Buying Bitcoin in Saudi Arabia could not be easier.

In just five minutes, an account with a crypto broker can be opened and the Bitcoin investment can be paid for with a variety of payment methods – including Visa and MasterCard.

In this beginner’s guide, we explain how to buy Bitcoin in Saudi Arabia with a regulated online broker that offers low fees and a secure wallet.

How to Buy Bitcoin Saudi Arabia – Quick Guide

To buy Bitcoin in Saudia Arabia right now, consider using Evest. This popular broker offers low trading fees and it supports instant Bitcoin investments with a debit or credit card.

Follow the quick step-by-step guide to buy Bitcoin via the Evest app right now.

- ✅ Step 1: Open an Evest account – Visit the Evest website to open an account. This will require an email address and some basic personal information.

- Step 2: Download Evest App – To buy Bitcoin instantly with a debit/credit card, this needs to be done via the Evest app. As such, click on the iOS or Android logo to download it to a suitable smartphone.

- Step 3: Deposit Funds – Next, make a deposit into the Evest app with Visa or MasterCard. The deposit will be processed instantly.

- Step 4: Search for Bitcoin – In the search bar, type in ‘Bitcoin’. This will bring up the investment screen to buy Bitcoin.

- Step 5: Buy BTC – Enter the amount of money required to invest in Bitcoin in Saudi Arabia today. Confirm the order and the Bitcoin tokens will be added to the Evest wallet.

In just five steps, Evest allows investors to buy Bitcoin in Saudi Arabia with ease. Read on if a more detailed step-by-step guide is required.

Where to Buy Bitcoin in Saudi Arabia

In order to buy Bitcoin in Saudi Arabia, residents are required to register an account with an online exchange or broker. In choosing a platform, be sure to consider deposit methods, fees and commissions, safety, wallet security, and supported markets.

Below, we discuss where to buy Bitcoin in Saudi Arabia today.

1. Evest – Overall Best Place to Buy Bitcoin in Saudi Arabia

Also wondering how to buy DOGE in Saudi Arabia? As well as BTC, users can also invest in and trade other top altcoins such as Ethereum, Litecoin, Cardano and Polkadot, as well as a handful of smaller cap and meme coins.

Evest, as the best trading platform in Saudi Arabia, which is regulated by the Vanuatu Financial Services Commission, offers cryptos as CFDS alongside more than 500 other financial investments for users, including stocks, forex and indices.

We have rated it as the overall best forex broker in Saudi Arabia.

Evest offers four levels of account for users of all different types from beginner to large investors. They are Silver, Gold, Platinum and Diamond, with each coming with different advantages.

It also comes with Islamic trading accounts where traders can leverage up to 400% of the stake amount.

A silver account, for example, is available for around 938 Riyals ($250) but the spread starts at 3 pips. In contrast, the Diamond account has customized pips but the minimum deposit is 187,000 Riyals ($50,000).

Those less sure can also download a demo account to familiarize themselves with the platform, as well as learn investing and trading with $25,000 in pre-loaded virtual funds, as well as an academy to learn about trading.

There is also a fee of around 19 Riyals ($5) on withdrawals, with a minimum amount of 94 Riyals ($25), although that does not apply to Diamond account holders, and there are inactivity fees.

Evest supports a number of major credit and debit cards as well as wire transfers and e-wallets.

The platform also gives users access to the highly-popular MetaTrader 5 and is available on a user-friendly mobile app for Android and iOS.

- Read our full Evest review for more information.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 10 | 0% commission | 0% | $250 (Silver account) |

What we like

2. OKX – Trusted Crypto Exchange Serving Millions of Clients Worldwide

It has more than 20 million users in 100 countries around the world, including Saudi Arabia, and has leading features such as offering both a centralized and decentralized exchange, crypto loans and margin trading.

Crypto data aggregator CoinGecko ranks OKX as the second-most trusted exchange in the space, behind only Coinbase, with OKX having leading security features and providing full information on its account reserves.

It is also in the top 5-10 by most metrics, including 24hr trading volume and monthly visits.

The platform offers more than 350 coins and nearly 800 crypto trading pairs, with BTC able to be purchased with 94 different currencies and 130+ methods.

That includes with VISA, Mastercard or other leading credit card and debit card companies, PayPal, Monzo, or e-wallets such as Apple Pay.

After signing up, which is free with no minimum deposit, users have to complete KYC verification to access OKX.

BTC can be purchased for a minimum of just $10 and fees are extremely low for spot trading with a maker fee of only 0.08% and a taker fee of $0.1 for accounts that hold less than $100,000.

Fees for futures and options vary but are generally lower than the spot trading fees.

The OKX is one of the most user-friendly in the space and the platform often is one of the best for staking, offering market-leading APYs on Bitcoin and other crypto holdings through its ‘Earn’ scheme.

It also has a trading bot that can carry out low-risk trades, as well as offering crypto loans and its native token, OKB – which offers improved fees for those who hold certain amounts.

OKX, which is regulated in the Seychells and Malta, also often offers bonuses and promos and also has a demo account feature.

Investors should also note that there is a BTC withdrawal fee of 0.0002 BTC (approx $3.95 or 15 Riyals).

- Read our full OKX review here.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 350 | from 0% | 0.10% | $0 |

What we like

Crypto assets are a highly volatile unregulated investment product.

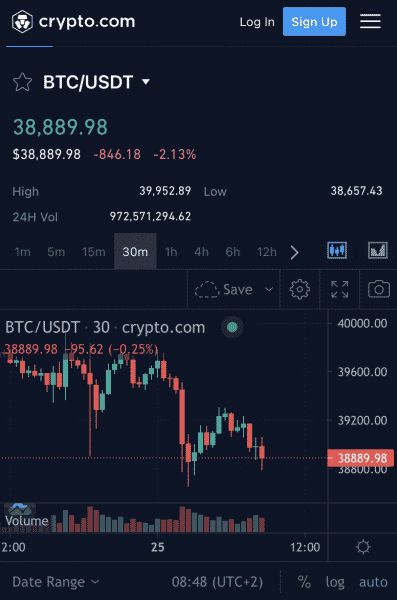

3. Crypto.com –Leading Platform Offering High Security for Users

Our research team found that Crypto.com is another top destination to buy Bitcoin in Saudi Arabia. This online platform offers a user-friendly app that allows investors in Saudi Arabia to invest in cryptocurrency with low fees. The standard commission charged by this platform is just 0.40% per slide.

This means that when buying and selling Bitcoin and other crypto assets, a fee of just 40 cents for every $10 traded will be charged. Those that are planning to trade actively will be offered lowered commissions when 30-day milestones are met.

In terms of supported payment methods, Crypto.com supports both Visa and MasterCard. This allows investors in Saudi Arabia to buy Bitcoin instantly and conveniently. Low minimum deposits are supported and debit/credit card fees amount to 2.99%. This works out at $2.99 for every $100 worth of Bitcoin being purchased in this manner.

Crypto.com is also popular with investors in Saudi Arabia that seek to create a diversified portfolio of digital tokens. This is because the platform supports more than 250 different markets. This covers everything from Bitcoin and Shiba Inu to Tether and Cardano. Crypto.com is also solid when it comes to security.

Not only is the platform regulated in the US, but it keeps virtually all client digital assets in cold storage. This makes it near-impossible for external hackers to breach the Crypto.com servers remotely. Crypto.com also offers a custodial wallet that can be accessed via its app or the main desktop website. This simply requires users to log in to view their Bitcoin balance.

There is also a non-custodial wallet offered by Crypto.com. This comes via an iOS and Android app and it offers users full control over their private keys. Another popular tool offered by Crypto.com is its savings accounts. By depositing a supported token, this allows users in Saudi Arabia to earn interest on their digital assets.

This stands at up to 14.5% on cryptocurrencies and 10% on stablecoin. The highest rates are offered on three-month lock-up terms, although one-month and flexible accounts are available too.

In addition to savings accounts, Crypto.com offers an NFT marketplace and instantly-approved loans that require no credit check.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 250 | 0.4% standard commission | 2.99% | $20 |

What we like

Cryptoassets are a highly volatile unregulated investment product.

4. Capital.com – Trade Bitcoin CFDs at 0% Commission

Capital.com is a CFD trading platform that enables residents of Saudi Arabia to speculate on the future value of Bitcoin and 470+ other digital currency pairs. There is no requirement to own Bitcoin when using Capital.com, as CFD instruments merely track the value of the underlying asset.

Traders will have the opportunity to speculate on Bitcoin in either direction – which means that both long and short orders are supported. This is particularly suitable for those that wish to trade the short-term price movements of Bitcoin. When it comes to trading fees, Capital.com does not charge any commissions.

We found that spreads are tight too and no deposit or withdrawal fees are charged. As such, Capital.com offers a super low-cost way to gain exposure to Bitcoin and other cryptocurrencies. Another reason to choose Capital.com is that the platform offers leverage. This allows traders to place an order at a higher amount than what is available in an account balance.

For instance, if a trader places an order worth $500 and leverage of 1:2 is applied, an account balance of just $250 is required. In terms of other crypto markets, Capital.com offers access to pairs of all shapes and sizes. This includes large-cap tokens such as Ethereum and XRP as well as DeFi coins like AAVE and Uniswap.

Wondering how to buy stocks in Saudi Arabia? In addition to crypto, Capital.com also offers access to thousands of other markets. This is inclusive of forex, commodities, indices, ETFs, and stocks. The minimum deposit required to get started with a Capital.com account is $250 when opting for a bank wire. However, when depositing funds via a debit/credit card or e-wallet transfer, the minimum deposit is reduced to $20.

When it comes to the Capital.com trading platform, this can be accessed via a standard web browser. The platform can also be accessed via the Capital.com app – which is available for both iOS and Android devices. Both platforms connect to one another – so switching between the two is just a case of logging in.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 470+ markets | Commission-free | No fee | $20 on debit/credit cards and e-wallets and $250 on bank wires |

What we like

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and can afford the risks.

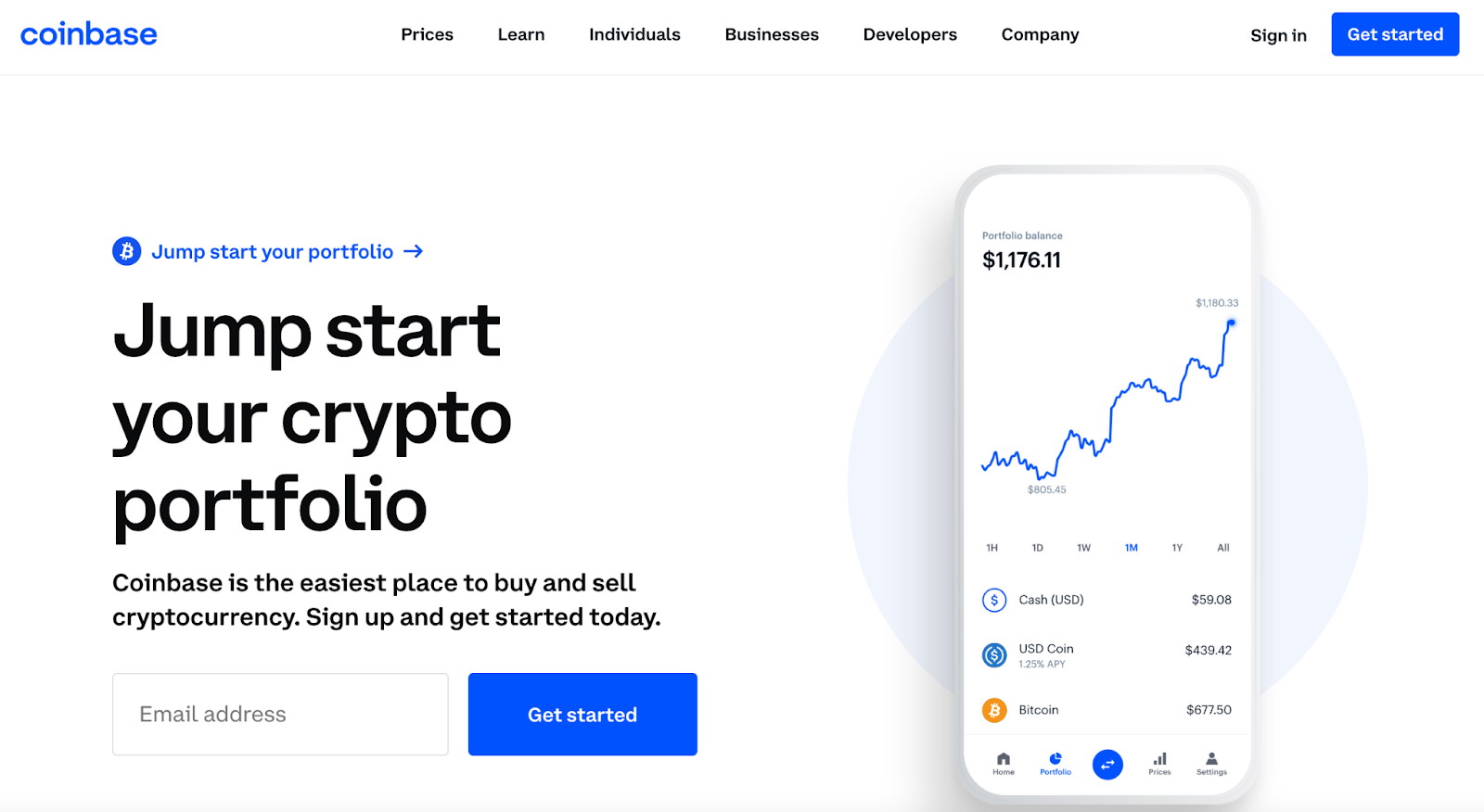

5. Coinbase – Popular Bitcoin Exchange For First-Time Investors

While Coinbase initially offered just four digital assets, it now offers access to more than 150 markets – including Bitcoin. This offers a great opportunity to create a diversified basket of cryptocurrencies at various weights. In order to buy Bitcoin via Coinbase, an account must be opened and a copy of a government-issued ID should be uploaded.

The platform supports instant Bitcoin investments with a Visa or MasterCard and this will be charged at 3.99% of the total transaction amount. This works out at $39.90 for every $1,000 worth of Bitcoin purchased. Bank wires reduce the cost of trading, but Coinbase is known to require several business days before the funds are credited.

Once Bitcoin has been purchased on Coinbase, investors have a number of options in terms of storage. The Bitcoin can be withdrawn to a private wallet and kept in the Coinbase custodial account for safekeeping. The latter option comes with a variety of security tools – such as two-factor authentication. 98% of client funds will be kept offline at all times.

Coinbase also offers a decentralized wallet app for iOS and Android. This is separate from the main Coinbase app and it allows residents of Saudi Arabia to have full control over their wallet private keys. This does, however, mean that investors will need to take full responsibility for their wallet and crypto tokens.

Coinbase has recently launched an NFT marketplace, so this is also worth considering for added diversification. Should investors wish to generate passive income on their idle tokens, Coinbase also offers staking on six different coins. However, this does not include Bitcoin. To earn interest on BTC tokens – Crypto.com offers an APY of up to 6%.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 150+ | 1.49% | 3.99% | $50 is recommended |

What we like

Cryptoassets are a highly volatile unregulated investment product.

6. Binance – Buy and Sell Bitcoin at 0.10% Commission

Binance offers over 600 digital currencies in addition to Bitcoin. This covers more than 1,000 trading markets – including spot trading, futures, and options. Binance also offers leverage on Bitcoin and other crypto assets. In order to deposit funds, Binance supports debit and credit card payments after a KYC process has been completed.

This takes a matter of minutes of simply requires some basic personal information and a copy of a government-issued ID. Binance charges an average of 1.8% on debit/credit card purchases – but this can vary, so be sure to check the specific fee before placing an order. The cheaper option is to deposit funds in crypto or perform a traditional bank wire.

On top of low fees and support for a significant number of markets, Binance is also a great option for those that wish to access interest-bearing services. Bitcoin, for instance, comes with an APY of 5% on flexible withdrawal terms. However, upon closer inspection, we found that an APY of 5% is only offered on the first 0.01 BTC being deposited.

After that, the APY drops to a mere 0.8%. Once again, those looking to earn interest on Bitcoin should instead consider Crypto.com. Nonetheless, Binance offers a secure web wallet that comes with two-factor authentication. The vast majority of client digital assets are kept in cold storage and there is a reserve pot in place to cover the event of a remote hack.

The latter is funded from the transaction fees and commissions that Binance collects from its users. The Binance app offers access to live trading markets at the click of a button. This is available on both iOS and Android smartphones. Finally, Binance is home to a decentralized app called Trust Wallet – which offers full access and control of private keys.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 600+ | Up to 0.10% | Averages 1.8% | $15 on debit/credit card payments |

What we like

Cryptoassets are a highly volatile unregulated investment product.

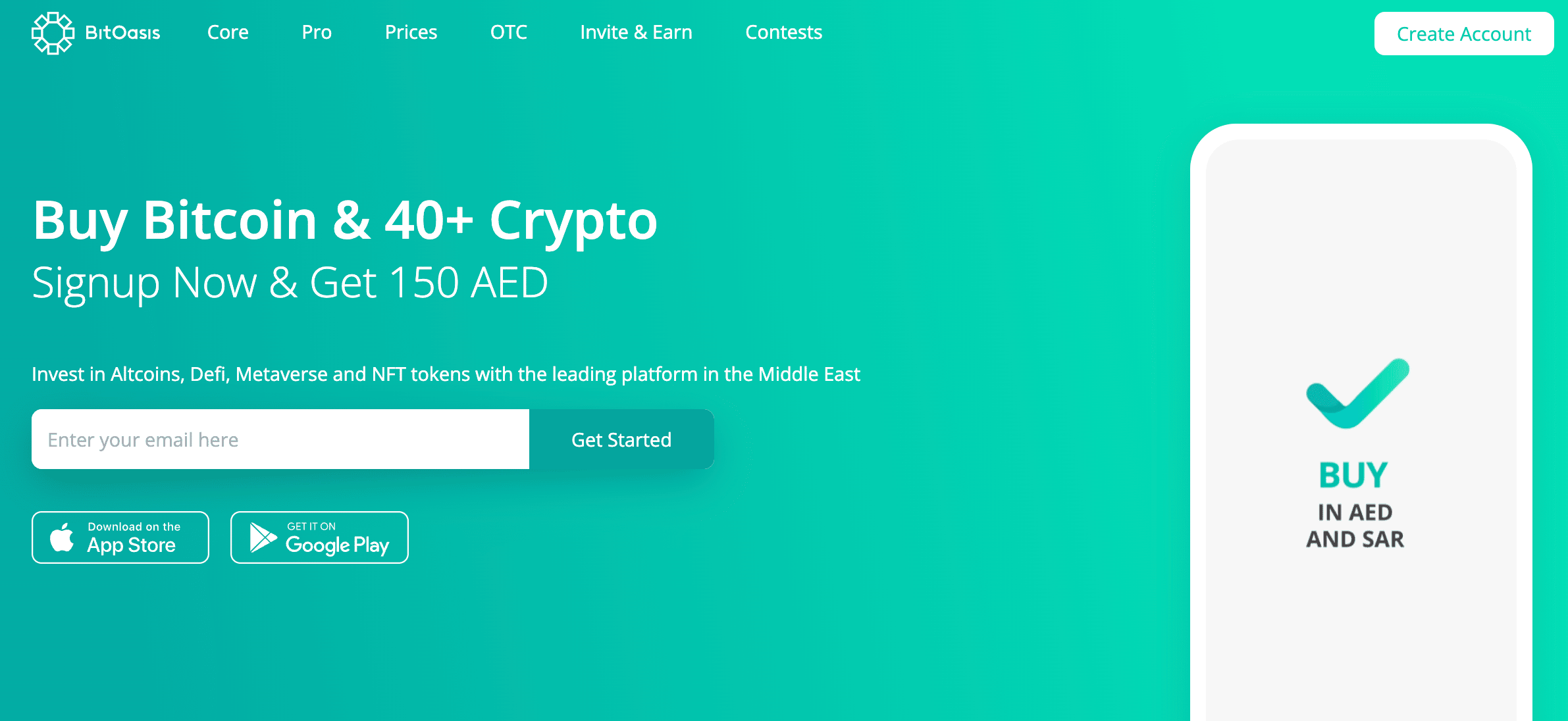

7. BitOasis – Bitcoin Exchange Based in the UAE

BitOasis is a Bitcoin exchange that is based in the UAE. The platform supports over 40 digital assets in addition to Bitcoin. Users can buy Bitcoin in Saudi Arabia at a commission of just 0.48%. As the platform has a market maker/taker fee structure, lower commissions are offered on higher volumes.

When paying for a Bitcoin purchase with Visa or MasterCard, a fee of 4.5% applies. This is expensive when compared to platforms like Crypto.com and Capital.com. Nonetheless, BitOasis does support OTC services that come with very competitive fees. BitOasis offers two platforms that are targeted to different skill sets.

The BitOasis Core platform is designed for beginners that simply want to buy Bitcoin and other digital currencies. This also comes with a portfolio management service alongside basic price charts. The BitOasis Pro platform is designed for seasoned investors that seek advanced tools.

The Pro platform also comes with SAR-denominated trading pairs, advanced order types, and high levels of liquidity. When it comes to the KYC verification process, this is carried out by a third party. In most cases, documents can be evaluated in under five minutes. Finally, BitOasis also offers an API service that allows users to trade on external platforms.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 40+ | Up to 0.48% | 4.5% | Not stated |

What we like

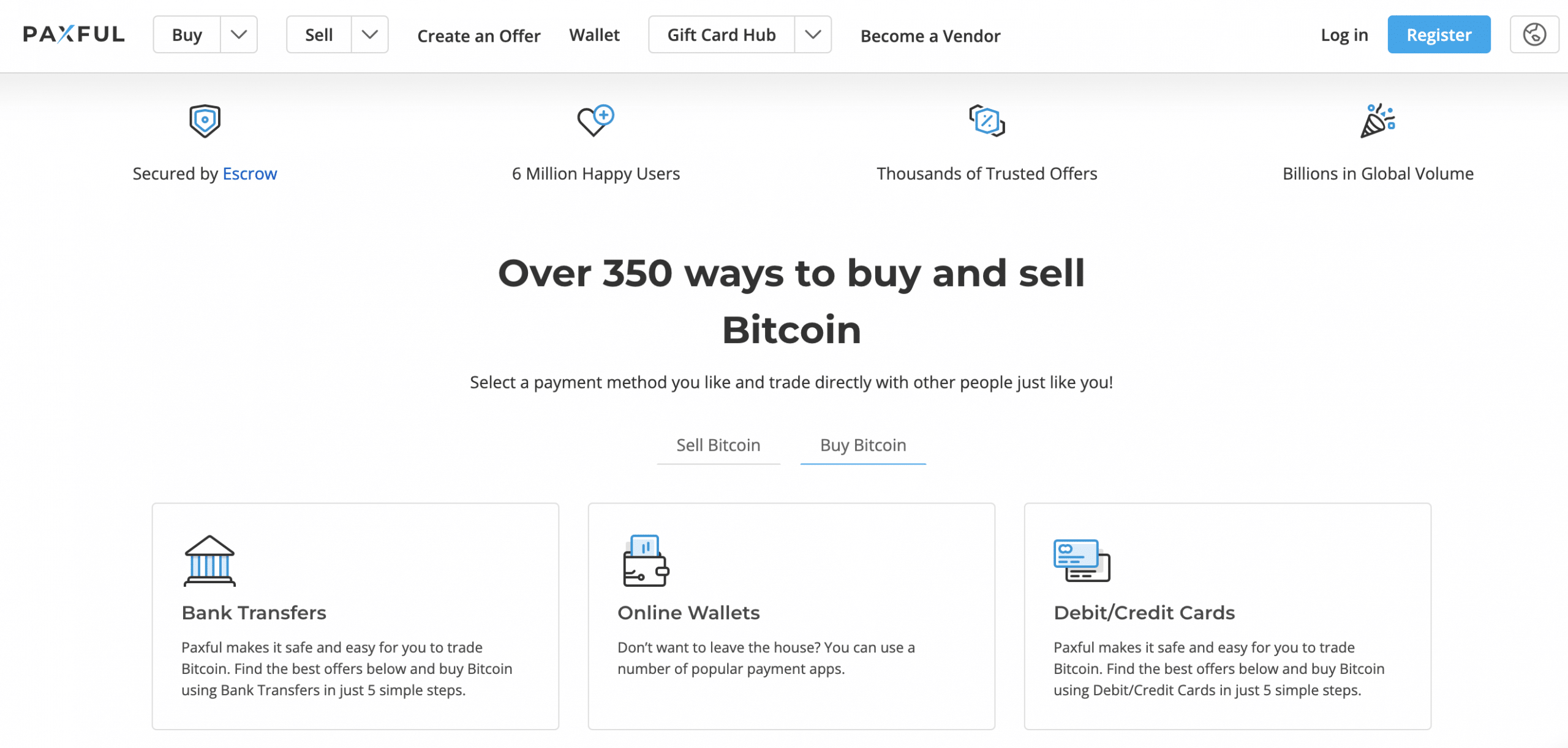

8. Paxful – Buy Bitcoin With Over 350 Payment Methods

Paxful supports over 350 different payment methods. This is inclusive of e-wallets, debit/credit card transfers, and local bank wires. However, the specific method accepted will be determined by each seller. Individual sellers will also determine what fees they charge – so be sure to do lots of research before proceeding.

When it comes to security, Paxful operates an escrow system. This means that when a buyer places an order, the seller is required to deposit their Bitcoin into the Paxful wallet. When the seller confirms that payment has been received, Paxful will release the Bitcoin to the buyer. With that said, peer-to-peer platforms can be problematic in terms of scammers – so tread with caution.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 3 | Depends on the seller. | Depends on the seller. | Not stated |

What we like

Should I Buy Bitcoin?

Those wondering whether or not Bitcoin represents a viable investment will need to remember that this asset class is both speculative and volatile. There is no guarantee that Bitcoin will recover its previous highs of $69,000.

On the other hand, Bitcoin has generated significant returns since it was launched in 2009. Back then, it was possible to buy Bitcoin in Saudi Arabia for less than a dollar. This means that as per its prior all-time high of $69,000 – this represents growth of over 6 million percent.

In more recent times, Bitcoin was trading at just $1,000 in 2017, and in 2020 – the digital asset hit lows of $5,000. As a result, Bitcoin has time and time again shown that it is here to stay in the long run.

Moreover, Bitcoin supports small investments from just a few dollars. This is because the asset class is digital, which means that it can split into tiny units. As a result, those that are unsure about Bitcoin can still gain exposure to this marketplace without risking huge sums of capital.

Benefits of Buying Bitcoin

To arrive at an informed investment decision, traders should perform independent research before they elect to buy Bitcoin in Saudi Arabia.

The main advantages of investing in Bitcoin are discussed in great detail in the sections below:

Inflation-Proof

Bitcoin is different from all fiat currencies. Whether it’s the Saudi riyal, US dollar, or British pound – fiat currencies are backed by central banks. This means that when it comes to the supply of a fiat currency, this can and will be manipulated.

- For instance, when central banks print additional currency, this is known as quantitive easing.

- And in turn, quantitative easing has the insured impact of increasing inflation levels.

- This is an issue that is facing economies all over the world – including the US. And, as inflation continues to rise, the purchasing power of the currency declines.

In comparison, the supply of Bitcoin is not controlled by any central bank or government. Instead, Bitcoin is backed by blockchain technology – which follows the thesis that ‘code is law’.

This means that the supply of Bitcoin can never be manipulated. On the contrary, new Bitcoin tokens enter the circulating supply every time a block is verified – which is at 10-minute intervals.

Limited Supply

Leading on from the above section, the 10-minute circulating increase of Bitcoin will continue until its total supply of 21 million tokens is met. This is expected to happen in 2140.

- Crucially, this means that Bitcoin is somewhat similar to gold, insofar that both assets have a finite supply.

- In turn, both gold and Bitcoin are also described as stores and value.

- This means that over the course of time, their value is expected to increase.

- This is because while demand continues to rise, the total supply cannot increase any further.

With that said, many market commentators argue that Bitcoin is more suitable as a store of value when compared to gold. After all, gold is a bulky asset class that is not only different to transport – but dividend into smaller units.

This is in stark contrast to how Bitcoin works. Transferring Bitcoin takes just 10 minutes regardless of where the buyer and seller are located. Moreover, as briefly mentioned above, Bitcoin can be fractionated into small units.

Decentralized Framework

The decentralized framework of Bitcoin and its underlying network is another reason to consider adding this asset to an investment portfolio. For those unaware, the term decentralized means that Bitcoin is not controlled by any single person or authority.

More importantly, this means that when keeping Bitcoin in a non-custodial wallet, nobody can access the funds unless they are in control of the private key. This is similar to an online bank account password or an ATM PIN.

However, unlike traditional bank accounts, the Bitcoin held in a private wallet cannot be frozen. Similarly, transactions cannot be blocked or reversed – owing to the decentralized nature of the blockchain protocol.

Ultimately, those that buy Bitcoin in Saudi Arabia and transfer the tokens to a decentralized wallet will have 100% control over their funds.

Top-Performing Asset

Now that we have covered the underlying technology, we can now discuss the price of Bitcoin from an investment perspective. After all, this is one of the main reasons why people will look to buy Bitcoin in Saudi Arabia.

As we briefly mentioned a moment ago, Bitcoin was worth less than $1 dollar when the technology was first released. This means that it has generated highly significant returns for early investors.

With that said, those that bought Bitcoin in early 2020 when it dropped to around $5,000 per token are also looking at above-average market gains.

In fact, those that held on until late 2021 when Bitcoin hit $69,000 would have been looking at gains of over 1,200%. In comparison, traditional stock markets continue to offer sluggish returns.

For example, over the prior one and five years, the Dow Jones Industrial Average has provided returns of -5% and 54% respectively. Therefore, those looking to generate much higher returns will often turn to cryptocurrencies like Bitcoin.

Bitcoin was Launched in 2009

While Bitcoin has already surpassed a market valuation of $1 trillion, this digital asset is only getting started. As such, by entering the market in 2023, an investment in Bitcoin is being made while the technology is still young.

After all, while Bitcoin was officially launched in 2009, it wasn’t until 2017 that the mainstream media began to take the digital asset seriously. In terms of upside potential, it is difficult to put a solid forecast in place for Bitcoin due to its speculative nature.

With that being said, if Bitcoin is to one day challenge gold as the de-facto store of value, it would only need to hit an estimated market capitalization of $11 trillion.

This means that based on its prior all-time high of $69,000 – Bitcoin would need to increase in value by 800% – which would take it above $600,000 per token.

Risks of Buying Bitcoin

Before electing to buy Bitcoin in Saudi Arabia, the risks should also be considered in addition to the aforementioned benefits.

The main risks of investing in Bitcoin and other digital assets that we identified are discussed below:

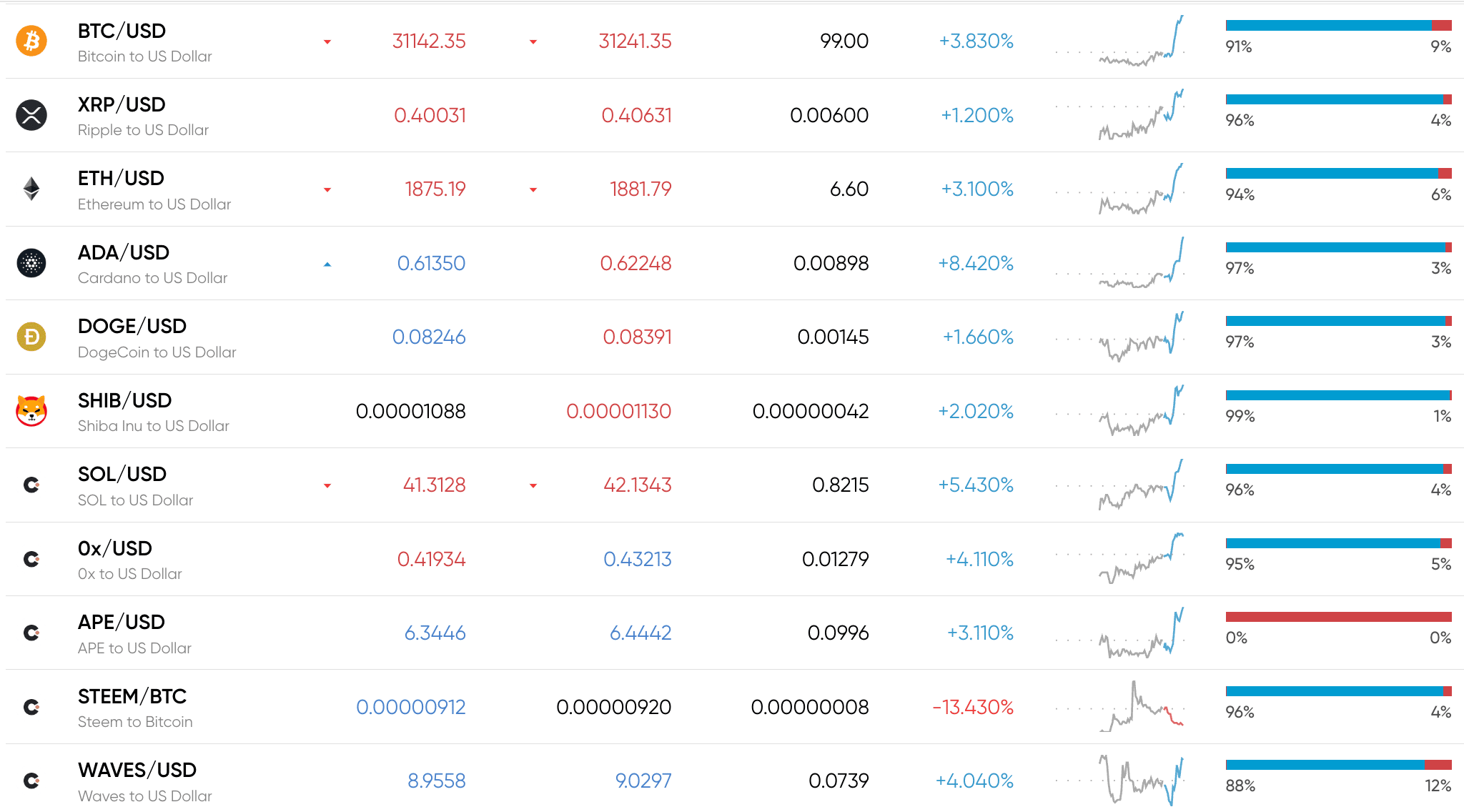

Bitcoin is Underperforming Other Cryptocurrencies

The first risk to consider is associated with opportunity cost. In a nutshell, over the prior few years, Bitcoin has underperformed other digital currencies.

This means that by allocating an entire cryptocurrency budget solely to Bitcoin – investors might be missing out on more attractive gains elsewhere.

For example, over the prior five years of writing, Bitcoin has increased in value by just over 1,000%. While these returns are still phenomenal, in comparison, BNB has increased by more than 7,000%.

Extreme Volatility and Speculation

Bitcoin, since being launched in 2009, has provided investors with significant returns. However, this digital asset is still highly volatile and speculative. This means that long-term investors need to be prepared for wild pricing swings.

For instance, after hitting an all-time high of $69,000 in late 2021, Bitcoin has since dropped to 52-week lows of $26,000. This translates into a downward swing of over 60% in less than a year.

Ways of Buying Bitcoin

Those looking to buy Bitcoin instantly in Saudi Arabia for the first time have several options when it comes to payment methods.

The fastest and most convenient ways of investing in this digital asset are explained below:

Buy Bitcoin With Credit Card or Debit Card

The process of buying Bitcoin in Saudi Arabia with a credit or debit card could not be easier. In fact, when using the Crypto.com app for this purpose, it shouldn’t take more than a few minutes from start to finish.

After opening an account and downloading the Crypto.com app, it’s just a case of entering the long 16-digit card number and expiry date, before entering the investment amount. Once confirmed, the Bitcoin purchase will be carried out instantly.

Buy Bitcoin With Paypal

From the list of top-rated exchanges and brokers that we reviewed earlier, only Coinbase supports direct deposits via Paypal. And, in choosing this platform for this purpose, investors will pay a Paypal deposit fee of 3.99%.

While this does include the trading commission, this is a very expensive way of buying Bitcoin.

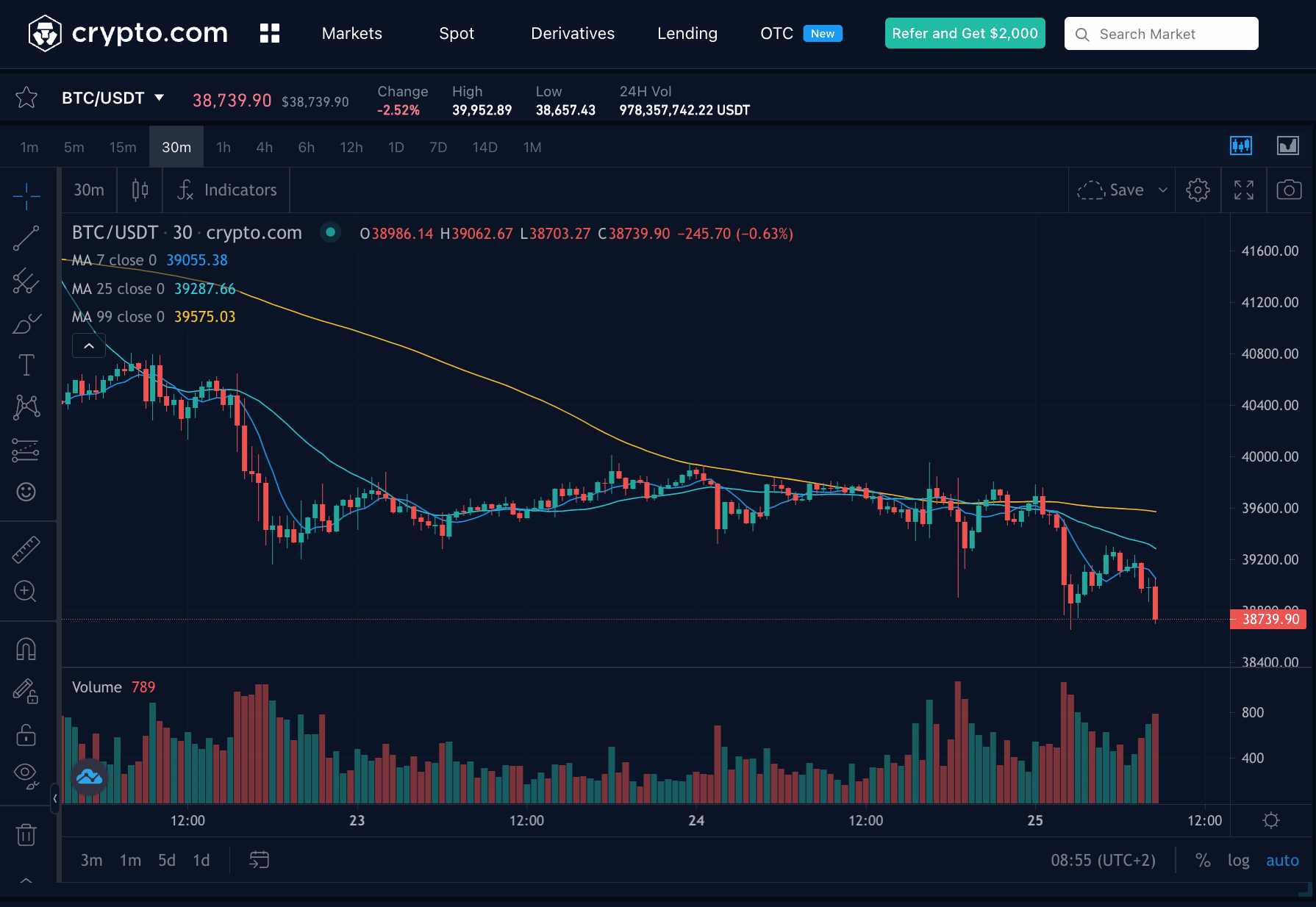

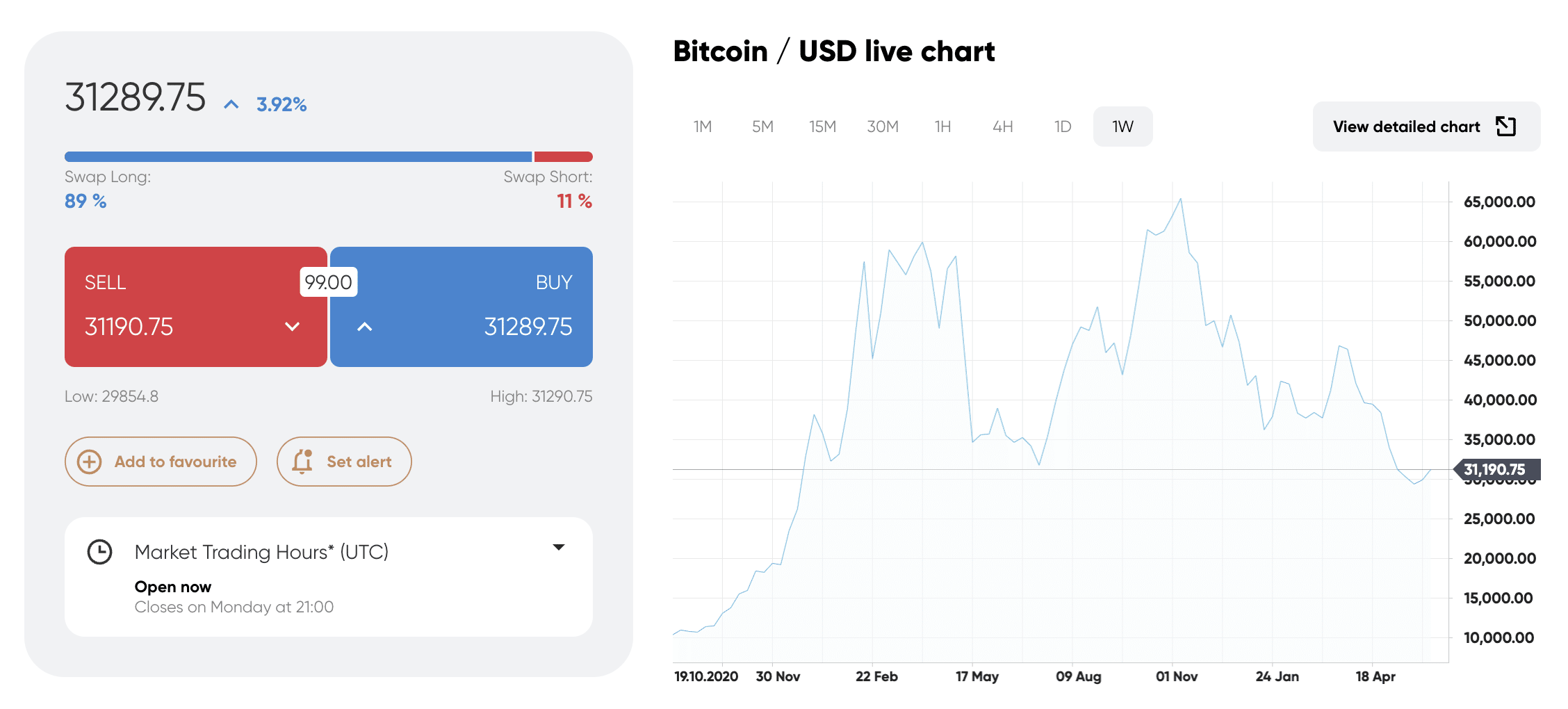

Bitcoin Price

Since launching in 2009, Bitcoin has continued its upward price momentum – with various bull and bear cycles along the way. As noted earlier, Bitcoin was available to buy for less than a dollar during its first couple of years.

In early 2017, the Bitcoin price went from $1,000 to $20,000 – representing one-year gains of 2,000%. After that, Bitcoin went on a prolonged bear cycle that saw the digital asset hit lows of under $4,000.

While Bitcoin was able to surpass $10,000 in early 2020, the pandemic resulted in the digital asset dropped by 50% in the space of just a few weeks.

However, Bitcoin then once again found some strong momentum, hitting highs of nearly$69,000 in late 2021. Since then, Bitcoin was hit 52-week lows of $26,000.

As is evident, Bitcoin can be extremely volatile. The key takeaway here is that the Bitcoin price favors those that hold in the long term. In contrast, short-term investors who panic sell every time Bitcoin drops in value will ultimately lose out.

Bitcoin Price Prediction

Inexperienced investors buying Bitcoin for the first time will often look for price predictions in the public domain. This is with the view of assessing whether Bitcoin will hit and surpass certain price targets within a particular timeframe.

- However, Bitcoin price predictions should not be relied upon.

- For instance, when the Bitcoin price went on a strong upward cycle in 2021, the general consensus from market proponents was that it was inevitable that the digital asset would surpass $100,000.

- As we now know, this never came to fruition.

- Similarly, when Bitcoin went from highs of $63,000 in April 2021 to lows of $30,000 just two months later, many from within the industry predicted that the digital asset would drop back to the $20,000 level.

- Instead, Bitcoin reverses back into an upward trend before hitting its prior all-time high of $69,000.

Therefore, price predictions and forecasts from third parties should be avoided. The best way to forecast the future value of Bitcoin is to do some independent research and analysis on a DIY basis.

How to Buy Bitcoin Safely

To buy Bitcoin in Saudi Arabia safely, consider the following factors before proceeding:

Licensed Bitcoin Broker

The safest and most secure way to buy Bitcoin in Saudi Arabia is to do so via a licensed broker. Crypto.com is a great example here, as the platform is regulated in the US.

This is why the platform is able to support fiat currency deposits and withdrawals via debit/credit cards. Capital.com is another example of a platform that is adequately regulated, with the provider holding licenses from the FCA, CySEC, ASIC, and NBRB.

Avoid Buying Too Much Bitcoin

While Bitcoin is a highly volatile asset class, investments can be made without risking too much money. This is because most exchanges and brokers support small minimum deposits that start at just a few dollars.

This means that traders can easily diversify their Bitcoin purchases with other investments. Not only in terms of buying alternative digital assets but perhaps stocks and ETFs too.

Note: It is also worth considering a dollar-cost averaging strategy rather than attempting to determine when to buy Bitcoin. This means purchasing small but frequent amounts as opposed to investing a lump sum.

Keep Bitcoin in a Secure Wallet

Another top tip that will allow investors to buy Bitcoin in Saudi Arabia safely is to ensure that the BTC tokens are kept in a secure wallet.

Crypto.com, for instance, offers a DeFi wallet that gives full control over private keys. This means that not even Crypto.com can access the wallet. Furthermore, the Crypto.com DeFi wallet comes as a convenient mobile app for iOS and Android.

How to Buy Bitcoin in Saudi Arabia – Tutorial

The conclusion of this beginner’s guide will explain how to buy Bitcoin in Saudi Arabia using the popular broker Crypto.com.

This platform supports instant debit/credit card Bitcoin purchases via its iOS and Android app.

Step 1: Visit Crypto.com Website

Investors will first need to download the Crypto.com app. The official download link for iOS and Android can be found on the Crypto.com website.

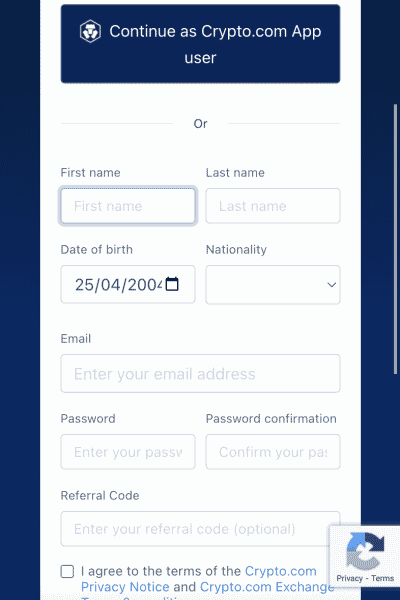

Step 2: Open Crypto.com Account

Before buying Bitcoin with a debit/credit card, users will need to open a Crypto.com account via the app. This will require the user to enter some basic personal information.

Crypto.com will also require a copy of a government-issued ID – such as a passport or driver’s license. This is to ensure that Crypto.com complies with all relevant laws on anti-money laundering.

Step 3: Deposit Funds

Once the account has been verified, a deposit with a debit/credit card can be made. Both Visa and MasterCard are supported for this purpose and the fee applicable amounts to 2.99%.

Step 4: Buy Bitcoin

Now that the Crypto.com account has been funded, enter ‘Bitcoin’ into the search box. Enter the amount of money to invest in Bitcoin in the relevant field.

After confirming the order, the Bitcoin purchase will be carried out by Crypto.com instantly.

How to Sell Bitcoin

When using Crypto.com to buy Bitcoin in Saudi Arabia, the cash out process could not be easier.

Users simply need to log back into their account portfolio, find Bitcoin, and confirm the sell order. This will be facilitated by Crypto.com instantly, meaning that the cash will be added to the user’s balance without delay.

Conclusion

Those based in Saudi Arabia can now buy Bitcoin in a matter of minutes – we found Evest was the best destination for users to purchase crypto.

The site offers a variety of leading tokens, including BTC, Ethereum and others, and offers a variety of different accounts – including Islamic ones – to sort all sorts of investors.

There is 0% commission on crypto trading with Evest, which also offers a large variety of other trading instruments, including forex, stocks, indices and commodities.

New investors should, however, be sure to conduct some independent research before adding Bitcoin to their portfolio.