Those looking to gain exposure to Bitcoin can do so with ease. Residents of Denmark simply need to register a trading account with a Bitcoin broker before making a deposit with a debit or credit card. Then, it’s just a case of placing a Bitcoin investment.

In this beginner’s guide, we show how simple it is to buy Bitcoin in Denmark in under five minutes with a regulated cryptocurrency platform.

How to Buy Bitcoin in Denmark – Quick Guide

Those investing in Bitcoin for the first time might be surprised how straightforward the process is when using a beginner-friendly platform.

Learn how to buy Bitcoin in Denmark via most broker websites by following the steps below:

- ✅ Step 1: Open an Account – First, visit the website for the broker you want to use and provide some personal information.

- Step 2: Deposit Funds – Some platforms may not require you to provide ID documents with lower initial deposits Choose your preferred deposit method and enter the required amount.

- Step 3: Search for Bitcoin – Look for the search bar at the top of the screen and begin to type in ‘Bitcoin’.

- Step 4: Buy Bitcoin – Look for the ‘Amount’ box and enter an investment stake of at least the site’s minimum purchase.

A more detailed and comprehensive walkthrough on how to buy Bitcoin in Denmark can be found further down on this page.

Where to Buy Bitcoin in Denmark

Before parting with any investment capital, it is wise to consider where to buy Bitcoin in Denmark.

First-time investors will want to choose a platform that offers a user-friendly interface and low minimum deposits. Competitive fees and access to alternative assets for diversification purposes are also worth looking for.

Below, reviews of the best places to buy Bitcoin in Denmark can be found.

1. Crypto.com – Buy Bitcoin With DKK and Start Earning Interest

Another online exchange that is worth considering when looking for a place to buy Bitcoin in Denmark is Crypto.com. This popular platform allows users to invest in Bitcoin and 250+ other digital currencies instantly with a debit or credit card via its iOS and Android mobile app.

The best part is that Crypto.com now accepts DKK deposits, so investors from Denmark won’t have to stress about foreign exchange fees. However, there is a 2.99% deposit fee for using Visa or MasterCard. On the other hand, users in Denmark can choose a bank wire, which has no fees.

The process of buying Bitcoin on the Crypto.com app is highly suitable for beginners, as it comes with a straightforward interface that was designed with newbies in mind. When it comes to trading commissions, this is where Crypto.com really stands out. In a nutshell, the exchange charges a flat rate of 0.4% per slide.

This means that for every 10,000 DKK worth of Bitcoin traded, investors in Denmark will pay a fee of just 400 DKK. Moreover, Crypto.com rewards its account holders with lower commissions when users trade higher volumes. After investing in Bitcoin, it is worth depositing the tokens into a Crypto.com savings account.

In doing so, investors can earn interest of up to 6% per year on Bitcoin and 14.5% on other cryptocurrencies. Targetting the highest APY possible is just a case of swapping Bitcoin for an alternative digital token on the Crypto.com exchange. Take note, a lock-up period of three months is required to obtain the highest APY.

Flexible and one-month accounts are supported too, but these do come with lower APYs. Nonetheless, this is a great way to earn a passive income on a Bitcoin investment while still retaining full control of the tokens. For those wishing to store their Bitcoin in a private wallet, Crypto.com offers a DeFi app that gives users ownership of their private keys.

The Crypto.com DeFi Wallet also offers access to staking and interest-bearing tools, alongside the ability to swap tokens in a decentralized manner. The other option is to keep the Bitcoin tokens in the standard custodial wallet – which is managed and safeguarded by the Crypto.com team. Either way, Crypto.com offers a safe and low-cost way to buy Bitcoin in Denmark.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 250+ | 0.4% standard commission | 2.99% | $20 |

Cryptoassets are a highly volatile unregulated investment product.

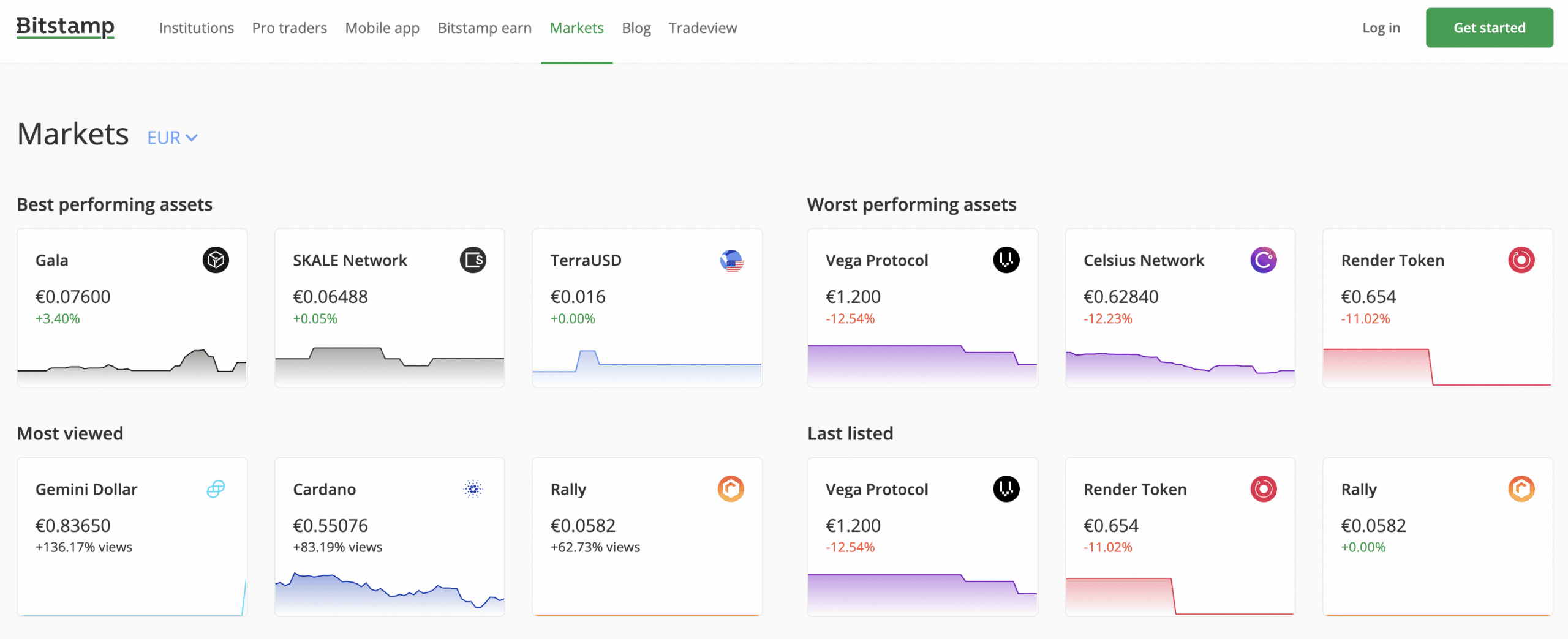

2. Bitstamp – Reputable Bitcoin Exchange That Supports Free SEPA Payments

Residents of Denmark have access to the SEPA system, which offers free transfers across Europe. Those wishing to use this payment method to buy Bitcoin in Denmark in the cheapest way possible might consider using Bitstamp for this purpose. In doing so, no deposit fees will be charged.

While Bitstamp also supports instant deposits via debit and credit cards, this is charged at 5% – which is expensive. Nonetheless, Bitstamp was first launched in 2011 – which makes it one of the most established Bitcoin exchanges in this marketplace. The platform has a great reputation – especially among experienced traders that seek access to high-level tools.

For example, the Bitstamp platform is great for performing technical analysis via customizable charts, and its advanced order types allow for a wide variety of investment strategies. Fees are reasonable on the Bitstamp platform too, with investors paying just 0.50% to buy and sell Bitcoin.

This covers crypto-crosses as well as fiat-backed pairs. By trading at least $10,000 in a single month, this trading commission is reduced to 0.25%. Bitstamp, in addition to Bitcoin, offers over 155+ cryptocurrency markets. This will suit those that wish to diversify their cryptocurrency portfolio.

The Bitstamp mobile app for iOS and Android is also worth considering. This will link to the main platform and offers all of the same features and benefits. The Bitstamp app also doubles up as a wallet, which means that users can send and receive Bitcoin at the click of a button.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 155 markets | Up to 0.5% | 5% | Not stated |

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Beginner-Friendly Broker For First-Time Bitcoin Investors

We also like Coinbase for its high-level security controls, which include storing 98% of client cryptocurrencies in cold storage wallets. All registered users must set up two-factor authentication too – which is required on each login attempt and withdrawal request. Coinbase is also popular with first-time investors for its beginner-friendly interface.

Across both its mobile app and web-trading platform, Coinbase allows newbies to buy Bitcoin in Denmark with a debit or credit card. For orders over $200 (about 1,400 DKK), a debit/credit card fee of 3.99% will be charged.

Coinbase also supports SEPA transfers and no deposit fees are charged on this payment type. However, investors will need to wait several working days for the funds to arrive in their Coinbase account. In choosing SEPA, trading commissions of 1.49% per slide will still apply. In fact, this is the case every time a user buys and sells cryptocurrency at Coinbase.

Paypal is also supported by Coinbase, but again, this comes with a deposit fee of 3.99%. On the flip side, we do like Coinbase for the fact that it has expanded its digital asset library to more than 150 cryptocurrencies. This covers a wide variety of projects and market capitalizations, which is great for those looking to diversify.

Coinbase is also great for storing Bitcoin safely and conveniently. While the web wallet might suffice for many, others might prefer the platform’s DeFi app. This ensures that only the user has access to the private keys of their wallet. The Coinbase DeFi app also enables users to trade cryptocurrencies without going through its centralized exchange.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 150+ | 1.49% | 3.99% | $50 is recommended |

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Trade Bitcoin and 600 Other Cryptocurrencies at 0.10% Commission

Binance operates a market maker/taker commission structure, which means that the more being traded throughout the month, the lower the fees. Moreover, by simply holding BNB tokens a further discount of 25% is applied to trading commissions. When it comes to deposit fees, Binance charges 1.8% on debit/credit card payments – which is competitive.

Another reason why we like Binance is that it offers more than 600 cryptocurrencies in addition to Bitcoin. This is perhaps the largest digital asset library in this space. Many of the tokens supported by Binance are newly launched, which allows investors to gain exposure to up-and-coming projects.

For those that know their way around a trading platform, Binance also offers Bitcoin derivatives. Not only do these complex instruments support short-selling, but the ability to trade with leverage too. To aid traders in making smart investment decisions, Binance offers customizable pricing charts, technical and economic indicators, and integration with TradingView.

Beginners will appreciate the standard client interface that offers instant purchases with a debit/credit card. The Bitcoin tokens will then be deposited into the user’s web wallet for safekeeping. Most tokens held by Binance are kept in cold storage and all account holders must set up two-factor authentication for added security.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 600+ | Up to 0.10% | 1.8% | $15 on debit/credit card payments |

Cryptoassets are a highly volatile unregulated investment product.

5. Safello – Scandinavian Bitcoin Broker With Support for DKK Payments

Once an account is funded, users can then proceed to buy Bitcoin at the click of a button. We should, however, note that Safello is perhaps one of the most expensive Bitcoin brokers that we came across. For a monthly volume of under 150k SEK (about 105k DKK), a trading commission of 5% will apply.

Lower commissions are offered as higher volumes are traded, but this will likely be out of reach for a casual investor. Furthermore, Safello charges a subscription fee of 3%. Another major drawback of using Safello to buy Bitcoin in Denmark is that it only supports five cryptocurrencies. In addition to Bitcoin, this is inclusive of Ethereum, Polygon, Polkadot, and Chainlink.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 5 | Up to 5% commission, 3% subscription fee | N/A | Not stated |

6. Bit2Me – Buy Bitcoin From Just 1 EUR

The final platform to consider when looking for a provider to buy Bitcoin in Denmark is Bit2Me. This platform is home to over 1 million customers in Europe. It is perhaps most suitable for investors in Denmark that wish to buy small amounts of Bitcoin.

This is because Bit2Me requires a minimum investment of just 1 EUR on each buy order. When it comes to trading fees, Bit2Me charges a standard commission of 0.95%. We also like the fact that Bit2Me supports debit and credit cards issued by Visa and MasterCard. The fee applied to this payment method is reasonable at 1.99%.

Another benefit of using Bit2Me is that the platform supports over 130 cryptocurrencies in addition to Bitcoin. Again, this will appeal to investors in Denmark that wish to build a diversified portfolio. Finally, inexperienced investors might appreciate the educational tools and guides offered by Bit2Me.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 130+ | 0.95% standard commission | 1.99% | 1 EUR |

Should I Buy Bitcoin?

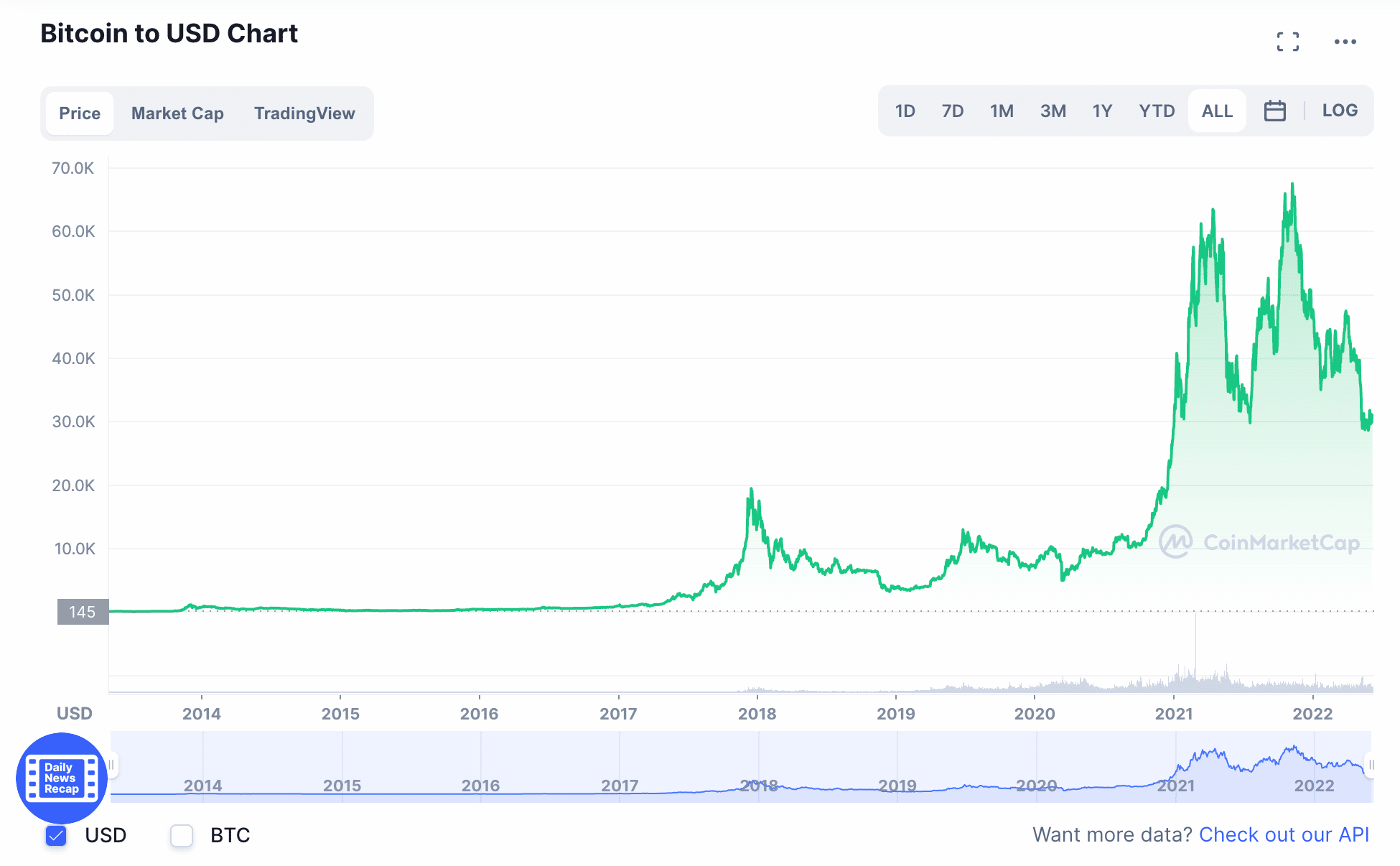

Bitcoin is a cryptocurrency that was first launched in 2009. The digital asset was trading at a small fraction of a cent during its first few years before finally breaking the $1 level in 2011. Therefore, early Bitcoin investors have potentially made life-changing money considering that in late 2021, it hit an all-time high of nearly $69,000.

With that said, even those that entered the market in recent years have potentially made significant gains. After all, Bitcoin was trading at less than $5,000 in early 2020. Crucially, in comparison to traditional financial markets – such as stocks and ETFs, Bitcoin is perhaps the best-performing asset of the prior decade.

However, it must be said that Bitcoin is no sure bet. On the contrary, the digital asset is viewed by many as a high-risk investment that is largely based on speculation rather than intrinsic value. Furthermore, Bitcoin experiences rapid pricing levels due to its volatile nature.

That is to say, those looking to buy Bitcoin in Denmark for the first time must be well-prepared to see the value of their investment drop by a double-digit percentage at any given time. On the other hand, while Bitcoin has indeed gone through some wild pricing cycles, over ther course of its 13+ year history, it has continued to generate sizable returns.

Benefits of Buying Bitcoin in Denmark

In order to determine whether or not buying Bitcoin is a smart investment, it is important to understand how this digital asset works and what its future might hold in terms of valuation and pricing.

Below, we offer some insight into this cryptocurrency that investors should consider before electing to buy Bitcoin in Denmark.

Bitcoin is Decentralized

One of the main characteristics of Bitcoin is that the digital asset is decentralized. Put simply, not only does this mean that it isn’t backed by any nation or central bank, but no single person or entity has control over the network.

- This means that by holding Bitcoin in a crypto wallet, the tokens remain under the sole ownership of the investor.

- In other words, by following the correct protocols (such as wallet security), nobody can touch the tokens that investors purchase.

Decentralization of the Bitcoin network extends to transactions. This means that when users transfer Bitcoin to another person, it does not go through a third party or centralized operator.

As a result, Bitcoin transactions cannot be blocked in the same way that banks and financial institutions can restrict transfers at their will. Ultimately, things like KYC and account limits do not come into place when buying and transacting in Bitcoin.

Bitcoin is a Store of Value

When Bitcoin was first designed, the overarching objective of its developer was to create a decentralized medium of exchange. This means that the creator aimed for Bitcoin to become both a global currency and a payments network for the purpose of sending and receiving funds.

However, many from within this sector argue that Bitcoin is instead a store of value like fine art, real estate, or perhaps most pertinently – gold. There are many factors that support this argument. First and foremost, unlike traditional currencies like the Danish krone and British pound, the supply of Bitcoin is finite.

This is because, in just under 120 years from now, the final Bitcoin will be minted by the blockchain protocol. This will result in the total Bitcoin supply hitting 21 million tokens. When this happens, there is every likelihood that demand will significantly outweigh supply.

Another reason why Bitcoin is viewed as a perfect store of value is that it is both durable and transferable. For instance, Bitcoin transactions take just 10 minutes to process irrespective of where the sender and receiver are located. Moreover, Bitcoin can be split down to eight decimal places. This means that Bitcoin is suitable for micro-transactions.

In comparison, gold is not conducive for small transactions due to its physical nature. This is also the case when it comes to transportation, as well as storage. And of course, being able to sell gold is no easy feat either. This is in stark contrast to Bitcoin, which can be traded globally at the click of a button.

Bitcoin is an Alternative Investment That Offers a Huge Potential Upside

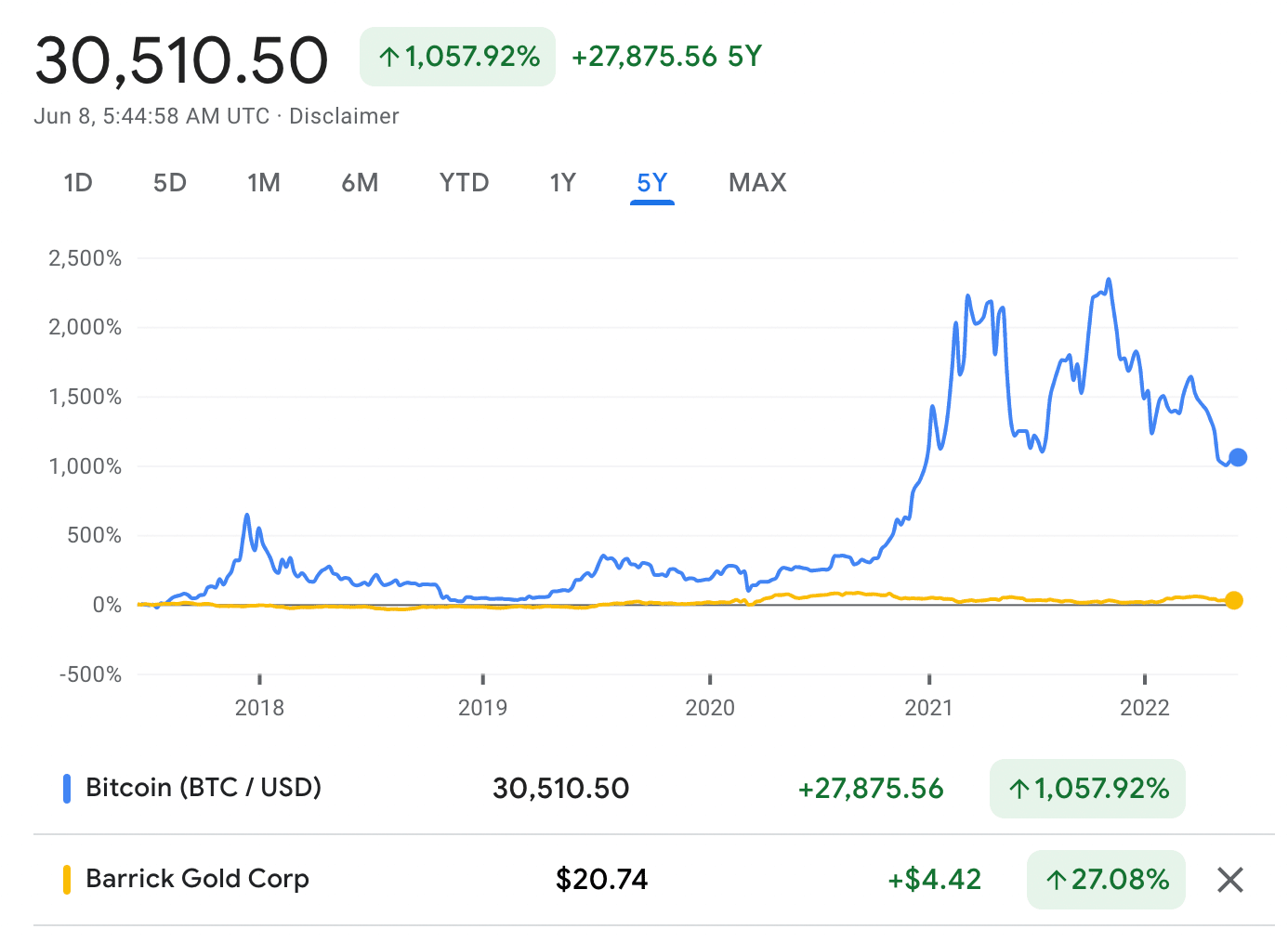

We briefly mentioned earlier that over the prior decade, Bitcoin is one of the best-performing asset classes in the global investment space.

- For instance, as is highlighted in the chart above, Bitcoin has increased in value by more than 1,000% over a 5-year period.

- Over the same timeframe, the value of gold has increased by a mere 27%.

- Another benchmark to consider when analyzing the performance of Bitcoin is the OMX Copenhagen 25. This is the primary stock market index in Denmark and it tracks the 25 most traded publicly-listed companies.

- Over the past five years, the OMX Copenhagen 25 has increased by just 46%.

- Even the NASDAQ 100 – which is a US-based index that tracks large-scale tech stocks like Apple, Amazon, and Tesla, has grown by just 120% over the prior five years.

Therefore, Bitcoin continues to hold its own against conventional investment markets.

Bitcoin is Affordable Due to its Divisibility

As mentioned above, Bitcoin can be divided into tiny units of up to 8 decimal places. This means that there is no requirement to risk large sums of money when electing to buy Bitcoin in Denmark. Instead, it is entirely possible to risk small amounts.

This means that instead of investing, say $2,000 into Bitcoin via a single transaction, a more risk-averse strategy might consist of 10 monthly purchases at $200 each.

Bitcoin is Highly Liquid

When Bitcoin previously hit an all-time high of nearly $69,000, this meant that the digital asset carried a market capitalization of over $1 trillion.

This means that other than a few US-based tech stocks like Microsoft and Amazon, Bitcoin was one of the most valuable trading instruments globally.

Although Bitcoin was since entered a market correction, it is still a multi-billion dollar asset class. Furthermore, Bitcoin attracts daily trading volumes in the tens of billions of dollars, which, again, is significantly higher than most investment markets.

What this means for investors that are looking to buy Bitcoin in Denmark is that the digital asset is highly liquid. Therefore, the process of buying as well as cashing out Bitcoin could not be easier.

This marketplace never sleeps – as Bitcoin can be traded on a 24/7 basis. This means that unlike other stores of value like real estate or gold, Bitcoin investors can realize their gains at the click of a button.

Risks of Buying Bitcoin in Denmark

After considering the benefits of buying Bitcoin in Denmark, next, it is important to explore the risks. All investments come with an element of risk and Bitcoin is no different.

However, in comparison to high-grade stocks and bonds, the risks of investing in Bitcoin are invariably greater.

Here’s why:

Wild Market Fluctuations

The main risk that needs to before considered before electing to buy Bitcoin in Denmark is that pricing fluctuations in this trading arena are super volatile.

- Bitcoin typically moves in rapid trends, both in terms of rising and falling prices.

- This means that when the broader markets are bearish on Bitcoin, its value can drop rapidly.

- Many inexperienced investors will begin to panic when they see the value of their portfolio decline in this manner and thus – will often opt to cut their losses by selling.

However, history suggests that by holding Bitcoin in the long term, these wild market fluctuations will eventually result in a prolonged upward trajectory.

Fraud and Scams

Bitcoin is unfortunately prone to scams and fraud. This can come in a variety of illicit methods, so newbie investors always face the risk of buying Bitcoin from an illegitimate platform.

If this does happen, investors might find that the Bitcoin they thought they were purchasing doesn’t exist.

As we explain in the more later on, the best way to mitigate the risk of fraud is to buy Bitcoin in Denmark from a regulated and licensed provider.

Wallet Hacks

Many investors will look to buy Bitcoin in Denmark and then transfer the tokens to a private wallet – such as those represented by a mobile app or desktop software.

Either way, Bitcoin wallets are prone to remote hacking attacks. If this happens and the perpetrator is successful, this can result in the user losing their entire Bitcoin investment.

Once again, the best way to mitigate the risk of cybercrime and wallet hacks is to keep the Bitcoin tokens in a regulated platform that is safeguarded by institutional-grade security controls.

Ways of Buying Bitcoin in Denmark

The best way to buy Bitcoin in Denmark is with fiat currency. This means that it’s just a case of choosing a suitable deposit method and having the Bitcoin purchased paid for in DKK.

Consider the methods below when choosing the best way to invest in Bitcoin today.

Buy Bitcoin With Credit Card or Debit Card

Those looking for the fastest and most convenient way of buying Bitcoin in Denmark should perhaps consider using a credit or debit card.

Most of the exchanges and brokers discussed today support Visa and MasterCard, which means that the Bitcoin investment will be processed instantly.

When using this payment method, users will need to go through a KYC process – which requires a copy of a passport or driver’s license.

Finally, consider fees when buying Bitcoin in Denmark with a credit or debit card. At Bitstamp, for instance, this will cost 5% of the investment amount.

Buy Bitcoin With SEPA

The most cost-effective way to buy Bitcoin in Denmark is via a SEPA payment.

Although investors will need to wait a couple of days for the funds to be processed, Crypto.com supports fee-free SEPA deposits.

Then, when the funds are credited, Crypto.com users can buy Bitcoin at a trading commission of just 0.4%.

Buy Bitcoin With PayPal

Coinbase supports Paypal deposits. The fee charged by the aforementioned platforms amounts to 0.5% and 3.99% respectively.

When investors elect to buy Bitcoin with Paypal, the payment will be processed instantly. Paypal is also suitable for making withdrawals from Coinbase.

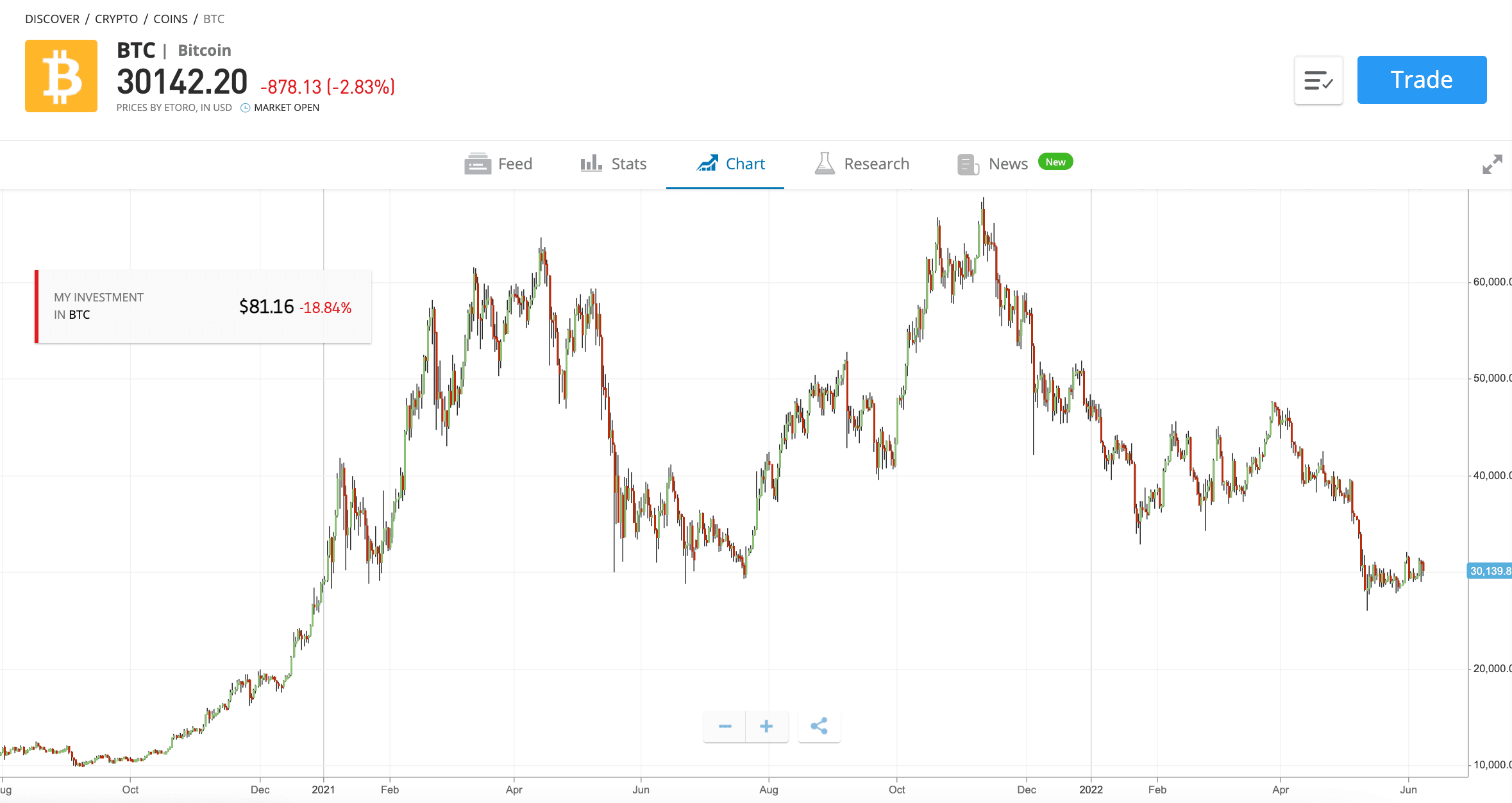

Bitcoin Price

We have stressed the importance of understanding just how volatile Bitcoin and other cryptocurrencies can be. Price movements are determined by market sentiment, in terms of buying and selling pressure.

For example, in just two months of trading in late 2021, Bitcoin went from a price of $40,000 to nearly $69,000. This translates into gains of over 70%. The reason for this is that the broader markets were bullish on Bitcoin, so buying pressure continued to increase.

On the other hand, after peaking at $69,000, the market sentiment very quickly reversed. In fact, also in the space of just two months of trading, Bitcoin hit lows of $35,000. This translates into a rapid decline of nearly 50%.

Most importantly, as the chart above highlights, Bitcoin has performed extremely well over the course of time. While both bearish and bullish pricing cycles have been witnessed, Bitcoin is up millions of percentage points since launching in 2009.

Bitcoin Price Prediction

There are a lot of subjective Bitcoin price predictions made in the cryptocurrency trading scene. A simple Google search will likely result in proponents of Bitcoin arguing that the digital asset is sure to surpass $100,000 or even $200,000 by the end of 2022.

However, similar Bitcoin price predictions have been made for many years, so investors are advised to arrive at their own informed opinions. As noted several times throughout this guide, Bitcoin is best viewed as a long-term investment.

Those that believe in the viability and use case of Bitcoin can therefore ignore shorter-term cycles and instead allow the value of the tokens to grow organically.

How to Buy Bitcoin Safely in Denmark

We mentioned earlier that when looking to buy Bitcoin in Denmark for the first time, doing so in a safe manner is crucial.

With this in mind, below we offer some insight into best practices to consider before completing a Bitcoin investment.

Join a Regulated and Reputable Bitcoin Broker

There are more than 300+ Bitcoin exchanges and brokers according to CoinMarketCap. Most of these platforms are not regulated and thus – should be avoided.

To buy Bitcoin safely, consider opening an account with a regulated and reputable broker.

Keep Private Keys Super-Safe

Those that wish to buy Bitcoin in Denmark and then transfer the tokens to a non-custodial wallet will have full control over their funds and private keys.

However, it is important to remember that should the user lose their private keys – or they fall into the wrong hands, the Bitcoin tokens will likely be gone forever.

As such, when using a non-custodial wallet, be sure to write the private keys down correctly and keep the respective sheet of paper someone safe.

Don’t Become Too Overexposed to Bitcoin

It can be easy to look at the historical performance of Bitcoin and get carried away with investment stakes. However, Bitcoin is still a new asset class in the grand scheme of things – at least when compared to the traditional stock markets.

And as such, after deciding when to buy Bitcoin, it is important to avoid becoming overexposed to this asset. Many experts in the investment scene will suggest capping an investment in Bitcoin to no more than 5% of an individual’s total portfolio value.

In doing so, if things don’t quite go to plan, losses will be limited to sensible amounts.

How to Buy Bitcoin in Denmark – Tutorial

Newbies wondering how to invest in Bitcoin in Denmark can follow the beginner-friendly tutorial outlined below.

This will explain how to register a trading account with most major sites, make an instant deposit, and subsequently buy Bitcoin with low fees.

Step 1: Open a Crypto Account

To buy Bitcoin in Denmark, you need to open an account with a broker platform of your choice. Go to the homepage, sign up, and fill out the registration form that appears on-screen.

After entering an email address and a username/password, you should have created an account.

Step 2: Upload ID

Upload the ID and address documentation that the platform requires. This will usually be a copy of your passport or driver’s license and a statement from your bank or similar.

Step 3: Deposit Funds

The next step required is the deposit process. Look for the option to deposit funds, choose one of the options your new crypto account accepts, and complete the process to fund your new crypto broker account.

Step 4: Search for Bitcoin

Next, utilize the search bar at the top of the website by typing in ‘Bitcoin’.

Step 5: Buy Bitcoin

Follow the on-screen prompts to use the money in your account to open a position in BTC.

You can usually either choose the USD amount you want to invest in Bitcoin or select the number or fraction of coins you want to own.

How to Sell Bitcoin in Denmark

After buying Bitcoin, the tokens will remain in the wallet on the site until a cash-out request is made by the user.

Selling Bitcoin therefore simply requires the user to log in to their account and place a sell order. This is essentially the same as the investment process but in reverse.

After confirming the cash-out request, the funds can then be used to make a withdrawal.

Conclusion

Beginners can buy Bitcoin in Denmark in a matter of minutes when using a regulated broker that accepts debit and credit card payments.