Coinbase and Robinhood are two of the largest cryptocurrency exchanges in the US today. Coinbase offers a wide range of cryptocurrencies with modest trading fees, while Robinhood offers a limited number of tokens with no trading fees.

So, which exchange is better for you? In our Coinbase vs Robinhood comparison, we’ll cover everything you need to know to decide.

Coinbase vs Robinhood at a Glance

Coinbase and Robinhood take very different approaches to cryptocurrency. Coinbase is a full-featured, top-ranked cryptocurrency exchange with 170 cryptocurrencies to trade. Robinhood is primarily a stock brokerage that offers trading on 11 popular cryptocurrencies.

Importantly, you can move coins purchased on Coinbase to any of the most popular crypto wallets. As a result, you can buy cryptocurrency on Coinbase and use it for staking, crypto lending, gaming, and a wide range of other DeFi applications. Coinbase even has its own crypto wallet with a decentralized app marketplace. Cryptocurrency purchased on Robinhood cannot be transferred out of your brokerage account.

One major advantage to Robinhood is that cryptocurrency trading is completely commission-free. At Coinbase, instant buy fees start at 1.49% plus a variable flat fee and spot trading fees start at 0.60%.

Overall, Coinbase is better suited for cryptocurrency traders and investors who want a full-featured exchange and access to a wide variety of altcoins. Robinhood offers commission-free crypto trading on the most popular cryptocurrencies only.

Cryptoassets are a highly volatile unregulated investment product.

Coinbase vs Robinhood – Quick Breakdown

| Fees & Features | Coinbase | Robinhood |

| Licensing | 42 US states, FCA, BaFIN | SEC, FINRA, 27 states |

| Number of Cryptocurrencies | 170 | 11 |

| Pricing Structure | Flat fee + transaction fee | Commission-free |

| Fee for Buying Bitcoin | $0.99-$2.99 or 1.49%-3.99% | None |

| Trading Tools and Features | Customizable trading platform, crypto order book, self-custody wallet | Line charts, news feed |

| Mobile App Rating | 4/5 | 4/5 |

| Payment Methods | Debit card, credit card, bank transfer, Apple Pay, Google Pay, PayPal, wire transfer | Bank transfer |

| Minimum Deposit | $2 | None |

| Demo Account | No | No |

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

What are Coinbase and Robinhood?

Coinbase has made a point of partnering with major financial institutions and regulators. The company is regulated as a money services business in 42 US states. It’s also overseen by the UK’s Financial Conduct Authority and the Federal Financial Supervisory Authority (BaFIN) in Germany. As a publicly traded company, Coinbase is regulated by the SEC and follows strict financial reporting requirements.

Robinhood is only available to users in the US and the UK. It is regulated in 27 states and is a member of the Financial Industry Regulatory Authority (FINRA). As a publicly traded company, it is also overseen by the SEC.

Tradable Cryptocurrencies on Coinbase & Robinhood

One of the biggest differences between Coinbase and Robinhood is in the number of cryptocurrencies you can trade on each platform.

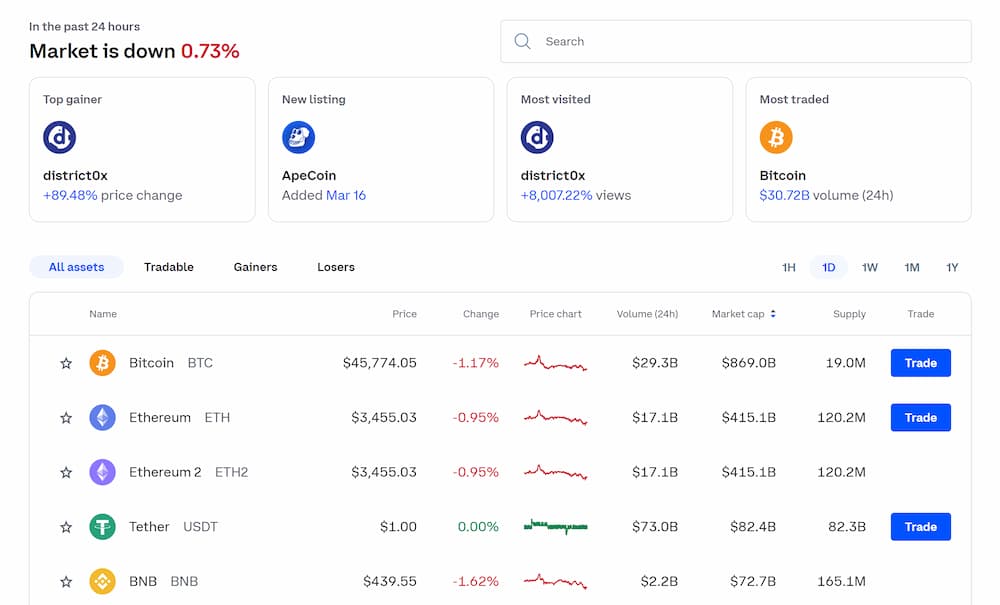

Coinbase offers 170 coins, including a wide range of stablecoins, the best DeFi coins, and meme coins. You can trade all popular cryptocurrencies on Coinbase with the notable exception of Ripple (XRP), which is currently under review by the SEC.

Coinbase is also in the process of launching its own NFT marketplace. It’s not available yet and users must sign up for a waitlist.

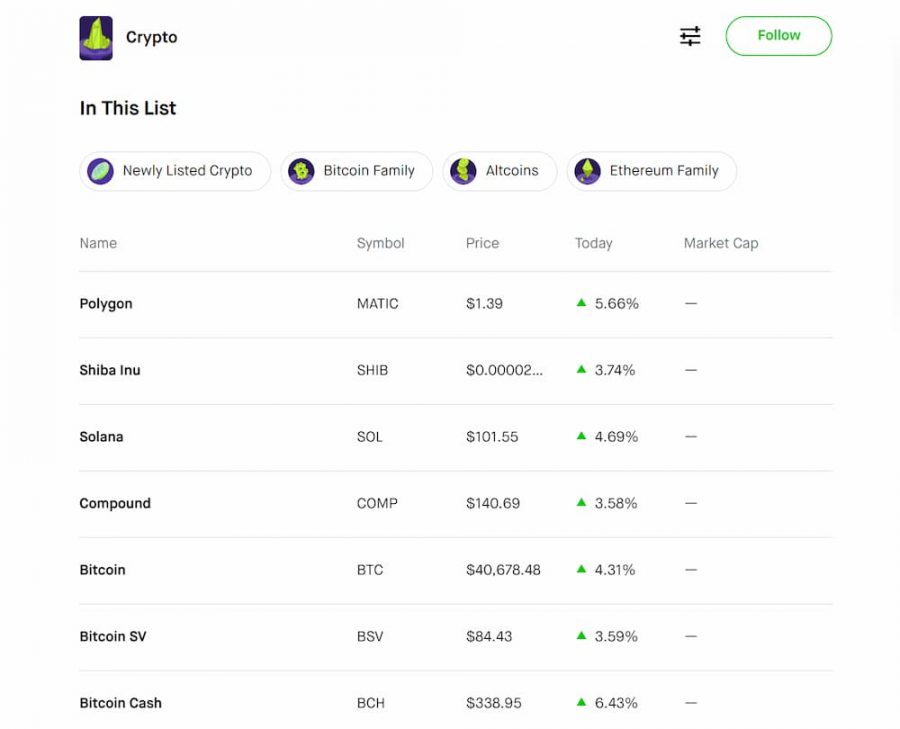

Robinhood offers only 11 cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Dogecoin. The platform recently added trading on Compound, Polygon, Shiba Inu, and Solana. Robinhood does not support NFTs and does not allow you to buy stablecoins.

Notably, Coinbase is exclusively a cryptocurrency exchange, while Robinhood is also a stock brokerage. You can buy stocks and ETFs commission-free on Robinhood.

Account Types

Coinbase offers a wide variety of exchange account types for different purposes. The majority of individual users will need either a standard Coinbase account or a Coinbase Pro account.

A standard Coinbase account lets you instantly buy and sell cryptocurrencies at current market prices. It gives you access to all 170 cryptocurrencies available for trading on Coinbase.

A Coinbase Pro account gives you access to the Coinbase Pro crypto trading platform. This trading platform is designed for fast-paced spot trading and offers pricing based on whether you create or remove liquidity in the Coinbase order book. Notably, you can transfer crypto between Coinbase and Coinbase Pro accounts at any time with no fees.

Other types of accounts at Coinbase include:

- Private client accounts for trusts, personal investment vehicles, and high net worth individuals

- Institutional accounts for financial firms that want to invest in or trade cryptocurrencies

- Commerce accounts that enable business to accept crypto for customer payments

- Custodial accounts for financial firms that need cold storage for clients’ cryptocurrency assets

Robinhood offers 3 different brokerage accounts, each of which enable you to trade stocks, ETFs, and cryptocurrencies. The main difference between the Instant, Gold, and Cash accounts lies in how much of your money you can access instantly after making a deposit by bank transfer (all funds typically settle in 2-3 business days).

By default, all Robinhood users start with an Instant account, which gives you instant access to up to $1,000 of each deposit you make. Robinhood Gold costs $5 per month and offers instant access to up to $50,000 of each deposit and margin trading. For more details about these account types, refer to the official Robinhood accounts page.

Coinbase Fees vs Robinhood Fees

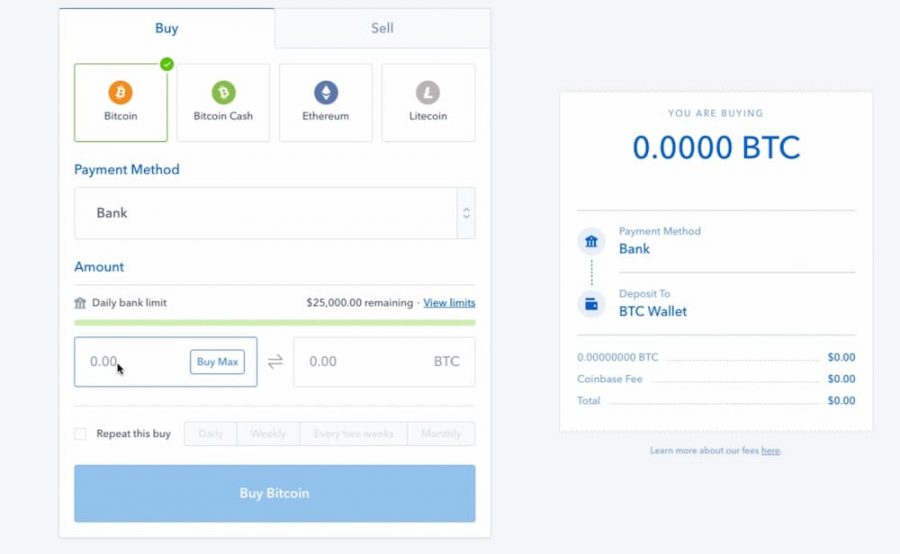

Coinbase charges different fees depending on whether you use a Coinbase account to instantly buy and sell cryptocurrency or a Coinbase Pro account to spot trade cryptocurrency.

For instant buys, Coinbase charges the higher of either a flat fee or a percentage-based fee. The flat fee ranges from $0.99-$2.99 and applies to trades up to $200. The percentage-based fee depends on your payment method. For bank transfers, the fee is 1.49%. For credit and debit card purchases, it is 3.99%.

For Coinbase Pro, Coinbase charges fees based on whether you make or take liquidity on the exchange and based on your total transaction volume for the current month. For accounts with under $10,000 in monthly trading volume, fees start at 0.60% when you take liquidity and 0.40% when you make liquidity. Bank transfers to or from Coinbase Pro are free.

| Fees | Coinbase | Robinhood |

| Cryptocurrency Trading Fees | $0.99-$2.99 or 1.49%-3.99% | None |

| Cost to Buy $100 of Bitcoin | $2.99 | $0 |

Cryptoassets are a highly volatile unregulated investment product.

You can move cryptocurrency between Coinbase and Coinbase Pro accounts at any time with no transfer fees. So, traders can use Coinbase Pro to make low-cost purchases and then move funds to a Coinbase account or vice versa.

There is a fee to transfer cryptocurrency to a crypto wallet, including the self-hosted Coinbase Wallet. The wallet transfer fee varies by cryptocurrency and is determined by the cryptocurrency’s underlying blockchain.

Robinhood doesn’t charge any fees for trading cryptocurrencies. Deposits and withdrawals are only available by bank transfer and are free. There are no fees for a standard Robinhood Instant account, but a Robinhood Gold account costs $5 per month.

| Coinbase | Robinhood | |

| Account Fees/Inactivity Fee | None | None ($5 per month for Robinhood Gold) |

| Deposit/Withdrawal Fees | None | None |

| Crypto Transfer Fees | Varies by coin | Not available |

Coinbase vs Robinhood User Experience

Coinbase and Robinhood both offer excellent user experiences. The platforms make it easy to choose a cryptocurrency, enter the amount you want to buy, and purchase it in seconds. The process is even easier with Coinbase since you don’t need to fund your account ahead of time if you’re using the instant buy option.

Both platforms provide an overview of the crypto market, including lists of prices for all of the cryptocurrencies available to trade. Coinbase has lists of top gainers and losers, making it easy to sort through the 170 cryptocurrencies available on the exchange. On Robinhood, you can sort cryptocurrencies by price change during the current day.

Notably, the Coinbase user experience gets much more advanced if you use Coinbase Pro. This platform is designed specifically for experienced traders, and you’ll want to spend some time customizing the interface to meet your needs. You can save chart layouts and indicators as defaults, making it easy to run your favorite technical analyses on a variety of different cryptocurrencies. For investors who are new to cryptocurrencies or trading, the Coinbase Pro platform can feel a little overwhelming.

Mobile Apps

Both Coinbase and Robinhood offer mobile apps for iOS and Android. Coinbase Pro requires a separate app, available for iOS and Android.

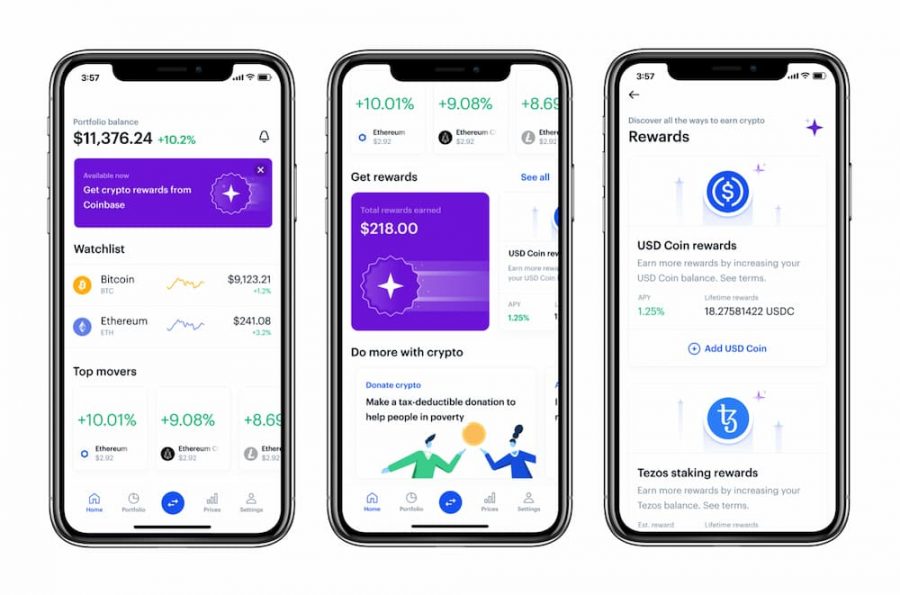

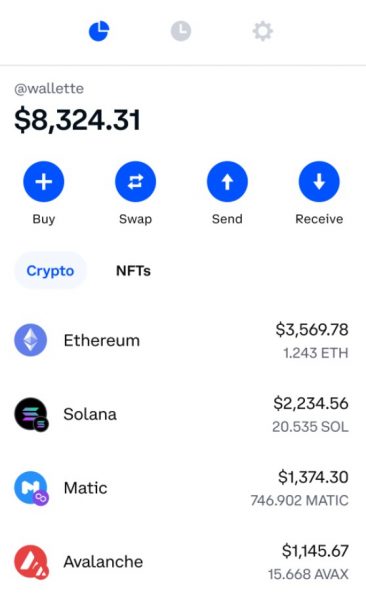

The Coinbase mobile app lets you instantly buy and sell any of the 170 cryptocurrencies available for trading on Coinbase. You can make deposits and withdrawals or transfer crypto to or from Coinbase Pro or a third-party wallet. The Coinbase app is very easy to use.

To access technical charts or spot trading, you’ll need the Coinbase Pro mobile app. This is a much more feature-rich app than the Coinbase app, but it’s also more complex to navigate. You can pull up technical charts and indicators, see your current portfolio of cryptocurrencies, and trade with stop and limit orders.

The Robinhood mobile app offers access to all of Robinhood’s features. In fact, Robinhood started as a mobile-only brokerage and only later added a platform for web trading. With the app, you can deposit and withdraw funds, trade cryptocurrencies using market, limit, and stop orders, and monitor market news. The Robinhood mobile app also supports crypto price alerts, but it does not have technical charting capabilities.

Trading Tools & Features on Coinbase & Robinhood

Coinbase offers a far greater variety of trading tools than Robinhood, particularly if you use Coinbase Pro.

Charting and Technical Analysis

Coinbase Pro offers a powerful trading platform that’s designed specifically for technical analysis. The Coinbase Pro platform includes customizable candlestick and Heiken-Ashi charts with modifiable price intervals down to 1 minute. The platform also comes with dozens of technical indicators and drawing tools, each of which can be modified to suit your analysis needs.

The Coinbase Pro platform allows you to place trades and set price alerts right from your chart. You can place stop and limit orders to manage risk, and the platform displays all of your open positions in a pane below your charts. Overall, the Coinbase Pro platform is one of the more comprehensive platforms available for trading cryptocurrency.

Robinhood doesn’t offer anything comparable to Coinbase Pro. Prices are displayed by basic line or candlestick charts, and there are no technical indicators or price intervals shorter than 1 day. Robinhood does allow you to place stop and limit orders when trading cryptocurrency.

Level 2 Data

Coinbase Pro users also get access to level 2 exchange data, including depth-of-market charts and the Coinbase order book. This information allows traders to evaluate buy and sell orders around the current market price and evaluate the volume of trading taking place for a specific cryptocurrency on Coinbase. The depth-of-market charts in particular make it easy to spot shifts in momentum for a specific coin.

Robinhood offers level 2 data for stocks and ETFs with a Gold account, but does not offer this data for cryptocurrencies.

Crypto Wallet

Both Coinbase and Robinhood allow you to store any cryptocurrency you buy on the exchanges inside your exchange account. This is convenient for trading, but it can also make your cryptocurrency susceptible to theft if your login credentials are compromised.

Coinbase offers its own self-custody crypto wallet called Coinbase Wallet. This wallet supports thousands of coins as well as NFTs. It also has a built-in marketplace for decentralized apps, making it easier to explore the world of Web3 and to take part in decentralized finance projects. You can swap coins within the Coinbase Wallet at any time using Coinbase’s exchange.

Robinhood recently introduced a new crypto wallet in beta. It is currently available only to select users and only supports the cryptocurrencies available to trade on Robinhood. You can send and receive crypto using the wallet, making it possible to transfer crypto out of Robinhood for the first time. It is not yet clear if or when Robinhood will make the wallet available to all users.

| Features | Coinbase | Robinhood |

| Candlestick Charts | Yes | Yes |

| Customizable Indicators | Yes | None |

| Level 2 Data | Yes | Stocks and ETFs only |

| Trading from Charts | Yes | No |

| Price Alerts | Yes | Yes |

| Crypto Wallet | Yes | No (in beta) |

Cryptoassets are a highly volatile unregulated investment product.

Borrowing and Staking

Coinbase offers a borrowing feature that lets you borrow cash using the Bitcoin in your trading account as collateral. You can borrow up to 40% of your Bitcoin’s value, allowing you to keep your crypto holdings while getting cash to reinvest or pay off everyday expenses. You only need to pay the interest each month and there’s no term limit on your loan.

Coinbase also lets you stake cryptocurrencies in exchange for interest. You can stake Ethereum, Algorand, Cosmos, Tezos, USD Coin, and Maker for up to 5.00% APY.

Robinhood doesn’t offer borrowing or staking, although you can trade on margin if you have a Robinhood Gold account.

Market News

Robinhood offers a market news feed that covers stocks, ETFs, and cryptocurrencies. It’s updated in real-time throughout the trading day, providing insights into the latest moves in the crypto market.

Coinbase has a weekly newsletter that is delivered to your inbox. Each newsletter looks at one issue or project in the crypto world in more detail to help investors understand the market.

Demo Accounts

Demo accounts, otherwise known as paper trading accounts allow users to practice crypto trading in a risk-free simulated environment. Consequently, there are no demo accounts on either Coinbase or Robinhood.

Coinbase vs Robinhood Payments & Minimum Deposit

Coinbase enables you to buy cryptocurrency with a credit card, debit card, or bank transfer. Bank transfers carry a fee of 1.49% for instant buy orders, while credit and debit cards carry a fee of 3.99%. You can also pay by Google Pay, Apple Pay, or PayPal, but these must be linked to a credit card, debit card, or bank account.

If you are using Coinbase Pro, you must make a deposit by bank transfer or wire transfer.

Coinbase requires a minimum deposit of $2 when you open a new account. For instant buy orders, payments are processed instantly. For Coinbase Pro deposits, bank transfers typically take 2-3 days to process.

Robinhood only accepts deposits by bank transfer and there are no fees for deposits. Bank transfers take 2-3 days to process, but you can access up to $1,000 of your deposit instantly (or up to $50,000 with a Gold account).

There is no minimum deposit required to open a Robinhood account.

| Exchanges | Coinbase | Robinhood |

| Payment Methods | Debit card, credit card, bank transfer, Apple Pay, Google Pay, PayPal, wire transfer | Bank transfer |

| Minimum Deposit | $50 | None |

| Processing Time | Instant (2-3 days for Coinbase Pro) | 2-3 days (up to $1,000 available instantly) |

Cryptoassets are a highly volatile unregulated investment product.

Customer Service

Coinbase offers 24/7 customer support by phone, email, and live chat. Phone support is the fastest way to get in touch, since you must work through a chatbot before you can connect to a representative by live chat.

Coinbase also has a very detailed online support center. FAQs are organized by account type and are fully searchable, so it’s relatively easy to find the information you need.

Robinhood offers 24/7 customer support by phone only. You can request a callback so you don’t have to wait on hold. Typically, it only takes a few minutes to get a call from support after making a request.

Robinhood also has a comprehensive online support center. It’s searchable and well-organized to provide answers to most common questions.

Coinbase vs Robinhood Regulation & Security

Coinbase and Robinhood are both widely used US-based platforms with strong regulatory track records.

Coinbase is regulated by 42 individual states, but is not a member of FINRA. The platform is also regulated by the SEC since it is a publicly traded company on the NASDAQ stock exchange. Cash deposits are insured by the FDIC and Coinbase has an insurance policy to protect against hacks. Abroad, Coinbase is regulated by the Financial Conduct Authority (FCA) in the UK and the Federal Financial Supervisory Authority (BaFIN) in Germany.

Coinbase offers 2-factor authentication to help protect your account, and the Coinbase Wallet is a fully self-hosted wallet to which only you have the encryption keys. Coinbase does not insure accounts against losses due to your login details being compromised.

Robinhood is regulated in 27 states and is a member of FINRA. It is also regulated by the SEC as a publicly traded company. All cash deposits on Robinhood are insured by the FDIC and securities are insured by the SIPC.

Robinhood uses encryption and 2-factor authentication to protect users’ accounts.

Is Coinbase or Robinhood the Best Crypto Exchange?

Our Robinhood vs Coinbase comparison found that for the vast majority of cryptocurrency investors and traders, Coinbase is the better choice. Coinbase offers trading on more than 170 cryptocurrencies, while Robinhood only offers 11. It’s hard to overstate the importance of this difference, especially for investors who want to build a diversified portfolio of stablecoins and high-growth cryptocurrencies.

In addition, Coinbase allows you to transfer your crypto to any third-party crypto wallet, opening up options for decentralized finance, yield farming, crypto gaming, and more. Coinbase even offers options for borrowing against your crypto and staking crypto, making it easy to put your digital currency to work for you. Robinhood lacks these features entirely and the platform doesn’t let you transfer cryptocurrency to a third-party wallet.

The main advantage Robinhood has over Coinbase is that it offers fully commission-free crypto trading. However, fees on Coinbase are competitive with other major exchanges, especially if you use Coinbase Pro to trade rather than buying crypto instantly with a credit or debit card. You can transfer crypto back and forth between Coinbase and Coinbase Pro for free, making it easy to avoid the steepest fees.

Coinbase offers a number of advanced features that Robinhood does not, particularly if you sign up for a Coinbase Pro account. For example, the Coinbase Pro trading platform is incredibly powerful for traders and offers a wide range of customizable technical indicators. In addition, traders have access to the Coinbase order book, making it easy to stay one step ahead of changes in momentum in the market.

Coinbase vs Robinhood – The Verdict

Our Coinbase vs Robinhood comparison found that Coinbase is the better crypto exchange for the majority of investors and traders. Coinbase offers a wider range of cryptocurrencies, more powerful trading tools, more deposit methods, and competitive fees.

Ready to start trading cryptocurrencies? Sign up for Coinbase to buy your first crypto today!

Cryptoassets are a highly volatile unregulated investment product.