Bitcoin has proved itself as one of the best investments in recent decades, massively outperforming traditional stock markets and generating healthy returns for early investors. This has been the case for the crypto markets more broadly, with coins like Ethereum and Doge also rising thousands of percent in relatively short periods. The best news is that currently, the crypto markets are in a bearish state, with Bitcoin down over 55% from its all-time high. Therefore, now could be a great time to open a BTC position.

If readers want to learn more about how to buy Bitcoin in Greece, then read on for our full beginner guide. We will cover how to buy Bitcoin in Greece, where to buy Bitcoin in Greece, Bitcoin’s current price and future predictions, and much more. Let’s start by taking a look at how readers can set up an account and buy Bitcoin instantly.

How to Buy Bitcoin Greece – Quick Guide

Below is a four-step guide that readers can use to quickly and easily set up an account and buy Bitcoin in Greece:

- Step 1: Open an account with a broker – Visit the website of the company you choose and sign up using an email and password. After this step, you should have successfully created an account.

- Step 2: Deposit funds – The next step is to deposit funds. Users must pass a KYC verification in order to be able to deposit funds with regulated brokers. Once the verification is complete, you can deposit using a number of payment methods including credit and debit cards, bank transfers, PayPal, and Skrill, depending on the platform.

- Step 3: Search for Bitcoin – Use the site’s search bar to search for Bitcoin. Once found, click on the buttons to buy or trade.

- Step 4: Buy – Fill out the required information and choose how much you want to invest. Eecute the transaction and a BTC position will be added to your account.

Where to Buy Bitcoin in Greece

With Bitcoin being the most popular coin on the crypto market, there is a high level of demand for it. Therefore, most brokers offer Bitcoin as part of their service. Whilst this is good, it also means that there are a lot of choices, with each broker offering unique fee structures and tools to enhance the user experience. To save readers the time and hassle of research, this article has compiled a list of the best brokers to buy Bitcoin in Greece. Brokers have been selected based on fees, ease of use, and security.

1. Crypto.com – Popular Cryptocurrency Exchange with a Wide Range of Features

Crypto.com is also a great place to buy Bitcoin in Greece with. Having a selection of over 250 altcoins, it is one of the most popular crypto brokerages in the world, with over 50 million users. It charges commissions of 2.99%.

A great point to consider regarding Crypto.com is that the platform has an NFT integration which was recently added to the site. NFTs have exploded in value over the last 18 months and have proved a very profitable investment. Therefore, trading with Crypto.com could give investors access to some of the best NFTs on the market.

Crypto.com also offers crypto staking which is where users ‘lock away’ their crypto for extended periods of time and earn interest of up to 15% in return. The current Bitcoin interest rate on Crypto.com is around 6%, which is higher than the dividends paid on some of the world’s largest indexes. Therefore, staking crypto with Crypto.com could be a great way to add some passive income to a portfolio.

Users can also earn cashback on their crypto by using a physical crypto.com card. It works in selected retailers and allows users the ability to be paid cashback of up to 8% on their purchases. The best part is that this cashback is paid directly back to users’ portfolios in the form of crypto!

| Deposit fee | Free |

| Commission | 2.99% |

| Fee to buy $100 BTC | $2.99 |

Pros:

- Cashback opportunity

- 250+ cryptos and altcoins

- Free deposits

- Crypto staking

- NFT integration

Cons:

- Not good for technical analysis

- 99% trading commissions

Cryptoassets are a highly volatile unregulated investment product.

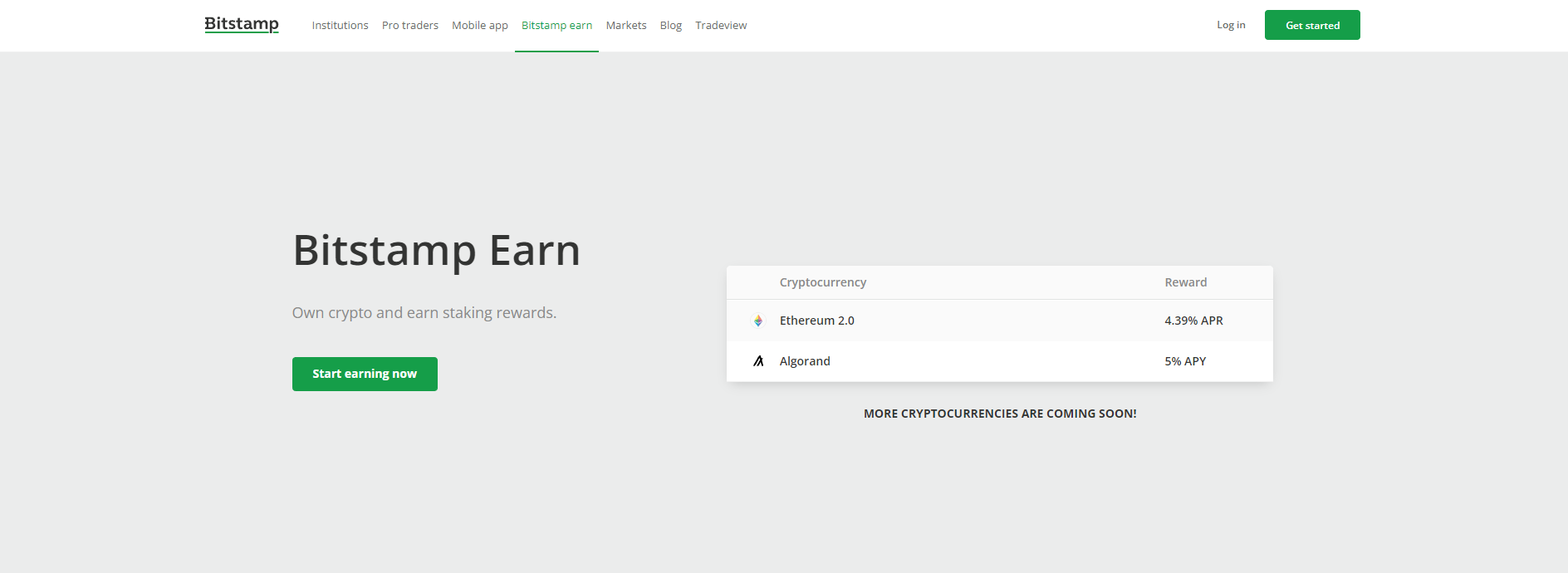

2. Bitstamp

Bitstamp gives users access to 45 cryptos, including two stakeable cryptos – Ethereum and Algorand. Users can earn interest of 4.5% and 5% respectively on these coins. However, users should note that Bitstamp does lack some of the big coins, for example, Solana and Polkadot.

Regarding fees, Bitstamp is a great option. It calculated its fees based on users’ monthly trade volumes. Investors who trade under $10,000 a month can expect to pay commissions of under 0.5% per trade. The good thing about this is when this volume goes up, the fees drop. If users are planning on trading large volumes, then Bitstamp could be a great cost-effective option!

Bitstamp has a high level of security. However, things haven’t always gone smoothly for Bitstamp in this respect. For example, in 2015 the broker suffered a huge cyber hack, which resulted in over $5 million Bitcoin being stolen. Users can rest assured that the developers completely rebuilt the Bitstamp wallet and platform after this attack, and no attacks have occurred since.

| Deposit fee | 0.1% |

| Commission | 0.5% under $10,000 volume |

| Fee to buy $100 BTC | $0.5 |

Pros:

- 45 cryptos

- Easy to use

- Low commission

- Great mobile app

- Advanced tools available

Cons:

- Hacked in 2015

- Solana and Polkadot coins not supported

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase

However, a downfall of Coinbase is that it charges pretty hefty fees. The fees do vary based on transaction volume, but users can expect to pay around 5% in commission if they are trading transactions of $50 or less. Lower transactions of under $10 will pay an even higher fee of 10% commission. In addition to this, there is a market maker fee of 0.5% on either side of each trade which users should be aware of. When depositing with a credit or debit card users will also be charged a 3.99% commission. Therefore, Coinbase is one of the more expensive brokers out there to trade with.

That being said, there are some good perks to the platform. For example, when users sign up, they can earn $5 free Bitcoin. This figure can be upped to $20 if users follow the Coinbase Earn program, where they can follow a series of educational videos to earn crypto. There is also a very low minimum transaction fee of just $2.

The platform is also well regulated, being insured by the FCA in the UK for individual figures of up to £85,000, and the FDIC in the US, for individual figures up to $250k.

| Deposit fee | 3.99% |

| Commission | 5% over $50 |

| Fee to buy $100 BTC | $5 |

Pros:

- FCA/FDIC insured

- 70 million users worldwide

- $2 minimum trade size

- Highly rated mobile app

- $5 Bitcoin earned when opening account

Cons:

- 99% credit card deposit charge

- 5% commission under $50

Cryptoassets are a highly volatile unregulated investment product.

4. Binance

Binance is a very secure platform. It offers a number of security protocols including two-factor authentication, private keys, and human verification to enter accounts. There are also more deeply embedded blockchain security measures in wallets. Users can therefore rest assured that their funds will be safe when trading with Binance.

Binance is in the middle ground when it comes to fees. It charges 0.5% commission on all trades which is great. However, it also charges a hefty 4.5% deposit fee when users deposit with a debit or credit card. This is much more expensive than some of the other brokers on our list!

Binance also has an NFT integration. All users need to do to access this is buy BNB coins for their wallets to use to buy NFTs from the Binance website.

| Deposit fee | 4.5% |

| Commission | 0.5% |

| Fee to buy $100 BTC | $0.5 |

Pros:

- 5% commission

- 500+ crypto pairs

- High security

- NFT integration

- Beginner and advanced options

Cons:

- Not available worldwide

- 5% credit card fee

Cryptoassets are a highly volatile unregulated investment product.

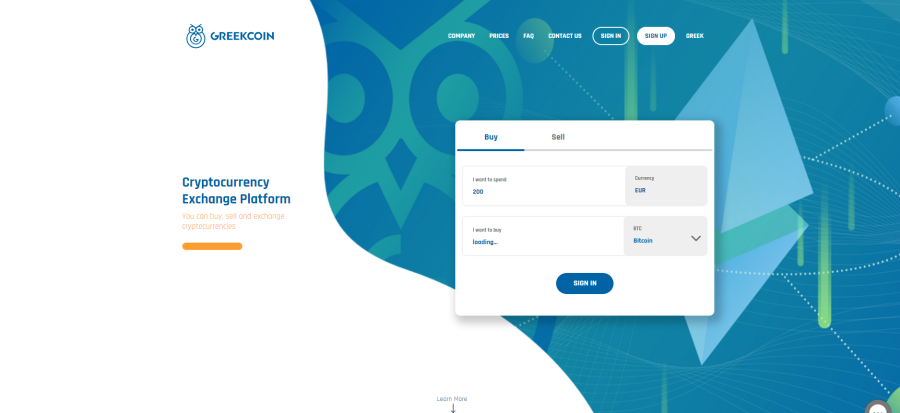

5. Greekcoin

Greekcoin is one of the best places to invest in Bitcoin in Greece. All users need to do is create an account, link their bank accounts, and Trade crypto. The platform has been running for over 3 years and has generated over 500 customers. They have also processed over 1 million euros in crypto transactions.

The platform itself gives users access to 13 cryptocurrencies, which isn’t tonnes but is a good start for most beginners. The commission charged per transaction is 2.45% for all of these coins. It is therefore arguably an expensive broker to trade with. There are also withdrawal and deposit costs. These vary per coin. For example, Bitcoin charges are 0.0005 BTC to deposit and 0.0003 BTC to withdraw.

There is a good level of customer service on Greekcoin, with a designated email and phone number should investors ever run into any trouble with their accounts. The platform is also EU-regulated.

| Deposit fee | Varies based on coin |

| Commission | 2.45% |

| Fee to buy $100 BTC | $2.45 |

Pros:

- 13 coins

- Over 500 customers

- Easy to use

- 1 million + euros of transactions

- EU regulated

Cons:

- Not available worldwide

- 45% commission

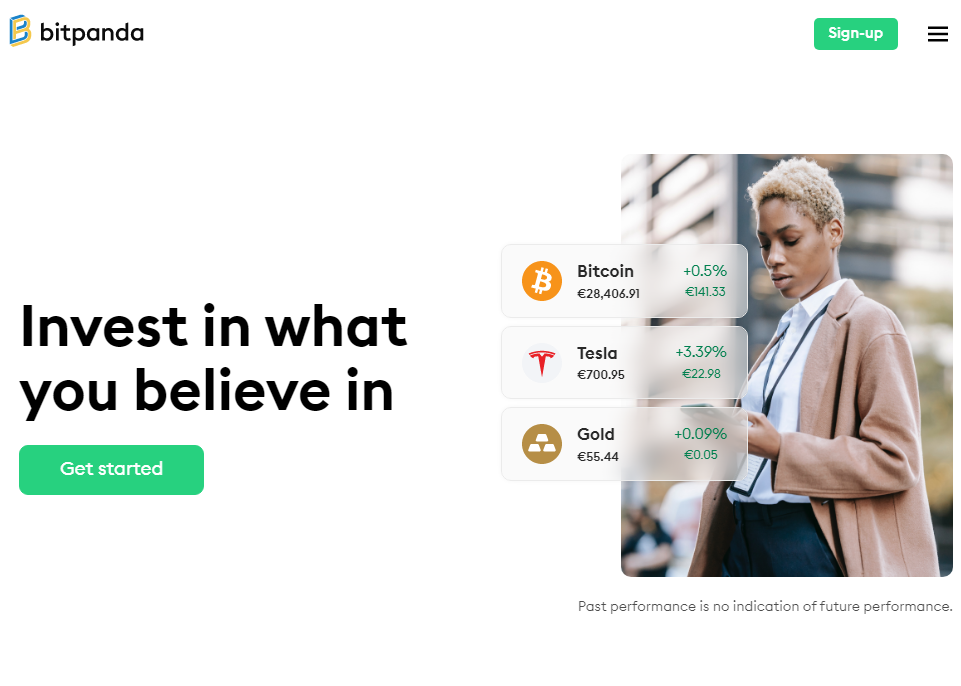

6. Bitpanda

Bitpanda is an excellent broker for EU investors of all levels. It makes it very easy for beginner investors to access markets and build diversified portfolios. A key way that Bitpanda does this is by giving users access to a crypto index fund. This allows investors to buy into funds with top 5, 10, or 25 coins based on market cap. These can be great for diversifying assets. Users can also trade stocks and commodities on Bitpanda, which is a great point to consider.

Commission fees come in at 1.49% for the basic platform. Bitpanda pro offers much lower fees of 0.1% per trade. There is a 1-euro minimum account, which is a great point to consider. There is also a low deposit fee of 0.95%.

One point to note that could be improved is that there is no crypto staking option on Bitpanda. If users want to stake crypto then Crypto.com could be a better option.

| Deposit fee | 0.95% |

| Commission | 1.49% |

| Fee to buy $100 BTC | $1.49 |

Pros:

- Low commission

- Low deposit

- Crypto Index fund options

- Great for beginners

Cons:

- No staking available

Should I Buy Bitcoin?

Buying Bitcoin in Greece can be a great way of making some extra cash. However, due to the volatile nature of the crypto industry, it can also lead to losses if correct safety protocols aren’t followed.

When trading crypto, there are usually two methodologies that investors take. These are long- or short-term positions. Due to the volatility of the crypto space investors can trade intraday movements hoping to profit from small price swings. These can compile into big profits over the long run. Conversely, investors can choose to take long positions. This entails picking precise entry points and then holding onto a position for an extended period of time. With markets currently in a bearish state, this could be a great way to invest in Bitcoin at its current price.

Benefits of Buying Bitcoin

Before any crypto (and stock) investment, users should aim to build a picture of what they want from their position. A key part of this is thoroughly researching the space, in order to determine the best time to enter the market. To save readers the hassle of researching, we have compiled a list of some of the benefits that opening a bitcoin position could hold for investors.

Decentralized asset

Bitcoin is a decentralized asset. This means that there is no central place where all payments and information is stored. Rather, everything goes through the blockchain, which makes payments quicker and more secure. It also makes them much more traceable meaning that payment fraud is actually a reduced risk. As the world comes to adopt this decentralized framework, the price of Bitcoin and other related coins will likely rise.

Staking ability

As mentioned above, Bitcoin can be staked using tools from some brokers. This entails locking away a position, during which time a broker will put the coin to work to validate other transactions on the blockchain. The reward for doing this is interest. Bitcoin staking tends to offer around 6% interest, but other coins can reach upwards of 15% APY interest.

Bear market opportunity

The current price of BTC is down over 55% from its all-time high of $64,000. Whilst this sounds like a bad thing, it could provide a great entry point for a portfolio position. When the next bull run occurs, the price of Bitcoin could surpass the $100,000 level, as predicted by some analysts. Therefore at the current price of around $30,000, now could be a good entry position for long-term growth.

High liquidity

Due to BTC being so popular, it is a highly liquid asset. This means that it can be easily bought and sold quickly on most exchanges. In addition to this, due to its popularity level, the coin is available on pretty much every single broker who offers cryptos.

Market proxy

A final great point about Bitcoin is that it is often a lot less volatile than some of the other cryptos in the market. This is because of its market cap and size largely outweigh the size of other cryptos in the space. Rather than being volatile, Bitcoin tends to act as a market proxy: when it rises, altcoins rise and vice versa. It could therefore be a great anchor for any crypto-based portfolio.

Ways of Buying Bitcoin

Most brokers offer users different payment methods for depositing cryptos. Let’s take a look at two of these: PayPal and credit/debit card:

Buying bitcoin with PayPal

One way that users can buy Bitcoin in Greece is with PayPal. PayPal is a very cheap way of buying Bitcoin in Greece as it often bypasses the expensive fees charged by brokers for credit cards. All users need to do is link their PayPal account to their broker and they can use it to deposit funds directly from their connected bank account.

Buy bitcoin with a credit card or debit card

If users don’t want the hassle of setting up a PayPal account, they can use the traditional method of using their credit or debit card. This step is no different from using a credit or debit card at a retailer, simply navigate to the deposit section and enter the card details to complete a deposit. Users should note that as mentioned, this method often incurs costs from brokers.

Bitcoin Price

The current price of Bitcoin is $28,557. This is down 8.9% in the last 5 days, and over 40% year to date. Broadening this time horizon to 12 months, the coin has returned a negative 23%. This fall has come after equity markets have tumbled due to rising inflation and interest rates. High-growth stocks are taking a hit as investors seek safer assets. This phenomenon seems to have carried over to the cryptocurrency space and investors are selling out of their positions. This is bad news for long-term holders of crypto, but also marks a good entry point for new investors.

[crypto_chart id=835]Bitcoin Price Prediction

It is very hard to predict the price of such a volatile asset as Bitcoin. There are many analysts who believe that the price of Bitcoin is going to reach the $100,000 mark in the next few years. However, there are speculators who believe that the price of BTC could fall below $20,000 and that it is still fundamentally overvalued.

The biggest determinant of the price for BTC will be how the decentralized framework is adopted by firms and other institutions over the coming years. Things already seem to be moving in the right direction in this respect, with Web 3 and the Metaverse making big strides forward in both technology and popularity. There is no real way of predicting where the price of BTC will go in the future, so the best thing to do is come up with a trading strategy (either long or short) and consistently execute it to generate returns.

How to Buy Bitcoin Safely

Bitcoin and the crypto industry more widely remain pretty unregulated. Although payments are secure, users should consider the fact that there are many scam brokers out there. For this reason, users should only deposit money with brokers who are regulated – like the ones in our list above.

In addition to this, users should employ tools like stop losses and take profit when trading crypto due to its volatility. This is because the markets are open 24/7 so prices can easily fluctuate overnight if positions are left open. Users should also be careful using tools like leverage when trading highly volatile assets like Bitcoin.

How to Buy Bitcoin in Greece – Tutorial

Now we have covered all of the necessary information regarding brokers and Bitcoins price, let’s take a step-by-step look at how readers can buy Bitcoin in Greece with a broker account.

Step 1: Open an account

Visit the website for the broker you choose by following one of the links in the article. Then follow the onscreen instructions to set up an account. This will basic personal and security information.

Step 2: Verify the account

Users need to verify themselves before they deposit funds. To do this, most sites will need two forms of government ID, which will usually ber verified within minutes.

Step 3: Deposit funds

Once verified, users can deposit funds using whichever funding options your chosen broker is set up to accept.

Step 4: Buy Bitcoin

Use the search bar to find Bitcoin. You will have a range of options for choosing how much you’re going to invest. Complete the on-screen steps to buy the coins you want.

How to Sell Bitcoin

When users want to sell out of their BTC positions, they should follow the simply 2 step guide below:

Step 1: Navigate to your portfolio

Users should navigate to the portfolio section of their brokerage account, which will show all open positions.

Step 2: Sell Bitcoin position

Click on the option to sell or close a position next to your Bitcoin holding and follow any prompts that you see.

Conclusion

As mentioned, now could be a great time to buy Bitcoin in Greece. If users do want to open a BTC position, we recommend doing so with one of our partnered brokers.