Hedera Hashgraph is a type of Distributed Ledger Technology, with the aim to provide a more efficient, sustainable and stable alternative to existing blockchain platforms. The Hedera platform uses a “gossip about gossip” protocol, exchanging information between all individual nodes on the network to reach a consensus on transactions for their validation. Its native token HBAR was founded at ICO in Aug 2018.

HBAR had an explosive bull cycle in 2021 after the Hedera Network announced Google will be joining its governing council. Now that most of that bull run has retraced, some investors are looking to buy HBAR in 2022 before the next bull market. This guide covers where to buy Hedera Hashgraph, if its a good investment, and some HBAR price predictions.

How to Buy Hedera Hashgraph – Quick Guide

- ✅ Step 1: Register with Your Broker: Visit the official website of your chosen broker to register and open a free account. Provide your personal details and upload the required ID documents.

- Step 2: Deposit: Add funds to your account to buy HBAR on the platform.

- Step 3: Search for HBAR: Go to the search bar and enter Hedera Hashgraph or HBAR. Click the result then click on the trade button to begin a trade.

- Step 4: Buy HBAR: Enter the amount that you want to invest in HBAR. Once you enter a USD amount, the quantity of HBAR tokens will be automatically calculated based on the market price. Click on ‘open trade’ to execute the trade.

Where to Buy HBAR – Top Platforms Reviewed

With its revolutionary approach to blockchain technology, many of the major crypto exchanges have already listed HBAR to buy and trade:

1. Crypto.com – Trade HBAR on Margin

This crypto exchange has both simple and advanced features, allowing veterans and newcomers to interact with the crypto market. To help beginners understand the platform, Crypto.com offers a free trial without fees for 30 days – allowing new investors to trade in cryptocurrencies without paying any transaction costs.

After completing the trial period, Crypto.com charges a 0.4% maker / taker fee per trade. When initially buying crypto like HBAR, the fee is 2.99% to deposit. Crypto.com also offers margin trading with leverage on perpetual trading pairs.

Along with HBAR, Crypto.com is home to over 250 cryptocurrencies, that include popular crypto-assets such as ETH, BTC, meme coins such Dogecoin, Shiba Inu and DeFi coins performing well in 2022 such as Storj.

Other features of Crypto.com include its crypto interest account that allows investors to earn up to 14.5% on certain crypto assets (Polkadot and Polygon offering the highest yield), and up to 10% on stablecoins.

Overall, it is an intuitive crypto exchange with features suitable for both newbies and long-time crypto investors. It’s particularly well known for offering its own metal VISA card.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

2. Binance – Buy Hedera Hashgraph and 600 Altcoins

Our next recommendation for buying HBAR online is Binance. In terms of trading volume,

This trading platform is preferred by experienced traders as it offers advanced trading features to users including Tradingview indicators. This can make it a little difficult for new traders to get to grips with, although there is a simplified classic mode.

Binance has a maker / taker fee structure of 0.1% without spread, making trading on this platform comparatively cheaper.

Join via a Binance referral link for a further discount on trading fees. The minimum deposit on Binance is $20. The minimum trade is $10.

The platform also facilitates P2P trading (transfer of cryptos among crypto holders on the platform). P2P transfer charges zero for the makers and a nominal amount for the takers. Over 150 payment methods are available for P2P payments. Trading through P2P can be done at mutually desired prices.

Like Crypto.com, Binance has margin trading as well as spot trading – so you can long HBAR or short HBAR for higher returns and to take advantage of the HBAR price volatility.

In the United States, users can access Binance.US a more scaled back version of the international site.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

3. Huobi – Reputable Crypto Exchange Supporting HBAR

The popular crypto trading platform has listed 300+ cryptocurrencies, including popular crypto-assets such as ETH and BTC, older altcoins such as IOTA and newer tokens like Shiba Inu. Considered one of the most liquid crypto exchanges globally, Huobi offers deep liquidity for its BTC/USDT and ETH/USDT pairs.

Huobi has a maker/taker model for fees although higher than Binance at 0.2%. It provides discounts to those high-volume traders that own HT tokens – native token of the Huobi chain.

Huobi implements standard features such as two-factor authentication, cold storage, and Identity verification when it comes to security. Since 2014, Huobi has added measures to fend off DDOS attacks. The platform also keeps a reserve of Bitcoin to compensate traders if the platform suffers crash or the users’ wallets get hacked.

Huobi also has a HBAR/USDC pair as well as a HBAR/USDT pair, something most other crypto exchanges that have listed HBAR don’t offer.

What is HBAR?

Firstly it helps to power decentralized applications and works as a security shield to protect the network from malicious attacks. It can also be used by developers to pay for using different network services.

- Token Service

HBAR’s token service enables the tokenization of fungible and non-fungible tokens (NFTs) on the public Hedera Network. It offers high throughput, low fees and high transaction speed. It costs less than one cent to transfer any sum of a tokenized asset.

The tokens deployed using the Hedera Token Service offer native programmability and adopt the same efficiency and security as HBAR.

Hedera has its own decentralized governing body that ensures the network’s stability.

- Consensus Service (HCS)

Hedera Consensus Service offers fast and secure consensus. HCS enables users to track assets across different supply chains and helps in creating auditable logs of events. HCS can also be used as a decentralized ordering service.

Unlike other distributed ledger, which requires complex configuration when used standalone, HCS offers high transaction throughput and charge low fees even when used standalone. It claims that a single HCS message costs $0.0001.

- Smart Contract

The Hedera Smart Contract can be used to build decentralized applications, either from scratch or over existing codes.

Its Smart Contract service is EVM compatible and optimized for hashgraph. It charges low and predictable gas fees and offers transaction finality in seconds.

How does HBAR Protect the Network Against Malicious Attacks?

The proof-of-stake public network of Hedera uses its native token, which is staked to a network node. Because of this, transaction consensus can be reached only through weighted voting with HBARs.

This way, performing malicious transactions becomes difficult and expensive as it will require the attackers to own and stake a high quantity of HBAR – which is over one-third of the network’s total supply of HBAR.

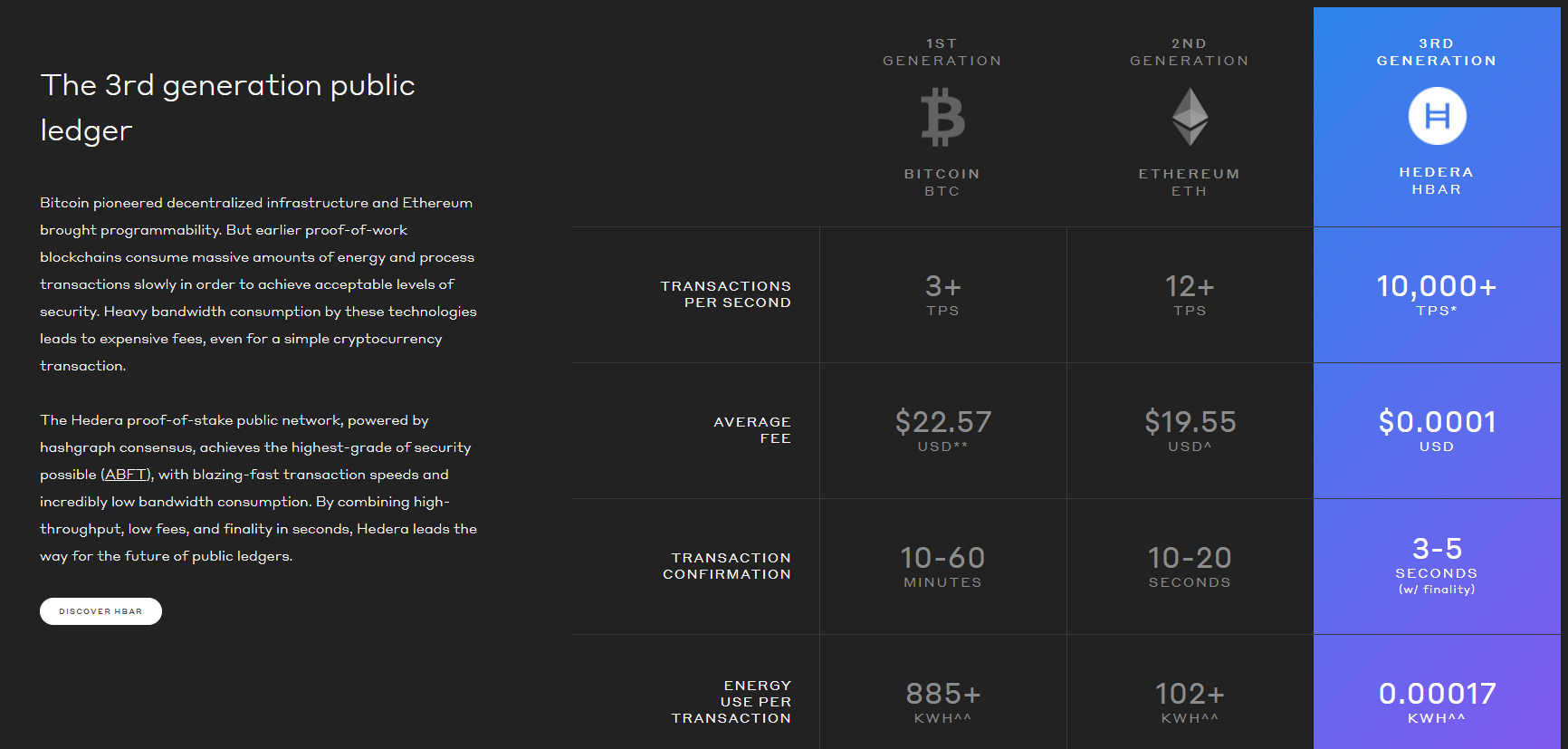

Different features of Hedera Hashgraph – click to enlarge

Is HBAR a Good Investment?

Before investing in HBAR, it is essential to consider some critical facts. Here are the advantages that HBAR brings to the crypto ecosystem, and some drawbacks.

- Low-cost Transactions:

Due to a lightweight consensus service, the cost per HBAR transaction is as low as USD 0.0001.

- High Transaction Speed:

The network achieves 10,000 HBAR cryptocurrency transactions per second without compromising its security and stability.

- Low Energy Consumption:

The Hedera Hashgraph project can be considered a green crypto project with its energy consumption at a mere 0.00017kW per hour. It is far lower than Bitcoin’s 885 kW an hour consumption.

- Lack of Decentralization:

Hedera Hashgraph is not decentralized. Only large corporate companies, such as Google, IBM, LG, etc., can operate the Nodes.

- Lengthy Name:

Hedera Hashgraph, is not an easy name to remember. When the purpose of a blockchain is to increase mass adoption, the name has to be memorable for branding purposes. Many might not consider it a significant issue however, and HBAR is more memorable.

- It is not a Truly Public Blockchain:

Hashgraph is patented technology under its creator, Leemon Baird. That means its blockchain doesn’t truly belong to the public.

- Only Council Members Can Run Nodes:

Unlike blockchains where node membership is given openly and based on a democratized system, the control of HBAR is only given to council members.

Hedera Price

The HBAR price was first tracked by Coinmarketcap at around USD 0.038 in Oct 2019. Shortly before that HBAR was listed on Binance in late September 2019, opening at $0.031.

There was then a long period of sideways trading and a slight bearish trend was observed from Nov 2019 to the end of the year, wherein the price made a low of just under $0.01 – which is still the generational low as of mid 2022.

At the beginning of 2020, the HBAR price made a new high of $0.083 in Feb 2020. The average price during the year remained at around $0.035 however.

HBAR price chart via CoinMarketcap

The beginning of 2021 began Hedera Hashgraph’s famous bull run when the price of HBAR exploded. The price remained highly bullish during the year reaching a high of over $0.4 by April 2021.

After a correction in mid 2021 the HBAR price then spiked again to its all time high of over $0.5 (reaching $0.576 on Binance). Today as of mid 2022 the HBAR price has corrected back to around $0.07 – $0.08.

HBAR Price Prediction

Multiple factors are driving the growth of Hedera Hashgraph. Taking into account the most recent among them can help us make an accurate Hedera Hashgraph price prediction:

- Hedera Hashgraph recently launched their debut NFT marketplace by the name “Hash Axis” on 6th May 2022. The platform operates only in HBAR, thus relying solely on hashgraph-based transactions.

- Swirlds Labs is a recently established incorporation founded by Dr. Leemon Baird and Mance Harmon, the minds behind Hedera. This incorporation was established with the sole motto of the development and improvement of the Hedera Network. On May 1, 2022, the founders resigned from their respective designations in Hedera to join as co-CEOs of Swirlds Labs. This move can be ascertained as a big step towards the growth of the Hedera Network in the coming future.

- Elon Musk’s Tweets are another reason behind the rising popularity of HBAR. On 22nd Feb 2022, Musk tweeted the official symbol of the token, which caused quite a stir among his over 100 million followers to learn about HBAR coin.

The price of HBAR showed a bearish trend throughout 2022 however. The current 2022 low is $0.0581 – although HBAR has held its value better than some altcoins that sold off around the time of the Terra (LUNA) and UST crash in May 2022, then Bitcoin dropping to $17,600 in June 2022.

HBAR has retraced as much as 90% from its all time high – some altcoins have retraced further – before bouncing to now be 88% off its high at the time of writing. Many investors are optimistic however that in the long term HBAR can set new highs.

One of the best crypto traders to follow, @CredibleCrypto, is a well-known HBAR bull. Also Jacob Crypto Bury on Youtube made a recent HBAR technical analysis video.

Best Ways to Buy HBAR

When investing in HBAR, these are the best options available:

Buy HBAR with Debit/Credit Card

When buying HBAR via debit/credit card, consider the transaction fee that crypto trading platforms charge for fiat-based transactions. Crypto.com and Binance charge 2.99% and 3.99%, respectively.

Buy HBAR with Paypal

If you don’t want to input your bank account details on a trading platform, we recommend using Crypto.com. On that platform you can use Paypal to affordably invest in HBAR without providing your bank details.

Buy HBAR Without ID

HBAR is also listed on Bybit which has lesser KYC requirements than other crypto exchanges – although daily withdrawal limits are lower for unverified users.

How to Sell HBAR

Selling HBAR and any other crypto holdings is as simple as the process to buy HBAR above – open a trade with the ‘Trade’ button and enter the amount you wish to sell. It’s possible to set limit orders to scale out of a position gradually, or close your position fully at the current market price.

Crypto.com can also be used to short sell HBAR if you’re confident the short term price action will be bearish, to compound your position during market corrections.

Conclusion

Hedera Hashgraph has taken a novel approach to the crypto ecosystem by implementing a distributed ledger technology. While its environmentally conscious approach is admirable, the centralized route it has taken leave some wondering if it bodes well for the future of crypto.

Despite some doubts, many investors are looking for a greener and more efficient blockchain alternative, and Hedera Hashgraph delivers it. To buy HBAR, we recommend using regulated platforms such as Crypto.com