BAL is the governance token of Balancer, a decentralized finance (DeFi) protocol that allows users to swap ERC-20 tokens without needing any centralized entity. It is a permissionless AMM protocol that allows anyone to conduct transactions on the platform just by connecting a crypto wallet.

As one of the top decentralized exchanges globally, Balancer DEX has gained the attention of DeFi enthusiasts looking to exchange crypto assets and earn passive income – but is BAL a good investment? In this guide we’ll make BAL price predictions and first review where to buy Balancer tokens.

How to Buy BAL – Quick Guide

To invest in Balancer, follow these steps:

- ✅ Step 1: Open a crypto account: Visit the official website of your selected broker and create a free account. The process only requires entering the necessary details and submitting KYC documents.

- Step 2: Deposit funds: To buy BAL, make a minimum deposit of $10 or more. You can choose any of the given fiat options to make the deposit, including Paypal, debit card, bank transfer, Neteller and more.

- Step 3: Search for Balancer: Enter ‘Balancer’ in the search bar. Once you see BAL cryptocurrency on the list, click it.

- Step 4: Buy Balancer: Clicking on the Trade button will lead you to the Balancer investment page. Use the slider to decide how much you want to invest in BAL, then click on “Open Trade” to confirm the buy order.

Where to Buy Balancer Token – Best Platforms

Below we’ll review some of the top crypto exchanges that have listed Balancer in more detail. These can also be used to trade BAL and sell BAL once you’re ready to take profits.

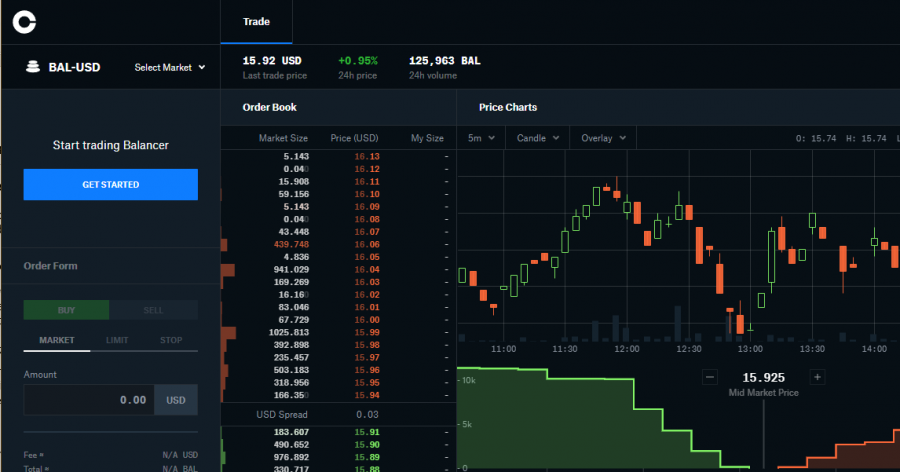

1. Crypto.com: Trade Balancer on Margin

A cryptocurrency platform that focuses on ease of use is Crypto.com. Crypto.com  listed BAL on 1st February 2021. This platform allows investors to not only buy Balancer and 250+ other cryptos but also to leverage trade them on perpetual futures pairs – use a stop loss if you attempt this to avoid liquidation.

listed BAL on 1st February 2021. This platform allows investors to not only buy Balancer and 250+ other cryptos but also to leverage trade them on perpetual futures pairs – use a stop loss if you attempt this to avoid liquidation.

You can buy Balancer (BAL) on Crypto.com using debit or credit card payments by paying 2% transaction fees. That fee is only applicable one month after you’ve created an account on this platform because Crypto.com offers a 30-day free trial for new users, allowing them to invest in the cryptocurrency of their choice without paying any charges.

Crypto.com has many built-in security protocols to protect the user’s assets. These protocols range from multi-factor authentication to other underlying safety layers to protect accounts from fraudulent activities. Additionally, US-based customers can benefit from Crypto.com’s coverage by the FDIC programme, which gives them up to $250,000 insurance.

The fees on Crypto.com vary depending upon the size of the transaction and trade. For users trading less than $25k monthly, the price is 0.4%. The higher volume you trade, the lower fees you’d need to pay. Crypto.com is a good platform if you intend to trade high volumes of cryptocurrencies.

You can reduce the fee by purchasing Cronos (CRO) – Crypto.com’s native token. Also, Crypto.com has its very own Crypto.com Visa card that you can use to purchase items from select retailers and gain cashback of up to 8%.

The platform also caters to NFT enthusiasts with its NFT marketplace.

Cryptoassets are a highly volatile unregulated investment product.

2. Binance: Trade BAL at just 0.10% fees

If you’re a seasoned trader looking for more technical indicators and the widest range of altcoins, Binance listed Balancer on 6th August 2020 and also offers 600+ other coins.

Some features that have attracted more than 90 million users to Binance include Binance Futures Battle, Asset Conversion, Cross Collateral, and Price Protection.

Binance Futures Battle gamifies trading – turning investors into players who must predict Bitcoins direction in the price graph within 5 minutes. With asset conversion, you can directly convert supported assets into other cryptocurrencies without transferring them on the spot market. Cross collateral allows users to collateralize their coins and borrow against other crypto assets. And with Price protection, users get protection against extreme market conditions.

Binance is the world’s number one cryptocurrency exchange. It provides a great deal of educational information about the blockchain ecosystem using plain language – which helps newbies enter the crypto space without fear. These include blogs and videos.

The Binance platform is one of the best places to trade Balancer with low fees. If you buy BAL with crypto like BTC or USDT (Tether), you only pay a 0.10% trading fee. The deposit fee using debit and credit cards is high though – 4.5%. Before choosing Binance as your trading platform to invest in BAL, also remember that it is an unregulated platform, having acquired regulations only from Canada and Bahrain.

Binance also caters to the NFT crowd, having its own marketplace Binance NFT that uses BNB – Binance Coin – as currency.

Along with BAL, Binance has listed other DeFi coins such as Bancor, Maker and Synthetix, among others.

3. Coinbase: Largest Exchange in the US to invest in BAL

Our other recommendation to invest in cryptocurrencies, including BAL, is Coinbase. I

Coinbase listed BAL on 6th October 2020. Like other exchange platforms we reviewed, Coinbase also provides insurance facilities to compensate its users if they lose their funds due to any fraudulent activity. Also, you can start investing in BAL on Coinbase for a minimum deposit of just $2. It is a good option for those retail investors on a budget.

When it comes to fees, Coinbase charges higher than some of its peers. For instance, the deposit fee for using a debit card is 3.99%, and for using a US bank transfer, the charge is 1.49% – the trade-off being it would take a longer time for the transaction process to complete.

As for the trading fees, use Coinbase Pro to pay low fees, which uses maker / taker fee amounts of 0.6% / 0.4%.

Despite the high deposit costs, some users prefer Coinbase due to its focus on security. Once you deposit your funds in your Coinbase account, the platform stores 98% of it in cold storage. Additionally, it gives you the option to enable two-factor authentication, requiring you to provide a One-Time-Password (OTP) every time you log in.

Cryptoassets are a highly volatile unregulated investment product.

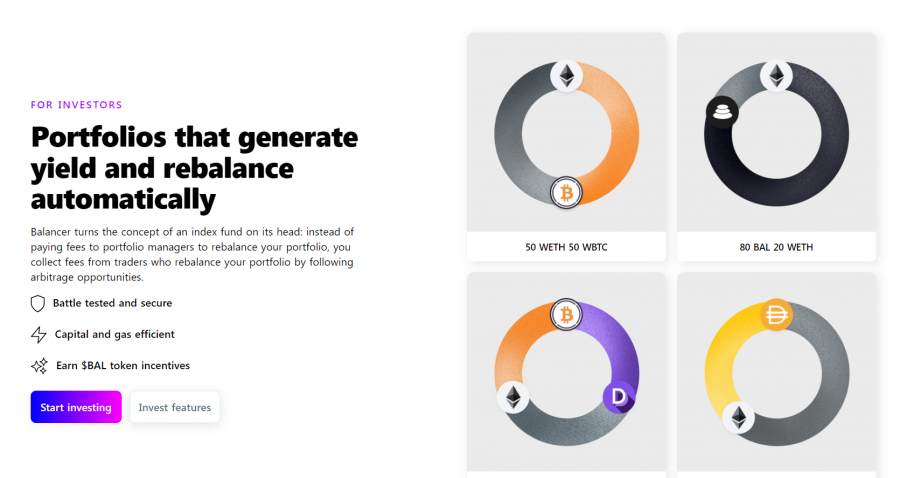

What is Balancer?

Balancer is a decentralized exchange (DEX), Automated Market Maker and liquidity pool protocol that you can leverage to swap ERC-20 tokens without the intermediation of any centralized entities. It is a permissionless platform – allowing users to engage with the crypto market without providing any verification.

At the core of this protocol lies AMM. AMM or Automatic Market Maker is a platform that uses an algorithm to manage crypto orders and determine the value of the assets.

The Balancer DeFi Protocol has been in development since 2018 by Balancer Labs. It was finally launched by BlockScience, a blockchain consulting firm, in 2020 after the platform raised $3 million in its funding round – selling 5 million BAL – the native token of the DeFi protocol.

Balancer is among the top 10 DeFi platforms globally and had more than $2 billion worth of assets locked up as of the beginning of 2022.

Working principle of The Balancer

Balancer uses algorithms instead of relying on centralized entities for setting trades. It has introduced a concept called the Balancer pools. These pools of two to eight different cryptocurrencies provide liquidity to the traders.

After a Balancer pool is created, the systems set the ratio of tokens within this pool. For instance, suppose a pool consists of Tether, Ether and Bitcoin; at that time, the algorithm sets the ratio of these crypto-assets at 25%, 25% and 50%.

After a user starts trading, this ratio rebalances. It means that once a ratio of a particular token is reduced, the percentage of another token present in the same pool increases. For instance, if someone takes 5% of Tether from the pool, the new ratio of the coins becomes 27.5%, 20%, and 52.5%.

During trading, the underlying balancer system decides the best price for the available pools using SOR or Smart Ordering Routing. It ensures that the trade achieves the highest yield without high fees and gas costs.

As for the charges to extract liquidity from the pool, that is a decision left to the pool creators. Charges vary from .0001% to 10%. The charges don’t exclusively go to the pool creators. Instead, the system splits them between those providing liquidity to the pool.

Balancer protocol has three types of pools:

- Private Pools: As the name suggests, these are privately-owned pools where the owner holds all the governance rights. Private pools only have the owners as the contributor to their liquidity. Also, owners can customize the terms of their pools.

- Shares Pools: Shares pools consists of multiple users who add liquidity to the pool. In return, the Balancer pool rewards them with BPTs or Balance Pool Tokens.

- Smart Pools: Smart Pools are private pools under the control of a smart contract. Like shared pools, they also reward using BPT and contribute liquidity to the pool.

Uniqueness of Balancer

Balancer is unique among exchanges. It is an Automated Maker offering permissionless transaction steps. That means no account creation and no verification steps are needed to trade non the platform. But that’s not the only differentiating factor about this DeFi protocol.

Balancer allows the pool operators – that can be any user – to set their swap fees, making Balancer the least expensive place to trade stable coins. Two versions of Balancer have been released, V1 and V2.

V2 provides additional features such as protocol value for assets, Flash loans, Flash swaps, Custom AMM formulas, Internal user Balances, etc.

The Balancer Token

The BAL coin is a governance token, which means the holders of the Balancer token that decide the development course of the balancer protocol. The total supply of the BAL tokens is capped at 100 million.

As per the white paper, 145,000 balancer tokens are distributed among those providing liquidity on the Balancer protocol every week. That would make the yearly BAL token distribution 7.5 million. Users can earn tokens by adding liquidity to the pools or customizing them.

That being said, the developers have not yet finalized the governance structure of the Balancer protocol, leaving the current utility of the BAL token questionable. But, it is likely, that BAL will follow the same governance structure as other DeFi protocols.

Is Balancer a Good investment?

We have taken a brief look at what Balancer is and what its use case and application is the DeFi space. Crypto assets tend to be volatile though, with their price varying rapidly every day. Before you buy BAL, consider the following factors:

The DeFi Market is Bullish

The DeFi market is rising rapidly. In February 2021, its value was $72 billion. But in 2022, this value has risen to $106 billion dollars – a 47% increase. As Balancer is one of the biggest DeFi exchanges in the market, the chance of a bull run in the BAL coin price is high.

Balancer Ecosystem Fund

Five million BAL tokens are allocated to the Balancer Ecosystem Fund. Its purpose is to attract strategic partners to help the Balancer ecosystem’s platform grow even more. Considering the rise of the DeFi market, there is a chance that the protocol will attract skilful investors who will leverage their expertise to expand the platform in the DeFi space.

Fundraising Fund

Balancer Labs, the team behind the Balancer protocol, raised $3 million during the seed funding round. These funds, if used right, can evolve the protocols’ ecosystem by expanding operations.

Balancer Price

At the time of writing, the BAL price is trading around $14 – $15, with the trading volume of the past 24 hours at $43.4 million. As per Coinmarketcap rankings, Balancer ranks #369 with a current market cap of $108.8 million. Approximately 6.94 million coins are in circulation, and the maximum supply is 100 million.

Since its release, Balancer has seen several peaks and valleys in the price action. It was launched at $17.5 and then dipped to $8 in the next few months.

Afterwards, the DeFi Protocol’s governance token saw several pumps:

- Shortly after Binance became the first major exchange to list BAL tokens, the first spike to the upside happened, and it drove up the price to $15.50 from $10. Soon afterwards, the price reached $34.03, the high of 2020.

- 2021 was a very bullish year for Balancer as the BAL price saw a massive uptick to $50.75 in March. After trending sideways within that range, the BAL price then reached its all-time high, $75, before undergoing a correction.

Since the start of 2022, the BAL price has been in an accumulation cycle between $18 to $16.

Balancer Price Predictions

Based on the current price of $15, Balancer has move up 433% to retest and reclaim its all time high. That would not be unheard of in crypto and since the price of BAL is back at historical support levels it may be a good investment – altcoins do tend to have several bull cycles and revisit their previous top.

Remember to take profits on the way up as new bull runs can be rejected at the previous ATH, or set a lower high before reaching them.

The year 2021 was bullish for many crypto assets, not just Balancer, with many growing in value by 10,000%. With that said, like those assets, Balancer has now entered a sideways trading range.

That range might take some time to resolve, cautious investors might want to dollar cost average (DCA) to get a better average entry position for a long-term hold. Overall, the Balancer price forecast is bullish as more institutions move into DeFi – recently Goldman Sachs noted DeFi has potential to reshape traditional finance (TradFi).

Best Ways to Buy Balancer Token

We have gone through all the facts you must consider before investing in Balancer. We have also covered the best crypto exchanges from where you can buy BAL, the BAL price’s current action and future predictions. This section discusses the best ways to buy Balancer.

Buy Balancer with Debit or Credit Card

If you want to use a debit or credit card to buy Balancer, you can do so within five minutes.

Platforms like Binance, Crypto.com and Coinbase provide this facility. And they all follow the same method. You only need to start an account, deposit the funds and invest in Balancer or any cryptocurrency.

But remember that the deposit fee that these crypto exchanges ask for can vary. For instance, Crypto.com charges a 2.99% deposit fee.

Buy Balancer using PayPal

If you don’t want to provide your bank account details at any crypto exchange, you can use PayPal to buy Balancer.

This process will allow you to connect your PayPal account with your crypto account and buy any cryptocurrency with a single click.

Buy Balancer without KYC

Very few safe platforms will allow you to deposit funds into your account unless you provide KYC verification documents. The reason is governments worldwide are pressuring crypto exchanges to become more regulated.

And providing the details is not a bad idea, and it would prevent trading platforms from recognizing you as a bad actor – allowing you to freely trade without any issues or accusations of money laundering.

Best Balancer Token Wallet

When it comes to wallets, you can choose between hardware or software wallets. An encrypted hardware wallet, especially those made by Trezor or ledger, provides high security to secure your funds. Also, as they are not connected to the internet, you’re safe from phishing scams or hacking attacks.

How to Sell Balancer

Once you’ve bought Balancer, the process of selling it is the same. There’s only a small $5 withdrawal fee to cash out your stored cryptocurrencies. Just go to your portfolio, select Balancer and place an order.

Conclusion

Balancer is a DeFi protocol, an Automated Market Maker that focuses on permissionless finance by allowing anyone to trade ERC-20 tokens on the platform without creating an account or providing detailed information. It is one of the biggest names in the growing DeFi space that gives complete control to the community via the BAL tokens.

In terms of how to buy Balancer tokens, we recommend Crypto.com It is beginner friendly, provides copy trading features, and it has the best software crypto wallet in the market that uses multiple security protocols to protect your assets.