Axie Infinity is a play to earn game that runs on the Ethereum blockchain. Axies are the main characters of the game. Each Axie is a non-fungible token (NFT), and players need three to begin the game. With Axie Infinity, players can raise, breed, battle, and trade these NFTs.

The cryptocurrency known as Axie Infinity, or Axie Infinity Shards (ticker symbol AXS), serves as the governance token for the P2E game. In 2021, it experienced one of the largest bull runs ever, reaching gains of 1660x, but has since dropped 86% in 2022. Some investors who are still interested in Axie Infinity’s concept are looking to buy at a lower price and earn interest on AXS while holding onto their tokens.

There are many platforms and options to consider when deciding where to earn interest on Axie Infinity. AXS has been listed on several best crypto exchanges, and some, such as Binance, support earning AXS interest.

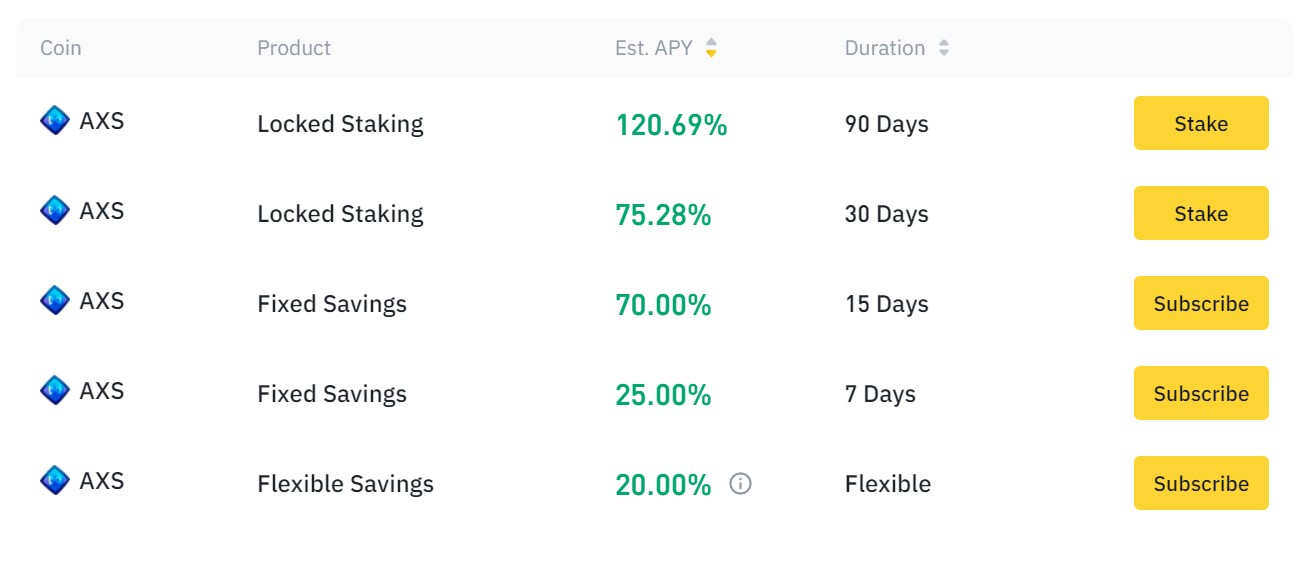

Best Axie Infinity Interest Rates Compared

Before we review each platform to earn interest on AXS, here’s a comparison of the top platforms:

APE Interest Account

APE Interest Rate

Terms & Conditions for Best Interest Rates

Nexo

Up to 36%

One-month Platinum membership with interest paid in NEXO tokens

Binance

Up to 20%

Loans are locked up for 90 days at AXS

Gemini

Up to 6.83%

Gemini cannot guarantee demand for particular cryptocurrencies or at particular rates.

Best Axie Infinity Interest Accounts Reviewed

Cryptocurrencies have been with us for more than a decade, and even after all that time, there are still many factors to consider before investing in a specific platform. Now with the Axie Infinity hype, many players of the game are interested in knowing where to earn interest on AXS with the best rates. Below we list and review some of the best platforms to consider:

1. Nexo – Best Crypto Savings Account To Earn Interest On AXS

This financial services company offers crypto-backed loans and one of the best crypto savings accounts. The Nexo platform offers customers the opportunity to earn up to 17% on their crypto savings, with a special promotion of 36% for Axie Infinity.

Users can also borrow crypto, using their cryptocurrency holdings as collateral for loans.

Nexo has lent over $400 million to date, making it one of the largest cryptocurrency lenders. Security is Nexo’s top priority, with multiple layers of security, including cold storage of all client crypto deposits.

The Nexo platform allows users to grow their AXS holdings with up to 36% interest p.a. paid out daily on the AXS platform. In addition, their Earn Crypto Interest suite enables users to top up or buy AXS and begin growing their passive income immediately.

Nexo has one of the best crypto savings accounts for those looking to earn interest on their cryptocurrency or take out a loan backed by crypto. Since the company is well-regulated with industry-leading security, it is a safe and reliable option.

There are some downsides, such as the requirement to hold 10% of your portfolio in NEXO tokens and receive interest in NEXO if you want to earn the highest interest rate. Nevertheless, the Nexo savings account is a good option for people looking for a cryptocurrency account that earns interest.

Nexo Regulation

The Nexo company is licensed and registered in many jurisdictions worldwide and complies with all legal and regulatory requirements to maintain a legal presence. The State Banking Department and the US Financial Crimes Enforcement Network are among the most important.

The Nexo Earn product isn’t currently available in some US states like New York or Vermont and some parts of Europe. However, customer support for Nexo has said that the service will be restored to some of these restricted regions. That is good news for Nexo in restricted countries since many crypto platforms have recovered from regulatory concerns. USA users can still take out crypto-backed loans.

AXS-backed Credit

With Nexo Instant Crypto Credit Lines, users can now borrow cash or stable coins with minimum interest, starting at 0% APR, using Axie Infinity’s AXS as collateral. In addition, the more NEXO Tokens they have in their account, the lower the interest rate they will pay on their credit line.

There is a minimum borrowing amount of $50 and a maximum borrowing amount of $2 million per withdrawal. Approval is typically immediate, and credit checks are not necessary. Additionally, crypto loans can be repaid partially or fully at any time, depending on user preference.

Pros: Cons:

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Binance – World’s Leading Crypto Exchange To Earn Interest On AXS

Binance is the largest cryptocurrency exchange and one of the most popular crypto trading platforms globally, offering something for crypto investors, holders and traders. Through its innovative technology, it has developed an online platform that connects traditional fiat money to crypto by providing feature-rich services that bridge the gap between the two.

Besides offering 600+ altcoins, Binance recently introduced a way to accumulate interest with Binance Earn. Binance Earn is an account that allows you to grow your wealth by accumulating interest on crypto that is stored in a storage wallet by the platform. In essence, you’re lending your assets to traders on the platform, and they pay you interest in return for borrowing those assets.

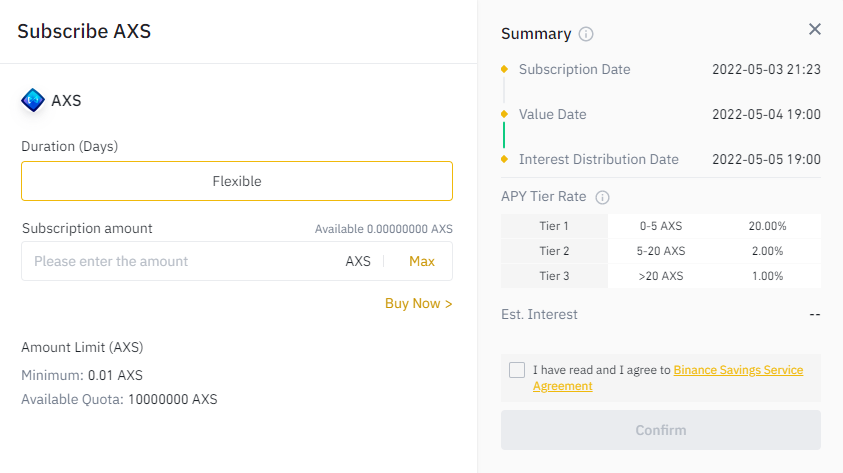

With a Binance savings account, you can earn interest on a wide variety of digital currency coins, including Bitcoin (BTC), Ethereum (ETH), Binance USD (BUSD), and Tether (USDT), and more. When it comes to earning interest on AXS, the platform offers up to a 20% interest rate for flexible savings.

There is a choice between a Fixed Deposit and a Flexible Deposit, with different crypto interest rates. Flexible deposits allow you to withdraw your funds at any time at a variable rate. That will appeal to traders who want to earn interest in their crypto portfolio while waiting for a trade setup.

Binance Regulation

Binance exchange was restricted from operating fully in America in 2019, however US citizens can use Binance.US, which is similar although with a few less features. Binance.US is also not available in certain US states, including Hawaii, Idaho, New York, Texas, and Vermont.

Multiple Lockup Periods On AXS

The lockup periods on Binance are different from those on other platforms. If you don’t want to give up your AXS tokens for three months, Binance also offers Axie Infinity rates for a one month lockup period – albeit at lower rates. AXS tokens can even be stored in a crypto savings account that gives you 25% annual interest.

Pros: Cons:

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. Gemini – Safe And Regulated Platform To Earn Interest On Axie Infinity

Cameron Winklevoss and Tyler Winklevoss, collectively known as the ‘Winklevoss twins’, founded Gemini in 2014 as a private trust company in New York. In addition to providing a reputable cryptocurrency exchange, the company also offers passive income on stored assets through Gemini Earn.

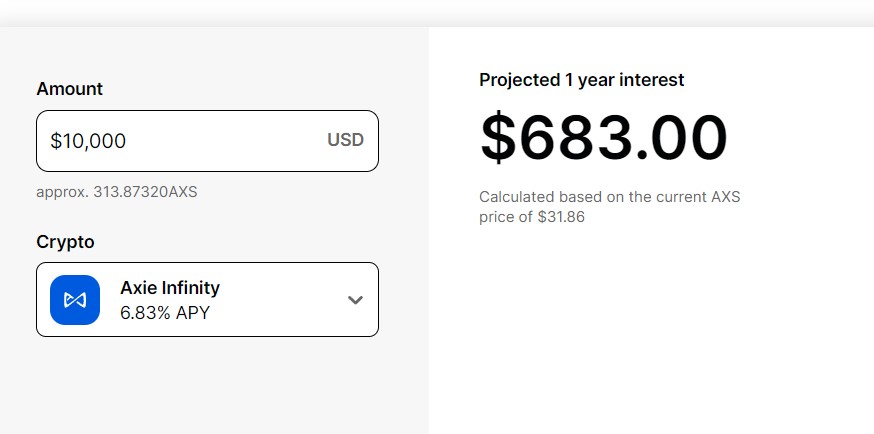

In addition to offering a safe trading platform, Gemini allows its users to get compound interest on their crypto with an APY of up to 7.4%. Only US residents are eligible for the Gemini Earn program. The Gemini platform allows crypto assets to be moved to the trading platform (with interest) and vice versa. Regarding earning interest on Axie Infinity, you can earn up to 6.83% on your AXS holdings.

Unlike the other platforms mentioned in this article, Gemini Earn has simplified the user interface by including a simple interest calculator. A drop-down menu displays all supported coins and calculates the project interest earnings based on the estimated interest rate over a 1-4 year period.

Gemini Regulation

Gemini is regulated by the New York State Department of Financial Services (NYDFS). As a result, Gemini is subject to anti-money laundering, capital reserve, consumer protection, cybersecurity requirements, and banking compliance standards set by the New York Department of Financial Services and New York Banking Law. Additionally, Gemini maintains a money transmitter license (or statutory equivalent) in all states where it is required.

Gemini Credit Card

Currently, the Gemini Credit Card does not offer a welcome bonus. However, any cryptocurrency available on Gemini’s trading platform can be earned in real-time with the card. Earnings are based on the following rates. Our review is based on these levels, but take note of the “up to” in the marketing before applying:

- Up to 3% on dining – 3% on the first $6,000 and 1% after that. The limit is reset annually.

- Earn 2% on groceries

- Earn 1% on any other purchases

One distinguishing feature of the Gemini Credit Card is the ability to earn your crypto rewards in real-time. Gemini states that you will earn crypto based on the above rates when you make purchases, and you don’t have to wait for your statements to close. As a result, you can potentially benefit from any increases in the value of your crypto before your statement closes, but you are also exposed to any losses.

Pros: Cons:

How to Earn Interest On Axie Infinity Tutorial

We’ll cover step by step how to earn interest on Axie Infinity using a trustworthy crypto interest platform. Below we review how to start earning interest on AXS with Binance.

Step 1: Open An Account With Binance

Visit the Binance website and click ‘Register’. You can sign up for Binance using your phone, email, or Apple ID. As soon as you complete the signup process, Binance will send you a confirmation email and SMS to the number you provided.

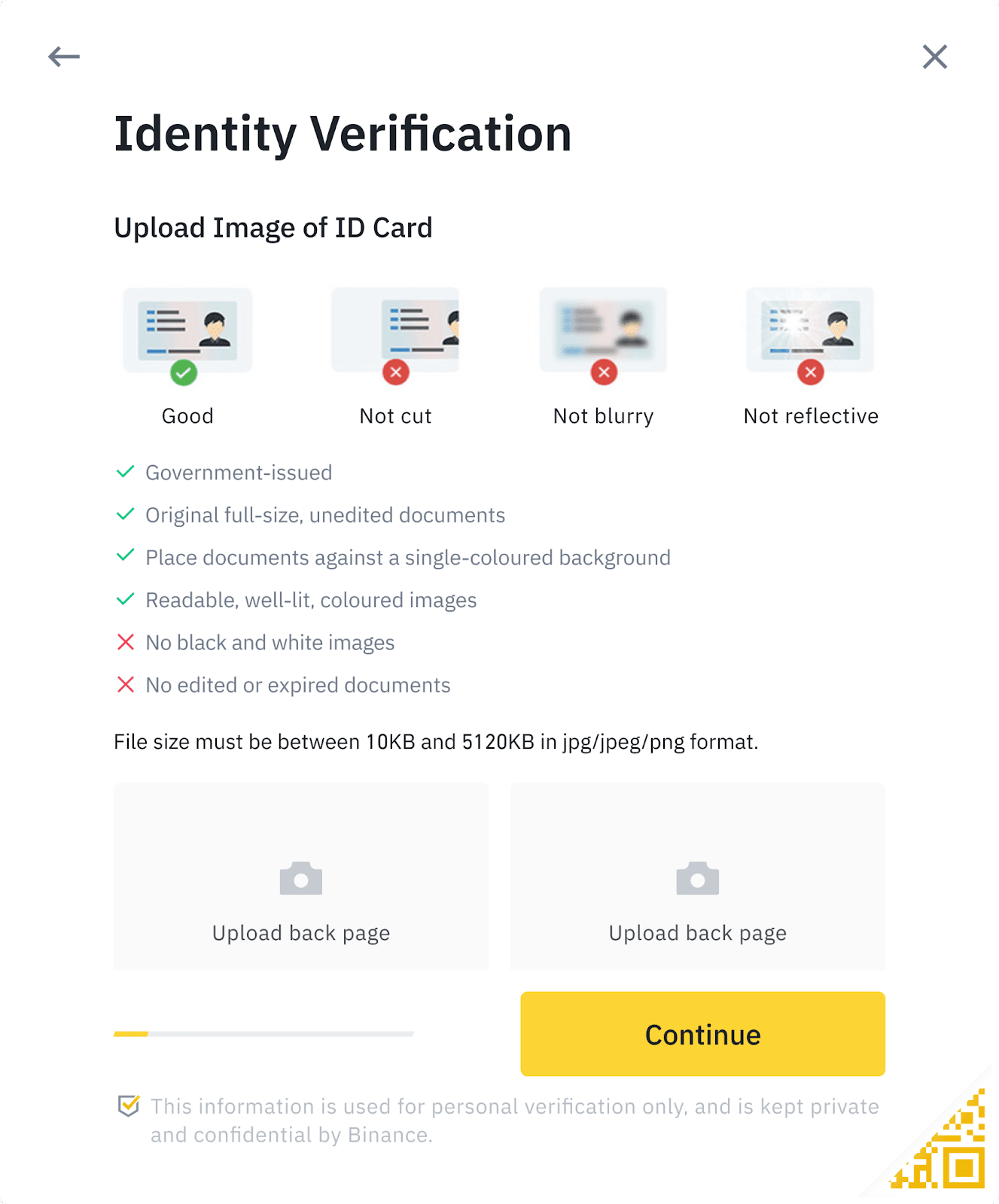

Step 2: Verify Your Identity

Verifying your identity is a prerequisite for trading, earning crypto, and accessing other features on the Binance platform. A valid ID must be uploaded during registration, such as a passport or driver’s license. If a current picture is required, upload a clear picture and follow the steps carefully.

Step 3: Add AXS Funds

Upon verification of your Binance account, you can deposit AXS funds. If you have AXS and other coins in another wallet, you can also send them to Binance using the built-in wallet on Binance. You can also buy AXS tokens directly using a bank card or exchange cryptocurrencies for AXS tokens using the peer-to-peer (P2P) market.

Step 4: Earn Interest On AXS On Binance Earn

Once you’ve added AXS to your Binance account, you can earn up to 20% APY through Binance Earn. Click on ‘Earn’ on the dashboard navbar to start earning AXS. Following that, you will be able to select either crypto staking or Flexible Savings. Finally, click ‘Confirm’ to get started after you’ve entered how much Axie Infinity you’d like to earn.

Is Earning Interest In Axie Infinity A Good Investment?

The Axie Infinity community grew wildly in popularity. Some countries reported that people quit their jobs to focus on playing the game. So it is not surprising that many cryptocurrency enthusiasts are adding the AXS token to their portfolio, considering how much it has grown since 2020.

Bear in mind it has corrected in 2022 however, alongside the overall crypto markets, and may continue to retrace to the $20 level.

Axie Infinity Shards price history

The Axie Infinity game is one of the most well known brands in the P2E gaming industry. It could continue to attract many gamers and investors in the coming years, and the overall play to earn and NFT gaming craze shows no sign of losing popularity.

Earning interest on AXS tokens while holding could be a good investment. AXS can be stored in accounts with flexible terms, such as Binance, so that you always have access to your AXS if you do decide to sell it.

AXS Interest vs. Staking

Axie Infinity staking and earning interest are both passive ways to get rewards. For example, many crypto lending platforms use the AXS tokens that you store with them and stake them themselves to earn profits for you. AXS tokens might even be used to provide liquidity to crypto exchanges. Binance, for example, allows you to stake or earn interest flexibly. There are, however, locking periods associated with stakes.

The more technical knowledge and configurations necessary to stake cryptocurrency themselves mean that many crypto investors would be better served by letting centralized exchanges handle their tokens.

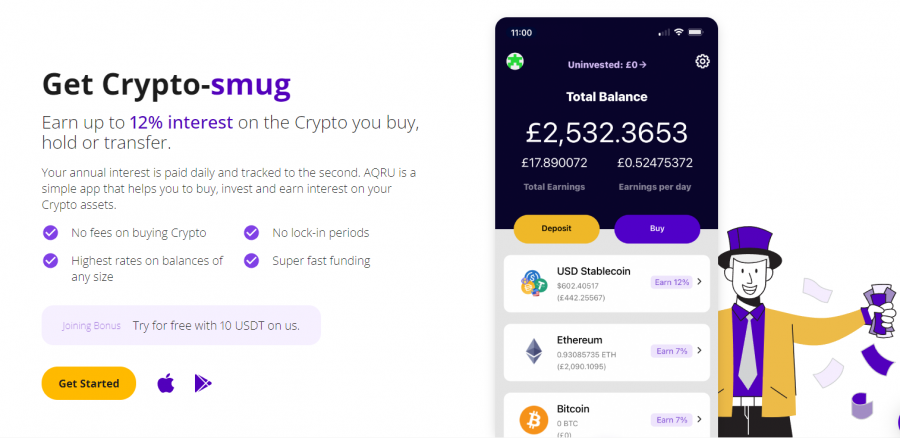

AQRU – Overall Best Crypto Interest

AQRU is another notable platform to earn on your cryptocurrency investments passively. Even though this platform does not offer an AXS interest account, it is our overall recommended platform for earning interest, thanks to very favorable earning rates and an easy-to-use interface.

AQRU crypto savings accounts have been designed by Dispersion as a gateway to competitive crypto yields. AQRU offers investors protection against theft and hacking. The platform is also open to institutional traders, enabling them to trade popular cryptocurrencies such as Bitcoin, Ethereum, USDT, USDC, and DAI.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

AQRU’s stablecoin interest rates offer an attractive 12% annual percentage yield with flexible terms. For the popular stablecoins Tether (USDT), USD Coin (USDC), and Dai (DAI), this rate is valid. Additionally, AQRU has a joining bonus of 10 USDT, which you can already use to start earning interest.

Conclusion

This guide has reviewed several platforms where you can earn good rewards. However, when earning interest on AXS, you must consider your investing strategy. For example, Nexo offers the highest AXS interest rate of 36% but you must meet the requirements for Platinum membership to get it.

That requires holding 10% of your portfolio in NEXO rather than AXS, and receiving interest payments in NEXO. Some US states are also restricted.

Binance also offers excellent interest-earning opportunities on AXS, but the highest ones are only available for locked staking, which is not available in all US states.

On the other hand, Gemini offers the lowest interest rate, with 6.83%, and allows you to use the platform anywhere in the US. In other words, the only fully available platform is also the one that pays the least.

The cryptocurrency market is also volatile. Several factors can contribute to the growth of a cryptocurrency project, including hype. The hype surrounding Axie Infinity was high in 2021, but AXS has been in a bear market so far in 2022.

To guard against bear cycles, you can earn interest on stablecoins, e.g. 12% APY on AQRU for USDT, USDC, and DAI. If the bull market resumes, the AQRU platform also supports Ethereum and Bitcoin at 7% APY.

You do not even need to stake any native tokens or lock up funds, so it’s a good secondary option for a crypto interest account alongside your AXS earn accounts.