You can buy Bitcoin in Nigeria in less than five minutes from start to finish when using a crypto exchange that supports e-wallets or debit cards.

Just be sure to explore what fees the exchange charges and of course – whether or not it is regulated by a reputable financial body.

In this guide, we explain how to buy Bitcoin in Nigeria in a safe and low-cost way.

How to Buy Bitcoin Nigeria – Quick Guide

If you’re looking to buy Bitcoin in Nigeria right now – the guidelines below will show you how to get started in a matter of minutes.

- ✅ Step 1: Open a Capital.com Account – We found that Capital.com is the best place to trade Bitcoin – as the platform offers 0% commission crypto markets. Get the process started by opening a Capital.com account and uploading a copy of your government-issued ID.

- Step 2: Deposit Funds – The minimum deposit at Capital.com is just $20 when using a debit/credit card or an e-wallet. No deposit fees are charged.

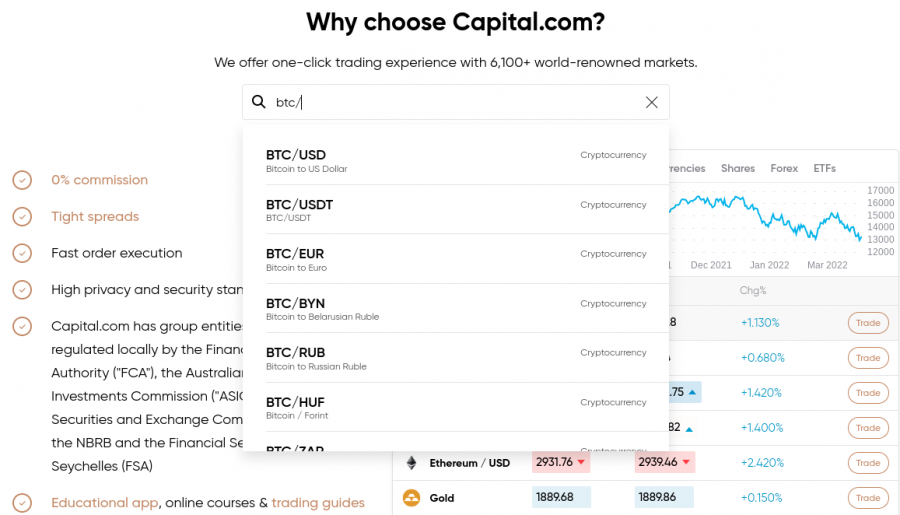

- Step 3: Search for Bitcoin – Most investors in Nigeria will trade Bitcoin against the US dollar. As such, in the search box, type in ‘BTC/USD’.

- Step 4: Trade Bitcoin – You can now select a ‘Buy’ position and enter your stake. Once you confirm the order, it will be carried out by Capital.com instantly.

Cryptoassets are a highly volatile unregulated investment product.

Read on for more information on how to buy Bitcoin in Nigeria.

Where to Buy Bitcoin Nigeria – Quick Guide

You will need to buy Bitcoin in Nigeria from a crypto exchange.

We find that the best crypto exchanges in Nigeria offer low trading fees and support for small account minimums. We also prefer exchanges that accept instant payment methods – such as debit/credit cards and Paypal.

In the sections below, we discuss where to buy Bitcoin in Nigeria right now.

1. Capital.com – Overall Best Place to Buy Bitcoin in Nigeria for 2022

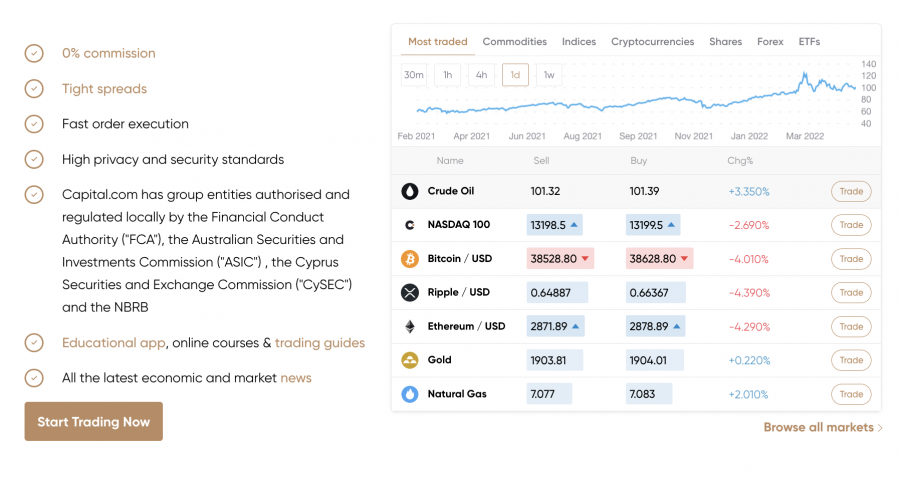

The best place to trade Bitcoin in Nigeria is Capital.com. This popular trading site requires a minimum deposit of just $20 to get started when using a debit/credit card or an e-wallet. Then, you can trade Bitcoin against the US dollar without paying any commission at all.

There are no fees to deposit or withdraw funds either, so Capital.com is truly a low-cost trading platform. As Capital.com offers Bitcoin CFDs, you won’t own the underlying tokens. Instead, when you trade Bitcoin here, you are merely speculating on whether the price of BTC/USD goes up or down.

As a result, you do not need to download and install a private crypto wallet – so this will suit beginners. Another major benefit of trading Bitcoin at Capital.com is that you will have access to leverage facilities. Therefore, you can multiply the value of your stake. For example, if you apply leverage of 1:2 and stake $1,000 – you can trade with up to $2,000.

Another reason that Capital.com is worth considering is that you can choose from a buy or sell position when entering a trade. Sure, if you think that the value of Bitcoin will rise against the US dollar, then you can place a buy order. However, if you think that the price of Bitcoin is likely to go down, Capital.com also allows you to profit from this via a sell order.

In addition to Bitcoin, Capital.com supports over 470 other crypto markets. As such, you will not be short of trading opportunities when using this platform. In fact, not only does Capital.com offer CFD markets on cryptocurrencies, but plenty of other asset classes. This includes ETFs, forex, commodities, indices, and thousands of US and international stocks.

Capital.com not only allows you to trade via its website but there is also an iOS and Android mobile app. This will connect to your main account, so all features and tools are accessible. Finally, Capital.com stands out for its strong commitment to safety and regulation. At the forefront of this is that Capital.com is licensed by the FCA, ASIC, CySEC, and the NBRB.

| Number of Cryptos | 470+ markets |

| Debit Card Fee | No fee |

| Fee to Trade Bitcoin | Commission-free |

| Minimum Deposit | $20 on debit/credit cards and e-wallets and $250 on bank wires |

What we like

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and can afford the risks.

2. Crypto.com – Buy Bitcoin and 250 Other Cryptocurrencies With Low Fees

If you would prefer to own and store Bitcoin as opposed to trading the digital currency via CFDs, then Crypto.com could be the best exchange for you. On this platform, not only can you invest Bitcoin in Nigeria, but 250 other leading digital currencies.

This means that you can create a diversified portfolio that could contain everything from Dogecoin, Ethereum, and XRP to Shiba Inu, EOS, and Dash. But, before you can access Bitcoin and other digital assets on this platform, you will need to open an account and upload some ID.

Fortunately, the process takes less than five minutes from start to finish at Crypto.com. You can fund your Bitcoin investments instantly with Visa or Mastercard, albeit, this typically attracts a fee of 2,99%. You can also transfer money from your bank account to save on fees. Either way, the minimum deposit stands at just $20.

Once your account is funded, you will then be able to invest in Bitcoin in Nigeria at super low commissions. The most you will pay at Crypto.com is just 0.40% per slide. With that said, the platform offers lower commissions to those that buy and stake its native token – CRO. In holding CRO, you will have access to a variety of other perks.

Another thing to note about this top-rated exchange is that you can earn interest on the Bitcoin tokens that you purchase. The APY on offer stands at 6%, but this requires a 3-month lock-up and a minimum number of staked CRO tokens. Lower Bitcoin interest rates are offered on flexible accounts without any staking requirements.

Moreover, interest rates of up to 14.5% are offered on other digital currencies, so this is definitely worth exploring if you seek regular passive income. Alternatively, you might also consider keeping your Bitcoin tokens in the Crypto.com wallet. This is a decentralized wallet app for iOS and Android – meaning that you will retain full ownership of your private keys.

| Number of Cryptos | 250+ |

| Debit Card Fee | 2.99% |

| Fee to Buy Bitcoin | Up to 0.40% commission |

| Minimum Deposit | $20 |

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

3. Binance – Low Commission Crypto Exchange and P2P Marketplace for Trading

You can also buy and stake BNB tokens here and receive reduced commissions. We also like Binance for its advanced trading suite, which allows you to perform technical analysis with ease. This is in addition to advanced trading orders and chart drawing tools. You will also have access to leveraged markets.

This is inclusive of Bitcoin futures and options, should you wish to speculate on BTC with more money than you have in your account. In terms of making a deposit, this is where Binance comes with a major drawback. That is to say, Binance doesn’t support direct Visa or MasterCard deposits for traders in Nigeria.

Instead, you will need to use its P2P Marketplace to add funds to your account. This means that you will be transferring funds on a peer-to-peer basis, outside of the scope of Binance. Nonetheless, once you have made a deposit and bought Bitcoin, Binance also offers savings accounts that allow you to generate interest on your tokens.

| Number of Cryptos | 600+ |

| Debit Card Fee | Depends on the payment processor |

| Fee to Trade Bitcoin | 0.1% standard commission |

| Minimum Deposit | Varies depending on the payment type |

What we like

Cryptoassets are a highly volatile unregulated investment product.

Should I Buy Bitcoin?

For instance, over the prior five years, Bitcoin has increased in value by over 1,600%. This means that on an investment of $2,000 five years prior to writing this guide, your money would now be worth $32,000.

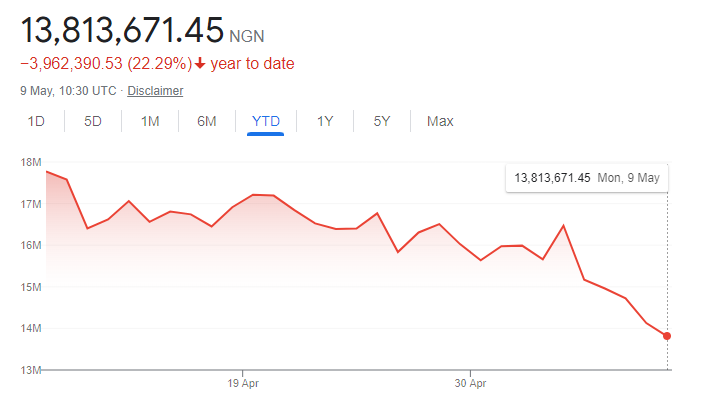

This represents significantly higher returns in comparison to the traditional stock markets. As we cover in more detail shortly, investors in Nigeria are also buying Bitcoin as a means to hedge against the ever-depreciating naira.

On the other hand, although Bitcoin now operates in a multi-trillion market globally, it is still a highly volatile and unpredictable asset class.

More specifically, if you buy Bitcoin in Nigeria, there is every chance that you will see the value of your investment decline. If it does and you decide to sell your BTC tokens, you will lose money.

Cryptoassets are a highly volatile unregulated investment product.

Benefits of Buying Bitcoin

In this section of our guide, we will take a closer look at some of the key reasons why so many people are looking to buy Bitcoin in Nigeria.

Bitcoin is Decentralized

The first benefit to consider when learning how to buy Bitcoin in Nigeria is that this digital asset class is decentralized. This means that no single person or authority owns Bitcoin.

This means that in keeping Bitcoin tokens in a private crypto wallet, you are the only person that has control over your funds. This is in stark contrast to keeping naira in a bank account.

After all, your money is held by the respective bank or financial institution, which means that in reality – you have no control over your wealth.

The Supply of Bitcoin Cannot be Manipulated

Another benefit of buying Bitcoin is that it is not controlled by any central bank or government. And as such, the supply of Bitcoin cannot be manipulated. This means that Bitcoin cannot suffer from the same inflationary issues as the naira.

On the contrary, the supply of Bitcoin is determined by the underlying code that is governed by the blockchain protocol. Every 10 minutes, a new block is verified, and thus – 6.25 new BTC enter circulation.

New Bitcoin will continue to enter circulation every 10 minutes until the total supply hits 21 million tokens. This is expected to happen approximately 118 years from now.

Cheap and Fast International Transactions

If you find yourself sending or receiving funds internationally, then you will know that remittance rates can be super expensive when the Nigerian naira is involved. You might also find that it takes several days for the funds to arrive.

In comparison, Bitcoin transactions take just 10 minutes to confirm – irrespective of where the sender and receiver are based. Moreover, fees rarely cost more than a few dollars per transaction. This is the case regardless of how much is being sent.

Bitcoin has Generated Huge Gains

When it comes to the benefits of buying Bitcoin from an investment perspective, this digital asset has generated huge gains since it was launched in 2009. As noted earlier, Bitcoin has increased by over 1,600% over the prior five years.

When you compare this to a traditional stock market index like the S&P 500, you would only be looking at gains of 72% over the same period.

Bitcoin is Budget-Friendly

We should also note that when you buy Bitcoin in Nigeria, you can get started with a small amount of capital. When using Capital.com or Crypto.com, for example, the minimum deposit stands at just $20.

This means that Bitcoin is suitable for all budgets, as you can slowly build your exposure to this digital asset without needing to risk large sums of capital.

Ways of Buying Bitcoin

You can buy Bitcoin in Nigeria with a variety of payment methods.

This includes:

Buy Bitcoin With Credit Card or Debit Card

The fastest way to buy Bitcoin in Nigeria is with a credit or debit card issued by Visa or MasterCard. Not only will your deposit be processed instantly, but fees are often competitive when you know where to look.

For example, if you deposit funds with a credit or debit card at Capital.com, you will not be charged any transaction fees. This is also the case when you make a withdrawal from your Capital.com account back onto your payment card.

Buy Bitcoin With Paypal

We found that very few platforms allow you to buy Bitcoin in Nigeria with Paypal. You might consider the P2P Marketplace at Binance for this purpose, but this can result in high fees.

Moreover, as you will be exchanging funds with a third party, you also need to consider the added risks.

With that said, Capital.com allows you to deposit funds with Paypal and a number of other e-wallets directly. And, as noted above, Capital.com does not charge any deposit fees.

Cryptoassets are a highly volatile unregulated investment product.

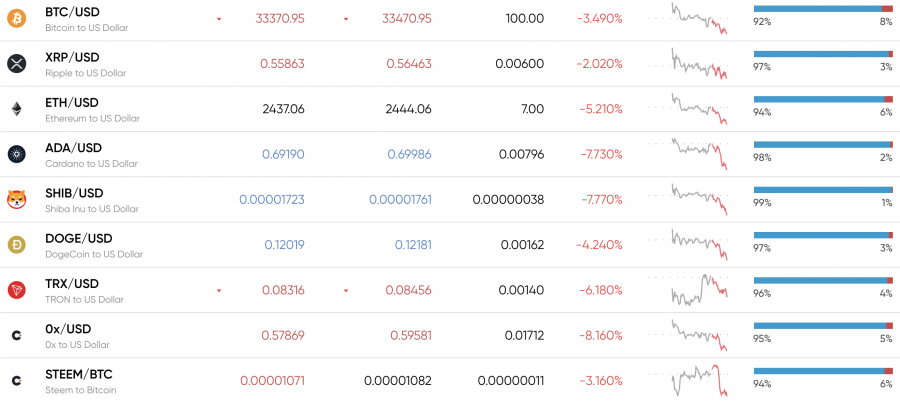

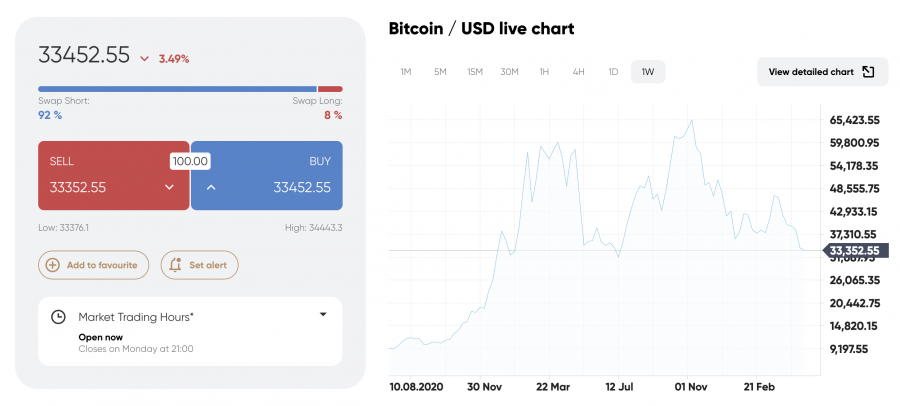

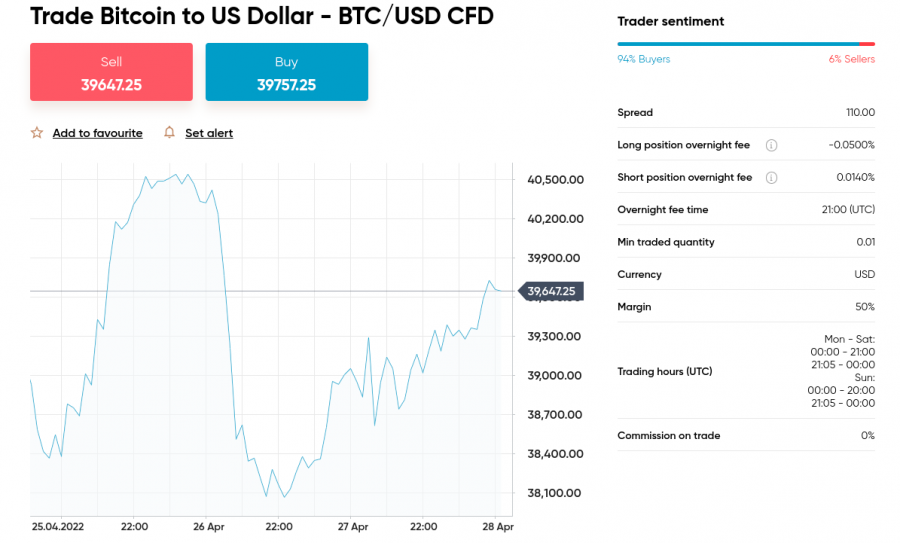

Bitcoin Price

The price of Bitcoin changes throughout the day like any other tradable asset class. With that said, in comparison to the traditional stock markets, Bitcoin price movements are a lot more volatile.

For example, in the six months prior to writing this guide, the price of Bitcoin has declined by 44%. However, it is best to view Bitcoin as a longer-term investment. In doing so, you can avoid focusing on short-term pricing spikes.

Another thing to note about the price of Bitcoin is that – just like this guide, analysts typically quote BTC against the US dollar. This is the same as other globally traded commodities like oil, natural gas, gold, and silver.

In terms of its all-time high, Bitcoin was priced at nearly $69,000 in late 2021. The price of the digital asset has since retracted, with 2022 lows amounting to $33,000 as of writing.

Although this represents a huge decline from its prior peak, this isn’t uncommon for Bitcoin. That is to say, since Bitcoin was launched in 2009, its value has gone through plenty of bull and bear cycles.

Bitcoin Price Prediction

In the short to medium term, proponents of Bitcoin will want to see its value get back towards its prior all-time high of $69,000. Based on 2022 lows of $33,000 as of writing, this would require an upswing of nearly 110%.

As such, when Bitcoin goes through downward pricing action as it has done throughout 2022, this often represents a great time to enter the market.

After all, if you believe in the long-term future of Bitcoin, it’s best to make a purchase when it is available at a discount. Over the longer-term, many Bitcoin price predictions point to the digital asset surpassing $100,000.

If and when this price target is realized, this would only give Bitcoin a market capitalization of roughly $2 billion. As such, there is still plenty of upside potential left on the table – even at $100,000 per token.

How to Buy Bitcoin Safely

When researching the best place to buy Bitcoin in Nigeria, we came across a plethora of exchanges that should be avoided. This is because many exchanges are either unregulated or they do not have a long enough track record in this space to be trusted.

Therefore, the first thing that you can do to ensure you buy Bitcoin safely is to ensure you are doing so through a reputable crypto exchange that is adequately licensed.

To recap, leading trading platform Capital.com is licensed by the FCA, ASIC, CySEC, and the NBRB. This means that you have regulatory oversight on four separate fronts.

When using Capital.com, there is no requirement to worry about the safety of your Bitcoin tokens either, as you will be trading CFD instruments.

With that said, if you decide to buy Bitcoin in the traditional sense through a crypto exchange, you will need to think about how you intend on storing your tokens. The best way to do this is by withdrawing the tokens to a private wallet app.

We like the Crypto.com wallet for this purpose, as it gives you full control over your private keys. This means that you are the only person to have access to your Bitcoin tokens.

Cryptoassets are a highly volatile unregulated investment product.

How to Buy Bitcoin in Nigeria – Tutorial

If you are ready to buy Bitcoin in Nigeria right now and need some additional guidance on how to complete the process online – this section is for you.

We will walk you through the steps required to trade Bitcoin at Capital.com on a commission-free basis.

Step 1: Open Capital.com Account

You will first need to open an account with Capital.com – which should take you no more than a couple of minutes. When prompted, enter your personal information and contact details.

You will also be asked to upload a copy of your government-issued ID. This can be a passport or driver’s license, for instance.

Step 2: Deposit Funds

Now that you have an account with Capital.com, you can deposit some funds.

It’s best to opt for a credit/debit card or a supported e-wallet for this purpose. The reason for this is that your deposit will be processed instantly and you only need to meet a minimum of $20.

If you must opt for a bank wire, then the minimum increases to $250 and you will need to wait several business days for the funds to arrive.

Step 3: Search for Bitcoin

We mentioned earlier that most Nigerians will look to trade Bitcoin against the US dollar – as this is the largest market in the crypto space. As such, look for the search bar towards the top of the page and type in BTC/USD.

You can then click on the market when it loads beneath the search bar.

Step 4: Trade Bitcoin

Now you will need to set up a trading order so that Capital.com knows what position you want to execute. Assuming that you believe the price of Bitcoin will rise, you will need to select a ‘Buy’ order.

Then, you will need to type in your desired stake. If you want to trade Bitcoin with leverage, you can select your preferred multiple. Capital.com also allows you to set up stop-loss and take-profit orders.

Once you place your Bitcoin order, it will be carried out by Capital.com instantly.

How to Sell Bitcoin?

After you buy Bitcoin in Nigeria, you will, at some point, look to cash out your investment. The process required will depend on how and where you decided to complete your original Bitcoin purchase.

For example, if you placed a buy order on the Capital.com website, you can cash out the position by placing a sell order. Once you do, Capital.com will sell the Bitcoin position at the next best available price.

On the other hand, if you are holding Bitcoin in a private wallet, you will need to transfer the tokens to a crypto exchange so that you can cash out.

Conclusion

This beginner’s guide has cleared the mist on how to buy Bitcoin in Nigeria. We’ve also discussed which crypto exchanges should be considered and what risks you need to take into account before getting started in African crypto projects.

If you want to gain exposure to Bitcoin right now, Capital.com is the best platform for this purpose. Not only can you deposit funds with a debit/credit card or e-wallet instantly, but no transaction fees are charged.

Furthermore, you can trade Bitcoin here without paying any commission and you will also have access to leverage – should you wish to amplify the value of your position.

Cryptoassets are a highly volatile unregulated investment product.