The easiest way to buy crypto online is with a credit card issued by Visa or MasterCard. In choosing this payment method, you will be able to invest in your chosen digital currency instantly.

In this guide, we discuss how and where to buy crypto with a credit card in less than five minutes with a low-fee broker.

Where to Buy Crypto With Credit Card – Top 5 Exchanges

If you’re looking for the best site to buy cryptocurrency with a credit card – the top five providers can be found in the list below.

- Crypto.com – Popular Crypto App That Supports Instant Credit Card Payments

- Binance – Leading Crypto Exchange With Low Trading Commissions

- Coinbase – Top Crypto Broker Platform for Beginners

- Kraken – Advanced Crypto Exchange for Seasoned Traders

Read on to assess which of the above platforms are right for you when buying crypto with a credit card.

Best Sites for Buying Cryptocurrency With Credit Card Reviewed

When choosing the best site to buy crypto with a credit card – you will first need to look at how much the platform charges in fees. After all, the five providers that we listed above charge anything from 0% to 4.5% on credit card payments.

You should also explore what markets the crypto exchange supports and whether the platform itself is user-friendly enough for your skillset.

We also wrote a guide on how to buy Bitcoin with a credit card that goes into more detail for BTC.

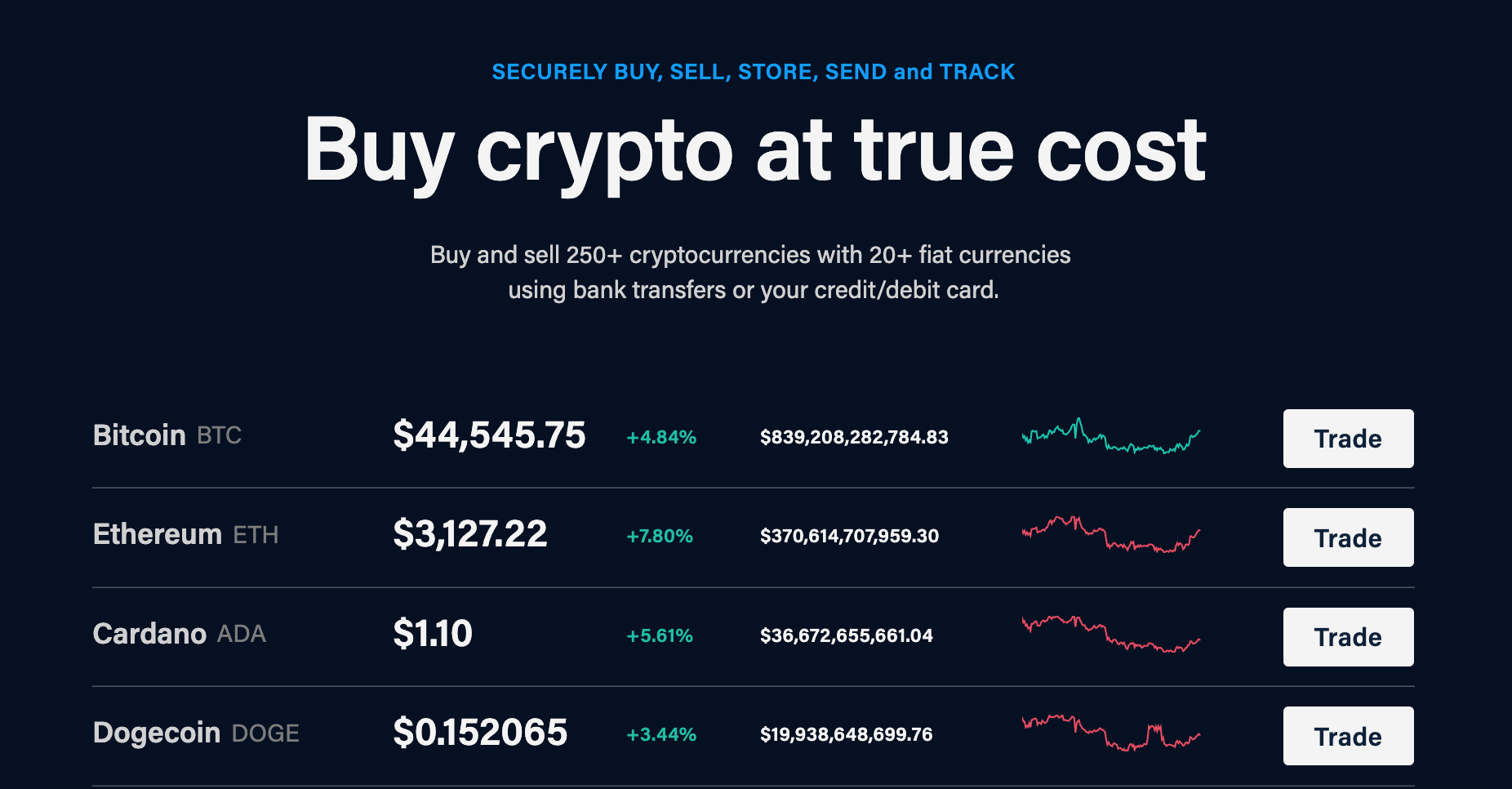

1. Crypto.com – Popular Crypto App That Supports Instant Credit Card Payments

In order to do this, you simply need to register an account and download the Crypto.com app to your mobile device. There’s also a desktop exchange platform.

You will be charged a fee of 2.99% for using your Visa or MasterCard, albeit, your transaction will be processed instantly. Moreover, the Crypto.com app gives you access to more than 250 digital currencies.

Therefore, this crypto exchange provider will suit those of you that are looking to invest in a wide range of tokens. When it comes to standard trading commissions, Crypto.com is very competitive in this department. The most you pay per slide is just 0.40%, but those trading larger amounts will be offered lower commissions.

Another way to reduce your commission is to stake the Crypto.com native token – Cronos (CRO). We also like Crypto.com for its storage facilities, which cover both custodial and non-custodial wallets. The former allows you to keep your digital tokens in your Crypto.com account, while the former gives you full control over your private keys.

Alternatively, you might instead decide to buy crypto with a credit card and then transfer the tokens to a Crypto.com savings account. This will allow you to earn interest on the tokens that you buy – with Crypto.com offering an APY of up to 14.5%. You will get the highest interest rate possible by staking CRO and opting for a 3-month lock-up period.

With that said, 1-month and flexible accounts are also offered, as is the ability to earn interest without staking CRO. You can also access crypto loans on this platform with a maximum LTV of 50%. Moreover, Crypto.com offers a popular prepaid credit card that is issued by Visa. This allows you to spend the tokens held in your Crypto.com wallet at ATMs, online, on in-store.

| Number of Cryptos | 250+ |

| Credit Card Fee | 2.99% |

| Fee to Buy Crypto | Included in credit card fee |

| Minimum Credit Card Deposit | Not stated |

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

2. Binance – Leading Crypto Exchange With Low Trading Commissions

For those outside the United States, Binance is also international, and worldwide investors have access to over 600 cryptocurrencies. Standard trading commissions amount to just 0.10% – which is perhaps industry-leading.

However, if your sole objective is to buy crypto with a credit card, it should be noted that Binance is expensive. In a nutshell, Binance will charge you 4.5% for using Visa or MasterCard, plus an instant buy fee of 0.5%. This means that for every $100 worth of crypto that you buy with your credit card, a fee of $5 will apply.

On the other hand, we like that Binance allows Americans to deposit US dollars via ACH or a domestic bank wire on a fee-free basis. Although this will delay the investment process, you can then proceed to trade crypto at the aforementioned commission of 0.10% per slide.

Binance will suit those of you that are looking for an advanced trading suite that comes packed with analysis tools. You will find a comprehensive charting area when trading here, alongside custom order types. You can also view live order books and utilize chart drawing tools via TradingView.

With that being said, the US version of Binance is a lot more limited than its global counterpart. This is because Americans do not have access to crypto interest accounts or staking tools, nor yield farming or leveraged markets. Nonetheless, you can download the Binance US app to your iOS or Android should you wish to trade on your smartphone.

| Number of Cryptos | 100+ |

| Credit Card Fee | 4.5% |

| Fee to Buy Crypto | 0.5% instant buy fee |

| Minimum Credit Card Deposit | Not stated |

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Top Crypto Broker Platform for Beginners

Coinbase is one of the most popular crypto exchanges in the US – especially for beginners. This top-rated platform allows you to open an account and buy crypto with a credit card in under 10 minutes from start to finish. The Coinbase website is simple to use – so no prior knowledge of crypto is required.

However, the main issue that we have with Coinbase for the purpose of buying crypto with a credit card is that you will be charged 3.99% of the transaction size. If your order size is below $200, you will pay a flat fee depending on the specific investment amount. This can make Coinbase unviable for those wishing to invest small sums of money.

Although Coinbase gives you the option of reducing your fees via an ACH deposit, you will still need to cover a standard commission of 1.49%. This hasn’t, however, deterred investors from using Coinbase, as the exchange is now home to nearly 100 million registered clients from over 100 countries.

Coinbase gives you access to a range of other tools on its platform – including a newly launched NFT marketplace. You can also engage in staking across a small number of tokens and even gain access to real-time loans. The latter allows you to raise cash in exchange for depositing Bitcoin as collateral.

Going back to its primary exchange platform, Coinbase gives you access to over 150 digital currencies. This is in stark contrast to its early days of Coinbase, which limited itself to just Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Nonetheless, diversification is now super-easy when using Coinbase. Most importantly, Coinbase is heavily regulated in the US – so safety is assured.

This is further supported by the exchange’s institutional-grade security controls. In addition to IP address whitelisting and two-factor authentication, Coinbase keeps 98% of the client funds in cold storage wallets. If you want to take full control over your crypto tokens, consider downloading the Coinbase non-custodial wallet app for iOS and Android.

| Number of Cryptos | 150+ |

| Credit Card Fee | 3.99% |

| Fee to Buy Crypto | Included in credit card fee |

| Minimum Credit Card Deposit | Not stated |

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

4. Kraken – Advanced Crypto Exchange for Seasoned Traders

The final option to consider in your search for the best place to buy crypto with a credit card is Kraken. This platform gives you access to over 65 digital currencies at competitive trading commissions. This begins at 0.26% for small-level trades for gradually reduces as you buy and sell larger volumes.

In terms of deposit fees, credit cards attract a transaction commission of 3.75%. Once again, in comparison to the likes of others that charge 0% in credit card fees, this is expensive. Therefore, if you have your heart set on using Kraken, you might want to instead consider depositing funds via ACH.

Nevertheless, we like Kraken for its advanced trading features and tools. In particular, seasoned investors will appreciate the Kraken Pro platform, which comes packed with advanced charting indicators and drawing tools. You might also like the Kraken Futures division, which allows you to trade leveraged Bitcoin markets.

Another plus point with Kraken is that it offers a fully-optimized mobile app for both iOS and Android devices. This enables you to research the markets and place orders at the click of a button. Kraken is also popular for its solid reputation. After all, Kraken has been offering crypto exchange services since 2013.

| Number of Cryptos | 65+ |

| Credit Card Fee | 3.75% |

| Fee to Buy Crypto | Included in credit card fee |

| Minimum Credit Card Deposit | Not stated |

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

Why Buy Crypto with Credit Card?

There are a number of ways that you can buy crypto from the comfort of your home. However, we would argue that opting for a credit card is by far the most convenient option on the table.

Here’s why:

Buy Crypto Instantly

The cryptocurrency markets have come a long way since the early days of exchanges – which only allowed you to deposit funds via a traditional bank wire.

Now, although some investors still prefer to deposit funds via ACH or a domestic bank wire, this can take several days for the funds to arrive.

Moreover, you will need to log into your online banking facility and manually transfer the funds. In some cases, you will need to add the respective crypto exchange as a beneficiary, which again, can take time.

In comparison, when you buy crypto with a credit card, the process is not only convenient but extremely fast. In fact, once your crypto exchange account is verified, your credit card deposit will be processed instantly.

This means that you can invest in your chosen crypto asset without delay and thus – you won’t be required to wait 1-3 working days for the funds to clear.

Ideal for First-Time Investors

If you are completely new to crypto exchanges, then you might be somewhat intimidated by the investment process. With that being said, exchanges that support credit card payments – such as those we reviewed earlier on this page, often make the process very straightforward.

For example, if opting for easy-to-use exchanges, it’s just a case of entering some basic personal information and then entering your credit card details when prompted. Then, you can simply search for the crypto asset that you wish to buy, enter your stake, and that’s it – your tokens will be added to your portfolio.

Convenient for Withdrawals

Another major benefit of electing to buy crypto with a credit card is that you can use the same payment method when you eventually get around to cashing out your investment.

The process typically works as follows:

- You buy crypto with your preferred credit card

- You keep the tokens in your exchange account

- At some point in the future, you sell your crypto back to US dollars

- You then request a withdrawal of the funds back to the same credit card that you used to make the deposit

In the vast majority of cases, once you request a withdrawal, you should find that the funds are credited to your card within 1-3 working days.

Low-Cost Credit Card Payments

If you read through our exchange reviews of the best places to buy crypto with a credit card, you might have noticed that many providers in this space still charge high fees when using this payment method.

- For instance, Coinbase charges 3.99% on credit card payments, while at Binance US, this will cost you 4.5% plus a buyer’s fee of 0.5%.

- Kraken is also costly, with the exchange charging 3.75%.

However, the good news is that you also have low-cost platforms.

This is also the case when you request a USD withdrawal back to your credit card after cashing out your crypto investment.

Can You Buy Crypto with Credit Card with No Verification

Under no circumstances will you be able to buy cryptocurrency with a credit card without verification.

Crucially, this would be against anti-money laundering regulations – so any platform that you come across that offers anonymous credit card deposits is doing so illegally.

As a result, if you wish to buy crypto with a credit card, you will need to go through a KYC (Know Your Customer) process. Depending on your chosen exchange, this can be a fast and burden-free process.

For example, you will simply need to provide some basic personal information before uploading a copy of your government-issued document. From start to finish, this typically takes five minutes.

Take note, the KYC requirement is not only valid for credit card payments – but any deposit or withdrawal that you make with fiat money.

Therefore, the only way to engage with the digital asset industry anonymously is to use a decentralized exchange via crypto-only transactions.

Best Credit Cards to Buy Cryptocurrency With

If you’re looking to buy crypto with a credit card, exchanges and brokers that accept this payment type will typically support Visa and MasterCard. In some cases, you might find that Visa Electron and Maestro are supported too.

However, very few platforms will allow you to use an American Express card to buy crypto.

In terms of specific issuers, the best credit card to buy cryptocurrency will offer cashback rewards on eligible purchases.

- It is also important to be wary of any additional fees that might apply outside of the control of your chosen exchange.

- For example, some exchanges support free USD credit card deposits, some issuers charge a cash advance fee when making a payment at an investment-related platform.

- If this is the case, cash advance fees typically amount to 3-5% of the transaction amount.

- Furthermore, interest on the payment will begin to accrue instantly.

As such, you should check with your credit card provider before making a payment at a crypto exchange.

Conclusion

From start to finish, it should take you no more than five minutes to buy crypto with a credit card from the comfort of your home. But, before choosing a crypto exchange for this purpose, be sure to check what fees apply.

After all, the likes of Binance US and Coinbase will charge you 4.5% and 3.99% respectively when making a credit card deposit.