Looking to buy Yearn.Finance (YFI)? Below we dive into the ins and outs of Yearn.Finance. We explore what this crypto offers investors and what its price is likely to do.

If you’re new to cryptocurrency trading, read on to find out how to buy YFI safely and with low fees in 2023.

How to Buy Yearn.Finance – Quick Steps

Thinking about buying cryptocurrency in 2023? Here’s how to buy Yearn.Finance safely and with low fees in less than five minutes:

- Step 1: Open an account – Sign up with your chosen broker. Enter a few personal details and verify your account with some ID.

- Step 2: Deposit -Deposit via bank transfer, credit/debit card and a range of e-wallets. No deposit fee applies.

- Step 3: Search for Yearn.Finance coin – Simply enter ‘YFI’ in the top toolbar to track down your crypto.

- Step 4: Buy – Use your account balance to buy YFI in seconds.

Where to Buy Yearn.Finance

Below we tackle the question of where to buy Yearn.Finance with a review of the three top crypto exchanges:

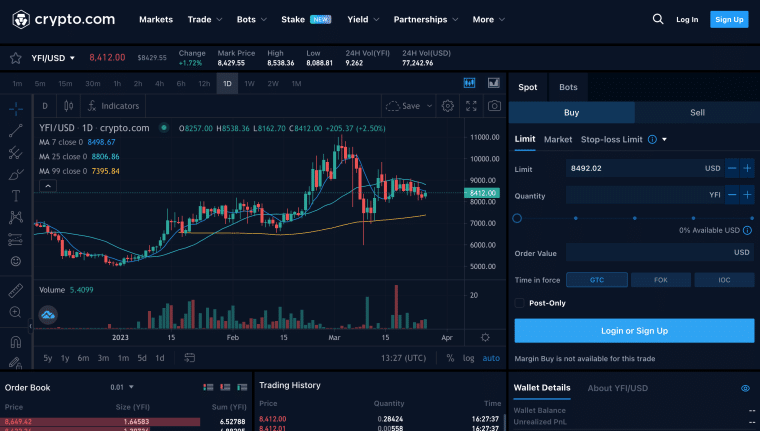

1. Crypto.com – Reputable Crypto Exchange with Beginner-Friendly Mobile App

Crypto.com is one of the world’s 460+ crypto exchanges. It is based in Singapore and is ranked by data experts CoinMarketCap as the 16th-biggest exchange. You may have seen the TV ads for Crypto.com fronted by film star Matt Damon.

Crypto.com divides its service between a full-on trading exchange and a far simpler smartphone app suitable for beginners.

If you want to trade crypto for crypto, you can use the exchange and pay only 0.4% in fees. Here, you can access advanced trading options and also apply to trade ‘on margin’ (this means borrowing to trade, so beginners should hold off until they are profitable and experienced). To get started on the exchange, you will need to buy some Tether, USD Coin, Bitcoin, or Crypto.com’s native crypto, CRO.

With Crypto.com’s crypto smartphone app, on the other hand, you can immediately buy up to 250 different crypto with credit card or fiat currency.

The Crypto.com app offers three key benefits in the area of finance. Firstly, you can access lucrative crypto-staking options. This allows you to lend your crypto out to earn rewards of up to 14.5% APY (annual percentile yield). Currently YFI interest isn’t one of the options but you can earn interest on 50+ other cryptos in your portfolio.

Secondly, you can get a Crypto.com credit card which allows you to spend your crypto like fiat currency as well as earn rewards on spending. Thirdly, you can put down some crypto and borrow more crypto off the back of it.

Crypto.com offers impressive security credentials. It keeps 100% of client crypto in ‘cold’ storage (which means offline, away from hackers). And a $750m insurance fund is on hand to reimburse any client in the unlikely event of a hack.

Although Crypto.com does not offer powerful social trading tools or high regulation, its offering is very much aimed at the beginner. Check out Crypto.com for easy-to-access crypto financing and a good range of crypto.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

2. Coinbase – Popular Cryptocurrency Exchange with Huge Asset Portfolio

Like Crypto.com, Coinbase is a major crypto exchange. Based in San Francisco, Coinbase does over $1bn worth of crypto business every day and boasts 73m verified users. It was the first crypto exchange to go public on the stock markets with a 2021 IPO on the NASDAQ.

Coinbase shares a few key features with Crypto.com: you can buy crypto instantly with credit card, you can stake crypto for rewards, and you can set up a credit card to spend your crypto in the real-world. An excellent range of 170+ of crypto is offered, including of course Yearn.Finance.

Getting going with crypto purchase with Coinbase is easy.. You get verified with some ID, fund your account and get buying. Coinbase will then hold your crypto for you until you want to sell, or you can transfer it to your free Coinbase wallet. Coinbase is set up with beginners in mind. Coinbase offers free crypto to complete learning modules as well as the definitive list of all crypto available in the sector. With Coinbase, you really can learn a lot.

The major downside of Coinbase is the dual fee structure. This mixes flat fees and commissions and has come in for a lot of stick over the years. Coinbase says its fees are under review. A definite upside of Coinbase, on the other hand, is its free smartphone app which is particularly well reviewed. On the App Store, 1.6m users give it an average rating of 4.7/5. On Google Play, 664k users give it an average score of 4.2/5.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

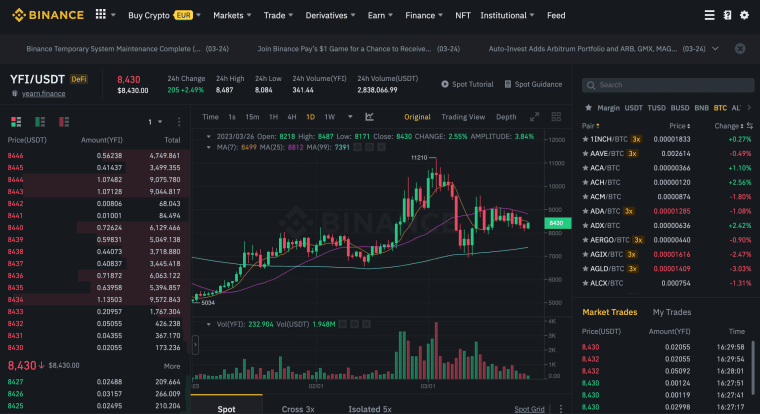

3. Binance – Giant Exchange to Invest in Yearn.Finance

Binance is the world’s biggest crypto exchange. It does $12bn worth of crypto business every day. As a result of this volume, Binance can offer super-low trading fees of 0.1% as well as a giant range of 400+ crypto.

How to buy Yearn.Finance? Binance gives you so many purchase options it can be quite overwhelming. You can deposit fiat currency into your account using bank transfer or credit card and the purchase YFI. Or you can trade YFI for other crypto. Or you can use P2P Trading to do deals direct with other traders. If you are newcomer to crypto, be sure to set your desktop Binance interface to ‘classic’ and use Binance Lite on the smartphone app to keep things simple.

Like Crypto.com, Binance offers a fantastic range of crypto financing options. These centre around their one-stop investment solution Binance Earn, which features staking and liquidity options across a massive range of crypto. Simply browse through your options, find a deal that you can manage, lock in some crypto – and wait for the financial interest to come in.

Binance is catching up when it comes to regulation. Nowadays the exchange offers full KYC procedures (Know Your Customer), which protects against fraudulent individuals getting involved. Some users complain that the computerised verification system is difficult to use; but certainly we managed to get registered. Teething problems with KYC is, unfortunately, a sector-wide problem. But at least exchanges are doing their best to keep everybody’s money safe. Like Crypto.com, Binance has its own insurance fund to reimburse any investor who gets hacked.

If you want to strike out and see what the crypto world has to offer, Binance is an ambitious destination.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

What is Yearn.Finance ?

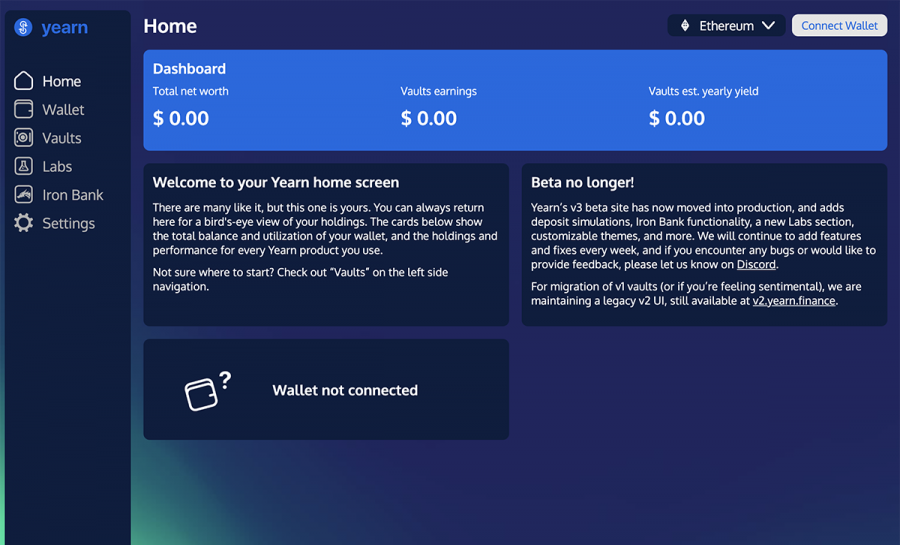

With Yearn, anybody can deposit crypto and choose to trade it for other crypto or use it to earn rewards through staking in liquidity pools. Yearn acts as a gateway for a range of crypto financing products provided by big names like Aave, Balancer and Curve.

Yearn.Finance was launched in 2020 by a single developer Andre Cronje. YFI is the 95th-biggest crypto (according to CoinMarketCap) with a market capitalisation of $670m. Approximately $80m YFI changes hands every day.

Is Yearn.Finance a Good Investment?

Let’s take a closer look as to why Yearn.Finance might be a good investment.

Buy the Dip

Though Yearn.Finance has almost doubled its value since its lowest price during the year 2022 and continued its upward trend in 2023; it is still considerably down compared to its all-time high. It means that you still have the chance to buy the dip before the crypto market recovers and Yearn.Finance follows market trends.

Be sure to minimize your crypto risk by a) investing only 1% of your total portfolio in crypto and b) spreading your crypto investment around different crypto sectors and coins. One risk management strategy you might check out is to receive crypto signals from expert companies, with guidance on individual crypto trades.

Get in on DeFi

As a gateway to a range of DeFi products, Yearn.Finance is well-positioned to benefit from ongoing support for the DeFi sector. If it gets a well-established project in this sector, Yearn.Finance can win more investors; hence, its value will increase due to the scarcity of coins. It will also enable you to enter the DeFi space and benefit from various tools and services in that field.

Diversify your DeFi Investment

There are many alternatives to Yearn.Finance, as this sector of cryptocurrencies, faces stiff competition. Still, YFI can be considered one of the best assets to add to your diversified DeFi portfolio. Now that it has been established that crypto financing offers far better returns than traditional banks can offer, numerous companies are setting up. That’s why investing in a spread of DeFi companies makes sense.

Assess your Risk Appetite

All crypto investment is risky. That is because crypto is a new sector. Nobody knows whether it will take over the world or become an offshoot of TradFi (Traditional Finance). But the risk is the price we investors pay for a chance at the reward. Compared with other cryptos, Yearn.Finance has a medium-to-high risk profile.

As a DeFi coin that is based on real business, Yearn.Finance is nowhere near as risky an investment as an obscure meme coin that offers no business value. But, as noted above, YFI’s underlying business Yearn faces stiff competition. Certainly, YFI is riskier than the giants of the sector Ethereum (ETC) and Bitcoin (BTC) — but the potential gains it offers are higher.

Back the Underdog with Real Bite

A standout feature of Yearn.Finance is that it got off the ground without any funding and without a team; just one developer, Andre Cronje, is responsible for the Yearn platform. For YFI to now be the 118th-biggest crypto is quite an achievement and suggests that the business model for the Yearn platform is sound.

Yearn.Finance Price

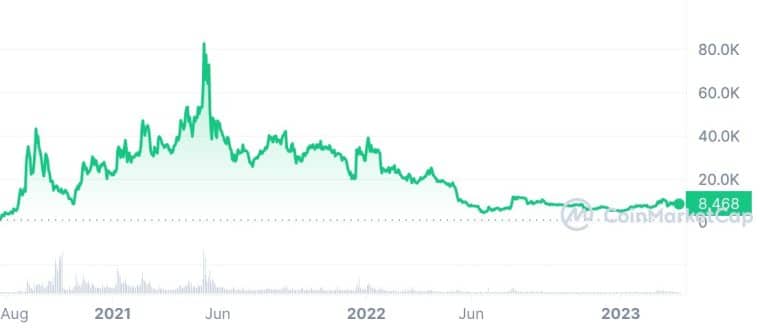

The native token of Yearn.Finance, YFI started its journey with an ICO price of $378 and got listed on exchanges with a price above $1000. It hit its first all-time high in September 2020, reaching almost $40,000 in a couple of months after its official launch. By the end of 2020, YFI’s value dropped to $21.000. Yearn. Like many other top cryptocurrencies, finance hit its all-time high in May 2021. According to Coinbase, when YFI experienced its all-time high, it was traded at $93.000.

Following the whole crypto market, YFI’s value has been down since the May 2021 crash of the cryptocurrency market, which was followed by several other events affecting the overall value of the market. In the middle of 2022, YFI value dropped as low as below $5000. Still, YFI has taken a positive direction since 2023 and has somehow recovered after losing almost 95% of its all-time high value.

According to CoinMarketCap, as of mid 2023, Yearn.finance is ranked 118th with a market capitalization of over $317.5 million USD and a circulating supply of 36,638 YFI coins. At the time of writing, YFI is trading at $8500 for a coin which indicates a 68% YTD return date.

Yearn.Finance Price Prediction

The price of Yearn.Finance depends, like all crypto, on investor sentiment concerning crypto as a whole. Most crypto, including YFI, tend to move in the direction that market-leader Bitcoin takes, and this depends largely on how investors feel about the future of crypto as a whole.

Though Bitcoin and the whole market have been experiencing “crypto winter” in the last 2 years, the prices seem to recover slightly, with YFI rising to $8589 since the beginning of 2023. Algorithm-based platforms mostly have positive projections about YFI’s future price. For example, Digital Coin Price predicts that YFI will have an average price of $18.437, possibly raising to a maximum price of $18.823 and dropping as low as $7640.

Price Prediction is even more bullish, indicating that the average price of YFI can reach $27.823 with a minimum price of $27.026 and a maximum price of $30.686. In contrast, Wallet Investor gives negative predictions suggesting that YFI will lose over 80% of its currency value and drop $1390 annually.

Watch this video for more trending coins to buy right now:

Ways of Buying Yearn.Finance

Here are all the different ways to buy YFI coin:

Buy Yearn.Finance with PayPal

With Coinbase, you can buy Yearn.Finance with PayPal (depending on which country you live in). With Binance, you can use PayPal for P2P trading; you might be able to pick up some YFI this way, depending on what deals are on offer. With Crypto.com, you can use PayPal to top up your Crypto.com Visa card.

Buy Yearn.Finance with credit card or debit card

Where to buy Yearn.finance with a credit card? Be smart and think outside the box: one of the cheapest ways to invest in Yearn.Finance with a credit card is not with instant credit card purchase.

You can use the best crypto exchanges such as Coinbase and Binance to buy YFI direct with credit card, but credit card fees are charged.

Best Yearn.Finance Wallet

If you are pondering how to invest in Yearn.Finance, allow us to clear up a key point: you do not need to own a crypto wallet to buy YFI or to sell it. Top brokers and exchanges allow you to buy crypto and will then hold it for you until you are ready to sell.

Reliable crypto wallets are needed when you want to send crypto around the internet, or to plug into DApps (Decentralised Applications). You need a crypto wallet, for example, to plug into the Yearn platform, and browse through the crypto lending and financing options available.

Conclusion

We have looked at how to buy YFI (go online!), where to buy Yearn.Finance (with a top broker or exchange) and even when to buy Yearn.Finance (when the price is low). But should you buy YFI? As a DeFi coin, YFI certainly offers investors the reassurance that its price is not purely based on sentiment, but grounded in real-world business.

If you are a crypto newcomer, we can recommend the three exchanges we have covered because they all go out of their way to help the beginner.

FAQs

Can you buy Yearn Finance on Coinbase?

Where can you buy Yearn Finance?

Is YFI a good investment?

Is Yearn.Finance going up?

Is Yearn.Finance undervalued?

Can you buy YFI?

Is YFI on Coinbase?

Is YFI coin on Binance?