects blocks from older ones.

The same private keys are required to access all the forked variants. At today’s prices, 10 of those tokens (BCH, BSV, BTG) would be worth around $3,000 – for free. The splits did not seem to have a major effect on the original tokens either, in the sense of reducing the value of the original coin. They can have the opposite effect.

When BCH split from BTC on August 1, 2017, the price of BTC went from $2,700 at the start of the month to $4,500 by the end of the month. The price of the original tokens was not negatively affected – users simply got to claim extra coins. Many traders and institutions seemed to want to get in on the action of the soon-to-be-forked cryptocurrencies and the general hype would seem to promote the ecosystem itself. A similar price increase can be observed in Ethereum hard forks.

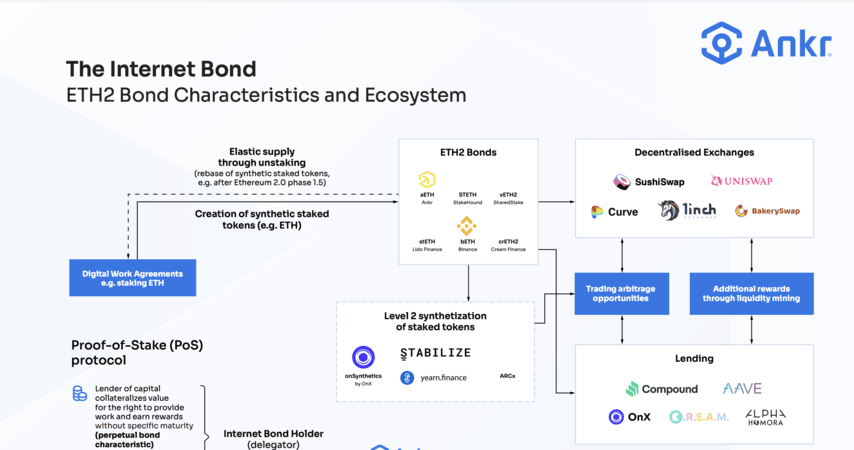

7. Derivative Staking

Derivative staking (also known as liquid staking) allows for maximum ROI in the context of Web3 – but it also comes with the most risk. It is an innovative approach that allows users to leverage their staked cryptocurrency assets while still earning free crypto rewards.

Derivative staking is promoted by firms like Ankr, known as “StakeFi”. When you stake your tokens, the tokens are locked up and cannot be used elsewhere. This can allow for increased rewards, as you can benefit on multiple levels. There are even more complicated variants, including internet bonds based on Ethereum.

Traditional staking involves locking up cryptocurrency in a specific blockchain network to support its operations and validate transactions. However, this process typically restricts the liquidity of the staked assets, limiting their usability in other financial activities. Liquid staking addresses this limitation by providing a mechanism to tokenize the staked assets and create derivative tokens representing the underlying stake.

With liquid staking, users can receive derivative tokens, often called staking derivatives or staked assets tokens (e.g, stETH for Ethereum staking), which can be freely traded on various DeFi platforms. These derivative tokens hold value equivalent to the underlying staked assets and enable users to access additional liquidity without the need to unstake their tokens.

By utilizing liquid staking, users can take advantage of the benefits of staking rewards while simultaneously engaging in other DeFi activities such as lending, borrowing, or trading. This flexibility expands the utility of staked assets and allows users to maximize their potential returns.

Liquid staking is riskier than traditional staking due to market forces affecting derivative token values. Users must be cautious when selecting platforms for staking to secure their assets.

8. Take Part in an Airdrop

One of the best ways to earn instant free crypto hassle-free is to offer free tokens, like the best crypto airdrops. Airdrops refer to the process of distributing crypto for free to people who are interested in a specific project. This process usually occurs when trying to generate even more hype around an upcoming token launch, as giving out free tokens to people tends to cause excitement on social media.

Airdrops can be manual or automated. Tokens are given to existing holders or users who meet specific criteria, such as holding a certain cryptocurrency or completing tasks.

The objectives of airdrops are manifold. First and foremost, they aim to generate interest and attract attention to a new cryptocurrency project. By distributing free crypto, projects can entice potential users to explore their technology and become active participants in their ecosystem. Airdrops can also reward loyal users or encourage token adoption by providing an initial stake in the project.

From the recipients’ perspective, airdrops can be an opportunity to obtain valuable tokens at no cost. It allows users to diversify their cryptocurrency portfolio without making any financial investment. Furthermore, airdrops can create community and involvement as individuals become part of a growing network of token holders.

However, it’s important to note that airdrops are not without challenges. The abundance of airdrops can lead to token saturation and diminish the value of distributed tokens. Additionally, scams and fraudulent projects may misuse the concept of airdrops to deceive users and extract their personal information.

9. Complete Educational Courses

Another option to consider if you’re wondering how to earn free crypto is to complete educational courses. This process, dubbed ‘Learn and Earn’, may seem too good to be true, but in fact, it is offered by an array of top platforms. Earning free crypto through learning involves participating in educational courses or watching videos, with small ‘rewards’ distributed on completion.

A popular platform offering the option to lear and earn free crypto is Coinbase, one of the best crypto exchanges on the market. The ‘Coinbase Earn’ service will reward you for watching educational videos and completing quizzes, with certain quizzes providing larger payouts than others.

The specific coins provided as rewards will vary depending on the task, although Coinbase offers over 20 tokens to be rewarded in. All that’s required is a Coinbase account, and you can complete the educational courses immediately. However, it’s important to note that the free crypto rewards are not very large and usually average just a few dollars worth of crypto per course.

10. Participate in DeFi Lending

Decentralized finance (DeFi) refers to the ecosystem of financial applications built using blockchain technology. Due to this decentralized nature, these applications do not rely on a centralized authority to facilitate transactions.

Many new and exciting possibilities can arise from blockchain technology – one of which is DeFi lending. DeFi lending involves depositing your cryptocurrency into a particular protocol, which will then loan it out to other parties. In exchange for providing your crypto assets, you will earn interest – often at rates much higher than traditional banking systems.

This means you can purchase the best cryptocurrency to invest in and then lend it out through a DeFi protocol, benefitting from value increases whilst generating a consistent yield. Yields will vary depending on the asset and the protocol you use, although they can reach over 10% per year in certain situations.

The great thing about DeFi lending is that most lending agreements are collateralized. This means that borrowers must post collateral in the form of cryptocurrency – with this collateral being valued higher than the loan itself. Since the whole process is facilitated through smart contracts, there is no way to cheat the system and no need to provide a credit check.

To further understand this crypto-earning strategy, please refer to our DeFi investment guide.

11. Earn Crypto Credit Card Rewards

If you’re wondering how to earn crypto online, using a crypto credit card could be the way forward. The best crypto credit cards follow a similar structure to regular ones because they offer cashback rewards for purchasing. However, the critical difference is that crypto credit cards reward users in digital currencies rather than FIAT.

Due to the rapid rate of crypto adoption, there is now an abundance of providers that offer crypto credit or debit cards. Many of the best altcoin exchanges offer dedicated card services that allow you to use your crypto holdings to pay for goods and services.

The great thing is that the end merchant doesn’t have to accept crypto for you to use these cards, as the provider handles the exchange process. This means you can pay in crypto, yet the merchant receives the proceeds in FIAT – making it a ‘win-win’ for all parties.

Cashback rewards will vary from provider to provider, although they tend to be distributed in the platform’s native token – for example, the Crypto.com credit card provides rewards in CRO. However, once cashback is earned, it can easily be withdrawn or used for trading, giving scope to boost your income even further.

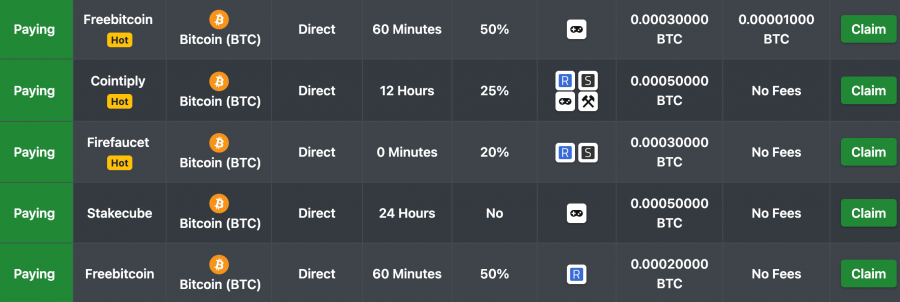

12. Use Crypto Faucets

How to earn free crypto instantly?

The easiest answer to this question is to use crypto faucets. Crypto faucets offer small sums of free cryptocurrency for completing easy tasks repeatedly. They require no special skills and can provide a reliable income stream if done consistently.

Examples of crypto faucet tasks may include viewing digital ads, watching videos, completing CAPTCHAs, participating in quizzes, and more. The amount of free crypto you will earn depends on the provider and the specific task, although amounts tend to be extremely small.

Another factor to keep in mind when trying to find different ways to get free crypto is that many providers require you to hit a certain account balance before being able to make a withdrawal. There may also be a time limit set on collecting the rewards, making crypto faucets a challenging method to utilize over the longer term. Finally, the crypto faucet sector also has a reputation for shady dealings – so it’s wise to conduct extensive research to ensure you’re not being scammed.

Why Earn Crypto Rewards Vs Cash Rewards?

Recent years have seen a surge of interest in cryptocurrencies. The new asset class has multiple use cases (particularly about decentralized finance) and also allows for direct asset ownership.

Two key reasons for choosing crypto rewards over cash rewards are the potential for increased profit and the fact that owners retain ownership over their private keys and, thus, their crypto assets.

1. Improved Earning Potential vs Fiat Currency

Cryptocurrencies are known for an impressive rate of return, even if these returns are not guaranteed and come with increased risk. When you get crypto rewards, it can potentially experience high levels of appreciation in its market value. This can be contrasted with receiving free rewards in cash/fiat, which are not appreciated.

Fiat currencies typically depreciate with quantitative easing policies – meaning that fiat rewards will get devalued as money is printed. In contrast, cryptocurrencies are often built within a deflationary ecosystem, potentially rising in value as time passes.

2. Security & Direct Asset Ownership

When you accept cryptocurrency, you assume ownership of an asset that is yours alone. This fact sets it apart from the other forms of rewards and incentives found in the world of Web2, dominated by fiat currency. Transactions are not meant to be tracked and monitored with cryptocurrencies, and pseudo-anonymity was an in-built feature for a specific purpose.

You are given a set of private keys when you set up a wallet identifier, but it is up to you to ensure that you don’t lose these keys. So, while it’s great having direct ownership, it comes with a lot of responsibility. If you lose your keys, you lose your crypto funds.

No tracking, monitoring, or KYC checks mean you can transfer your crypto anywhere, whether it’s DeFi for higher returns, yield farming, or to help a friend. You have full control over your funds.

Risks of Crypto Rewards

Cryptocurrency rewards have some significant advantages. But the very things that make it attractive to investors are also the things that make it unsafe. For example, the high volatility and lack of regulation might result in greater returns (in some instances), but it also increases the risk of market manipulation, hacks, and scams.

1. Lack of Regulation

The lack of regulation in the crypto market has been a significant concern for investors. An example of this is the Ripple vs SEC court case, which ended in 2023, luckily with Ripple on top.

The absence of regulation creates opportunities for fraudsters to enter the market with various schemes to defraud investors. The unregulated crypto market is more prone to market manipulation, which could lead to price fluctuations. Although the crypto markets offer various opportunities to earn free crypto coins, regulatory authorities can also ban specific coins, causing the value of crypto assets to fluctuate.

Investors should be aware of the risks involved in investing in an unregulated market. It is essential to stay informed and be cautious when investing in the crypto market.

2. Volatility

The crypto markets are known for their volatility. This has important implications because investors often sell their tokens or financial instruments when times are difficult and buy when times are easy – in other words, they buy high and sell low, which is not an optimal maneuver when trying to save or invest.

If you’re considering taking savings or rewards in crypto instead of cash, then you need to be aware of the dangers of volatility. You might save up for a particular goal (house, car, wedding, holiday, computer, etc) in BTC or ETH but these assets can fall sharply in value. And these coins are actually the most stable of the crypto assets, due to their trade volume.

Lesser known tokens are more volatile due to this lower overall trade. A lower market capitalization makes it easier for large institutions (whales) to place huge orders, affecting the price.

3. Hacked Accounts & Lost Keys

One of the biggest risks of crypto is that there is no recourse for lost or stolen funds. If you misplaced your wallet keys, your funds are gone. If you send your crypto to a scam artist, your funds are gone (with some exceptions, such as when official authorities get involved or when the entire blockchain gets revised, as in the case of Ethereum).

Despite the risks, however, you can safeguard your cryptocurrency in many ways. Making two secure copies of your private key is a good way to stay safe, and the vast majority of hacks occur when people are either phished from their funds or forget their keys.

How To Make The Most Of Your Crypto Rewards

If you’ve decided to start earning free crypto it’s now time to think about how best to leverage your capital and maximize it. A good option is to look at staking and yield farming so you can judge how much it is possible to make over a given period.

Binance can be useful for those looking to consolidate their holdings on a platform offering many features – an NFT marketplace, staking, new tokens, launchpads, trading, option contracts, loans, cashback, etc. The idea is to leverage as many of the above ideas as possible – airdrops, staking, play to earn, cashback, etc so they all stream into a unified source of returns.

Staying in touch with key social media sites on Reddit, YouTube, Twitter, and Discord can further assist in making the most of crypto rewards. The JacobCryptoBury YouTube channel, for example, focuses on the best ways to earn free crypto, including the latest offers, and goes far beyond surveys. Certain Reddit threads are designed specifically to outline the best ways to earn free crypto, which are in-depth and comprehensive.

Exchanges and applications are frequently shifting their promotions and offerings, new projects are continually coming online, and there is an incredibly rapid rate of change within Web3 that can render useful strategies ineffective in a very short time. So, it’s good to find resources that compile all of this information from you in an easily digestible format.

Conclusion

In summary, understanding how to earn free crypto can be valuable for new crypto enthusiasts. Although we’ve explored several safe and legitimate ways to do so, it’s important to remain cautious and informed to avoid scams. You can continue investing and even get free crypto without unnecessary risks by sticking to the trusted platforms and methods discussed.