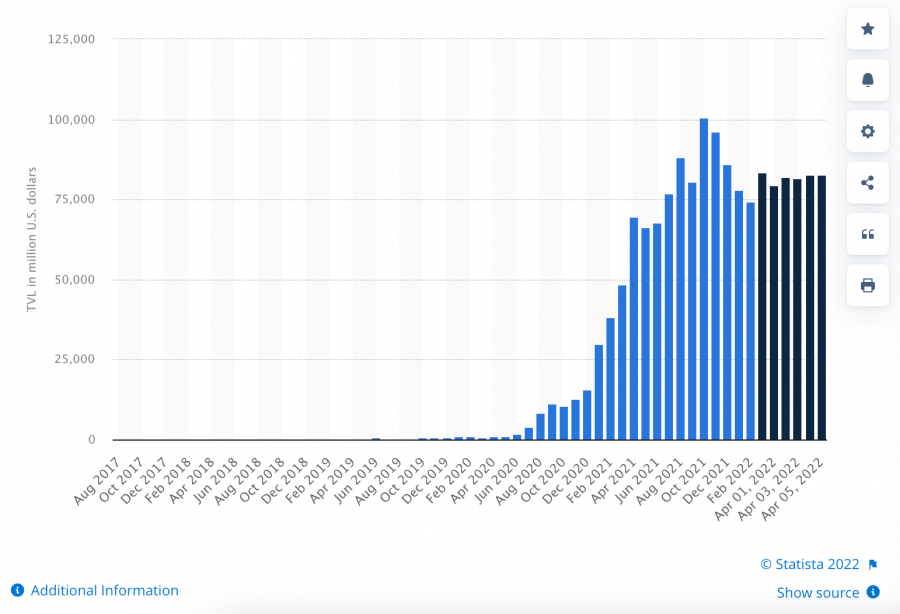

Over $200 million was locked in within decentralized finance (DeFi) projects during Q1 2022, highlighting the remarkable growth that this area of the cryptocurrency market has experienced. Along with this growth have come numerous exciting projects that look to disrupt legacy systems – with DeFi Coin being the latest to attract the media’s attention.

This guide discusses our in-depth DeFi Coin price prediction, covering everything you need to know about the project and its value potential before showing you how to invest in DeFi Coin today – all in a matter of minutes.

DeFi Coin Price Prediction 2025

The DeFi Coin token price is currently hovering around the $0.3578 level, following some remarkable bullish momentum over the past few weeks. Let’s dive in and take a look at the coin’s prospects over the longer term, ensuring you have an idea of the type of returns that a DEFC investment could generate:

- End of 2022: Now that DeFi Swap is in operation, DeFi Coin should naturally experience higher demand for services such as swapping and staking. Over time, this demand should help push DEFC higher – with our prediction noting that the price could reach $0.65 by the end of 2022.

- End of 2023: The growth trend that the DeFi sector is on shows no signs of stopping, which will likely draw more and more investors away from legacy financial systems. Should this occur, our DEFC price prediction estimates the coin could be worth $0.95 by the end of 2023.

- End of 2025: In the years ahead, DeFi Coin and DeFi Swap will likely continue to expand within the DeFi space, offering more and more ways for investors to generate yields on their holdings. The price of DeFi Coin should naturally rise in tandem with this expansion, leading us to forecast that DEFC could be worth $1.40 by the end of 2025.

| 📈 Coin Name | Defi Coin |

| 💲 Price | $0.0000000 |

| 🔆 Coin Symbol | DEFC |

| ⏳ Price Change 1h | 0% |

| 🌕 Price Change 24h | 0% |

| 💵 Market Cap | $0 |

| 🥇 Rank | |

| 🌐 24h Volume | $0 |

| 🔄 Circulating Supply | N/A |

| 💰 Total Supply | 100,000,000 |

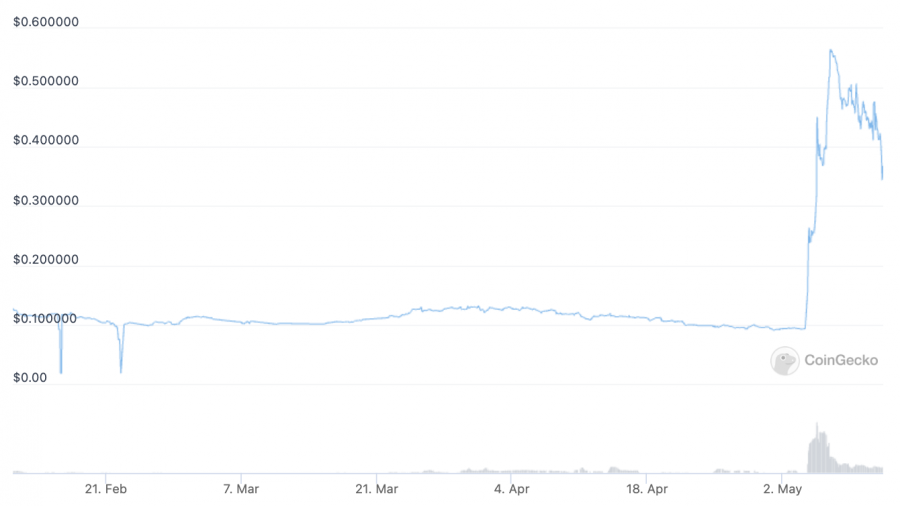

DeFi Coin Price History

Although DeFi Coin was launched back in May 2021, it has had a rocky road since then, mainly due to developmental delays in its partner decentralized exchange (DEX). However, now those delays are a thing of the past, DeFi Coin looks set to be one of the best altcoins for 2025. With that in mind, let’s look at what DEFC is and how price got to this point.

Put simply, DeFi Coin is a BEP-20 token that is part of the DeFi Swap ecosystem – one of the best DeFi exchanges on the market. Within the ecosystem, DeFi Coin is used for various services, such as token swapping, staking, and yield farming. In addition to these services, investors have also used DEFC to gain exposure to the growth of the DeFi Swap exchange.

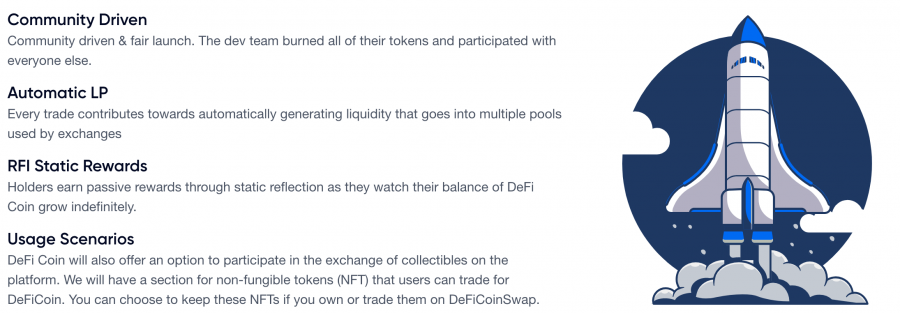

Investors who buy DeFi Coin for speculative purposes can also benefit from the token’s innovative ‘static rewards’ mechanism. Whenever someone buys or sells DEFC, a 10% transactional tax is levied on the position. A total of 50% of the collected amount is re-distributed back to the remaining DEFC holders – creating a steady stream of passive income.

An added benefit is that this transactional tax also incentivizes investors to hold the token long term. This reduces the intraday volatility caused by large buy or sell orders, which can wreak havoc on other investors’ positions. Thus, DeFi Coin will likely appeal to investors with a wide range of risk tolerances.

As touched on earlier, although DeFi Coin was initially launched in mid-2021, its growth has been hampered by delays in the launch of the DeFi Swap exchange. The token’s price did remain above the $1 level until August 2021, at which point the value plummeted and began a steady bearish trend which lasted around nine months.

However, this all changed in May 2022, when the price of DeFi Coin rocketed over 300% in one day following the launch of the DeFi Swap exchange. As the native token of the platform, DEFC naturally benefitted from this launch, with investors eager to get their hands on the coin to gain exposure to the DEXs growth. Ultimately, this trend shows no signs of stopping, making DEFC one of the most exciting coins on the market at present.

Before wrapping up this section, here’s a quick overview of the key points to bear in mind regarding DeFi Coin and its journey so far:

- Launched in May 2021

- Remained above $1 until August 2021 and then began a steep decline

- Gradually trended downwards for the next nine months

- Began skyrocketing in May 2021 following the launch of DeFi Swap

DeFi Coin Price Prediction 2022

Given the information presented above, there’s an argument that DeFi Coin token could be the best crypto under $1 due to the incredible potential that the coin has. This potential is bolstered even further by the remarkable growth of the DeFi sector, which should form the basis for DeFi Coin’s demand going forward.

A recent article by Yahoo Finance noted that the DeFi sector has grown by 47% over the last year. This growth has been driven by the success of well-known DeFi protocols such as Uniswap, PancakeSwap, and Curve, which have offered investors an alternative to the centralized financial markets. The path set by these protocols has paved the way for DeFi Coin to experience similar success.

All signs indicate that decentralized exchanges (DEXs) could soon be the go-to for crypto investors ahead of centralized exchanges. Most of the best crypto exchanges right now are inherently centralized, meaning that investors must verify themselves and complete KYC checks before being able to trade. This tends to be viewed as a negative in today’s fast-moving environment.

DeFi Coin and DeFi Swap remove the need for these checks, allowing people to invest anonymously. All that’s required is a compatible crypto wallet, as any token swaps occur directly between two parties – ensuring they are entirely decentralized. Over time, this process looks likely to become ‘the norm’, especially given the fast-growing nature of the cryptocurrency market.

With that information in mind, our optimism around DeFi Coin’s prospects is sky-high. Due to this, our DeFi Coin price prediction estimates that the token could reach a valuation of $0.65 by the end of 2022.

DEFC Price Prediction 2023

Another reason that DeFi Coin could be the best crypto to invest in during 2025 is its small size relative to other DeFi projects. As highlighted earlier, DeFi coin is currently trading around the $0.3578 level, following some impressive bullish momentum in early May. There are also only 100 million tokens in existence, with no more able to be minted.

According to CoinGecko, this gives DeFi Coin a fully-diluted market cap of just over $32 million. This low market cap is one of DeFi Coin’s most appealing aspects, as it showcases the infancy of this project. As you’ll likely know if you invest in cryptocurrency regularly, projects early into their lifespan are often the ones that produce the highest returns over time.

There’s no escaping the fact that investing in a new crypto project can be a risky endeavour. It can be likened to investing in the best penny stocks, which tend to be highly volatile and challenging to analyze from a technical standpoint. However, DeFi Coin’s built-in transactional tax helps reduce this volatility, creating a more straightforward pathway to growth.

Another essential aspect to be aware of is DeFi Coin’s inherent ‘burn’ mechanism. This works by destroying a set number of tokens at a specified point in the future, determined by the coin’s development team and the broader community. When tokens are destroyed, it reduces the total supply and makes the remaining coins scarcer – which helps drive the price higher over time.

Ultimately, this ensures that DeFi Coin is deflationary rather than inflationary, which is better for speculative investors. As such, our DEFC price prediction estimates that the coin’s price could reach $0.95 by the end of 2023.

DeFi Coin Price Forecast Long Term Outlook – 2025 Prediction

Looking further ahead, DeFi Coin’s prospects appear even more optimistic. The coin’s value will remain closely tied with the growth of the DeFi Swap exchange, which is excellent news for investors since the development team already have numerous plans in the works to implement upgrades to the platform.

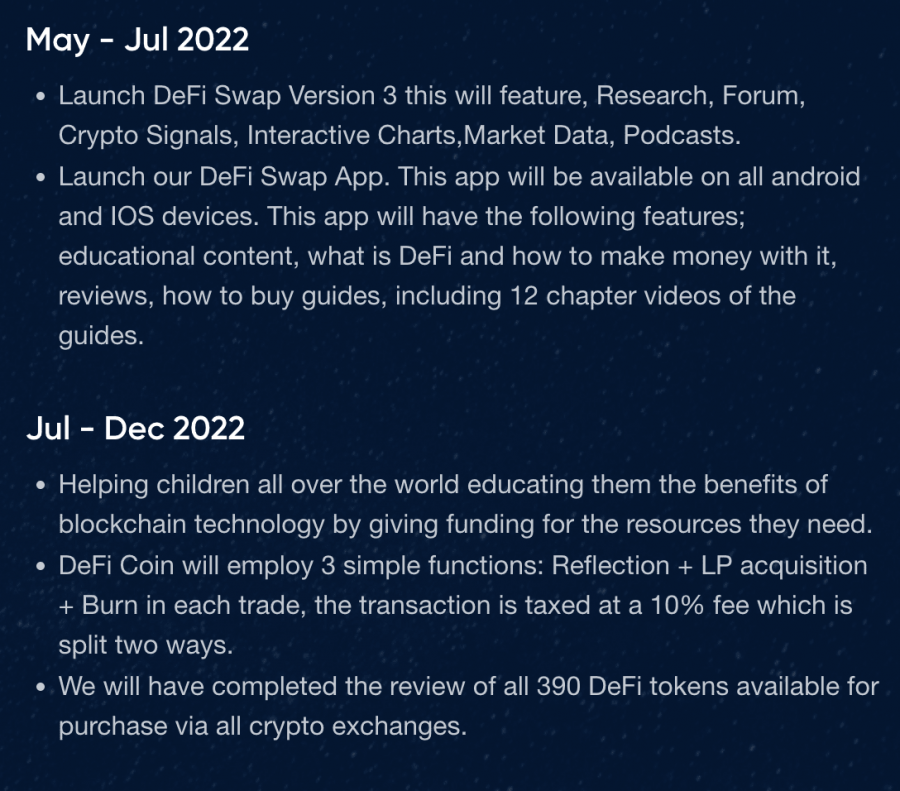

The team developed a mobile version of DeFi Swap, which is one of the best DeFi apps. DeFi Swap’s app allows instant access to the exchange and all of its services and provide a suite of in-depth educational materials.

DeFi Swap’s team also have plans to offer V2 of the exchange soon, which will add technical analysis options, webinars, news, and more. Following this, V3 will then be released, integrating crypto signals, forums, interactive charts, real-time market data, and podcasts into the ecosystem. These features will help drive users towards DeFi Swap rather than other DEXs.

The DeFi Coin website even notes plans to get involved in the NFT space. Those who wish to invest in NFTs will be able to do so via the DeFi Swap ecosystem, as the development team aims to create a section for buying and selling these digital assets. The NFTs will be denominated in DEFC, providing another compelling use case for the coin.

Taking all of these plans into account, it’s clear that DeFi Coin’s future looks exceptionally bright. As such, our DeFi Coin price prediction estimates the token could reach a valuation of $1.40 by the end of 2025 – a 284% increase from today’s price.

Cryptoassets are a highly volatile unregulated investment product.

Potential Highs & Lows of DeFi Coin

Until now, we’ve focused on what DeFi Coin is and why you should remain enthusiastic about the coin’s prospects. However, it’s also essential to examine the coin from a technical standpoint to gain insight into future price targets.

With that in mind, the table below presents some of the price chart’s main areas of interest, which could become key support or resistance levels as we advance:

| Year | Potential High | Potential Low |

| 2022 | $0.65 | $0.25 |

| 2023 | $0.95 | $0.70 |

| 2025 | $1.40 | $1.05 |

Cryptoassets are a highly volatile unregulated investment product.

What is DeFi Coin Used For?

When you buy cryptocurrency to add to your portfolio, it’s vital to understand the token’s use cases, which form the basis of its long-term prospects. Considering this, let’s take a look at closer look at DeFi Coin’s utility:

Decentralized Token Swapping

One of the primary use cases for DeFi Coin is as a medium to exchange into different tokens. Decentralized exchanges work differently from centralized platforms because they do not allow users to purchase crypto using a credit/debit card or bank transfer. Due to this, users must hold crypto and use their holdings to exchange for other tokens.

This is where DEFC comes in, as you can use it to exchange into over 50 different cryptocurrencies through the DeFi Swap exchange. The exchange process can be facilitated online, with DeFi Swap able to connect to several top crypto wallets. Thus, by holding DEFC, you’ll gain access to a vast array of assets that you can invest in.

Staking & Yield Farming

DeFi Coin also plays a vital role in the staking and yield farming services DeFi Swap offers. Crypto staking involves ‘locking up’ your tokens for a specified period, which helps validate transactions on ‘Proof-of-Stake’ (PoS) blockchains. In return for staking your holdings, you will be able to earn a fixed rate of interest.

Yield farming works in much the same way as crypto staking platforms, except it involves placing your tokens into the platform’s liquidity pools, which provides the liquidity needed to facilitate other users’ trades. Again, this process rewards you with fixed interest payments, which tend to be far higher than those offered by traditional bank accounts.

Generating a Passive Income Stream

Finally, DeFi Coin is also used to generate a regular passive income stream. This works through the token’s taxation process, which rewards DEFC holders for their long-term commitment to the project. The process works as follows:

- A 10% tax is levied on buy and sell orders of DEFC

- A total of 50% of the accumulated tax amount is re-distributed back to remaining token holders

- Therefore, if $10,000 is given back to DEFC holders, and you own 1% of the total supply of DEFC, then you will receive a payment of $100.

This process will allow token holders to generate returns that rival (or beat) those offered by the best dividend stocks. The taxation also helps reduce overall volatility, which will suit those with lower risk tolerance.

What Drives the Price of DeFi Coin?

As one of the best low cap crypto gems, DeFi Coin tends to react positively to various external factors. Let’s dive in and discuss three of the main elements that drive the DEFC price:

Strong Community Backing

Much like the best meme coins, DeFi Coin’s price strongly correlates to the level of community backing that the coin receives. If a token has lots of support on social media sites, this translates into more significant buzz around the project. In turn, more and more retail traders purchase the token, which boosts the price.

DeFi Coin is already beginning to pick up steam in this regard, with the DeFi Swap Telegram group already boasting over 6,000 members. The token also has a dedicated subreddit with 5,000 members, where token holders can discuss the project and its price trajectory.

Exciting Future Upgrades

As mentioned earlier, DeFi Coin and DeFi Swap’s development team have numerous exciting plans to take the ecosystem to the next level. This is crucial in the ultra-competitive crypto market, as new projects are launching every day that look to carve out a profitable niche.

The team’s plans include upgrades to the DeFi Swap exchange, a dedicated mobile app, and even an NFT marketplace. However, as the exchange grows, further objectives will likely be revealed, adding even more use cases for DEFC.

Speculation Potential

Finally, the price of DeFi Coin is also affected by investors using the token for speculation purposes. This is natural, given the impressive returns experienced in recent times, although large buy/sell orders can often have an oversized impact on the price of a low market cap coin.

However, when sentiment is bullish towards a token, it can help push the price up dramatically. This was evidenced in mid-2021, when investors sought to buy Dogecoin, leading to quadruple-digit returns. DEFC holders will be hoping for a similar scenario to play out in the future, which could lead to exponential returns.

How to Buy DeFi Coin

Before we round off this DEFC price prediction, let’s focus on the investment process. As one of the best penny cryptocurrencies, there’s no doubting that DeFi Coin has a great future ahead of it – meaning now could be the ideal time to add the token to your portfolio.

If you wish to do so, the steps presented below will walk you through the entire process – which should only take around fifteen minutes to complete.

Step 1 – Set Up a Crypto Wallet

As mentioned earlier, DeFi Coin is a BEP-20 token – so you must set up a crypto wallet that is compatible with the Binance Smart Chain (BSC) network. Many of the best crypto wallets offer this compatibility, although two of our recommended providers are MetaMask and Trust Wallet. Both can be downloaded from the provider’s website, with setup taking just a few minutes to complete.

Step 2 – Purchase Binance Coin (BNB)

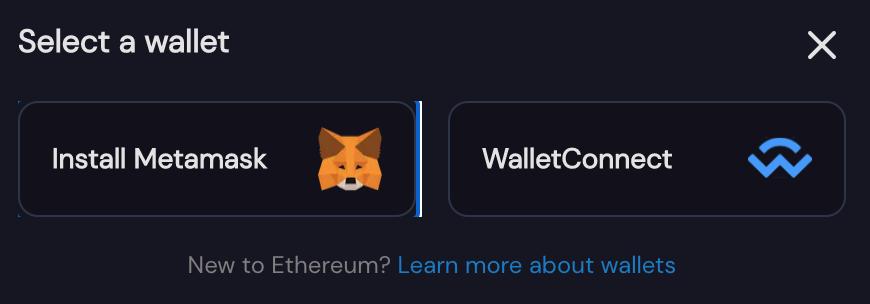

Step 3 – Link Wallet to DeFi Swap

Head over to the DeFi Swap website and click ‘Connect to a Wallet’. A pop-up will appear, asking you to choose which wallet provider you are using. After this, simply follow the on-screen instructions to link your wallet to the exchange.

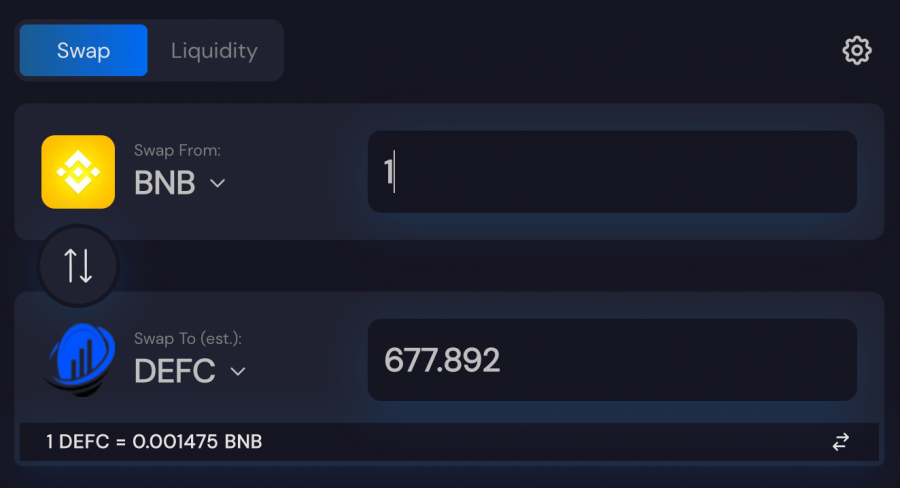

Step 4 – Buy DeFi Coin

In the order box on the DeFi Swap homepage, make sure that you are converting BNB to DEFC – which should be displayed as default. You can also alter the trade parameters, such as the slippage tolerance and transaction deadline. Finally, enter the amount of BNB you’d like to exchange for DEFC and confirm the transaction.

Step 5 – Add DeFi Coin to Crypto Wallet

Since DeFi Coin is a BEP-20 token, you’ll need to manually add the contract address to your wallet to store your holdings. To do so, go to your wallet provider’s settings and opt to ‘Add Custom Token’. When asked for the contract address, use the following:

- 0xeb33cbbe6f1e699574f10606ed9a495a196476df

Once everything is set up, confirm the changes, and your DEFC investment should appear in your wallet’s holdings.

DeFi Coin Price Prediction – Conclusion

In summary, this DeFi Coin price prediction has covered everything you need to know about this exciting project, touching on why the coin is so highly coveted and showing you how to invest in DEFC today. Thanks to the rapid growth of the DeFi market and the token’s valuable use cases, DeFi Coin looks set to be one of the most exciting crypto projects this year.

If you’d like to invest in DeFi Coin today, you can do so by clicking the link below. All you need is a BSC-compatible crypto wallet and some Binance Coin (BNB), which will enable you to exchange your holdings into DEFC in seconds.

For investors looking for another great project making waves within the industry, IMPT is a trending presale crypto. Click the link below for more details.

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st

FAQs

What will Defi Coin be worth in 2025?

How can I buy DeFi Coin?