Bitcoin is the largest cryptocurrency globally, with a market cap of $580 billion. If you are looking for how to buy bitcoin in Brazil, this guide will review the best platforms available in the region.

We cover when to buy Bitcoin, price predictions of BTC and how to invest in Bitcoin in Brazil.

How to Buy Bitcoin Brazil- Quick Guide

If you’re looking for how to buy Bitcoin in Brazil, the table below shows you how to buy Bitcoin instantly with most brokers available in the country.

- Step 1: Open an account - Users can begin trading by heading to their chosen platform and begin the registration process. Enter your personal details and create a username and password to continue.

- Step 2: Deposit Funds - With the multiple payment methods that platforms offer, users can buy BTC in Brazil with a low minimum deposit.

- Step 3: Search for Bitcoin - Search for BTC on the platform’s navigation bar to begin your investment process.

- Step 4: Buy Bitcoin- The final step is to complete the buy order process and insert the amount of BTC you wish to trade. Click on “Open Trade” to confirm the transaction.

Where to Buy Bitcoin in Brazil

If you’re looking for where to buy Bitcoin in Brazil, you may want to do so with a cryptocurrency platform that provides low fees, multiple trading tools and an intuitive user interface.

In the sections below, we review some of the best platforms from where to buy Bitcoin in Brazil.

1. Crypto.com - Stake BTC in Brazil

Launched in 2016, Crypto.com is a global cryptocurrency exchange that hosts over 10 million users on its platform.

Launched in 2016, Crypto.com is a global cryptocurrency exchange that hosts over 10 million users on its platform.

Notably, Crypto.com allows users to access an intuitive mobile app - which allows you to buy, sell, trade and earn interest on Bitcoin and more than 250 cryptocurrencies.

In terms of payment methods, you can buy BTC directly with a credit or debit card on Crypto.com. However, this will cost an additional fee of 2.99%. While users can fund their account balance with crypto free of charge, fiat deposits are not yet facilitated on the platform.

Crypto.com also offers competitive fees, only charging a 0.40% slide fee per transaction. The exchange also allows users to trade CRO tokens - the native token of Crypto.com. For users holding a certain number of CRO in their portfolios, the trading fees can be reduced by 10%.

Crypto.com is well-known for its interest-earning features through Crypto.com Earn. Users can stake their BTC for a set period and earn an APY (Annual Percentage Yield) of up to 5%. If users hold CRO, this can increase by an additional 2%. Additionally, Crypto.com offers many investment options, such as its own NFT marketplace, Crypto Credit service, and a DeFi wallet for swapping and storing tokens.

| Pricing Structure | Fees for Trading Bitcoin | Minimum Deposit |

| Maker/Taker Fee | 0.40% | $20 (Buy BTC directly) |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Bitstamp - Advanced Trading Options for BTC in Brazil

With Tradeview, Bitstamp’s active trading platform, users can access real-time insights into markets and access analytical tools and powerful order types. Bitstamp can be accessed via its mobile app, which provides full trading functionality and includes all the features you get on the web-based trading platform.

Furthermore, the site charges a low trading fee of 0.50%, which reduces to 0.1% with an increase in trading volume. However, the site does charge high fees on payment options.

For example, a fee of 8% is applied on small credit card transactions, which can reduce to 5% when the transaction size increases.

Bitstamp also stores a bulk of its assets in cold storage and provides multifactor authentication for added security. Along with Bitcoin, users can trade more than 50 cryptocurrencies using this exchange.

| Pricing Structure | Fees for Trading Bitcoin | Minimum Deposit |

| Spread Fee (Reduces per Trading Volume) | Beginning at 0.50% | Varies per Payment Method |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. Coinbase - Two Trading Platforms to Buy BTC in Brazil

Coinbase allows users to access two trading platforms - Coinbase and Coinbase Pro. The former is beneficial for beginners as it hosts a very intuitive user interface, making it easy to purchase BTC and more than 100 cryptocurrencies.

With Coinbase Pro, users can access a more advanced trading platform with complex charting tools and patterns. Furthermore, the Pro account gives users access to more than 250 cryptocurrencies.

Coinbase takes a commission of 1.49% per trade. A further charge of 3.99% is applied when purchasing crypto with debit/credit cards. Furthermore, a maker/taker fee model beginning at 0.50% per transaction is also applied.

However, Coinbase Pro allows users to pay no extra charge when purchasing BTC and other cryptocurrencies with a Credit/debit card.

Coinbase also stores 98% of all assets in cold storage - which means the assets are safely stored offline.

| Pricing Structure | Fees for Trading Bitcoin | Minimum Deposit |

| Maker/Taker Fee + Commission Per trade | Maker/Taker fee beginning from 0.50%. 1.49% slide fee | $50 |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Binance - Multiple Passive Income Opportunities with Bitcoin

Binance is another platform from where to invest in Bitcoin in Brazil. The platform is known for providing some of the lowest fees in the space - charging only a 0.1% spread per transaction. By holding BNB tokens, the local coin of Binance, users may further reduce their fees by 25%.

Besides trading BTC, users can buy, sell, and trade over 600 cryptocurrencies. Binance is also one of the few platforms that lets users leverage their trades to boost the value of their BTC holdings. However, this option is best for traders with a high-risk tolerance, as it can lead to bigger losses as well as bigger gains.

Users can earn passive income on Binance by accessing Binance earn to earn interest on BTC. Furthermore, Binance hosts an affiliate programme, allowing users to earn a commission for every successful referral they make.

Binance provides many charting options and API keys for integrating software tools for advanced traders. However, the platform does take a 4.5% charge on debit/credit card payments. Users may use ACH and wire transfers as an alternative.

With Binance Academy, the platform provides educational content and articles, which may benefit novice investors looking to learn more about the space.

| Pricing Structure | Fees for Trading Bitcoin | Minimum Deposit |

| Maker/Take Fees | 0.1% | $50 |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Mercado Bitcoin - Brazil’s Largest Cryptocurrency Exchange

Mercado Bitcoin is the largest cryptocurrency exchange in Bitcoin, with more than 3 million users. Along with Bitcoin, users in Brazil can trade more than 20 cryptocurrencies with Mercado Bitcoin.

The platform’s pricing structure works on a maker/taker model, charging a 0.70% taker fee and 0.30% maker fee. Users can access Bitcoin by making a wire deposit on the platform for no additional charge. However, Mercado Bitcoin does not support credit/debit card methods as a payment option.

One benefit of Mercado Bitcoin is that it supports Brazillian Real (BRL) as a fiat currency. The platform takes a low withdrawal fee of 0.0005 BTC, which equates to $15 per transaction.

| Pricing Structure | Fees for Trading Bitcoin | Minimum Deposit |

| Maker/Take Fees | 0.70% taker fee, 0.30% maker fee | Free |

6. Kraken - Low Fees on BTC

Beginners are better off starting with the regular Kraken account, which will enable you to complete a quick verification process and purchase BTC with a linked bank account. Furthermore, users can earn passive income by staking their BTC on the Kraken platform.

More advanced users can access Kraken Pro, an active trading platform that can be accessed via the web interface. Importantly, Kraken Pro provides multiple charting options and fewer trading fees, which is beneficial for regular traders.

Kraken operates on a maker/taker fee model - charging 0.16% and 0.26% simultaneously. For instant purchases, the fee is 1.5% for all cryptocurrencies. However, users may also need to pay additional fees depending on their chosen payment methods.

| Pricing Structure | Fees for Trading Bitcoin | Minimum Deposit |

| Maker/Take Fees | 0.16% maker fee, 0.26% taker fee | Varies Per Payment Method |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Should I Buy Bitcoin?

Since its launch in 2009, Bitcoin has rewarded investors with significant gains. While Bitcoin currently holds a market cap of more than half a trillion dollars, it has still proved to be a very volatile asset.

It was not until 2013 that Bitcoin began trading above the $1,000 mark. Since then, the value has risen as high as $69,000 and has faced multiple corrections and bull runs over the years.

Thus, knowing the best platforms that allow users to invest in Bitcoin in Brazil is only half of the job. Users must also research and properly analyse the token to make an investment decision for the future.

Did you know that many crypto enthusiasts are turning to the best Bitcoin casinos in Brazil to try their luck with crypto gambling?

In the below sections, we will cover some of the benefits of Bitcoin.

Benefits of Buying Bitcoin

It is important to analyse any cryptocurrency token before investing. This will allow users to get an idea of the asset they may choose to invest in more detail.

In the sections below, we cover 5 benefits of Bitcoin.

Price Correction

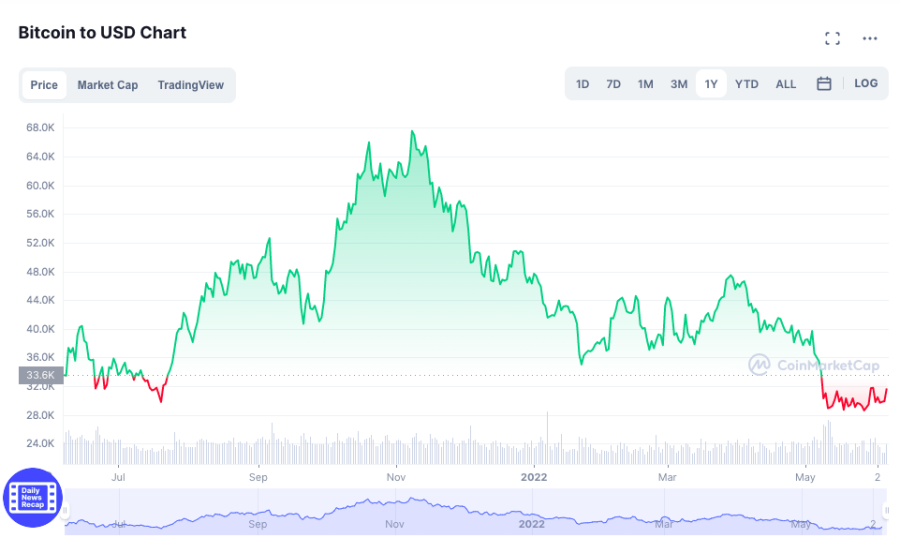

Bitcoin and the broader cryptocurrency markets have faced a severe price correction since the beginning of 2022. While the token rallied to an all-time high (ATH) of nearly $70,000 in November 2021, it has lost more than 50% of its value.

While this may seem like a tricky time to invest in the token, BTC has always experienced severe price shifts since it began trading in 2009. BTC might be a preferable investment at a discounted price for long-term investors if their trading strategy involved holding Bitcoin tokens for multiple years.

While there is no guarantee of profits in the future, BTC is currently much cheaper than it was 6 months ago.

Scarcity of Tokens

Bitcoin has often been termed a ‘hedge against inflation’ due to its limited supply. Launched in 2009 on its blockchain, Bitcoin will have a maximum supply of 21 million tokens.

Since Bitcoin is one of the few tokens with a limited supply, the demand beats the supply. Thus, this results in an upwards movement of the token price. For users looking to diversify their assets by investing in deflationary assets, Bitcoin is one such available asset in the cryptocurrency markets.

Furthermore, Bitcoin reduces its mining reward by 50% every 4 years. This means that new Bitcoin tokens will become even more scarce to mine in the coming decades. This can make the coin even more valuable in the long term.

Monopoly and First-Mover Advantage

Bitcoin is the most traded and the largest cryptocurrency globally. Furthermore, BTC has a market share of more than 40% in the cryptocurrency space. BTC is the equivalent of a blue-chip stock has never lost its position as the largest digital asset.

Bitcoin also has the first-mover advantage in the industry since it was the first token of its kind when it was built on the blockchain. Due to the strong results it has delivered repeatedly, many analysts and investors tend to hold a certain amount of BTC in their crypto portfolios.

Alternative to Fiat Currency

Bitcoin was created as an alternative to fiat currencies. This was due to the lack of transparency and autonomy that fiat currencies have since they are controlled and released in the markets by central governments and financial institutions.

On the other hand, Bitcoin is permissionless and can be accessed without any third party or organisation. Furthermore, Bitcoin can be sent cross-borders in under 10 minutes. This works as a great alternative for investors and users looking for a more transparent currency.

Source of Passive Income

A complaint of Bitcoin and cryptocurrencies has been the high levels of volatility that have been prevalent while investing in these assets. However, Bitcoin can be held to generate passive income by earning interest and staking.

Some of the top cryptocurrency exchanges like Crypto.com allow users to lock up their BTC assets for a certain period in exchange for an interest in your assets. Therefore, you can hold Bitcoin and still generate revenue, even if the token price depreciates in value.

Ways of Buying Bitcoin

Users looking to invest in Bitcoin in Brazil can do so with multiple payment options. The sections below cover two available payment methods that users can choose while buying BTC.

Buying Bitcoin with PayPal

PayPal is a global payment processor which easily allows you to purchase cryptocurrencies, including Bitcoin. Once you connect your PayPal wallet to your trading account, you can instantly deposit funds and buy Bitcoin.

Buy Bitcoin with credit card or debit card

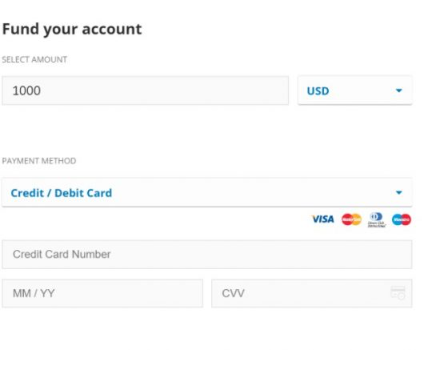

Another popular payment option to use while purchasing Bitcoin is via Credit/debit cards. Users can simply connect their debit/credit card by entering their exchange details and instantly deposit money.

One thing to note while choosing this payment feature is the fees involved. Often exchanges can charge significantly higher fees on credit and debit cards, so it is best to evaluate and compare the best platform to cater to your investing needs.

Bitcoin Price

Before investing in Bitcoin in Brazil, it is essential to look at the digital asset price. This way, users can analyse the past performance of BTC and create their investing plans before entering into a new position.

Unfortunately, Bitcoin and the other assets in the crypto space have been very volatile in the past 1 year. Bitcoin has experienced two major price corrections in 2021, followed by bull runs shortly after.

For example, Bitcoin traded sideways around the $30K region from May 2021 until it experienced a significant bull-run beginning in October. This saw the price of BTC rally to an ATH of almost $69,000 in November 2021.

However, BTC corrected by more than 50% shortly after. In 2022, the price collapse resulted from various factors, including the high inflation numbers, which resulted in a correction in the cryptocurrency and stock markets.

Furthermore, the Russia-Ukraine conflict has created more pressure in the global markets, which may be another reason for the token's slow performance in the last few months.

As of May 2024, Bitcoin is trading at $68,000.

Bitcoin Price Prediction

After sitting on highs of $69,000 towards the end of 2021, Bitcoin has entered a bearish cycle since the beginning of 2022.

In 2024,just before the BTC halving event, i.e., on March 29, Bitcoin reached its ATH of $70,000. After the halving event, which took place on April 19, BTC’s price fluctuated between $60,000 and $63,000.

The price of the token very volatile at the time. While many analysts and investors believe that Bitcoin can experience a price jump in the coming months, it is impossible to predict the price of BTC in the future.

Investors may be better off by making a long-term assessment of Bitcoin and deciding whether or not to invest depending on their future goals and strategies.

How to Buy Bitcoin Safely in Brazil

In the sections below, we discuss how users can invest safely in Bitcoin in Brazil.

Invest Smaller Amounts

For beginning investors entering the cryptocurrency space, it may be sensible to invest a small amount in BTC or any other assets at the start. Since BTC is a very volatile asset, users should only invest what they can afford to lose.

Furthermore, many platforms like Binance provide educational materials and additional tools that help you build your knowledge of the markets.

This can benefit those looking to trade in a live-market environment without risking their money.

Invest with a Regulated Broker

Another critical method to ensure investors can buy Bitcoin in Brazil safely is investing with a regulated platform or broker. Furthermore, users may want to ensure that top-tier regulatory organisations regulate the platforms.

How to Buy Bitcoin in Brazil - Tutorial

Now, let's look at how to buy Bitcoin in Brazil with a popular cryptocurrency exchange.

The sections below will cover a step-by-step process of buying BTC with most major platforms available in Brazil.

Step 1: Open an Account

Navigate to the homepage of the crypto broker you want to use and start the account registration process.

You'll be asked for some personal information and to set up a username and password to keep your Bitcoin secure.

Step 2: Identity Verification

Users will need to verify their identity before beginning investing in Bitcoin. To complete this step, provide/upload two documents on the trading site you've chosen.

- Firstly, upload a valid photo ID. This can be either a passport copy or a valid driver’s license.

- Secondly, you will need to provide a proof of address. This can be done by providing a bank statement or any utility bill.

If your details meet the requirement, the platform will verify your account instantly.

Step 3: Deposit Funds

To begin trading, you can deposit funds on your account with whichever payment methods are open on your chosen broker site.

There will also be a range of minimum deposits that will differ between sites, so choose which one will suit your needs.

Step 4: Search for BTC

Once you are on the homepage, you will find a search bar or search icon. Here, you need to search for BTC or Bitcoin.

Step 5: Buy Bitcoin

The final step is to complete your BTC buy order.

Enter the amount of money you wish to deposit into the trade and click on the buttons on the site to confirm your actions.

How to Sell Bitcoin

If you have successfully managed to make a profit on BTC, you may want to know how to sell your positions. In the sections below, we show you how to do this on most major platforms.

Click on where you see your BTC held on the site's homescreen or app. You should have a list of open positions, and to sell your Bitcoin, you need to select that coin.

You will now be able to see your open positions in Bitcoin. Follow the on-screen prompts to sell or close your position.

Conclusion

This guide has shown you how to buy Bitcoin in Brazil. We have reviewed some of the best bitcoin exchanges in Brazil, comparing them based on their pricing structure, BTC fees, available tools, etc. We have also analysed the BTC price and variables involved in the trade to allow you to decide on when to buy Bitcoin in the future.

FAQs

Is Bitcoin available in Brazil?

How can I buy Bitcoin in Brazil?

Which apps can I use to buy Bitcoin in Brazil?

Can I use Coinbase in Brazil?