In March 2022, XRP holders wanting to invest in FLR finally received their much-anticipated Spark airdrop after repeated delays since 2020. Spark is the governance token of Flare, a distributed network that integrates with the Ethereum Virtual Machine.

Flare is also the world’s first Turing complete FBA (Federated Byzantine Agreement) Network. As per its whitepaper, Flare is a new way for scaling smart contract platforms – decoupling the network’s security from the value of its native token – Spark.

Anticipation for the new Spark crypto asset has always been high. And after long delays, the developers say that Spark (FLR) will finally be able to be traded on exchanges in 2022, on July 4th. This guide reviews where to buy Spark tokens on launch day and some FLR price predictions.

How to Buy Spark token (FLR) – Quick Guide

Once you find a trading platform that lists Spark, you simply need to create an account and get started.

- Step 1: Open an Account: First, visit your selected platform’s official site. Complete the quick registration process – enter your details and upload the necessary documents for verification.

- Step 2: Deposit Funds into the account: After you’ve created your account, log in and go to your dashboard. Click to Deposit funds and choose the payment method.

- Step 3: Search for Spark: Enter Spark into the site’s search bar, or FLR. Select it and once the Trade button becomes clickable, select that, and you’ll land on the FLR investment page.

- Step 4: Buy Spark: Enter the amount you want to invest in Spark. Afterwards, click on the Open Trade button to buy FLR.

Where to Buy FLR – Best Platforms in 2025

Flare made an update to its roadmap in March 2022, stating investors can buy Spark tokens by July 4th 2022, although it will confirm this in mid-June.

As per their latest social media updates, Flare won’t just be enabling early L1 tokens so that they can be used in smart contracts but will also bring advanced cross-chain interoperability to all networks. This level of utility is sure to attract many crypto exchanges in the future. The best crypto platforms to list Spark so far are:

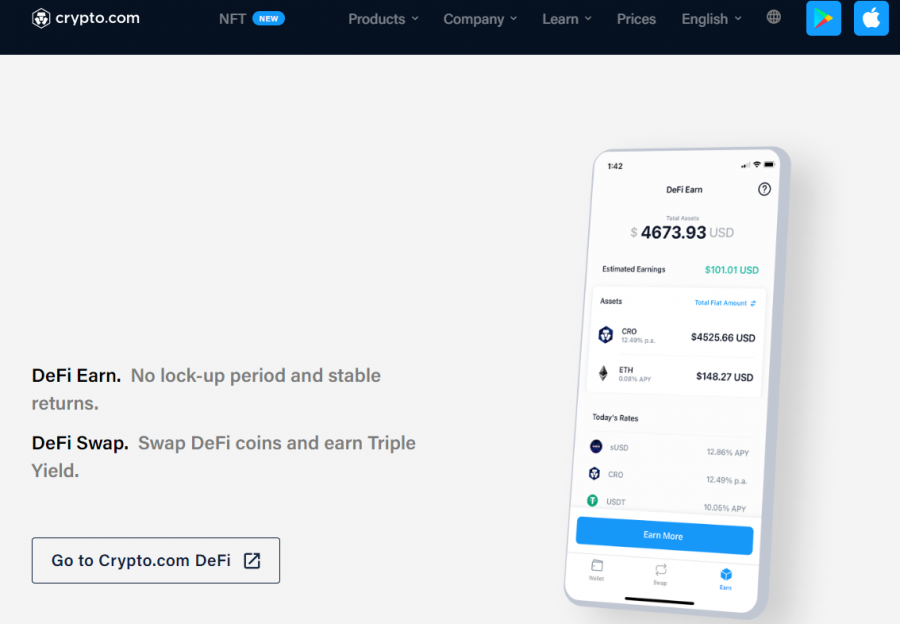

1. Crypto.com: Trade Crypto on Leverage

Crypto.com might list Spark soon.

Crypto.com was launched in 2016 and now has more than 10 million users. This crypto trading platform hosts 250+ cryptocurrencies and, as per the website, allows users to buy and sell them at true cost. Many users might prefer Crypto.com to buy Spark due to its focus on user interactivity.

Crypto.com has a wide ecosystem. It consists of a Mobile App – allowing users to invest in cryptocurrencies while on the move, a Crypto.com exchange – through which users can invest in select crypto pairs, and a DeFi swap, a tokens-swapping DEX powered by CRO – Crypto.com’s native token.

Additional components of the ecosystem are the Crypto.com wallet and Crypto.com Pay. The wallet can securely store the crypto assets of the investors. At the same time, Crypto.com Pay is a payment solution – offering generous cashback and rewards to users for paying or getting paid in crypto. This trading platform offers fiat and crypto options regarding payment methods.

To buy Spark (when it gets listed) on Crypto.com via credit or debit card, you’ll need to pay 2.99% transaction fees. But if you want to invest in cryptos via Crypto.com regularly, you can reduce the price by investing in Cronos, the native currency of this trading platform.

It acts as an intermediate currency and converts your crypto into its fiat counterparts at a lower cost. Also, you can get crypto “cashback” as high as 8% by using a Crypto.com VISA card. There is also a Crypto.com savings account available for users, and storing your tokens in a savings account will generate interest.

Crypto.com offers MFA – Multi-Factor Authentication and whitelisting functionality for those with security concerns. And to those looking for NFTs to invest in, the trading platform provides Crypto.com NFT marketplace.

Cryptoassets are a highly volatile unregulated investment product.

2. Coinbase: User Friendly Crypto Exchange

Coinbase launched three years after Bitcoin and has become one of the most expensive

Coinbase has stated that it will facilitate future airdrop of spark tokens to eligible Coinbase customers (those with XRP tokens in their accounts). Thus, Spark (FLR) is likely to be listed in its catalogue soon.

As we mentioned, the transaction fee for investing in cryptocurrency on Coinbase is high for using fiat methods like debit and credit cards, and it is 3.99%. But, if you don’t mind slow transaction speeds, you can choose ACH transfers. The standard commission for using this method is 1.49%.

Then why does it remain a top choice for crypto investors in the US? There is only one reason – the minimum balance requirement. If you have at least $2 in your Coinbase account, you can invest in crypto. Additionally, the Coinbase platform offers opportunities to earn free crypto, currently including earning XLR, AMP, and GRT through its Coinbase Earn program.

Another reason why Coinbase is the trading platform of choice for US customers is the User-Friendly UI. After watching a short tutorial video, beginners will find it easy to trade in cryptocurrencies on this platform.

If the high transaction costs worry you, you can switch to Coinbase Pro. It has more technical indicators and advanced tools for technical analysis (TA), although still not as many as Crypto.com. It also has lower fees. For institutional users, there is also Coinbase Prime.

It is an integrated crypto solution within the crypto exchange that provides an advanced trading platform, secure custody and advanced crypto-asset management facilities. It offers many market indicators for advanced users who want to get more information before investing in cryptocurrencies.

Coinbase has a free learning section and blog to study crypto. They cover all the basics and educational information about blockchain, cryptocurrencies and crypto taxes.

Cryptoassets are a highly volatile unregulated investment product.

3. Binance: Buy Crypto with Low Fees

Binance is the largest cryptocurrency exchange in the world. It has over 600 different cryptocurrencies

As per the official Flare update on the official website, Binance US is yet to decide whether it will list Spark in the catalogue.

In February 2022, Binance US delisted many cryptocurrencies, XRP included. And since Flare network is created initially to hold other cryptocurrencies, starting with XRP, it does put a question on whether Binance will list Spark in future.

Since its competitors are planning to list Spark upon its launch, the international Binance site may do the same. Binance’s top selling point is the low fees. It charges only a 0.1% trading fee for trading using crypto assets. Also, it charges no fees for crypto deposits.

Once Spark gets listed, you’d likely be able to trade it on an FLR/USD pair against many cryptocurrencies, including BTC and ETH, by only paying a 0.1% trading fee. That’s not to say that Binance doesn’t support traditional payments, and it does via the Fiat GiveAway. Using that, you can purchase crypto using traditional payment methods.

Fiat currencies allow newcomers to enter the crypto ecosystem conveniently. But there is a different minimum deposit amount required to invest in cryptocurrency on Binance. For instance, Bitcoin requires a minimum investment of $15.

This platform is also suitable for those who want to enter the stablecoin market – those are digital assets pegged on a 1:1 basis to another asset, including USD, precious stones and others.

But Binance isn’t limited to trading cryptocurrencies. It also has its own NFT marketplace. There, you can trade your crypto for BUSD or BNB to invest in NFTs including projects by the most sought-after creators such as WorldBeans, PACHISPACE and others.

Cryptoassets are a highly volatile unregulated investment product.

What is Spark?

Spark is the native governance token of the Flare Network. A distributed network facilitates secure interoperability between blockchains, such as the Ethereum Blockchain and XRP ledger. The Flare network merges with the Ethereum Virtual Machine to convert smart contracts to machine-understandable instructions.

What is Flare?

In 2017, Hugo Philion and Sean Rowan, both Master’s degree holders in machine learning, announced the launch of the Flare network. Although founded in 2017, it was not until 2019 that Sean Rowan started posting about the network on the Interledger Protocol forums.

It soon got the attention of Ripple Labs. Soon afterward, the project got its seed funding of an undisclosed amount from Xpring – the investment arm of RippleLabs. It was after that investment that developers publicly introduced Flare Network in 2019.

Flare’s goal is to make it possible for any cryptocurrency to be used in smart contracts, starting with XRP. Conceptually, you can think of it as a combination of DeFi protocol such as AAVE and cryptocurrency wrapping protocol like Ren. But the difference here is that Flare has its own native smart contract blockchain.

The Flare Network claims to be the world’s first Turing complete FBA (Federated Byzantine Agreement) network. FBA is similar to consensus mechanisms used by banking networks like Stellar and XRP ledger.

The underlying consensus that Flare follows is the same as Avalanche (Avalanche consensus).

But what is the meaning of being a Turing Complete network? It means that the Flare network can perform any computational task as long as it has enough memory to run it.

Flare takes a different approach to scaling a smart contract. Therefore, unlike the standard proof-of-work and proof-of-stake blockchains (PoW and PoS), it doesn’t rely on the value of its native token for security and decentralization. Traditionally, that would mean that the mining participants won’t earn awarded tokens. But Flare takes a different approach to rewarding Spark tokens.

Smart contracts are complex in nature. Therefore, to enable the use of any cryptocurrency in a smart contract, Flare leverages the Ethereum Virtual Machine. And in this instance, leveraging means copying EVM to create FVM, Flare Virtual Machine. Despite that, it is critical to note that Flare is not on Ethereum.

What are Spark Tokens?

Spark is a cryptocurrency native to the flare network. It has the following usages:

- Collateral: Spark tokens can be used as collateral to issue F-Assets, tokenized cryptocurrencies that are not native to the Flare Network.

- Voting: They can be used during voting to determine the prices of F Assets

- Rewards: Spark tokens are issued as a reward for voting in the FTSO – Flare Time Series Oracle.

- Governance: Flare can be used to govern over the Flare network and FCA

After the launch of the network, the initial supply of Spark token will be 100 billion, like XRP and XLM. Out of that, 45 billion tokens have been airdropped, and the remaining 55 billion are split between Flare foundation and Flare networks limited.

Out of the 45 billion airdropped FLRs, users will only receive 15% of their eligible tokens. The Flare network will distribute the rest over 25 to 34 months.

Is Spark Token a Good Investment?

There are certain points in the above section that you might not have understood. This section will give you the clarity to make an informed decision before considering Spark tokens as your next crypto investment.

There are three mechanisms about Flare to consider before making your investment decision.

Flair Asset Protocol

The protocol consists of F-Assets. They are tokenized cryptocurrencies that are not native to Flare blockchain: non-smart contract chain tokens with a smart contract functionality on Flare. There are two parties needed to issue an F Asset.: an originator and an agent.

An Originator is an investor who wants to convert his cryptocurrency into an F-Asset and an Agent is the Flare network participant who issues the asset. The way it works is quite interesting but quite complex. For example:.

- Suppose you have Bitcoin that you want to convert into an F-Asset (fBTC)

- To get started, you send your Bitcoin to the agents on the Flare Network

- If there were any other networks trying to intercept the transaction, the Flare network prevents that by introducing certain changes. Before an agent can accept a coin, he has to first stake his Spark tokens equal to 2.5 times the value of that coin on the Flare network

It makes accepting coins from users a great responsibility. Therefore, the investor has to first pay the agent for him to receive their tokens.

Flair Price Oracle

FTSE or Flare Time Series Oracle is how Flare rewards financial incentives (Spark tokens) for participation instead of mining or staking. This mechanism repeatedly checks that spark tokens correctly collateralize every asset. To estimate FTSO price, two groups are involved, Spark holders and holders of F asset whose price is being evaluated, and these participants vote on the F-Asset price.

Spark token holders can vote on the price of any F-Asset, while token holders can only vote on the cost of their assets. When it comes to rewards, Spark token holders are rewarded for any F-Asset, while the F asset holders only get rewards for the assets they hold.

Spark token holders earn additional rewards for participating in FTSO price voting. Spark holders who don’t want to participate in the FTSO can delegate their tokens to someone else. These delegated spark tokens can be collateralized, giving the inactive spark holders a way to earn passive income rewards.

Governance

Spark token holders can govern the Flare Network. It is accurate at both micro and macro levels. Spark Dependent Applications or SDA will use Spark as collateral, involve FTSO and have some governance. The F- Asset protocol is one example of SDA. The Flare Network has stated that more SDAs will come, and they would allow the token holders to change just about anything in the Flare network.

Flare Foundation

Flare is a non-profit foundation watching over the Flare network. In addition to developing the chain, this foundation also issues grants, conducts onchain research, and educates others about the Flare network. Intending to be as transparent as possible, the Flare Foundation seeks to have only a minimal influence on the Flare network.

In the spirit of transparency and letting the network run and prosper on its own terms, Flare will issue two financial reports per year, will not participate in the flare network, and will not delegate its tokens to others.

Also, the spark token holders can vote to dissolve the Flare foundation, which will lead to the burning of the foundation’s assets of the Flare blockchain.

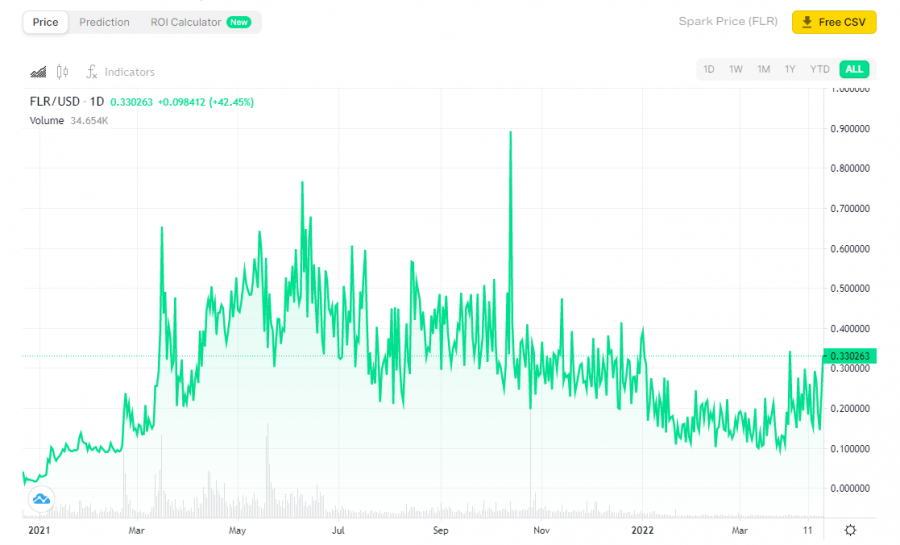

Spark Price

FLR isn’t live on any blockchain yet (other than Flare network). Currently the Spark price can be seen on price tracking websites like Nomics. Below is the current sideways trading range of FLR / USD.

Spark price history 2021 – 2022

At the time of writing, the price of Spark is $0.33, with a 24-hour trading volume of $27,327. In terms of market cap the Spark crypto is ranked #5960, but its ranking is not yet tracked on larger sites like Coinmarketcap.

Spark Price Prediction

The exchanges where FLR is currently listed cannot give a clear picture of where the price might be heading next. Also, the Flare Mainnet hasn’t been launched yet. What coincided with the FLR airdrop on 30th March 2022 was the addition of two security protocols on Songbird – Flare’s canary network.

Even though most crypto exchanges are yet to list it, the hype building around Spark makes it safe for us to make some predictions, based on the impression Spark has left on the market.

There are many investors making a bullish case for Spark. Low cap altcoins tend to pump hard on listing day, and give a high ROI to early investors.

Some have made a bearish case for FLR in the long-term – its non-compounding inflation rate. The whitepaper says that Flare will have a non-compounding inflation rate of 10%. That means 10 billion Spark per year.

That inflation rate is on the high side, giving voice to negative Spark price predictions. The demand may not be high enough to offset this enormous rise in supply if that’s the case there may be a dip in Spark’s value.

Even though only 15% of allocated tokens will be available to the holders after Mainnet’s launch, it would still be difficult for the demand to exceed the supply rate.

Conclusion

Flare is poised to provide additional value to XRP and other cryptocurrencies by creating a smart-contract compatible FBA blockchain. It borrows key elements of EVM to create F-Assets – non-native tokens with smart-contract compatibility. To maintain the fair value of these assets, the Flare Time-Sensitive Oracle will incentivize participants to vote on their fair price.

In return, these participants will earn Spark (FLR) – the native token of the Flare network. In addition to being given as a reward for voting on FTSO and being collateralized, Spark tokens will govern the flare network.