It takes just five minutes from start to finish to buy Bitcoin in Germany from an online broker. Many platforms now accept debit/credit cards and even Paypal too – alongside small minimum deposits and low fees.

In this guide, we explain how to buy Bitcoin in Germany from a regulated provider. We also explore the potential upside and drawbacks of buying Bitcoin today, alongside an analysis of what the future holds for this digital currency.

How to Buy Bitcoin in Germany – Quick Guide

To buy Bitcoin in Germany right now – the steps below explain how to complete the process at Crypto.com.

This crypto exchange offers competitive trading fees and support for a wide variety of payment methods – including Visa and MasterCard.

- ✅ Step 1: Download Crypto.com App

Unlike other exchanges where you can open an account online, with Crypto.com you have to download the mobile app first. - Step 2: Create an Account

Enter your email and password and wait for Crypto.com to send you back a verification email. Follow the prompts. - Step 3: Deposit Funds

You can deposit with a card or bank transfers. - Step 4: Buy Bitcoin

Search for Bitcoin (BTC) in the search tab and select “Buy BTC”. Enter the amount you wish to buy.

Cryptoassets are a highly volatile unregulated investment product.

Electing to buy Bitcoin in Germany is a smart move in terms of safety, cost-effectiveness, and simplicity.

For a more detailed explanation of how to invest in Bitcoin in Germany – a comprehensive walkthrough can be found later on in this guide.

Where to Buy Bitcoin in Germany

We found that the best place to buy Bitcoin in Germany is through a regulated online broker or exchange. Be sure to explore what fees the platform charges before opening an account – alongside the payment types that it supports.

Ideally, investors will want to choose a platform that supports an everyday deposit method like a debit or credit card.

To help decide where to buy Bitcoin in Germany today, consider one of the pre-vetted platforms discussed below.

1. Crypto.com – Popular Crypto Exchange to Buy Bitcoin and Earn 6% Interest

Payment methods are inclusive of debit/credit cards and SEPA. Regarding the former, Crypto.com charges a deposit fee of 2.99% when using Visa or MasterCard. For those that do not wish to pay any deposit fees, SEPA transfers are free. However, do note that it can take 2-5 days for Crypto.com to credit the account.

Nonetheless, once the account is funded, it is then possible to buy Bitcoin in Germany at a commission of just 0.40%. This means that by purchasing 2,000 euros worth of Bitcoin, a fee of just 8 euros would apply. Traders that find themselves investing large volumes into Bitcoin and other cryptocurrencies will be offered a lower commission via a maker-taker system.

Crypto.com is also one of the best places to buy Bitcoin in Germany as the platform offers interest accounts. There are three Bitcoin accounts to choose from – flexible, 1-month, and 3-month. This dictates how long the tokens need to be locked away before a withdrawal can be made. The 3-month account offers the highest APY.

If staking CRO tokens – which is native to the Crypto.com exchange, the APY on Bitcoin is 6%. In addition to Bitcoin, Crypto.com offers over 250 altcoins. Many of these altcoins can also be deposited into a Crypto.com savings account for the purpose of earning interest.

Crypto.com also offers secured loans with an LTV of up to 50%. This means that by depositing 2,000 euros worth of Bitcoin as collateral, 1,000 euros worth of credit can be accessed. This is a great way for investors to raise funds without being forced to cash out their cryptocurrency holdings.

Another top-rated feature offered by Crypto.com is its DeFi wallet. This is actually a non-custodial wallet, which means that users must take full responsibility for their crypto funds. This also means that private keys will only be accessible by the user. The Crypto.com DeFi wallet is available to download for free as an iOS or Android app.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 250+ | 0.4% standard commission | 2.99% | $20 |

Cryptoassets are a highly volatile unregulated investment product.

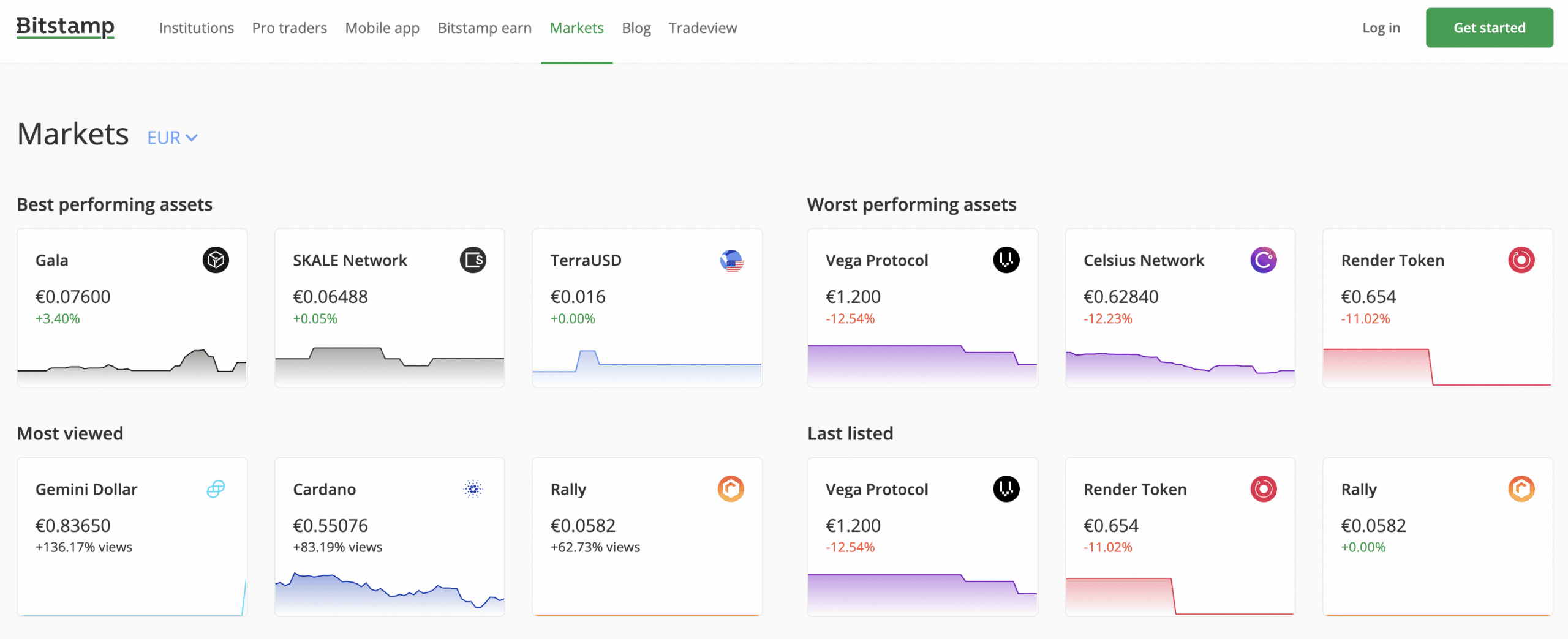

2. Bitstamp – Solid Bitcoin Exchange That Supports Free SEPA Payments

Bitstamp is an established Bitcoin exchange that has a great reputation in this space. The platform is particularly useful for those that wish to buy BTC in Germany via a SEPA transfer. This is because Bitstamp does not charge any fees on SEPA payments and the funds will be credited within 1-2 working days.

On the other hand, those that want to buy Bitcoin in Germany instantly might instead consider using a debit or credit card issued by Visa, MasterCard, or Maestro. Unfortunately, Bitstamp is expensive in this department, with the exchange charging 5% of the transaction amount.

This means that for every 100 euros deposited with a debit or credit card – a fee of 5 euros will be taken. In terms of trading commissions, Bitstamp utilizes a maker-taker pricing structure.

The most that traders will pay to buy and sell Bitcoin is 0.50% per slide. This is reduced to 0.25% per slide when trading volumes of over $10,000 are met within a 30-day period. The absolutely lowest commission possible at Bitstamp is 0%, albeit, this requires a minimum 30-day volume of over $2 million.

Unless buying Bitcoin instantly with a debit/credit card, we should note that the main Bitstamp trading platform might appear somewhat complex for beginners. The charting area is packed with information surrounding trends, volume, volatility, pricing, and order books. There is also the option to deploy technical indicators and chart drawing tools.

The Bitstamp mobile app is available on both iOS and Android devices and this connects to the main platform. Full functionality is offered on the app, which means that traders can buy and sell Bitcoin on the move. When it comes to security, Bitstamp keeps 98% of all client digital assets in cold storage wallets.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 155 markets | Up to 0.5% | 5% | Not stated |

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Simple Bitcoin Broker For First-Time Investors

Debit and credit card payments are processed instantly after an account has been verified, but this will cost 3.99% in transaction fees. Other supported deposit methods include Ideal, Sofort, Apple Pay, and Paypal. Trading commissions are also expensive here, with Coinbase charging a fee of 1.49% per slide.

There are no fees to maintain an account nor store Bitcoin in the Coinbase wallet. While we are on the subject of storage, Coinbase offers a custodial web and mobile wallet – both of which are connected. 98% of funds held in the custodial wallet are kept in cold storage and all account holders will need to set up two-factor authentication to access their tokens.

Those wishing to retain full control over their Bitcoin and private keys might prefer the decentralized wallet app offered by Coinbase. This is separate from the main Coinbase website. Nonetheless, Coinbase is superb for beginners that wish to learn about Bitcoin and cryptocurrencies in general – as it offers multiple guides and mini-courses.

This includes the ability to earn free crypto when progressing through each chapter of the Coinbase educational suite. This popular platform is used by nearly 100 million clients around the world – which makes it one of the most popular exchanges globally. Coinbase has since gone public too – with its stocks listed on the NASDAQ exchange.

We like that Coinbase takes regulation and security seriously, and all new customers are required to go through a verification process before having access to fiat deposits and withdrawals. Coinbase has since launched a loan facility too – which allows Bitcoin investors to raise capital on the back of their holdings.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 150+ | 1.49% | 3.99% | $50 is recommended |

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Buy and Sell Bitcoin at 0.10% Commission

There is also the option of depositing funds via a SEPA transfer. In total, Binance offers more than 600 cryptocurrencies of various market capitalizations. This translates into over 1,000 tradable markets. There is also the option of trading Bitcoin via futures and options. For those with a higher appetite for risk, leveraged Bitcoin markets are supported too.

Binance also offers an NFT marketplace alongside DeFi tools such as yield farming, interest accounts, and staking. There are some highly competitive APYs up for grabs, albeit, this will depend on the respective token that is being invested. We also like Binance for its advanced trading suite.

This gives Germans the ability to perform high-level technical analysis with economic indicators, drawing tools, and customizable charts. For beginners, there is a standard client interface that supports simple Bitcoin buy and sell orders. The Binance app for iOS and Android will appeal to those that wish to trade Bitcoin and other cryptocurrencies on their smartphone.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 600+ | Up to 0.10% | 1.8% | $15 on debit/credit card payments |

Cryptoassets are a highly volatile unregulated investment product.

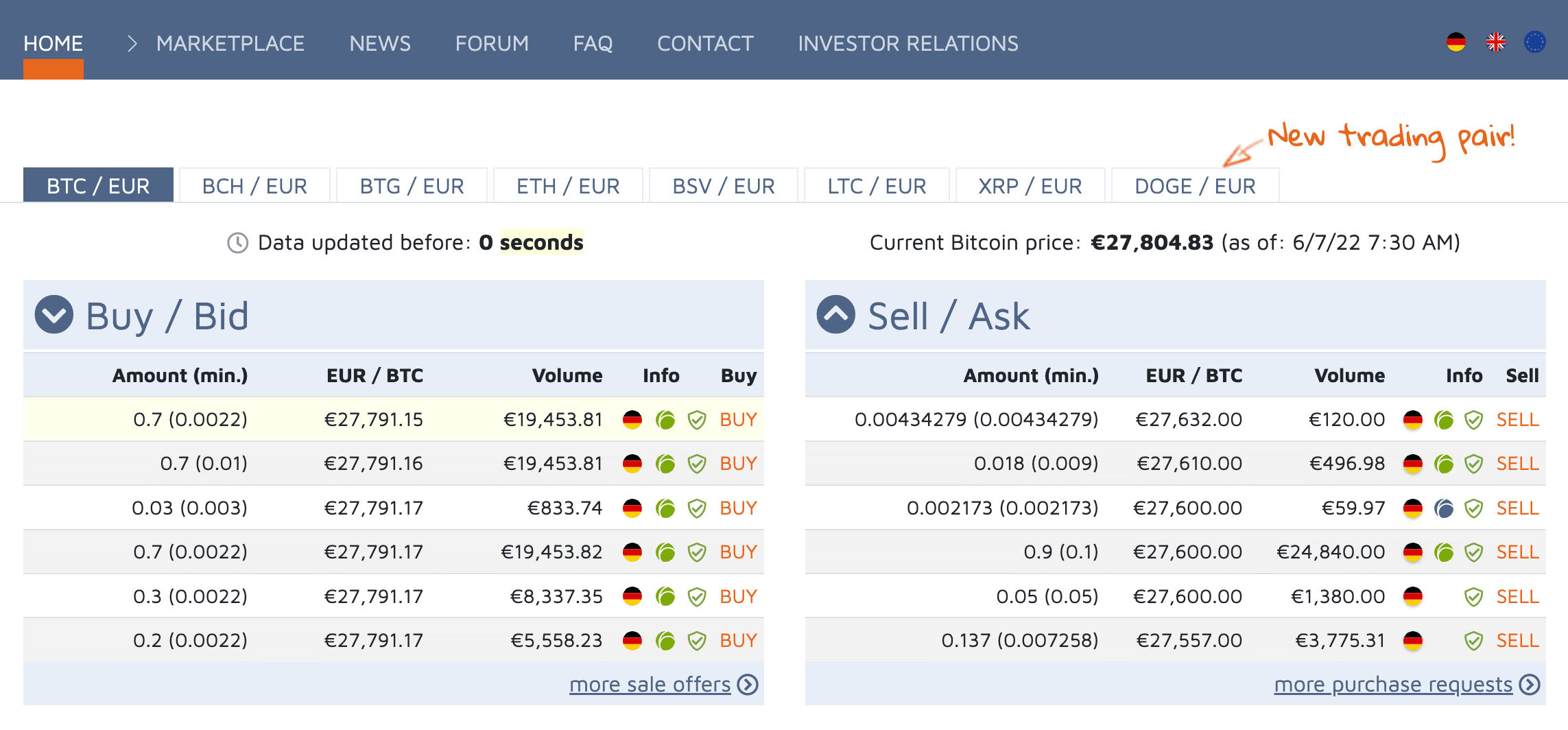

5. Bitcoin.de – German Marketplace to Buy Bitcoin Online

Bitcoin.de is a Germany-based marketplace that allows users to buy Bitcoin with euros. The platform only supports seven other digital currencies – Bitcoin Cash, Bitcoin Gold, Ethereum, Bitcoin SV, Litecoin, XRP, and Dogecoin.

As such, Bitcoin.de likely won’t suit investors that are looking to build a higher diversified portfolio of digital assets. Nonetheless, it is important to note that as a P2P marketplace, investors will not be purchasing cryptocurrency directly from Bitcoin.de. On the contrary, the platform sits between buyers and sellers.

This means that both prices and supported payment methods are dictated by the seller – so buyers will need to find a suitable deal. Some of the payment methods supported by Bitcoin.de include SEPA and Fidor Bank transfers. Bitcoin.de also offers a news portal alongside a forum that allows users to interact with one another.

The Bitcoin.de platform itself is very basic and somewhat outdated. With that said, the platform is now used by over 1 million customers across Europe. Once a purchase is complete on the Bitcoin.de website, users are advised to withdraw their tokens to a private wallet. This is because Bitcoin.de only offers a custodial web wallet – which comes with limited security.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 8 | Depends on the seller | Not supported | Depends on the seller |

6. Bit2Me – But Bitcoin From Just 1 Euro

Those looking to buy Bitcoin in Germany with a very small amount of money might want to check out the Bit2Me platform. This cryptocurrency exchange supports a minimum deposit of just 1 euro when using a debit or credit card.

Furthermore, the minimum amount of Bitcoin that can be bought and sold on the exchange is just 10 cents. As such, Bit2Me supports budgets of all shapes and sizes. When it comes to fees, Bit2Me charges just under 2% on debit/credit card transactions. SEPA deposits are free and come with no account limits.

Trading fees amount to 0.95% – which is charged on both buy and sell orders. Bit2Me also offers a trading app for iOS and Android that doubles up as a Bitcoin wallet. The Bit2Me Academy might appeal to those that are looking to buy Bitcoin in Germany for the first time and need some guidance on how things work.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 130+ | 0.95% standard commission | 1.99% | 1 euro |

Should I Buy Bitcoin?

Choosing the best place to buy Bitcoin in Germany is only half the job. Next, investors will need to research Bitcoin from top to bottom to ensure that this digital asset aligns with their financial goals and tolerance for risk.

In a nutshell, Bitcoin has increased in value by millions of percentage points since it was launched in 2009. Back then, the price of a single Bitcoin amounted to a tiny fraction of one cent. In fact, it wasn’t until 2013 that Bitcoin surpassed $1,000.

Over the years, Bitcoin has demonstrated that it is a highly volatile and speculative asset class. With that said, long-term investors that have been able to look beyond wild pricing swings have ultimately done very well from Bitcoin.

- For instance, let’s suppose that 1 Bitcoin was purchased in early 2020 at $10,000.

- Not long after, Bitcoin declined by around 50% to hit lows of $5,000.

- An inexperienced cryptocurrency investor likely would have panicked and perhaps sold their Bitcoin at a loss.

- However, those holding on would have no doubt made significant returns – as Bitcoin surpassed a value of $60,000 the following year.

Crucially, first-time Bitcoin investors need to understand that digital currencies do not operate in the same way as blue-chip stocks like Johnson & Johnson or Lockheed Martin.

On the contrary, the value of Bitcoin can go up or down by a double-digit percentage in a single day of trading.

Therefore, the best way to approach Bitcoin is with sensible stakes and an understanding that the value of the investment will move in a volatile manner.

Benefits of Buying Bitcoin in Germany

Bitcoin is now one of the most traded assets globally. The cryptocurrency has generated some phenomenal gains since launching 13 years ago, however, this isn’t to say that Bitcoin is right for all investor profiles.

To help make an informed decision, below we discuss some of the core benefits to consider before electing to buy Bitcoin in Germany today.

5-Year Returns of Over 1,000%

Let’s start with the price performance of Bitcoin. In a nutshell, those that invested in Bitcoin five years prior to writing would have paid in the region of $2,600 per token. This means that today, the same Bitcoin token would be worth an additional 1,000%.

These returns are significant, especially considering that Bitcoin has since dropped by over 50% as per its all-time high of $69,000. Nonetheless, Bitcoin has generated returns that outperform traditional assets by some distance.

- For example, over the same period, the DAX 40 – which is the primary stock market index that tracks leading German companies, has increased by just 20%.

- The S&P 500 in the US has performed better than the DAX 40 during a 5-year period, albeit, gains amount to just 70%.

As a result, those opting to buy Bitcoin in Germany five years ago as opposed to traditional stock index funds are now looking at much higher financial gains.

Buy the Market Correction

As noted above, the all-time high of Bitcoin stands at just under $69,000. This feat was achieved in late 2021. Since then, Bitcoin has declined by more than 50%.

This is great news for first-time investors, as it allows people to buy Bitcoin in Germany at a significant discount.

Fixed Supply

Unlike fiat currency, Bitcoin has a fixed and predictable supply. In the year 2140, Bitcoin will reach a maximum supply of 21 million tokens. After this, no more Bitcoin will be entered into circulation.

This supply is determined by the underlying blockchain which cannot be changed or manipulated. Instead, a new allocation of Bitcoin enters the market at 10-month intervals.

In comparison, the supply of euros continues to increase as per policies implemented by the European Central Bank. In turn, this devalues the euro and ultimately – contributes to inflation.

No Single Authority Controls Bitcoin

Bitcoin and its underlying blockchain protocol are decentralized technologies. Therefore, the network is not controlled by any single person or authority. Nor is it backed by a central bank or government.

Instead, Bitcoin transactions are confirmed by a group of miners. Anyone can become a miner by purchasing specialist hardware and plugging it into a device.

Nonetheless, the decentralized nature of Bitcoin ensures that investors retain 100% control over their tokens. This means that as long as the tokens are kept in a non-custodial wallet, nobody other than the investor can access the funds.

Bitcoin Interest Accounts

In a similar nature to fiat money like the euro or US dollar, Bitcoin allows investors to generate interest on their tokens. This can be achieved by depositing the funds into a third-party platform like Crypto.com or Aqru.

The platform will then lend the Bitcoin tokens to those that wish to borrow funds. In turn, the borrower will pay the owner of the Bitcoin a competitive APY. At Crypto.com, for example, investors can earn an APY of up to 6% on Bitcoin deposits.

Global Transactions

Bitcoin was originally created as an alternative to conventional global payments systems. Tokens can be transferred from one Bitcoin wallet to another in just 10 minutes.

This is irrespective of where the transacting parties are located. Moreover, Bitcoin network fees are typically much lower when compared to what banks and financial institutions charge for international transactions.

Risks of Buying Bitcoin in Germany

Investors should also consider the risks before electing to buy Bitcoin in Germany.

This includes the following:

Wide Pricing Swings

Experienced cryptocurrency investors know first-hand just how volatile Bitcoin can be.

As we briefly mentioned earlier, the digital currency went from $10,000 down to $5,000 in the space of just a few weeks in early 2020. Then, in late 2021, Bitcoin went from all-time highs of $69,000 down to less than $30,000 just a couple of months later.

Investors that do not feel comfortable with such high volatility levels might want to avoid Bitcoin. After all, it can be stressful to see the value of a portfolio decline by a double-digit percentage in a short amount of time.

Regulatory Risks

Both the European Union and the US government continue to ponder over how cryptocurrencies, in general, should be regulated moving forward.

While regulation isn’t necessarily a bad thing, uncertainty over how this sector will be overseen in the future is in itself a risk to consider.

Opportunity Risk

Bitcoin is just one of many thousands of cryptocurrencies. While Bitcoin is the de-factor digital asset in terms of valuation, market capitalization, and mass awareness, other tokens in this marketplace generated much better returns in recent years.

- For example, Dogecoin saw gains of over 10,000% in the first half of 2021.

- Shiba Inu has since returned millions of percentage points for early investors since it was launched in 2020.

- BNB has gained in value by more than 6,000% over the prior five years.

While Bitcoin offers lower levels of volatility than many of its altcoin peers, there might be better investment opportunities elsewhere.

Ways of Buying Bitcoin in Germany

The best ways to buy Bitcoin in Germany online are explored in the sections below:

Buy Bitcoin With Credit Card or Debit Card

The easiest and most common way to buy Bitcoin in Germany is with a Visa or MasterCard. Apart from Bitcoin.de, all of the crypto exchanges that we have discussed on this page support debit and credit card payments.

However, as our reviews covered in great detail, fees on debit/credit card deposits can and will vary significantly depending on the platform.

For example, Bitstamp and Coinbase charge 5% and 3.99% respectively.

Buy Bitcoin With PayPal

From the platforms that we discussed today, PayPal is supported by Coinbase. While both of these platforms allow investors to buy Bitcoin with PayPal, the fee structure could not be further apart.

Coinbase charges 3.99% on PayPal deposits.

Buy Bitcoin With SEPA

For those seeking a low-cost way to buy Bitcoin in Germany, perhaps consider a platform that supports SEPA. At Crypto.com, for example, Germans can deposit funds with SEPA on a fee-free basis.

The only drawback with SEPA is that it can take several working days for the Bitcoin broker or exchange to credit the funds.

Bitcoin Price

The Bitcoin price is both volatile and speculative, as this guide has discussed in great detail. Unlike stocks and ETFs, Bitcoin does not trade on a centralized exchange. This is why the price of Bitcoin can vary slightly from one platform to the next.

Nonetheless, demand and supply is the main driving force behind the value of Bitcoin. When investors are bullish on Bitcoin and the broader economy is strong, this typically results in the digital asset going through an upward pricing swing.

With that said, Bitcoin also performed well in 2020 – when the vast majority of the global economy was struggling as per COVID-19. For instance, Bitcoin went from $5,000 in April 2020 to close the year at $29,000.

Once again, this highlights that Bitcoin is unpredictable. The best way to determine the future price of Bitcoin is to understand the many benefits that this technology offers and which solutions it can solve.

Bitcoin Price Prediction

Since hitting highs of $69,000 towards the end of 2021, Bitcoin has been in a bearish cycle. The digital currency has since hit 52-week lows of $26,000.

Therefore, perhaps the first target for Bitcoin to hit in the medium-term is a return to its prior all-time high. After that, many Bitcoin proponents will hope that the digital currency can hit that all-important $100,000 level.

When or even if this happens, however, remains to be seen. With so many Bitcoin price predictions published on a daily basis, they offer little value to long-term investors.

While one analyst will be bullish on Bitcoin, the next might be bearish. Therefore, it can be difficult to reach a consensus in this highly speculative industry.

Investors should therefore do their own research when trying to evaluate the future price direction of Bitcoin.

How to Buy Bitcoin Safely in Germany

Below we discuss three proven methods that will ensure investors can buy Bitcoin in Germany in a safe and secure manner.

Only Invest Affordable Amounts

Before opening an account with a Bitcoin broker or exchange, investors should consider the amount of money that they can realistically afford to lose on this speculative asset class.

While Bitcoin has performed extremely well since launching in 2009, there is no way to predict what the future will hold. Therefore, investing in Bitcoin safely can only be achieved when sensible stakes are used.

Invest via a Regulated Platform

Another important method that will ensure investors can buy Bitcoin in Germany safely is to ensure that purchases are conducted via a regulated platform. Furthermore, ensure that regulation comes from a reputable financial authority.

Diversify to Mitigate Volatility Risk

In addition to investing sensible amounts via a regulated platform, it is also wise to consider diversifying a Bitcoin portfolio. A great way to achieve this goal is to invest in several different cryptocurrencies.

This will ensure that investors are not overexposed to Bitcoin. Perhaps consider other leading projects such as Ethereum, XRP, and Cardano.

How to Buy Bitcoin in Germany – Tutorial

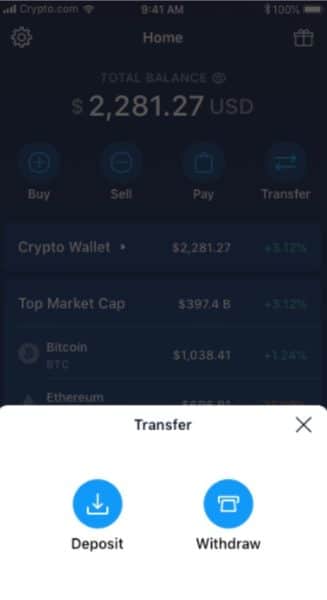

Buying Bitcoin online is simple and safe when using the Crypto.com app. Follow the steps below to buy Bitcoin in Germany right now with a debit/credit card or e-wallet transfer.

Step 1: Download Crypto.com App

To open an account with Crypto.com, you first need to download the mobile app.

Step 2: Create an Account

Once you got the Crypto.com app, provide the necessary information to open an account, including your email. Wait for Crypto.com to send you a verification email before you proceed. Follow the prompts.

Step 3: Deposit Funds

Now it is time to make a deposit. Crypto.com accepts multiple deposit options including bank transfer and a credit card. Select the “Deposit” option under “Transfer”.

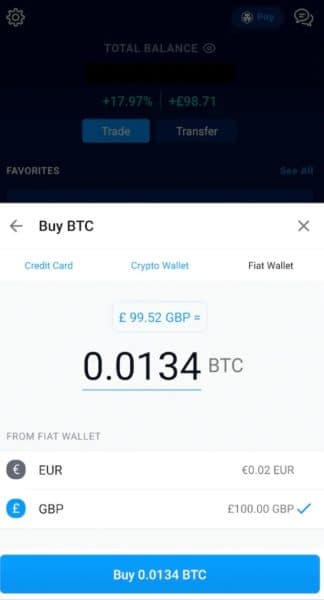

Step 4: Search for Bitcoin and Buy it

Search for Bitcoin (BTC) in the search tab. The final step is to specify the total investment amount into Bitcoin and tab the “Buy” button.

How to Sell Bitcoin in Germany

Crypto.com allows investors to sell Bitcoin as well as buy it. This means that cashing out a Bitcoin investment is very convenient. Users simply need to log into their Crypto.com account and head over to their wallet page.

Then, after confirming that the user wishes to sell their Bitcoin position, Crypto.com will do so at the current market price. The funds will then be added to the user’s withdrawable balance.

Conclusion

This beginner’s guide has explained how simple it is to buy Bitcoin in Germany. Before allocating capital to Bitcoin and other cryptocurrencies, investors are advised to conduct lots of independent research.

Those ready to invest in Bitcoin right now might consider Crypto.com for this purpose. It offers multiple deposit options at low fees.

Cryptoassets are a highly volatile unregulated investment product.