Although the fastest way to buy Bitcoin is with a debit card or a credit card, it’s not always the most secure. A prepaid card, on the other hand, is not only a more secure alternative for buying Bitcoin but comes with several additional advantages.

In this guide we’ll review where and how to buy Bitcoin with a prepaid card – it’s easier than you think and there are some well-regulated crypto exchange platforms to choose from.

Where to Buy Bitcoin with Prepaid Card

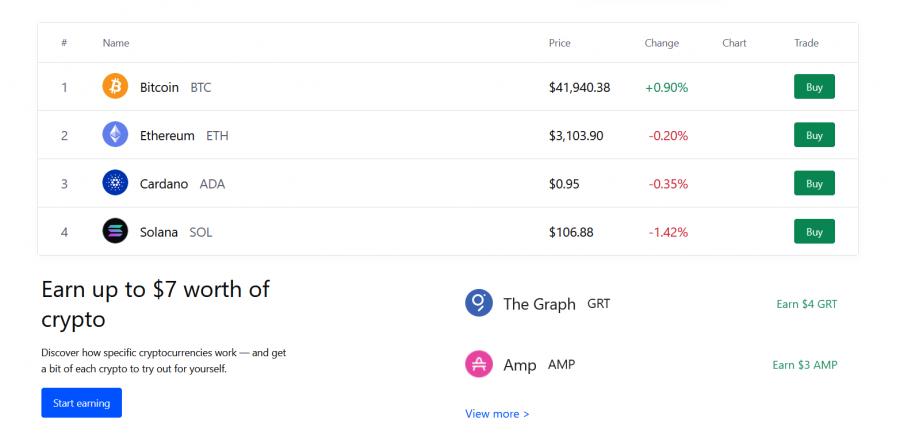

Here’s a quick overview of the 4 best crypto exchanges to buy Bitcoin with a prepaid card.

- Crypto.com – Buy Bitcoin with prepaid card and 250+ other cryptocurrencies

- Coinbase – Buy Bitcoin with prepaid card in the US

- CEX – Buy Bitcoin and get crypto-collateralized loans

- Coinmama – Accessible platform to buy Bitcoin with a prepaid card

Below we’ll take a closer look at these crypto exchanges for prepaid cards and their features and fees.

How to buy Bitcoin with Prepaid Card – Quick steps

Follow these steps to use a prepaid card to buy Bitcoin in a matter of minutes:

- Create an account – The first step to buying Bitcoin with your prepaid card is to open an account on an exchange. Register by filling in details like your name, address, email ID and enter a password. Upload the requested documents to verify your identity.

- Deposit funds – Connect your prepaid card to your account. Enter the amount you want to deposit, and confirm the transaction request on your device. US dollar deposit are fee-free.

- Search for Bitcoin – Search for Bitcoin in the top menu bar and click on “Trade”.

- Buy Bitcoin – Enter the amount of Bitcoin you wish to buy – you can purchase a fraction of one Bitcoin – and click on “Open trade”. Your Bitcoin will be transferred to your crypto wallet instantly.

Top Exchanges to Buy Bitcoin with a Prepaid Card

The most common payment method used to buy Bitcoin is debit and credit cards. The latter may not be the best option – overinflated charges being one issue – although it is convenient.

Debit cards may have higher fees compared to buying Bitcoin through a bank transfer (ACH or SEPA), but they are quicker and processed right away. In the end, it depends on how much you value your time. Instant Bitcoin purchases can be beneficial during events like the May 2022 crypto crash, when investors who bought the dip saw a 20% bounce.

A prepaid card is one of the safest ways to buy cryptocurrency, something that beginners and experienced traders alike are concerned about. Not all crypto exchanges support prepaid cards though. Some of the best platforms that currently do accept prepaid cards are:

1. Crypto.com – Buy Bitcoin with Prepaid Card and 250 Cryptocurrencies

Once done, search for Bitcoin and click on “Trade”. Click on the buy button right after you’ve entered the amount of Bitcoin you wish to purchase. Most prepaid cards have two-factor authentication, so you have to confirm a transaction request either by entering a PIN or using your biometrics. Once the request is confirmed, your Bitcoin should be reflected in your wallet in no time.

The platform has listed over 250 cryptocurrencies you can trade against Tether (USDT), Bitcoin, or its native token Cronos (CRO).

Apart from trading, the platform also supports earning interest on Bitcoin. The annual percentage yield (APY) for Bitcoin can go up to 6%, but there’s a three-month lock-in period required – flexible terms are available for a lower APY. It offers the best crypto staking services via its Crypto Earn facility.

The platform has its own NFT marketplace (like Binance), and it also offers a prepaid card of its own – a metal VISA card.

The exchange offers a discount on trading fees if you hold their cryptocurrency, CRO, and stake it. That recently dropped in value in mid-2022 when their prepaid card rewards were adjusted and could be a good investment on the dip.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Coinbase – Buy Bitcoin with a Prepaid Card in the US

As of 2022, it has 89 million users across the globe. There are over 100 cryptocurrencies available on the platform, and they constantly add new and most promising altcoins.

Buying Bitcoin on Coinbase is again beginner friendly and straightforward. The regular Coinbase is made with the vision of being an easy-to-use platform for beginners. While Coinbase Pro is more inclined to serve traders and is more complex in appearance and technical indicators.

You’ll need to complete KYC in order to buy Bitcoin. After you’ve done that, you just need to add the necessary funds to your wallet using your prepaid card, search for Bitcoin, and confirm the transaction after entering the amount of Bitcoin you wish to purchase. This process can be done in as little as 10 minutes.

Coinbase has a complicated structure when it comes to transaction fees. There is a deposit fee of 2.5% on the total deposit done via a prepaid card. There are several other payment methods available such as buying Bitcoin with Apple Pay and the charges for each of them vary individually.

The exchange takes security seriously – Coinbase offers authentication tools like two-factor authentication and biometric fingerprint logins. In case of a breach, Coinbase is insured for all its USD balances and also has AES-256 encryption for digital wallets. Coinbase stores 98% of customer funds in offline wallets where they are safe and secured from any online hacks.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. CEX – Buy Bitcoin and Get Crypto Loans

CEX.IO is a well-known regulated crypto exchange present in over 200 countries, along with the 48

The exchange complies with all the necessary regulations and has required licenses to operate in the US. They also store the majority of their digital assets in cold wallets to maximize safety. CEX.IO also has a good reputation for customer service, which is a department where many major crypto exchanges fall short.

The process to buy Bitcoin on CEX is similar to any other exchange. Set up an account, add payment information, and trade. The fee to deposit funds is average as well, which is 2.99% of the deposit amount.

The platform also supports crypto staking, giving users a chance to earn interest on their holdings. Another notable feature is its crypto-collateralized loans, where users can take out cash/fiat by issuing their crypto holdings as collateral. This can be beneficial in a situation where users need cash but would rather not sell their crypto.

CEX.IO offers many features, and it can be overwhelming, especially for beginners. Lack of liquidity, when compared to the competition, is another aspect where CEX.IO falls short. Even though there are a few cons, the platform is one of the best platforms to buy Bitcoin with a prepaid card.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Coinmama – Most accessible platform to buy Bitcoin

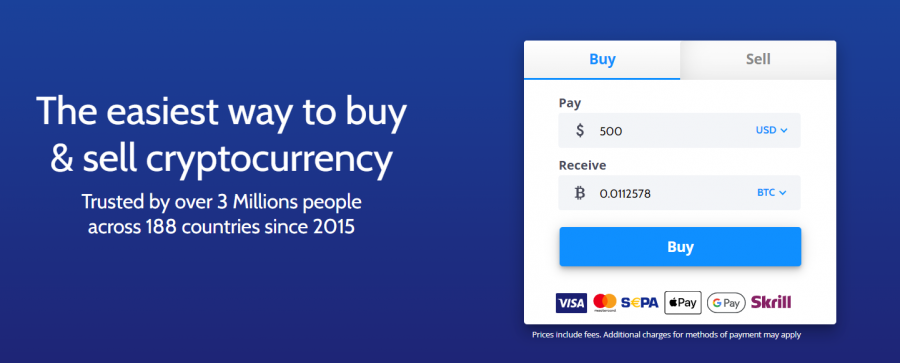

Coinmama is present in more than 200 countries worldwide, making it one of the few crypto exchanges that serve such a wide demographic. The platform was launched in 2013 and now serves more than 3 million users across the globe.

Due to the wide reach, the platform supports multiple languages. The downside is the platform charges 5% as a transaction fee when buying Bitcoin with a Prepaid card. Additionally, they only support Visa and Mastercard for Prepaid card purchases.

Adding to the inconvenience of using the platform is the accessibility. Coinmama is only available on the web, there’s no mobile app.

Coinmama also does not share your personal information with any third parties, nor do they save your payment information, and has fast customer support. Those are some advantages.

Why Buy Bitcoin with a Prepaid Card?

When there are so many payment options available, why should you choose a prepaid card to buy BTC? There are multiple ways in which prepaid cards are better than any other alternative payment method – secure transactions being one.

Here’s a list of factors that make prepaid cards debatably the best way to buy Bitcoin:

Buy Bitcoin Instantly

If there’s one thing we know about crypto it is that the markets are highly volatile. Along with slightly higher risks than normal assets, this also means increased opportunity to make a profit. Dogecoin reacting quickly to Elon Musk tweets is one example of that.

You need to constantly think on your feet if you want to trade crypto so being able to instantly purchase crypto is of paramount importance. A prepaid card enables you to do that effortlessly.

In some cases, it takes days for funds to reflect in your wallet if you use an alternative payment method. Wire transfers, for example, can take up to 5 days to process a transaction. Prepaid cards are one of the best ways to purchase crypto, given you already have an account and have completed the KYC process.

Owning a Prepaid Card is Easy

One of the most used payment methods to buy crypto is using credit cards. The problem is that not everyone can get their hands on one depending on their credit history. Even if they can, the process of acquiring a credit card is somewhat exhausting.

Prepaid cards on the other hand can be acquired instantly. All you need to do is fill out the required form and make the necessary payment. Then you have your hands on your prepaid card in no time.

It’s important to note though that you need to deposit funds to the card for it to be activated (hence ‘pre-paid’, a pre-payment). Once you do that, you can use those funds to buy crypto.

Prepaid Cards are Convenient

As mentioned earlier, acquiring prepaid cards is very easy. Using one is just as easy too.

Unlike debit cards that ask for confirmation, a transaction can be processed in no time. Not just debit cards, but prepaid cards are faster at processing a transaction than almost every other alternative payment method available on crypto exchanges.

The biggest convenience with prepaid cards is you don’t have to pay interest on your purchases, unlike credit cards – where the interest (APR) just keeps on piling up. So you can buy even more crypto with the money you saved on the monthly interest you don’t pay. A win-win situation.

Spends in Moderation

We all end up spending way more than we plan when we use a credit card. There’s a chance we can do the same when it comes to crypto.

Crypto markets are constantly changing and sometimes we end up making impulsive decisions that can cost us our hard-earned money. When you use a credit card, you might end up trading with a lot more money than you can afford.

With prepaid cards, that’s not an issue as you’ve already logically planned how much you need to invest and avoid making any decisions that you’ll later regret.

Highly Secure

Although unlikely, there’s the possibility of your bank details being hacked. If you use a credit card, then too there’s the possibility of someone stealing your info and using it to withdraw money from your credit. It’s always better to be safe than sorry and this is why using a prepaid card is a wise decision.

To hack a prepaid card, one needs to get through the two-factor authentication, which can only be done if they get access to the authentication code required to process a transaction. As long as you don’t share your bank card details with someone, being hacked is virtually impossible. An additional layer of security prepaid bank cards offer is the use of biometrics to validate a transaction request. It’s almost impossible for someone to get access to these.

The only way someone can use your card is if they actually stole it – but you’re never losing more than the funds present in your wallet, which can be minuscule if you only deposit a large amount when you make a purchase. Lastly, you always have the option to deactivate your card in a matter of minutes. Hence, security is the last thing you need to worry about.

Fees

When you purchase crypto using a card, you need to pay a fee. Sometimes, you are required to pay a fee for depositing funds into your wallet, and otherwise, you are charged a fee for a crypto purchase transaction.

Almost all the major crypto exchanges allow users to buy crypto with a prepaid card, and the charges vary accordingly. Most of them charge somewhere around 2-5% for a deposit.

Conclusion

Buying Bitcoin is an easy task, a few clicks and you have your Bitcoin in your wallet balance. As a beginner, there’s always confusion about where to start and hopefully, this guide helped you navigate through the process.

Not only did we discuss the top exchanges to buy Bitcoin, but we also went over the process of how to actually buy Bitcoin with a prepaid card – from opening an account to depositing with your card.