Storj coin (ticker symbol STORJ) is an ERC-20 Ethereum token that powers the decentralized cloud storage network called Storj DCS. That platform allows users to rent their hard disk spaces to others connected to the wider Storj network.

This guide will explain the background of the Storj crypto project, plus where and how to buy Storj coin. We also review whether Storj is a good investment and make some predictions for the Storj price.

How to Buy Storj Coin – Quick Guide

To invest in Storj, follow these steps:

- Step 1: Create an account: Visit the website of your preferred broker. Create an account using the quick sign up process. Provide an email address and upload the required KYC documents.

- Step 2: Deposit: Make deposits via fiat currencies using payment modes such as credit/debit card, PayPal, Bank transfer or eWallet.

- Step 3: Search for Storj coin: Go to the search bar and enter “Storj”. Click on the “Trade” button.

- Step 4: Buy Storj: The final step is to enter the amount you want to invest in Storj. Then press “Open trade” to confirm the buy order.

Where to Buy Storj Token – Best Crypto Platforms

Storj can be purchased on several premier crypto exchanges. Below are the three best platforms to invest in Storj tokens or other crypto assets.

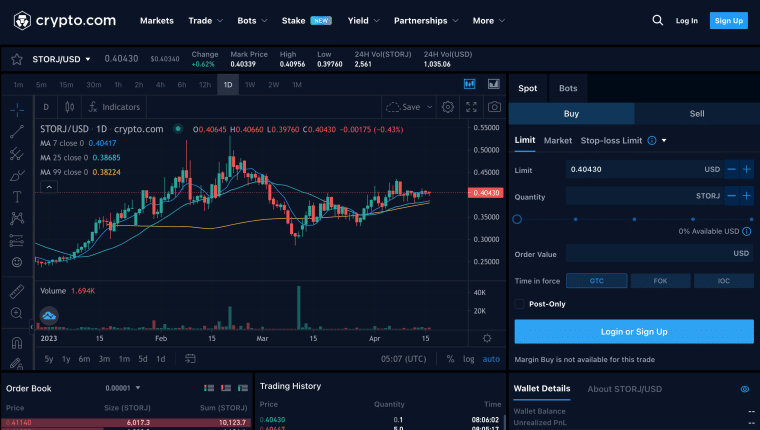

1. Crypto.com: Margin Trade Storj

Another exchange that takes a user-friendly approach to buying Storj and 250+ other coins is Crypto.com which launched in 2016. Since then it has become a reputable choice for over 10 million cryptocurrency investors. This exchange listed Storj on September 4th 2020.

One of the benefits of Crypto.com is its user-friendly features. It has a straightforward process for bringing in new users, asking for just a few basic details and KYC information. Once you sign up with Crypto.com, you can invest in Storj or other cryptocurrencies without any transaction fees for 30 days.

Once this trial period is over some deposit fees can be higher, it also offers margin trading with leverage on perpetual futures pairs, and more indicators for technical analysis (TA) including Tradingview indicators.

This platform has listed many of the most popular meme coins which can go on explosive bull runs and also the top metaverse coins shaping the blockchain ecosystem.

Crypto.com also has its native cryptocurrency known as Cronos (CRO). Owning it allows customers to use the goods and services available in the Crypto.com DeFi wallet app and pay lower fees. Users have the option to stake CRO and earn interest on crypto – when staking CRO the maximum APY is increased, up to 14.5% depending on the crypto or stablecoin.

Additional features of crypto.com include using cryptocurrencies for retail purchases by loading them onto the platform’s Visa card, and its NFT marketplace featuring a wide array of digital art.

Cryptoassets are a highly volatile unregulated investment product.

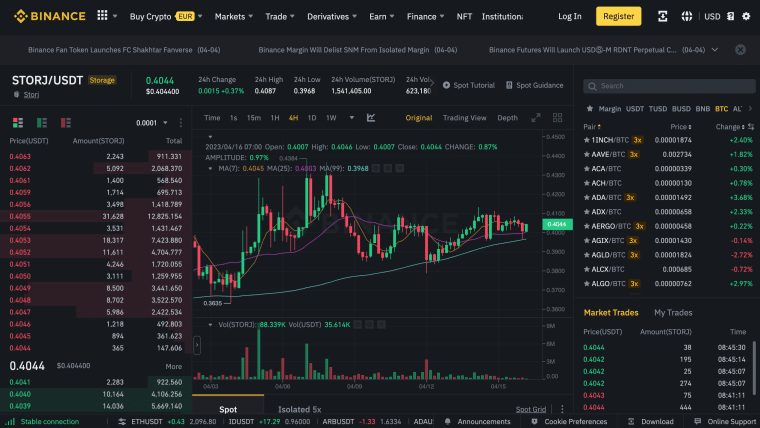

2. Binance – Trade Storj with a 0.10% Trading Fee

Binance also allows users to invest in Storj quickly and simply. It is the largest cryptocurrency exchange in the industry – having amassed more than 100 million clients. Binance was among the first platforms to list Storj, supporting Storj on November 6th 2017.

Binance exchange has both an international platform and one dedicated to US-based clients, Binance US, and users have two ways to buy Storj using fiat currencies: debit cards and bank transfers.

Investors can use bank transfers or ACH for cost-free transactions. The trade-off is that the transaction speeds will be slower, and it will take a while for the charges to reflect in your account.

That being said, most don’t choose fiat currencies for transactions on Binance as it provides ways to buy to those using a private crypto wallet. You can swap your tokens or USDT (Tether) for Storj at just 0.10% commission.

Binance isn’t well regulated by any government authority, but is very popular among crypto traders with a good reputation.

Binance offers a wide array of security tools to keep your account safe, including two-factor authentication every time you log in. Binance has implemented SAFU – Secure Asset Fund for Users. It is an insurance fund that holds a portion of the transaction fees. And in the event of any loss, users are reimbursed.

Binance is also another good option for NFT traders. The Binance NFT marketplace has a wide variety of digital artworks from leading crypto artists worldwide.

Cryptoassets are a highly volatile unregulated investment product.

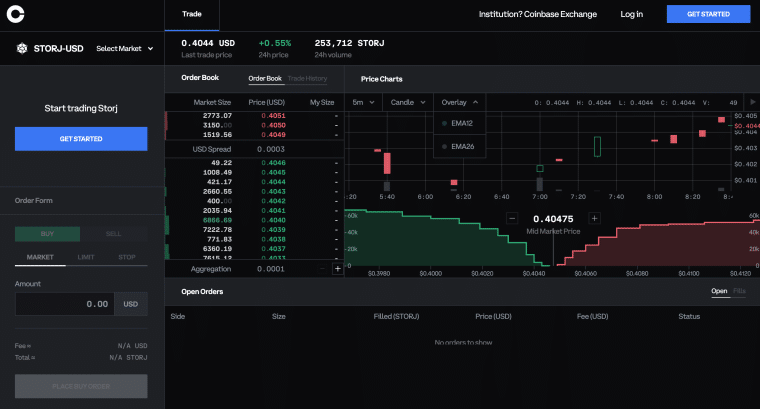

3. Coinbase: Another Crypto Exchange Supporting Storj

Coinbase listed Storj on 24th March 2021. You can buy Storj at the click of a button on the main Coinbase broker platform although we recommend the lower fees on its exchange platform Coinbase Pro.

To start investing in Storj via Coinbase, you must authenticate yourself as a legitimate investor by uploading KYC documents. Coinbase requires two papers when it comes to documentation: a government-issued ID and residential proof. After verification, you can buy Storj or any other crypto of your choice.

It is possible to buy crypto on Coinbase with a bank transfer, requiring a standard commission of 1.49% after the funds arrive or debit and credit cards with a fee of 3.99%.

Despite being one of the more expensive brokers on this list, Coinbase has a good reputation for those wanting to buy crypto online. As a listed public company, it follows regulatory standards of various authorities in the US. And it keeps 98% of client’s digital assets in cold storage, giving an extra layer of security.

In addition to Storj coin, Coinbase supports over 100 cryptocurrencies. For investors on the move, Coinbase has a dedicated mobile app, downloadable via the website.

Cryptoassets are a highly volatile unregulated investment product.

What is Storj?

Storj is an ERC-20 Ethereum token powering Storj DCS, a decentralized cloud storage network that aims to compete with the likes of centralized cloud storage systems offered by Amazon, Google, Microsoft Azure, and Dropbox cloud storage providers.

Interested parties can install Tardigrade software on their computers and rent their hard disk spaces to other users connected to the network. In return, the borrowers pay them via the Storj platform.

Tardigrade is open-source software. It is a decentralized object storage service that enables data storage across the Storj network of Storj nodes.

The Storj project is a blockchain-based, end-to-end encrypted cloud storage system. It uses a decentralized network of nodes to host user data and secures the hosted data with advanced security measures.

An Atlanta-based software developer founded Storj in May 2014 after realising the potential of blockchain technology to create non-centralized cloud storage. It started as a concept in the whitepaper published in December 2014.

The original vision was to create a peer-to-peer encrypted cloud stage platform. Two years later, in 2016, a new whitepaper was released describing a decentralized network that connects those in need of extra space to those with hard drive space to rent.

The second white paper was realised with the platform’s release in 2018. This platform allows people with ample hard-drive space (several terabytes worth) and a good internet connection to participate in the network. By paying a starting fee, they can connect with the network as a node.

Those needing extra hardware space can then connect to these nodes and pay them Storj coins in return. Within the ecosystem, the providers of disk space are known as farmers. They are “farming” Storj tokens by providing storage space.

Because the network is decentralized, there are no slowdowns with 99.99% availability at all times. So, what makes Storj DSC unique?

It is the lack of access the farmers have to the data they are hosting and thus, don’t have the power to alter or view any of them. It is because customers’ files are divided into pieces before being sent out to the farmer’s systems for storage.

Is Storj a Good Investment?

Cryptocurrency markets have always been volatile. Some low cap meme tokens can pump for little reason. Few coins have as much utility as the Storj token, although it may take time for its valuation on the crypto markets to reflect its many use cases. Consider the following points before deciding whether invest in Storj:

Providing a Secure System

Traditional cloud-based projects fall under the control of centralized platforms and authorities. So despite any system owners’ reputation, such systems are honeypots for security attacks. In 2017, the Equifax hack impacted the lives of 123 million American consumers. Storj divides the files across several nodes and encrypts them – decentralization provides much more robust security.

Cheaper Storage Facilities

Storj cloud storage services are considerably cheaper than traditional centralized ones. For instance, 1 TB on Amazon would cost around 23$. In comparison, Storj DSC charges only $15 for 1 terabyte of storage space.

Presence of Other Competitors

Storj’s main competitor in the decentralized storage market is SIA, offering lower prices ($2 per terabyte per month) and also seeing some mass adoption within the DeFi space.

Revenue for Open Source Companies

The farmers are generally not from the general public but rather open-source companies that rely on renting storage spaces for revenue. Storj provides these companies with a source of income.

In summary, Storj DSC provides more secure and cheaper storage facilities than its centralized competitors. Also, it promotes open-source companies by rewarding them with Storj tokens. But the prices of its services are higher than its competitor, Sia.

Storj Price

The STORJ cryptocurrency is traded at $0.397 at the time of writing, with a 24-hour range of $0.385-$0.399. The 24-hour trading volume stands at $14.3 million. According to Coinmarketcap rankings, Storj is at #177 largest cryptocurrency with a market capitalization of over $164 million. STORJ has a circulating supply of 412,937,122 STORJ tokens.

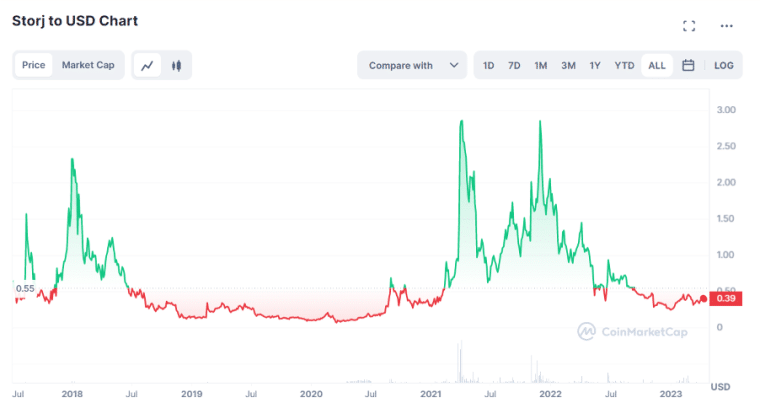

Storj coin launched at the price of $0.55 in early 2017, and since then, has seen both highs and lows. The first pump arrived in December of the same year when the price rose by 240%, leading to many on crypto Reddit speculating whether it was genuine interest behind the price increase or the standard “pump and dump” approach common in the crypto ecosystem.

Storj price chart via Coinmarketcap

After that, STORJ started a correction and was still traded at $.125 in April 2018. STORJ prices continued to decrease and by July 2018, STORJ was already traded below its initial listing price of $0.55. STORJ never recovered its price of $1 during 2019 and 2020, which was also the result of the sell-off in the cryptocurrency market.

The uptrend started at the beginning of 2021, which was the year when STORJ experienced its highest pump. It happened in April 2021, when the price saw a 4x increase, reaching over $3. The core reason behind the rise may have been FOMO. But after exploring the utility of the Storj token, it’s also likely that people’s interest in this token’s technology is genuine.

After dropping to $0.6 by June 2021, STORJ value experienced another pump, but this time it was lower than its all-time high of April 2021. After reaching $2.9, STORJ started to lose value and again reached below the price of its initial listing in June 2022. Influenced by the downtrend of the crypto market and the negative events happening around it, STORJ dropped as low as $0.25 in 2022.

STORJ started 2023 with a price of $0.25, but it managed to gain some value during the first months of 2023. Currently, it is trading at almost $0.4 and has a YTD return rate of 60%.

Storj Price Prediction

As we observed from the pricing history of Storj, it has gone through several peaks and valleys. Sometimes, the bullish upward trend resulted in a blow-off top, followed by a long correction. The Storj price history has included multi-month bull runs and bear markets of the same length.

It’s common for altcoins to have several bull cycles, and in early 2021 Storj exploded from around $0.29 to $3.83, a 13x gain in the Storj token price. If it repeated that in the run-up to the 2024 Bitcoin halving, that would put the price of Storj at over $10 per coin.

In June 2022, Storj was a top crypto gainer after the Bitcoin crash to $17,600, showing strength and recovering faster than other altcoins. Youtuber Jacob Crypto Bury also made the following Storj crypto price prediction video.

Storj price predictions are difficult to make; however, decentralized finance is beginning to see mass adoption, acknowledged by major banking institutions like Goldman Sachs. Predictions made by algorithm-based platforms indicate that STORJ will keep on growing slowly over the years. According to Digital Coin Price, STORJ will have an average trading price of $0.84 during 2023, possibly rising to $0.87.

Digital Coin Price indicates that STORJ can hit $1 in 2024; by 2030, its value can increase to $.4 and above.

Though less optimistic about its value in the short-term perspective, Price Prediction again sees a rise in STORJ value. According to it, STORj will be traded at $0.5 on average during 2023. STORJ can hit $1 only in 2025, and by 2030 it can be traded above $6 on average with the highest price of $7.69.

In contrast, Wallet Investor predicts a possible drop in the STORJ price. It indicates that STORJ can fall from $0.39 to $0.011 in one year, losing 97% of its current value.

Best Ways to Buy Storj

There are multiple ways to invest in Storj. You can opt for fiat currencies using platforms such as Crypto.com or Coinbase. Or, you can use a crypto wallet to swap your tokens for Storj on Binance.

With that in mind, below listed are the suitable ways to buy Storj in 2022:

Buy Storj with Debit or Credit Card

If safety and convenience are your priorities, the best way to buy cryptocurrencies like Storj is via debit or credit card. But bear in mind the fees.

- Platforms like Crypto.com are made for all types of users. They allow the usage of fiat methods – Credit/debit cards, PayPal, eWallets and bank transfers – to provide instant transactions at a low cost.

- Platforms like Binance made for crypto veterans charge a high fee if you invest in cryptocurrencies using debit or credit cards.

In the case of Coinbase, debit card charges are 3.99%, a steep amount in the crypto ecosystem. Similarly, Binance charges a high 5% fee – 4.5% for debit card transactions and 0.5% for the instant transfer – to provide crypto investment facilities using debit or credit cards.

Therefore, if you’re considering using cards to invest in cryptocurrency, use Crypto.com. There is no transaction fee for using debit or credit cards (as long as the currency used is USD) on Crypto.com, the transaction fee is 2.99%.

Buy Storj with PayPal

Security is a major concern for anyone making online transactions. Therefore, many opt for wallets or PayPal accounts instead of providing bank details. The transaction fee you’d need to pay to invest in Storj vary from exchange to exchange.

In the case of Coinbase, the fee is 3.99%.

Buy Storj without ID

Many are wary about uploading personal information on any online website. But the crypto ecosystem is increasingly becoming regulated – which in the long-term is bullish for crypto.

While certain platforms provide a way to trade without KYC, they do so at a limited scale.

Best wallet for Storj

As a token powering the Storj decentralized cloud-based system, it deserves the best crypto wallet that is secure, easy to use and provides a fast-transfer mechanism.

One way to store Storj and keep it secure is through hardware wallets such as Trezor or Ledger Nano S. As they are not connected to the internet, these wallets are secure from all hacking attempts. Additionally, accessing your coins from these wallets is easy.

How to Sell Storj

Selling Storj follows a similar process to buying Storj on the trading platform Click the ‘Trade’ button again when you’re ready to take profit and enter a limit order to specify a sell price, or sell instantly at the current market rate and bid / ask spread displayed.

You may be eligible for capital gains tax when you realize profits by selling a cryptocurrency, depending on your country of residence.

Conclusion

To su up, Storj is a decentralized cloud storage platform built to address the underlying weaknesses of the current centralized storage systems on the market. Its approach to reward the farmers – providers of storage spaces – should increase the Storj token’s valuation over time and potentially make it a good investment.

If this cryptocurrency interests you, we recommend using Crypto.com. Since Storj has a volatile price action it’s useful to join a social trading platform where professional investors can be interacted with and copytraded. All users have their own profile and can access a news feed where other traders post their thoughts on current market conditions and what a good entry price for coins like Storj might be at a given time.