This beginner’s guide will explain how to buy Bitcoin in Norway from the comfort of home in under 10 minutes.

We also review the best Bitcoin brokers for the job in terms of low fees and regulation as well as explore whether or not this digital currency represents a viable investment.

How to Buy Bitcoin in Norway – Quick Guide

The process of investing in Bitcoin online is relatively straightforward when using a broker – most accept instant payments via a debit/credit card or e-wallet. For a quick overview of the process, follow the steps below to learn how to buy Bitcoin in Norway right now.

Note: Most international Bitcoin brokers operate in USD. As such, where relevant, we will display fees and pricing in US dollars.

- ✅ Step 1: Open an Account – Get the account opening process underway by clicking to create an account at your chosen broker and filling out the registration form. After choosing a username and entering an email address, the site should ask for some personal information.

- Step 2: Deposit Funds – The deposit process at most brokers requires a minimum amount, each broker will be slightly different. Choose from an e-wallet, bank wire, or debit/credit card, depending on the platform you’ve picked and the fees it charges.

- Step 3: Search for Bitcoin – Next, search for ‘Bitcoin’ and click the option to buy when you see the cryptocurrency appear from the list of results.

- Step 4: Buy Bitcoin – Enter an investment amount of the site minimum or more and follow the process to buy your BTC.

The above steps highlight that it takes less than 10 minutes from start to finish to buy Bitcoin in Norway via a broker platform.

We offer a more detailed explanation of how to invest Bitcoin in Norway further down in this guide.

Where to Buy Bitcoin in Norway

Before investing in cryptocurrencies like Bitcoin, an account with a trusted exchange or broker must be opened.

In this section, we discuss where to buy Bitcoin in Norway in a cost-effective, simple, and user-friendly way.

1. Crypto.com – Buy and Sell Bitcoin Plus 250 Other Digital Assets

Each and every digital asset supported by Crypto.com can be traded at a commission of 0.4%. Those looking for even lower commissions might consider staking the platform’s native token – CRO. Users will need to make a deposit before being able to buy Bitcoin. Crypto.com offers two options in that regard.

First, users in Norway can deposit funds via a SEPA transfer. While this can take several days for the funds to arrive, there are no fees attached to this payment type. Second, Crypto.com also supports instant debit/credit card payments for those in a rush. This will attract a fee of 2.99% of the transaction size. NOK payments are supported so no additional FX fee will apply.

Crypto.com is also popular with investors that seek a non-custodial wallet. This means that Crypto.com will not have access to the user’s private keys. Instead, the wallet owner will retain 100% control over their Bitcoin tokens. For beginners, Crypto.com also offers a custodial web wallet. This will mean that Crypto.com takes full responsibility for the Bitcoin tokens.

Another storage option to consider is the Crypto.com interest account. This allows investors to deposit their Bitcoin tokens and earn an APY of up to 6%. Flexible terms and 1 or 3-month lock-up periods are available. Higher yields are offered on longer-term interest account plans. Finally, Crypto.com also offers a prepaid debit card alongside an NFT marketplace.

| Number of Cryptos | 250+ |

| Debit Card Fee | 2.99% |

| Fee to Trade Crypto | Up to 0.4% standard commission |

| Minimum Deposit | $20 |

Features

Cryptoassets are a highly volatile unregulated investment product.

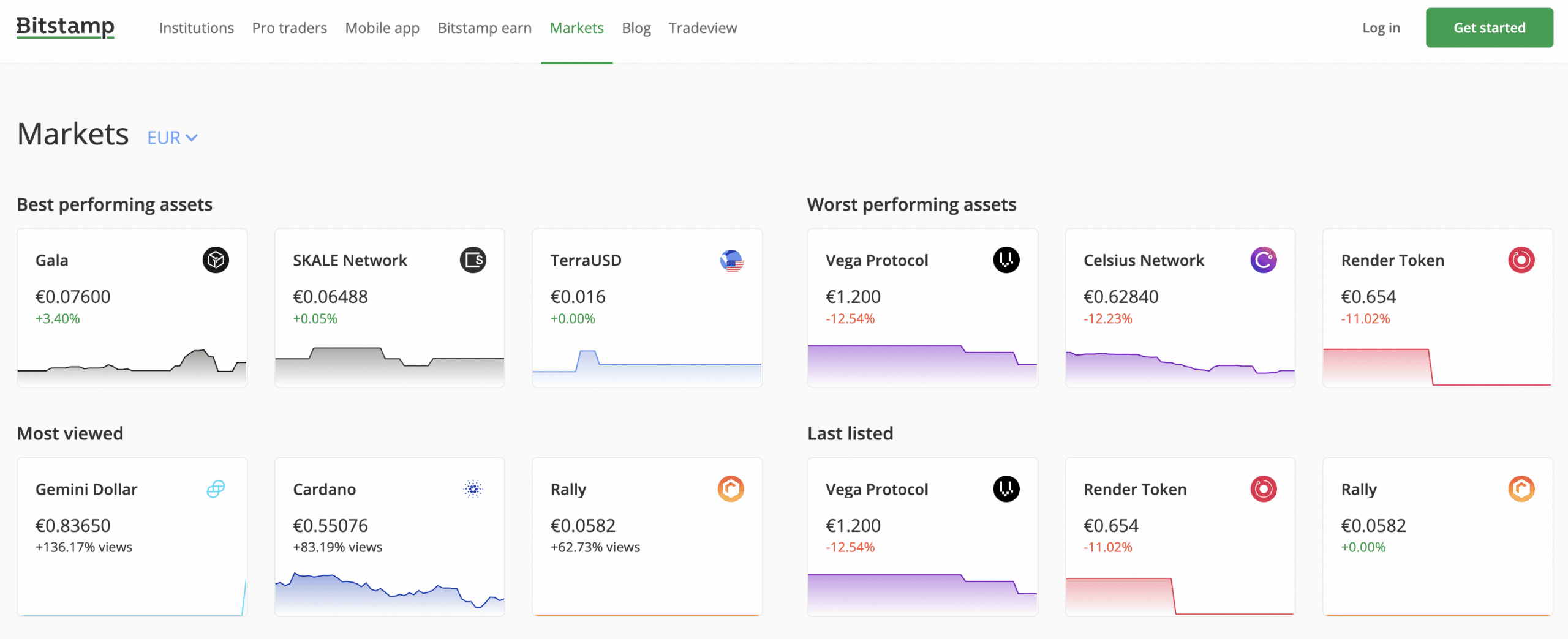

2. Bitstamp – Great Bitcoin Exchange for Experienced Pros

We found that one of the best crypto exchanges in Norway for experienced pros is Bitstamp. This platform was first launched in 2011 and it has a great reputation with serious investors. Bitstamp is home to significant liquidity levels around the clock and it offers a wide variety of sophisticated trading tools.

This includes everything from custom charting screens and real-time pricing fees to economic indicators and advanced order types. These tools can be accessed across three different Bitstamp platforms. This includes the web trading platform, mobile app for iOS and Android, and even fully-fledged desktop software.

All three platforms connect to the same Bitstamp account – which offers seamless Bitcoin trading. To get started with Bitstamp, users will need to open an account and upload some ID. Next, a deposit can be made with a debit/credit card. Although this will be processed instantly, a fee of 5% will apply.

The alternative here is to opt for a SEPA transfer, which, while slow, will alleviate all deposit fees. Once the account is funded, Bitstamp users will then be able to buy Bitcoin at a commission of 0.5% per slide. Lower commissions are available when higher amounts are traded, but this requires a minimum monthly volume of over $10,000.

In addition to Bitcoin, we like that Bitstamp offers over 155+ other markets. This includes an assortment of crypto-crosses and fiat-to-crypto pairs. Ultimately, while Bitstamp has a great reputation alongside a competitive commission structure, this platform is best for those that wish to buy Bitcoin in Norway with prior experience.

| Number of Cryptos | 155+ markets |

| Debit Card Fee | 5% |

| Fee to Trade Crypto | Up to 0.5% standard commission |

| Minimum Deposit | Not stated |

Features

Cryptoassets are a highly volatile unregulated investment product.

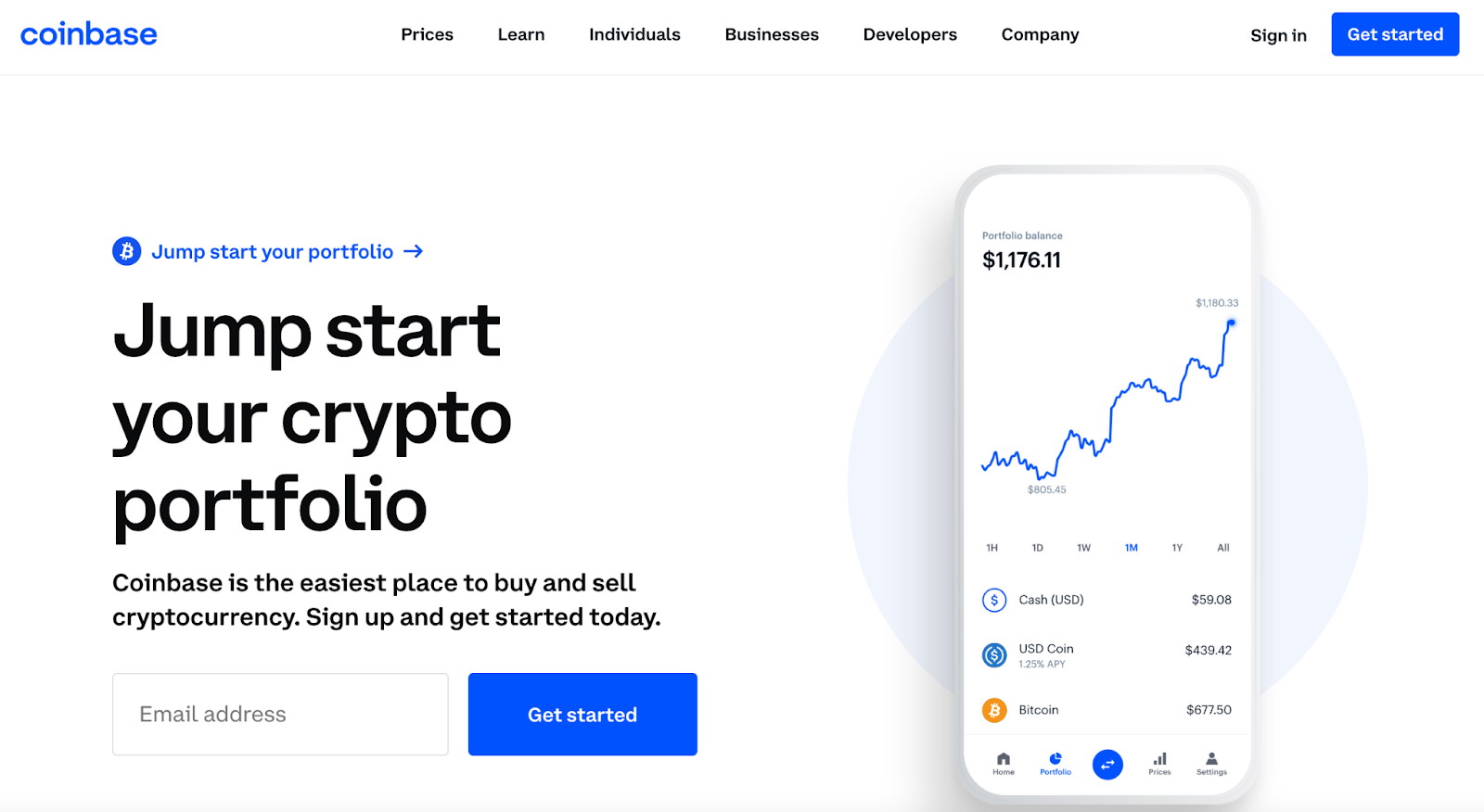

3. Coinbase – Buy Bitcoin in Minutes With Visa/MasterCard

Coinbase is another popular cryptocurrency exchange that allows users to buy BTC in Norway quickly. It typically takes just a few minutes to register an account and upload a copy of a government-issued ID. Then, account holders at Coinbase can purchase Bitcoin with Visa or MasterCard.

The fee charged on debit and credit cards on this platform is 3.99%. A more cost-effective option is to transfer funds via SEPA. No fees are charged by Coinbase when using this payment method. Paypal is also supported, but again, an instant buy fee of 3.99% will apply. Trading commissions at Coinbase amount to 1.49% – which is charged on each buy and sell order.

While expensive, we like Coinbase for its user-friendly platform and secure wallet system. When keeping Bitcoin in the Coinbase web wallet, 98% of the tokens are kept offline at all times in cold storage. All users are required to set up 2FA too, which adds a superb level of security to the account.

Coinbase is also great for diversifying, as the platform supports no less than 150 altcoins. It is also possible to earn interest at Coinbase via its staking tool. The higher rate on offer is 5%, albeit, just six tokens are supported and this does not include Bitcoin. Nonetheless, Coinbase also offers a prepaid Visa that allows users to spend Bitcoin online or in-store.

There is also Coinbase Pro, which has been designed for short-term traders with previous investment experience. This offers medium-level charting tools and pricing fees, albeit, in comparison to Bitstamp, this likely won’t suit seasoned day traders. Finally, Coinbase is a regulated entity that is now used by nearly 100 million clients worldwide.

| Number of Cryptos | 150+ |

| Debit Card Fee | 3.99% |

| Fee to Trade Crypto | 1.49% standard commission |

| Minimum Deposit | $50 is recommended |

Features

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Low-Commission Bitcoin Exchange

Binance is another exchange to consider when buying Bitcoin in Norway for the first time. This is because, at a fee of just 1.8%, users can instantly invest in Bitcoin with a debit or credit card. Users will, however, need to go through a quick KYC process first by uploading a copy of their driver’s license or passport.

In addition to supporting fast payments, we also like Binance for its advanced trading suite. This integrates with TradingView, which is often the go-to analysis platform for seasoned pros. Users will find technical indicators, custom order types, and customizable charts.

Binance supports more than 600 cryptocurrencies in addition to Bitcoin – which is huge. The platform continues to add new tokens to its digital asset library as per client demand. Those seeking access to margin when buying Bitcoin will find futures, options, and leveraged markets on the Binance platform.

In terms of commissions, Binance charges just 0.10%. Through its maker/taker commission structure, fees decline as monthly trading volumes increase. Investors holding BNB tokens in their Binance web wallet will also have access to more competitive fees. Take note, when utilizing leveraged markets, additional funding fees will apply.

Those looking to buy Bitcoin in Norway via their smartphone will appreciate the Binance app. While this iOS and Android app comes packed with tools and features, it is relatively simple to use. The main drawback with Binance is that it is under investigation by several financial authorities – which is why its payments system is sometimes suspended.

| Number of Cryptos | 600+ |

| Debit Card Fee | 1.8% |

| Fee to Trade Bitcoin | 0.1% standard commission |

| Minimum Deposit | Varies depending on the payment type |

Features

Cryptoassets are a highly volatile unregulated investment product.

5. Firi – Domestic Bitcoin Exchange for Norwegian Investors

Firi is a popular Bitcoin exchange based in Norway. The platform specializes in Bitcoin only – which means that users will not be able to diversify into other cryptocurrency projects.

Nonetheless, those wishing to buy Bitcoin will have access to trading commissions of just 0.7%. There are no deposit fees charged by Firi, but only banking methods are supported.

This usually takes 1 working day for the exchange to credit the funds. The Firi platform itself is very user-friendly – which is also the case with its iOS and Android app.

Firi might also appeal to first-time Bitcoin investors that wish to increase their knowledge of cryptocurrency trading. This is because the platform’s learning department offers a wide range of free guides and explainers.

| Number of Cryptos | 1 – Bitcoin only |

| Debit Card Fee | Not supported |

| Fee to Trade Bitcoin | 0.7% standard commission |

| Minimum Deposit | Not stated |

Features

6. NBX – FSA-Registered Bitcoin Exchange Based in Norway

The Norwegian Blockchain Exchange (NBX) allows local investors to buy Bitcoin with low trading fees. Standard commissions here stand at just 0.5% per slide – which is charged at both ends of the trade.

Unlike fellow Norway exchange Firi, NBX allows users to invest in a variety of digital assets in addition to Bitcoin. However, in total, just 25 markets are supported.

Nonetheless, it takes just five minutes to register an NBX account – which includes the KYC process. Users can then deposit funds via a local bank transfer. There is also the option to deposit funds via a debit/credit, but this is processed by a third-party payment processor.

NBX also offers a mobile trading app that connects to the user’s main web account. Finally, NBX is registered with the Financial Supervisory Authority of Norway (FSA).

| Number of Cryptos | 25 markets |

| Debit Card Fee | Depends on third party |

| Fee to Trade Bitcoin | 0.5% standard commission |

| Minimum Deposit | Not stated |

Features

Should I Buy Bitcoin?

Bitcoin offers a great alternative to traditional financial instruments. This digital asset class is still relatively young too – considering it was only launched to the public in 2009. Bitcoin has produced huge returns in the prior decade that now exceed millions of percentage points.

Furthermore, Bitcoin allows users to invest in a decentralized asset – which means that the digital currency is not controlled by any single authority. Investors in Norway might also appreciate Bitcoin for its limited and finite supply, as well as its ability to facilitate fast and cheap international transactions.

However, Bitcoin is arguably still unproven in the grand scheme of things. As such, this asset class comes with a variety of risks. At the forefront of this is that the value of Bitcoin is very volatile. This is on another level when compared to conventional blue-chip stocks or high-grade bonds.

Therefore, when deciding on whether or not to buy Bitcoin in Norway, consider that the value of the investment will fluctuate in a volatile manner. On the other hand, it is possible to invest in Bitcoin and other cryptocurrencies with small stakes. As noted earlier, some platforms require a minimum Bitcoin purchase.

Benefits of Buying Bitcoin in Norway

The above sections summarized the pros and cons of buying Bitcoin for an investment portfolio today.

Now, we will go into a lot more detail regarding the core benefits of Bitcoin, before moving on to its risks.

No Single Person or Authority Controls Bitcoin

One of the most pertinent benefits of Bitcoin is that, unlike traditional currencies, it is not backed or controlled by any single person or authority. In simple terms, this means that Bitcoin is decentralized.

Those wondering why this is important might first consider how traditional currencies like the krone are safeguarded.

- For instance, when depositing krone into a bank account, the respective financial institution retains full control over the funds.

- This means that the financial institution can implement draconian measures like limiting transaction amounts or even preventing withdrawals in their entirety.

- In a more extreme example, the bank has the ability to close the bank account itself.

Now, when we compare this to Bitcoin, things are completely different. After all, the fact that Bitcoin is decentralized means that there is no involvement from banks or financial institutions, let alone third parties.

On the contrary, those buying and owning Bitcoin in Norway retain full control over their digital assets. This is, however, on the proviso that the Bitcoin is kept in a non-custodial wallet – as opposed to a third-party exchange.

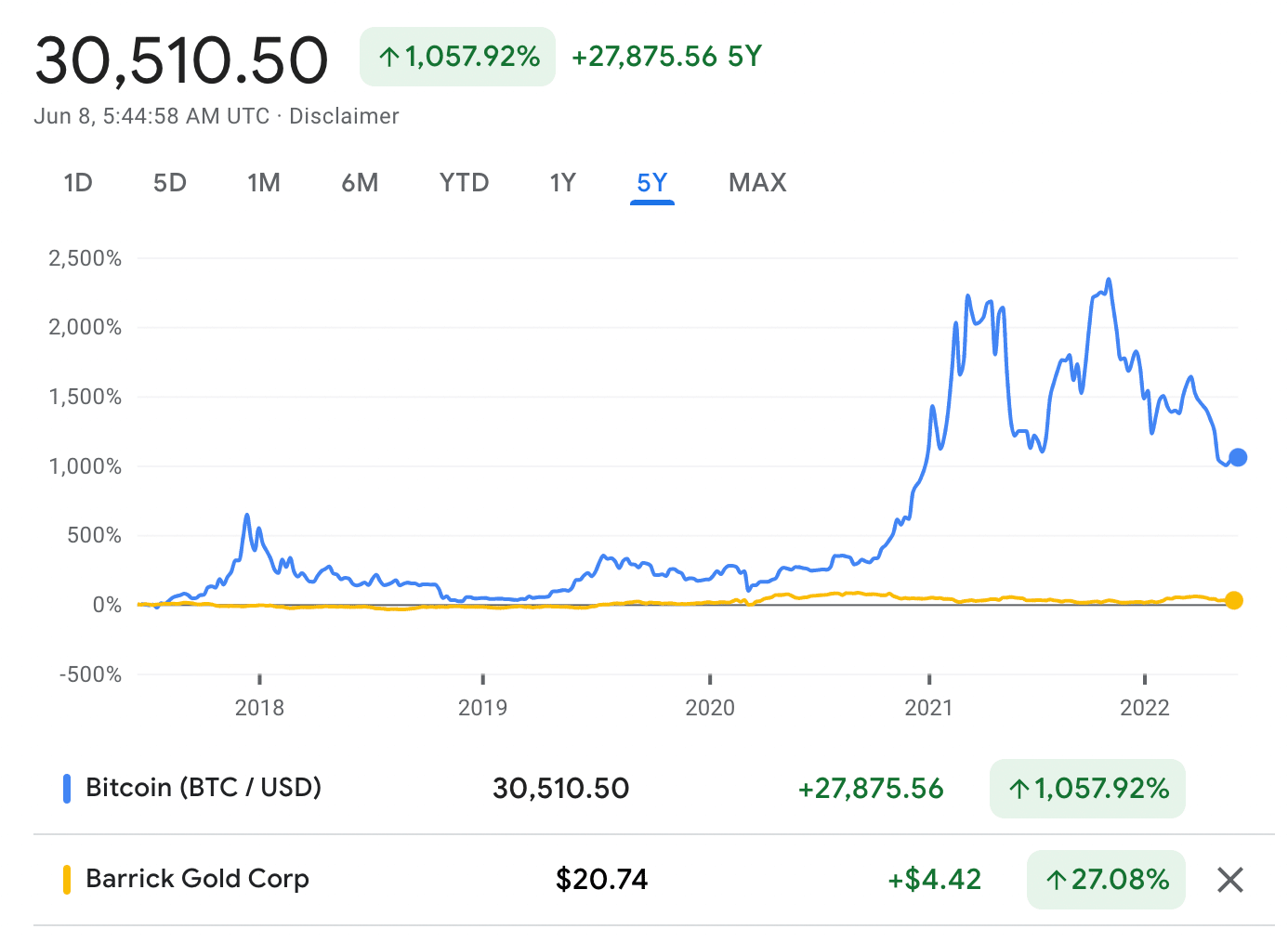

Bitcoin is a Better Store of Value Than Gold

While some investors will look to trade Bitcoin on a short-term basis, many argue that the digital asset is much better suited as a long-term store of value. In fact, there are many comparisons between Bitcoin and gold for this purpose.

For example, both Bitcoin and gold are finite asset classes. After all, once the last ounce of gold is mined, no more will ever enter circulation.

Similarly, when the last Bitcoin is mined in 2140 – which will take the total supply to 25 million, no more tokens will be created. As such, the theory is that as demand for Bitcoin continues to rise, its limited supply will have a positive impact on its valuation.

With that said, Bitcoin is arguably a lot more suited as a store of value when compared to gold. For a start, Bitcoin can easily be divided into small units at the click of a button. Gold, on the other hand, cannot.

Gold is also challenging to store. Bitcoin is not exposed to the same issue as it is a digital currency that is stored in a software or hardware wallet.

And finally, unlike gold, Bitcoin can easily be used as a medium of exchange. This is because users can send and receive Bitcoin electronically in just 10 minutes.

Bitcoin is an Emerging Asset Class

Although Bitcoin was launched in 2009, this is still a very short period of time when compared to the likes of gold – which has been traded for thousands of years.

- One way to view this is that those looking to buy BTC in Norway in 2022 is perhaps like investing in Amazon stock in 2010 – which is 13 years after its IPO.

- Back then, Amazon stock could have been purchased at just $6 per share (adjusted for stock splits).

- Baring in mind that Amazon has since hit highs of $188 – this represents gains of over 3,000%.

The key takeaway here is that by investing in Bitcoin today, it is possible to gain exposure to this emerging asset class while it is still in its infancy. And in doing so, this could perhaps offer a great entry point in terms of the cost price of the investment.

Bitcoin is a High-Growth Investment

Bitcoin has produced unprecedented returns since launching 13 years ago. It was initially available to buy for a small fraction of a cent, before hitting $1 in 2011. It wasn’t until 2013 that Bitcoin hit $100. Nonetheless, Bitcoin is now worth thousands of dollars per token.

In fact, it broke a value of $68,000 in late 2021 – which represents its most recent all-time high. This means that had an investor elected to buy Bitcoin in Norway back in 2013, the funds would have been worth 68,000% more. In other words, a Bitcoin investment of $500 in 2013 would have been worth nearly $340,000 in late 2021.

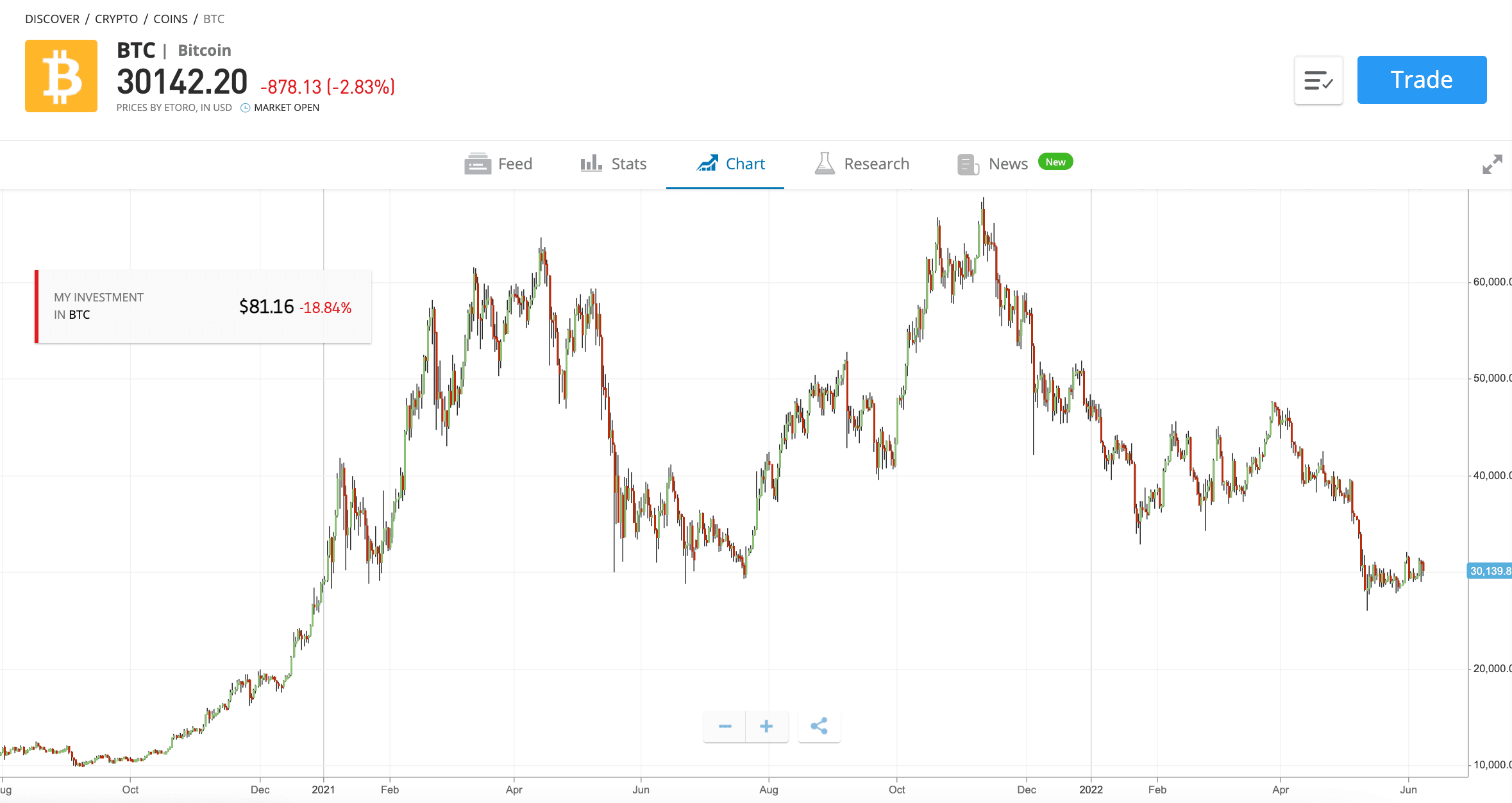

2022 is a Bear Market – Buy the Dip

When deciding on when to buy Bitcoin, it is always a wise move to try and invest when the digital asset is going through a bear market. This is investment jargon to say that as of 2022 – the price of Bitcoin has struggled to move upwards.

On the contrary, Bitcoin has gone from over $68,000 in November 2021 to lows of under $30,000 in 2022. This means that Bitcoin is available to buy at a huge discount.

Risks of Buying Bitcoin in Norway

Now that we have explored the core benefits of making an investment, we will now discuss the main risks to consider before electing to buy Bitcoin in Norway.

Bitcoin is Volatile

Those adding Bitcoin to their investment portfolio should be prepared for wild pricing swings. As we mentioned just a moment ago, the digital currency has gone from highs of $68,000 to lows of under $30,000 in a matter of months.

In fact, those buying Bitcoin at its peak in late 2021 would have since seen the value of their investment decline by over 55%.

This is why Bitcoin should be viewed as a long-term investment. Ultimately, taking a longer-term approach to this digital asset, allows investors to ride out volatile market waves.

Taxation

Another risk that needs to be considered before electing to buy Bitcoin in Norway is with regards to taxation. Crucially, many first-time investors make the mistake of thinking that Bitcoin is exempt from tax – but it isn’t.

On the contrary, Bitcoin is liable for capital gains tax – which covers the profit element of the investment after it is sold. However, even unsold Bitcoin can be liable for tax.

This is because Norway implements a wealth tax of 0.7% on investment holdings of over 1.5 million NOK – which is inclusive of Bitcoin.

Moreover, those who deposit Bitcoin into a crypto savings account will need to consider that any proceeds received are liable for income tax.

All in all, failing to report the right taxes on a Bitcoin investment can lead to serious consequences.

Risks of Buying Bitcoin in Norway

The best Bitcoin exchanges in this marketplace support a wide variety of payment methods.

The best ways to buy Bitcoin in Norway online are discussed in the sections below:

Buy Bitcoin With SEPA

Those that are not in a hurry to buy Bitcoin immediately might consider performing a SEPA transfer.

While this will delay the process by a number of working days, all of the platforms discussed today that accept SEPA do so on a fee-free basis.

Once the funds arrive, the user will need to place an order to buy Bitcoin.

Buy Bitcoin With Credit Card or Debit Card

While SEPA is often much cheaper, it can be cumbersome to have to wait several days for the money to arrive in the user’s crypto exchange account. Instead, it might be worth buying Bitcoin with a credit or debit card.

This will allow the investor to purchase Bitcoin instantly. The most expensive exchanges to accept credit/debit cards include Bitstamp and Coinbase, which charge 5% and 3.99% respectively.

Crypto.com is slightly cheaper at 2.99%.

Buy Bitcoin With PayPal

Some platforms also allows users to buy Bitcoin with Paypal. The fee will depend on the platform you choose.

Bitcoin Price

The Bitcoin price has gone from a small fraction of a cent in 2009 to tens of thousands of dollars in 2022. This means that Bitcoin is one of the best-performing asset classes of all time – especially for those that invested early.

The price of Bitcoin is determined by the forces of demand and supply. This is no different from other commodities, such as gold or oil. While investors in Norway can buy Bitcoin with NOK, this asset class is typically traded in US dollars.

Over the prior five years of trading, Bitcoin has increased in value by over 1,000%. This means that those investing $5,000 into Bitcoin just 12 months ago would have a portfolio worth more than $50,000.

In order to keep tabs on the Bitcoin price, investors might want to consider a price-tracking app.

Bitcoin Price Prediction

Trying to come up with a reliable Bitcoin price prediction is somewhat challenging considering how volatile and unpredictable this asset is.

After all, when Bitcoin was approaching the $70,000 level in late 2021, nobody could have predicted that it would have quickly reversed back down to $30,000 in a matter of months.

On the contrary, many market proponents forecast that it was only a matter of weeks before Bitcoin surpassed $100,000. Perhaps 6-figures should be viewed as a longer-term target, as this is well within reach for Bitcoin.

However, in the shorter term, Bitcoin needs to get back to its prior all-time high range of $68,000.

How to Buy Bitcoin Safely in Norway

The most effective way for first-time investors to ensure that they buy Bitcoin in Norway safely is to pick very carefully when choosing an exchange or broker.

Even domestic exchanges like NBX are only registered with the FSA, which offers limited oversight.

In choosing a regulated platform to buy Bitcoin in Norway, investors can be certain that they are using a trusted provider. After all, it can take several years to obtain authorization and licensing from a body like the SEC.

- Another thing that investors can do to ensure they buy Bitcoin safely is to research their chosen wallet provider.

- While non-custodial wallets offer full control over private keys, this means that the user is 100% responsible for safekeeping their tokens.

How to Buy Bitcoin in Norway – Tutorial

Those looking to buy Bitcoin in Norway today can follow the step-by-step guide below.

In doing so, an account will be opened with a regulated broker in less than five minutes. Then, the user can proceed to buy Bitcoin instantly with a debit or credit card, and other payment options

Step 1: Open a Crypto Account

First, visit your chosen broker’s site to open a crypto account. Click to join or create an account and enter some personal information as required by the site.

This information will likely include your name, nationality, date of birth, email address, and cell phone number.

Step 2: Upload ID

Upload a copy of a passport or driver’s license to get verified. This is a requirement to ensure the broker complies with KYC and AML regulations.

Step 3: Deposit Funds

The minimum deposit at each broker will vary. There will be different payment methods available depending on the site you choose.

Fees may also apply when you fund your account.

Step 4: Search for Bitcoin

In the search box towards the top of the site you’re using, type in ‘Bitcoin’.

When Bitcoin appears like in the image above, click the option to buy or trade the coin.

Step 5: Buy Bitcoin

You can choose a USD amount to invest, or a BTC amount that you want to buy. Follow the prompts you’ll see on screen to complete the trade and add Bitcoin to your wallet.

How to Sell Bitcoin in Norway

To sell Bitcoin on the broker site you use, the process will be much the same as completing the original investment – but in reverse.

- Log into the broker account

- You will then need to head over to your investment portfolio

- Look for Bitcoin and create a sell order

- Confirm the sell order

At the current market rate, Bitcoin will then be sold by your broker. The proceeds will then be reflected in the user’s account balance.

Conclusion

To buy Bitcoin in Norway today, consider using a regulated broker that offers low fees.