Cardano (ADA) is an open-sourced blockchain platform and one of the most popular cryptocurrencies in the world. After entering the market at an ICO of just $0.02, ADA has provided investors with a 150x return after reaching an all-time high of $3.

However, this highly profitable financial asset has proven to be just as volatile – dropping below the $1 mark on multiple occasions. Since the Cardano network runs on a Proof-of-Work (PoW) consensus, it can provide value to stakeholders in the form of interest via staking.

This guide provides you with all the information you need to earn interest on Cardano. We will also reveal the best crypto exchanges to earn interest on Cardano and reveal the best Cardano interest account.

Where to Earn Interest on Cardano

Let’s look at the best places to earn interest on ADA.

- Nexo – Best platform for earning interest on ADA.

- Crypto.com – Flexible interest rates on ADA.

- Blockfi – Earn interest on Cardano in the US.

- Binance – Earn interest on ADA with a 2-month lockup period.

Cryptoassets are a highly volatile unregulated investment product.

Best Cardano Interest Rates Compared

Here’s a quick breakdown of all the interest rates of each top-provider pinned against each other:

| ADA interest account | ADA interest rate | Terms & Conditions for Best Interest Rates |

| Nexo | 6% – 8% | Lockup time only for earnings more than 6% |

| BlockFi | 5.5% | No limit |

| Binance | 1 – 8.24% | 1-month lockup minimum – 7% and above |

| Crypto.com | 5% – 7% | Minimum lockup for 3 months (More interest earned with $40K CRO staking) |

Best ADA Interest Accounts Reviewed

Since the amount of interest earned on ADA can vary from platform to platform, we are going to review the best platforms to earn interest on Cardano. However, you may want to open several ADA interest accounts to split your holdings.

1. Nexo – Best Platform to Earn Interest on ADA

Nexo will give you a minimum return of 5% annually on ADA without any lockup, allowing you to trade your ADA holdings freely on the side. This feature will enable you to earn daily compounding interest on ADA. Therefore, the 5% APY (Annual Percentage Yield) is applied to your new balance daily.

Loyalty Levels

Nexo is also the best Cardano interest account as it lets you earn up to 8% interest on ADA by accessing their loyalty programme. There are 4 basic loyalty levels – Base, Silver, gold and platinum.

While the Base level secures ADA interest earners a minimum of 5% APY on Cardano without any lockup or additional features – you can earn more interest on Cardano by accessing the other 3 levels.

To gain further interest in Cardano, users can increase their holdings of $NEXO – the platform’s native crypto token. The silver level can be accessed if your portfolio comprises at least 1% of NEXO token.

The platinum level will require you to hold 10% of NEXO – but with the benefit of increasing your Cardano interest rates to 8%.

Safety & Regulations

Nexo is an EU licensed and regulated financial institution.

To ensure the safety of user portfolios worldwide, Nexo is heavily safeguarded and holds licenses and registrations among various jurisdictions. In the United States, Nexo is registered with the U.S. Financial Crimes Enforcement Network.

Nexo is regulated by the Australian Securities and Investment Commission (ASIC) in Australia and the Financial Transactions and Reports Analysis Centre of Canada.

Pros Cons

Cryptoassets are a highly volatile unregulated investment product.

2. BlockFi – Earn Interest on Cardano In The U.S.

BlockFi has a reputation for providing low-interest rates on popular cryptocurrencies such as BTC and ETH – often reducing interest rates as they increase holdings. However, BlockFi is one of the best platforms for you to earn interest on ADA.

On BTC holdings, you can earn a maximum APY of 4.5%, depending on the size of your holdings. However, the Cardano interest rate is fixed at 5.5%. The benefit of holding ADA in BlockFi is that the interest rates do not decrease as your holdings increase.

Regulation

Operating primarily in the United States, many cryptocurrency platforms are subject to risks and regulatory crackdowns by the Securities & Exchange Commission (SEC).

While BlockFi came under the SEC’s radar in February 2022, both parties have made a settlement. For a regulatory body that is notorious for shutting down multiple crypto platforms, BlockFi’s deal allows them to run operations in the United States from now on safely.

Additionally, BlockFi holds a consumer credit license, finance lender and broker license and a consumer loan license, among other permits and licenses.

Benefits

BlockFi is an attractive platform for beginners and new investors due to the variety of signup and first-time bonuses they offer throughout the year.

New users can earn a sign-up bonus of $15 – $250. Although, a deposit of $100,000 would be required to avail the maximum bonus limit.

BlockFi also has a referral programme set up, allowing users to earn $10 for every new referral member who deposits a minimum of $100 into their account.

The BlockFi rewards VISA signature card is another perk you can receive. You can earn 1.5% cashback paid in crypto on your retail purchases.

Pros Cons

Cryptoassets are a highly volatile unregulated investment product.

3. Crypto.com – Earn High Interest on ADA with a 3-month lockup

A large chunk of earning interest on ADA and other cryptocurrencies on this platform depends on your CRO (Cronos) holdings – the platform’s native crypto token. Fortunately, the CRO coin is one of the biggest cryptocurrencies in the industry.

Rising from an ICO of $0.01 to a current market price of $0.4 in April 2022, CRO is the 19th largest cryptocurrency with a total market cap of $25 billion.

If you want to earn interest on ADA with no lockup – the APY is between 0.5% – 1% depending on your CRO holdings. Crypto.com offers you the chance to earn higher Cardano interest rates with a lockup period of 1 or 3 months.

With an investment of $2,500 on ADA for a 3 month lockup period, you can earn 5% interest on ADA. However, this would require a minimum threshold of $40,000 in CRO holdings. Crypto.com private users benefit from receiving an additional 2% interest on Cardano – allowing you to earn 7% on Cardano interest rates annually.

Crypto.com has a flexible pay-out structure – crediting your account weekly. 2% of your earnings are deposited in CRO, while the rest is credited in ADA.

You can also receive a Crypto.com bonus sign up bonus of $10 – $50 after creating an account on Crypto.com. Read more about the Crypto.com bonus.

Regulations

Crypto.com is a fully regulated company, making it one of the safest and most secure ways of earning interest on ADA. For all residents in the United States, Crypto.com is insured by the Federal Deposit Insurance Corporation (FDIC).

In 2012, Crypto.com was awarded a direct insurance protocol of $100 million by Lloyd’s Syndicate for the platform’s cold assets. This ensures protection to users in matters related to hacking and theft.

Crypto.com is also a licensed electronic money institution, receiving the Malta Financial Services Authority (MFSA) license in 2021.

Pros Cons

Cryptoassets are a highly volatile unregulated investment product.

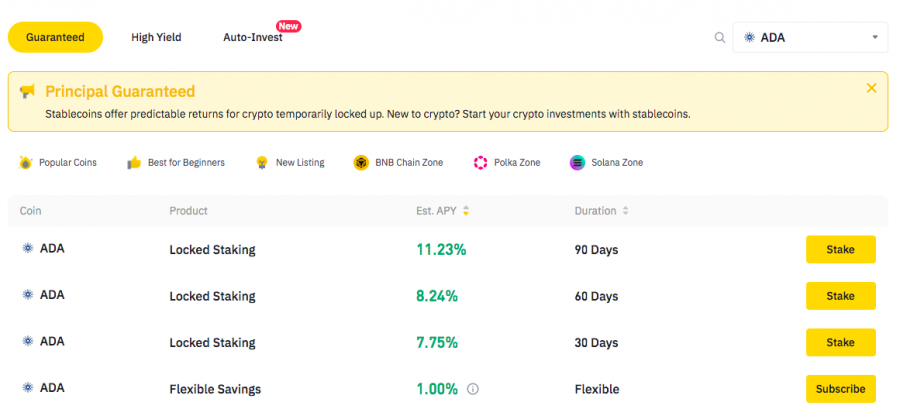

4. Binance – Earn High Interest on ADA with Binance Earn

Binance Earn is a service that allows you to earn free interest on ADA and over 60 different cryptocurrencies. Binance has a flexible earnings option, which will enable you to earn 1% interest on ADA annually.

This number decreases to 0.5% if you hold more than 1,000 ADA or approximately $900 worth of this cryptocurrency. For a 1 month lockup period, you can earn up to 7.75% on your Cardano interest account and 8.2% for a 2-month lockup.

Despite being the largest cryptocurrency exchange, Binance has faced regulatory issues from governing bodies in the US and UK. The Justice Department and the IRS closely monitor Binance’s role in previous money laundering issues.

The UK’s Financial Conduct Authority (FCA) has also mentioned that Binance’s affiliate had been operating without permission in the country back in 2021. Binance is currently operating in these countries and is a popular platform for millions of sure globally.

Pros Cons

Cryptoassets are a highly volatile unregulated investment product.

How to Earn Interest on Cardano Tutorial

Now that you know where to earn interest on Cardano let’s quickly take a look at the steps involved in confirming your purchase.

Since the ideal platform should provide you with a high interest on Cardano with minimum lockup and conditions, we recommend Nexo as the best Cardano interest account.

- Go to the Nexo website or app and create an account.

- Go to the Account page and click on Identity Verification.

- Provide your personal information – Full name, address, and a relevant photo ID to complete your verification.

- Deposit or use another wallet address to transfer at least 1 ADA to your Nexo account.

Cryptoassets are a highly volatile unregulated investment product.

Is Earning Interest on Cardano a Good Investment?

Cardano (ADA) is one of the most bought and popular digital assets in 2022. From an ICO of $0.002, ADA has provided investors with over a 400x return, currently trading at $0.8.

Despite the price uptrend, ADA is more than 66% lower than its all-time high of $2.9. With the high-user adoption and multiple features that allow investors to earn passive income on ADA, many crypto traders see this as a valuable investment.

The benefit of earning interest on ADA is that you can accumulate additional income by holding this cryptocurrency – regardless of its price. This may be a lucrative opportunity for investors looking to tackle the current volatility in the market.

Alternatively, if you are unwilling to lockup your ADA for a significantly long period, you can read our tutorial on how to buy Cardano now.

The biggest challenge is to find the best crypto savings accounts that will provide you with high-interest rates on ADA- which is why we recommend Nexo as the best Cardano interest account.

Cryptoassets are a highly volatile unregulated investment product.

Cardano Interest vs Staking

Earning interest on Cardano and other cryptocurrencies are similar to how a bank makes money by distributing loans. A bank makes money on the interest charged, which they can accumulate at the end of the stipulated contract from an individual or institution.

Similarly, earning interest on Cardano requires you to lend out assets, in this case, ADA, to other institutions in the form of a loan. The total interest earned or the Annual Percentage Yield (APY) is the yield you receive from being a loan provider.

Like different banks provide varying interest rates with their perks and advantages, earning interest on Cardano varies depending on your brokerage of choice.

Similarly, staking is another popular way of making money with cryptocurrencies. While staking also requires users to set aside their crypto assets for a stipulated amount of time, the borrowed assets are mainly used by the network for securing and validating the blockchain. Generally, depending on the size of your stake, you are given voting rights to control and monitor the network.

Both methods eventually provide users with passive income in their separate ways. If you are interested to know more about staking ADA and other cryptocurrencies – you can read our guide on how to stake crypto to learn more.

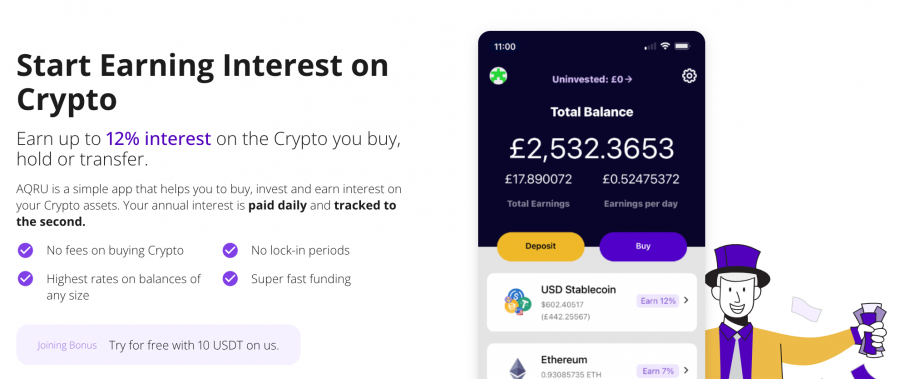

Aqru – Overall Best Interest Crypto Platform

If you want to earn interest in multiple other tokens for a high rate with relative ease, we recommend the platform Aqru. This user-friendly trading platform provides investors with a convenient way to store and earn profits from their crypto holdings.

According to Aqru’s website, the platform supports interest accruals on stablecoins and conventional cryptocurrencies.

USDT, USDC and DAI are among the stablecoins covered by Aqru. The APY rate for these coins reach as high as 12% – providing a healthy return on your collateral. Aqru also supports interest accrual from the two largest cryptocurrencies globally – BTC and ETH, among others.

One of the biggest risks for BTC investors opting to earn interest is the volatility of the cryptocurrency’s price during the lockup period. Aqru tackles this issue by providing a 5% – 7% fixed return on Bitcoin regardless of a price dip. You can also earn an APY of 7% on Ethereum – allowing you to diversify your assets and simultaneously earn passive income on your total portfolio.

Moreover, Aqru is one of the best platforms for earning interest on crypto due to its flexible terms. All savings accounts on Aqru have no lockup period, allowing you to cash out on your crypto holdings at any given time.

We also like Aqru for its convenient pricing model – making it a lucrative platform for new investors. The APY you make does not yield any commission. Instead, a standard fee of 0.5% is charged for all cryptocurrency transactions.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

This guide has provided you with information on how to earn interest in Cardano. We have covered all the information about the benefits of using Cardano as a tool to earn passive income via earning interest.

Click the link below to visit AQRU and start earning interest on a range of cryptos including stablecoins, Ethereum, and Bitcoin. There are also no lock-in periods and you could earn up to 12% interest on the cryptocurrency you purchase, hold, or even transfer.

Cryptoassets are a highly volatile unregulated investment product.