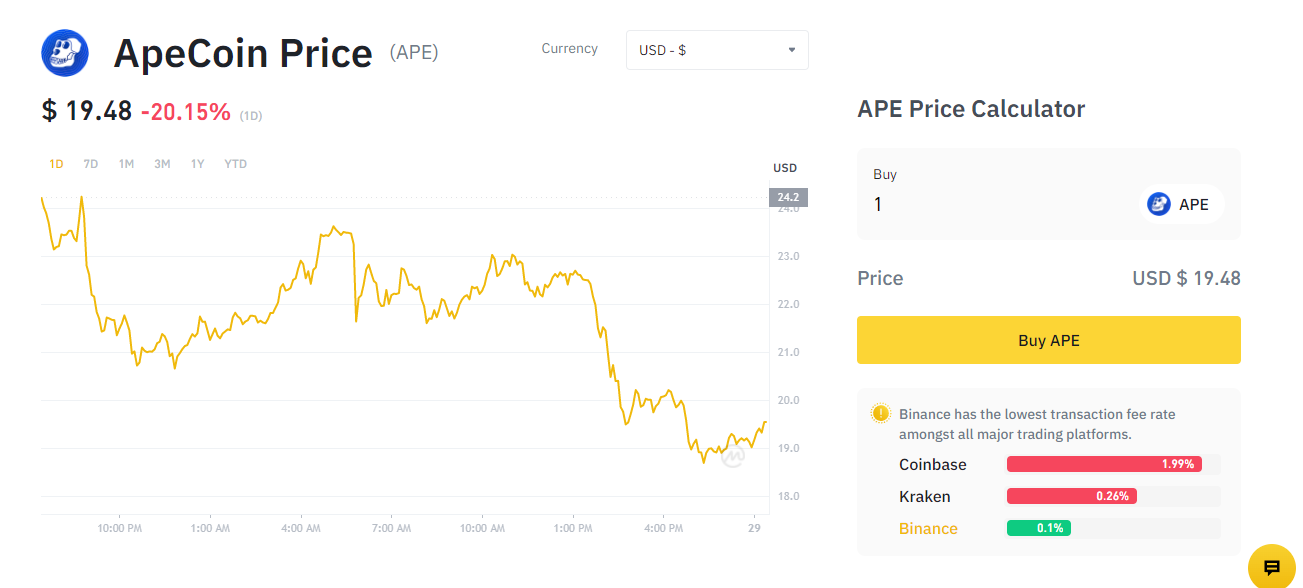

ApeCoin (APE) is a new ERC-20 token that launched on March 5th at $5 during its ICO, reached a peak of $28, and is now trading in a fluctuating range between $12 and $17. ApeCoin serves as the official token for the Bored Ape Yacht Club NFT collection, which is the most successful ever.

The APE price changes more than many other cryptocurrencies, so you should skip trading the ups and downs unless you have experience. Instead, earn interest on ApeCoin while you hold it. As the governance token for the Otherside metaverse, which is used to purchase land in that virtual space, it might increase in value and market cap in the coming years.

Since APE is new on the market, not many exchanges have the option to earn interest on ApeCoin yet. In this guide we review three of the best platforms to earn interest on APE.

Best ApeCoin Interest Rates Compared

You can find a helpful table below to know which crypto lending platform offers the best interest rate.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Best ApeCoin Interest Accounts Reviewed

Here are our top recommendations for earning interest on APE with no lock-ups or complicated terms. You may want to open several APE interest accounts to divide your holdings.

1. Nexo – Earn Interest On Ape Up To 12%

Nexo was founded in 2018 by Antoni Trenchev and is led by him as CEO. As well as earning interest on crypto you can take out crypto-backed loans and NFT loans.

Users receive a 2% boost in the interest rate per asset from the “Earn in Nexo” option, and ApeCoin is the same. If you want your interest to be paid in APE, you’ll earn 10%, otherwise it’s 12% if you opt to receive interest payments in NEXO tokens.

The dividend rate on stablecoins is around 10% without earning in NEXO. The NEXO token was recently listed on Binance causing a pump in price – it then retracted, but may continue to uptrend now its listed at the highest trading volume exchange.

You can use the Nexo platform to buy ApeCoin with a credit card, or swap another crypto for APE on the Nexo Exchange, and earn 0.5% cashback as a Platinum member – earn that VIP tier level by holding 10% or more of your portfolio in NEXO coin.

Regulations

Nexo companies are licensed and registered in numerous jurisdictions worldwide and strive to bring their operations up to current with new laws and regulations to comply with all applicable regulations fully. State Banking Department and US Financial Crimes Enforcement Network are among the most important.

Nexo is not available in a few countries and jurisdictions:

- Bulgaria

- The Central African Republic

- Cuba

- Estonia

- Iran

- North Korea

- Syria

- Some US states – New York, and Vermont

Nexo Insurance

With Ledger Vault, all cryptocurrencies are stored. All keys entrusted to Ledger Vault are stored in multi-signature cold storage with bank-grade security. Arch and Marsh back the Ledger Vault, which insures assets up to $150 million. Nexo reports that they have an insurance portfolio worth $375 million. They state that Nexo plans to insure more than $1 billion in 2021 through a syndicate of insurers. Perhaps the best insurance policy among all crypto lending and borrowing platforms. They take this part of their business so seriously is reassuring.

Loyalty Benefits

The Nexo Loyalty program is a four-tier system. According to your Nexo Savings and Credit wallets, you accumulate benefits based on the combined balance of your NEXO Tokens in each wallet.

Each tier has the following requirements:

- Silver: You must hold NEXO Tokens in your portfolio balance of at least 1%

- Gold: Your portfolio balance must contain at least 5% NEXO Tokens

- Platinum: You must hold NEXO Tokens in your portfolio for at least 10% of your account balance

As you accumulate more NEXO Tokens, you will earn greater rewards, reducing your borrowing rates with Instant Crypto Credit LinesTM, increasing your yields with Earn on Crypto and FiatX suites, and increasing the number of free cryptos withdraws you are eligible to make per calendar month.

Pros: Cons:

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

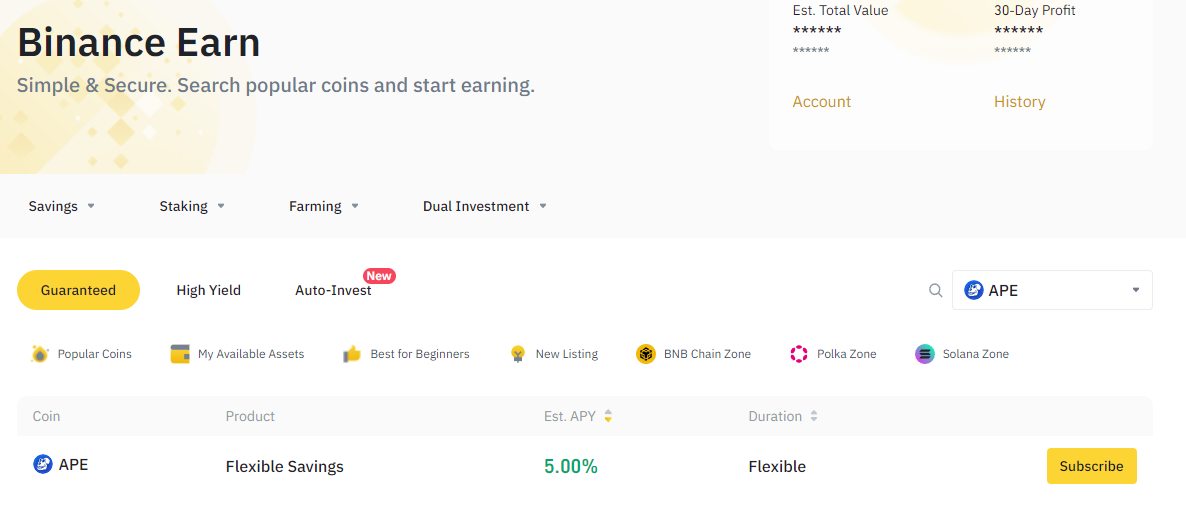

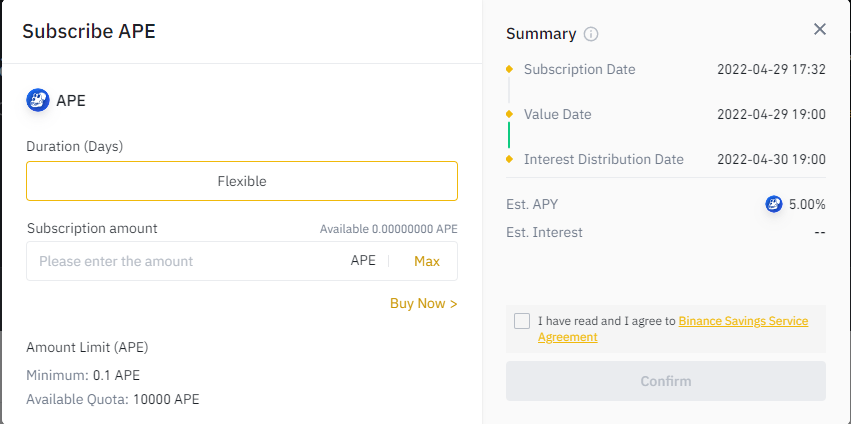

2. Binance – Earn Interest On APE Flexibly

Staking options on Binance fall into two categories: those that guarantee your principal and those that don’t. The risk associated with your initial investment is significantly higher when it isn’t guaranteed, so these coins offer a higher level of protection.

Binance Earn is simple to use. You can select from dozens of crypto financial products with the platform, transfer your crypto to the chosen solution, and watch your funds grow. You can also cash out your profits as easily as choosing a product.

Among the products offered by Binance Earn, you can use more than 60 cryptocurrencies. In addition, stablecoins and other digital assets are available as well.

The next day, your crypto earnings can be seen. All you need to do is transfer your preferred amount into a product. Earnings vary by product, but you can usually see them displayed on your dashboard as soon as they are deposited. For example, you will receive an approximate APY of 5.00% if you choose ApeCoin.

Regulation

A regulatory ban was imposed on Binance in America in 2019. As a result, it is no longer accessible to US citizens. The company responded by partnering with Binance.US, which Binance describes as a distinct exchange. Americans investing in ApeCoin can use that platform.

There are certain US states where Binance.US isn’t available yet. These include Hawaii, Idaho, New York, Texas, and Vermont.

Several Funding Methods Are Available

One of the best ways to improve the user experience is to provide users with multiple funding options for crypto and ApeCoin interest accounts. For example, with Binance, clients can deposit through wire transfers, bank transfers, and credit cards while also adding cryptocurrencies.

Using local payment methods, users can also buy and sell cryptocurrency. In addition, Binance account holders can also receive cryptocurrencies from other wallets using Binance’s hot crypto wallet. Among Binance’s many funding methods, many users hold and earn interest in cryptocurrencies.

Pros: Cons:

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

3. Gemini – Earn Interest On APE Instantly

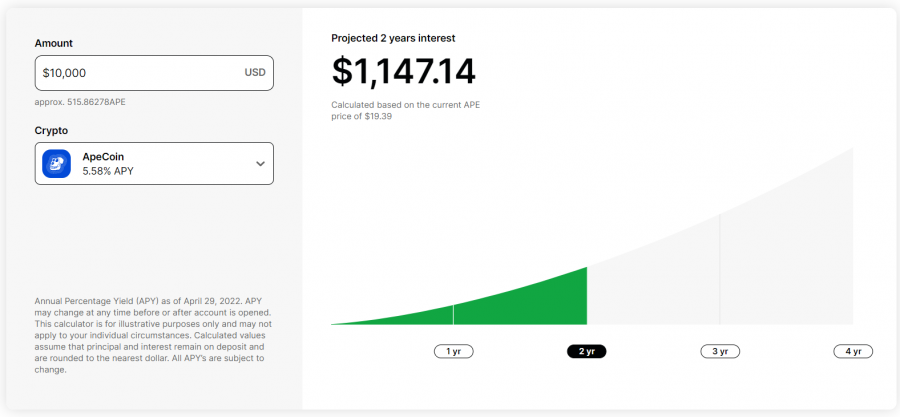

In addition to being a well-known crypto exchange, Gemini has a competitive earning program. F

or example, up to 8.05% can be earned for stablecoins, including Gemini’s Gemini dollar. Reward payments are done daily. Other currencies have different rates. For example, if you own Bitcoin, you’ll get 1.49%, Ether will give you 1.76%, Dogecoin will give you 3.78%, and Apecoin will give you 5.58%.

It’s simple to earn money with Gemini. You need to transfer currency from your trading account to your earn account to earn rewards. In addition, Gemini supports dozens of currencies, so it could be an attractive option for individuals interested in many popular cryptocurrencies.

Regulation

Gemini is a trusted company in New York regulated by the New York State Department of Financial Services (NYSDFS). As a result, they must comply with capital reserve requirements, cybersecurity requirements, and banking compliance standards outlined by the NYSDFS and the New York Banking Law. The company is also a fiduciary and qualified custodian.

Insurance

Earn funds are not insured by Gemini but are held by their trusted partners. All of their partners are vetted through Gemini’s risk management framework, which they disclose to you so that you know which institution has borrowed your funds. For example, Gemini is currently partnered with accredited third-party borrower Genesis.

Also, Gemini Earn is not insured by FDIC, SIPC, or any other government program or Gemini. It is similar to many non-deposit services offered by financial institutions. The customer gets a seamless experience with Gemini’s platform, earning interest and redeeming funds quickly through open-term, callable loans.

Gemini Crypto Rewards Credit Card With Instant Earning

Credit cards for crypto rewards are becoming increasingly popular, and the Gemini Credit Card is the latest to enter the market. In addition to offering 3% back on dining, groceries, and everything else, this card issued by WebBank and the Mastercard network also offers 2% back on groceries.

With a few exceptions, cardholders can earn rewards for purchases made with their card as soon as the purchase is made. However, according to the cryptocurrency exchange, only one crypto rewards credit card offers this feature.

The Gemini Credit Card offers over 60 different cryptocurrencies, and you can reload your rewards at any time. Unlike other crypto rewards cards, which limit you to earning Bitcoin and Ethereum, you can exchange your rewards for more than 60 cryptocurrencies with the Gemini Credit Card. There are no exchange fees when you earn rewards, but you may have to pay a fee if you sell or convert your crypto afterward.

Pros: Cons:

How to Earn Interest In ApeCoin Tutorial

It’s time to earn interest on ApeCoin by using a reliable crypto interest platform. Below you will find how to start earning interest on APE with Binance.

Step 1: Open An Account With Binance

Click the ‘Register’ button on the top right of the Binance website. Binance gives you the option of signing up using your phone, email, or Apple ID. Upon completing the signup process, Binance will send you a verification email and SMS on the number you used to register.

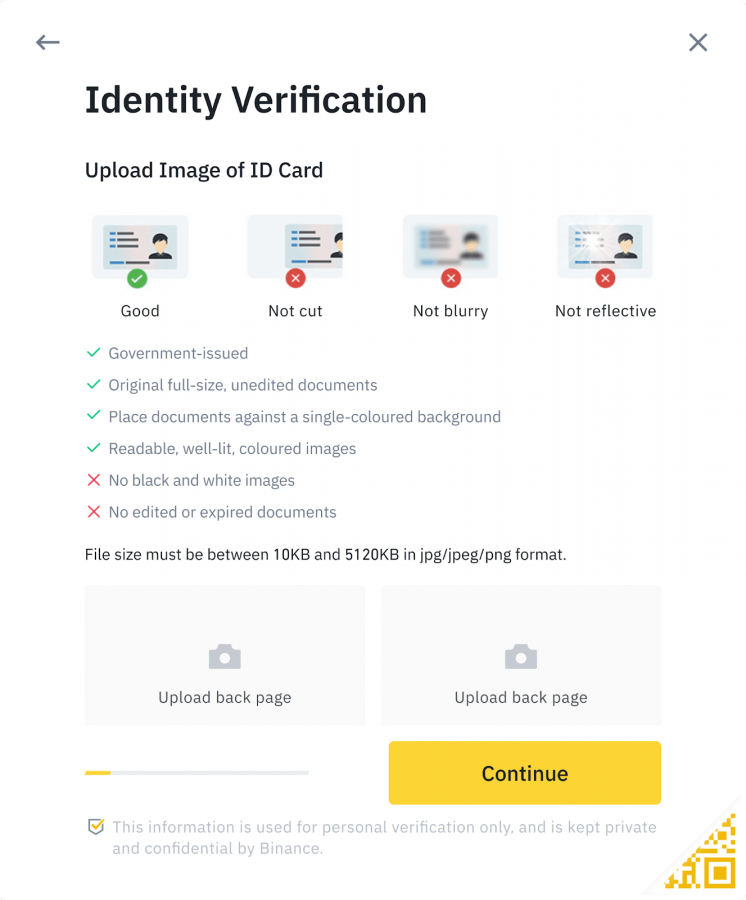

Step 2: Verify Your Identity

In order to trade, earn crypto, and access other features on the Binance platform, you must verify your identity. You’ll be asked to upload a valid ID during registration, such as a passport or driver’s license. Make sure you upload a clear picture and follow the steps carefully, particularly if you are required to submit a current picture.

Step 3: Add APE Funds

APE funds can be deposited to your Binance account once your account has been verified. Furthermore, APE and other coins can be sent to Binance using the built-in wallet on Binance if you have them in another wallet. Additionally, you can buy cryptocurrency directly with your bank card or exchange cryptocurrencies for APE tokens using their peer-to-peer (P2P) market.

Step 4: Earn Interest On APE On Binance Earn

You can now earn 5% APY through Binance Earn once you’ve added APE to your Binance account. Go to the dashboard navbar and click on ‘Earn’ to earn APE. You will then be able to choose Flexible Savings options. Next, enter how much ApeCoin you’d like to earn and click ‘Confirm.’

Is Earning Interest On ApeCoin a Good Investment?

Within hours of entering the crypto world, APE gained 1,000% in value. The performance of the APE token in recent weeks and the nature of the ecosystem suggest that the price of ApeCoin may increase in the months to come.

By the end of 2022, some investors speculate the ApeCoin price may increase to $50 based on the popularity of BAYC and the Otherside metaverse. NFTs representing virtual land plots there, Otherdeeds for Otherside, have been trending and topping the charts for sales volume.

ApeCoin is potentially a good investment if you want to make money in the future. Additionally, its low price makes it an attractive option. However it is prone to high price volatility.

You can earn up to 12% interest on some crypto exchanges due to the coin’s high demand among borrowers. That high yield will help to offset any future drop in the ApeCoin price.

APE Interest vs Staking

Yuga Labs is currently considering whether to offer some form of ApeCoin staking – as yet it isn’t available. What staking refers is your tokens being used in some way to support the crypto ecosystem surround that token – for example by validating transactions on its network.

Earning interest on crypto refers to when a platform lends your coins out to borrowers. The people borrowing it have to pay an APR to the platform, part of which is then awarded to you. High street banks do the same thing, lending out saving deposits to people taking out loans.

A crypto account that earns interest is like a regular savings account at a bank because it earns interest. By depositing APE, you earn compound interest.

However compared to traditional savings accounts, the rate of return on a crypto savings account is much higher. Wallets can also be credited weekly, and funds can be withdrawn.

Savings accounts in the US offer an average interest rate of 0.7% APY, while crypto interest-earning accounts offer well over 10% APY, with the highest yields depending on a lock-up term or certain deposit amount.

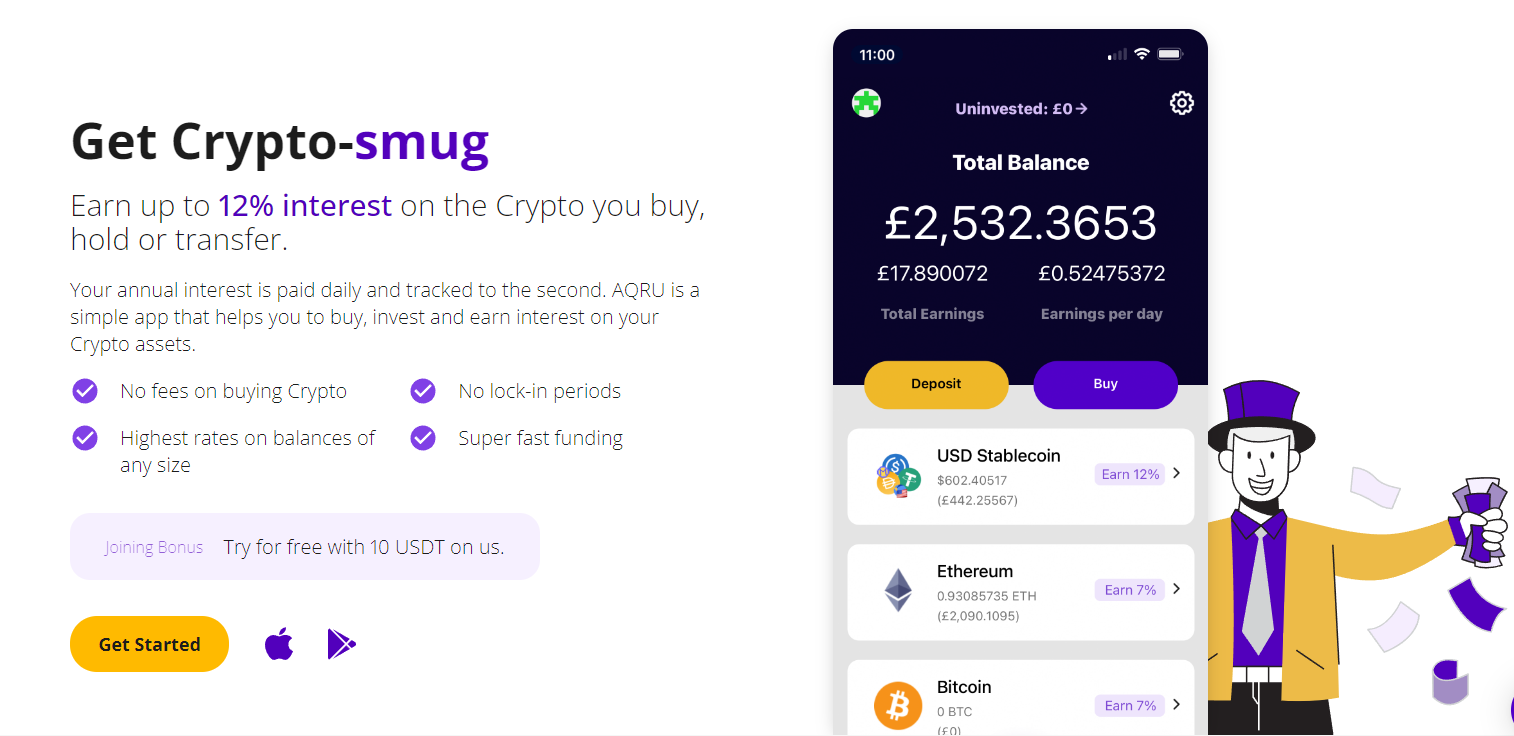

AQRU – Overall Best Crypto Interest Platform

Now you understand how APE works, let’s discuss which interest platforms are the best in the cryptocurrency space.

Our recommendation for earning interest in multiple other tokens with relative ease is the platform AQRU. Investors can store their cryptocurrency holdings on this user-friendly platform and earn profits. Unfortunately, the platform does not offer the option to earn interest on APE yet. However, AQRU has a lot of advantages that you can use to earn interest in crypto.

The platform is capable of accruing interest on stablecoins and conventional cryptocurrencies, according to AQRU’s website.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Aqru provides stablecoins, including USDT, USDC, and DAI. Investing in these coins can offer a high rate of return as they offer an APY of up to 12%. In addition, AQRU also supports interest accrual from the two most popular cryptocurrencies globally, BTC and ETH.

The flexible nature of AQRU makes it a worthwhile platform for earning interest from crypto. There is no lock-up period on savings accounts on Aqru, so that you can cash out at any time.

In addition, AQRU offers a convenient pricing model, which makes it a lucrative investment platform. There is no commission for your investment. In place of this, a standard 0.5% fee is charged for all cryptocurrency transactions.

Conclusion

In this guide we’ve covered how to earn interest in ApeCoins. APE can be used to earn passive income via earning interest on Nexo and Binance.

You could also earn a high return on investment (ROI) from it rising in value over time, as more people play the metaverse game Otherside, buy NFTs (OpenSea recently supported $APE payments on its site), or learn about and invest in APE since its a new crypto launched in March 2022.

We recommend opening several crypto interest accounts to diversify. On AQRU you can earn interest on a range of cryptos, including stablecoins, Ethereum, and Bitcoin. In addition, there is no lock-in period, and you could earn 12% interest on the cryptocurrency you buy, hold, or even transfer.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.