After an explosive bull run from $0.16 to $3.85 in 2021 – a 24x gain – followed by a correction in 2022, some traders will be wondering where to buy Loopring now for the next bull cycle.

The Loopring price has hit the top gainers list on several crypto exchanges in recent days, and Loopring trading volume has been rising – buyers are interested now that it has retraced to a low price point and the support levels around $0.50 – its current 2022 low was $0.32.

In this guide we’ll review the top platforms to buy Loopring crypto – the protocol’s native coin LRC.

How to Buy Loopring – Quick Guide

- ✅ Step 1: Open an account: Visit the official website of your chosen broker and open a free account. Enter your personal details and upload ID documents to complete the verification process.

- Step 2: Deposit: Deposit funds to buy Loopring – the minimum deposit is $10 in the US and UK, and slightly more worldwide. You can choose deposit methods including bank transfer, debit / credit card, Paypal, eWallets and more.

- Step 3: Search for LRC: At the top of the website enter Loopring or its ticker symbol LRC – then click the ‘Trade’ button to begin trading.

- Step 4: Buy LRC: Enter the amount you want to invest in Loopring. Then click on open trade. Your trade will be executed and LRC crypto tokens added to your wallet balance.

Where to Buy Loopring (LRC) – Best Platforms

The Loopring crypto token is listed on many crypto platforms since it’s been around several years and is a popular altcoin. The best places to buy Loopring include:

1. Coinbase – Platform Used by More Than 89m Users

Coinbase is one of the largest platforms operating across more than 100 countries. Its current userbase is more than 89 m. The platform is operated by the United States Coinbase, Inc., which is licensed to engage in money transmission in most U.S. jurisdictions.

It is also registered as a Money Services Business with FinCEN. These regulations mandate it to comply with all applicable laws and regulations applicable in the jurisdictions in which it operates.

The platform has advanced security features in place to safeguard users’ holdings and personal information. It offers Hosted Cryptocurrency Wallet service free of cost. It can be used by users to store their cryptos in cold storage directly on their devices.

The fees of Coinbase are comparatively on the higher side, which is a major downside. Its taker fee rate ranges from 0.05% and 0.60% and maker fee rate ranges from 0.00% and 0.40%.

Coinbase facilitates the staking of assets in a third-party proof-of-stake network via staking services provided by Coinbase The rewards of staking are determined by the protocols of the applicable network. Coinbase deducts a flat 25% commission on the rewards before crediting them to the users’ accounts.

The minimum amount needed to buy cryptocurrency on Coinbase is $2.

Cryptoassets are a highly volatile unregulated investment product.

2. Binance – Most Known Platform in the Crypto World

Binance popular among traders and has a huge trading volume.

Whether you are looking to short or long Loopring, Binance is a platform that can consider because of its advanced technical analysis. These technical features come in handy for experienced traders for executing successful and profitable trades. The platform also facilitates options and futures trading.

Binance has in place robust security mechanisms including Secure Assets Fund (SAFU) to safeguard user funds. It has become one of the safest exchanges to buy LRC or any other crypto online.

Another reason to pick Binance as your trading platform is its competitive fee structure. It charges a 0.1% maker/taker fee. However, the fee is higher if you use debit or credit cards for deposits. This means you’ll pay a 2% transaction fee for all Visa and MasterCard options when adding funds. The minimum deposit is $20, and the minimum trade is $10.

Binance offers various income opportunities to its users. Its flexible savings and locked savings feature enable traders to earn interest on their crypto holdings. The Binance Earn program offers dozens of crypto financial products to help you earn additional income on your holdings.

Cryptoassets are a highly volatile unregulated investment product.

What is Loopring?

Loopring is an open protocol developed with the aim of building decentralized crypto exchanges. It also allows users to create a non-custodial, order book-based exchange on the Ethereum network using zero-knowledge proofs (ZKPs).

The Loopring project was founded by Daniel Wang in 2017 with the goal to scale up decentralized exchanges to make transactions therein faster and cheaper. It was launched in August 2017.

Loopring (LRC), the native utility token of the Loopring protocol, is an ERC-20 token built on the Ethereum Blockchain.

Loopring uses a form of cryptography, known as the zero-knowledge rollups or zk rollups. It is a layer 2 scalability solution. It facilitates faster validation and settlement of transactions while keeping gas prices at a very nominal level.

The zk-rollups enable Loopring exchanges to execute most of the operations, including trade and settlement anywhere besides the Ethereum Blockchain. As such, the Loopring exchange can submit less number of transactions to the Ethereum blockchain.

Few Ethereum transactions imply faster and cheaper for investors. The zk-rollup also ensures 100% user control on the assets.

Should You Invest in Loopring?

It is a known fact in the crypto world that users have to incur ‘high gas fees’ when using Ethereum. This has left users searching for alternatives such as Cardano and others.

This is where exchanges such as Loopring L2 would be beneficial. As per the info mentioned on their website, users could trade cheaply and speedily without worrying about the Ethereum congestion and gas fees.

It’s important to note that security is never compromised, and users can feel assured about their safety. This is just a brief overview of the various features provided by Loopring L2. We recommend checking out their blog section for a range of well-written articles.

Risk of Buying LRC

Given below are a few risks associated with buying Loopring, which must be considered by every investor:

- Being a relatively new token, it is still considered to be very volatile.

- Despite numerous price predictions, the future of the token cannot be surely determined.

- Before buying this token, it will require a significant amount of research and analysis to avoid financial losses.

Loopring Price

The LRC price today is trading around $0.50 – $0.55 with a 24-hour trading volume over $300 million.

CoinMarketCap ranks LRC the #69 largest crypto by market capitalization – the LRC market cap is $710 million with a circulating supply of 1.33 billion – 97% of its max supply is unlocked, which should be bullish for the LRC price.

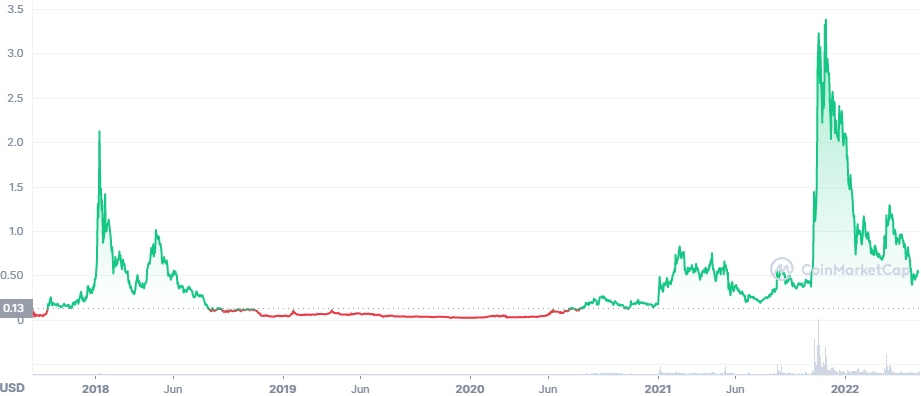

Loopring price history via CoinMarketCap

The 2022 yearly open was $2.08, compared to a 2021 open of $0.17 – despite the recent crypto market correction, largely caused by Bitcoin retracing from $69,000, Loopring is in a long-term bull market.

The 2021 low was $0.17 compared to $0.32 in 2022 – almost 100% higher. Loopring may have bottomed in May 2022 after the LUNA crash and Bitcoin losing the $30,000 level – even the best cryptos can drop before rallying to new highs.

Loopring Price Prediction

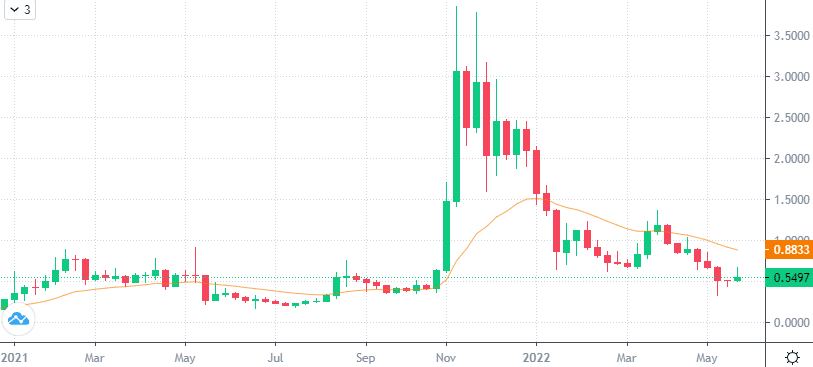

The 21 weekly EMA is currently at $0.88 which has been holding the LRC price down so far – since it lost that exponential moving average in mid January 2022 and has failed to reclaim it.

If the LRC price can find support on that EMA again – as it did before its bull run in late 2021 – then breakout back above $1 the next resistance level would be $1.35, its March 2022 monthly high.

LRC price chart – 21 weekly EMA

Currently the crypto market is volatile with BTC still around $30,000 and US stocks selling off, causing panic amid rising inflation and recession fears. When that passes LRC could move up to retest the $2 resistance level – which previously held up the LRC price as support in Q4 2021.

If LRC can close a weekly candle above $2.50 there’ll be little resistance left to the upside and it could easily enter price discovery and set a new all-time high above $4 – $5.

Ways to Buy Loopring

You could invest in Loopring in several ways. Read ahead as we give a brief description of each one.

Buy LRC with Credit or Debit Card

Many investors buy crypto directly with their bank cards. This is one of the fastest ways of purchasing crypto but might depend on your bank. There may be extra fees when choosing to buy crypto with a credit card.

Buy Loopring Without ID

Platforms require users to submit their ID to buy cryptocurrency. This is because they are regulated by financial authorities internationally.

If you don’t wish to submit your ID, Changelly and ByBit could be suitable options. Although there are some restrictions for users who don’t pass KYC, such as lower daily withdrawal limits.

Best Loopring Wallet

Keeping cryptocurrencies with the exchanges may not be a good idea. Your tokens may be at risk of being lost in case of any data breach or malware attack.

This is why it is suggested to use Crypto wallets, whether physical or online, to store your cryptocurrencies. The Binance Trust Wallet is a reliable option for security and safety.

Conclusion

The fact that Loopring has proactively joined other exchanges indicates its intention to increase liquidity. It has been highly regarded by many crypto experts as its lowest-order price-matching feature is useful in eliminating crypto market arbitrage.

The Loopring protocol can easily accommodate various other exchanges, and it has the edge over other platforms for this reason. From a fundamental analysis and tech standpoint you want to invest in LRC if you think features like ring-matching and ring orders will take the traditional trading experience to the next level.

From a technical analysis standpoint LRC is also likely undervalued, now it’s back at around the $0.50 price range.