Ethereum (ETH) is one of the best performing financial assets of the last decade, rising from a price at ICO of $0.31 in 2014 to thousands of dollars today, and $4875 at its current all-time high (Nov 2021). Many Ethereum investors are confident its bull run will continue in 2025 and future years.

It’s very volatile however, as with any cryptocurrency, so you may want to avoid trying to trade the swings unless you’re an experienced trader, and instead earn interest on Ethereum while holding it.

Where to Earn Interest on Ethereum – Top 2 Platforms

- Aqru – earn daily interest on ETH

- Crypto.com – highest ETH interest rate with lockup period

These are our picks for the best platforms to earn interest on Ethereum which is different to Ethereum staking in terms of how your interest rate, APR or APY is derived – we’ll explain that in this guide.

Best Ethereum Interest Rates Compared

| ETH Interest Account | ETH Interest Rate | Terms & Conditions for Best Interest Rates |

| Aqru | 7% | None |

| Crypto.com | 3.5% – 8.5% | Three month lockup, and staking $40k in CRO |

Who pays the most interest on Ethereum depends on how much you’re willing to invest, and risk tolerance.

Best Place to Earn Interest on Ethereum – Reviews

Earning interest on Ethereum is one of the most effective ways to make money with cryptocurrency in 2025.

Our pick for the best platform to earn interest on ETH that has no complicated terms or lock-up requirements, is Arqu. You may want to open several ETH interest accounts however to split up your holdings.

You can also refer to our Ethereum price prediction article for more details on how some market analysts believe the world’s second-largest crypto could perform in the foreseeable future.

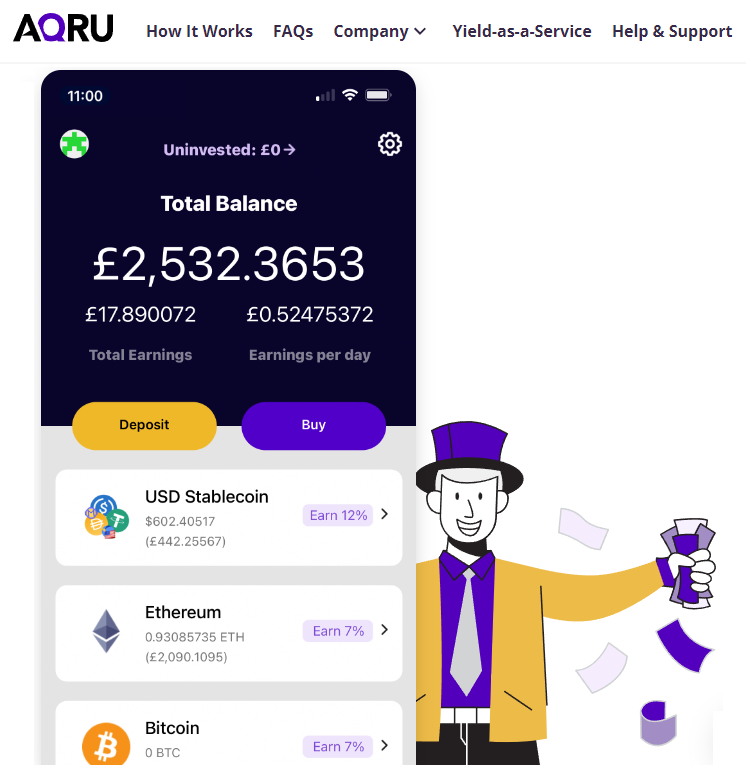

Arqu – Earn daily interest on ETH

Aqru.io pay 7% annual interest on Ethereum paid daily directly into your account balance, alongside the same interest rate on Bitcoin and 12% on stable coins pegged to the US dollar (USDT, USDC and DAI).

Unfortunately Aqru is not currently available in the United States, however Crypto.com is are so see our review of that platform below.

Earn interest on Ethereum on Aqru

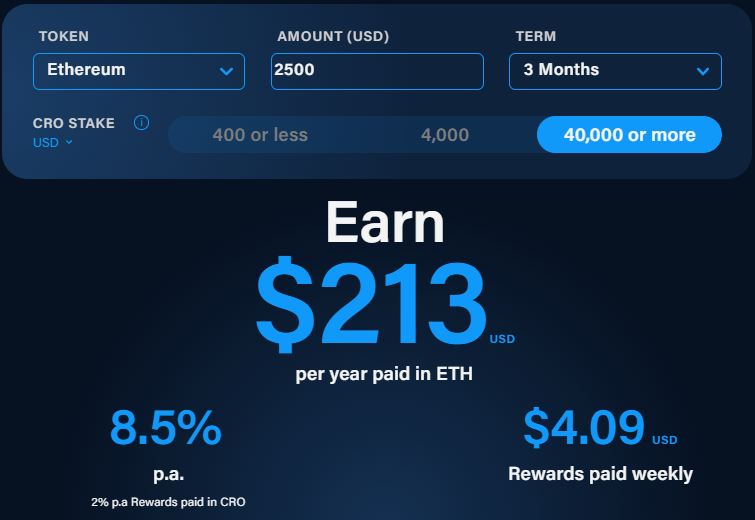

A balance of e.g. £2,500 would return around £0.50 a day to start – in the example screenshot above some of the balance is held in stablecoins. The daily payments would then increase with compounding gains – the 7% APY (annual percentage yield) is applied based on your new balance each day.

The lack of any requirement to deposit a certain amount, or lockup funds for a set time period, makes Aqru appealing especially for small accounts and investors on a budget.

The one disadvantage is their app and desktop platform are relatively new to the crypto lending market, launching in December 2021. The parent company Accru Finance Ltd was founded in 2019.

Aqru have a limited but growing online presence on forums for user feedback like Reddit, and are verified on Trustpilot with an excellent rating based on 23 reviews so far.

Regulation & Security

According to the FAQs on their website Aqru are a regulated company and virtual assets service provider and have a $30 million insurance policy in place in the event of hacking.

Their crypto wallet software is encrypted by Fireblocks, a leading wallet infrastructure provider.

Free $10 USDT

To try out the platform and learn how to earn interest on Ethereum, Bitcoin or stablecoins Aqru credit a free $10 in Tether to your account balance instantly on sign up.

There’s also a refer a friend bonus where you can earn $75 USDT free for every referral, for you and the friend you refer.

Cons

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Crypto.com – highest ETH interest rate with lockup period

$2,500 invested on Crypto.com (which accepts USA customers) would return 3.5% per annum if you want a flexible term (no lockup period) and no other conditions.

However if you are willing to commit to three month terms and hold and stake at least $40,000 worth of the native token of Crypto.com, Cronos (CRO), you can earn 8.5% interest on Ethereum.

Earn interest on Ethereum on Crypto.com

Since its founding in 2016 Crypto.com has established a good reputation and is considered one the best crypto exchanges, that expanded to become a platform to earn interest on Ethereum as well as many other cryptocurrencies and DeFi tokens.

Its native token Cronos (previously known as ‘Crypto.com coin’) has increased in value from around one cent in 2019 to over $0.40 today, and is now the #18 ranked cryptocurrency on Coinmarketcap.

So while it can seem like a high commitment to stake such a large amount of CRO and commit to locking up your Ether, most investors that have done so up to this point have earned an additional return on investment (ROI) just from the requirement to invest in CRO.

The only investors to not be in profit will be those that held CRO between late 2021 and early 2022, as when Bitcoin crashed from its all-time high of $69,000 to $33,000, CRO also corrected from $0.90 to around its current level. Ethereum has also seen a correction.

It’s possible CRO will revisit that ATH however or set new highs, as the popularity of Crypto.com improves and more users join the platform – it has recently featured Matt Damon in its advertising, and secured sponsorships with the UFC and Formula One. Their Reddit currently has 162,000 subscribers.

FDIC Insurance

According to the Crypto.com website if you are a US resident, any USD funds held on the platform are held at Metropolitan Commercial bank, an FDIC member and insured up to $250,000. For security, it’s partnered with Ledger and integrates its industry-leading custody solution, Ledger Vault.

Crypto.com is also a licensed electronic money institution receiving its EMI license from the Malta Financial Services Authority (MFSA) in 2021, and an Australian Financial Service License (AFSL) in 2020.

Bonuses & Perks

Crypto.com users can also take out instant loans with no credit checks, deadlines or late fees, using their crypto holdings as collateral. You can borrow up to 50% of your crypto funds at 12% interest p.a. which is lowered to 8% if you stake over $40k in CRO.

Users that create and account through the links on this site can receive a $10 – $50 sign up bonus. Read more about the Crypto.com bonus.

Cons

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

How to Earn Ethereum Interest on Aqru – Step by Step

- Visit the official Aqru.io website and click ‘Sign Up’

- To create an account enter your email, a password, referral code if you have one, and your preferred currency – GBP, EUR, USD or CAD

- Upload a copy of your government-issued ID such as a passport or drivers license

- Copy the Ethereum wallet address unique to your account

- Transfer the amount of ETH you want to earn interest on to your Aqru wallet

To see these steps in screenshots read our review of the best crypto savings accounts.

Earning Interest on Ethereum vs Staking

On crypto lending platforms like those we reviewed, your crypto, in this case ETH, is lent out to institutions in the form of loans, and the annual percentage return (APR) also called yield that you receive is a share of the revenue they earn as a loan provider. High street banks do the same thing with deposits you make into a savings account, paying their customers a much lower interest rate.

When you stake Ethereum, your ETH is used to validate transactions on the network, although you still receive payments in ETH and earn crypto passive income, just in a different way.

Read our guide on crypto staking to learn more. Some of the best platforms to stake ETH are:

Is Ethereum a Good Investment?

Is it too late to buy Ethereum? With the upgrade to ETH 2.0 expected to take place in 2022, Ethereum is potentially a good investment now. Its market structure is bullish, consistently printing higher highs and higher lows. Many investors are targeting $6,000 and beyond in future years.

Many decentralized finance projects and top DeFi coins run on the Ethereum blockchain. DeFi is often called the ‘future of finance’, with many decentralized applications (Dapps) already being adopted in the financial system, decentralized lending just one of them.

Ethereum is central to most of them, alongside Cardano and Polygon.

The Verdict

Crypto.com has the highest yield on Ethereum if you are willing to stake $40k of its native coin CRO and use three-month fixed terms, making it the best way to earn Ethereum for those who want to convert more of their savings to crypto.

To mitigate the risk of any one platform to earn interest on Ethereum being shut down, you might consider opening accounts on several platforms to not have all your eggs in one basket. Just as you wouldn’t go ‘all in’ on one altcoin, don’t put all your money into one crypto savings account.

Also use part of your portfolio for earning interest on stablecoins in case crypto does experience another multi-year bear market. The yield is also usually higher on those.

Both Ethereum mining platforms and crypto interest platforms are becoming increasingly popular in 2022, recently featured in the Times, Business Insider and Reuters. We’re cautiously optimistic they’ll continue to be a viable alternative way to make money and grow wealth fast in the years to come.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.