Update – Luna dropped 99% due to a black swan event, and a hard fork was implemented. The old coin was renamed to Terra Classic (LUNC) and the buying guide below still applies for eToro. The second coin, Terra (LUNA) has now been listed on Crypto.com.

Terra Luna is a relatively new blockchain and cryptocurrency that checks a lot of boxes for cryptocurrency investors. It lets you stake your cryptocurrency to earn interest, makes it easy to create new stablecoins, and has garnered attention amongst the DeFi community. However, after the recent de-pegging of Terra’s USD stablecoin, can it still be considered a viable investment opportunity?

With that in mind, we’ll explain in detail how you can buy Terra Luna today and review the top crypto exchanges that offer Luna. We’ll also help you decide whether Terra Luna is a good investment and cover the coin’s recent price movements.

How to Buy Terra Luna – Quick Steps

Want to buy Terra Luna right away? You can get started in just 4 simple steps:

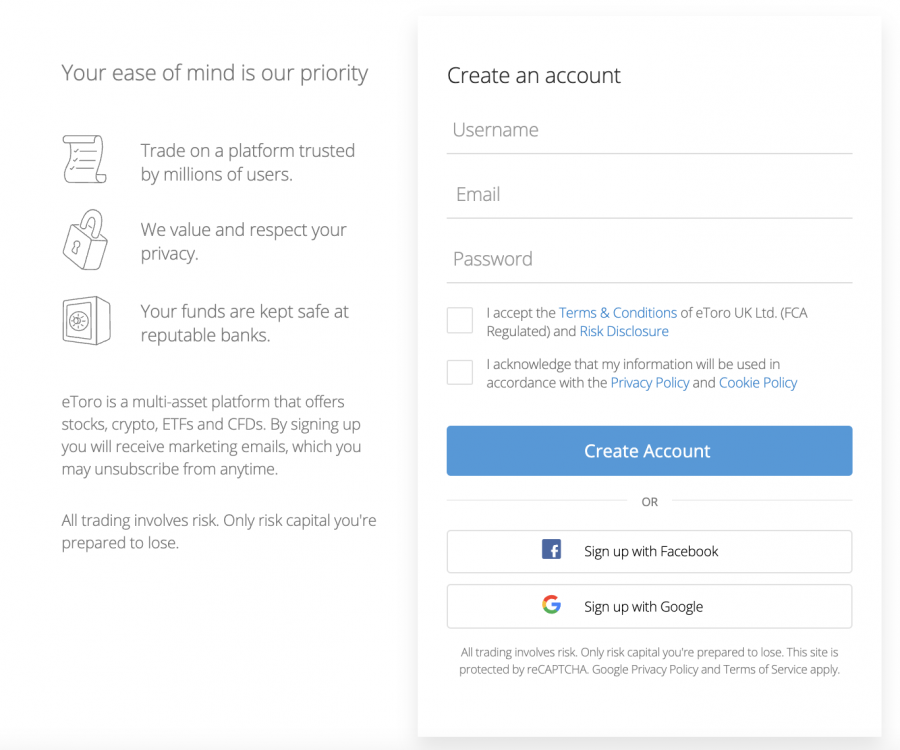

- Step 1: Open an account with eToro. eToro is our top-rated crypto exchange to buy Terra Luna. Head to eToro’s website and create a free account.

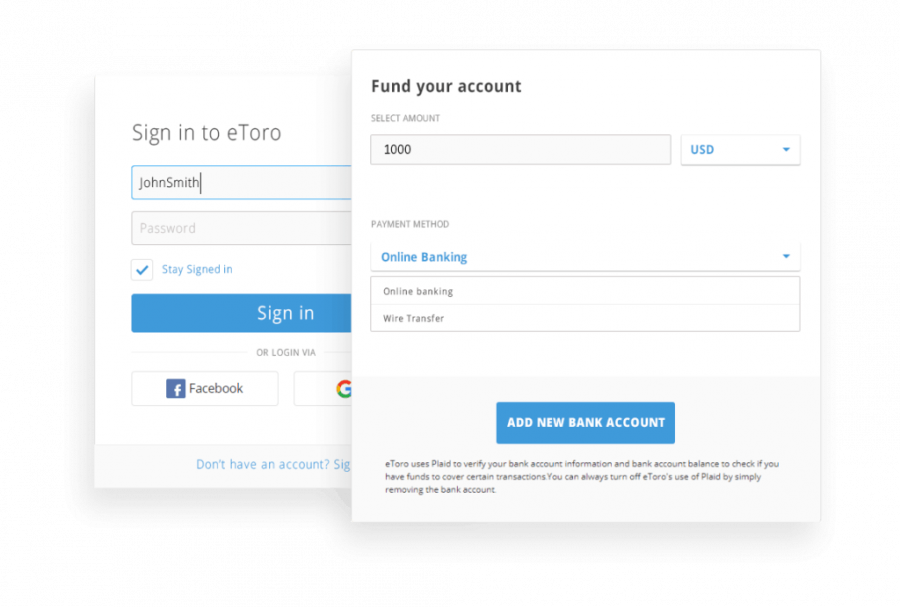

- Step 2: Deposit. eToro requires a minimum deposit of $10 – depending on your home country – which you can make by debit card, Neteller, Skrill, or bank transfer.

- Step 3: Search for Terra Luna. Search for LUNA and click Trade when it appears to open a new order form.

- Step 4: Buy. Enter the amount of Terra Luna you want to purchase, then click Open Trade.

Where to Buy Terra Luna

In order to buy Luna coin, you’ll need a crypto exchange that offers this new cryptocurrency. Given its popularity, most major exchanges now offer Terra Luna. So, you can pick the best exchange based on price, investing tools, ease of use, and more. We’ll review our 4 favorite crypto exchanges you can use to invest in Terra Luna today.

1. eToro – Overall Best Exchange to Buy Terra Luna

eToro is our top-rated crypto exchange that you can use to buy Terra Luna token today. eToro is one of the only major exchanges that lets you buy Terra Luna with a debit card without additional processing fees. It also supports e-wallets like Neteller, and Skrill to make it easier to buy cryptocurrency.

Another benefit to eToro is that it has relatively low trading fees. You can buy Terra Luna for only 1% per purchase (plus the spread). This ensures that you know exactly how much you’ll be charged for each transaction.

While eToro’s fees are attractive, it’s the investing tools this exchange offers that really set it apart. eToro offers user-friendly technical charts, expert insight into the crypto market, and a crypto news feed to help you stay on top of the market. In addition, the platform has a built-in social network where you can connect with other crypto investors and share trade ideas. Finally, for investors who want to take a hands-off approach to trading crypto, eToro offers copy trading.

eToro lets you store your Terra Luna right inside your exchange account, but you can also transfer coins to the eToro Money crypto wallet for safekeeping. The wallet app is free and easy to use, and it integrates seamlessly with the eToro exchange for simple coin swapping.

Pros:

Cons:

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

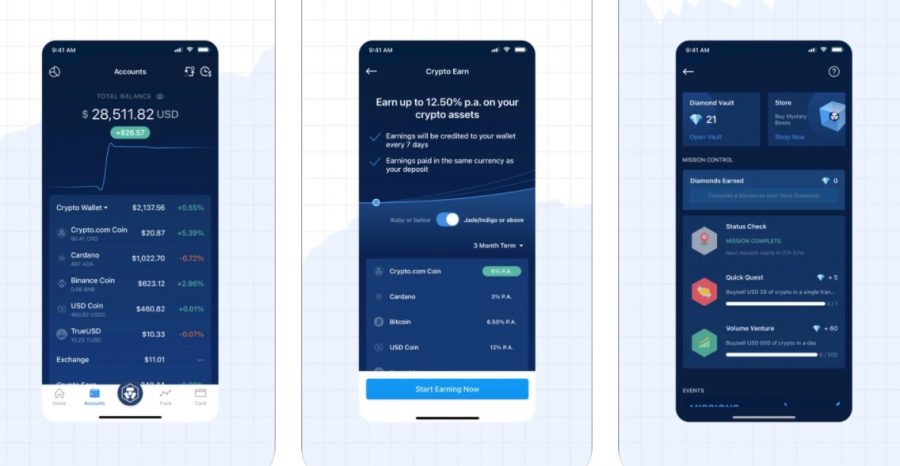

2. Crypto.com – Lowest Fees to Buy Terra Luna Token

If you want to buy Terra Luna with a credit card, transaction fees are 2.99%. While that’s a lot more than eToro charges, it’s very affordable compared to other top crypto exchanges.

Crypto.com also stands out for offering a huge number of different ways to interact with Terra Luna once you own coins. You can store them in Crypto.com’s mobile wallet, which is available for free for iOS and Android devices. You can also lend out Terra stablecoins to earn up to 3% APY. If you want to earn even more, Crypto.com offers a Visa rewards crypto credit card that pays out up to 8% on your transactions, depending on which tier you are part if.

Pros:

Cons:

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Most Beginner-friendly Exchange to Buy Luna

The catch, however, is that Coinbase has some of the highest instant buy fees of any major exchange. You’ll pay a 3.49% processing fee when you buy Terra Luna with a credit card or debit card, and a 1.49% fee when you pay with a bank account. Coinbase does offer spot trading, which is significantly cheaper, but its 0.50% transaction fees are still higher than most competing services.

If you’re willing to overlook Coinbase’s prices, the exchange has a lot of other things going for it. Coinbase has one of the most secure and trusted software wallets around, and it has a built-in marketplace of decentralized apps to help you make the most of your cryptocurrency. Coinbase also offers crypto lending serivces, borrowing, and staking. You cannot lend out either Terra or Luna at this time, but you can stake your Luna to the Terra blockchain to earn rewards.

Pros:

Cons:

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Best Exchange for Trading Terra Luna

The Binance trading platform offers customizable technical charts with dozens of built-in indicators. You can set price alerts, monitor crypto market news, and even track the Terra Luna order book to stay ahead of changes in trading momentum.

On top of that, Binance charges just 0.10% per buy and sell order. That’s already one of the lowest transaction fees we’ve seen, but you can also qualify for discounts based on trading volume or for holding BNB, Binance’s native cryptocurrency.

Binance has numerous features for decentralized finance, too. You can stake Luna, lend out your Terra stablecoins, and run decentralized apps inside the Binance Trust wallet.

Pros:

Cons:

Cryptoassets are a highly volatile unregulated investment product.

What is Terra Luna?

The Terra blockchain includes two distinct cryptocurrencies: Terra and Luna.

Terra is a stablecoin that tracks a particular fiat currency. In fact, there are multiple versions of Terra. TerraUSD tracks the US dollar, TerraGBP tracks the British pound, and so on for dozens of fiat currencies.

Luna is the governance token for the Terra blockchain, as well as the coin that is mined when transactions are validated on the Terra blockchain. Importantly, Luna helps keep the prices of Terra stablecoins consistent.

This system was designed to work flawlessly, making Terra what’s known as an ‘algorithmic stablecoin’. Although the Terra network had worked well, many market commentators had expressed their concerns about these types of stablecoins since they aren’t backed by FIAT currency or physical assets like gold.

Instead, algorithmic stablecoins are kept stable through an advanced computer program which automatically mints and burns LUNA to keep Terra’s stablecoins pegged to their partner currency. For example, since TerraUSD should theoretically be valued at $1, if the price were to decrease to $0.95, the program would burn a set number of tokens to make the remaining tokens scarcer – driving the price back to $1.

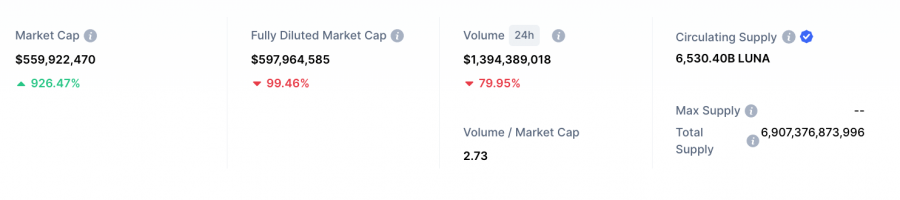

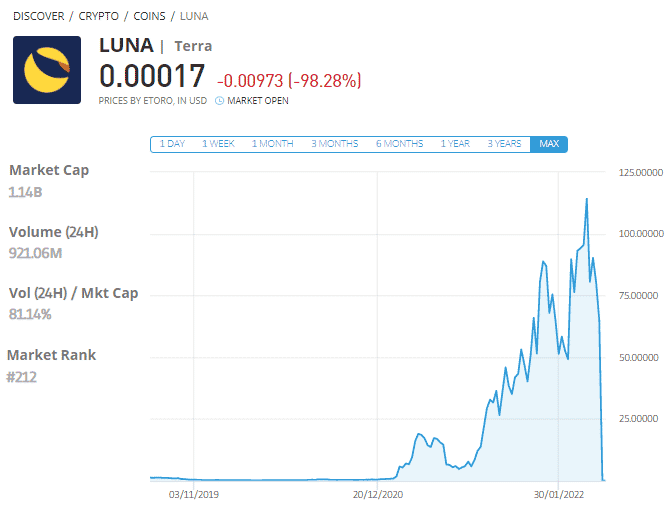

However, the whole system came crashing down in May 2022, when the supply of LUNA spiked, causing TerraUSD to ‘de-peg’. The algorithm behind the stablecoin could not resolve this issue, causing panic amongst investors. This panic led to a massive sell-off of LUNA, resulting in the coin losing a remarkable 99% of its value.

Thus, LUNA has gone from being one of the best altcoins to one of the worst performers in the crypto market’s history. This situation has likely damaged investors’ faith in the Terra ecosystem forever, meaning that even if TerraUSD were to re-peg, the trust would not be there anymore. Given this fact, many market commentators believe that this could be the death knell for the Terra network.

Is Terra Luna a Good Investment?

Terra Luna has gained the attention of crypto investors over the past few years, but is it a good idea for you to invest in Terra Luna right now? Here are some of the key reasons why this digital asset stands out and why many investors are looking to buy this cryptocurrency right now.

Volatile Price Effects

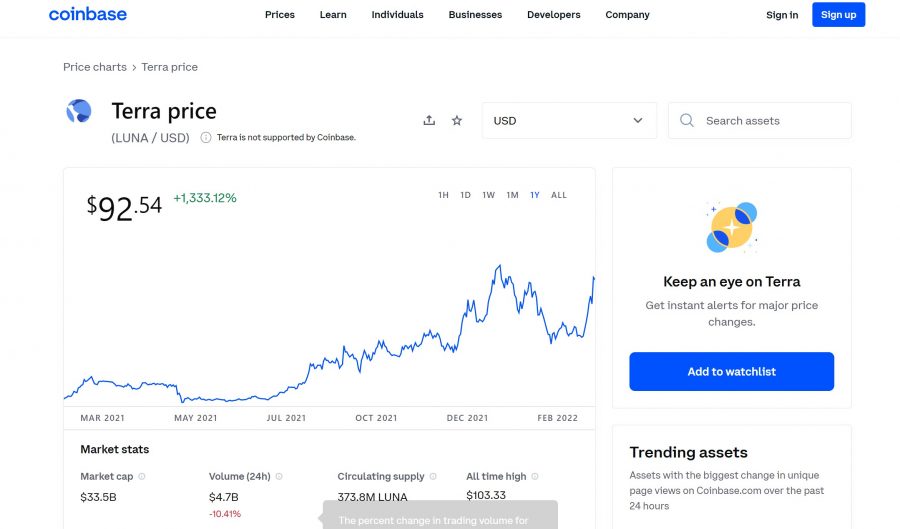

Terra Luna was one of the hottest cryptocurrencies on the market in 2021. It gained roughly 14,000% over the course of the year, which is astonishing even by the standards of fast-growing cryptocurrencies.

That explosion of value shows just how excited investors are about Terra Luna. While the crypto has tumbled by 99% over the past few weeks, there are still investors who believe LUNA could regain its value if TerraUSD were to re-peg. Time will tell whether this happens, although it’s likely that Terra’s reputation will be damaged irreparably.

Excellent Interoperability

Terra Luna has made interoperability across blockchains and payment systems a core tenet of its platform. Terra the platform recently inked a high-profile deal with Chainlink, making it easier for smart contract developers on Terra to access reliable price feeds and other critical data.

The more deals that Terra can make like this, the more important the Luna token will become throughout the world as one of the best decentralized finance coins. In turn, this could help Terra rebuild confidence amongst investors.

Growth of Decentralized Finance

Speaking of decentralized finance, this is an area where Terra Luna held a ton of promise. Terra stablecoins were designed to be price stable, making them suitable for a wide range of traditional financial applications, including lending and borrowing. Given recent events, this has shaken faith in Terra’s ability to work within the DeFi sector. If Terra can rebuild investors’ confidence, we could see the token grow once more.

Earn Interest from Staking

One of the nice things about Terra Luna is that the price of the Luna token doesn’t necessarily have to increase for investors to make money. The Terra blockchain operates using a Proof of Stake (PoS) transaction verification algorithm, which requires Luna to be staked to the blockchain for transactions to be processed.

Crypto staking platforms let you earn rewards every time a transaction is verified. In effect, you earn interest on Luna tokens just for holding Luna.

Opportunities for Arbitrage

You can also take advantage of Terra Luna’s structure to find opportunities for arbitrage. When the price of TerraUSD, for example, rises above the price of USD, you can burn Luna to mine TerraUSD and then sell it for more than its face value.

As we now know, this system wasn’t as ‘foolproof’ as expected. However, given that TerraUSD is still trading well below $1, there’s certainly scope for it to re-peg and return to $1 – meaning there may be an arbitrage opportunity at present.

Terra Luna Price

Terra Luna’s price has been on a wild ride over the past year. At the start of 2021, the Luna token was worth less than $1. By the end of the year, it had reached nearly $100 per token.

Terra Luna then started off 2022 on a poor footing, sliding to a low of around $47 per Luna coin by the end of January. After rising into early April, the price of LUNA plummeted by 99%, following the de-pegging of TerraUSD. At the time of writing in May 2022, LUNA is now trading at $0.0119.

This has given LUNA a market cap of only $328 million, making it the 215th largest crypto in the world.

Terra Luna Price Prediction

Price predictions for Terra Luna vary widely, although the bull thesis is highly risky, given current events. Considering that Terra is now 99% below April 2022’s highs, it’s hard to make any assumptions based on technical analysis. There is certainly a chance that LUNA could go all the way to $0, thereby evaporating the Terra ecosystem. However, we may also see rapid rebound if TerraUSD were to re-peg – meaning that ‘anything could happen’ is undoubtedly a true statement.

Ways of Buying Terra Luna

When it comes to how to buy Luna crypto, there are a couple different options. Here, we’ll take a look at the most popular ways to buy Luna.

Buy Terra Luna with PayPal

You can buy Terra Luna with PayPal at certain crypto platforms. All you have to do is make a deposit to your exchange account using funds from PayPal.

It’s worth noting that PayPal does have its own crypto exchange. However, it does not offer Terra Luna and there is no way to send your crypto to an external wallet, so there is no way to buy Terra Luna through PayPal directly.

Buy Terra Luna with a Credit Card or Debit Card

Most major crypto exchanges let you buy Terra Luna with a credit card or debit card. The catch is that many of them charge high fees that can run to 4% or more of your purchase. We recommend using an exchange like eToro that doesn’t charge any additional processing fees when you fund your account with a or debit card. eToro also provides a top crypto app, meaning you can buy cryptos and manage your portfolio conveniently and safely directly via your smartphone or tablet.

Best Terra Luna Wallet

In order to safely store your Terra stablecoins or Luna cryptocurrency, you’ll need a crypto wallet. Top crypto wallets work a little like traditional bank accounts – they’re centralized hubs for storing all of your cryptocurrencies and sending and receiving crypto. In addition, many crypto wallets support decentralized financial applications like saving and lending.

There are several different types of wallets you can use to store Terra Luna. Hot storage wallets, many of which are software wallets, are connected to the internet, making them easier to use. Since they’re already connected – and often integrated with a crypto exchange – you can buy, sell, send, and receive crypto at any time. However, hot wallets are more susceptible to hacks since they are always connected.

Cold wallets, most of which are hardware wallets, are more secure since they are disconnected from the internet most of the time. However, they can be somewhat cumbersome since you have to connect them anytime you want to interact with your cryptocurrency.

If you’re looking for the best wallet to store Terra Luna, we recommend the eToro Money wallet app. This free wallet is available for iOS and Android devices and is capable of storing hundreds of different cryptocurrencies, not just Terra Luna. It’s connected to the eToro crypto exchange, making it easy to buy, sell, and swap cryptocurrencies. Plus, the eToro Money app is highly secure.

You can download the eToro Money app today from the Apple App Store or Google Play.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

How to Buy Terra Luna – Tutorial

Now that you know where to buy Terra Luna, it’s time to get started. We’ll walk you through the process of buying Luna at eToro, our top-rated exchange for 2024.

Step 1: Open an eToro Account

Head to eToro’s website and open a free account. Enter your email and select a username and password. Then fill in details like your name, address, and phone number. You will also need to upload a copy of your driver’s license or passport to verify your identity.

Step 2: Deposit Funds

You can make a deposit by debit card, Neteller, Skrill, or bank transfer. However, keep in mind that when depositing via bank transfer the minimum deposit becomes $500.

Step 3: Search for Terra Luna

Head to your eToro dashboard and enter LUNA in the search box. When Terra Luna appears, click Trade to open a new order form.

Step 4: Buy Terra Luna

Enter the amount of Luna coin you want to purchase in US dollars. You can opt to set a stop loss or take profit level for your trade, or leave these blank if you are investing in Luna for the long-term. When you’re ready, click Open Trade to complete your purchase.

How to Sell Terra Luna

You can sell Terra Luna in the same way you bought it – through an exchange. All of the exchanges where you can buy Luna coin also allow you to sell Luna.

Typically, the process is the same as for making a purchase, except that you select the sell option rather than the buy option. Funds from your sale will be available in your exchange account and can be used to buy another cryptocurrency or withdrawn.

Conclusion

We reviewed where to buy Luna crypto and whether LUNA is a good buy – only invest what you can afford to lose as despite its low price point after the crash, it’s still volatile. If you’re ready to invest in Terra Luna, you can buy Luna at eToro with low trading fees. It was relisted by eToro on May 19th 2022.