DeFi Swap is a new and innovative decentralized exchange that offers a full suite of services. In addition to instant and low-fee token swaps, this includes yield farming, staking, and more.

In this DeFi Swap exchange review, we cover everything there is to know about the platform in terms of features, user-friendliness, fees, supported tokens, safety, and more.

What is DeFi Swap?

In a nutshell, DeFi Swap is a decentralized exchange that offers a range of crypto-centric services. At the forefront is the ability to swap one token for another without needing to go through a centralized exchange.

Instead, you simply need to connect your preferred wallet to the platform, select which tokens you wish to convert, and that’s it – DeFi Swap will instantly execute the transaction on your behalf.

The exchange is able to do this autonomously as it is backed by an immutable and transparent smart contract that is built on top of the Binance Smart Chain.

In addition to being able to exchange BSc tokens anonymously, DeFi Swap offers several ways that you can earn interest on your idle digital asset investments.

First:

- You might elect to opt for the DeFi Swap staking service.

- After connecting your wallet, this allows you to generate a yield on your BSc tokens across a variety of terms.

- This covers 30, 90, 180, and 365 days – and the longer the term, the higher the APY.

- For example, if you were to stake DeFi Coin – which is the native token of the DeFi Swap ecosystem, you can earn up to 75% annually.

Second:

- DeFi Swap is also home to yield farming services.

- This means that you can provide liquidity for a trading pair that is hosted on the DeFi Swap exchange.

- For instance, if you have an allocation of DeFi Coin and BNB tokens, you could provide liquidity for the DEFC/BNB pair.

- And in doing so, whenever somebody uses DeFi Swap to exchange DEFC for BNB or visa-versa, you will receive a share of the fees collected from that conversion.

It is important to note that the DeFi Swap ecosystem is still in its infancy and thus – there are plenty of additional services and tools that the platform is working on.

For instance, DeFi Swap will soon be incorporating an NFT feature into the exchange. Moreover, DeFi Swap is in the final stages of launching its mobile app for iOS and Android.

Nevertheless, all of the features offered on the DeFi Swap exchange right now can be accessed in a user-friendly manner. And, if this is your first time using a decentralized exchange, DeFi Swap offers a wide selection of step-by-step guides on its website.

Most importantly, DeFi Swap is fully decentralized and as such, you are not required to open an account to use its services. There is no need to provide any personal information or contact details, nor upload verification documents.

Tradable Cryptocurrencies

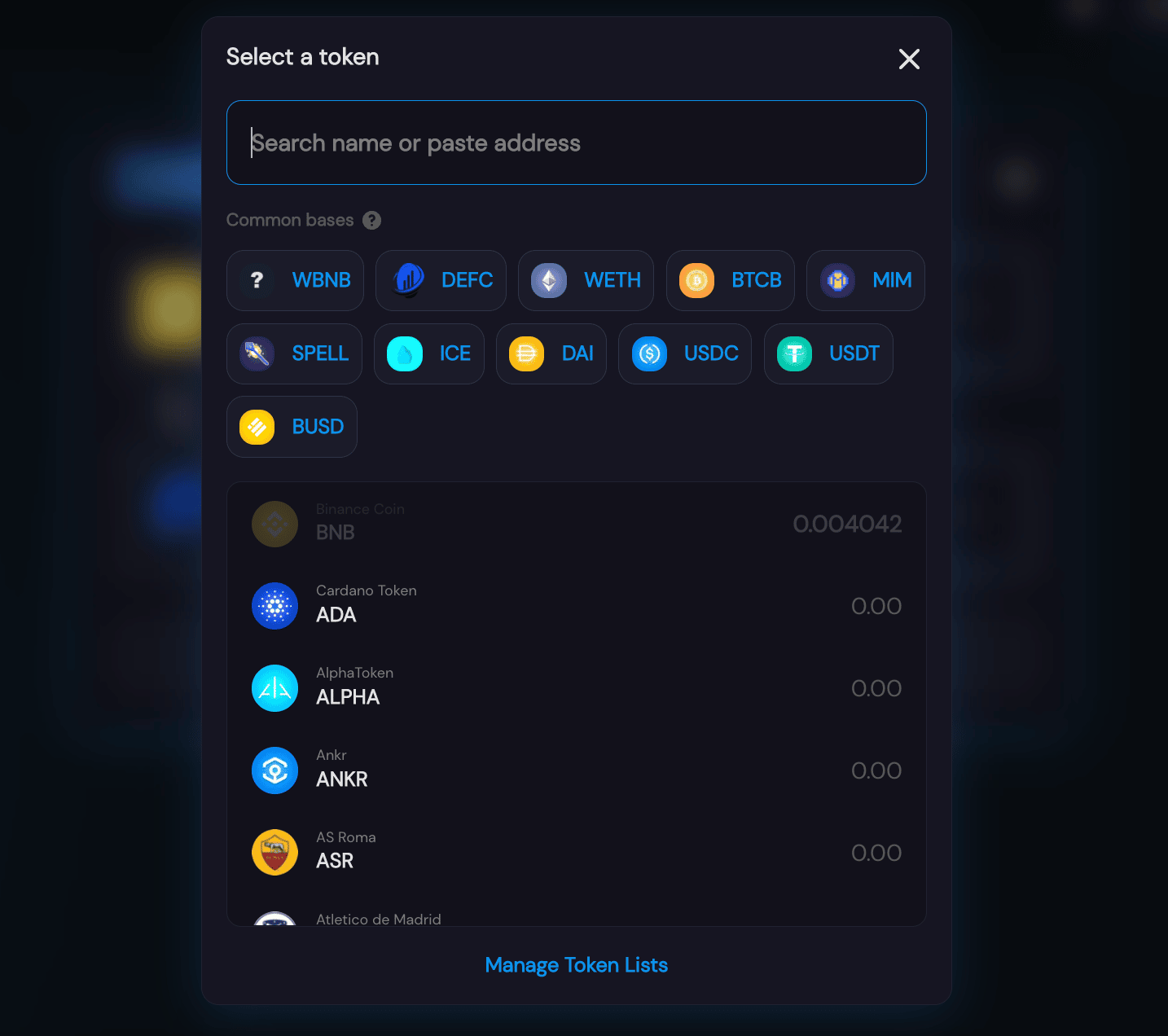

So now that you know the basics, let’s move on to the type of tradable cryptocurrencies that the exchange offers.

Our DeFi Swap exchange review found that the platform specializes in tokens listed on the Binance Smart Chain (BSc). This means that you will have access to a wide range of up-and-coming projects, including some of the best penny cryptocurrencies.

With that being said, our DeFi Swap exchange review found that the team is currently working on cross-chain functionality.

Put simply, this means that in the coming months, you will be able to swap a token on the Binance Smart Chain with one operating on the Ethereum network – and visa-versa.

As such, there will be no limit to the number or type of digital assets hosted on the DeFi Swap platform.

Investors might also be interested in checking out coins on PancakeSwap, a decentralized exchange offering numerous cryptocurrencies.

Trading Tools & Features

In this section of our DeFi Swap exchange review, we will explore in great detail the many features and tools that the platform offers.

Swap Tokens Instantly

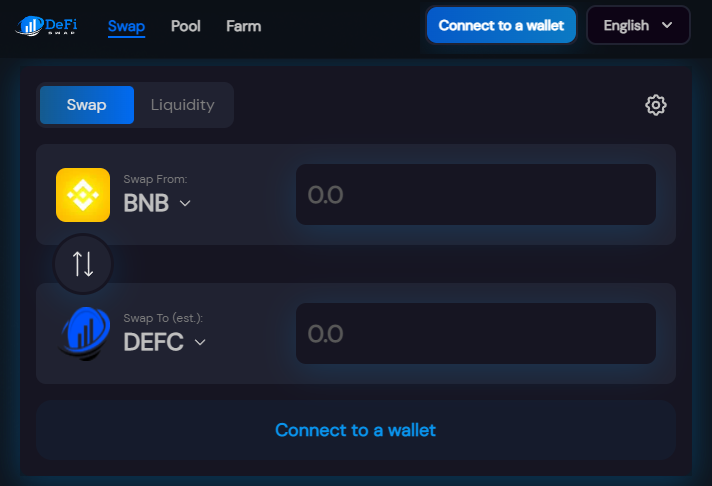

The first feature to consider when using DeFi Swap is its token conversion service. This tool allows you to swap one digital token for another without needing to use a traditional centralized exchange.

There are many reasons why you might consider using a decentralized exchange like DeFi Swap for this purpose. First and foremost, unlike a conventional exchange, there is no requirement to open an account.

This means that you are not required to provide any personal information or KYC documents and thus – you can buy cryptocurrency anonymously.

This is because you simply need to connect your wallet to the DeFi Swap website to start using its exchange tool. Furthermore, when you swap tokens on DeFi Swap, the transaction will be executed by the underlying smart contract instantly.

And in doing so, the smart contract will perform the swap on your behalf – meaning that your newly purchased tokens will appear in your wallet automatically. This prevents the need to request a withdrawal – like you would on a centralized exchange.

Another thing to note about the DeFi Swap exchange tool is that it is very simple to use. You simply need to select the crypto assets that you wish to swap (e.g. BNB for DEFC) followed by the number of tokens.

After confirming the swap via your connected wallet, it takes place in real-time. To recap, as of writing this DeFi Swap exchange review, the platform specializes in BSc tokens. However, cross-chain compatibility is being worked on.

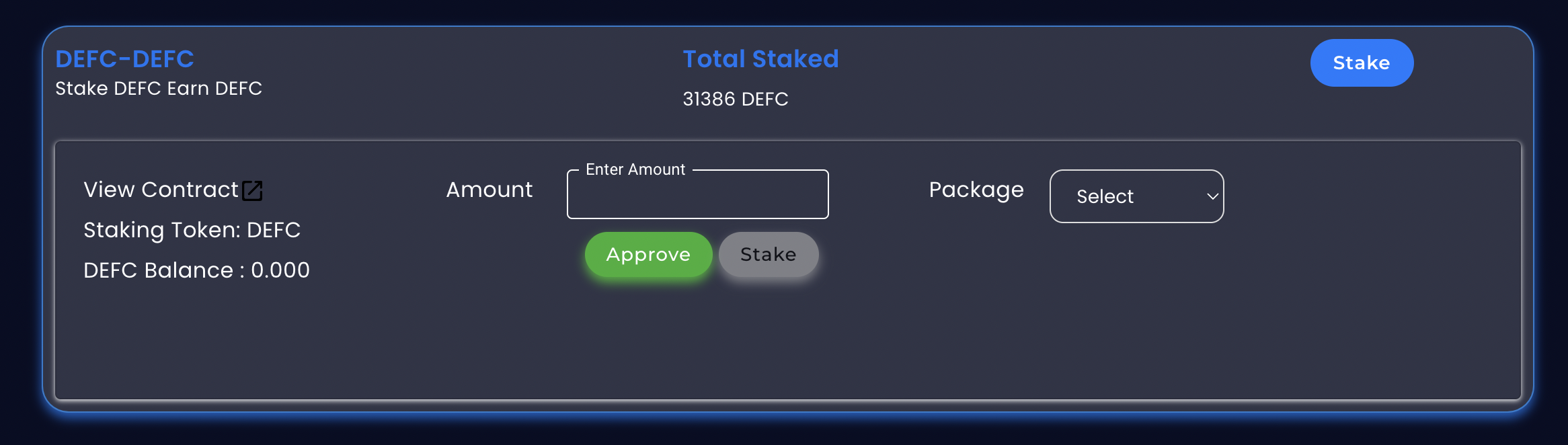

Staking

Crypto staking is a hugely popular tool utilized by long-term investors that wish to reap the rewards of passive income. This is because instead of leaving your crypto tokens idle in a private wallet, you can deposit them on one of the top crypto staking platforms to earn interest.

At DeFi Swap, the process of staking your tokens is very straightforward. Moreover, you will get to choose from four lock-up terms – 30, 90, 180, and 365 days.

The higher the lock-up period, the more you will earn in interest. When the respective term that you choose has concluded, your initial investment will be transferred to your wallet. This is also the case with the interest payments that you have generated.

Crucially, if you are staking a cryptocurrency that has since increased in value, this will amplify your earnings.

To illustrate this point, let’s look at an example of what you could make when staking DeFi Coin on the DeFi Swap platform:

- You decide to stake 4,000 DeFi Coin tokens for a period of 180 days – which offers a yield of 60%

- When you start the staking period, DeFi Coin is valued at $0.40. This means that you are staking the crypto-equivalent of $1,600

- After 180 days have passed, you receive your original 4,000 tokens back

- Additionally, you also made 1,200 DeFi Coin tokens in interest (60% x 4,000 tokens x 180 days)

- However, DeFi Coin is now trading at $1 per token – so your returns are amplified

- As such, your 5,200 DeFi Coin tokens are now worth $5,200

- Your original investment was $1,600 – so you have generated a profit of $3,600

On the other hand, you also need to remember that the value of the tokens that you are staking could decline. If this decline is at a greater amount than what you earn in interest, you will make a loss.

Yield Farming

DeFi Swap also offers yield farming services. Once again, this is offered on a decentralized basis via smart contracts. And therefore, you alleviate the risk associated with trusting a centralized operator.

Nonetheless, our DeFi Swap exchange review found that you will be providing the platform with liquidity. This links back to the previously discussed swapping service.

- For instance, on a pair like BNB/BUSD, there needs to be sufficient quantities of both tokens to ensure that buyers and sellers can trade in a decentralized manner.

- As such, if you were to deposit equal quantities of BNB and BUSD into the DeFi Swap yield farming tool, you will be entitled to a share of trading fees that are collected on the respective pair.

This offers a superb way to generate a passive income with little risk. After all, your tokens are being lent to an immutable and transparent smart contract as opposed to a centralized entity.

With that being said, like all investment products, you need to consider the risks of yield farming. At the forefront of this is the risk of impairment and volatility loss.

NFTs

The team at DeFi Swap is also working on integrating NFT swapping and staking tools into its platform – which will be launched in the very near future.

DeFi Swap Fees

DeFi Swap does not have a fixed pricing structure like you will find on centralized exchanges. On the contrary, fees are determined by the underlying AMM – automated market maker.

The AMM model is the gold standard in the decentralized exchange industry as it is not only able to calculate token prices based on volume, market capitalization, and depth, but fees too.

More specifically, the amount that you will pay to trade on DeFi Swap depends on how busy the underlying network is. In this case, that’s the Binance Smart Chain.

The good news is that when you set up a swap, the DeFi Swap confirmation box will let you know how much you will pay in fees. Not only that, but you are also told the minimum number of tokens that you will receive after taking into account, slippage.

When this DeFi Swap exchange review tested out the fee system ourselves, we found that oftentimes, you’ll pay less than a dollar.

There are no deposit or withdrawal fees charged by DeFi Swap, as everything goes through smart contracts. Moreover, there are no commissions charged when you utilize yield farming or staking services on the platform.

Mobile App

As of writing this DeFi Swap exchange review, the team is still working on the final stages of launching their mobile app. This will be free to download and fully optimized for both iOS and Android services.

In the meantime, you can still access all of the features and tools offered by DeFi Swap on your standard mobile web browser. You will, however, need to ensure that you have your crypto wallet stored on the same device.

For example, if you want to connect your MetaMask to the DeFi Swap website on your mobile browser, make sure it is installed on the same smartphone.

Payments & Minimum Deposit

DeFi Swap is a decentralized exchange which means that ultimately – it has no relationship with fiat money. This is why it is able to offer its services without requiring you to open an account or provide any personal information.

It is also important to note that you will never be required to actually deposit crypto assets into the DeFi Swap platform. On the contrary, any services that you wish to access – such as token swaps, yield farming, or staking – are executed via a smart contract.

This means that all you need to do is connect your wallet to the DeFi Swap website and you are good to go. In terms of supported wallets, DeFi Swap currently accepts a connection via MetaMask and WalletConnect.

The former can be accessed via a web browser or mobile app. If you use Trust Wallet or any other wallet provider outside of MetaMask, you’ll need to opt for the WalletConnect option.

This will populate a QR code that can be scanned via your preferred wallet app. When it comes to processing times, this depends on the underlying Binance Smart Chain. However, in most cases, transactions are completed in less than five seconds.

There is no minimum transaction size on the DeFi Swap platform, which will suit those of you that wish to trade or invest with small amounts.

Customer Service

As a decentralized exchange, DeFi Swap is a fully autonomous platform. This means that the platform can operate without the need for human interaction. Instead, all transactions are executed by smart contracts.

With this in mind, the DeFi Swap website does not list any contact details. On the other hand, the website of its native digital token – DeFi Coin, does have a contact form that you can fill out. The team will then reply directly to your email.

Regulation & Security

Once again, DeFi Swap is a decentralized change that does not deal with fiat currency deposits, withdrawals, or markets. Therefore, the platform does not fall under the regulatory scrutiny of any licensing bodies or authorities.

Instead, it is smart contracts that govern the DeFi Swap platform – which are both immutable and transparent. Therefore, DeFi Swap offers a safe and secure way to swap tokens and utilize interest-earning tools.

Conclusion

This DeFi Swap exchange review found that the platform is well worth considering if you are looking to access decentralized finance services in a user-friendly and safe space.

Not only does DeFi Swap allow you to buy and sell tokens instantly without a third party, but you can generate interest on your crypto investments via staking and yield farming.