Switzerland is one of the most Bitcoin-friendly countries globally. In fact, it is possible to purchase Bitcoin in Switzerland not only via online exchanges but also using crypto ATMs.

Our guide on how to buy Bitcoin in Switzerland covers all the crucial points on this topic – including a list of the top providers in the country that offers access to this digital asset.

How to Buy Bitcoin Switzerland – Quick Guide

Follow these steps to buy BTC in Switzerland right now:

- ✅ Step 1: Open an Account

Begin the process by opening an account with your chosen broker. New users will have to provide an email address, username, and password. - Step 2: Deposit Funds

Deposit funds into the account with a credit/debit card, PayPal, or by making a bank transfer. The minimum deposit required for users in Switzerland is $50 – which is around 50 CHF. - Step 3: Search for Bitcoin

Look for the search bar and enter ‘Bitcoin’. Click on the ‘Trade’ button when the result appears. - Step 4: Trade Bitcoin

In the order box, enter the investment amount and use the ‘Open Trade’ button to confirm the purchase.

Where to Buy Bitcoin in Switzerland

There is a long list of cryptocurrency exchanges in Switzerland that support Bitcoin trading.

To pick the best platform – one has to consider factors such as fees, security, user-friendliness, and the features available.

Here’s a list of the top six crypto platforms that lets users buy Bitcoin in Switzerland.

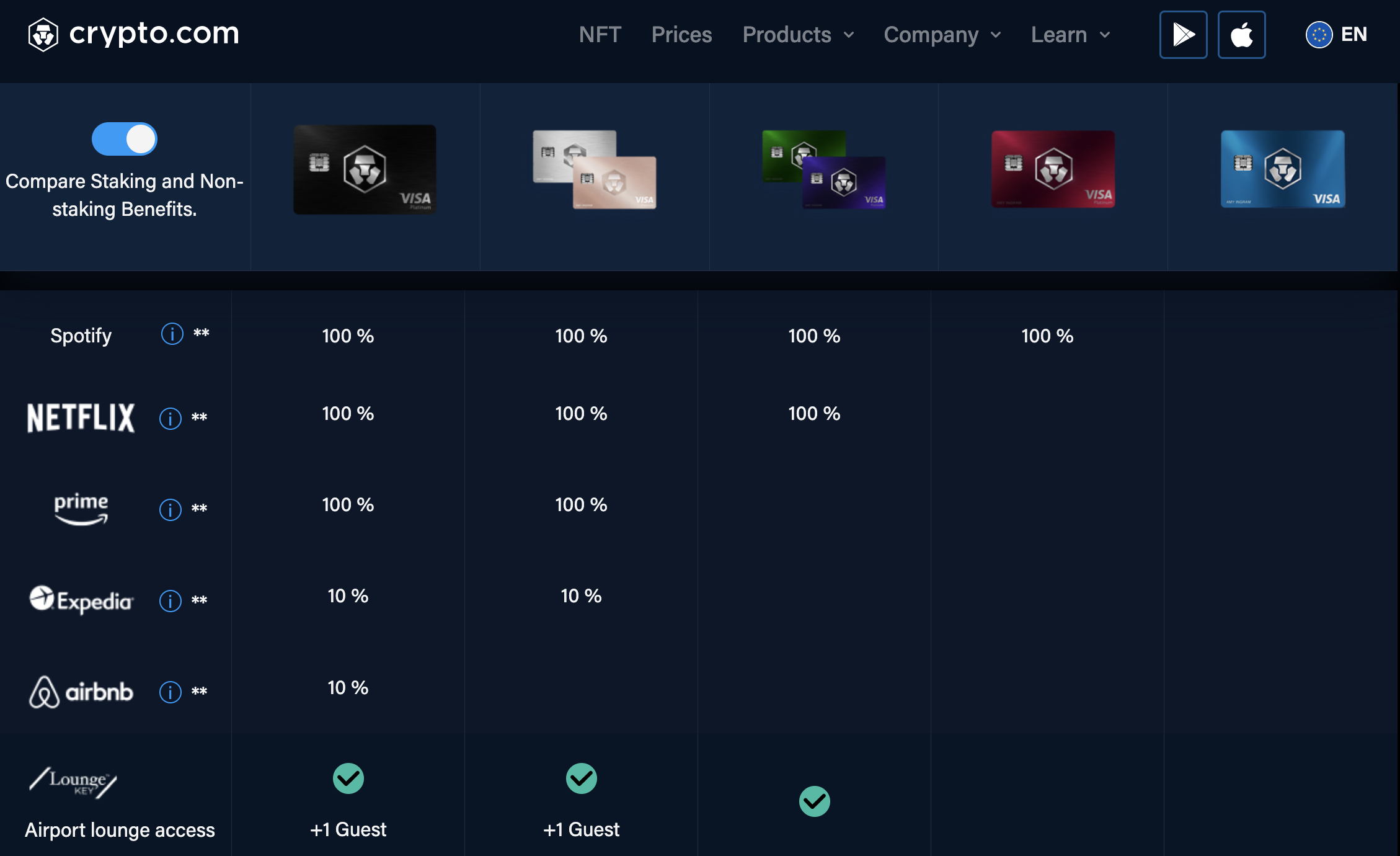

1. Crypto.com – Earn Up to 6% APY on Bitcoin

The platform charges a 2.99% fee to buy Bitcoin in Switzerland with a credit or debit card. It also accepts funding via bank transfer, at a 0% deposit fee – however, users will not be able to purchase Bitcoin instantly. Crypto.com also has a web-based exchange for its users to invest in Bitcoin in Switzerland.

But, this requires having access to a stablecoin such as Tether/USD Coin, or to CRO – the native digital token of Crypto.com. CRO has a few other use cases within the Crypto.com ecosystem. For instance, it allows customers to get a discount on the commission – which ranges from 0.04% to 0.40% based on the user’s trading volume.

Similarly, CRO can also be used to boost interest rates on Crypto.com’s savings accounts. This way, users can receive up to 6% APY on Bitcoin. And in case investors are looking to hold their BTC tokens for a few years, Crypto.com also comes with a non-custodial DeFi Wallet that functions as a separate app.

We also found that Crypto.com is a secure platform to buy Bitcoin in Switzerland. It holds only corporate funds in hot wallets, and 100% of all clients’ assets are secured in cold storage – with Ledger Vault. The provider also has $750 million in insurance to protect the users’ funds against physical damage, destruction, or theft.

| Number of cryptocurrencies | 250+ |

| Debit card fee | 2.99% |

| Fee to buy Bitcoin | Up to 0.40% trading fee |

| Minimum deposit | $20 |

Cryptoassets are a highly volatile unregulated investment product.

2. Bitstamp – Top Crypto Platform for Trading Bitcoin

BitStamp is one of the world’s most popular Bitcoin exchanges. It was launched back in 2011, and since then, has attracted millions of users with its secure crypto services. Bitstamp is known for its user-friendliness and easy-to-use mobile app, making it a great choice for beginners.

However, Bitstamp charges a high fee for facilitating the direct purchase of Bitcoin with fiat currencies. For instance, credit/debit card transactions on Bitstamp cost up to 5%.

Regardless, Bitstamp is considered a top exchange for traders. It supports over 70 cryptocurrencies and multiple trading platforms. Users will be able to trade Bitcoin via Bitstamp’s web platform as well as the mobile app.

Bitstamp’s default trading interface comes with support for different order types – including market, limit, and stop-limit. In addition to this, the platform also has a separate advanced platform called TradeView. It integrates customizable pricing charts, in-depth analysis tools, and other useful technical indicators.

The trading fees on Bitstamp stand at 0.5% per slide, and users can bring this down to 0% with sufficient trading volume. It also offers staking services, however, this feature isn’t supported for Bitcoin at the time of writing.

| Number of cryptocurrencies | 70+ |

| Debit card fee | 5% |

| Fee to trade Bitcoin | Up to 0.5% commission |

| Minimum deposit | $10 |

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Great Bitcoin Exchange for Beginners

It even sends a verification email if someone tries to access a user account from a different IP address. On top of this, Coinbase carries insurance to protect the digital assets in its custody against losses from cybersecurity breaches. It also offers a non-custodial wallet, which provides users full control over their private keys.

In a nutshell, Coinbase is one of the most secure platforms to choose to buy Bitcoin in Switzerland. Coinbase customers can fund their account with a debit/credit card or bank transfer. However, using a credit or debit card is expensive, as Coinbase charges a hefty fee of 3.99%. The platform also levies a relatively high trading commission of 1.49%.

Nonetheless, Coinbase continues to be a top choice for Bitcoin investors. Apart from its industrial-grade security, Coinbase is also beginner-friendly. It comes with an intuitive interface and several resources that cater to new investors.

Moreover, users can also earn crypto rewards through the Coinbase Learn feature. That being said, Coinbase also attends to the requirements of advanced traders. Its advanced trading platform Coinbase Pro comes with real-time charting tools and order books.

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Large Crypto Exchange With Low Trading Fees

Binance allows its users to buy Bitcoin in Switzerland with a credit/debit card instantly. However, users will have to pay a fee of up to 2% for this option. Alternatively, Swiss users can also fund their Binance wallet with Swiss francs via a bank transfer.

Moreover, those willing to purchase Bitcoin from other traders can also check out Binance’s P2P marketplace. Binance offers an escrow service to facilitate safe and secure transactions for P2P trading. Moreover, depending on the seller, users will be able to buy Bitcoin using payment methods such as a bank transfer, cash deposit, Wise, Revolut, and more.

We particularly like Binance as a crypto trading platform. This exchange charges a maximum of 0.1% commission for crypto trades. And notably, both makers and takers can benefit from up to a 25% discount in trading fees by holding BNB tokens in their Binance wallet.

Binance also offers access to advanced trading tools and technical indicators. It even facilitates ‘responsible trading’ for Bitcoin with features such as price protection, anti-addiction notice, cooling-off period function, and more. Furthermore, investors can also use Binance to take out a loan against their BTC tokens or open a savings account for Bitcoin.

| Number of cryptocurrencies | 600+ |

| Debit card fee | Up to 2% |

| Fee to buy Bitcoin | Up to 0.1% trading fee |

| Minimum deposit | Depends on the payment type |

Cryptoassets are a highly volatile unregulated investment product.

5. Bitcoin Suisse – Swiss Crypto Investment Platform

This platform supports both crypto-to-BTC pairs, as well as fiat-to-BTC markets. However, Bitcoin Suisse handles things a bit differently from other exchanges. It functions as an aggregator, finding the best available prices for Bitcoin from the most popular crypto platforms in the market.

Moreover, Bitcoin Suisse has also launched a stablecoin, named CryptoFranc, that is pegged to the Swiss franc. The fee for trading Bitcoin is 1.25% and if the chosen pair is not supported by major crypto exchanges, there will be an extra 0.5% charged.

While Bitcoin Suisse might come across as an attractive choice for Swiss residents, it also has a few shortcomings. For instance, it is not straightforward to open an account with the platform. Users will have to send an application request and this has to be accepted manually.

Secondly, it does not accept credit/debit card payments. It also requires a high initial deposit of 100,000 CHF from private individuals. Therefore, even though Bitcoin Suisse is a native platform, we found other brokers such as Crypto.com to be a cheaper and more secure alternative for Swiss residents.

| Number of cryptocurrencies | 40+ |

| Debit card fee | N/A |

| Fee to buy Bitcoin | 1.25% |

| Minimum deposit | 200 CHF |

6. Bity – Buy Bitcoin via Crypto ATMs

The ATMs accept US dollars, euros, and Swiss francs – and users will be able to purchase Bitcoin worth up to 1,000 CHF without providing any verification. However, buying Bitcoin in Switzerland via Bity ATMs can come with an extortionate fee of 8%.

That being said, Bity also comes with a crypto exchange that individuals can use to purchase Bitcoin from the comfort of their home. If choosing this method, the commissions are included in the sale price of Bitcoin.

One perk of using Bity is that users will be able to buy Bitcoin in Switzerland anonymously, without having to create an account. However, the fees can be significantly high. Moreover, if using the crypto exchange, there is no support for debit/credit card transactions.

| Number of cryptocurrencies | 4 |

| Debit card fee | N/A |

| Fee to buy Bitcoin | Up to 8% via ATMs |

| Minimum deposit | N/A |

Should I Buy Bitcoin?

Since its launch in 2009, Bitcoin has gone through a meteoric growth. Its historical outperformance to stocks and global indices encourages individuals to consider this digital asset for their portfolio.

That being said, it is also crucial to comprehend that Bitcoin is speculative and volatile. Therefore, users will be taking additional risk in exchange for potentially high returns. One way to mitigate the risk is by investing small amounts in Bitcoin.

This can be done via a broker that supports fractional investments into Bitcoin.

Investors can also set up recurring deposits to adopt a ‘dollar-cost averaging strategy’ by regularly investing small amounts in Bitcoin, rather than making a large purchase in one go.

Benefits of Buying Bitcoin

Bitcoin has been around for over a decade now.

In order to understand why Bitcoin is considered a top asset, let us look at what makes this digital coin an attractive investment.

Hedge Against Inflation

Bitcoin is known as ‘digital gold’ in the investment space, particularly because its value is unrelated to other financial markets such as stocks.

Aside from this, Bitcoin has many characteristics that allows it to be used as a hedge against inflation.

- For one, Bitcoin is decentralized, and as such, it is resistant to any monetary policies set by any national government.

- Secondly, Bitcoin has a limited supply of 21 million tokens.

- This means that the minting of Bitcoin will stop once the number of tokens in circulation reaches its hard cap of 21 million.

This built-in scarcity, combined with the rapid mainstream adoption, suggests that the value of Bitcoin may increase over the years.

For this reason, many investors choose to add Bitcoin to their portfolios as an asset that can outgrow inflation.

Undervalued in 2022

Bitcoin reached its high point of over $68,000 in late 2021. However, thereafter, the value of Bitcoin has dropped considerably.

In fact, as of writing, Bitcoin has dropped to its lowest price level since December 2020 and is trading at around $21,000.

Now, keeping the investment adage of ‘buy the dip’ in mind, individuals might be looking at a window to purchase Bitcoin at an attractive entry price. This is, of course, in the hope that the market correction will be followed by a bullish turn.

And if Bitcoin is to return to its previous all-time-high, this means that investors will be looking at a gain of over 200% – based on its 2022 lows.

High Liquidity

Bitcoin is the most popular cryptocurrency in the world. Its top position in the market also comes with a few advantages. Bitcoin is highly liquid, meaning – users will be able to buy, sell, spend, or swap their BTC tokens without any issues.

This means that traders will be able to cash out of their investment without any trouble, no matter where they are.

Moreover, there are also many BTC-dominated markets available for crypto trading. This means that investors will easily be able to trade Bitcoin for another currency.

Generate Passive Income

The crypto market has come a long way in the past few years.

Today, investors can not only buy and sell digital assets, but they can also earn passive income from their crypto investments.

To give an example:

- Investors can deposit Bitcoin into a crypto savings account to generate interest.

- These are similar to traditional savings accounts available for Swiss francs, however, with Bitcoin, individuals will be able to generate much higher interest rates.

- For instance, Crypto.com offers up to 6% APY for Bitcoin. In comparison, Swiss banks typically offer internet rates in the range of 0.25% to 1%.

- Similarly, it is also possible to collateralize Bitcoin to take out a loan in fiat or other cryptocurrencies.

In summary, after deciding to buy Bitcoin in Switzerland, individuals have many different options for generating a passive income from their investment.

Spend BTC for Online Purchases

Thanks to the popularity of Bitcoin, an increasing number of global merchants have started accepting Bitcoin as a payment option.

This includes some of the most reputable brands globally – such as Starbucks, Microsoft, Overstock, and PayPal.

On top of this, individuals can also use crypto Visa cards such as those issued by Crypto.com to spend Bitcoin online. These cards convert BTC into fiat money in real-time.

This means that it is now possible to spend Bitcoin anywhere that Visa cards are accepted, be it on eCommerce platforms, physical stores, or even ATMs.

Ways of Buying Bitcoin

As noted, the deposit fee for buying Bitcoin depends on the chosen payment method. As such, it is crucial to know which modes of payment are accepted by a specific broker and what charges come with them.

In this section, let us take a look at the two most popular ways to buy BTC in Switzerland.

Buy Bitcoin With Credit Card or Debit Card

Funding an investment with a debit or credit card is by far the easiest way to buy Bitcoin instantly.

The majority of crypto providers in Switzerland support Visa and Mastercard for Bitcoin purchases.

Users simply have to create an account with a trusted exchange and enter their credit/debit card details when prompted.

However, remember that the fees can vary widely from platform to platform.

Buying Bitcoin With PayPal

It is also possible to buy Bitcoin with PayPal in Switzerland, however, this payment method is not widely accessible.

Bitcoin Price

The value of Bitcoin was practically null when it was founded in 2009. Until 2013, the price of Bitcoin remained under $500. Since then, the price continued to grow – to reach $20,000 by the end of 2017.

Through the years 2018, 2019, and 2020, the price of Bitcoin stayed between $2,800 to $10,000. But by 2020, Bitcoin started gaining popularity again. Between 2020 and 2021, the value of Bitcoin soared, gaining by nearly 1,000%.

Bitcoin’s all-time high was in November 2021, when it surpassed $68,000. Having said that, Bitcoin is also known for its volatility. As per the price chart below, the value of Bitcoin has fallen many times – even during its bullish run between 2020 to 2021.

[crypto_chart id=849]After taking Bitcoin’s price history into account, it seems as if the digital currency is going through a slump – as with the rest of the crypto market. After hitting its high point in late 2021, Bitcoin’s value has plummeted significantly.

At the time of writing, Bitcoin is trading at a 52-week low of just over $20,000 and is considered by many to be undervalued. In other words, it might be a good time to step into the market for those interested in investing in Bitcoin.

Bitcoin Price Prediction

Bitcoin has demonstrated great growth potential.

And some analysts suggest that Bitcoin’s value could rise even more as blockchain technology becomes more mainstream.

- However, as we discussed earlier, Bitcoin has also experienced devastating lows.

- In simple terms, Bitcoin remains a very volatile investment.

- This is why experts advise investors never to blindly follow Bitcoin price predictions.

- After all, a single tweet from Elon Musk can raise or decimate the value of digital currencies, including Bitcoin.

Therefore, it is wise that investors only stake small amounts on Bitcoin. It would also be smart to diversify, within the crypto industry or to other asset classes.

How to Buy Bitcoin Safely

Before buying Bitcoin, individuals should ensure that they follow the necessary steps to keep the risks to a minimum.

Here are some points that our readers should bear in mind when investing in BTC tokens.

Choose a Secure Crypto Platform

Perhaps the most important step for a prospective investor is to figure out where to buy Bitcoin in Switzerland. With the abundance of choices, finding the right platform that does not compromise security can be tricky.

The best way to approach this would be to choose a platform that balances ease of use with competitive fees and high security. Investors can start by checking out top picks for the best Bitcoin exchanges in Switzerland, like Crypto.com.

Think of How to Store Bitcoin

Before investing, individuals should not only think of when to buy Bitcoin but also how to store their BTC tokens after making the purchase.

For instance, if planning to HODL Bitcoin, it is important to find a secure wallet for holding the tokens for the long term. The most secure crypto wallets are those that provide non-custodial storage options for digital coins.

As we discussed earlier, Crypto.com offers a DeFi wallet for storing Bitcoin and other digital assets. This wallet gives its users complete control of their private keys. Moreover, bear in mind that the DeFi Wallet is different from the Crypto.com app.

On the other hand, for those who find themselves frequently trading Bitcoin, the easier option would be to choose a secure custodial wallet.

This allows users to trade Bitcoin directly from the portfolio.

Risks of Buying Bitcoin

The crypto market is still in its infancy and is therefore incredibly volatile. It is not uncommon for Bitcoin to go through wild swings in the market, within days or even minutes.

Therefore, before buying Bitcoin, all individuals should thoroughly understand that there is a high risk involved. For instance, in 2022, Bitcoin saw its value drop by over 70% from its all-time high. And this happened in a matter of just seven months.

In other words, investors should be prepared to face losses when taking a risk on Bitcoin. The simple principle to follow would be to risk only what one can afford to lose.

How to Sell Bitcoin

All crypto platforms we reviewed today can be used to buy as well as sell Bitcoin in Switzerland.

Users can simply sign in to their account, visit their portfolio, choose Bitcoin, and sell directly. The cash from the sale will be added to the account balance and can be withdrawn to the original payment method.

Conclusion

In summary, those interested in buying Bitcoin in Switzerland have plenty of options. For traders, there are platforms such as Crypto.com that feature an advanced exchange, along with a variety of Bitcoin-related financial products.