Bitcoin is the largest cryptocurrency in the world, with a market cap of $600 billion. Since this digital asset is responsible for more than 40% of the entire industry’s market share, users worldwide will be interested in purchasing and holding BTC.

In this guide, we look at how to buy Bitcoin in Hong Kong. Comprising an in-depth study on BTC’s price and when to buy Bitcoin, the guide will also review the popular places from where to buy Bitcoin in Hong Kong.

How to Buy Bitcoin in Hong Kong – Quick Guide

For users looking for the simplest way to buy Bitcoin in Hong Kong, here are the steps

- Open an account – Begin the registration process with your preferred trader and enter your personal details, and create a username and password.

- Deposit Funds – Using one of the multiple payment methods on the platform, deposit cash in the platform.

- Search for Bitcoin – Search for BTC on the platform’s navigation bar and click on ‘Trade’ to continue.

- Buy Bitcoin – Insert the amount you wish to insert into the trade and confirm your purchase by clicking on “Open Trade”.

Where to Buy Bitcoin in Hong Kong

This section will look at the various platforms from where to buy bitcoin in Hong Kong. Due to the abundance of crypto brokerages, users may want to evaluate their options based on cryptocurrencies supported, tools & features, and the fees provided.

Users can invest in bitcoin in Hong Kong with the following cryptocurrency platforms:

1. Crypto.com – Stake BTC for Passive Income

Crypto.com is a platform from where to buy Bitcoin in Hong Kong. A global crypto exchange, Crypto.com supports the trading of BTC and 250+ cryptocurrencies through its platform. After accessing the platform via the website or mobile app, users can buy Bitcoin instantly with a debit card. This method will cost 2.99%.

the trading of BTC and 250+ cryptocurrencies through its platform. After accessing the platform via the website or mobile app, users can buy Bitcoin instantly with a debit card. This method will cost 2.99%.

Alternatively, users can reduce their costs by transferring funds via ACH wire transfer. Once the funds are transferred, users can purchase BTC by paying a simple slide fee of 0.40% per transaction. However, you have the opportunity to reduce the fees by holding CRO coins – the native crypto token of Crypto.com.

If you’re looking to invest in bitcoin in Hong Kong and earn passive income, Crypto.com provides interest-earning opportunities by staking your BTC earnings. Users can earn an Annual Percentage Yield (APY) of 4% by staking BTC on crypto.com – this increases by a further 2% for users holding CRO tokens. This may be a valuable option for users looking to hold BTC for the long term and earn some extra earnings on the side.

Finally, Crypto.com provides users with a crypto wallet and an NFT marketplace, which can offer diversification opportunities for the future.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

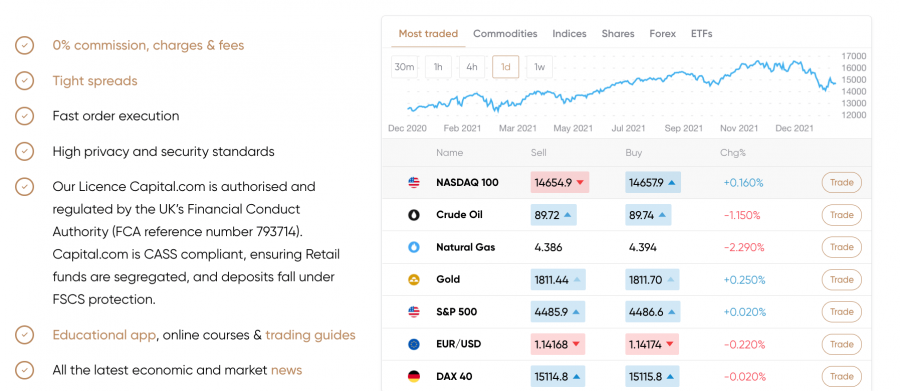

2. Capital.com – Trade BTC without holding the underlying asset

Launched in 2016, Capital.com is a popular trading platform to invest in

Capital.com is notable for charging no commission on BTC and crypto trading fees. Instead, the platform charges a low spread fee – the difference between the buying and selling price of BTC in real-time.

Capital.com is a CFD (Contracts For Differences) broker – meaning that users do not have to hold the underlying asset. Instead, users can invest in the future price movements of BTC and apply leverage to enhance their trading positions. This can be an attractive proposition for risk-tolerant traders looking to buy and sell BTC and other cryptos regularly.

Users can buy bitcoin in HK with Capital.com with a minimum deposit of $20 – using bank transfers, credit/debit cards or electronic wallets. Capital.com offers 24/7 customer support and assigns each user with their dedicated account managers to solve account queries and problems.

Capital.com is regulated by international bodies, including the FCA, ASIC, CySEC and the National Bank of the Republic of Belarus.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. Coinbase – Beginner Friendly Platform

Coinbase is another global crypto exchange that allows users to buy BTC in Hong Kong. Coinbase is a simple

After completing a simple KYC process and the registration process, users can choose between a credit/debit card option or bank transfer to complete their Bitcoin purchase in Hong Kong. Coinbase charges a hefty commission of 1.49% per trade. A further charge of 3.99% will be added when purchasing with debit/credit card payments. If you choose to buy bitcoin with PayPal, you are offered 24/7 customer support service.

Should users in Hong Kong choose to diversify their funds, Coinbase offers 100+ cryptocurrencies including altcoins, meme tokens and stablecoins. A highly secured platform, Coinbase offers 2FA protocols and holds 98% of client tokens in cold storage – which prevents the assets from online hackings and thefts.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Binance – Buy BTC & 600 crypto assets

Binance is the most popular crypto exchange, allowing users to buy and sell more than 600

Binance is a lucrative trading platform for advanced traders, as it provides advanced charting options with hundreds of indicators and overlays. Along with peer-to-peer transactions that allow users to exchange cryptocurrencies with ease, Binance lets investors earn passive income on their holdings as well.

The platform is also FDIC insured and stores most assets in cold storage. Binance also allows users to make more income through its affiliate programme – allowing users to earn a commission for every new user they bring onto the platform.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Tidebit – Hong Kong-based crypto platform

If you’re looking at how to buy bitcoin in Hong Kong – Tidebit

The platform charges a flat fee model, through which users can invest in BTC and HKD (Hong Kong Dollar) trading pairs for a fee of just 0.30%. However, users only have access to wire transfers as an available payment method on Tidebit.

Furthermore, Tidebit takes a fee of 0.003 BTC per withdrawal – which equates to $93 at the time of writing. One notable aspect of Tidebit is its multi-channel customer service – allowing users to connect with the support team via Whatsapp, Facebook and email.

Using Tidebit’s web interface or mobile app, users can locally buy Bitcoin in HK.

Should I Buy Bitcoin?

Bitcoin is currently the largest cryptocurrency in the world, with a market cap of $600 billion. Many new investors look at BTC when entering the digital asset space due to the long-term growth the token has accumulated since its inception in 2009.

However, with new projects and many altcoins entering the space, users may want to evaluate the token in-depth and only then decide on their investment strategy.

Benefits of Buying Bitcoin

Before looking at how to buy Bitcoin in Hong Kong, users may want to decide on their investment. Thus, the sections below cover some of the major benefits of holding BTC and may give you some insight on whether or not to invest in Bitcoin in Hong Kong.

Market Leader

While investing in any asset class, many users tend to look at the leading performers in the industry. While cryptocurrencies may be more volatile than other asset classes, Bitcoin has always been the biggest performer in the industry.

Currently, Bitcoin amounts to 46% of the entire cryptocurrency market cap. While a monopoly in the current market is not indicative of future performances, BTC is the highest traded crypto asset. It is worth more than double of the second-largest token in the industry.

Discounted Price

Despite a current market cap of $600 billion, BTC has corrected by more than 50% since November 2021. Based on past performance, BTC has often corrected massively after a major bull-run, after which it usually trends sideways before its next rally.

While future price indicators can not be predicted, BTC is much more affordable right now than it was a couple of months ago. It is best for investors with a high-risk tolerance to analyse the token and decide on a preferable entry point for buying bitcoin.

Hedge Against Inflation

Bitcoin has always been termed a hedge against inflation – due to its limited token supply. While most altcoins have a lower price point due to high supply and low demand issues, the price of BTC has been going up to high demand. In total, Bitcoin has a maximum supply of 21 million tokens.

Many analysts and investors are under the impression that the tokens limited supply will drive the price further up; however, this can be considered speculatory as best.

Decentralisation

Bitcoin and cryptocurrencies were created to be decentralised in nature. This means that, unlike fiat currency controlled by central banks and financial institutions, no third party or agency regulates BTC supply.

Exceeding the barriers of traditional financing systems, BTC is a currency which can be traded from one part of the world to another in just a few minutes. Since cryptocurrencies provide more autonomy to users and allow them to be solely in charge of their personal assets, it is a good alternative to traditional banking methods.

Staking Options

One of the main concerns of BTC and cryptocurrencies is high-trading volatility. A solution to this is to earn passive income on your BTC holdings. Beneficial for long-term holders, many cryptic exchanges allow you to lock up your BTC holdings and earn interest on them.

Depending on your chosen crypto platform, users have the potential to earn anywhere from 4% – to 7% APY on BTC holdings.

Ways of Buying Bitcoin

There are several ways for users to buy bitcoin in Hong Kong. The sections below cover two different payment options that allow you to invest in bitcoin in Hong Kong.

Buying bitcoin with PayPal

If you’re looking for how to buy Bitcoin in Hong Kong, you can do so with the global payment provider – PayPal. This payment method allows users in Hong Kong to quickly deposit money from their PayPal wallets into their trading accounts.

Buy bitcoin with credit card or debit card

Another method to invest in Bitcoin in Hong Kong is by using a credit/debit card. Since this is the preferred payment option for many users, most platforms allow users to deposit currency with a credit/debit card.

However, users may want to compare the different platforms and see the fees involved while using credit/debit methods – since they can vary from exchange to exchange.

Bitcoin Price

Another essential feature to cover before purchasing BTC is analysing the price of Bitcoin. As you may know, Bitcoin and most cryptocurrencies are considered highly volatile instruments due to their constant price fluctuations.

As a result, users need to be aware of the risk involved in trading with any cryptocurrencies before making an initial investment. For example, a key talking point of the BTC performance in 2021 was the massive rally that the token enjoyed towards Q4.

From a price of $30,000 in July 2021, BTC traded to an all-time high of $68,789 on 8th November 2021. This was a 2x price increase that the token witnessed in just 4 months.

However, since the bull run towards the end of last year, 2022 has seen Bitcoin and the broader crypto markets correct massively following a global panic due to increasing inflation and the Ukraine-Russia geopolitical turmoil.

Currently, Bitcoin has corrected to a price of $31,000 as of June 2022. As seen in 2021, BTC was trading sideways at a similar level before beginning a massive bull run towards the end of the year.

Users may want to carefully analyse and conduct their research on the price of BTC and review the crypto asset before making a decision on their investment.

Bitcoin Price Prediction

Many analysts and investors have varying and differing price predictions on the potential future of the largest cryptocurrency asset in the world.

For example, many analysts believed a price point of $100K to be inevitable for BTC following its bull-run towards the end of 2021. However, as we saw, Bitcoin and the crypto markets tumbled as we entered the new year.

Therefore, users may want to analyse and study a token in detail rather than basing their trades on differing price predictions made by analysts. Users may wish to work out a trading strategy that may suit their investment goals & purposes.

For example, investors who believe in the future and strength of Bitcoin and the cryptocurrency space may want to purchase and hold onto Bitcoin for the long term. On the other hand, day traders and experienced traders may prefer to trade on the future price of Bitcoin by applying leverage and margin trading options.

How to Buy Bitcoin Safely

There have been cases of large-scale hackings and thefts in the past, which have resulted in millions worth of Bitcoin being stolen from investors. To trade BTC and cryptocurrencies as safely as possible, you may want to adhere to the following strategies while trading.

Buy Bitcoin with a regulated Broker

When you are looking for how to buy Bitcoin in Hong Kong, you should look to invest with a regulated and global brokerage. Such a brokerage must follow the financial bodies’ guidelines and regulations, thus adhering to a higher standard of safety and measure to protect investors’ funds.

Invest a Limited Amount

New investors may want to begin trading Bitcoin with a limited amount when they are just getting started. Although the price of 1 BTC starts at more than $30,000, users can start trading with just $5 to $10.

With fractional sharing, investors can own a part of BTC and other cryptocurrencies instead of purchasing a whole token.

Furthermore, other platforms also allow fractional sharing, which is very convenient for users with a tight budget.

Use a Bitcoin Wallet

Another concern of users trading BTC is that their assets are being held in an online wallet, which is run by a central party. For example, when you trade directly with a central entity, your assets are stored online and can be prone to online hacking.

However, a Bitcoin wallet is a cold wallet – meaning that it stores your assets offline. In the case of an online hacking or phishing episode, your assets are safe since they can only be accessed with a private key that belongs to you.

How to Sell Bitcoin

If you have managed to make a profit on your BTC holdings and wish to sell your Bitcoin, the process could not be more straightforward.

Simply click on the “Portfolio” section on your homepage. Once you can see all your assets, click on your BTC holdings.

This will redirect you to a page that displays all your BTC holdings. If you want to close a trade, click on the red cross sign on the right-hand sign of your page. A pop-up will appear that shows the amount you invested and the profit/loss you have made on the trade.

Click on “Confirm Trade” at the bottom of your screen to close your BTC trade.

Conclusion

This guide has provided users with an in-depth analysis of how to buy bitcoin in Hong Kong. By providing the benefits of holding this asset and a review of the current price of the coin, you have enough information to make a well-informed decision on your investment strategy.

Should you choose to buy bitcoin in Hong Kong, Crypto.com is one of the best platforms. Boasting a simple-to-use interface and a low-commission trading set-up, you can buy bitcoin in Hong Kong easily.