Polygon is the most popular layer-two scaling solution that operates alongside the Ethereum blockchain. MATIC is the native token of the Polygon chain and is used to reward validators for helping secure the network.

Since MATIC is used to incentivize validators to verify transactions on the chain, holders of the token can passively earn interest on Polygon. As you continue reading, we’ll discuss how you can do this along with choosing where to earn interest on MATIC tokens.

Where to Earn Interest on MATIC – Top Platforms

Below are some of the best platforms to earn interest on Polygon. Each platform has key differences that we’ll touch on later in the article.

- Nexo – earn on MATIC tokens through daily payouts

- Crypto.com – rewards paid weekly for MATIC tokens

- BlockFi – accrue daily MATIC earnings at monthly payouts

- Binance – high MATIC interest rate at 90 day lockup

Best Polygon Interest Rates Compared

Here is a table that compares the different Polygon interest rates alongside some requirements for getting the highest rates based on your MATIC interest account. Similar to some of the best DeFi coins, MATIC interest rates are computed in annual percentage yield (APY), a percentage of the principal earned after a year of daily compounding rewards.

MATIC Interest Account

MATIC Interest Rate

Terms & Conditions for Best Interest Rates

Nexo

16%

Platinum loyalty tier, 1-month fixed term, and interest paid in NEXO tokens

Crypto.com

14.5%

3 months lockup with a CRO stake of $40k or more

BlockFi

11%

None

Binance

21.54%

90 day lockup period, capped at 150 MATIC for lending

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Best Polygon Interest Accounts Reviewed

The Polygon network is one of the biggest proponents for decentralized finance (DeFi) as it helps scale Ethereum-based DeFi apps like Curve finance and the AAVE protocol.

A popular method of earning cryptocurrencies in DeFi is through the staking process on some of the top platforms for staking crypto. Since Polygon is a proof-of-stake (PoS) chain, anyone with MATIC tokens can store them in a Polygon interest account to start earning rewards. Aside from this, crypto lending platforms can let you earn interest on your MATIC coins which are collected for liquidity pools and other crypto products.

1. Nexo – Earn on MATIC Tokens With Daily Payouts

Nexo is the leading digital assets lending platform and lets you earn up to 16% APY on MATIC tokens. To earn this highest amount with Nexo you’ll need to follow some requirements:

- 10% or more of your portfolio with Nexo is comprised of NEXO tokens which lets you avail of their Platinum membership

- Hold your MATIC tokens with their 1-month fixed term plan

- Choose to have your earnings paid out in NEXO tokens

Users can also opt to hold their MATIC tokens in Nexo’s FLEX plan which only lowers the interest rate to 14% (from 16%) given everything else remains the same. Subscribing to the FLEX plan with MATIC tokens lets you collect daily payouts which will be used to compound your earnings.

Similar to Binance, earning MATIC tokens on Nexo is unavailable for U.S. citizens so the current state of the platform won’t allow them to benefit from other crypto earnings products as well. However, Nexo is working on releasing an EARN 2.0 product that aims to comply with American regulations as mentioned by their customer support.

No Hidden Fees

Unlike buying cryptocurrencies from other exchanges, there are no fees for depositing or withdrawing cryptocurrencies with Nexo. With a built-in crypto wallet, Nexo also does not charge any amount for holding your cryptocurrencies.

High-level Security

Asset security and insurance is a top priority for Nexo. They’ve partnered with the leading cryptocurrency security providers in the industry such as BitGo, Bakkt, Ledger Vault, and Armanino. Digital assets are audited in real-time while cryptocurrencies are stored in both warm and cold storages.

$375 million is insured and protected on digital assets that are stored at Nexo.

Being ISO/IEC 27001 certified, even information is stored safely with high security servers and other infrastructure to hold data firmly. Users are advised to use their two-factor authentication features and the biometric identification to further bolster the account security.

Pros Cons

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Crypto.com – Earn Interest On MATIC Through Weekly Rewards

Crypto.com is a crypto exchange that also offers high APY on MATIC earnings. It has developed its own blockchain called the Cronos Chain and utilizes its native token, Cronos (CRO) for rewards and utility. Unlike the last two platforms we reviewed, Crypto.com’s earning products are completely available for U.S. citizens.

Users can benefit from the maximum MATIC earnings of 14.5% APY on Crypto.com after staking $40,000 or more worth of CRO and opting for the 3-month deposit term or lockup period.

The interest rate is also bracketed if over $30,000 worth of MATIC tokens are used for Crypto.com’s earning plan. The first $30,000 (Tier 1) will enjoy the full rewards while the remaining amount (Tier 2) will benefit half of the rewards.

CRO Staking Rewards

If you’re bullish on the Crypto.com ecosystem or even better, already have CRO staked for at least six months then you’ll benefit from the many rewards that come along with staking Crypto.com’s native token. Increased adoption of the Crypto.com platform can even lead to earning more from the higher value of Cronos.

With the Crypto.com app, you may even choose from a selection of Crypto.com Visa cards with benefits like Spotify, Netflix, and Amazon Prime cashbacks. Higher tiered cards even give you select airport lounge access and other bonus rewards.

Security Measures

Behind Crypto.com’s crypto wallet and earning products are strong security measures and safety features. Their partnership with leading custody technology solution Ledger Vault lets them store all user-owned cryptocurrencies in secure, cold storage. $750 million is insured from hardware damage and breaches.

Pros Cons

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. BlockFi – Accrue Daily MATIC Earnings At Monthly Payouts

BlockFi is another digital assets platform with many different crypto products under its belt. A built-in crypto wallet, crypto exchange, interest account, and even crypto-backed loans are integrated in the application.

Storing MATIC tokens in a BlockFi interest account gives 11% APY in total earnings. The interest yielded is compounded per day and the MATIC payouts are issued every month. You can even choose how the earnings will be paid out in—these are cryptocurrencies like bitcoin, stablecoins, or plain MATIC tokens.

Regulatory Framework

After a recent settlement with the United States Securities and Exchange Commission (SEC) in February 2022, BlockFi no longer has their Interest Account product available for U.S. BlockFi account holders. This is because the BlockFi Interest Account is not registered with the Federal Securities Act.

It’s common for popular crypto platforms like BlockFi to have these settlements with the SEC and many platforms release regulated versions of their products after some time. Moving forward, the crypto community still sees these companies as safe, established, and reputable so it’s good news that BlockFi continues to operate with its other products.

Other Benefits

From time to time, BlockFi gives different deals and promos for its users. For example, a recent promo gives users who buy at least $150 worth of Avalanche (AVAX), they’ll earn the share of rewards from a pool of $250,000 in AVAX.

If you’re looking to invite friends over to BlockFi, they offer a special promo that lets both you and your friend earn a small percent from their trades. If you avail of the BlockFi Visa Rewards Card, you and your friend can get $30 in GUSD, the Gemini Dollar stablecoin.

Pros Cons

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

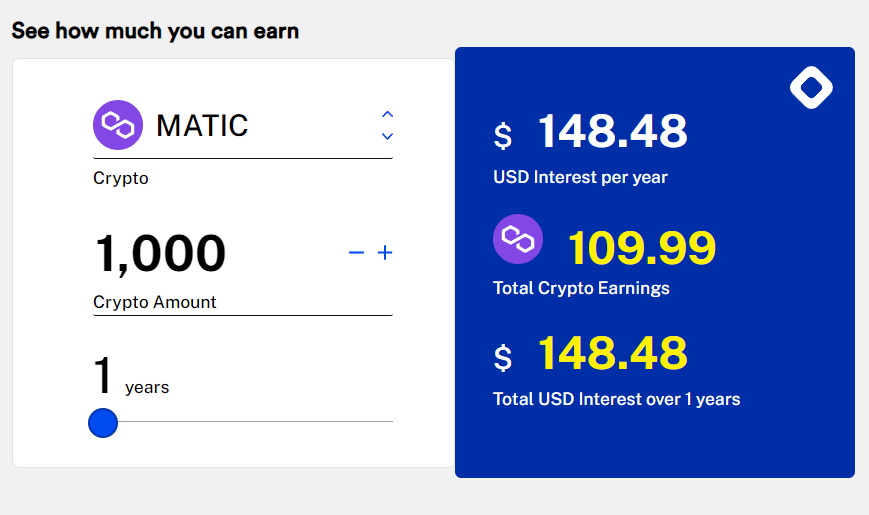

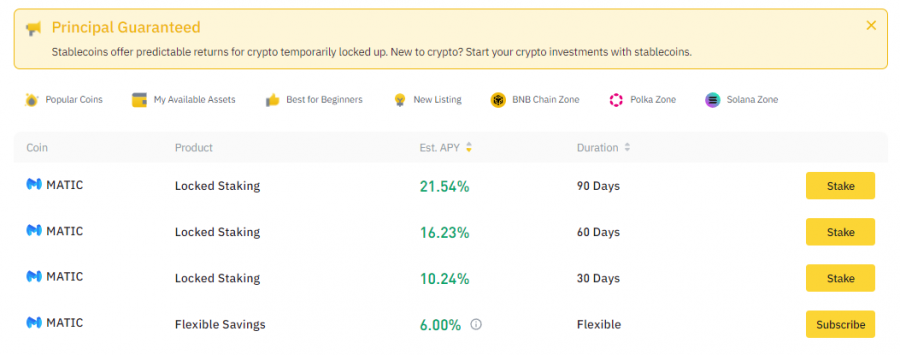

4. Binance – High MATIC Interest Rate At 90-Day Lockup Period

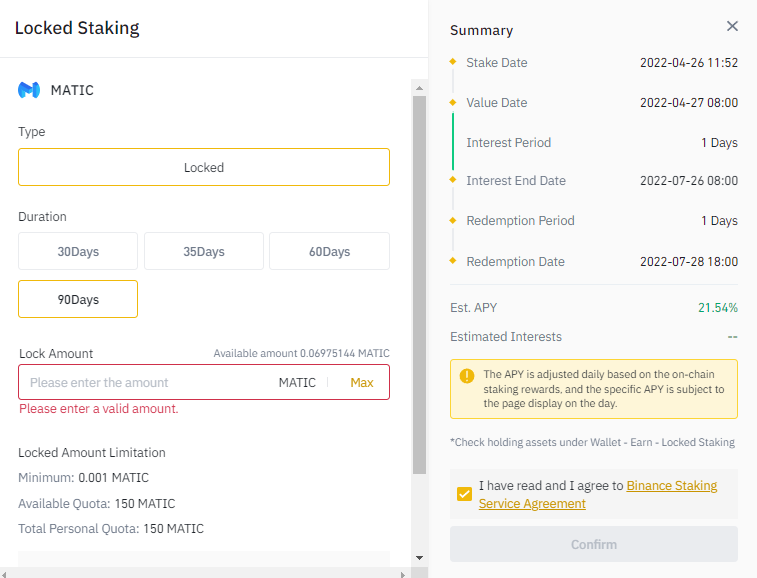

With a maximum APY of 21.54% for MATIC, Binance is the best MATIC interest account if you’re looking to buy Polygon with the highest interest rate. As your interest accrues with Binance, your cumulative earnings collect every day and will be distributed once the lockup period has ended.

Binance is also the most popular cryptocurrency exchange and has the largest volume for crypto trading among the other centralized platforms. It has established itself as the leader in crypto investing, crypto earn products, and even margin trading.

Regulation

Founded in 2017, Binance has seen its share of regulatory conflicts. Notably, Binance was outlawed in the United States back in 2019 but has since rebounded in the region through the separate exchange Binance.US, a platform that adheres to US laws and legal frameworks.

Multiple Lockup Periods

An advantage that Binance has over other platforms is differing lockup periods. If you’re not keen on handing your MATIC tokens over for three months, Binance offers Polygon interest rates for two month and one month lockup periods as well—albeit at lower rates. You can even store MATIC tokens in a flexible crypto savings account which gives you 6% APY for up to 100 MATIC tokens.

Given that Binance continually updates their crypto earning products, these plans and rates may change over time. With a cap of up to 150 MATIC tokens for the 90-day lockup, small-time investors and MATIC holders will find value in staking their tokens with Binance at 21.54% APY.

Pros:

- 21.54% APY for a 3 month lockup period

- 90-day, 60-day, and 30-day locked periods available

- Flexible savings available at 6% APY

- Peer-to-peer trading available

- Highly rated mobile app

Cons:

- Earn products currently unavailable in the U.S.

- Lose all rewards when ending lockup period early

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

How to Earn Interest on Polygon

Let’s look at how to earn interest on MATIC with the Binance platform. Below is a step by step guide to get you started.

Step 1: Open An Account With Binance

First, head over to the Binance website and click on the ‘Register’ button located on the top right. You can choose to sign up with your phone, email, or Apple ID. To finish setting up your account, Binance will send a verification email as well as an SMS to the phone number you used for registration.

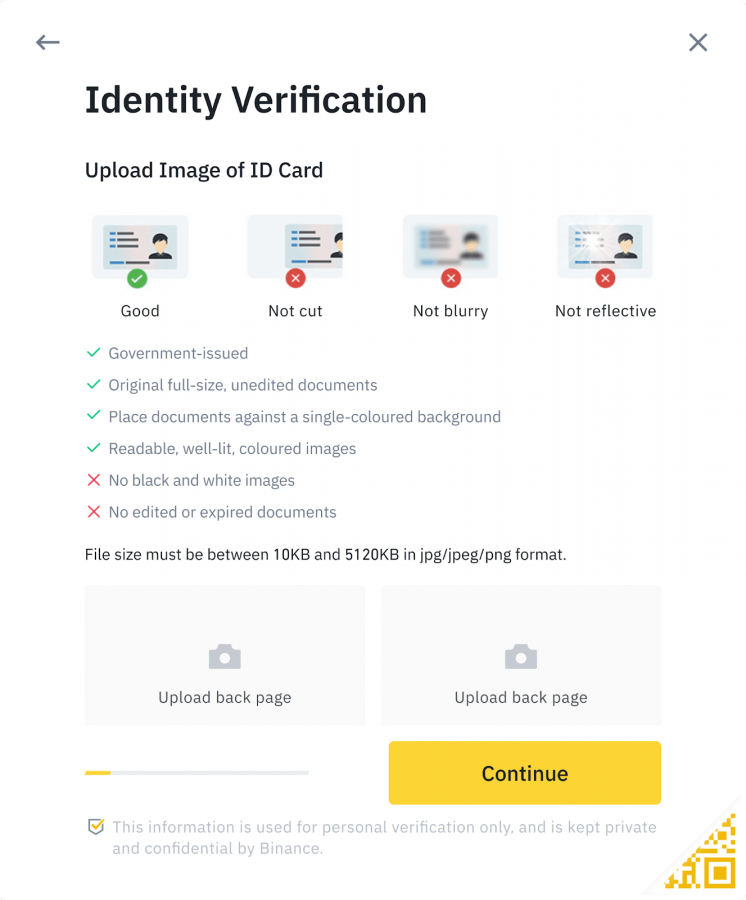

Step 2: Verify Your Identity

Next, you’ll need to verify your identity to start trading, earning from crypto, and use other features on the Binance platform. You’ll be asked to upload a valid ID such as a passport or license. Make sure to upload a clear picture and follow the steps carefully, especially when you need to send a current picture for them to complete the verification.

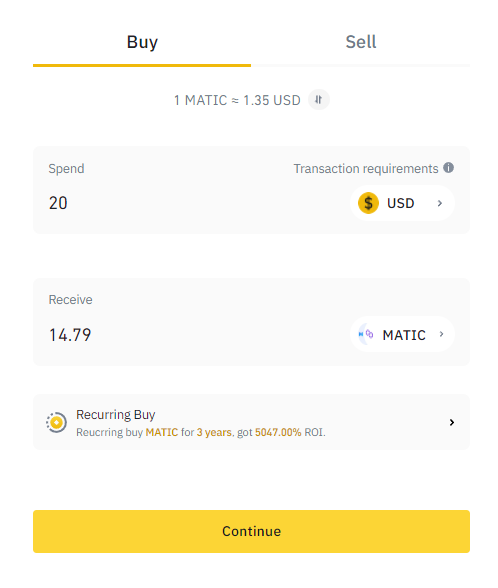

Step 3: Add MATIC funds

After your Binance account has been verified, you can start depositing MATIC funds to your account. If you have cryptocurrencies from another wallet, you can use Binance’s built-in wallet and send MATIC and other coins from your wallet to Binance. You also have the option of either using your bank card to directly buy cryptocurrencies or use their peer-to-peer (P2P) market to buy cryptocurrencies from other users which you can convert into MATIC tokens.

Step 4: Stake MATIC coins on Binance Earn

Now that you have MATIC in your Binance account, you may start earning 21.54% APY with Binance Earn. On your dashboard, go to the navbar and click on ‘Earn’ and search ‘MATIC’. You’ll get Locked Staking and Flexible Savings options to subscribe to. For the maximum amount of interest on Polygon, click on the 90-day locked staking option, enter the amount of MATIC you want to earn with, and click on ‘Confirm’ and you’re all set.

Is Earning Interest on Polygon a Good Investment?

As a scaling solution to the Ethereum blockchain, Polygon’s native token MATIC could continue to grow in price as its parent chain becomes more widely adopted. See our Polygon price prediction guide.

If you have idle MATIC tokens and are willing to hold, then it’s best to make them earn interest for you. From the various crypto interest accounts we’ve reviewed in this article, you’ll definitely find that earning interest on your MATIC tokens is probably a good investment.

If you want to keep your options open, you can use a flexible terms account to store your MATIC tokens. On the other hand, if you want to hold long term for more APY, then you can opt for a fixed-term lockup period. The best MATIC interest account for you is one that best suits your investing needs.

Polygon Interest vs Staking

Practically speaking, earning interest from Polygon and staking Polygon both give you rewards passively. In fact, some crypto lending platforms use the MATIC tokens that you store with them and stake it themselves in order to earn for you. They might even use the pool of MATIC tokens to provide liquidity for crypto exchanges.

In any case, many crypto investors are better off delegating their tokens to centralized exchanges since staking cryptocurrencies themselves requires more technical knowledge and some hardware configurations.

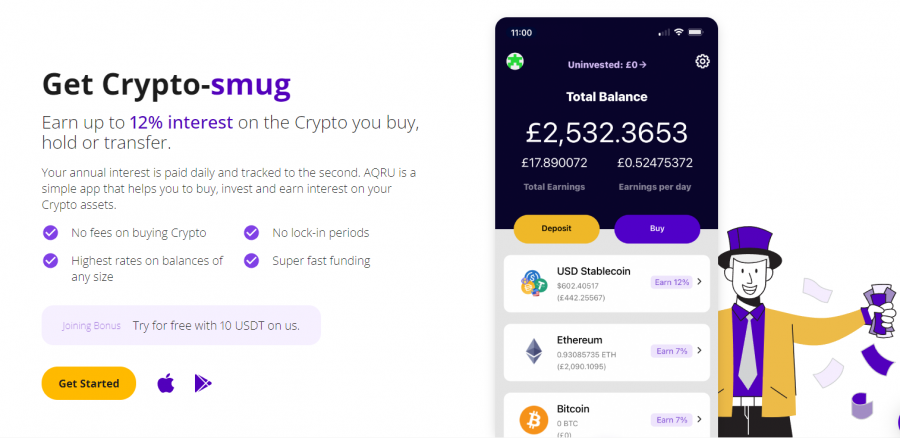

AQRU – Overall Best Crypto Interest Platform

AQRU is the best platform to earn passively on your cryptocurrencies. Although the platform does not offer a MATIC interest account, it’s still our overall recommended platform for earning interest thanks to very favorable earning rates, an easy-to-use platform, and being a fully regulated application.

Bitcoin and Ethereum are the major cryptocurrencies that AQRU accepts and they offer them at a substantial 7% APY with no lockup periods or complicated tier levels. You can easily fund your account through bank transfer or credit card and start earning passively from these digital assets.

AQRU lets you earn interest rates on stablecoins, at an attractively high 12% APY with flexible terms. This rate applies for the popular stablecoins Tether (USDT), USD Coin (USDC) and Dai (DAI). On top of this, AQRU already has a joining bonus of 10 USDT which you can already use to start accruing interest.

If you have any investments in cryptocurrency, chances are, you own some stablecoins, Bitcoin, or Ethereum.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Conclusion

Each crypto lending platform we reviewed for earning interest on Polygon has its advantages and disadvantages depending on your MATIC investing strategy. Binance offers the highest Polygon interest rate at 21.54% but only allows for a maximum of 150 MATIC tokens at a three month lock up period.

With Nexo, you can hit 16% APY on MATIC tokens for just a one month lockup term and after reaching the platinum tier. If you want to earn from Polygon through NEXO tokens and live outside the US, then this is a great option.

Crypto.com provides a close 14.5% APY on Polygon for the same lock up period but requires you to stake $40,000 in CRO for six months. They are, however, fully regulated and available for US clients.

BlockFi offers a decent 11% interest rate on MATIC tokens without much requirements. However, US clients will have to wait for the American-regulated BlockFi interest account product to come out before being able to start earning.

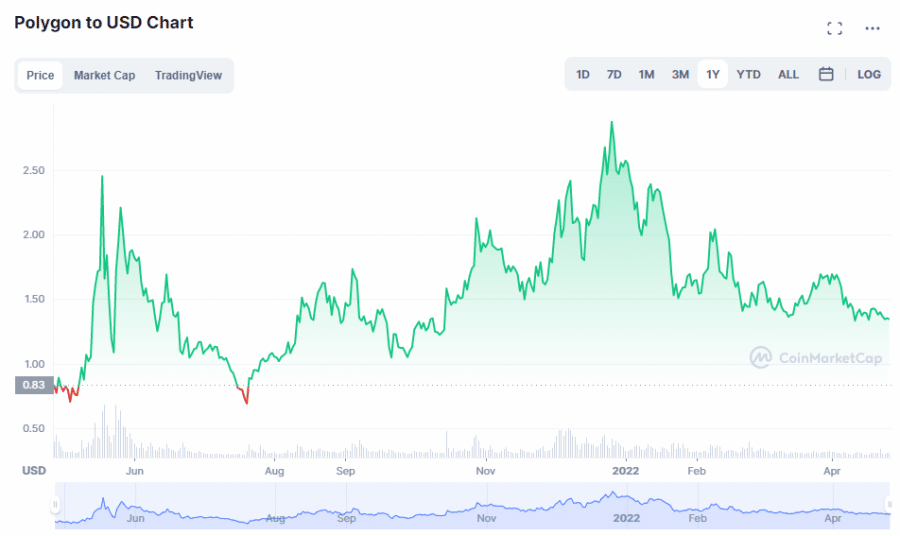

That being said, earning interest on Polygon still comes with the risk of a potential market crash since the price of MATIC remains volatile. Many investors recommend diversifying your portfolio to mitigate this risk and earning passively through stablecoins is a great way to do this.

For this reason, we recommend using AQRU for your USDT, USDC, and DAI and start earning 12% APY. With some of the best rates for stablecoin earning and even for Ethereum and Bitcoin at 7% APY, the AQRU platform is one of the best so far.

You don’t even need to worry about any fiat withdrawal fees or stake any native tokens to get the best rates. Alongside your MATIC earn accounts, open an AQRU account to diversify and start earning with the best rates through stablecoins and the top cryptocurrencies.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.