Bitcoin remains the ‘top dog’ in the crypto space, mainly due to its first-mover status. However, numerous projects have emerged in recent years that aim to improve on Bitcoin’s structure – with Chia being one that has stood out from the crowd.

This guide presents our in-depth Chia Coin Price Prediction, covering what the coin is and how it works, before diving into a comprehensive overview of XCH’s prospects for the months and years ahead.

Chia Coin Price Prediction

We’ll dive into our in-depth Chia crypto price prediction later in this guide. However, presented below is a brief overview of our estimates for the years ahead:

- End of 2023: If the crypto markets recover and we have another bull run then we may see Chia Coin head to the $200 level by the end of 2023.

- End of 2025: The price of Chia reacted bearishly the last time it hit $200, immediately dropping by around 30%. If the price can sustain itself above here, we may see the $500 region tapped by the end of 2025.

| 🍃 Coin Name | Chia |

| 💲 Price | $16.80 |

| 🔆 Coin Symbol | XCH |

| ⏳ Price Change 1h | 1.65% |

| 🌕 Price Change 24h | 5% |

| 💵 Market Cap | $234,551,525 |

| 🥇 Rank | 249 |

| 🌐 24h Volume | $7,465,664 |

| 🔄 Circulating Supply | 13,957,509 |

| 💰 Total Supply Total Supply | 32,332,509 |

Chia Coin Price History

First of all – what is Chia Coin? Put simply, Chia Coin (XCH) is the native token of the Chia Network, a layer-1 blockchain platform with its own smart contract infrastructure. Unlike Bitcoin, the Chia Network uses a ‘Proof of Space and Time’ consensus mechanism, designed to be much greener than a ‘Proof of Work’ (PoW) algorithm.

The Chia Network was designed by Bram Cohen, the brains behind the BitTorrent platform. Chia emerged as one of the best altcoins on the market when it launched in May 2021 due to its unique consensus mechanism.

Instead of mining, the Chia Network uses space on hard drives and solid state drives to secure the blockchain.

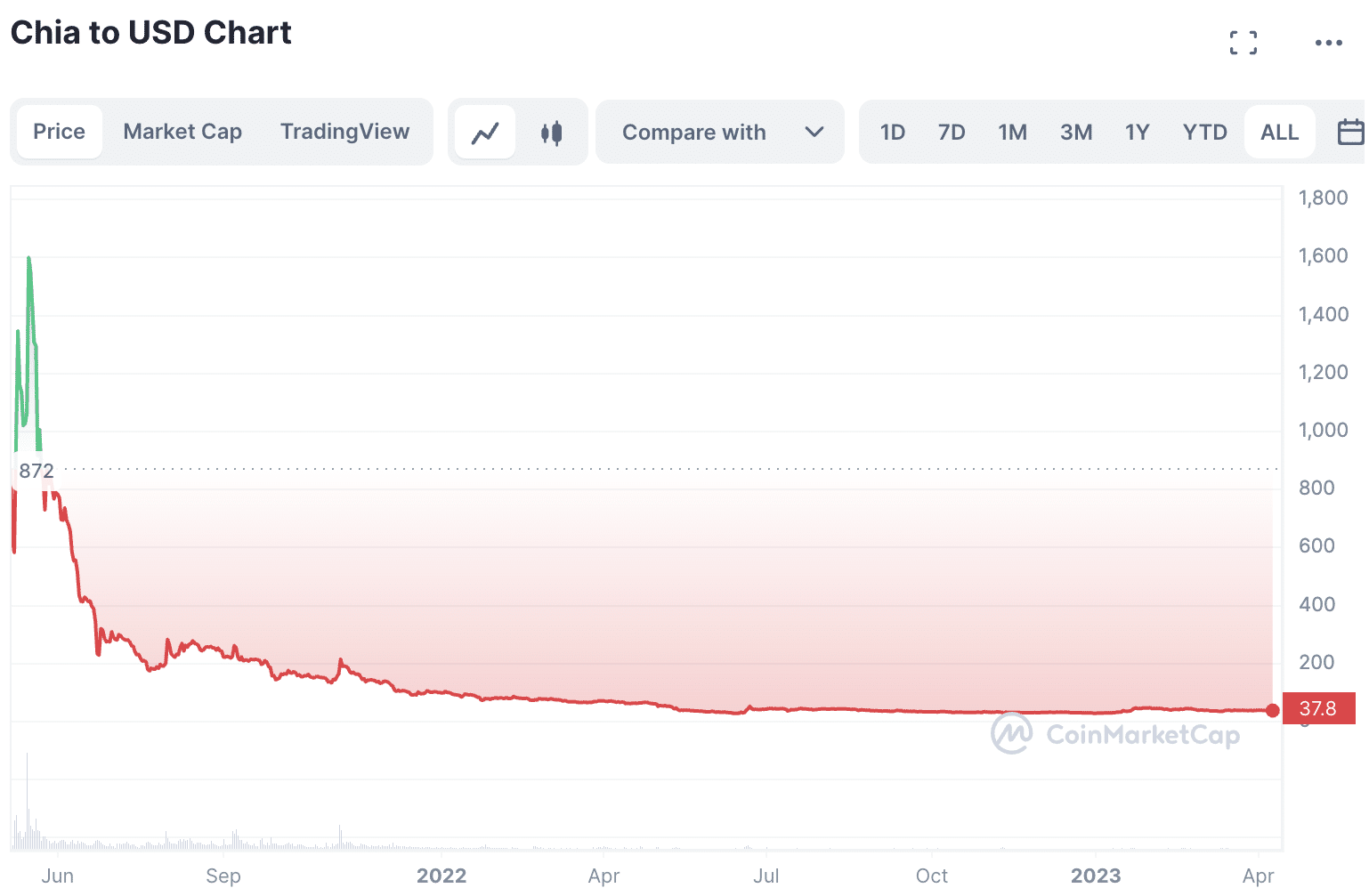

The Chia XCH price debuted on several of the best crypto exchanges around the $950 mark and immediately surged by over 125%. This resulted in the Chia stock price reaching an all-time high of $1,934.51 on May 3, 2021.

However, this high was short-lived, and the XCH price immediately plummeted – and hasn’t stopped since. Between May 2021 and January 2023, Chia Coin’s price fell by over 98%, settling around the $30 level, where it remains at the time of writing.

Here’s a brief summary of the information presented above:

- Chia Coin was launched in May 2021 on several CEXs

- Immediately surged by 125%, hitting an all-time high of $1,934.51.

- After hitting that high, the XCH price immediately began to fall.

- The coin has only once briefly broken out from its $30 to $40 range, briefly closing at $52 in late June.

- XCH continues to see strong support at $30 but has not been above $35 since mid-September.

- At the time of writing in April 2023, Chia is trading at a level that is 98% less than its all-time high.

XCH Coin Price Prediction 2023

Now let’s focus on our XCH price prediction for the years ahead. A growing trend in the crypto market is that more people are opting to invest in DeFi (decentralized finance).

This is because DeFi protocols can provide much higher yields than investors can achieve using ‘traditional’ asset classes.

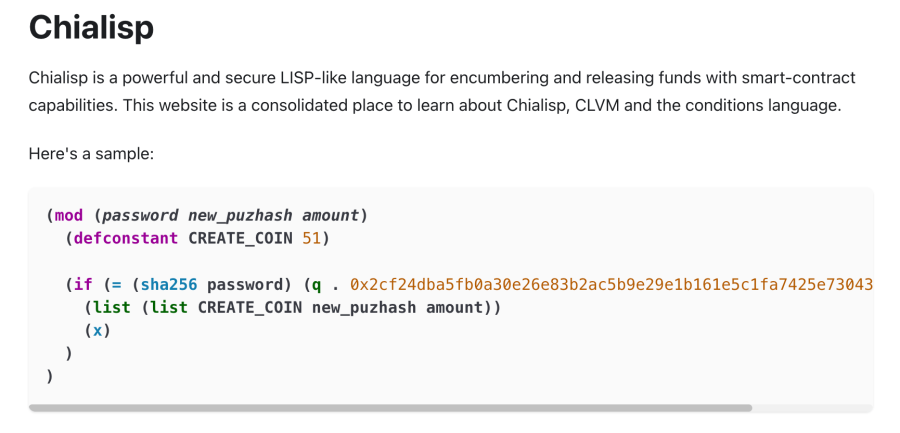

This is excellent news for Chia Coin, as the network has its own custom smart contract language called Chialisp. Chia’s developers claim this is a flexible and robust language that can be easily audited, appealing to dApp developers worldwide.

The price of Chia Coin will likely benefit from greater adoption of this blockchain, which is essentially what happened when BTC’s price took off.

The possibilities of Chialisp technology are endless, allowing developers to launch DeFi protocols, NFT collections, automated market makers (AMMs) and more.

If we start to see an uptake in this area, it could cause a ‘snowball effect’ leading to rapid XCH price increases.

With the next Bitcoin halving also approaching, and a further decoupling of crypto from traditional market forces, we predict Chia could reach up to $200 by the end of 2023.

Chia Coin Price Prediction 2025-30 Prediction

Recently, one of the most significant upgrades to the Chia Network is the launch of NFTs on its mainnet. Those wondering how to buy an NFT can now do so through the Chia Network, thanks to its new ‘NFT1’ token standard.

Although the NFT market has taken a severe downturn, this is seen as a huge step forward for the developers.

Chia can now compete with the likes of Ethereum and Solana, which have dominated the NFT space over the past year. These networks have had issues of late due to Ethereum’s high GAS prices and Solana’s poor network stability. Since the Chia Network has never had downtime, the developers hope to gain market share from its rivals.

Furthermore, investors looking to make money with NFTs can now do so in a more eco-friendly manner by using the Chia Network.

Although Chia may not be as scalable as Ethereum and Solana, the development team have opted to focus on security and decentralization – two components of the so-called ‘Blockchain Trilemma’.

Once the NFT market picks up, we may see more creators opt to host their collections on the Chia Network rather than other blockchains.

If this occurs, coinciding with another potential crypto bull run, we estimate the Chia price may hit $500 by the end of 2025, especially considering its small total supply of just 26 million coins.

Looking even further ahead to 2030, it wouldn’t be unsurprising to see the XCH price double, assuming that adoption of this network continues to grow.

However, it may remain a long time before we see XCH test new all-time highs.

Potential Highs & Lows of Chia Coin coin

Now that we’ve touched on our Chia Network price forecast for the years ahead, let’s summarize the key takeaways from our analysis. The table below presents the potential highs and lows of XCH from now until 2025 – which can be helpful to investors looking for the best crypto investment for long term.

| Year | Potential High | Potential Low |

| 2023 | $200 | $55 |

| 2025 | $500 | $100 |

What is Chia Coin Used For?

So, what is Chia Coin (and the Chia Network) actually used for? Let’s dive in and explore some of its primary use cases:

Making Payments

Chia Coin’s primary use case is as a method of making decentralized payments. Many people opt to buy Bitcoin for this purpose since it was the ‘first mover’ in the crypto payments space. However, Bitcoin’s technology has become outdated and is deemed to be highly energy-intensive.

Chia Coin offers a viable alternative since the network’s ‘Proof of Space and Time’ consensus mechanism allows participants to use their free disk space to secure the blockchain. As such, Chia Network uses around 500x less energy than ‘Proof of Work’ chains.

Farming Rewards

As mentioned earlier in our Chia Coin price prediction, those with spare space on HDDs or SSDs can use that space to help secure the network. This is called ‘plotting’ and essentially involves writing 100GB worth of hashes to these drives.

Chia Network then facilitates a sort-of ‘lottery’, whereby a new block’s hash is compared to those stored on users’ drives. The user with the closest match receives a farming reward – providing a way for market participants to generate a passive income stream in XCH.

Minting NFTs

The Chia XCH price will likely be heavily influenced by NFT-based activity, given the massive popularity of these digital assets. Although trading volume has died down, NFTs still have fantastic utility – so there’s always scope for a rebound.

Many new NFT projects have already been launched on the Chia Network, including Chia Friends and Marvelous Marmots. There’s also a ‘Mint Garden’ feature where anyone can mint NFTs on the Chia blockchain, along with a dedicated NFT marketplace for trading.

dApps with Smart Contracts

Finally, Chia Network’s ‘Chialisp’ programming language allows developers to create dApps. Although this language is relatively complex compared to the structures used by the likes of Ethereum, it is designed to be extremely secure – making it a good choice for developers creating DeFi protocols and stablecoins.

What Drives the Price of Chia Coin?

Given the information presented until this point, could XCH be the next crypto to explode? To clarify this, let’s dive into the next section of our Chia Coin price prediction – the factors that affect the coin’s price.

Social Media ‘Hype’

Like all of the best DeFi coins and utility tokens, the Chia Coin price is affected by hype driven through social media. Retail investors are always looking for cryptos that can produce market-beating returns – which is why many coins experience price rises when they begin gaining traction on Reddit and Twitter. Thus, if Chia’s team can tap into this demographic of traders, we could see the ‘buzz’ translate into price increases.

Blockchain Adoption

As more market participants opt to construct dApps or mint NFTs on the Chia Network, the demand for XCH will naturally rise. This is because XCH is the network’s native token, meaning the coin is used to pay for NFTs and interact with dApps.

Future Roadmap

Finally, Chia Coin’s future roadmap is crucial to its price potential. A key goal of the Chia Coin team is to achieve a public listing for the company, meaning investors can buy stocks in Chia. This goal is relatively rare in the crypto market due to most projects aiming to be decentralized – so there’s no telling how the XCH price may react if this comes to fruition.

Where to Buy Chia Coin

Crypto.com offers a user-friendly mobile app where investors can purchase over 250 cryptocurrencies in just a few taps. Those looking to buy crypto with a credit/debit card can do so instantly, with a 2.99% transaction fee charged. However, Crypto.com also offers an exchange service which uses a maker/taker model.

This model means that investors will only be charged 0.4% per trade when operating in the spot market. Interestingly, this fee can be reduced by 10% when paying in CRO – Crypto.com’s native token.

Crypto.com also has various additional features, including one of the best crypto wallets for those interested in the DeFi space. This wallet is non-custodial and supports over 700 tokens (including XCH), allowing for quick token swapping.

Crypto.com also allows free crypto deposits when funding the app, with added support for an array of FIAT currencies. Finally, users can even benefit from Crypto.com’s Visa card, which has no annual fees and offers up to 5% cashback on the Obsidian tier.

Is XCH the Best Coin to Buy in 2025?

As highlighted throughout this Chia Coin price prediction, XCH still has potential – even after the 98% drop from all-time highs. However, can it be considered the best coin to buy in 2025? This all depends on the individual investor, although there are viable alternatives that could provide higher returns.

Best Chia Alternative – Love Hate Inu – Innovative Memecoin and the Hottest Presale of 2025

Love Hate Inu is a memecoin project that combines the social fundamentals of a memecoin with the voting powers of a DAO crypto. The project leverages its unique USP to power a Vote2Earn ecosystem where you can vote on multiple types of polls and earn rewards.

The voting process that Love Hate Inu is going with involves staking. When you vote on any of hte social, entertainment or other topics on polls, you are voting through the process of staking. And just like in regular staking, the more tokens you stake, the more APY you are going to earn.

This seemingly simply fundamental is why people presale watchers have been looking at Love Hate Inu attentively. Many have said that with enough time, Love Hate Inu has the potential to overpower the likes of Dogecoin and Shiba Inu.

The project has three systems working for it. The first one is the voting system that allows users to cast their votes through staking. The second element is. the polling system that allows you to create your own polls using onboarded tools and the final element is the poll management dashboard – which allows you to manage your polls and ensure that voting is done fairly.

A unique use case like this can find its way into many brands who can leverage it to create their own polls. The project’s main goal is to compete with the current online survey industry and make the voting process more fair and rewarding.

Love Hate Inu is currently under presale and has already raised $7 million at press time – close to selling out. The tokens currently presents a lucrative early moving opportunity if you buy LHINU tokens at a discount.

$LHINU Tokenomics

LHINU is an ERC-20 token with a total supply of 100 billion. 90% of these tokens are dedicated to presale and the remaining 10% reserved for rewards, liquidity and listing – which tells the community that there is no change of this project being a rug pull.

Presale Started

8th March 2022

Purchase Methods

ETH, USDT

Chain

Ethereum

Min Investment

None

Max Investment

None

Chia Coin Price Prediction – Conclusion

In summary, this guide has presented our in-depth Chia Coin price prediction, covering the token’s use cases, development team, and roadmap. Although XCH has undoubtedly been through a challenging period, the network’s infrastructure is still appealing – providing a solid platform for a future rebound.

Investors looking for an alternative to Chia Coin may wish to consider checking out Love Hate Inu, which we have outlined in further detail above.

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards