The serum cryptocurrency project is a DeFi protocol that introduces a decentralized exchange with SRM as its native token. The ecosystem is built on the Solana blockchain and is designed to improve speeds and transaction costs in the DeFi ecosystem. After hitting its all-time high of $12.5 in 2021, the SRM token corrected to $3.6 by the beginning of 2022.

But the prices continued to drop during the previous year, and by the end of the year, it was traded at $0.15. The current low price of Serum is observed as a good chance to buy cryptocurrency.

This guide reviews the best platforms to buy Serum with low fees. We also review the Serum project’s background, chart the SRM price action, and predict what lies ahead for Serum based on the wider crypto market and the Serum roadmap.

How to Buy Serum – Quick Guide

Here is a quick guide to start investing:

- Step 1: Open an Account: Visit the official platform of the broker you choose and create a crypto account. The process will take a few minutes. Upload KYC documents when prompted.

- Step 2: Deposit: Top up your account using the several available fiat methods. Crypto transfer is also possible.

- Step 3: Search for Serum: Type Serum in the search box, or SRM. Click on the first option, and you’ll land on the Serum trading page. Review the latest Serum news, price chart and click on “Trade” when ready to buy SRM coins.

- Step 4: Buy Serum: Choose an amount to invest in Serum and click the “Open Trade” button to finalize the order.

Where to Buy SRM Crypto – Best Platforms Reviewed

Serum was first listed by Binance in 2020, followed by Crypto.com in 2021. There was news circulating in early 2022 that Coinbase would also add support for SRM, but it hasn’t happened yet. With that in mind, here are the best exchanges to buy Serum in 2023.

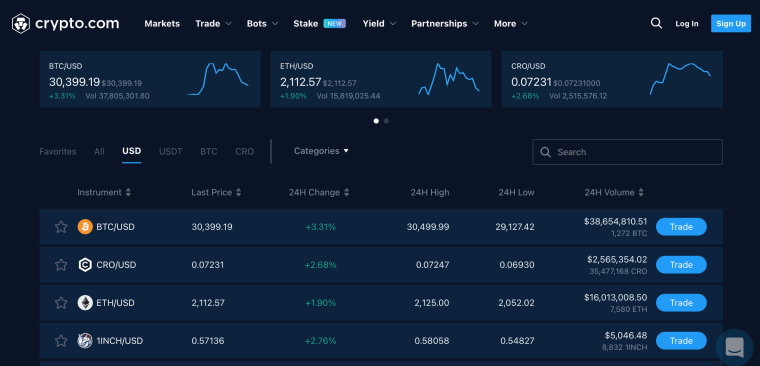

1. Crypto.com: Trade SRM on Margin

Crypto.com listed SRM on October 22, 2021, and opened spot trading SRM-USDT, SRM-USDC, and SRMUSD-PERP perpetual futures contracts.

It is one of the most media-savvy crypto exchanges on the list, having sponsored Matt Damon as the brand ambassador and has spent millions on marketing. It has listed over 250 crypto assets and allows advanced traders to margin trade crypto with leverage up to 100x.

Other than a traditional exchange, Crypto.com also is a DeFi lending platform – offering a DeFi wallet and users a chance to earn interest on DeFi tokens and other assets. Only Fantom, NEAR, and Zilliqa protocols are currently supported. Serum Protocol hasn’t been added to this yet. If it happens, there is a chance that you’d be able to earn interest on SRM.

To further help the advanced traders, Crypto.com introduced Recurring Buy. The exchange added another utility to this feature with Dollar-Cost Averaging bot – allowing investors to automatically scale their position on the crypto they are interested in without actively interacting with the platform to trade.

Crypto.com’s flagship product is the Visa Crypto card. You can use it to pay retailers using crypto assets and earn lucrative cashback. In the early days, you could have made as much as 8% cashback using the card. However, Crypto.com slashed the rewards from 8% to 5% and removed cashback incentives for low-tiered crypto cards.

Crypto.com is also one of the most popular staking platforms on the list – providing as high as 14.5% APY on crypto assets and 10% APY on stablecoins. To earn the highest interest, you must also stake CRO – the native asset of Crypto.com’s ecosystem.

Crypto.com also has its own NFT marketplace and a collection of learning blogs under the Crypto.com University project.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

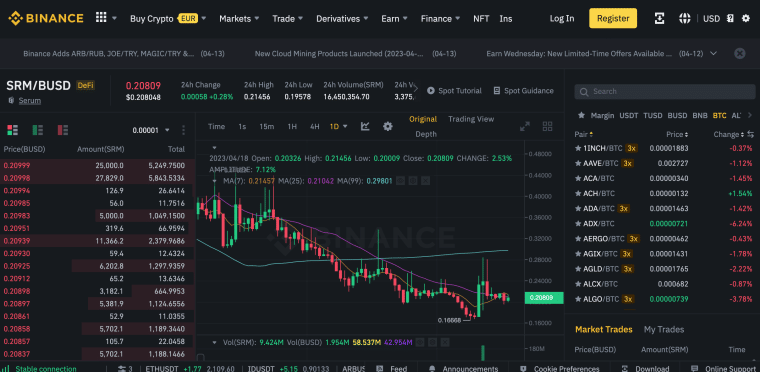

2. Binance: Buy SRM at the lowest Fees

Binance listed SRM on August 11, 2020, and opened trading for SRM/BNB, SRM/BTC, SRM/BUSD, and SRM/USDT trading pairs.

In May 2022, it added SRM/USDT to the isolated margin pairs.

As the world’s leading cryptocurrency exchange, Binance has listed over 600 altcoins and has nearly 100 million users. US users cannot directly trade on Binance, but can access Binance.US. That United States facing platform has listed over 100 cryptocurrencies – SRM is yet to be added for US-based users but may be in the near future.

Binance is known for Binance Earn, a utility that offers savings, staking, farming, and dual investment – allowing users to make huge gains on their stored crypto assets. SRM investors can use Binance’s flexible savings feature to earn up to a 2.00% Annual Percentage Yield.

Binance has Binance Academy, a collection of education courses that you earn learn about crypto markets.

Binance is on our list of the best platforms to buy Serum because of the low fees. It takes a 0.1% maker/taker fee. That’s lowered further for traders using a Binance referral link and buy paying the fees using BNB.

Binance has recently removed trading fees for many Bitcoin spot trading pairs. While SRM has not been added to the list, it can happen.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

What is Serum?

Serum is a DeFi protocol designed to fix the long-standing issues of the DeFi ecosystem, including:

- Segmented liquidity: It forces most DeFi protocols to populate their silos with unused capital. This wasted capital could instead be redirected towards improving the DeFi network.

- Inefficient markets: It is caused by the limitation of current technologies to maintain a central limit order book that forces DeFi networks to rely on centralized bodies. A central limit orderbook is a transparent system that matches all the bids and offers according to the asset’s price.

- Layer settlement risk: Layer2 solutions limit composability which causes settlement risks between transactions.

To resolve these issues, the Serum protocol combines the speed of centralized markets with fair, efficient and trustless systems.

The Serum Protocol is built on Solana’s layer 1 blockchain and consists of four main components:

- A full central limit order book: At the heart of the Serum Protocol lies the Serum core, an asset agnostic order book built on the Solana blockchain. It allows the protocol to operate regardless of the type of crypto assets. The code supports advanced financial markets for assets such as derivatives and lending

- Developer ecosystem and services: Developers can connect their projects to Serum and use its liquidity.

- True composability: Diverse applications can share middleware at one place on the Serum protocol. It allows trading applications to share a single liquidity source – making it accessible to institutional and individual users

- The Serum DAO: The Serum Decentralized Autonomous Organization puts the future of the serum ecosystem’s development in the hands of the community.

The Serum crypto project website

For an introductory guide to decentralized finance see our ‘What is DeFi?‘ page.

Serum Ecosystem

The components of the Serum Ecosystem consist of the asset agnostic orderbook, which has an unchained central limit orderbook and matching engine. Both these components combine to provide price-time-priority matching and liquidity to traders and the composing project – allowing users to choose the trade’s size, price, and direction.

Serum Code allows apps to create their own orderbooks or work with existing orderbooks.

Any Solana program can use Serum code in need of an orderbook. In doing so, Serum outsources tasks such as implementation and maintenance for matching buyers and sellers. The design helps users to process traders across all applications within the network at the same time.

SRM Token

SRM is the native token of the Serum protocol. It is based on the SPL token standard. However, it has also been cross-listed as an ERC 20 token. The two ways that this token provides value are through utility and adoption. Project Serum designed economic locks for Serum, with over 90% of SRM tokens having long-term unlocking periods.

The maximum supply of the SRM token is 10 billion. And at the time of writing, there were 263,244,669 SRM coins in circulation. There are over 125 million tokens placed in reserves to ensure liquidity. The remaining 825 million tokens in the Serum ecosystem are rewarded as incentives.

The primary utility of Serum is used for staking rewards or as a way to reduce the fee to trade on Serum DEX – a decentralized derivatives exchange. The other utility of the SRM token is voting. Users can participate in on-chain governance through tokens. In addition to that, SRM is also used for fees and structuring rewards.

Is Serum a Good Investment?

Serum provides the world’s first fully decentralized and open liquidity infrastructure. It offers high speed and low transaction fees to the DeFi ecosystem. As one of the leading DeFi project, it has attracted attention from the crypto crowd. However, in the current bear market, placing your faith in tokens that have a future is important. So, is Serum one of them?

Serum derivatives allow faster transactions. Developers have clocked the speeds up to 65,000 TPS – higher than most fiat transaction methods.

SRM’s use cases are continually evolving. It has use cases in not just DeFi, but also crypto gaming – making it one of the few DeFi tokens with utilities beyond governance. The project’s current roadmap has many projects in the pipeline. These include on-chain bridges, Automated Market Makers. Binance’s recent listing of the SRM/USDT pair to the isolated margin list is part of that development.

With cross-chain trading, Serum is more secure than a custodial exchange. Users enjoy a permissionless and transparent trading experience across networks.

There are also rumors more top altcoin exchanges will list SRM in the new future and add support for the SPL standard.

Another reason that many are bullish on SRM is because of the founders. FTX and Alameda are headed by Sam Bankman-Fried, who has been bailing out crypto lending platforms affected by the recent crypto winter.

Serum Price

Since launch, Serum has formed three major bull runs over the course of trading and has seen a couple of massive blow-off tops. The first and largest bull run happened from November 2020 to Feb 2021. The value of the SRM token grew by 740%.

The second time SRM rallied was from March 2021 to May 2021, and the price grew by 190.1%. The third SRM Price rally happened from June to September 2021, and the token grew by 370%. It was here that the crypto reached its all-time high of $12.

These rallies coincided with various developments in the project, such as the launch of the full DEX and listing on trading platforms. Other reasons were FOMO and the project’s strong fundamentals that, to this day, are being counted upon.

Serum Full Price History

Serum opened in 2022 at $3.66. It then followed a steep downtrend until the month-end to $2.11, followed by a brief period of sideways trading and a minor upswing.

SRM started pumping mid-march in response to the announcement by Project Serum of a $500k Ecosystem price for developing a cross-chain exchange. Serum price started to increase from $1.8, and in half a month, it reached as high as $3.3.

This happened due to the Serum partnership with Wormhole to launch the ecosystem project prize of up to $500k. The aim of the partnership was to bring the community to build a cross-chain exchange that uses Serum’s limit order book and combines it with Wormhole’s Portal bridge and generic message passing.

The price then started to decline, slowly looking for levels to reach an accumulation range. Serum corrected nearly $1 along with other altcoins as the crypto entered the bear market as BTC failed to find support at $25k. It then bounced to $1.35, followed by a marginal correction.

Such events as the collapse of the FTX exchange, the Terra Luna crypto project, and the fall of many other altcoins started the so-called “crypto winter” which affected the performance of the whole crypto market. Influenced by these negative events, SRM dropped to $0.15 by the end of last year.

SRM prices also dropped as a result of the failure of Serum DEX, which was announced as “defunct” after the collapse of the FTX exchange. While Bitcoin and altcoins have shown some recovery signs from the beginning of 2023, SRM prices continued to drop, reaching as low as $0.15.

At the time of writing, Serum is traded below the $1 mark with a 24-hour price range of $0.19-$-0.21. With a market capitalization of $ 52,673,016, SRM’s current rank is #400 on CoinMarketCap.

Serum Price Prediction

Serum price projections are different depending on the platform, with some indicating that SRM will grow in the next few years and others showing Serum will continue the downtrend and lose its value. The most pessimistic results are predicted by Wallet Investor, which indicates that SRM will lose 85% of its value and drop to $0.0298 from $0.2 in a year.

Digital Coin Price is quite optimistic, predicting that SRM will have an average trading rate of $0.42, possibly reaching as high as $0.44 for 2023. According to this platform, the SRM price won’t hit the $1 mark until 2028. In 2030 SRM will be traded at $2.07 on average, with a maximum price of $2.09 and the minimum price of $1.95.

The Price Predictions platform gives lower predictions for 2023, indicating that Serum’s medium price will be $0.29. However, the platform predicts that Serum will reach $1 in 2027 and be traded at $1.21 on average. According to this platform, in 2030, Serum prices will increase as high as $3.57, possibly having its maximum price at $4.22.

Best Ways to Buy Serum

Here are the best ways to buy Serum:

Buy Serum with Debit or Credit Card

If you’re using a debit card to buy Serum on Crypto.com, the fee is 2.99%.

Buy Serum with Debit or Credit Card

Bybit is another popular crypto exchange to have listed SRM. It allows users to start buying cryptocurrencies without providing ID details. Withdrawals are also possible without providing identifications, but they are limited to 2 BTC per day.

Changelly is another non-KYC platform that allows you to swap other cryptos for Serum.

How to Sell Serum

Once you have bought Serum, it will be available on your dashboard. Select the token, and click on the red cross on the right side. Then click on the “Close Trade” button.

Conclusion

Serum has seen a steep downtrend after the minor surge at the beginning of 2023. The overall cryptocurrency market crash has negatively influenced many altcoins, including Serum. Hence, it is hard to say whether Serum is a good investment. The price of the SRM coin depends on both the crypto market’s performance and the Serum project itself.

Currently, many cryptocurrencies are showing recovery signs, with Bitcoin rising to almost $30,000. So many altcoins may follow this subtle uptrend. The low Serum coin price could represent a buying opportunity as a long-term hold. However, Serum prices can easily drop because of the market’s volatility; hence you need to be cautious with your investment and always research the market before the final decision.