The native token of the Tezos cryptocurrency project, XTZ, is in a deep bear market currently. It is almost 90% down compared to its all-time high and almost 70% down compared to its initial price. While many traders consider XTZ rather a risky investment, others think that buying Tezos right now will bring you huge rewards considering its potential for growth.

In this guide, we will take a closer look at Tezos coin, find out how its platform works, and what it tries to achieve in the cryptocurrency space. We will also examine Tezos’ market performance and where and how to buy this coin with low fees.

How to Buy Tezos (XTZ) – Quick Guide

- Step 1: Create an account – To create an account on your chosen platform you’ll need an email address and to provide some basic details.

- Step 2: Verify your identity with the exchange – Also called the KYC or Know Your Customer process, verification requires uploading a copy of your photo ID and proof of address.

- Step 3: Depositing funds – Once your account is created, you will be required to deposit funds in it to buy Tezos. You can deposit local currency from a bank account, Paypal, e-wallet or credit card, or transfer crypto from another wallet.

- Step 4: Buying Tezos – Search for ‘Tezos’ or ‘XTZ’ in the menu, click it, then select ‘Trade’ and ‘Open Trade’ if you’re happy about the Tezos price today. Or review the XTZ price chart and set a limit order for a lower price to buy XTZ at.

Where to Buy Tezos Coin?

As it’s a popular altcoin, you have a variety of choices if you plan to buy Tezos crypto coins. It’s been listed at most of the best crypto exchanges in the USA.

Below we’ve picked out four of the best platforms to buy Tezos and invest in Tezos, as they each also provide a free secure crypto wallet to store your XTZ, and even stake it for passive income.

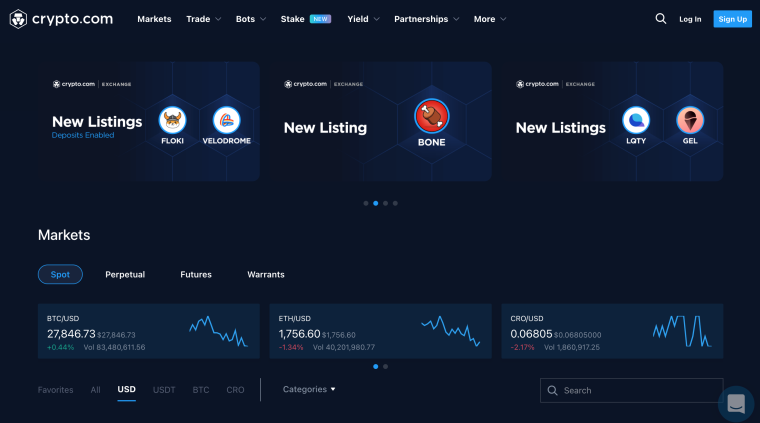

1. Crypto.com – Earn Interest on Tezos

Crypto.com listed XTZ in August 2019. It’s one of the most popular online cryptocurrency exchanges in the market right now due the ability to earn interest on crypto, and put crypto assets on its prepaid metal VISA card to use for retail purchases.

After you have gone through the steps of opening a Crypto.com account and verified your identity, you will be able to buy Tezos coin with a debit card. Crypto.com offers a super-convenient way to invest, as both Visa and MasterCard are acceptable.

Apart from Tezos, Crypto.com houses more than 250 other digital assets also, which include a wide variety of small, mid, and large cap crypto projects, and DeFi tokens.

There’s also a Crypto Earn part of the website where you can earn interest on stablecoins or cryptos. You can earn 5% per annum interest on Tezos if you commit to three month fixed terms and stake CRO, the native token of the exchange, which like XTZ has been in an uptrend.

Cryptoassets are a highly volatile unregulated investment product.

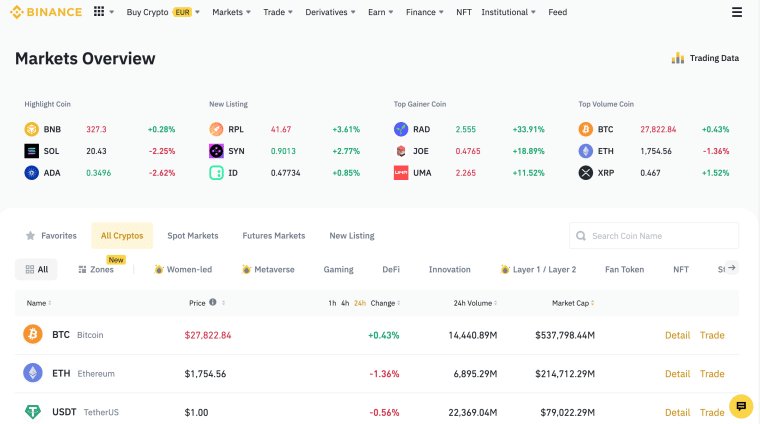

2. Binance – Buy Tezos with Crypto at Just 0.10% Per Trade

When you trade Tezos against a supported digital asset like Bitcoin, Ethereum, BNB, or USDT, Binance will only charge a 0.1% trading fee or less if you buy Binance coin to use to pay fees.

This nominal charge, though, is only on the condition that the customers have the ability to deposit funds in crypto. Binance also lets its users deposit funds via ACH and domestic bank wire for free. However, customers must remember that although ACH withdrawals are not chargeable, domestic wire transfers are chargeable for every cash-out request.

Signup via our Binance referral link for a further discount on fees and unlockable cashback vouchers.

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Buy Tezos Instantly & Stake Tezos

Favored by beginners as it has an instant buy button that just requires one mouseclick without any confusing order types, candlestick charts and a whole exchange platform, Coinbase is another of the best places to buy Tezos. It listed XTZ in August 2019.

Using the main Coinbase platform to buy Tezos or buy crypto in general – Coinbase exchange supports over 100 cryptos – is on the expensive side for that convenience. It charges 3.99% for buying Tezos with a debit card, and 1.49% with a bank account. To avoid those fees you can use Coinbase Pro and pay a low fee of 0.5%.

The Coinbase Pro platform can be logged into using your Coinbase credentials and you can transfer crypto and fiat money between the two platforms seamlessly with no fees. Coinbase is more of a broker, whereas Coinbase Pro is an exchange where you have more control over the exact Tezos price you buy at, and the price you sell Tezos at when exiting your position.

The 0.5% trading fee on Coinbase Pro can be reduced further if you have a high trading volume in the last 30 days and use limit orders rather than market orders.

Coinbase is a top crypto staking platform as well as a brokerage and exchange, and their exact interest rate for Tezos is 4.63% APY.

Cryptoassets are a highly volatile unregulated investment product.

What is Tezos?

Tezos is a decentralised open source blockchain that may be used to conduct P2P (peer to peer) transactions and as a platform for smart contract deployment. The Tez, abbreviated as XTZ, is the native coin of the Tezos network.

The blockchain is community-governed and can execute complicated smart contracts for asset settlement and decentralised apps (dApps) that benefit from censorship resistance, decentralisation, and user control.

Tezos was first proposed in 2014 by Arthur and Kathleen Breitman, a husband-and-wife duo. Launched in 2017, the Tezos foundation managed to raise $230 million in BTC and ETH in what was one of the largest ICOs (initial coin offering) in history, at the time.

Proof-of-stake is used by the Tezos network to gain consensus. Tezos has an on-chain governance architecture that allows the protocol to be updated when community members approve upgrade proposals. Tezos is able to avoid hard forks as a result of this.

It launched its testnet in June 2018 and its mainnet in September 2018. On the Tezos network, 400 nodes are put in place to validate blocks (called bakers).

Tezos’ main protocol uses liquid proof of stake (LPoS) and supports Turing-complete smart contracts written in Michelson, a domain-specific language. Michelson is a totally functional stack-based language with a small instruction set and no side effects, specifically developed for formal verification.

The Tezos protocol can be changed through a phased procedure that involves committing operations to the stored blockchain in order to submit proposals (intended code modifications) and voting on them. If a proposal wins enough votes, the protocol automatically adjusts to reflect the changes in the code.

Tezos Analysis

Everyone has heard of Bitcoin and Ethereum, but what makes Tezos unique and a challenger to those more established cryptos and blockchain platforms?

1. Self-Amendment and Upgradability

Without the requirement for a hard fork, Tezos can upgrade itself through an in-protocol amendment process. This method of upgrading speeds innovation, minimises the possibility of controversial splits, and brings together stakeholders within the Tezos community over time. Upgradability provides a strong assurance to developers developing on Tezos that the protocol will continue to run properly in the future. Tezos was designed to last a long period.

The proposal amendment process has the potential to change anything, including Tezos’ amendment mechanism. In reality, Granada’s recent proposal is to replace Emmy+, the current Tezos consensus algorithm, with Emmy*, a new consensus algorithm.

Emmy* is intended to cut Tezos block delays in half, from 60 seconds to 30 seconds, and enabling transactions to reach finality faster than the existing consensus method. Granada also has liquidity baking and a number of significant performance enhancements, all of which result in significantly lower gas use.

2. Proof-of-Stake

Tezos is based on a decentralised network of nodes, similar to other cryptocurrencies. These Tezos “participants” or nodes supply the computational resources required to keep the Tezos network available and secure.

Proof-of-Stake (PoS) is the method through which Tezos users come to an agreement on the current state of the blockchain. The consensus mechanism in Bitcoin, on the other hand, is based on proof-of-work (i.e. mining).

Baking is Tezos’ proof-of-stake-based consensus process, which includes optional delegation, allowing any stakeholder to participate in consensus without relinquishing possession of their tokens. Liquid Proof of Stake is the name given to Tezos’ approach to consensus.

Without any lock-in or freeze mechanism, Tezos allows its stakers or delegators can receive rewards by delegating their Tez currencies. Tezos’ proof-of-stake implementation has a “liquid” aspect as a result of this.

Improved scalability and encouragement to incentive alignment are two of the most major benefits of Proof-of-stake. It also raises the cost of 51 percent attacks and eliminates the wasteful proof-of-work process. Tezos was one of the first significant Proof-of-Stake networks, launching in June 2018. Tezos has about 425 bakers and more than 216 public delegation services in all six major continents.

3. Smart Contract Security and Formal Verification

Tezos and Michelson, its smart contract language, were built with security and formal verification in mind. Developers can use formal verification to mathematically show that code runs as expected based on its formal specification or certain attributes.

This is ideal for financial smart contracts that have significant real-world value (e.g. tokenized assets, loans, etc.) and require assurances that funds will not be lost or frozen due to code faults.

Tezos Price

At the time of writing, Tezos is experiencing a bear market and is traded at $1.14 with a YTD return rate of 30%. Tezos entered a deep decline phase after hitting its all-time high in October 2021 as the whole crypto market was experiencing a downtrend. Tezos’ price continued to drop during 2022 reaching as low as $0.7.

Tezos All-time Price Performance, Source: coinmarketcap.com

However, the cryptocurrency started the year 2023 with a price of $0.71 and has slightly recovered hitting $1 again. It’s the 49th largest crypto currently with a market cap of over $1 billion according to the data by CoinMarketCap. The total volume of Tezos traded in any 24-hour period usually exceeds $16 million. The circulating supply of Tezos is almost 932 million XTZ coins.

Tezos Price Prediction

If we consider the fundamental analysis, the native token of the Tezos blockchain has good potential for growth. The XTZ price has room to grow if it can prove its use case as a more eco-friendly alternative to BTC and ETH that doesn’t require hard forks and enter the top 10 cryptos, which would mean a market cap of over $25 billion.

Tezos is currently among the 50 largest cryptocurrencies, with a market capitalization of $1,058,418,731 and a circulating supply of 931,957,813 XTZ. Its trading price at the time of writing is $1.14, which is quite low compared to its historic all-time high. The fact that Tezos survived a bear market in 2019 gives hope it can survive this one. Still, make sure to do your own research before putting money into this project, as it can be quite a risky investment.

Looking at the future price projections by AI-based platforms, we see some controversial results about the future price of the XTZ coin. While Price Prediction and Digital Coin Price indicate that XTZ will gradually increase over the years, Wallet Investor predicts that this coin’s price can drop from $1.14 to $0.2 in a year.

Update – see our more recent Tezos price prediction.

How to Buy XTZ

Anyone who has been planning to buy cryptocurrency at low prices in 2023, shall not be disappointed as the markets have corrected from their 2021 highs. Don’t delay though as many altcoins are beginning to bounce hard as of early 2023.

Tezos can be bought on any of the cryptocurrency exchanges listed in this article. These are specialised marketplaces that act similarly to stock trading platforms and allow you to purchase and sell cryptocurrencies.

How to Sell Tezos?

It all comes downs to your personal investment strategy. Depending on that, you may want to sell your Tezos tokens after a few weeks, months, or even years after your purchase. The best part about it is that if you followed our step-by-step guide and decided to buy Tezos coin your tokens will remain in your portfolio until the time you decide to sell them.

Conclusion

Tezos was one of the most promising cryptocurrencies in recent years and is holding its value so far in 2023. If you’re looking to buy Tezos to add it to your portfolio right now, it will just take five minutes at a crypto platform.

FAQs

Where can I buy Tezos crypto?

Should I buy Tezos?

Is Tezos on Binance?

Is Tezos on Coinbase?