We reviewed five decentralized exchanges to determine which one is the best Uniswap alternative.

Uniswap is the biggest decentralized exchange (DEX), but, despite its popularity, many investors seek an alternative platform that provides an even better offering and cheaper fees.

Our Top 5 Picks of Uniswap Alternatives

- OKX — Overall Best Uniswap Alternative Offering 100+ Coins

- DeFi Swap — Popular Exchange Enabling Staking up to 75% APY

- PancakeSwap — Globally-Known Exchange with Low Fees and Large User Base

- 1inch — Multi-Blockchain Decentralized Exchange Enabling Limit Orders

- SushiSwap — Top Lending and Borrowing Multi-Purpose Exchange

What Is the Best Alternative to Uniswap?

We’ve found five sites like Uniswap that might be a better fit for your needs. Let’s get into the details of each exchange to determine their offerings, benefits, and the way they differ from Uniswap.

1. OKX — Overall Best Uniswap Alternative Offering 100 Coins

Investors who don’t have regional access to OKX’s centralized exchange can use the DEX version. It enables investors to trade 100 coins.

OKX’s split-route algorithm finds the best route to minimize slippage and network fees and optimizes the input by finding the best liquidity provider. Investors can choose from numerous payment options to fund their accounts.

Using OKX’s P2P crypto exchange enables investors to avoid trading fees. Investors pay fees only when creating an advertisement for their trade.

This exchange enables trading across multiple blockchains with just one click while ensuring that it provides investors with the best asset prices.

OKX provides an NFT marketplace, allowing investors to create, buy and sell NFTs. Managing a DeFi portfolio in one place is enabled by connecting with a Web 3.0 wallet. The platform also offers gaming dApps and connection to DeFi with its Web 3.0 wallet via the app.

One of the key reasons that investors have opted for the OKX Web 3.0 wallet is safety. It’s connected to a KYT system, detracting fraudulent projects and alerts users based on risk monitoring to protect an investor’s assets.

Best Features

2. DeFi Swap — Popular Exchange Enabling Staking up to 75% APY

A popular Uniswap alternative is DeFi Swap, a platform boasting an impressive DeFi app collection. This community-driven platform offers an array of blockchain features such as token swapping, yield farming, and staking.

DeFi Swap is currently working on cross-chain functionality, enabling investors to swap tokens on competing blockchain networks. Investors have access to more than 50 cryptocurrencies and top-rated DeFi coins on this exchange.

It’s a compelling staking platform because it allows investors to earn up to 75% on its native token, DeFi Coin (DEFC). Investors have the option to lock their coins for 30, 90, 180, or 365 days. In addition to staking, investors can also gain more tokens through a 10% sales tax — half of which is given to token holders as dividends. An investor’s share is based on their ownership of the total token supply.

DeFi Swap enables investors to earn returns via liquidity pools. Each trade contributes toward generating liquidity, and the liquidity pools’ smart contract functionality enables investors to earn fixed DeFi interest rates on their crypto holdings.

Best Features

3. PancakeSwap — Globally-Known Exchange with Low Fees and Large User Base

One of the reasons that PancakeSwap has amassed a huge user base is that the platform is convenient for investors of all trading levels. Even newbies can navigate this exchange and place a trade.

Considering PancakeSwap was launched in September 2020, it has made a significant impression on the market. It was the largest automated market maker (AMM) in 2021 on the BSC network, having more than $3.7 billion in staked assets.

This exchange allows you to purchase Battle Infinity, Lucky Block, and many other coins. PancakeSwap supports over 10 of the top crypto wallets like MetaMask and the Binance wallet. Investors incur a 0.25% fee on all trades, and the exchange uses part of the commission to buy back CAKE — its native token.

Investors can stake CAKE tokens in the Syrup Pools. PancakeSwap also offers yield farming to earn more CAKE. This exchange also enables investors to earn newly launched tokens during initial farm offerings (IFOs).

Another key distinguishing feature of this platform is the lottery. Investors can buy tickets and participate in a crypto lottery to win cash prizes.

Best Features

4. 1inch — Multi-Blockchain Decentralized Exchange Enabling Limit Orders

1inch operates differently than most decentralized exchanges. It’s a decentralized aggregator, running across multiple blockchains and creating solutions for Polygon, Smart Chain, and Ethereum.

When investors want to swap coins, it automatically searches numerous decentralized exchanges to find the most affordable trade with low gas fees. To get investors the best prices, 1inch may sometimes need to swap the coins on numerous platforms.

Another feature that separates 1inch from most exchanges is that it offers limit orders. Investors set the swapped tokens, the desired price, and the duration of the order. When the specified price is reached, the platform automatically executes the trade.

The ‘1inch earn’ feature is an enhanced version of liquidity pools, enabling investors to benefit from a stable yield.

Best Features

5. SushiSwap — Top Lending and Borrowing Multi-Purpose Exchange

SushiSwap is another popular alternative to Uniswap because it has branched out to blockchain platforms such as Binance Smart Chain, Polygon, Fantom, and several others. This exchange has positioned itself as one of the main Uniswap competitors.

It has done that by enabling investors to deposit Uniswap LP tokens into SushiSwap to earn SUSHI tokens. Investors can then stake their SUSHI tokens to earn a portion of the fees that the exchange makes.

That resulted in numerous investors flocking to SushiSwap, prompting it to expand its product offering.

Besides swapping, earning, and stacking yields, investors can use SushiSwap as a crypto lending platform. The lending and borrowing of assets have been enabled via Kashi Markets.

Best Features

What to Look For in a Cheaper Alternative to Uniswap

Investors should analyze several key factors of decentralized exchanges to ensure they provide an offering required to benefit from such platforms.

Assets

Some of the best altcoins aren’t listed on all the major exchanges. One of the main reasons investors opt for DEXs is to trade coins that are difficult to find. The more assets an exchange lists, the easier it is for an investor to trade the desired coins.

Fees

A decentralized exchange should offer low and transparent fees. Investors need to know all the fees involved in owning an asset, such as deposits, withdrawals, trading, and gas fees.

Rewards

A platform should enable investors to earn tokens in several ways. Most of the exchanges we reviewed enabled staking, yield earning and even lending.

How to Buy Crypto via Alternative Decentralized Exchange

Our top pick for a Uniswap alternative exchange is OKX. We’ve provided a step-by-step guide to help investors buy assets.

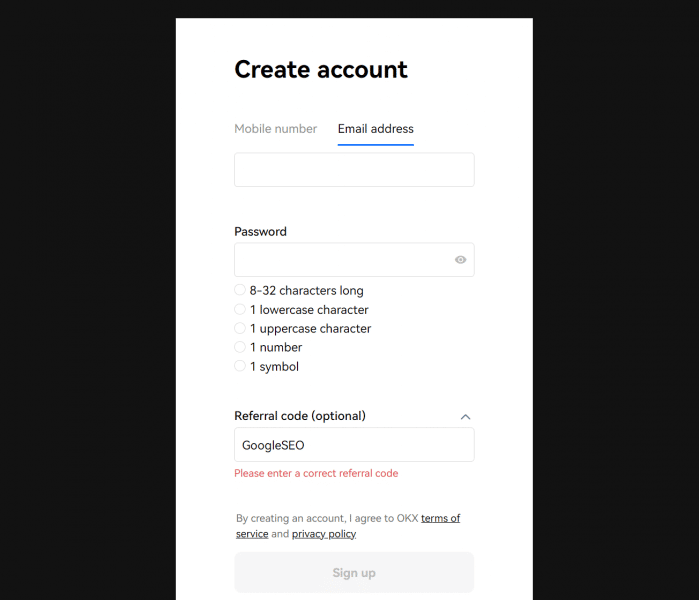

Step 1 — Sign Up

If you don’t yet own any crypto, these first steps will enable you to buy crypto on OKX. If you already own crypto it’s not necessary to sign up or provide any information on a DEX, so skip to step 4.

Visit the OKX DEX and click ‘Sign Up’. Enter an email address or phone number and a password, then click Sign Up.

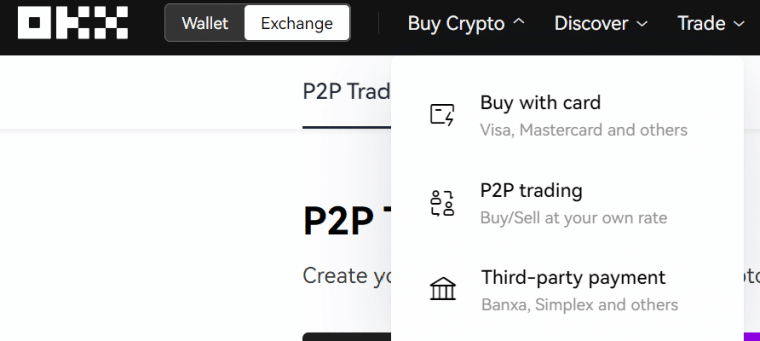

Step 2 — Go to the Exchange

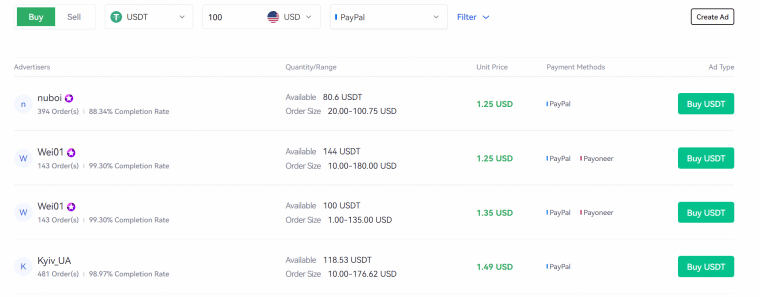

Click ‘Buy Crypto’ from the navigation menu and then choose P2P trading.

Step 3 — Buy Crypto

Click ‘Buy’ and then select the asset to own. Enter the preferred currency and payment method.

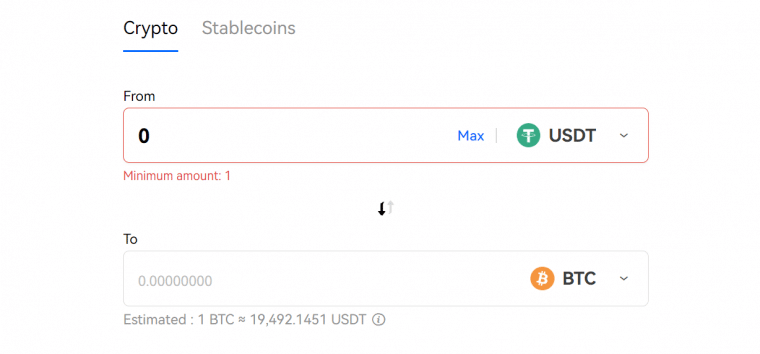

Step 4 — Convert coins

Now that you own USDT, convert it into the desired cryptocurrency by inputting an amount.

Conclusion — Is Uniswap Still Good?

Although our guide explored alternatives, Uniswap is a great option for transacting on a decentralized exchange. While centralized exchange FTX collapsed, Uniswap has proven that the best platforms are community driven.

Although all the DEXs we reviewed are great FTX alternatives, we found OKX to take the top spot. Its platform is easy to use, provides numerous tokens and enables investors to earn rewards.

FAQ

What’s cheaper than Uniswap?

What is the disadvantage of Uniswap?

Is PancakeSwap or Uniswap better?

Is Uniswap cheaper than MetaMask?