Founded in 2018, the UMA protocol, also known as Universal Market Access, is an Ethereum-based cryptocurrency project which provides services related to decentralized financial contracts. It ensures the creation of financial contracts which would be self-executing and self-enforcing.

The native token of this protocol, the UMA coin, entered the market with a starting price of $1.3 and quickly peaked at $24 in a couple of months. Influenced by the condition of the crypto market UMA’s price is currently at $2.08 which is still higher than its initial listing price.

So, is UMA a good investment, and how to buy it? This guide reviews the best platforms to buy UMA, including regulated crypto exchanges that support UMA. Based on the UMA project roadmap, we also chart the UMA price history and predict its potential future price action.

How to Buy UMA Coin – Quick Guide

To invest in UMA, follow these steps:

- Step 1: Create an Account: Choose a broker and create a free account within a few minutes. Enter the necessary details and upload ID documents to complete the process.

- Step 2: Deposit Funds: Users can deposit funds using a debit/credit card, eWallet, PayPal, or bank transfer. Or transfer crypto from an existing crypto wallet to buy UMA with.

- Step 3: Search for UMA: Enter ‘UMA’ or ‘Universal Market Access’ in the search bar, and the token will appear in the dropdown-result. Click the name to review the price chart or the ‘Trade’ button to get to the buy area.

- Step 4: Buy UMA: Enter a USD amount to buy UMA tokens with on the pop-up box and click ‘Open Trade’ to confirm the buy order. UMA coin will then be added to your balance.

Where to Buy UMA – Best Crypto Platforms

UMA has been active since 2018. But it wasn’t until 2020 that it started to gain the attention of top crypto exchanges. Coinbase and Binance added support for the token that year, followed by Crypto.com and Bitstamp in 2021.

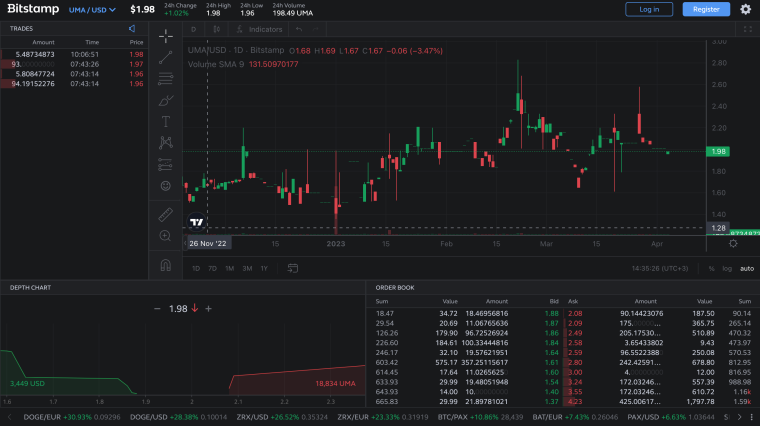

1. Bitstamp: Buy UMA in the United States

Bitstamp is an ‘OG’ crypto trading platform on this list – launched in 2011, it is one of the oldest Bitcoin exchanges. Its simple-to-use interface, low fee structure, and advanced pro-trader tools are sought by traders with different levels of trading experience.

Bitstamp listed UMA on 13th April 2021 and provides spot trading for UMA/USD, UMA/EUR, and UMA/BTC pairs. Along with UMA, Bitstamp supports 70+ cryptocurrencies, including the major tokens such as Bitcoin and Ethereum and Defi assets such as AAVE, which was listed the same day as UMA.

The fee structure of Bistamp changes based on the pre-determined tiered system depending upon the user’s 30-day trading volume. The trading fee starts at 0.5% for users trading up to $10,000 worth of crypto assets in a month. Higher monthly volume results in a lower trading fee.

Advanced traders of UMA coin or other crypto assets can use tools to chart and analyze the price of assets they seek to invest in using its Bitstamp Tradeview feature. That includes technical indicators such as Fibonacci Retracement levels, EMAs and RSI, and an in-house analytical tool.

Also, Bitstamp also provides staking rewards but currently only for Ethereum 2.0 and Algorand, stating that it will support other cryptocurrencies to its Bitstamp Earn program.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

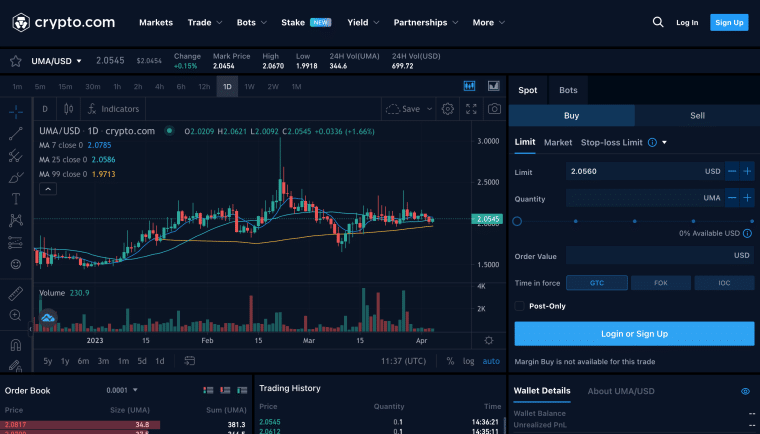

2. Crypto.com: Also Supports UMA Coin

Only an UMA/USDT pair is available on Crypto.com currently. Also, while Crypto.com supports up to 10x leverage on most crypto-pairs, UMA is not yet on the list. In that aspect, it differs from Binance – which added UMA to the list of isolated margin assets in 2020.

The trading platform follows a maker-taker fee model. The 0.04% to 0.10% maker fee model is implemented on the trading volume of the last 30 days. And the 0.10% to 0.16% taker fee model is charged per order. Investors can also use debit or credit cards to invest in crypto via Crypto.com’s mobile app. The processing fee for those fiat methods varies from 2.99% to 3.99%.

Users who want to reduce the fees can stake CRO – the native coin of Crypto.com’s ecosystem.

Crypto.com has many other features besides its exchange platform, including a metal VISA crypto card, an NFT marketplace, and Crypto Earn.

Through Crypto Earn, users can stake their crypto assets and earn up to 14.5% APY. With the VISA debit card, users can directly pay retailers with crypto and get up to 5% cashback (Crypto.com has removed the cashback for lower-tiered crypto cards).

In the second quarter of 2020, Crypto.com launched Recurring Buy. It allows users to create recurring purchases for 64 listed cryptocurrencies. The core of this technology is Dollar Cost Averaging. This investment strategy allows investors to split the amount they want to invest and then invest in their chosen asset at regular intervals.

On 29th April 2022, Crypto.com launched a dollar-cost-averaging bot for spot trading. It allows investors to automatically invest a specific amount on a regular schedule. Crypto.com marketed it as a feature to hedge against the volatility of the crypto market.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

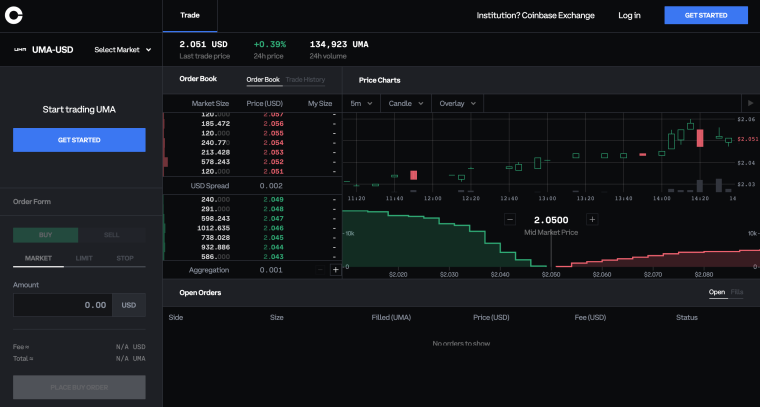

3. Coinbase: Buy UMA Coin with GBP, USD and EUR

Coinbase listed UMA on 10th September 2020, causing the UMA price to pump to $17.

Along with UMA, Coinbase offers more than 200 crypto assets. Among them is a diverse altcoin collection that includes big cap coins like Dogecoin and Cardano to low cap coins like Stepn (GMT).

Like Crypto.com, Binance, and Bitstamp, Coinbase is a platform that offers crypto staking. It allows investors to earn passive income by staking one of the seven available crypto assets, including Ethereum, Cardano, DAI, Tezos, Algorand, Solana and Cosmos. There is no news yet on whether UMA will be added to the list.

The UMA pairs available on Coinbase are UMA-USD, UMA-EUR, UMA-GBP, and UMA-BTC. With these pairs, Coinbase provides most ways to buy UMA using fiat currencies. Like Crypto.com, Coinbase also follows a maker-taker fee model, with the maker fee ranging from 0.00% to 0.40% and the taker fee ranging from 0.05% to 0.6%.

Coinbase announced on 24th June 2022 that it plans to merge its Coinbase Pro platform with the main app, so the advanced trading features of Coinbase Pro will also be available on Coinbase.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

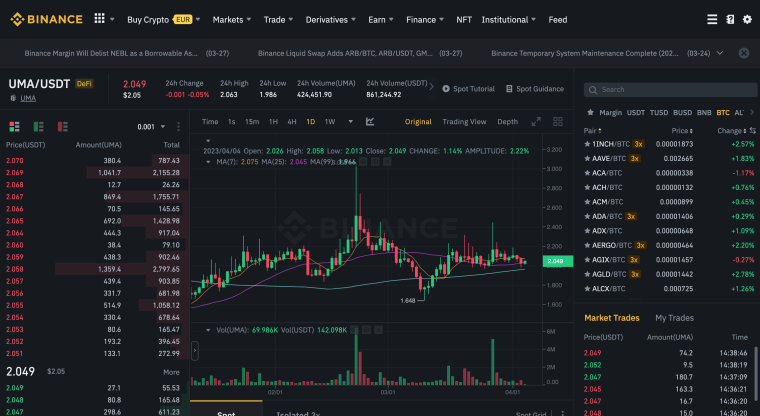

4. Binance: Trade UMA with a 0.10% Maker / Taker Fee

Binance listed UMA on 8th September 2020 – two days before Coinbase – and opened trading for UMA/BTC and UMA/USDT pairs.

A week later, both of these trading pairs were added to the list of isolated margin pairs – Binance users can spot trade or margin trade on leverage, i.e. long UMA or short UMA.

The UMA price pumped 20%, from $15 to $18 three days after UMA was listed on Binance.

Binance leads the crypto market in the number of tokens listed and the number of active customers, with over 600 crypto assets listed and over 100 million users. US users can only invest in crypto through Binance.US, which has listed a little over 100 crypto assets, excluding UMA.

Binance has the lowest trading fees among all the crypto trading platforms. Users can buy UMA at just a 0.10% trading fee. The cost can be reduced even more if the investor pays using Binance Coin.

Investors wanting to earn passive income from their crypto holdings can choose Binance Earn, which offers up to 35% APY. It offers Savings, BNB vault, Auto Invest, staking, yield farming, and other ways to earn through crypto holdings.

The only downside of this platform is the interface. Binance was designed keeping the institutional users in mind – making the user interface too advanced for beginners.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

What is UMA?

UMA or Universal Market Access is a DeFi protocol to create globally accessible financial markets. Users can use the framework UMA provides to create synthetic derivatives using the Ethereum Protocol. Simply put, users can leverage UMA to enter into a financial contract that removes the need for any centralized entity to enforce that contract.

The UMA project was created as a way to add inclusivity to the financial markets that are not accessible. For instance, in TradFi, users must start a brokerage account, complete the KYC process, go through Anti Money Laundering regulations and pass the investor suitability check to open a spot position. Since investors need to trust their broker to manage any risks, the chances of losses are high. Such an ecosystem isn’t conducive to those new to the financial markets.

Another reason for creating UMA was the limited number of derivatives available in the markets and the large amount of paperwork involved in trading those derivatives. With UMA, such complicated issues are removed as it creates a contract purely governed by code.

UMA defines an open-source protocol, allowing any parties to create their own financial contracts. Each contract has five components:

- Public addresses of all counterparties

- Margin accounts for all the counterparties

- Economic terms to calculate the values

- Smart contract functions to maintain the margin balance

- An Oracle providing a secure and verified off-chain date

These factors combine to ensure that smart contracts created are enforced in a secure and trustless manner.

UMA Founders

Uma is the brainchild of two Goldman Sachs Traders, Allison Lu, and Hart Lambur. Their idea was to transfer the risk across the internet without involving any centralized authority.

Hart Lambur is a Columbia University Graduate with a computer science degree. Before co-founding UMA, she worked as a government bond trader at Goldman Sachs.

Allison Lu is an MIT alumnus, having received degrees in Economics and Management. Before co-founding Risk Labs, the company that developed Universal Market Access Protocol, she was the vice president at Goldman Sachs. She has been an advisor at One Daijo, an Ethereum-based P2P lending platform.

UMA Token

UMA Token

The UMA token is the ERC-20 token on the UMA protocol, acting as its utility asset. It has an initial supply of 100 million, and the distribution is divided as follows:

- 2 million tokens were the part of initial Uniswap listing

- 5 million tokens were dedicated for future sales

- 35 million tokens were devoted to developers and users of the UMA protocol

- The remaining 48.5 million tokens were distributed among the founders, investors, and early contributors.

The UMA token has three utilities: a governance token, a way to settle disputes on the UMA protocol, and fees to burn to control the supply of tokens.

IS UMA a Good Investment?

UMA protocol seeks to make an inclusive financial ecosystem that doesn’t rely on centralized authorities to enforce the terms of the contract. Many are bullish on UMA, going as far as saying that it is the best crypto project executed in the right manner and with a clear development plan and roadmap.

Voters can vote on proposals using UMA tokens to improve the UMA protocol. These voters get part of the inflationary rewards – 0.05% of the token supply.

The tokens are used to vote on disputes. However, here the cost of voting is higher than voting on proposals for improvement. It ensures that no whales can manipulate the on-chain oracle – something that has been the case in the past for many premier DeFi cryptos.

Because of the presence of an on-chain oracle, UMA is different from other DeFi Protocols like Synthetix, which rely on off-chain oracles like Chainlink. Also, on-chain priceless oracles allow users to create smart contracts with an inexhaustive range of price feeds, such as exotic currencies, commodities, equities, etc.

Risk labs’ venture capital investors include Two Sigmas, Blockchain Capital, Box group, Dragonfly Capital, Place Holder VC, and Coinbase Ventures.

These factors make UMA a suitable crypto investment.

UMA Price

During the initial distribution of UMA, 2 million tokens were sold through Uniswap DEX. The token was sold at 26 cents back then, but things changed after UMA got listed on Coinbase. This resulted in the first UMA pump, which happened in September 2020. The UMA price rallied by 100x and reached almost $25. As is common with all altcoins, the price corrected shortly after that pump, bottoming at $6 by the beginning of October 2020.

The UMA price then accumulated for several months until the end of January. Now it was due to the Crypto.com platform, which announced adding support for UMA. That led to the token reaching its all-time high at $44 in February 2021. The ATH level was tested in April, five days after the token was listed on Bitstamp.

Signs of major correction started in May 2021, and the price bottomed at $7.8 in July. The second major pump of 2021 happened in November with the launch of the Across Protocol, which UMA described as the “fastest, cheapest, and most secure L2 to L1 bridge.”

UMA Coin All-time Price Performance, Source: coinmarketcap.com

That would be the last pump the UMA token would experience, as the UMA price has followed a downward path since then. UMA opened in 2022 at $9.2 and, like all altcoins, suffered from the 2022 bear market. It may have found a bottom on 12th June 2022 when it hit just under $2 before bouncing.

UMA prices surged to $3.79 in August 2022 but another downtrend started in the crypto market which led to the coin’s price drop to $1.49 by the end of the year. UMA started 2023 with a price of $1.5 but recovered slightly due to the overall uptrend of the cryptocurrency market.

At the time of writing, UMA Price today trades sideways between $2.03 and $2.10 with a 24-hour trading volume of $6.8 million. The token currently ranks #139.

UMA Price Prediction

The UMA token has recovered by almost 40% since its all-time low in 2022. The bear market pushed the token down to as low as $1.49, based on the CoinMarketCap data, which coincided with Bitcoin crashing. Looking at its price history, we can notice that UMA has taken advantage of pumping during all the bull markets peaking at new highs.

It also didn’t crash during the recent “crypto winter” and has a 38% YTD return rate so far. The UMA price action creates a symmetrical triangle – signaling a breakout. While the price could lose support and retrace further, if UMA breaks out from the upper trendline, there is potential for high percentage gains.

Let’s see what some algorithm-based analytical platforms predict about the future price of the UMA coin. We have explored three such platforms, of which only Wallet Investor gives negative projections. According to it, UMA will take a bearish direction, and in 1 year, its price can drop from $2.08 to $0.39, losing almost 81% of its value.

According to Price Prediction’s platform, UMA prices will grow over 2023 at an average price of $2.68. UMA’s maximum price for 2023 can reach $2.96 and the minimum price can be $2.6. The projections indicate UMA can hit $5 in 2025, possibly reaching as high as $6.77. Price Prediction shows a drastic growth for the UMA coin in the next few years. According to the platform, UMA’s average price will reach $36 in 2030.

While Digital Coin Price predicts that UMA will be traded above $4 in 2023 it is less optimistic about the UMA price than Price Prediction in a more long-term perspective. It indicates UMA will reach $5 in 2024 but it will be traded below $30 by the year 2032. It is important to note that these predictions are based on calculations and any other factors can spring up in the future to affect the UMA price so be cautious with your investment.

Best Ways to Buy UMA

Below are the different ways to buy UMA through crypto platforms:

Buy UMA using a Debit/Credit card

Crypto.com is the best option to buy UMA using a debit or credit card. The fee is low compared to Coinbase and Crypto.com, and the transaction speeds are generally high.

Buy UMA using Paypal

PayPal good option for those who want to buy UMA without putting much effort into repeatedly entering details.

Also see our guide to buying crypto on Paypal.

Buy UMA Without ID

Changelly allows crypto swapping without the need to provide an ID. You can also check out the Bybit exchange. It provides the same services with no documents requirement.

How to Sell UMA – Full Tutorial

Once you have bought UMA tokens, you can check your open positions on your dashboard. To close your position on UMA, click on the red cross on the right side and click on the “Close trade” button.

The process is the same for any cryptos you hold on the trading platform

Conclusion

Universal Market Access came to the market with the radical idea of creating an inclusive financial market without the need for an intermediary. While the token has been in a bearish downtrend during most of previous year, it shows signs of recovery in early 2023, along with the increase of Bitcoin. So, there is a probability that the coin can generate high returns with another bullish market run.

UMA Token

UMA Token